Imagine you’re 25 years old, standing at a crossroads. You’ve just received a $10,000 bonus from work. You could spend it on a dream vacation, or you could invest it. Fast forward 40 years, that same $10,000, invested wisely, could be worth over $217,000. How? Through the magic of future value.

Understanding this concept isn’t just for finance geeks; it’s the secret weapon that separates those who merely save from those who build lasting wealth. Whether you’re planning for retirement, saving for your child’s education, or simply trying to make smarter money decisions, grasping future value will transform how you think about every dollar you earn today. Investopedia

TL;DR

- Future value (FV) is the amount an investment made today will grow to at a specific point in the future, given a certain interest rate and time period.

- The basic future value formula is: FV = PV × (1 + r)^n, where PV is the present value, r is the interest rate, and n is the number of periods.

- Understanding future value helps investors make informed decisions about savings, retirement planning, and comparing investment opportunities.

- Present value is the inverse concept—it tells you what future money is worth in today’s dollars, helping you evaluate whether future returns justify current investments.

- Even small differences in interest rates or time horizons can create dramatic differences in future value outcomes due to compound interest.

What Is Future Value? A Clear Definition

In simple terms, future value means the amount of money an investment will grow to over a period of time at a given interest rate.

Think of it this way: if you plant an apple seed today, you won’t have apples tomorrow. But given time, water, and sunlight, that seed grows into a tree that produces hundreds of apples. Future value is the financial equivalent; it’s about understanding what your money “seed” will grow into, given time and the right conditions (interest rate).

Future value is one of the most fundamental concepts in finance because it quantifies the time value of money; the principle that a dollar today is worth more than a dollar tomorrow because of its earning potential. This concept underpins virtually every financial decision, from choosing between investment options to determining how much to save for retirement. Corporate Finance Institute

Why does future value matter? Because it allows you to:

Compare investment opportunities on an apples-to-apples basis

Set realistic savings goals for major life events

Understand the true cost of spending money today versus investing it

Make informed decisions about loans, mortgages, and financial products

Plan for retirement with confidence and precision

The Future Value Formula: Your Financial Crystal Ball

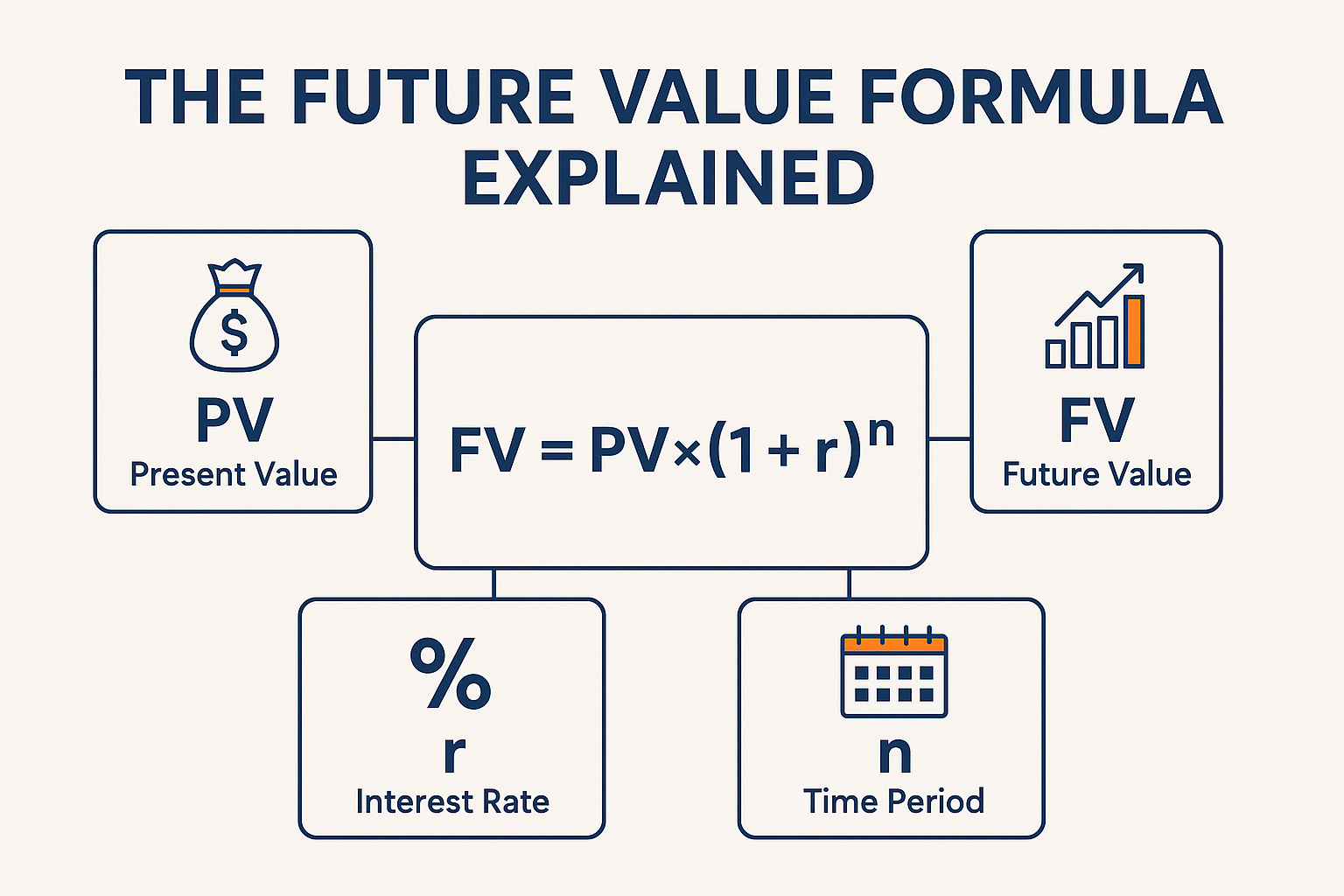

The future value formula is surprisingly simple, yet incredibly powerful. Here’s the basic version:

FV = PV × (1 + r)^n

Where:

- FV = Future Value (the amount you’ll have in the future)

- PV = Present Value (the amount you’re investing today)

- r = Interest rate per period (expressed as a decimal)

- n = Number of time periods

Let’s break down each component:

Present Value (PV)

This is your starting point—the amount of money you have right now or plan to invest. It could be $100, $10,000, or any amount. The present value is the “seed” you’re planting.

Interest Rate (r)

This represents the growth rate of your investment. If you’re earning 8% annually, you’d use 0.08. The interest rate is arguably the most critical variable in the future value equation because even small differences compound dramatically over time.

Number of Periods (n)

This is how long your money will be invested. Periods are typically measured in years, but they could also be months, quarters, or any consistent time interval. The key is that your interest rate and time periods must match (if using annual interest, use years for n).

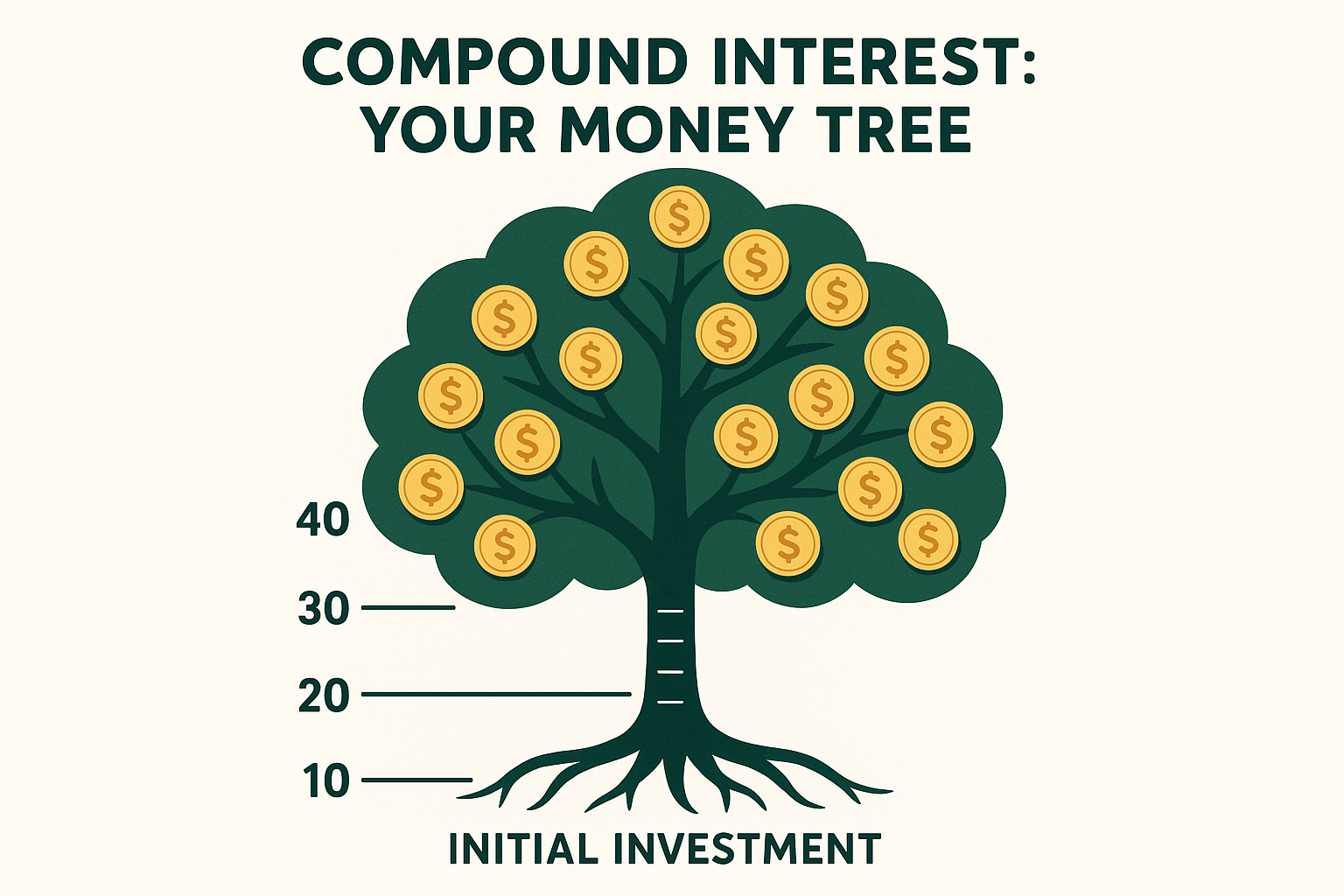

The Power of Exponents

The “^n” part of the formula is where the magic happens. This exponent creates compound interest; you earn interest not just on your original investment, but on all the interest you’ve previously earned. Albert Einstein allegedly called compound interest “the eighth wonder of the world,” and for good reason.

Future Value with Regular Contributions

Most people don’t just make a single investment and walk away. Instead, they contribute regularly, monthly to a 401(k), quarterly to a savings account, or annually to an IRA. For these scenarios, we need a modified formula:

FV = PMT × [((1 + r)^n – 1) / r]

Where:

- PMT = Payment amount per period

- r = Interest rate per period

- n = Number of periods

This formula calculates the future value of an annuity, a series of equal payments made at regular intervals.

Real-World Future Value Examples

Let’s make this concrete with some practical examples that demonstrate how future value works in everyday situations.

Example 1: The Single Investment

Scenario: Sarah invests $5,000 in an index fund that historically returns 10% annually. She doesn’t add any more money. How much will she have in 30 years?

Calculation:

- PV = $5,000

- r = 0.10 (10%)

- n = 30 years

FV = $5,000 × (1 + 0.10)^30

FV = $5,000 × (1.10)^30

FV = $5,000 × 17.449

FV = $87,247

Sarah’s initial $5,000 investment grows to over $87,000—more than 17 times her original investment. That’s the power of compound interest over time.

Example 2: Regular Monthly Contributions

Scenario: James decides to invest $300 every month in his retirement account, which earns an average of 8% annually. How much will he have after 25 years?

Calculation:

First, we need to convert the annual rate to a monthly rate:

- PMT = $300

- r = 0.08/12 = 0.00667 (monthly rate)

- n = 25 × 12 = 300 months

FV = $300 × [((1 + 0.00667)^300 – 1) / 0.00667]

FV = $300 × [((1.00667)^300 – 1) / 0.00667]

FV = $300 × [(7.396 – 1) / 0.00667]

FV = $300 × 958.68

FV = $287,604

James will have contributed $90,000 over 25 years ($300 × 300 months), but his account will be worth nearly $288,000. The difference—$197,604—is pure investment growth.

Example 3: The Cost of Waiting

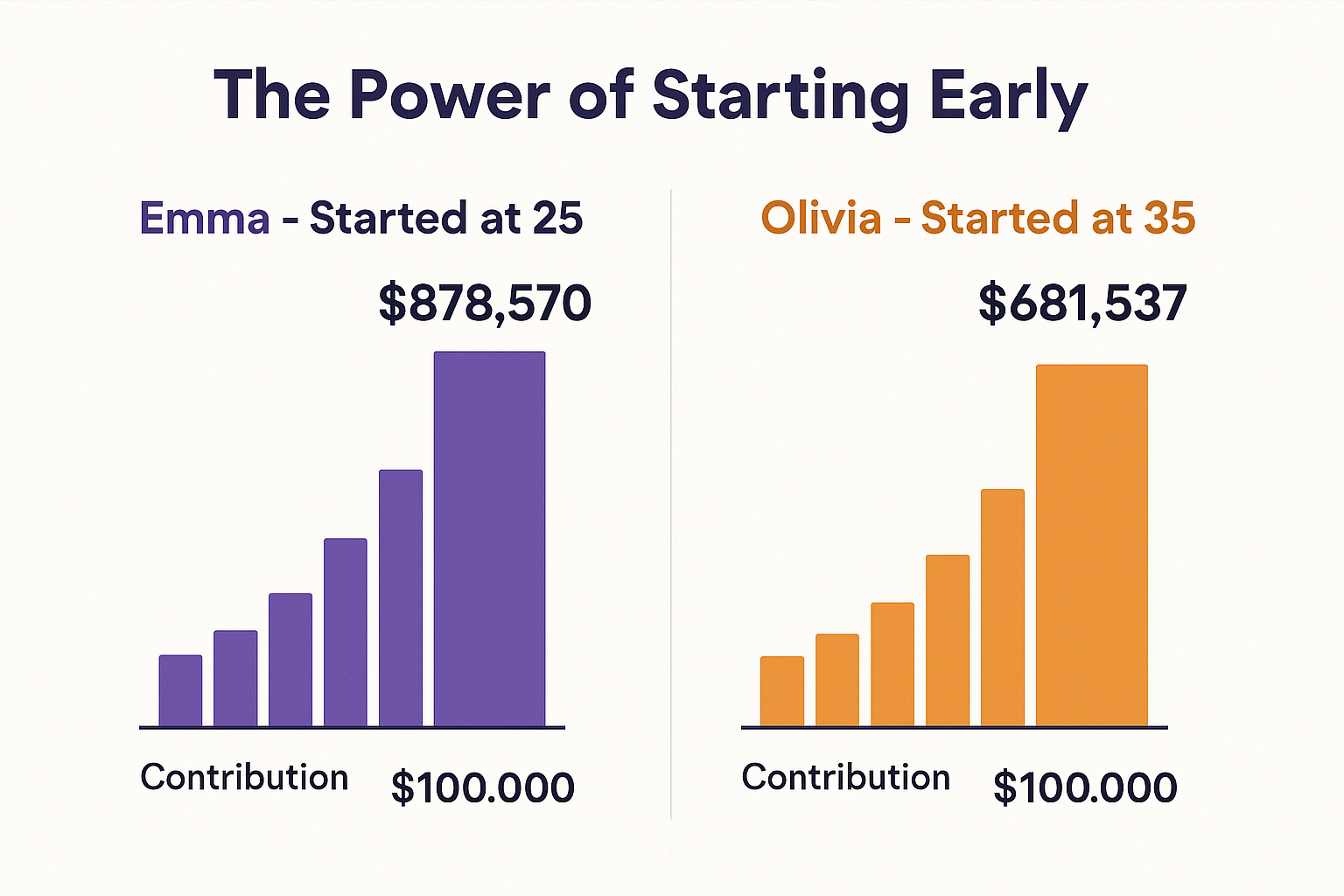

Scenario: Two friends, Emma and Olivia, both plan to retire at 65. Emma starts investing $200/month at age 25. Olivia waits until 35 to start but invests $400/month (twice as much). Both earn 9% annually. Who ends up with more?

Emma’s calculation (40 years):

- PMT = $200

- r = 0.09/12 = 0.0075

- n = 40 × 12 = 480 months

FV = $200 × [((1.0075)^480 – 1) / 0.0075]

FV = $878,570

Olivia’s calculation (30 years):

- PMT = $400

- r = 0.0075

- n = 30 × 12 = 360 months

FV = $400 × [((1.0075)^360 – 1) / 0.0075]

FV = $681,537

Even though Olivia invested more money each month, Emma ended up with nearly $200,000 more because she started earlier. This example powerfully illustrates why time is your most valuable asset when it comes to investing. Understanding how to make your kid a millionaire starts with grasping this principle early.

Present Value vs Future Value: Two Sides of the Same Coin

While this article focuses on future value, it’s impossible to discuss it without mentioning present value—its mathematical twin.

Present value answers the question: “What is a future amount of money worth in today’s dollars?” It’s the inverse of future value.

The present value formula is:

PV = FV / (1 + r)^n

Why Present Value Matters

Present value helps you:

🔹 Evaluate investment opportunities by determining if future returns justify today’s cost

🔹 Compare options with different payment schedules

🔹 Understand the real cost of delayed payments or long-term obligations

🔹 Make better business decisions about capital investments

A Quick Present Value Example

Suppose someone offers to pay you $10,000 five years from now. If you can earn 6% annually on your investments, what’s that future payment worth today?

PV = $10,000 / (1 + 0.06)^5

PV = $10,000 / 1.338

PV = $7,473

In today’s dollars, that $10,000 future payment is only worth $7,473. If someone asked you to pay $8,000 today for the right to receive $10,000 in five years, you’d be overpaying because the present value is only $7,473.

How to Use Future Value in Investment Decisions

Understanding future value transforms how you approach financial decisions. Here’s how to apply it practically:

1. Retirement Planning

Future value calculations are essential for retirement planning. They help answer questions like:

- How much do I need to save monthly to reach my retirement goal?

- Will my current savings be sufficient?

- How will different rates of return affect my retirement nest egg?

Many successful investors use future value calculations to set clear targets and start earning passive income through dividend investing with a specific end goal in mind.

2. Education Savings

If you’re saving for a child’s college education, future value helps you determine:

- How much to contribute to a 529 plan

- Whether you’re on track to meet education costs

- The impact of starting earlier vs. later

3. Comparing Investment Options

When evaluating different investment vehicles—stocks, bonds, real estate, or savings accounts—future value provides a common framework for comparison. You can calculate the expected future value of each option and make informed choices.

For instance, understanding why the stock market goes up over the long term helps you appreciate why stocks typically generate higher future values than bonds or savings accounts, despite short-term volatility. wallstreetprep.com

4. Understanding Opportunity Cost

Every spending decision has an opportunity cost—what you give up by not investing that money instead. Future value quantifies this cost.

That $50 dinner? If invested at 8% for 30 years, it would become $503. The $30,000 car? It could have been $301,635 in your retirement account. This doesn’t mean you shouldn’t enjoy life, but it helps you make conscious, informed choices about spending versus investing.

The Variables That Impact Future Value

Several factors influence how much your money will grow. Understanding these variables helps you optimize your investment strategy.

Time Horizon (n)

Time is the most powerful variable in the future value equation. The longer your money is invested, the more dramatic the effects of compound interest.

Consider investing $10,000 at 8%:

- 10 years: $21,589

- 20 years: $46,610

- 30 years: $100,627

- 40 years: $217,245

Notice how the growth accelerates? The jump from year 30 to 40 ($116,618) is more than five times larger than the jump from year 10 to 20 ($25,021). This is compound interest at work.

Interest Rate (r)

The interest rate has an exponential impact on future value. Even small differences in rates create massive differences over time.

Investing $10,000 for 30 years:

- At 5%: $43,219

- At 7%: $76,123

- At 9%: $132,677

- At 11%: $228,923

The difference between 5% and 11% is $185,704—more than 18 times your original investment! This is why choosing high dividend stocks or investment vehicles with strong historical returns matters so much.

Contribution Frequency and Amount

When making regular contributions, two factors matter:

- How much do you contribute

- How often do you contribute

More frequent contributions (monthly vs. annually) result in slightly higher future values because money enters the market sooner and has more time to compound.

Inflation Consideration

While not part of the basic future value formula, inflation is crucial for real-world planning. A future value of $1 million sounds impressive, but if inflation averages 3% annually, that million will have less purchasing power in the future.

To calculate real future value (adjusted for inflation), use:

Real FV = FV / (1 + inflation rate)^n

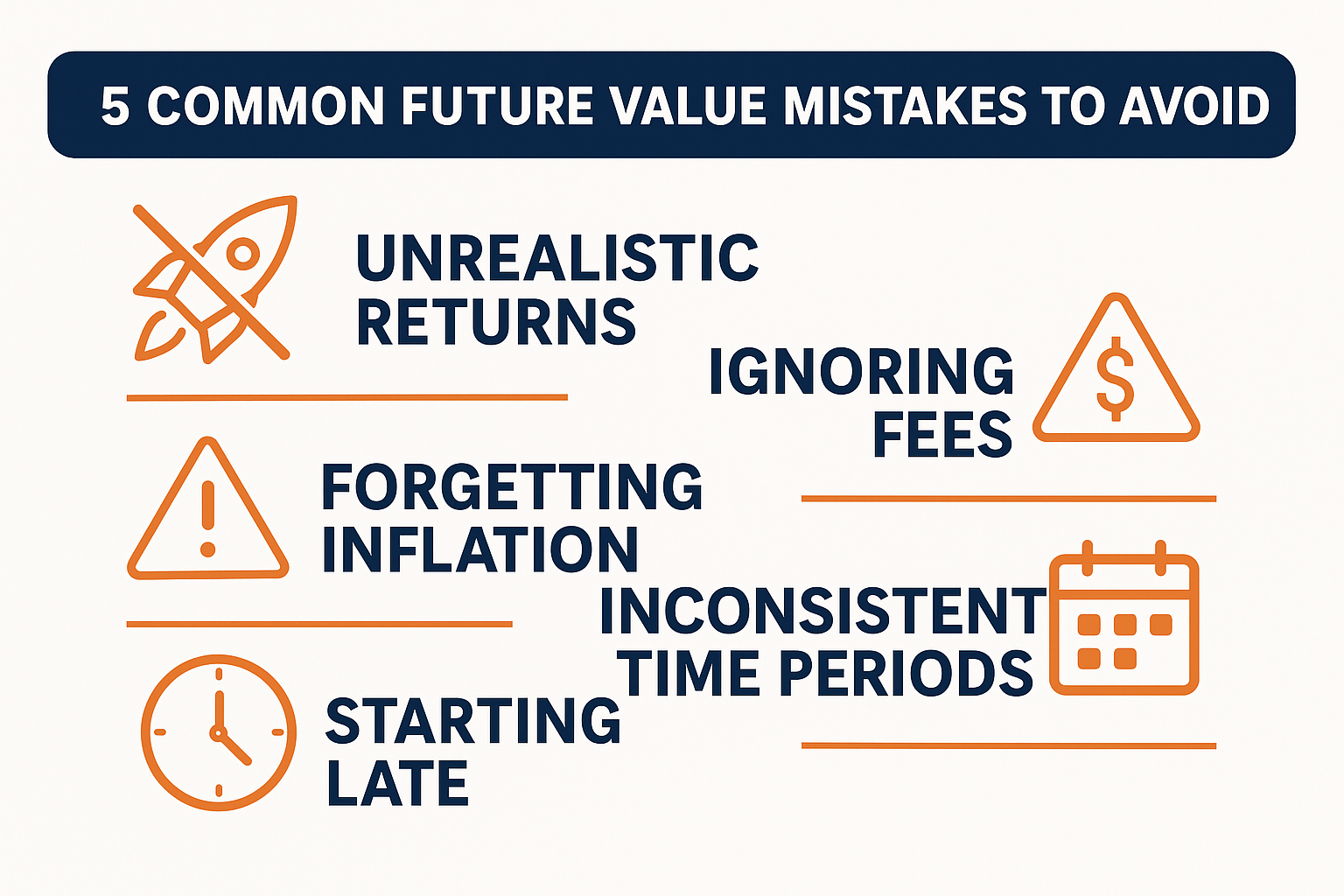

Common Future Value Mistakes to Avoid

Even experienced investors make these errors when working with future value:

1: Using Unrealistic Return Assumptions

The problem: Assuming you’ll earn 15% annually because you read about a hot stock tip.

The reality: Historical stock market returns average around 10% annually, but this includes significant volatility. Conservative planning uses 7-8% for stock-heavy portfolios and 4-6% for balanced portfolios.

The fix: Use historical averages for your asset class and consider running multiple scenarios with different return assumptions.

2: Ignoring Fees and Taxes

The problem: Calculating future value without accounting for investment fees, expense ratios, or taxes.

The reality: A 1% annual fee might seem small, but over 30 years, it can reduce your returns by 25% or more.

The fix: Subtract fees from your expected return rate. If you expect 8% returns but pay 1% in fees, use 7% in your calculations.

3: Forgetting to Adjust for Inflation

The problem: Celebrating a future value of $2 million without considering what that will buy in 30 years.

The reality: At 3% inflation, $2 million in 30 years has the purchasing power of about $824,000 today.

The fix: Always calculate both nominal and real (inflation-adjusted) future values for long-term goals.

4: Inconsistent Time Periods

The problem: Using an annual interest rate with monthly time periods, or vice versa.

The reality: Your interest rate and time periods must match. Annual rate = annual periods; monthly rate = monthly periods.

The fix: Always convert rates and periods to the same time frame. For monthly calculations, divide the annual rate by 12 and multiply the years by 12.

5: Underestimating the Impact of Starting Early

The problem: Thinking “I’ll start investing seriously in my 30s or 40s.”

The reality: Every year you delay costs you exponentially more in future value due to lost compound interest.

The fix: Start investing as early as possible, even with small amounts. As shown in Example 3, time often matters more than the amount invested.

Understanding the cycle of market emotions helps you avoid the psychological mistakes that prevent consistent, long-term investing.

Future Value in Different Investment Vehicles

Future value calculations apply across various investment types, but each has unique considerations:

Stocks and Stock Funds

Expected returns: 8-10% annually (historical average)

Volatility: High short-term, moderate long-term

Best for: Long time horizons (10+ years)

Stocks offer the highest potential future value but come with volatility. Learning about the stock market and understanding why people lose money in the stock market helps you harness stocks’ growth potential while avoiding common pitfalls.

Bonds and Bond Funds

Expected returns: 3-5% annually

Volatility: Low to moderate

Best for: Shorter time horizons or conservative investors

Bonds generate lower future values than stocks but provide more stability and predictable income.

High-Yield Savings Accounts

Expected returns: 1-5% annually (varies with interest rates)

Volatility: None (FDIC insured)

Best for: Emergency funds and short-term goals

These are safe but generate modest future values, often barely keeping pace with inflation.

Real Estate

Expected returns: 4-8% annually (varies significantly by location)

Volatility: Moderate

Best for: Long-term wealth building and income generation

Real estate future value calculations are more complex because they must account for rental income, property appreciation, maintenance costs, and property taxes.

Dividend-Paying Investments

Expected returns: 6-9% annually (dividends + appreciation)

Volatility: Moderate

Best for: Income-focused investors and retirees

Dividend investments combine growth with regular income. Exploring smart ways to make passive income often includes dividend strategies that enhance future value through reinvestment.

Advanced Future Value Concepts

Once you’ve mastered the basics, these advanced concepts can refine your financial planning:

Future Value of an Annuity Due

An annuity due is when payments occur at the beginning of each period (like rent) rather than the end (like a typical investment contribution). The formula is:

FV (Annuity Due) = PMT × [((1 + r)^n – 1) / r] × (1 + r)

This generates a slightly higher future value because each payment has an extra period to grow.

Future Value with Variable Contributions

In reality, your contributions might increase over time as your income grows. While there’s no simple formula for this, you can:

- Calculate future value for each contribution amount separately

- Sum all the individual future values

- Use financial software or spreadsheets to model complex scenarios

Future Value with Changing Interest Rates

Interest rates rarely remain constant over decades. For variable rates, calculate the future value in stages:

FV = PV × (1 + r₁)^n₁ × (1 + r₂)^n₂ × (1 + r₃)^n₃…

Where each subscript represents a different time period with a different rate.

Creating a Future Value-Based Financial Plan

Here’s how to build a comprehensive financial plan using future value principles:

Step 1: Define Your Goals

Be specific:

- “I want $2 million in today’s dollars for retirement in 30 years.”

- “I need $100,000 for my child’s college in 15 years.”

- “I want to buy a $500,000 house in 7 years.”

Step 2: Calculate Required Contributions

Work backward from your future value goal to determine how much you need to save regularly. Rearrange the future value formula:

PMT = FV × [r / ((1 + r)^n – 1)]

Step 3: Choose Appropriate Investment Vehicles

Match your time horizon with suitable investments:

- 0-3 years: High-yield savings, CDs, short-term bonds

- 3-10 years: Balanced portfolio of stocks and bonds

- 10+ years: Stock-heavy portfolio for maximum growth potential

Step 4: Monitor and Adjust

Review your progress annually:

- Are you meeting your contribution targets?

- Are your investments performing as expected?

- Have your goals or time horizons changed?

- Do you need to adjust your risk tolerance?

Making smart moves means regularly reassessing your strategy and adapting to life changes.

Step 5: Account for Multiple Goals

Most people have several financial goals simultaneously. Prioritize them:

- Emergency fund (3-6 months of expenses)

- High-interest debt payoff

- Retirement savings

- Children’s education

- Major purchases (home, car)

- Wealth building and legacy planning

Calculate the future value needed for each goal and determine total monthly contributions required.

The Psychology of Future Value

Understanding future value intellectually is one thing; acting on it is another. Here’s why people struggle and how to overcome these challenges:

Present Bias

Humans are wired to value immediate rewards over future benefits. A $100 dinner today feels more tangible than $1,000 in your retirement account 30 years from now.

Solution: Make investing automatic through payroll deductions or automatic transfers. What you don’t see, you don’t miss.

Analysis Paralysis

The complexity of financial planning can be overwhelming, leading to inaction.

Solution: Start simple. Even imperfect investing beats perfect planning that never happens. Begin with a target-date retirement fund and refine your strategy over time.

Overconfidence

After a few successful investments, people sometimes assume they’ll consistently beat the market, leading to unrealistic future value expectations.

Solution: Use conservative assumptions in your planning. If you beat them, great! If not, you’re still on track.

Loss Aversion

Fear of losing money prevents people from investing in vehicles with higher potential future values.

Solution: Understand that for long time horizons, diversified stock portfolios have never lost money over any 20 years in history. Time reduces risk.

Future Value Calculator: Interactive Tool

Below is an interactive calculator that helps you calculate future value for both lump-sum investments and regular contributions. Experiment with different scenarios to see how time, interest rates, and contribution amounts affect your future wealth.

💰 Future Value Calculator

Calculate how much your investment will grow over time

Your Investment Growth

Frequently Asked Questions (FAQ)

Future value is the amount an investment made today will grow to at a specific point in the future, assuming a certain interest rate. It’s a way to calculate what your money will be worth later if you invest it now.

For a single investment, use the formula: FV = PV × (1 + r)^n, where PV is the present value (initial investment), r is the interest rate per period, and n is the number of periods. For regular contributions, use: FV = PMT × [((1 + r)^n – 1) / r].

Conservative planning typically uses 7-8% for stock-heavy portfolios and 4-6% for balanced portfolios. The historical stock market average is around 10%, but it’s wise to use more conservative estimates to avoid overestimating future wealth.

Future value tells you what money invested today will be worth in the future. Present value tells you what future money is worth in today’s dollars. They’re inverse concepts—future value looks forward in time, while present value looks backward.

Inflation reduces the purchasing power of future money. While your investment might grow to $1 million in nominal terms, inflation means that a million won’t buy as much as it would today. Always calculate real (inflation-adjusted) future value for long-term planning.

Absolutely! Future value is essential for retirement planning. It helps you determine how much to save monthly to reach your retirement goal and shows whether your current savings rate will be sufficient.

Time is the most powerful variable in the future value equation. Due to compound interest, money invested earlier has exponentially more time to grow. Someone who starts investing at 25 will typically accumulate far more wealth than someone who starts at 35, even if the latter invests more money.

Key Risks and Limitations of Future Value

While future value is an invaluable planning tool, it has limitations you should understand:

Market Volatility

Future value calculations assume consistent returns, but real markets fluctuate significantly. The stock market might average 10% annually over decades, but individual years can range from -40% to +40%.

Mitigation: Use conservative return assumptions and understand that actual results will vary. Consider running multiple scenarios (optimistic, realistic, pessimistic).

Changing Personal Circumstances

Life rarely follows a straight path. Job losses, health issues, family changes, and other events can disrupt your investment plan.

Mitigation: Build an emergency fund before aggressive investing, maintain flexibility in your financial plan, and review it regularly.

Tax Implications

Future value calculations often ignore taxes, but investment taxes can significantly reduce returns. Capital gains taxes, dividend taxes, and required minimum distributions all affect your actual future value.

Mitigation: Consider tax-advantaged accounts (401(k), IRA, Roth IRA) and factor in estimated tax rates when planning.

Behavioral Challenges

Knowing what to do and actually doing it are different things. Emotional reactions to market volatility often derail even the best-laid plans.

Mitigation: Automate investments, maintain a long-term perspective, and consider working with a financial advisor for accountability.

Real-World Success Stories

Understanding future value intellectually is one thing; seeing it work in real life is another. Here are some anonymized examples from real people:

The Teacher Who Started Small

Maria, a 28-year-old elementary school teacher, started investing just $150 per month in a low-cost index fund. She felt it was such a small amount that it wouldn’t matter, but she committed to consistency.

After 35 years of investing $150 monthly at an average 9% return, Maria retired with $411,000—despite contributing only $63,000 total. The remaining $348,000 came purely from compound growth. Her small, consistent contributions created life-changing future value.

The Late Starter Who Caught Up

David didn’t start investing seriously until age 45. Realizing he was behind, he maximized his 401(k) contributions at $1,500 per month and took advantage of employer matching.

By age 65, with a 7.5% average return, David accumulated $783,000. While he would have been better off starting earlier, his story proves it’s never too late to harness the power of future value.

The Parent Who Invested in Their Child

When their daughter was born, Jessica and Tom started a 529 education savings plan with $5,000 and contributed $200 monthly. By the time their daughter turned 18, the account had grown to $89,000 at 6% returns—enough to cover four years at a state university.

Their total contributions were $48,200, but the account’s future value was nearly double that, thanks to compound growth.

Integrating Future Value into Your Financial Life

Making future value work for you requires more than understanding the math—it requires action. Here’s how to integrate these principles into your daily financial life:

Start Today, Not Tomorrow

The single most important action is to begin. Even if you can only invest $50 per month, start now. You can always increase contributions later, but you can never recover lost time.

Automate Everything

Set up automatic transfers from your checking account to investment accounts on payday. Automation removes willpower from the equation and ensures consistency.

Increase Contributions Over Time

When you get a raise, increase your investment contributions by at least half the raise amount. You’ll still enjoy higher take-home pay while significantly boosting your future value.

Diversify Across Time Horizons

Match investments to time horizons:

- Short-term goals (0-3 years): High-yield savings or CDs

- Medium-term goals (3-10 years): Balanced funds

- Long-term goals (10+ years): Stock-heavy portfolios

Review and Rebalance

Check your investments quarterly, but avoid overreacting to short-term volatility. Rebalance annually to maintain your target asset allocation.

Educate Yourself Continuously

Financial markets evolve, and so should your knowledge. Reading articles like this is a great start. Continue learning about smart investing strategies to refine your approach over time.

The Bigger Picture: Future Value and Wealth Building

Future value isn’t just about retirement accounts or specific financial goals—it’s a mindset that transforms how you think about money.

Every financial decision has a future value cost. That $5 daily coffee? Over 30 years at 8% returns, it’s $22,800. The $50,000 car instead of the $30,000 car? That’s $86,000 in lost future value over 20 years.

This doesn’t mean you should never spend money on things you enjoy. Life isn’t just about maximizing future value—it’s about balancing present enjoyment with future security.

The key is intentionality. Make conscious choices about what matters to you. If that daily coffee brings genuine joy and connection, it might be worth the future value cost. But if you’re buying it out of habit without thinking, redirecting that money toward investments could dramatically improve your financial future.

Understanding future value empowers you to make these trade-offs consciously rather than accidentally.

Conclusion: Your Future Starts Today

Future value is more than a financial formula—it’s a lens through which to view every financial decision. It quantifies the profound truth that time is your most valuable financial asset and that small, consistent actions compound into life-changing results.

The examples and calculations throughout this article demonstrate that you don’t need to be wealthy to build wealth. You need to be consistent, patient, and informed. Whether you’re 25 or 55, whether you have $100 or $10,000 to invest, the principles remain the same.

Your Next Steps

- Calculate your current trajectory: Use the calculator above to determine where your current savings and investments will take you.

- Define specific goals: Set clear, measurable financial goals with specific future value targets and timelines.

- Create a plan: Determine how much you need to save monthly to reach each goal.

- Start immediately: Open investment accounts if you haven’t already, and set up automatic contributions today.

- Educate yourself: Continue learning about investing, personal finance, and wealth building through trusted resources.

- Monitor and adjust: Review your progress quarterly and adjust your strategy as your life circumstances change.

The most important thing to remember is this: the best time to start investing was yesterday; the second-best time is today. Every day you delay costs you compound growth you can never recover.

Future value isn’t about getting rich quickly; it’s about getting rich slowly and surely through the miracle of compound interest. Start small if you must, but start. Your future self will thank you.

Disclaimer

This article is for educational purposes only and does not constitute financial advice. Investment decisions should be based on your individual circumstances, goals, and risk tolerance. Past performance does not guarantee future results. Consider consulting with a qualified financial advisor before making significant investment decisions. All examples and calculations are for illustrative purposes and assume consistent returns, which do not reflect real-world market volatility.

About the Author

Written by Max Fonji — With over a decade of experience in financial education and investment strategy, Max is your go-to source for clear, data-backed investing education. At TheRichGuyMath.com, Max breaks down complex financial concepts into actionable insights that help everyday people build wealth and achieve financial independence. When not writing about finance, Max enjoys analyzing market trends, studying behavioral economics, and helping readers transform their financial futures through education and empowerment.