What Is Free Cash Flow (FCF)?

Free Cash Flow (FCF) is the cash a company generates after covering its operating expenses and capital expenditures (CapEx). Think of it as the “spare cash” available for paying down debt, rewarding shareholders, or reinvesting in growth.

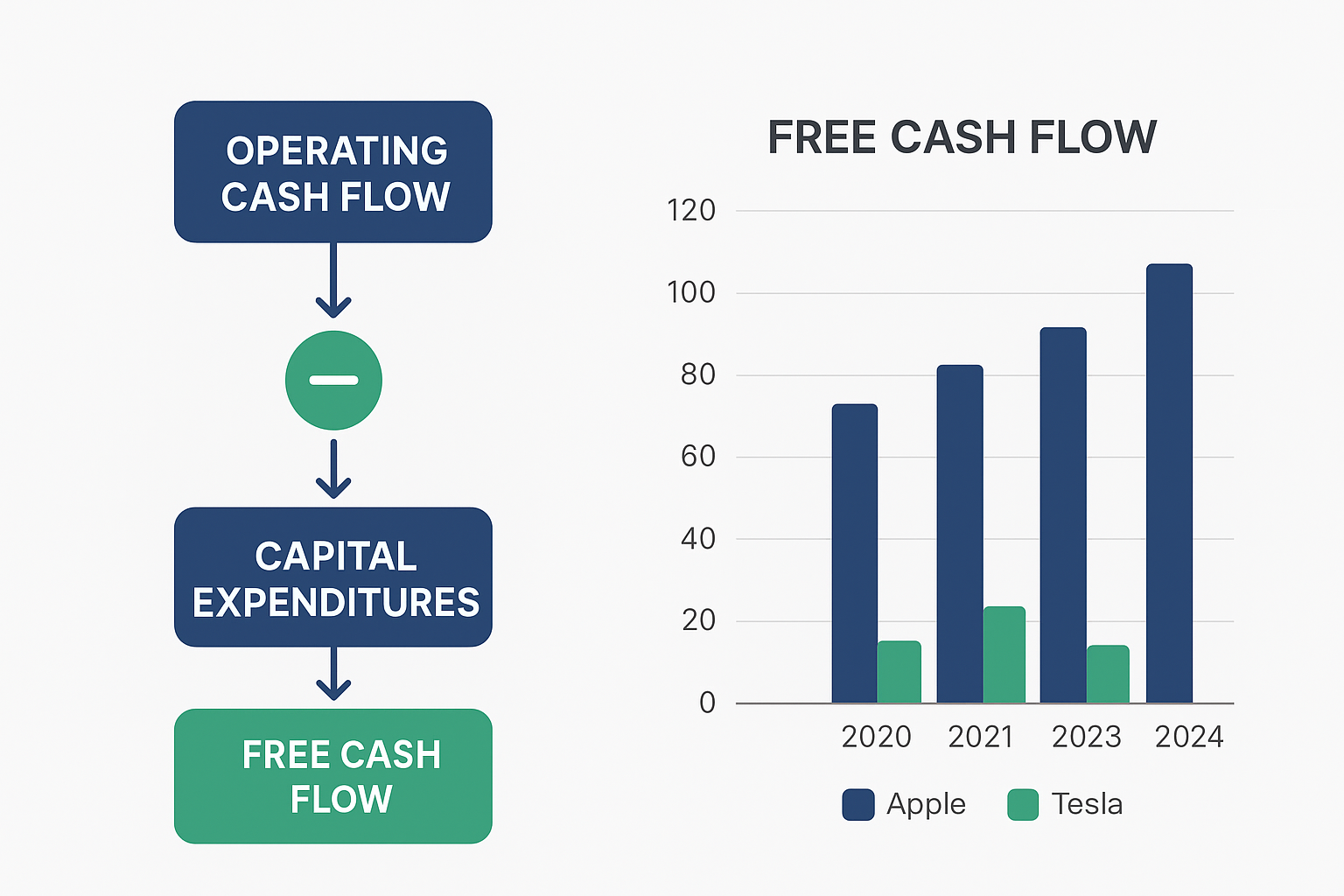

Formula:

Free Cash Flow = Operating Cash Flow ‒ Capital Expenditures (CapEx)Key points:

- Operating Cash Flow (OCF): Money from core operations (after non-cash items like depreciation, after accounting for changes in working capital).

- Capital Expenditures (CapEx): Spending on plant, property, equipment; maintenance vs growth investments.

Why FCF Matters to Investors

- Financial health check – Companies with consistent FCF can survive downturns and self-fund growth.

- Valuation tool – FCF powers Discounted Cash Flow (DCF) models, helping analysts estimate a company’s fair value.

- Shareholder rewards – Strong FCF supports dividends and buybacks.

- Risk signal – Negative FCF isn’t always bad (growth phase), but persistent negative FCF can raise red flags.

Types of Free Cash Flow

| Type | Formula | Use Case |

|---|---|---|

| Free Cash Flow to the Firm (FCFF) | OCF − CapEx (before interest) | Used in enterprise valuation; useful for comparing across companies. |

| Free Cash Flow to Equity (FCFE) | FCFF − Interest − Net Debt Payments | Relevant for equity investors, dividend analysis, and shareholder returns. |

Step-by-Step: How to Calculate Free Cash Flow

- Find Operating Cash Flow (OCF) on the cash flow statement.

- Locate Capital Expenditures (CapEx) under investing activities (e.g., “purchase of PP&E”).

- Subtract CapEx from OCF.

Pro tip: Separate maintenance CapEx (to sustain operations) from growth CapEx (for expansion). Investors often adjust for this when estimating “owner’s earnings.”

Real-World Examples (Apple vs Tesla)

Apple Inc. (AAPL)

- 2024 FCF: ~$108.8 (up from $99.6B in 2023)

- 5-year trend: Generally upward since 2020 (~$73B → $108.8).

- Drivers: Strong product demand, stable CapEx, high-margin services.

Tesla Inc. (TSLA)

- TTM (Jun 2025): ~$5.6B

- 2022 peak: ~$8.5B → decline to $3.6B in 2024.

- Drivers: Heavy CapEx for gigafactories, production scaling, supply chain costs.

Investor Insight:

Apple’s FCF is large and stable, making it easier to forecast. Tesla’s is volatile, which increases risk but also potential upside.

Comparative Metrics

| Metric | Apple | Tesla |

|---|---|---|

| FCF / OCF Ratio | High, stable | Fluctuates, often low during heavy investment years |

| FCF Margin (FCF ÷ Revenue) | Consistently healthy | Highly variable |

| 5-Year CAGR | ~6% growth | Higher but inconsistent |

How Investors Use FCF in Practice

- Stock Screening: Investors filter for companies with strong and consistent FCF.

- Valuation Models: FCF is the foundation for DCF valuation, FCFF, and FCFE models.

- Comparisons: Helps compare across industries (e.g., utilities vs SaaS).

- Red Flags: Declining FCF despite rising revenue may signal trouble.

Limitations & Risks Of Free Cash Flow

- One-time events (asset sales, legal settlements) can distort FCF.

- Accounting differences (leases, R&D treatment) affect comparability.

- Industry bias: High-CapEx sectors naturally show lower FCF.

Forecasting Free Cash Flow

When projecting future FCF, analysts consider:

- Revenue growth assumptions

- Operating margin changes

- CapEx trends (maintenance vs growth)

- Working capital needs

- Debt & interest obligations

Key Takeaways

- Free Cash Flow is one of the most important metrics for evaluating financial strength.

- Apple demonstrates the power of stable FCF; Tesla shows the risk/reward tradeoff of volatile FCF.

- Investors should focus on multi-year trends, not just single-year numbers.

FAQS

Not always; a company might underinvest in CapEx, inflating FCF temporarily.

It could mean growth investments (healthy) or financial stress (unhealthy). Always check context.

Yes. By delaying CapEx or managing working capital, reported FCF may look better than reality.

It depends on the company’s maturity and industry. For mature large caps like Apple, stable mid single-digit growth might be healthy. For high-growth or riskier companies, higher growth might be expected, but also riskier. Look at consistency and risk.

High‐CapEx sectors (utilities, manufacturing, telecom) naturally have lower or more volatile FCF; software/service businesses often have lower CapEx and more stable FCF. Always compare apples to apples.

Related Resources

- How to Read a Cash Flow Statement

- Discounted Cash Flow (DCF) Valuation Explained

- Operating Cash Flow vs. Net Income

External references:

Author: Max Fonji — The Rich Guy Math

Founder of TheRichGuyMath.com, Max is a financial strategist and personal finance writer with 8+ years of experience studying wealth-building strategies. His mission is to help everyday investors achieve financial independence through data-driven strategies, behavioral finance insights, and real-world case studies.

Disclaimer: This article is for educational purposes only, not financial advice. Consult a licensed professional before making financial decisions.