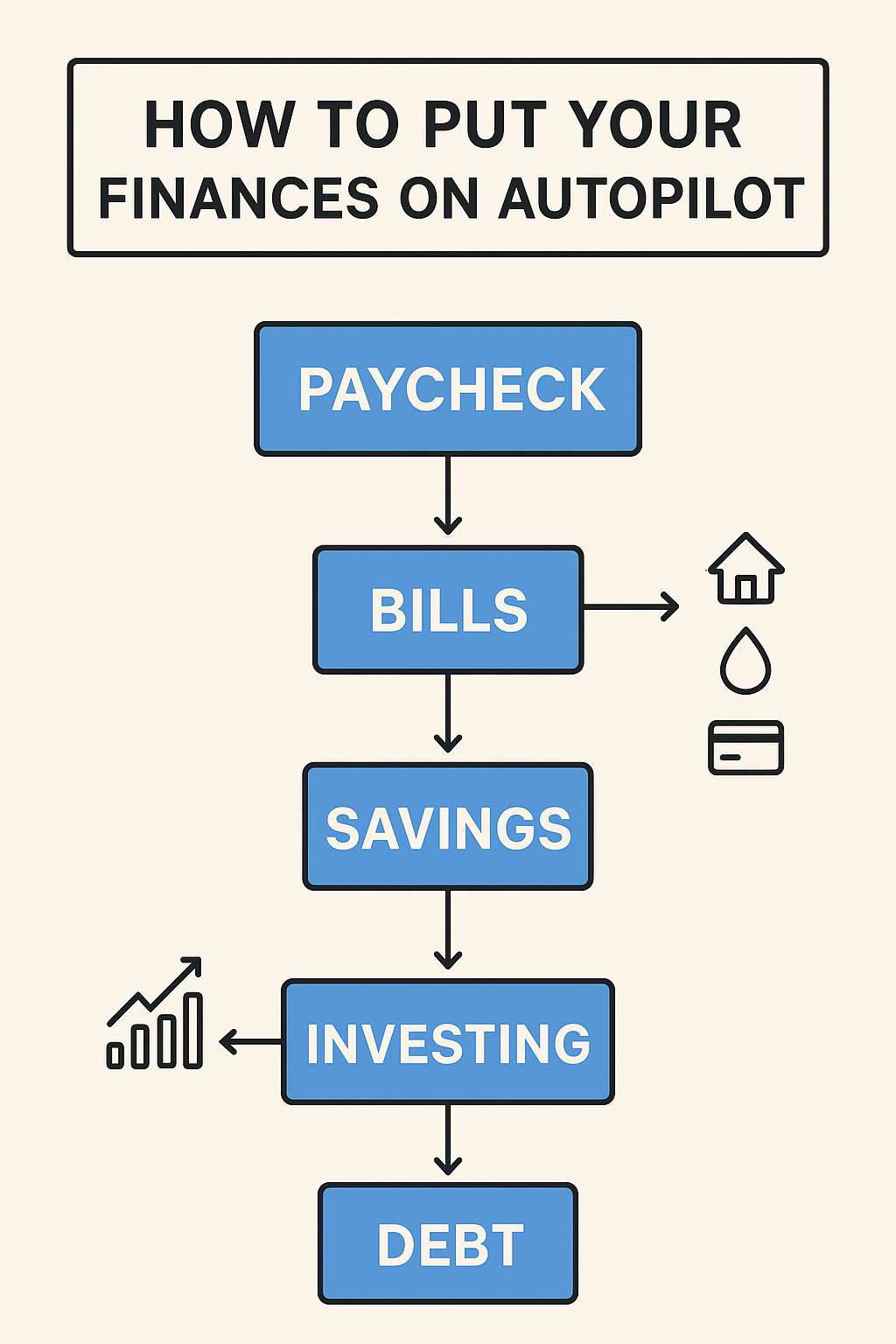

Automate Finances: Putting your finances on autopilot means setting up systems that automatically manage your money saving, investing, and paying bills without daily effort. This approach reduces stress, eliminates missed payments, and ensures consistent progress toward your financial goals.

Whether you’re just starting out or already managing multiple accounts, automating your money helps you build wealth and peace of mind.

Why Automate Your Finances?

Most people struggle not because they don’t know what to do, but because they don’t do it consistently. Automation fixes that.

Benefits include:

- Never missing a bill (avoid late fees and interest).

- Saving and investing without thinking about it.

- Reducing decision fatigue.

- Staying on track with financial goals.

Step 1: Automate Your Income Allocation

When your paycheck hits, direct it into different “buckets” automatically.

- Direct Deposit Splits: Send a portion to checking, savings, and investment accounts.

- Formula (50/30/20 Rule):

50% Needs + 30% Wants + 20% Savings/Investing

Example:

- $4,000 paycheck

- $2,000 → Needs

- $1,200 → Wants

- $800 → Savings/Investments

Step 2: Automate Bill Payments

Use your bank’s bill pay or your credit card autopay.

- Set credit cards to “Pay in Full” each month.

- Automate utilities, rent/mortgage, and insurance premiums.

- Keep a buffer in checking (1 month’s expenses recommended).

Step 3: Automate Saving

Instead of saving “what’s left,” pay yourself first.

- High-Yield Savings Account (HYSA): Set recurring transfers.

- Emergency Fund Rule: Aim for 3–6 months of expenses.

Example:

$200 auto-transfer every payday → HYSA

$200 × 24 pay periods = $4,800/year savedStep 4: Automate Investing

Long-term wealth grows through consistency.

- 401(k)/IRA Contributions: Schedule automatic payroll deductions.

- Robo-Advisors (e.g., Betterment, Wealthfront) automatically rebalance your portfolio.

- Dollar-Cost Averaging (DCA): Invest a fixed amount regularly.

Formula:

Investment Value = Contribution × Number of PeriodsExample:

$500/month × 12 months = $6,000/year invested

Step 5: Automate Debt Repayment

- Schedule extra payments toward high-interest debt.

- Use the Debt Snowball (smallest balance first) or Debt Avalanche (highest interest first).

- Apps like Tally or Qoins can automate extra payments.

Step 6: Automate Credit Building & Tracking

- Set autopay to avoid late fees.

- Use free monitoring tools like Credit Karma or Experian alerts.

Advantages & Disadvantages of Automating Finances

| Advantages | Disadvantages |

|---|---|

| Removes human error & missed payments | Less flexibility if income fluctuates |

| Builds consistent wealth | Risk of overdraft if not monitored |

| Saves time & energy | Requires upfront setup |

| Reduces financial stress | May create an “out of sight, out of mind” mindset |

Use Cases: Who Should Automate Finances?

- Busy professionals: Reduce financial tasks.

- Beginners: Build good habits without effort.

- Parents: Manage household finances efficiently.

- Entrepreneurs: Smooth out irregular income.

Begin by automating bills and savings, then move on to investing and debt repayment.

Not entirely. You still need a budget, but automation enforces it.

Use percentage-based allocations instead of fixed amounts.

Yes, as long as you use reputable banks and apps with security features.

Other Link Suggestions

- Smart Investing Habits That Pay Off Forever

- How to Start Investing with Just $100

- Dollar Cost Averaging Explained

Source Links

- Consumer Financial Protection Bureau – Automating Payments

- Morningstar – Investment Automation

- IRS – Retirement Contributions

The Bottom Line

Automating your finances makes money management effortless. By putting savings, bills, debt repayment, and investing on autopilot, you create a system that builds wealth in the background.

Start small—set up one automation today (like automatic savings transfers)—and let your money work for you while you focus on living.