Credit cards are one of the most powerful financial tools available in 2026, but only when you understand the math behind money. How credit cards work is a question every beginner should master before swiping their first card.

This guide breaks down exactly how credit cards function, from the moment you purchase to how interest compounds on unpaid balances. You’ll learn the mechanics of billing cycles, the true cost of minimum payments, and how to use credit responsibly to build wealth instead of debt. This article is part of our Credit Cards basics.

Whether you’re considering your first card or trying to understand why your balance keeps growing, this step-by-step explanation provides the data-driven insights you need to make informed decisions.

Key Takeaways

- Credit cards provide revolving credit—you borrow money with each purchase and repay it monthly, unlike debit cards, which withdraw from your bank account immediately

- Interest only applies when you carry a balance—paying your full statement balance by the due date means zero interest charges

- The billing cycle determines your payment timeline—understanding statement dates, due dates, and grace periods prevents costly mistakes

- Minimum payments create compound debt—paying only the minimum extends repayment for years and costs hundreds or thousands in interest

- Credit utilization affects your credit score—keeping balances below 30% of your credit limit demonstrates responsible usage and improves creditworthiness

What Is A Credit Card?

A credit card is a financial instrument that provides revolving credit, a pre-approved borrowing limit you can use repeatedly as long as you repay what you borrow.

When you use a credit card, you’re not spending your own money. You’re borrowing from the card issuer (typically a bank) with the agreement to repay the borrowed amount either immediately or over time with interest.

This differs fundamentally from a debit card, which withdraws money directly from your checking account. With credit cards, the issuer pays the merchant on your behalf, creating a debt you owe to the card company.

Example scenario: You buy groceries for $100 with a credit card. The card issuer pays the grocery store $100 immediately. You now owe the issuer $100, which appears on your next statement. If you pay the full $100 by the due date, you pay no interest. If you pay only $25 (the minimum), the remaining $75 accrues interest charges.

The key concept is revolving credit—as you repay your balance, that credit becomes available to use again. Unlike a traditional loan with fixed payments, credit cards allow flexible borrowing up to your credit limit.

This flexibility makes credit cards powerful for building a credit score and managing cash flow—but also dangerous when misunderstood.

How Credit Cards Work Step By Step

Understanding how credit cards work requires breaking down the complete cycle from purchase to payment. Here’s the exact sequence that occurs every time you use credit.

Step 1 — Making a Purchase

When you swipe, insert, or tap your credit card, several things happen in seconds:

The merchant’s payment terminal sends your card information to the card network (Visa, Mastercard, American Express, or Discover). The network contacts your card issuer to verify you have available credit and the transaction isn’t fraudulent.

If approved, the issuer authorizes the charge and reduces your available credit by the purchase amount. The merchant receives payment from the issuer, and you receive your goods or services.

Important: You haven’t paid anything yet. The issuer has paid on your behalf, creating a debt you’ll see on your next statement.

Step 2 — Billing Cycle

Every credit card operates on a billing cycle, typically 28-31 days, during which all your purchases accumulate.

Your billing cycle has a start date and an end date (the statement closing date). Every transaction made during this period appears on one statement.

For example, if your billing cycle runs from January 1 to January 31, all purchases made during those 31 days appear on your January statement, generated on February 1.

The billing cycle is critical because it determines when charges appear and when payment is due. Purchases made on January 31 and February 1 appear on different statements, affecting when you must pay them.

Step 3 — Statement Balance

At the end of your billing cycle, your issuer generates a statement showing:

- Statement balance: Total amount you owe for all purchases, fees, and interest from the billing cycle

- Minimum payment due: The smallest amount you can pay to avoid late fees (typically 1-3% of the balance)

- Payment due date: The deadline to make your payment (usually 21-25 days after the statement date)

- Available credit: Your credit limit minus your current balance

The statement balance is the most important number. Paying this amount in full by the due date means you pay zero interest on purchases made during that billing cycle.

Example: Your statement shows a $1,200 balance from January purchases. If you pay the full $1,200 by the February 25 due date, you pay no interest. If you pay only the $36 minimum, interest begins accruing on the remaining $1,164.

Step 4 — Minimum Payment

The minimum payment is the smallest amount your issuer will accept to keep your account in good standing.

Minimum payments typically equal 1-3% of your statement balance or $25-$35, whichever is greater. Some issuers calculate minimums as interest charges plus 1% of the principal balance.

Critical insight: Paying only the minimum payment is mathematically devastating. Interest compounds on the remaining balance, extending repayment for years and multiplying your total cost.

Example calculation: A $5,000 balance at 20% APR with a 2% minimum payment ($100 initially) takes 30 years to pay off and costs $9,332 in interest—nearly triple the original amount.[1]

The minimum payment trap is how credit card debt becomes a wealth-destroying cycle. The math behind money shows that minimum payments primarily cover interest, barely reducing principal.

Step 5 — Interest (APR)

If you don’t pay your full statement balance by the due date, interest charges begin on the remaining balance.

Credit card interest is expressed as an Annual Percentage Rate (APR) but calculated daily. The issuer divides your APR by 365 to get a daily periodic rate, then applies this rate to your average daily balance.

Interest formula:

Daily Periodic Rate = APR ÷ 365

Daily Interest Charge = Balance × Daily Periodic Rate

Monthly Interest = Daily Interest × Days in Billing CycleExample: You carry a $1,000 balance with a 20% APR:

- Daily periodic rate: 20% ÷ 365 = 0.0548% per day

- Daily interest: $1,000 × 0.000548 = $0.548

- Monthly interest (30 days): $0.548 × 30 = $16.44

This $16.44 gets added to your balance, and next month’s interest is calculated on $1,016.44—this is compound interest working against you instead of for you.

Understanding APY vs APR helps clarify how interest compounds. Unlike savings accounts, where compound interest builds wealth, credit card interest destroys it.

Credit Card Billing Cycle Explained

The billing cycle is the foundation of how credit cards work and determines your entire payment timeline.

Every credit card account operates on a recurring cycle—typically 28, 30, or 31 days—that repeats monthly. Understanding three key dates within this cycle prevents late payments and unnecessary interest charges.

Statement Closing Date

This is the last day of your billing cycle. All transactions made through this date appear on your statement. Purchases made the day after this date appear on next month’s statement.

The statement closing date triggers your statement generation. Your issuer calculates your total balance, minimum payment, and due date, then sends your statement (electronically or by mail).

Strategic insight: Making large purchases right after your statement closes gives you the longest interest-free period, up to 51-55 days before payment is due.

Payment Due Date

Your payment must be received by this date to avoid late fees and maintain your grace period. Due dates typically fall 21-25 days after the statement closing date, as required by federal law.[2]

Missing this deadline triggers:

- Late payment fee ($25-$40)

- Potential APR increase to penalty rates (up to 29.99%)

- Negative impact on your credit score

- Loss of grace period on new purchases

Critical rule: Set up autopay for at least the minimum payment to never miss this deadline. You can always pay more manually, but autopay prevents costly mistakes.

Grace Period

The grace period is the interest-free window between your statement closing date and payment due date—typically 21-25 days.

During this period, you owe the statement balance but pay no interest on purchases if you pay the full balance by the due date.

Important condition: Grace periods only apply if you paid your previous statement balance in full. If you carry a balance from month to month, you lose the grace period, and new purchases begin accruing interest immediately.

| Term | Definition | Example |

|---|---|---|

| Billing Cycle | Period when transactions accumulate | January 1-31 (31 days) |

| Statement Closing Date | Last day of billing cycle | January 31 |

| Statement Generation | When your bill is created | February 1 |

| Payment Due Date | Deadline for payment | February 25 |

| Grace Period | Interest-free days | February 1-25 (25 days) |

Understanding your billing cycle allows strategic timing of purchases and payments. The math behind money shows that maximizing your grace period provides free short-term financing, but only when you pay in full.

What Is APR And How Interest Works

APR (Annual Percentage Rate) represents the yearly cost of borrowing on your credit card, but the actual interest calculation happens daily.

Most credit cards in 2026 carry APRs between 16% and 25% for standard purchases, with penalty APRs reaching 29.99% for late payments.[3] These rates are variable, meaning they fluctuate with the Federal Reserve’s benchmark interest rate.

Daily Interest Calculation

Credit card issuers calculate interest daily using your average daily balance and daily periodic rate.

Step-by-step calculation:

- Convert APR to daily rate: Divide your APR by 365

- Example: 20% APR ÷ 365 = 0.0548% daily rate

- Calculate average daily balance: Add each day’s balance during the billing cycle and divide by the number of days in the cycle

- Example: If your balance was $1,000 for 15 days and $1,500 for 15 days: ($1,000 × 15 + $1,500 × 15) ÷ 30 = $1,250 average

- Apply daily rate to average balance: Multiply average daily balance by daily rate by days in cycle

- Example: $1,250 × 0.000548 × 30 = $20.55 in interest charges

This $20.55 gets added to your next statement balance, where it begins accruing its own interest, compound interest working against you.

When Interest Applies

Interest charges depend on whether you carry a balance:

Scenario 1 — Pay statement balance in full:

- No interest on purchases from that billing cycle

- Grace period remains intact for next month

- Only annual fees apply (if any)

Scenario 2 — Pay less than the full balance:

- Interest accrues on the remaining balance immediately

- New purchases begin accruing interest from the transaction date (no grace period)

- Interest compounds daily on the growing balance

Scenario 3 — Cash advances:

- Interest begins immediately (no grace period)

- Higher APR applies (typically 25-30%)

- Additional cash advance fee (3-5% of the amount)

The mathematical impact is severe. A $5,000 balance at 20% APR costs $1,000 per year in interest if you only make minimum payments—that’s $1,000 that could have been invested for compound growth.

Takeaway: The only way to avoid interest entirely is to pay your full statement balance by the due date every month. Any other payment strategy costs you money through compound interest.

For a deeper understanding of how APR affects your finances, read our detailed guide on Credit Card APY Explained.

Credit Limit Explained

Your credit limit is the maximum amount your card issuer allows you to borrow at any time. This limit is not arbitrary; it’s based on your creditworthiness and financial profile.

What Sets Your Credit Limit

Card issuers evaluate several factors when assigning your initial credit limit:

Income: Higher income suggests greater ability to repay, resulting in higher limits. Issuers typically want your credit limit to be a manageable percentage of your annual income.

Credit score: Higher scores indicate responsible credit management, earning higher limits. Scores above 750 typically qualify for premium limits ($10,000+), while scores below 650 may receive limits under $1,000.

Credit history: Longer credit history with on-time payments demonstrates reliability. New credit users typically start with lower limits ($500-$2,000) that increase over time.

Existing debt: High debt-to-income ratios signal risk, resulting in lower limits. Issuers want to ensure you can handle additional credit obligations.

Employment status: Stable employment provides confidence in your ability to make payments.

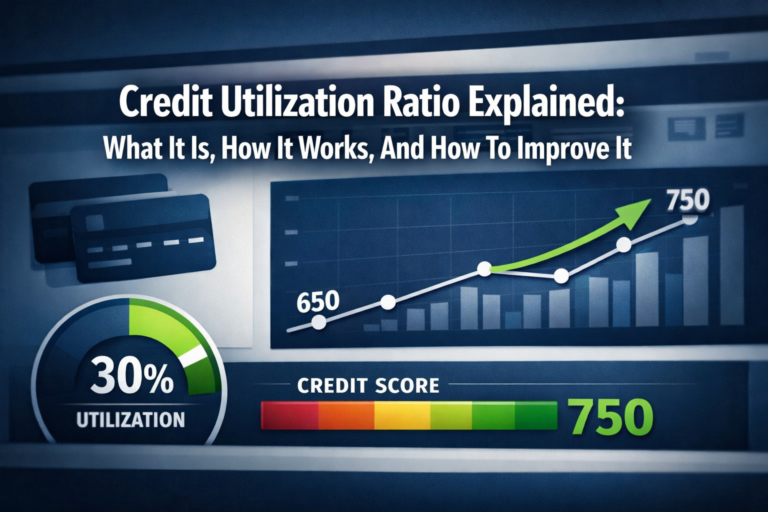

Credit Utilization Ratio

Your credit utilization ratio, the percentage of available credit you’re using, is the second most important factor in your credit score after payment history.

Formula:

Credit Utilization = (Total Balances ÷ Total Credit Limits) × 100Example: You have two cards:

- Card A: $3,000 balance on $10,000 limit

- Card B: $1,000 balance on $5,000 limit

- Total: $4,000 balance on $15,000 total limits

- Utilization: ($4,000 ÷ $15,000) × 100 = 26.7%

Optimal utilization: Keep utilization below 30% on individual cards and across all cards. Below 10% is ideal for maximizing your credit score.

Why it matters: High utilization signals financial stress to lenders, even if you pay on time. A maxed-out card hurts your score significantly, while low utilization demonstrates responsible credit management.

Your credit limit directly impacts your ability to maintain low utilization. A $10,000 limit with $2,000 spending (20% utilization) looks better than a $3,000 limit with the same $2,000 spending (67% utilization).

Strategic approach: Request credit limit increases annually once you’ve demonstrated responsible usage. Higher limits make maintaining low utilization easier, improving your credit score over time.

For a comprehensive understanding of how utilization affects your credit, read our guide on credit utilization.

Rewards, Cash Back, And Points (Overview)

Many credit cards offer rewards programs that return a percentage of your spending as cash back, points, or travel miles. These programs can provide significant value—but only when used strategically.

Types of Rewards

Cash back cards return 1-5% of purchases as statement credits or deposits. Flat-rate cards offer the same percentage on all purchases (typically 1.5-2%), while category cards offer higher rates (3-5%) on specific spending like groceries, gas, or dining.

Points cards award points per dollar spent, redeemable for travel, merchandise, or statement credits. Points are typically valued at 1-2 cents each, though transfer partners can increase value.

Travel cards provide miles for airline tickets or hotel stays, often with premium benefits like airport lounge access, travel insurance, and no foreign transaction fees.

The Math Behind Rewards

Rewards seem appealing, but the math only works if you pay your full balance monthly.

Example calculation:

- Spend $1,000 monthly on a 2% cash back card

- Earn $20 monthly in rewards ($240 annually)

- Carry a $1,000 balance at 20% APR

- Pay $200 annually in interest

- Net result: Lose $160 despite “earning” rewards

Critical insight: Interest charges always exceed reward earnings. A 20% APR costs 10-20 times more than typical rewards rates (1-2%).

Rewards programs benefit the disciplined user who pays in full monthly. For anyone carrying balances, rewards are a marketing illusion that masks the true cost of debt.

Takeaway: Focus on avoiding interest before optimizing rewards. The real benefit of credit cards isn’t rewards—it’s building credit history and managing cash flow without paying interest.

For those ready to maximize rewards responsibly, understanding different card types helps optimize value. But remember: the best “reward” is zero interest charges.

Types Of Credit Cards

Credit cards come in several categories, each designed for different financial situations and goals. Understanding these types helps you choose the right card for building financial literacy.

Secured Credit Cards

Secured cards require a cash deposit (typically $200-$500) that becomes your credit limit. The deposit protects the issuer if you default, making these cards accessible to those with no credit history or poor credit.

How they work: You deposit $300, receive a $300 credit limit, and use the card normally. Your deposit remains untouched unless you default. After 6-12 months of on-time payments, many issuers upgrade you to an unsecured card and return your deposit.

Best for: First-time credit users, rebuilding damaged credit, and establishing credit history.

Unsecured Credit Cards

Unsecured cards don’t require a deposit. Your credit limit is based on your creditworthiness, and you’re approved based on income, credit score, and credit history.

These are standard credit cards that most consumers use. They offer higher limits, better rewards, and more benefits than secured cards—but require good credit for approval.

Best for: Those with established credit (scores above 650), regular credit users seeking rewards or benefits.

Student Credit Cards

Designed for college students with limited credit history, these cards feature lower credit limits ($500-$1,000), fewer fees, and basic rewards programs.

Issuers are more lenient with approval requirements, understanding that students lack extensive credit history. Many offer incentives for good grades or responsible usage.

Best for: College students building their first credit history, learning responsible credit management.

Rewards Credit Cards

These cards offer cash back, points, or miles on purchases. They typically require good to excellent credit (scores above 700) and may charge annual fees for premium benefits.

Rewards cards work best for disciplined users who pay balances in full monthly and can maximize category bonuses through strategic spending.

Best for: Responsible credit users with good credit, those who can maximize category bonuses, and travelers seeking airline miles or hotel points.

Balance Transfer Cards

Balance transfer cards offer 0% APR promotional periods (12-21 months) on balances transferred from other cards, allowing you to pay down debt without accruing interest.

Most charge a balance transfer fee (3-5% of the transferred amount), but the interest savings can be substantial if you pay off the balance during the promotional period.

Best for: Those with existing credit card debt, disciplined users with a payoff plan, and those consolidating multiple high-interest balances.

Warning: Balance transfer cards are debt management tools, not solutions. Without a clear payoff strategy and budget, they simply delay the problem.

Common Beginner Mistakes

Understanding how credit cards work theoretically differs from using them effectively. These mistakes cost beginners thousands in interest charges and damage credit scores.

Carrying Balances Month to Month

The mistake: Believing that carrying a small balance “builds credit” or is acceptable because you’re making payments.

The reality: Carrying any balance costs you compound interest. Credit scores improve through on-time payments and low utilization, not by paying interest.

The cost: A $2,000 balance at 20% APR costs $400 annually in interest, money that could have been invested for compound growth instead.

The fix: Pay your full statement balance every month. If you can’t afford to pay in full, you can’t afford the purchase.

Paying Only the Minimum

The mistake: Making only the minimum payment because it keeps your account current.

The reality: Minimum payments primarily cover interest, barely reducing principal. A $5,000 balance takes 30+ years to pay off with minimum payments, costing 2-3 times the original amount.

The math: On a $5,000 balance at 20% APR with a 2% minimum payment:

- Monthly payment starts at $100

- Total interest paid: $9,332

- Time to payoff: 30 years

The fix: Always pay more than the minimum. Even $50 extra monthly dramatically reduces payoff time and total interest.

Maxing Out Credit Limits

The mistake: Using your entire credit limit because “that’s what it’s there for.”

The reality: High utilization (above 30%) damages your credit score significantly, even if you pay on time. Maxed-out cards signal financial distress to lenders.

The impact: A maxed $5,000 card (100% utilization) can drop your credit score 50-100 points. The same $5,000 limit with a $1,000 balance (20% utilization) maintains or improves your score.

The fix: Keep balances below 30% of your limit at all times. Below 10% is optimal. Request credit limit increases to make this easier.

Missing Payment Due Dates

The mistake: Forgetting or delaying payments, assuming a day or two late doesn’t matter.

The reality: Even one day late triggers fees ($25-$40), potential APR increases to penalty rates (29.99%), and negative marks on your credit report.

The cost: One missed payment can:

- Drop your credit score by 60-110 points

- Increase your APR to 29.99%

- Remain on your credit report for 7 years

The fix: Set up autopay for at least the minimum payment immediately. Use calendar reminders for manual payments. Never rely on memory alone.

Applying for Too Many Cards

The mistake: Applying for multiple cards quickly to maximize rewards or credit limits.

The reality: Each application triggers a hard inquiry that temporarily lowers your credit score by 5-10 points. Multiple inquiries suggest financial desperation to lenders.

The impact: Five applications in six months can drop your score 25-50 points and result in denials as issuers see you as high-risk.

The fix: Apply for credit strategically, spacing applications 3-6 months apart. Focus on building history with existing cards before seeking new ones.

Takeaway: Credit card mistakes compound over time. The math behind money shows that small errors, a missed payment, a maxed card, paying only minimums, create exponentially larger problems through compound interest and credit damage.

How To Use Credit Cards Responsibly

Responsible credit card usage transforms these tools from debt traps into wealth-building instruments. Follow this evidence-based framework for mastering credit.

Pay Your Full Statement Balance Monthly

This is the single most important rule. Paying your full statement balance by the due date means:

- Zero interest charges on purchases

- Maintained the grace period for next month

- Positive payment history builds your credit score

- No compound debt accumulation

Implementation: Treat your credit card like a debit card, only charge what you can pay off immediately. Your available balance in checking should always exceed your credit card balance.

Track All Spending

Credit cards make spending feel abstract because you’re not handing over cash or seeing your bank balance decrease immediately.

The solution: Review transactions weekly through your issuer’s app or website. Compare spending against your budget categories to ensure you’re not overspending.

Tool recommendation: Use your card issuer’s spending categorization features or link your card to budgeting apps that track spending automatically.

Psychological insight: The pain of payment is delayed with credit cards, making overspending easy. Active tracking restores awareness and prevents budget violations.

Enable Autopay for at Least the Minimum

Autopay prevents the single most costly mistake: missed payments.

Set up strategy:

- Set autopay for the full statement balance if you consistently pay in full

- Set autopay for the minimum payment as a backup, then pay manually for the full amount

- Link autopay to a checking account with sufficient funds

Verification: Check that autopay processes correctly for the first 2-3 months. Confirm the payment date falls 2-3 days before your due date to account for processing time.

Understanding autopay mechanics prevents the assumption that “it’s handled” when technical issues occur.

Keep Utilization Below 30%

Credit utilization—your balance divided by your credit limit—should remain below 30% on each card and across all cards.

Calculation example:

- Credit limit: $5,000

- Target maximum balance: $1,500 (30%)

- Optimal balance: $500 (10%)

Strategy for high spenders: If you regularly spend more than 30% of your limit, either:

- Request a credit limit increase to lower your utilization percentage

- Make multiple payments throughout the month to keep the reported balance low

- Use multiple cards to distribute spending

Timing insight: Card issuers typically report your balance to credit bureaus on your statement closing date. Making a payment before this date lowers your reported utilization even if you pay the full balance later.

Request Credit Limit Increases Annually

Higher credit limits make maintaining low utilization easier and improve your credit profile.

When to request: After 6-12 months of on-time payments and responsible usage, contact your issuer to request an increase.

How to request: Call the number on your card or use the online request feature. Provide updated income information if it has increased.

Expected outcome: Issuers often approve increases of 10-25% without a hard credit inquiry if you’ve demonstrated responsible usage.

Caution: A higher limit does not mean permission to spend more. It’s a tool for maintaining lower utilization on your existing spending.

Monitor Your Credit Report

Review your credit report from all three bureaus (Equifax, Experian, TransUnion) at least annually to verify accuracy and track progress.

Free access: AnnualCreditReport.com provides free reports from all three bureaus annually, as required by federal law.

What to check:

- Payment history accuracy

- Credit limits reported correctly

- No unauthorized accounts or inquiries

- Utilization percentages

Action on errors: Dispute any inaccuracies immediately through the bureau’s website. Errors can suppress your score by 20-50 points.

Understanding your credit score components helps you optimize behavior for maximum improvement.

Use Cards for Budgeted Purchases Only

Credit cards should fund planned expenses, not enable lifestyle inflation or impulse purchases.

Framework: Before any purchase, ask:

- Is this in my budget?

- Can I pay this off in full next month?

- Would I make this purchase with cash?

If the answer to any question is no, don’t charge it.

Budgeting integration: Consider using the 50/30/20 rule to ensure your spending aligns with your financial goals. Credit cards should facilitate your budget, not undermine it.

Takeaway: Responsible credit card usage requires discipline, awareness, and systematic processes. The math behind money shows that these habits compound positively—building credit, avoiding interest, and creating financial flexibility—while poor habits compound negatively through debt and credit damage.

Interactive Credit Card Payment Calculator

💳 Credit Card Payment Calculator

See the true cost of minimum payments vs. paying in full

Conclusion: Mastering How Credit Cards Work

Understanding how credit cards work transforms them from confusing financial products into powerful tools for building credit and managing cash flow.

The key insights are mathematical and behavioral:

Mathematical reality: Credit cards provide interest-free borrowing if you pay your full statement balance by the due date. Any other payment strategy costs you through compound interest that multiplies your debt exponentially.

Behavioral reality: Credit cards make spending feel abstract, encouraging overspending. Systematic processes—tracking spending, enabling autopay, and monitoring utilization—counteract this psychological effect.

Strategic reality: Credit cards build your financial foundation through credit history and credit scores, which determine your access to mortgages, auto loans, and other wealth-building opportunities.

The math behind money shows that small decisions compound over time. Paying your balance in full monthly, keeping utilization low, and never missing payments creates a positive compound effect—building credit, avoiding interest, and creating financial flexibility.

Conversely, carrying balances, making minimum payments, and maxing out limits creates a negative compound effect—accumulating debt, paying thousands in interest, and damaging your credit score.

Next steps:

- Review your current credit card statements and identify your utilization percentage

- Set up autopay for at least the minimum payment on all cards

- Create a spending tracking system to monitor purchases weekly

- Commit to paying your full statement balance next month

- Request credit limit increases if you’ve demonstrated responsible usage for 6+ months

Related Guides

Master credit card fundamentals:

- Credit Utilization Guide — Learn how utilization affects your credit score and strategies to optimize it

- Credit Score — Understand the five factors that determine your score and how to maximize it

- Billing Cycle — Deep dive into billing cycle mechanics and strategic timing

Build financial literacy:

- 50/30/20 Rule Budgeting — Create a sustainable budget that prevents overspending

- Financial Literacy Hub — Comprehensive resources for building financial knowledge

- Budget — Essential budgeting principles and frameworks

Disclaimer

This article provides educational information about how credit cards work and should not be considered financial advice. Credit card terms, interest rates, fees, and features vary by issuer and individual creditworthiness.

Before applying for or using credit cards, carefully review the terms and conditions provided by the card issuer, including APR, fees, rewards programs, and payment requirements. Your individual financial situation, credit history, and spending habits should guide your credit card decisions.

Interest calculations in this article are simplified examples for educational purposes. Actual interest charges may vary based on your card’s specific terms, billing cycle, payment timing, and balance calculation method.

While this guide emphasizes responsible credit card usage, credit cards involve borrowing and carry risks, including debt accumulation, interest charges, and potential credit score damage if mismanaged. Only use credit cards if you can commit to paying your full statement balance monthly.

The Rich Guy Math provides financial education and analysis but does not offer personalized financial advice. Consult with a qualified financial advisor for guidance specific to your situation.

Author Bio

Max Fonji is the founder of The Rich Guy Math, a data-driven financial education platform that explains the math behind money with precision and authority. With a background in financial analysis and a commitment to evidence-based investing principles, Max breaks down complex financial concepts into clear, actionable insights.

Max’s approach combines analytical rigor with educational clarity, helping readers understand not just what to do with money, but why financial strategies work through mathematical principles and data. His work focuses on compound growth, valuation principles, risk management, and building financial literacy through numbers, logic, and evidence.

At The Rich Guy Math, Max teaches the cause-and-effect relationships that drive wealth building, empowering readers to make informed financial decisions based on understanding rather than emotion or marketing.

References

[1] Federal Reserve. (2023). “Consumer Credit – G.19.” Board of Governors of the Federal Reserve System. https://www.federalreserve.gov/releases/g19/current/

[2] Consumer Financial Protection Bureau. (2024). “Credit Card Agreement Database.” CFPB. https://www.consumerfinance.gov/credit-cards/agreements/

[3] Federal Reserve Bank of St. Louis. (2026). “Commercial Bank Interest Rate on Credit Card Plans, All Accounts.” FRED Economic Data. https://fred.stlouisfed.org/series/TERMCBCCALLNS

[4] FICO. (2024). “What’s in my FICO Scores?” myFICO. https://www.myfico.com/credit-education/whats-in-your-credit-score

Frequently Asked Questions (FAQ)

Do credit cards charge interest every month?

Credit cards only charge interest if you carry a balance from month to month. If you pay your full statement balance by the due date, you pay zero interest on purchases made during that billing cycle.

Interest applies to any remaining balance after the due date and is calculated daily using your APR divided by 365. This daily interest compounds, meaning you pay interest on previously accrued interest if balances remain unpaid.

Cash advances and balance transfers follow different rules. Cash advances usually begin accruing interest immediately and do not include a grace period.

What happens if I miss a credit card payment?

Missing a payment triggers both immediate fees and long-term credit damage.

Immediate effects:

- Late payment fee (typically $25 for the first offense, up to $40 for subsequent late payments)

- Loss of grace period on new purchases

- Possible penalty APR increase (up to 29.99%)

Credit report impact:

- Payments 30+ days late are reported to credit bureaus

- Credit score can drop 60–110 points depending on your profile

- Late payments remain on your credit report for up to 7 years

Prevention tip: Set up autopay for at least the minimum payment. Payments made less than 30 days late are not reported to credit bureaus.

Is carrying a balance good for my credit?

No. Carrying a balance does not help your credit score and costs you unnecessary interest.

Credit scores improve through on-time payments and low credit utilization—not by paying interest.

What actually builds credit:

- On-time payment history (35% of your score)

- Credit utilization below 30% (30% of your score)

- Length of credit history (15%)

- Credit mix (10%)

Paying your full statement balance every month maximizes your credit score while avoiding interest entirely.

How long does it take to build credit with a credit card?

You can establish a credit score in as little as 3–6 months. Building a strong credit score (750+) usually takes 1–2 years of consistent positive behavior.

- Months 1–3: First payment history reports and initial score is generated

- Months 6–12: Score stabilizes with consistent on-time payments

- Years 1–2: Score reaches good or excellent range (700+)

- Years 2+: Optimization through low utilization and credit mix

Becoming an authorized user on a long-established account can accelerate this timeline significantly.

What’s the difference between statement balance and current balance?

Statement balance is the amount you owed at the end of your last billing cycle. This is the amount you must pay by the due date to avoid interest.

Current balance includes your statement balance plus any new purchases, payments, or credits since the statement closed.

Example:

- Statement balance on January 31: $1,000

- New purchase on February 5: $200

- Current balance on February 5: $1,200

- Amount due to avoid interest: $1,000

Paying the statement balance—not the current balance—prevents interest charges.

Can I use credit cards to build wealth?

Credit cards are not wealth-building tools by themselves, but they can support wealth building when used responsibly.

Direct benefits:

- Strong credit scores qualify you for lower mortgage and auto loan rates

- Rewards programs return 1–2% of spending

- Fraud protection safeguards your money

Indirect benefits:

- Demonstrates financial discipline

- Enables access to investment and business financing

- Provides short-term cash flow flexibility through grace periods

The key rule: Credit cards build wealth only when balances are paid in full. At 20% APR, debt destroys wealth faster than any rewards program can compensate.