Ever wondered how the ultra-wealthy grow their fortunes while most people struggle to beat the market? The answer often lies in exclusive investment vehicles called hedge funds, sophisticated pools of capital that use aggressive strategies most everyday investors never see. These financial powerhouses manage over $4.5 trillion globally, yet remain shrouded in mystery for the average person. Whether you’re curious about alternative investments or simply want to understand how the financial elite play the game, this comprehensive guide will demystify hedge fund and show you exactly how they work.

TL;DR

- Hedge funds are private investment partnerships that use diverse strategies—including leverage, derivatives, and short selling—to generate returns regardless of market conditions

- Minimum investments typically start at $100,000 to $1 million, making them accessible primarily to accredited and institutional investors

- The standard fee structure is “2 and 20”—a 2% annual management fee plus 20% of profits—significantly higher than mutual funds or ETFs

- Hedge funds face lighter regulations than mutual funds, allowing managers greater flexibility but also carrying higher risks

- Performance varies widely: while some hedge funds deliver exceptional returns, many underperform simple index funds after fees

What Is a Hedge Fund?

In simple terms, a hedge fund is a private investment fund that pools capital from wealthy individuals and institutions to invest in a wide range of assets using sophisticated strategies designed to maximize returns.

Unlike traditional mutual funds that typically buy and hold stocks, hedge funds employ aggressive tactics, including short selling (betting against stocks), leverage (borrowing money to amplify returns), derivatives trading, and investments in alternative assets like real estate, commodities, and cryptocurrencies.

The term “hedge” originally referred to strategies that reduced risk by balancing long and short positions. Today, however, many hedge funds focus more on generating absolute returns—meaning they aim to make money whether markets go up or down—rather than simply hedging against losses.

How Hedge Funds Actually Work

The Basic Structure

Hedge funds operate as limited partnerships with a specific organizational structure:

- General Partner (GP): The hedge fund manager who makes investment decisions and typically invests their own money alongside investors

- Limited Partners (LPs): The investors who provide capital but have no say in day-to-day management

- Fund Administrator: Handles accounting, reporting, and compliance

- Prime Broker: Provides financing, securities lending, and trade execution services

This structure allows hedge fund managers to maintain control over investment strategies while limiting investor liability to their contributed capital. CFA Institute – Research and Policy Center on Hedge Fund

Investment Strategies Hedge Funds Use

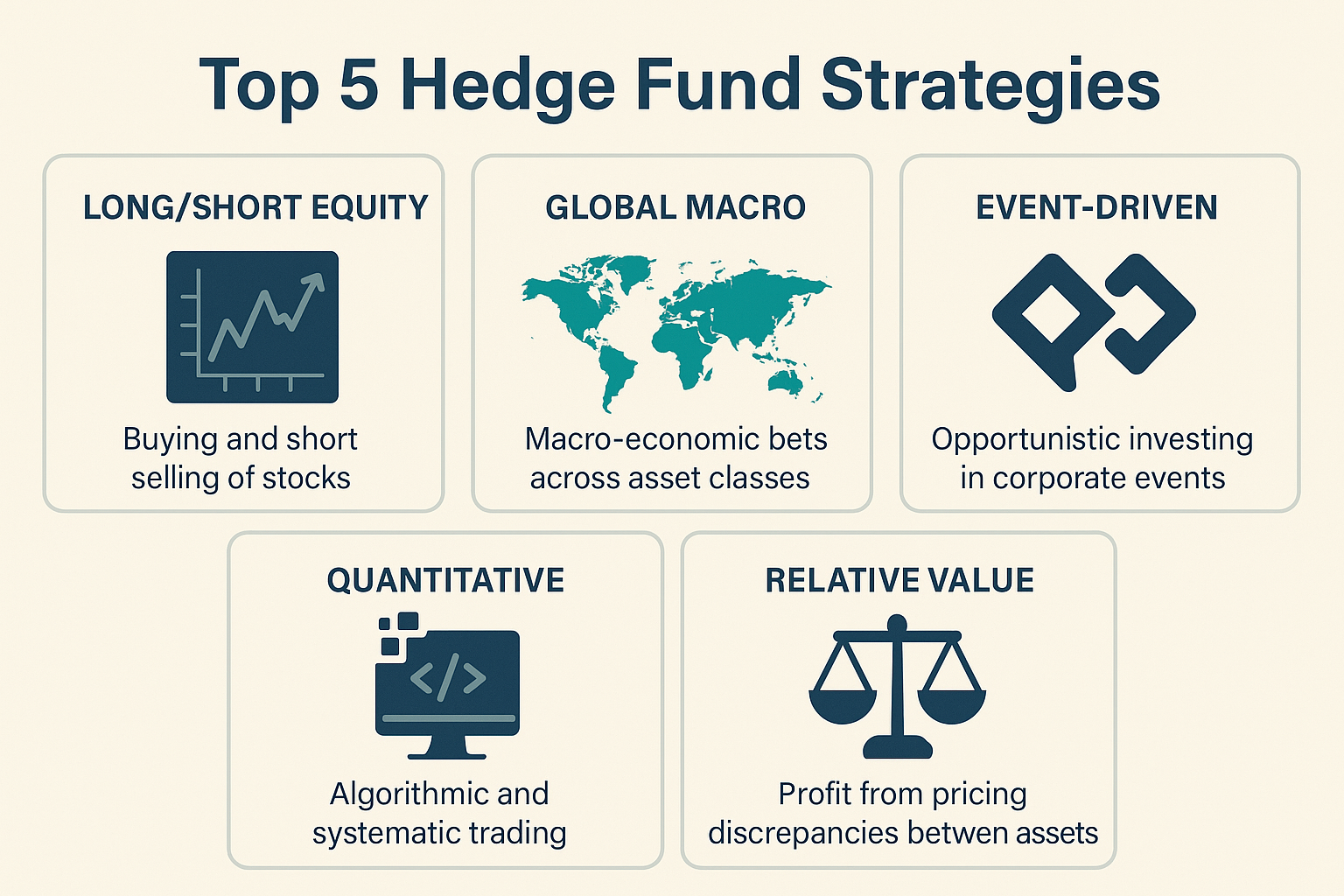

Hedge funds employ dozens of different strategies, but here are the most common:

1. Long/Short Equity

- Buy undervalued stocks (long positions)

- Short overvalued stocks (betting they’ll decline)

- Profit from both rising and falling stocks

- Example: Buying Tesla while shorting traditional automakers

2. Global Macro

- Make bets on economic trends across countries

- Trade currencies, commodities, bonds, and stocks

- Based on macroeconomic analysis and geopolitical events

- Famous example: George Soros betting against the British pound in 1992

3. Event-Driven

- Capitalize on corporate events like mergers, bankruptcies, or restructurings

- Merger arbitrage: Buy target company stock, short acquirer stock

- Distressed debt: Invest in struggling companies’ bonds at deep discounts

4. Quantitative/Algorithmic Trading

- Use mathematical models and computer algorithms

- Execute thousands of trades based on statistical patterns

- Relies on speed, data analysis, and technology

- Also called “quant” funds

5. Relative Value

- Exploit price differences between related securities

- Convertible bond arbitrage

- Fixed-income arbitrage

- Market-neutral strategies

Understanding what moves the stock market helps hedge fund managers identify opportunities across these strategies.

Who Can Invest in Hedge Funds?

Hedge funds aren’t for everyone. In fact, they’re legally restricted to specific types of investors:

Accredited Investors

To qualify as an accredited investor in the United States, you must meet one of these criteria:

- Income: Earn at least $200,000 annually ($300,000 with spouse) for the past two years

- Net Worth: Have a net worth exceeding $1 million (excluding primary residence)

- Professional Credentials: Hold certain financial licenses (Series 7, 65, or 82)

Qualified Purchasers

Some hedge funds require even higher thresholds:

- Individuals with $5 million+ in investments

- Institutions with $25 million+ in investments

Minimum Investment Requirements

| Fund Type | Typical Minimum |

|---|---|

| Small Hedge Funds | $100,000 – $250,000 |

| Established Funds | $500,000 – $1,000,000 |

| Elite/Flagship Funds | $5,000,000 – $10,000,000+ |

| Fund of Hedge Funds | $25,000 – $100,000 |

These high minimums exist because hedge funds limit the number of investors they accept (typically 99-499) and want committed, sophisticated partners rather than retail investors who might panic during volatility. U.S. Securities and Exchange Commission (SEC) – Investor.gov

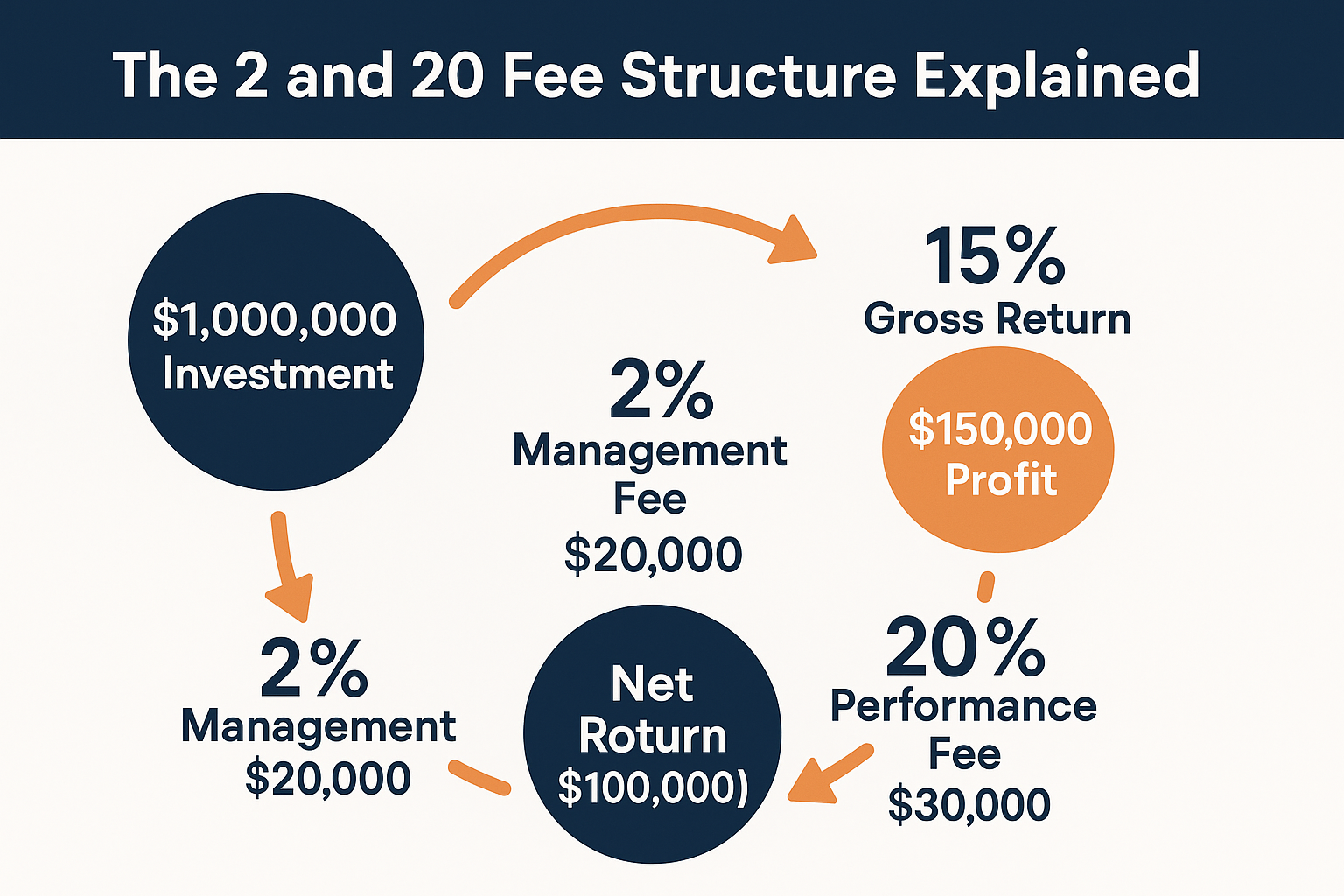

The Hedge Fund Fee Structure: “2 and 20” Explained

Hedge funds are notorious for their expensive fee structures, traditionally known as “2 and 20”:

Management Fee (The “2”)

- 2% of assets under management (AUM) annually

- Charged regardless of performance

- Covers operational expenses, salaries, and research

- Calculated and deducted quarterly or monthly

Performance Fee (The “20”)

- 20% of profits generated above a certain threshold

- Only charged when the fund makes money

- Incentivizes managers to maximize returns

Example Calculation

Let’s say you invest $1,000,000 in a hedge fund that returns 15% in one year:

Management Fee:

- $1,000,000 × 2% = $20,000

Gross Profit:

- $1,000,000 × 15% = $150,000

Performance Fee:

- $150,000 × 20% = $30,000

Total Fees:

- $20,000 + $30,000 = $50,000

Your Net Return:

- $150,000 – $50,000 = $100,000 (10% net return)

Notice how a 15% gross return becomes a 10% net return after fees—a significant difference that compounds over time.

High-Water Marks and Hurdle Rates

Many hedge funds include investor-friendly provisions:

High-Water Mark

- Managers only collect performance fees on new profits

- If the fund loses money, it must recover those losses before earning performance fees again

- Protects investors from paying fees twice on the same gains

Hurdle Rate

- A minimum return threshold before performance fees kick in

- Example: 5% hurdle rate means the fund must return at least 5% before the 20% performance fee applies

- Often tied to risk-free rates (Treasury bills)

Modern Fee Trends

The traditional “2 and 20” model is evolving:

- Average fees have declined to approximately 1.5% and 17%

- Larger institutional investors negotiate lower fees

- Some funds offer tiered structures (lower fees for larger investments)

- Activist investors push for more alignment with investor interests

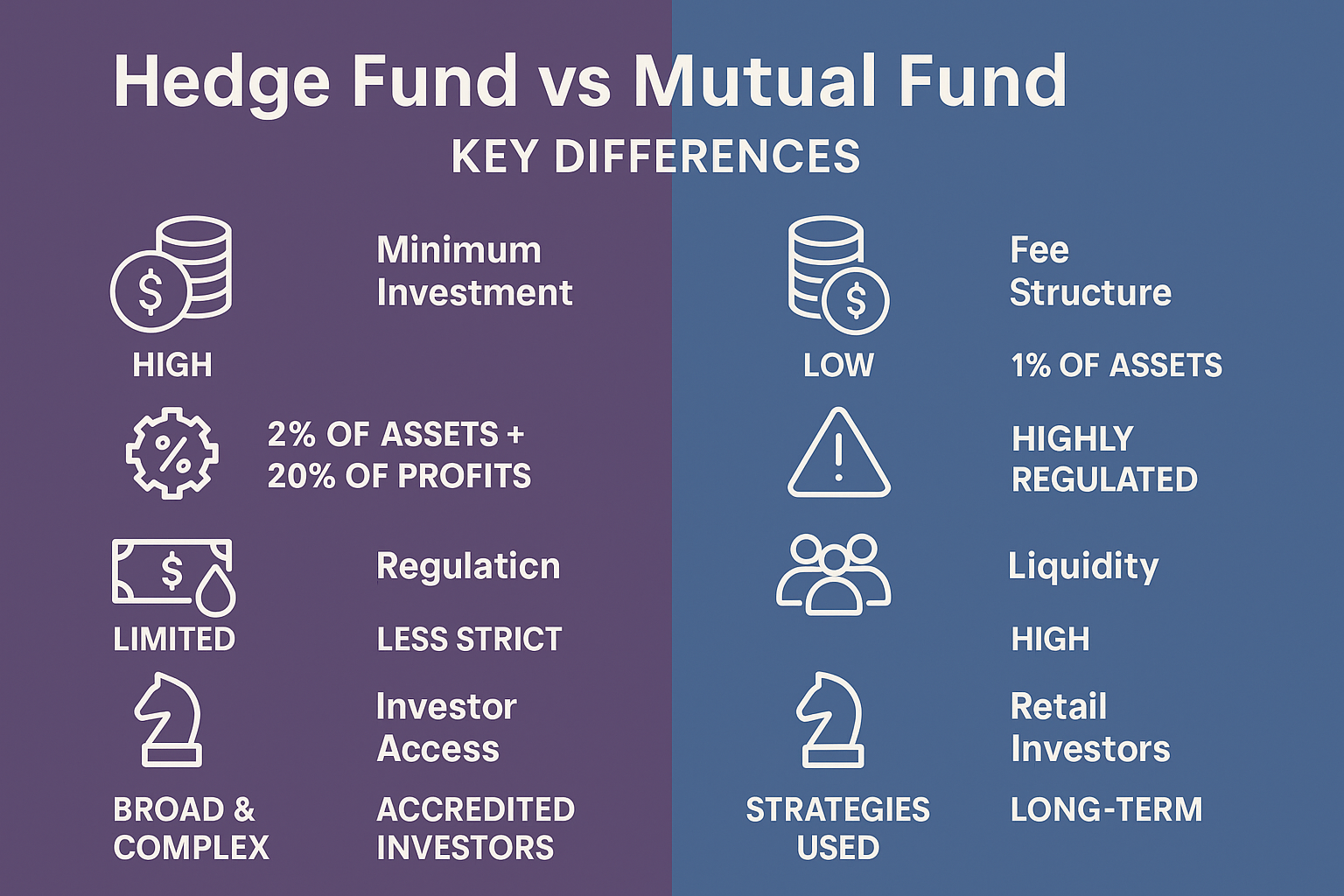

Hedge Funds vs Mutual Funds: Key Differences

| Feature | Hedge Funds | Mutual Funds |

|---|---|---|

| Regulation | Lightly regulated (SEC oversight minimal) | Heavily regulated (SEC Registration Act of 1940) |

| Investor Access | Accredited/qualified investors only | Open to all retail investors |

| Minimum Investment | $100,000 – $1,000,000+ | Often $500 – $3,000 |

| Fee Structure | 1.5-2% + 15-20% performance fee | 0.5-2% expense ratio only |

| Liquidity | Lock-up periods (1-3 years), quarterly redemptions | Daily redemptions |

| Transparency | Limited disclosure | Daily NAV, quarterly holdings reports |

| Investment Strategies | Leverage, short selling, derivatives, alternatives | Primarily long-only stock/bond positions |

| Performance Benchmark | Absolute returns | Relative to index benchmarks |

While stock market investing through mutual funds and ETFs works well for most people, hedge funds offer sophisticated strategies unavailable in traditional vehicles. Federal Reserve – Hedge Fund Monitoring Data

Advantages of Hedge Funds

1. Potential for Superior Returns

Skilled hedge fund managers can generate alpha—returns above what the market delivers—through superior analysis, timing, and strategy execution.

2. Diversification Benefits

Hedge funds provide access to:

- Alternative asset classes (commodities, real estate, private equity)

- Market-neutral strategies are uncorrelated with stocks and bonds

- Global opportunities across currencies and countries

3. Downside Protection

Many hedge fund strategies aim to preserve capital during market downturns:

- Short positions profit when stocks fall

- Hedging strategies reduce portfolio volatility

- Absolute return focus (making money in any environment)

4. Access to Top Investment Talent

Elite hedge fund managers often have:

- Decades of market experience

- Advanced degrees (PhDs in mathematics, physics, economics)

- Proprietary research and analytical tools

- Insider industry networks

5. Flexibility and Innovation

Unlike mutual funds bound by strict regulations, hedge funds can:

- Quickly shift strategies based on market conditions

- Use leverage to amplify returns

- Invest in illiquid or complex securities

- Implement creative, unconventional approaches

Understanding the cycle of market emotions helps hedge fund managers exploit behavioral inefficiencies other investors miss.

Disadvantages and Risks of Hedge Funds

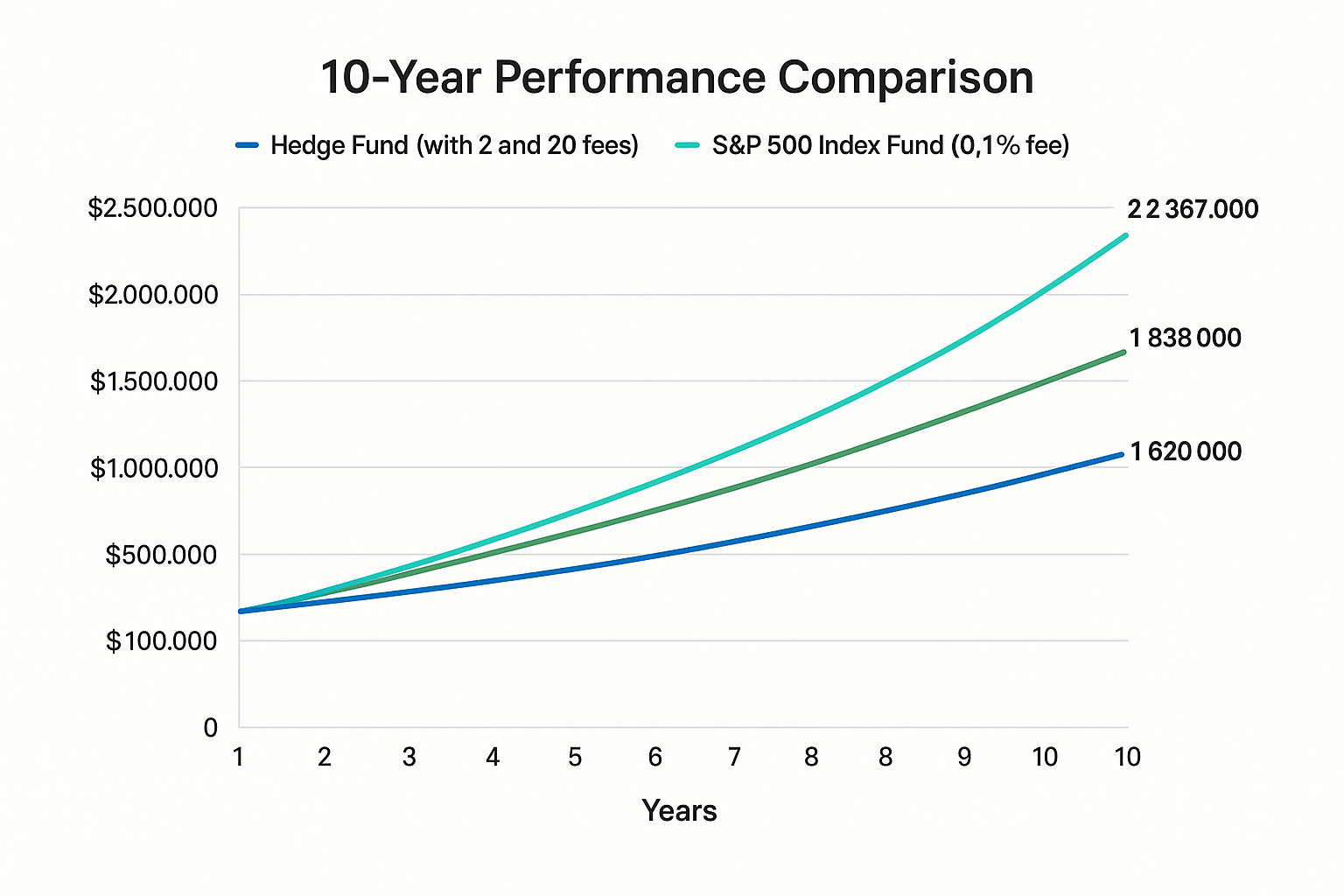

1. Extremely High Fees

The “2 and 20” structure significantly erodes returns:

- A fund must outperform by 2-3% just to match index fund returns

- Fees compound negatively over decades

- Many hedge funds underperform after fees

2. Limited Liquidity

Lock-up periods prevent investors from accessing their money:

- Initial lock-ups: 1-3 years typically

- Redemption windows: Quarterly or annually only

- Gates: Funds can limit withdrawals during stress periods

- This can be devastating if you need emergency cash

3. Lack of Transparency

Hedge funds disclose minimal information:

- Holdings reports are infrequent and delayed

- Strategy details are proprietary secrets

- Investors often don’t know exactly what they own

- Makes due diligence difficult

4. Higher Risk of Total Loss

Aggressive strategies can backfire:

- Leverage amplifies losses as well as gains

- Complex derivatives can blow up

- Concentrated positions create volatility

- Famous blowups: Long-Term Capital Management (1998), Amaranth Advisors (2006)

5. Inconsistent Performance

Research shows:

- Most hedge funds underperform the S&P 500 over 10+ years

- Survivorship bias makes industry returns look better than reality

- Past performance doesn’t predict future results

- Manager skill is extremely difficult to identify in advance

6. Regulatory and Operational Risks

- Less regulatory oversight means more potential for fraud

- Bernie Madoff ran his Ponzi scheme through a hedge fund structure

- Operational failures (poor controls, weak compliance)

- Counterparty risks with prime brokers and derivatives

Many investors lose money because they don’t fully understand these risks, similar to why people lose money in the stock market.

How to Evaluate a Hedge Fund

If you’re considering a hedge fund investment, ask these critical questions:

Performance Metrics

1. Risk-Adjusted Returns

- Sharpe Ratio: Return per unit of risk (higher is better; >1.0 is good)

- Sortino Ratio: Similar to Sharpe, but focuses on downside volatility

- Maximum Drawdown: Largest peak-to-trough decline (lower is better)

2. Consistency

- How many positive years vs. negative years?

- Performance during the 2008 financial crisis, 2020 COVID crash?

- Monthly/quarterly return volatility

3. Comparison to Benchmarks

- How does the fund perform vs. the S&P 500?

- Vs. hedge fund index (HFRI, HFRX)?

- Vs. relevant strategy benchmark?

Manager Due Diligence

Experience and Track Record

- How long has the manager been running money?

- Performance at previous firms?

- Investment philosophy and process?

Alignment of Interests

- How much of the manager’s personal wealth is invested in the fund?

- Significant personal investment aligns incentives

Team Stability

- Turnover among key investment professionals?

- Depth of research and operational teams?

Operational Due Diligence

Fund Structure

- Domicile (Cayman Islands, Delaware, etc.)?

- Legal structure and governance?

- Independent board oversight?

Service Providers

- Reputable auditor (Big Four accounting firm)?

- Established administrator?

- Prime broker relationships?

Compliance and Controls

- Internal compliance function?

- Risk management systems?

- Valuation policies for illiquid assets?

Real-World Hedge Fund Examples

Renaissance Technologies (Medallion Fund)

Strategy: Quantitative/algorithmic trading

Performance: Approximately 66% annualized returns (before fees) from 1988-2018

Secret Sauce: Mathematical models, machine learning, massive data analysis

Access: Closed to outside investors since 1993; employees only

Bridgewater Associates (Pure Alpha Fund)

Strategy: Global macro

Founder: Ray Dalio

AUM: $150+ billion (world’s largest hedge fund)

Philosophy: “Radical transparency” and systematic, rules-based investing

Notable: Successfully navigated the 2008 financial crisis with positive returns

Pershing Square Capital Management

Strategy: Activist investing

Founder: Bill Ackman

Approach: Takes large stakes in companies and pushes for changes

Famous Trades:

- Made $2.6 billion betting against the market in March 2020

- Lost billions on Valeant Pharmaceuticals and JCPenney

Citadel

Founder: Ken Griffin

Strategy: Multi-strategy (equity, fixed income, commodities, quant)

AUM: $60+ billion

Performance: Consistently strong risk-adjusted returns across multiple strategies

These examples show the diversity of hedge fund approaches and the wide variation in outcomes.

Are Hedge Funds Worth It?

For most individual investors, hedge funds are not worth the high fees and restrictions.

When Hedge Funds Make Sense

- You’re an ultra-high-net-worth individual ($10+ million investable assets)

- You want specific exposure to alternative strategies unavailable elsewhere

- You have a long investment horizon and don’t need liquidity

- You’ve maxed out simpler investment options

- You have access to truly elite managers (top quartile performers)

- You understand the risks and can afford potential losses

When to Avoid Hedge Funds

- You’re building wealth and need growth (index funds typically perform better)

- You might need access to your money within 3-5 years

- You can’t afford the minimum investment comfortably

- You’re investing retirement savings (too risky)

- You don’t understand the strategy being employed

- The fees seem excessive relative to the value provided

For most people, a diversified portfolio of low-cost index funds, perhaps combined with some high dividend stocks or passive income strategies, will deliver better long-term results than hedge funds.

Alternatives to Hedge Funds for Regular Investors

You don’t need hedge fund access to employ sophisticated strategies:

1. Liquid Alternative Mutual Funds (“Liquid Alts”)

- Mutual funds that use hedge fund-like strategies

- Daily liquidity and lower minimums ($2,500-$10,000)

- Lower fees than hedge funds (1-2% typically)

- Examples: long/short equity funds, managed futures funds

2. Alternative ETFs

- Exchange-traded funds with alternative strategies

- Trade like stocks with instant liquidity

- Very low fees (0.5-1.5%)

- Examples: inverse ETFs, leveraged ETFs, commodity ETFs

3. Private Real Estate Investment

- Direct ownership of rental properties

- Real estate crowdfunding platforms (Fundrise, RealtyMogul)

- REITs for passive real estate exposure

- Provides diversification and income

4. Interval Funds

- Closed-end funds with periodic redemption windows

- Access to private credit, real estate, and infrastructure

- Lower minimums than hedge funds ($2,500-$25,000)

- More liquidity than traditional hedge funds

5. DIY Hedge Fund Strategies

- Implement your own long/short strategies using margin accounts

- Options trading for hedging and income

- Tactical asset allocation based on market conditions

- Requires education and discipline

Learning about dividend investing can provide a steady income without hedge fund complexity.

The Future of Hedge Funds in 2025 and Beyond

The hedge fund industry faces significant challenges and changes:

Trends Reshaping the Industry

1. Fee Compression

- Institutional investors are demanding lower fees

- Competition from cheaper alternatives

- Performance-based fee structures are gaining popularity

2. Technology and AI

- Machine learning and artificial intelligence are becoming standard

- Quantitative strategies dominating

- Human discretionary managers under pressure

3. Cryptocurrency and Digital Assets

- Dedicated crypto hedge funds are emerging

- Traditional funds adding crypto exposure

- Blockchain technology for fund operations

4. ESG Integration

- Environmental, Social, and Governance factors in investment decisions

- Pressure from institutional investors (pensions, endowments)

- Impact investing alongside returns

5. Democratization

- Lower minimum investments to attract younger investors

- Retail-accessible hedge fund strategies

- Technology platforms are reducing operational costs

6. Consolidation

- Small funds struggling to survive

- Mega-funds getting larger (economies of scale)

- Fewer funds managing more assets

Understanding why the stock market goes up over time helps contextualize hedge fund performance claims.

Common Mistakes to Avoid

1: Chasing Past Performance

Just because a hedge fund delivered 30% last year doesn’t mean it will repeat that performance. Many top performers revert to the mean or even underperform after hot streaks.2: Ignoring Fees

A fund returning 12% gross but charging 4% in total fees nets you only 8%, which you could beat with a simple S&P 500 index fund. Always calculate net returns after all fees.

3: Lack of Due Diligence

Never invest based solely on marketing materials or performance numbers. Conduct thorough operational and investment due diligence, or hire a consultant who can.

4: Overconcentration

Don’t put all your eggs in one hedge fund basket. If you’re investing in hedge funds, diversify across multiple managers and strategies.

5: Misunderstanding Liquidity Terms

Read the fine print on lock-ups, redemption windows, and gates. Make sure you won’t need the money during restricted periods.

6: Assuming “Hedge” Means “Safe”

Despite the name, hedge funds can be extremely risky. They use leverage, derivatives, and concentrated positions that can result in significant losses.

7: Investing Money You Can’t Afford to Lose

Hedge funds should only be a small portion of a well-diversified portfolio, and only if you have substantial assets beyond your hedge fund investments.

Regulatory Environment and Investor Protections

SEC Oversight

Hedge funds operate under different rules than mutual funds:

Registration Requirements

- Funds with <$150 million AUM: Often exempt from SEC registration

- Funds with >$150 million: Must register as investment advisers

- Must file Form ADV with basic information

Exemptions Hedge Funds Use

- Section 3(c)(1): Limits fund to 100 beneficial owners

- Section 3(c)(7): Allows unlimited “qualified purchasers”

- These exemptions avoid the Investment Company Act of 1940 restrictions

Dodd-Frank Act (2010)

- Increased reporting requirements

- Systemic risk monitoring for large funds

- More transparency to regulators (not public)

Investor Protections

Unlike mutual funds, hedge funds offer minimal regulatory protection:

What’s NOT Protected:

- No SEC review of offering documents

- No standardized valuation requirements

- No limits on leverage or concentration

- No daily NAV calculations required

- No SIPC insurance (only covers broker-dealer failures, not investment losses)

What IS Protected:

- Anti-fraud provisions still apply

- Managers have a fiduciary duty to investors

- Criminal penalties for misrepresentation

- Civil lawsuits for breach of contract

This lighter regulatory framework is why hedge funds are restricted to sophisticated investors who can supposedly protect themselves.

How to Get Started (If You Qualify)

Step 1: Verify Your Accreditation Status

- Calculate your net worth (excluding primary residence)

- Review income documentation for the past 2 years

- Consult with a CPA or financial advisor to confirm status

Step 2: Define Your Investment Objectives

- What role should hedge funds play in your portfolio?

- What level of risk can you tolerate?

- What’s your investment time horizon?

- What liquidity needs do you have?

Step 3: Research and Screen Funds

- Use hedge fund databases (Preqin, HFR, Morningstar)

- Attend industry conferences

- Work with placement agents or fund-of-funds

- Review offering documents (PPM – Private Placement Memorandum)

Step 4: Conduct Due Diligence

- Interview fund managers

- Review audited financial statements

- Check manager backgrounds and references

- Analyze performance attribution

- Assess operational infrastructure

Step 5: Start Small

- Make an initial investment at the minimum level

- Monitor performance and communications

- Assess whether the fund meets expectations

- Gradually increase allocation if satisfied

Step 6: Monitor and Rebalance

- Review quarterly reports and letters

- Track performance vs. benchmarks and expectations

- Reassess fit within the overall portfolio

- Be prepared to redeem if circumstances change

Consider working with a financial advisor experienced in alternative investments to guide this process.

💰 Hedge Fund Fee Calculator

Calculate the true cost of hedge fund fees on your investment returns

📊 Long-Term Projection (After 10 Years)

💡 Key Insight: High fees compound negatively over time. Even if a hedge fund delivers strong gross returns, fees can significantly reduce your net wealth accumulation compared to low-cost index funds.

Key Risks to Remember

Before considering hedge fund investment, understand these critical risks:

Market Risk

Even with hedging strategies, hedge funds remain exposed to market downturns. The 2008 financial crisis saw many “market-neutral” funds lose 20-40%.

Liquidity Risk

Lock-up periods and redemption restrictions mean you can’t access your money when you need it. Some funds have “gated” redemptions during crises, trapping investor capital for years.

Manager Risk

Hedge fund performance depends heavily on the manager’s skill. If key personnel leave or lose their edge, performance can deteriorate rapidly.

Leverage Risk

Many hedge funds use borrowed money to amplify returns. While this magnifies gains, it also magnifies losses and can lead to total wipeouts.

Counterparty Risk

Derivative positions and prime broker relationships create dependencies on other institutions. If a counterparty fails (like Lehman Brothers in 2008), it can devastate hedge fund portfolios.

Operational Risk

Weak internal controls, inadequate risk management, or fraud can result in catastrophic losses. Always conduct thorough operational due diligence.

Regulatory Risk

Changes in tax laws, securities regulations, or financial rules can impact hedge fund strategies and profitability.

Making Smart Moves with Your Investment Strategy

Whether or not hedge funds fit your portfolio, the principles of successful investing remain constant:

Diversify broadly across asset classes, geographies, and strategies

Minimize fees whenever possible—they compound negatively over decades

Understand what you own—never invest in strategies you don’t comprehend

Think long-term—wealth compounds over years and decades, not days and weeks

Match risk to goals—your investment strategy should align with your financial objectives and timeline

Stay disciplined—avoid chasing performance or making emotional decisions

For most investors, a simple portfolio of low-cost index funds, supplemented with strategic dividend investments and perhaps some alternative assets, will outperform complex hedge fund strategies over the long run.

Conclusion: Should You Invest in Hedge Funds?

Hedge funds represent a sophisticated corner of the investment world that offers both opportunity and risk. While they provide access to alternative strategies, top-tier managers, and potential for superior returns, they come with high fees, limited liquidity, and significant risks that make them unsuitable for most investors.

The bottom line: Unless you’re an ultra-high-net-worth individual with substantial investable assets ($10+ million), a long time horizon, and access to truly elite managers, you’re likely better served by simpler, lower-cost investment vehicles.

Your Next Steps

If you’re not ready for hedge funds:

- Build a diversified portfolio of low-cost index funds covering stocks and bonds

- Consider adding high-quality dividend stocks for income

- Explore liquid alternative mutual funds or ETFs for diversification

- Focus on tax-efficient investing and minimizing fees

- Continue learning about how the stock market works

If you’re exploring hedge funds:

- Verify your accredited investor status

- Define clear investment objectives and risk tolerance

- Conduct extensive due diligence on managers and strategies

- Start with a small allocation (5-10% of portfolio maximum)

- Work with experienced advisors who understand alternatives

- Monitor performance and fees vigilantly

If you’re building wealth:

- Maximize contributions to tax-advantaged accounts (401k, IRA)

- Pay off high-interest debt before making speculative investments

- Build an emergency fund covering 6-12 months’ expenses

- Focus on increasing your income and savings rate

- Develop multiple streams of passive income

Remember, the best investment strategy is the one you can stick with through market ups and downs. For most people, that means simple, low-cost, diversified portfolios—not complex hedge fund structures.

Understanding hedge funds helps you make informed decisions about where they fit (or don’t fit) in your financial plan. Armed with this knowledge, you can confidently navigate conversations with advisors, evaluate opportunities that come your way, and focus your energy on strategies that truly serve your long-term wealth-building goals.

The path to financial independence isn’t paved with exclusive hedge fund access—it’s built through consistent saving, smart investing, continuous learning, and disciplined execution over decades. Stay focused on what you can control, minimize unnecessary costs, and let compound interest do the heavy lifting.

FAQ: Hedge Fund

A good hedge fund return depends on strategy and market conditions, but generally, 8-12% annualized returns after fees are considered solid performance. Top-tier funds may deliver returns of 15- 20%+, while the average hedge fund historically returns 7-9% annually. Compare returns to relevant benchmarks and risk-adjusted metrics, not just raw percentages.

To calculate hedge fund fees, use this formula:

Management Fee = Assets Under Management × Management Fee %

Performance Fee = (Gross Profits – Management Fee) × Performance Fee %

Total Fees = Management Fee + Performance Fee

Net Return = Gross Return – Total Fees

For example, with $1M invested, 15% gross return, 2% management fee, and 20% performance fee: Management = $20,000, Performance = ($150,000 – $20,000) × 20% = $26,000, Total = $46,000.

Regular investors generally cannot invest in hedge funds due to SEC regulations requiring investors to be “accredited” (earning $200,000+ annually or having $1M+ net worth excluding primary residence) or “qualified purchasers” ($5M+ in investments). Some platforms now offer access to hedge fund-like strategies through liquid alternative funds with lower minimums.

The key differences are:

Regulation: Mutual funds are heavily regulated; hedge funds operate with minimal oversight

Access: Mutual funds are open to all investors; hedge funds are only open to accredited investors

Strategies: Mutual funds typically use long-only approaches; hedge funds use leverage, short selling, and derivatives

Fees: Mutual funds charge 0.5-2% expense ratios; hedge funds charge 1.5-2% + 15-20% performance fees

Liquidity: Mutual funds offer daily redemptions; hedge funds have lock-up periods

Hedge funds impose lock-up periods (typically 1-3 years) for several reasons:

Strategy implementation: Some strategies require time to develop and realize value

Liquidity management: Prevents forced selling of illiquid positions during redemptions

Capital stability: Ensures managers have committed capital to execute long-term plans

Investor alignment: Discourages short-term speculation and encourages patient capital

No, hedge funds are not inherently safer than stocks. While some hedge funds use hedging strategies to reduce volatility, many employ leverage and complex derivatives that increase risk. The term “hedge” refers to their original purpose of hedging market risk, but modern hedge funds often take aggressive positions. Individual stock diversification through index funds is typically safer for most investors.

To invest in a hedge fund, you typically need $100,000 to $1,000,000. To start a hedge fund as a manager, you need:

Seed capital: $5-10 million minimum (preferably $25M+)

Operating capital: $500,000-$1,000,000 for legal, compliance, technology, and operations

Track record: Documented investment performance history

Credentials: CFA, MBA, or relevant experience

Legal structure: Attorney fees for fund formation ($50,000-$150,000)

Most hedge funds do not outperform the S&P 500 over long periods, especially after fees. According to multiple studies:

Over 10 years (2010-2020), the S&P 500 returned approximately 13.9% annually

The average hedge fund returned approximately 7.2% annually

Only about 15-20% of hedge funds consistently beat the S&P 500 after fees

However, the best hedge funds significantly outperform, and some strategies (market-neutral, absolute return) aren’t designed to beat the S&P but to provide uncorrelated returns.

Disclaimer

This article is for educational purposes only and does not constitute financial, investment, tax, or legal advice. Hedge fund investing involves substantial risks, including the potential loss of principal. Past performance does not guarantee future results.

Before making any investment decisions, consult with qualified financial, tax, and legal professionals who understand your specific situation. The information presented here is based on publicly available sources and general industry knowledge as of 2025. Regulations, fee structures, and market conditions change over time.

Always conduct thorough due diligence before investing in any hedge fund or alternative investment vehicle. Read all offering documents carefully and ensure you fully understand the risks, fees, liquidity terms, and investment strategies involved.

About the Author

Written by Max Fonji — With over a decade of experience in financial markets and investment education, Max is dedicated to making complex financial concepts accessible to everyday investors. As the founder of TheRichGuyMath.com, Max provides clear, data-backed insights that empower readers to make informed investment decisions and build lasting wealth.

Max’s mission is simple: demystify finance, eliminate jargon, and give you the knowledge to take control of your financial future—whether that involves hedge funds, index funds, or any strategy in between.