Picture this: your child’s 18th birthday arrives, and instead of just getting a driver’s license, they’re also sitting on a six-figure investment account. Sounds like a fantasy? It’s not. With the right financial strategy started early, making your kid a millionaire isn’t about luck or lottery tickets; it’s about understanding the incredible power of compound interest and taking consistent action. The best part? You don’t need to be wealthy yourself to set your child up for millionaire status. You just need to start now.

TL;DR

- Start early: Beginning when your child is born gives you 18+ years of compound growth—the single most powerful wealth-building tool available

- Consistent contributions matter more than large amounts: Investing $200-$300 monthly from birth can potentially grow to $1 million by retirement age

- Tax-advantaged accounts are game-changers: Custodial Roth IRAs and 529 plans offer tax-free growth that dramatically accelerates wealth building

- Financial education is the real inheritance: Teaching kids about money, investing, and delayed gratification creates generational wealth beyond just dollars

- Automate everything: Set up automatic transfers and investments to remove emotion and ensure consistency over decades

What Does It Really Mean to Make Your Kid a Millionaire?

In simple terms, making your kid a millionaire means strategically building wealth on their behalf through early investing, smart account selection, and leveraging the power of time and compound interest.

This isn’t about spoiling children or creating trust-fund babies who never work. It’s about giving them a financial foundation that provides options, security, and freedom as adults. It means they can pursue their passions without being trapped by student debt, afford a home without financial stress, or retire comfortably, even early.

The concept matters because financial security has become increasingly challenging for younger generations. With rising education costs, housing prices, and economic uncertainty, parents who take proactive steps today can dramatically change their children’s financial trajectory tomorrow. Investopedia

The Mathematics Behind the Million-Dollar Goal

Understanding Compound Interest: Your Secret Weapon

Albert Einstein allegedly called compound interest “the eighth wonder of the world.” Whether he said it or not, the sentiment is accurate. Compound interest means you earn returns not just on your original investment, but on all the accumulated interest over time.

The formula for compound interest is:

A = P(1 + r/n)^(nt)

Where:

- A = Final amount

- P = Principal (initial investment)

- r = Annual interest rate (as a decimal)

- n = Number of times interest compounds per year

- t = Time in years

But let’s skip the math class and look at real numbers.

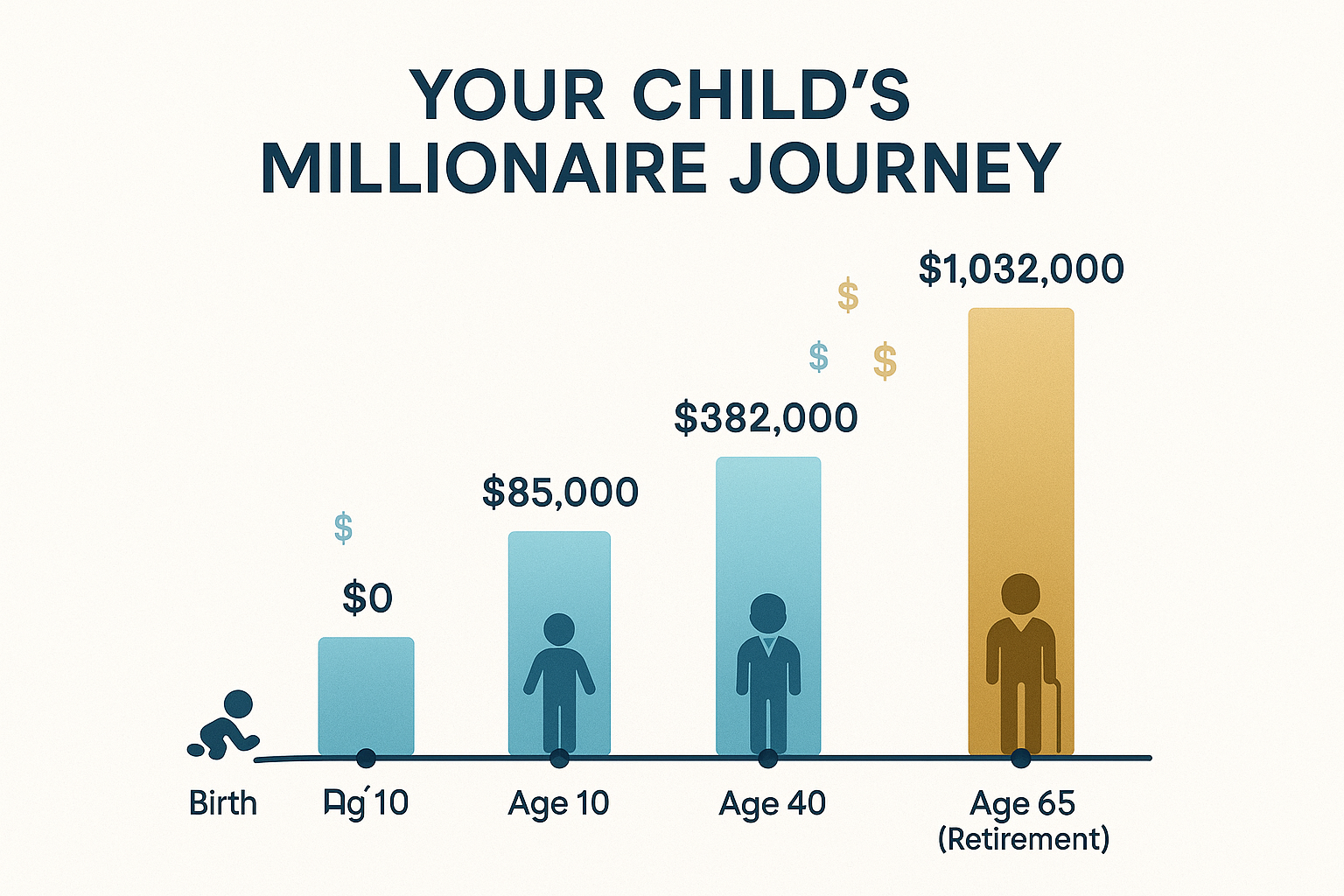

Real-World Example: Birth to Millionaire

Scenario 1: The Early Bird

- Start investing: At the child’s birth

- Monthly contribution: $250

- Average annual return: 10% (historical stock market average)

- Time horizon: 65 years (until retirement)

- Result: Approximately $2.3 million

Scenario 2: The Late Starter

- Start investing: At the child’s 18th birthday

- Monthly contribution: $250

- Average annual return: 10%

- Time horizon: 47 years

- Result: Approximately $650,000

The difference? Those first 18 years added $1.65 million to the final total, without increasing the monthly contribution at all.

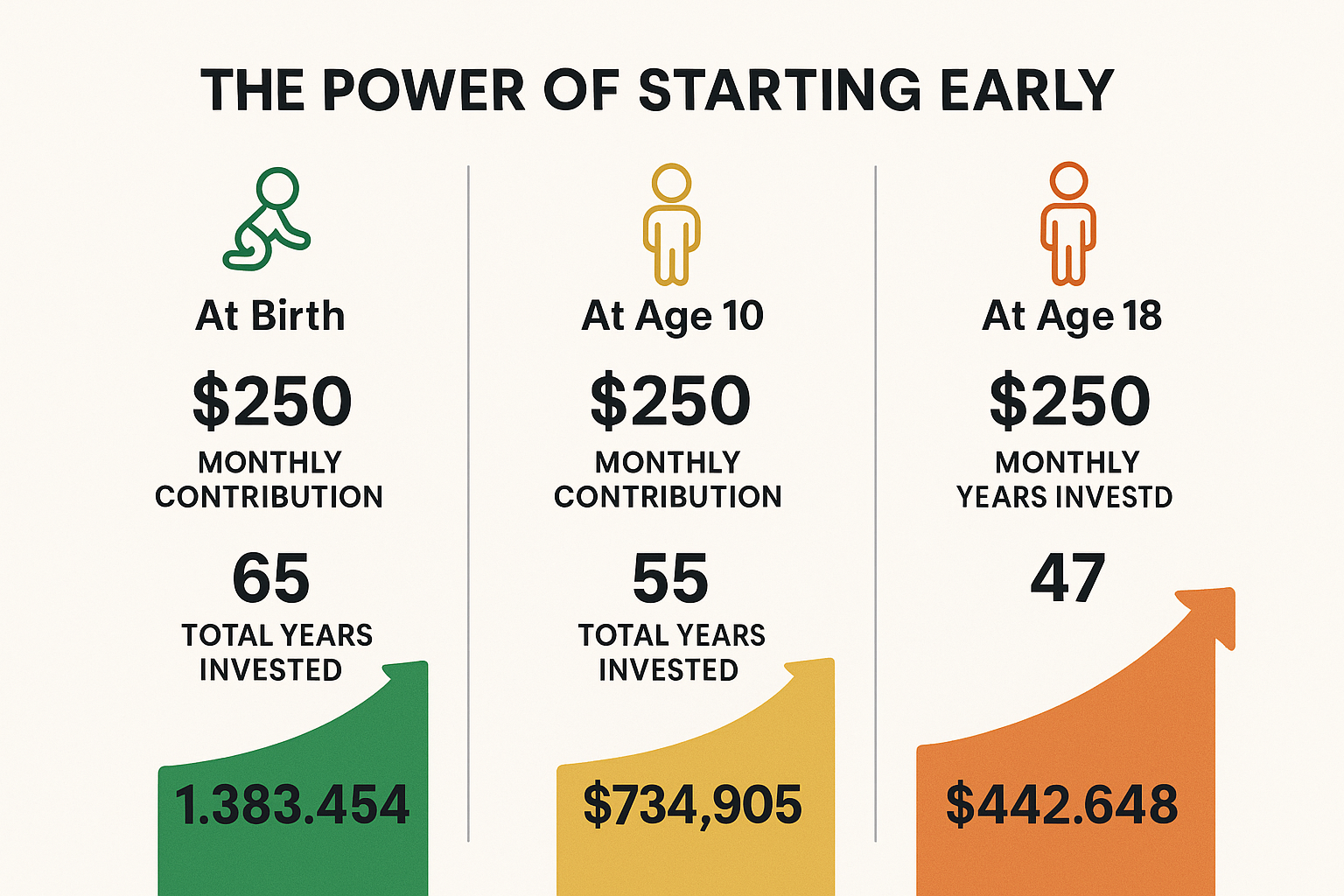

The Power of Starting Early: A Comparison Table

| Start Age | Monthly Investment | Years Invested | Total Contributed | Value at Age 65 (10% return) |

|---|---|---|---|---|

| Birth | $250 | 65 | $195,000 | ~$2,300,000 |

| Age 10 | $250 | 55 | $165,000 | ~$1,100,000 |

| Age 18 | $250 | 47 | $141,000 | ~$650,000 |

| Age 25 | $250 | 40 | $120,000 | ~$380,000 |

| Age 35 | $250 | 30 | $90,000 | ~$170,000 |

Key insight: Starting at birth versus age 10 means contributing just $30,000 more but ending up with over $1.2 million more at retirement. Time is literally money.

Step-by-Step: How to Make Your Kid a Millionaire

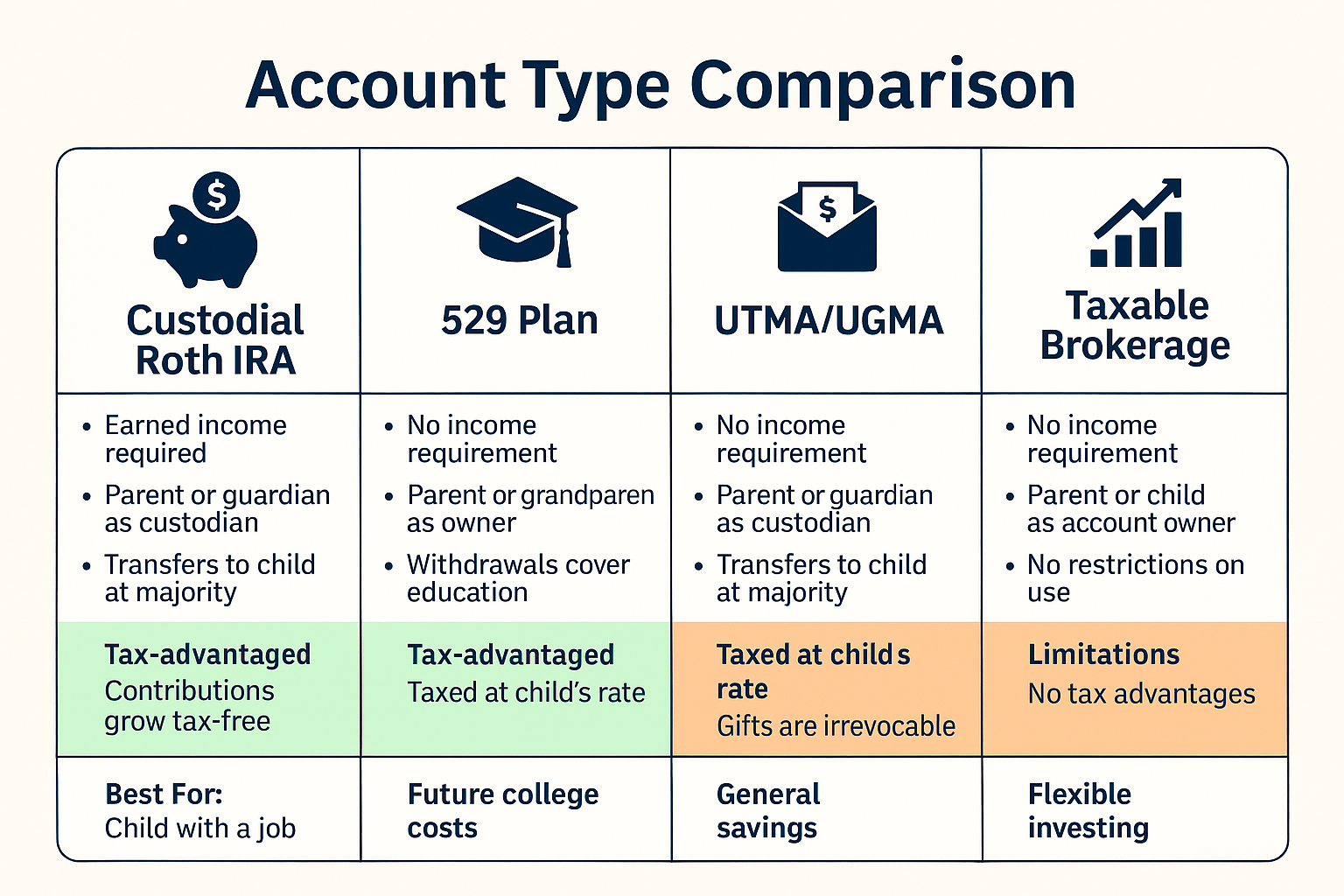

Step 1: Choose the Right Investment Accounts

Not all accounts are created equal. Tax advantages can add hundreds of thousands to your child’s final balance.

Custodial Roth IRA

A Custodial Roth IRA is one of the most powerful wealth-building tools for children who have earned income.

Key features:

- Child must have earned income (from modeling, acting, working in a family business, etc.)

- Contributions grow completely tax-free

- Withdrawals in retirement are tax-free

- 2025 contribution limit: $7,000 per year

- Parent controls account until child reaches majority age (18-21, depending on state)

Why it’s powerful: A $6,000 investment at age 15 growing at 10% annually becomes $470,000 by age 65, completely tax-free. That’s the power of 50 years of tax-free compound growth.

529 College Savings Plan

While primarily for education, 529 plans offer significant advantages:

Benefits:

- Tax-free growth when used for qualified education expenses

- Many states offer tax deductions for contributions

- Can be transferred to other family members

- Recent changes allow up to $35,000 lifetime rollover to a Roth IRA (under certain conditions)

Consideration: Funds must be used for education or face penalties, making this less flexible than other options.

UTMA/UGMA Custodial Accounts

Uniform Transfers/Gifts to Minors Act accounts offer maximum flexibility:

Advantages:

- No income requirements

- No contribution limits

- Can invest in stocks, bonds, ETFs, and mutual funds

- Funds can be used for anything that benefits the child

Disadvantages:

- No tax advantages beyond the first $1,250 of unearned income

- A child gains full control at the age of majority

- Can impact financial aid eligibility

Taxable Brokerage Account in Parent’s Name

Sometimes the simplest approach works best:

When to use:

- You want maximum control

- The child has no earned income

- You’ve maxed out other options

Strategy: Invest in tax-efficient index funds and hold long-term to minimize taxes. Understanding why the stock market goes up helps maintain conviction during downturns.

Step 2: Select the Right Investments

Account selection matters, but what you invest in determines your success.

Index Funds: The Set-It-and-Forget-It Approach

For most parents, low-cost index funds are the perfect solution:

Top choices:

- S&P 500 Index Funds (VOO, SPY, IVV): Tracks the 500 largest U.S. companies

- Total Stock Market Index Funds (VTI, ITOT): Covers the entire U.S. stock market

- Target-Date Funds: Automatically adjusts risk as child ages

Why index funds win:

- Low fees (often under 0.05% annually)

- Instant diversification

- Historically returns ~10% annually

- Requires zero expertise or time

Warren Buffett has repeatedly recommended index funds for most investors. In his 2013 letter to shareholders, he instructed that his wife’s inheritance be invested in index funds—that’s the ultimate endorsement.

Individual Stocks: Proceed with Caution

While buying individual stocks can be tempting, it comes with significant risks:

Risks:

- Company-specific risk (remember Enron? Lehman Brothers?)

- Requires ongoing research and monitoring

- Emotional decision-making during volatility

- Most professional investors can’t beat index funds long-term

If you choose this route:

- Limit individual stocks to 10-20% of portfolio

- Focus on established, profitable companies

- Consider dividend-paying stocks for compounding benefits

- Understand why people lose money in the stock market to avoid common pitfalls

The Recommended Portfolio for Long-Term Growth

For a child with 50+ years until retirement:

Aggressive Growth Portfolio (Ages 0-25):

- 90% Stock index funds

- 10% International stock index funds

- 0% Bonds (time is your safety net)

Moderate Portfolio (Ages 25-40):

- 80% Stock index funds

- 10% International stocks

- 10% Bonds

This approach maximizes growth potential while your child has decades to recover from market downturns. Learning about the cycle of market emotions helps you stay committed during inevitable volatility.

Step 3: Determine Your Contribution Strategy

You don’t need to be wealthy to make your kid a millionaire. You need to be consistent.

Monthly Contribution Scenarios

| Monthly Amount | Total After 18 Years (10% return) | Total After 40 Years | Total After 65 Years |

|---|---|---|---|

| $50 | $30,727 | $316,204 | $465,109 |

| $100 | $61,453 | $632,408 | $930,217 |

| $200 | $122,907 | $1,264,816 | $1,860,435 |

| $300 | $184,360 | $1,897,224 | $2,790,652 |

| $500 | $307,267 | $3,162,040 | $4,651,087 |

The million-dollar sweet spot: Contributing between $200-$300 monthly from birth puts your child firmly on the millionaire path by retirement. Morningstar

Alternative Contribution Strategies

Birthday/Holiday Contributions:

Instead of toys that break, invest:

- Birthday: $500-$1,000 annually

- Holidays: $250-$500 annually

- Total: $750-$1,500 per year

Over 18 years at 10% return, $1,000 annually becomes approximately $54,000—and that’s just the beginning.

Windfall Investing:

Redirect unexpected money:

- Tax refunds

- Work bonuses

- Gift money from relatives

- Inheritance

The “Pay Yourself First” Method:

Set up automatic transfers on payday—before you see the money and before you can spend it. Automation removes willpower from the equation.

Step 4: Teach Financial Literacy (The Real Inheritance)

Money without wisdom often disappears quickly. The greatest gift isn’t the account balance; it’s the financial education.

Age-Appropriate Money Lessons

Ages 3-5: Basic Concepts

- Money is exchanged for goods and services

- Different coins and bills have different values

- Saving means waiting for something you want

Ages 6-10: Earning and Saving

- Allowance tied to chores teaches work-reward connection

- Three-jar system: Save, Spend, Give

- Simple interest concepts (piggy bank grows when you add money)

Ages 11-14: Banking and Budgeting

- Open a savings account together

- Create a simple budget for their money

- Introduce the concept of compound interest

- Discuss needs versus wants

Ages 15-18: Investing Basics

- Show them their investment accounts and explain the growth

- Discuss stock market fundamentals

- Teach about different investment vehicles

- Explain tax-advantaged accounts

- Discuss the importance of passive income

Ages 18+: Advanced Concepts

- Transfer account control gradually

- Discuss retirement planning

- Explain asset allocation

- Teach about dividend investing

- Discuss real estate, entrepreneurship, and wealth building

The Psychology of Delayed Gratification

The famous Stanford marshmallow experiment showed that children who could delay gratification achieved better life outcomes. Teaching this skill is invaluable:

Practical exercises:

- “Wait one day” rule for impulse purchases

- Saving for larger goals rather than immediate gratification

- Discussing opportunity cost (buying X means not buying Y)

- Celebrating milestone achievements in their investment account

Step 5: Protect and Optimize the Plan

Avoid Common Mistakes

1. Stopping contributions during market downturns

This is the single biggest mistake. Market crashes are opportunities to buy investments on sale. Investors who continued contributing during the 2008 financial crisis saw extraordinary returns.

2. Being too conservative

With decades until retirement, your child can afford volatility. Being too conservative (holding too much cash or bonds) costs hundreds of thousands in lost growth.

3. Failing to increase contributions

As your income grows, increase contributions proportionally. Even small increases compound dramatically.

4. Not rebalancing

Once annually, rebalance the portfolio back to target allocations. This forces you to “sell high, buy low” automatically.

5. Letting fees eat returns

A 1% annual fee might seem small, but over 40 years, it can reduce your final balance by 25% or more. Stick with low-cost index funds.

Tax Optimization Strategies

Maximize tax-advantaged space first:

- Max out the Custodial Roth IRA if the child has earned income

- Contribute to a 529 up to the state tax deduction limit

- Use UTMA/UGMA for additional savings

- Taxable brokerage as a final option

Harvest tax losses:

In taxable accounts, sell losing investments to offset gains and reduce tax liability. Immediately reinvest in similar (but not identical) investments to maintain market exposure.

Gift tax considerations:

In 2025, you can gift up to $18,000 per person annually ($36,000 per couple) without filing gift tax returns. Grandparents and other relatives can contribute too, multiplying the impact.

Advanced Strategies for Accelerated Wealth Building

The “Roth IRA Conversion Ladder” Strategy

For children with earned income:

- Contribute the maximum to the Custodial Roth IRA annually

- Invest in growth stocks/funds

- At age 59½, all withdrawals are completely tax-free

- Before 59½, contributions (not earnings) can be withdrawn penalty-free for a first home, education, or emergencies

This creates a triple benefit: tax-free growth, tax-free withdrawals, and emergency access to contributions.

The “Business Owner” Approach

If you own a business, you can legitimately employ your children:

Benefits:

- Pays them real wages for real work (modeling for marketing, filing, computer work)

- Wages are a business expense deduction for you

- Child’s first ~$14,600 of earned income is tax-free (2025 standard deduction)

- Enables Roth IRA contributions

- Teaches work ethic and business skills

Important: Work must be legitimate and age-appropriate. Document everything. Consult a tax professional.

The “Grandparent Boost” Strategy

Involve grandparents in the wealth-building plan:

Instead of traditional gifts:

- Birthday: $500 to investment account

- Holidays: $250 to investment account

- Graduation: $1,000 to investment account

Advantage: Grandparents often want to help but don’t know how. This creates a lasting impact versus toys forgotten in weeks.

The “Match Program” for Older Kids

For teenagers with jobs:

Offer to match their savings/investments:

- They invest $100, you add $100

- Teaches saving habits

- Doubles their wealth-building power

- Creates skin in the game

This is essentially a “parent 401(k) match”—one of the most powerful wealth-building tools for adults, now available to your teen.

Real-World Case Studies: From Theory to Practice

Case Study 1: The Consistent Contributor

Sarah’s Story:

- Started: At daughter Emma’s birth (2007)

- Account: UTMA custodial account

- Investment: S&P 500 index fund

- Contribution: $250/month, never missed a payment

- Additional: Birthday gifts from grandparents ($500/year)

Results after 18 years (2025):

- Total contributions: $63,000

- Account value: ~$142,000

- If Emma never adds another dollar and it grows until age 65: ~$2.1 million

Key lesson: Consistency through the 2008 crash and 2020 pandemic volatility paid off. Sarah never stopped contributing, even when the market dropped 50% in 2008-2009.

Case Study 2: The Late-Start Hustler

Marcus’s Story:

- Started: When son Jayden turned 12 (2020)

- Account: Custodial Roth IRA (Jayden worked in the family business)

- Investment: Total stock market index fund

- Contribution: $6,000/year (maximum allowed)

Results after 5 years (2025):

- Total contributions: $30,000

- Account value: ~$42,000

- Projected value at age 65 (53 more years): ~$5.8 million

Key lesson: Starting late can still work with maximum contributions. Marcus also taught Jayden about investing, creating a lifelong skill.

Case Study 3: The Balanced Approach

The Chen Family:

- Started: At twins’ birth (2015)

- Accounts: 529 plan + UTMA for each child

- Strategy: $300/month to 529, $200/month to UTMA per child

- Total: $1,000/month for both children

Results after 10 years (2025):

- 529 accounts: ~$60,000 each (for college)

- UTMA accounts: ~$40,000 each (for general wealth)

- Total: ~$200,000 for both children

Projection: 529 funds cover most college costs. UTMA accounts continue growing—projected $850,000 each by retirement if left untouched.

Key lesson: Diversifying account types provides flexibility. Education is funded, and long-term wealth continues building.

The Psychological Game: Staying the Course

Understanding Market Volatility

The stock market will crash during your child’s investment timeline. Multiple times. This is guaranteed.

Historical crashes since 1950:

- 1973-1974: -48%

- 1987: -34% (in one day: -22%)

- 2000-2002: -49%

- 2008-2009: -57%

- 2020: -34% (fastest crash in history)

Here’s what matters: Every single crash was followed by recovery and new highs. Investors who stayed invested through all of these crashes still averaged ~10% annual returns.

The Emotional Cycle of Investing

Understanding the cycle of market emotions helps you avoid panic selling:

- Optimism → Market rising, feeling good

- Excitement → Big gains, telling friends

- Thrill → “I’m a genius!” peak confidence

- Euphoria → Maximum financial risk, market top

- Anxiety → First signs of trouble

- Denial → “It’s just a correction”

- Fear → Significant losses

- Desperation → “Make it stop!”

- Panic → Capitulation, selling at the bottom

- Despondency → “I’ll never invest again”

- Depression → Maximum pessimism

- Hope → First signs of recovery

- Relief → “Maybe it’ll be okay”

- Optimism → Cycle begins again

Your job: Recognize this cycle and refuse to sell during fear/panic/desperation phases. In fact, those are the best times to increase contributions.

Strategies for Emotional Resilience

1. Automate everything

Remove emotion by setting up automatic transfers and investments. You can’t panic-sell if you never manually buy.

2. Don’t check balances frequently

Checking daily creates unnecessary anxiety. Quarterly reviews are sufficient for long-term investments.

3. Focus on contribution consistency, not account value

Control what you can control (regular contributions), not what you can’t (market movements).

4. Remember the goal

You’re building wealth over 40-65 years. This week’s 5% drop is completely irrelevant to that timeline.

5. Study history

Every crash in history has been temporary. Every long-term investor who stayed the course has been rewarded. For more insights on market behavior, explore smart moves during volatility.

Common Mistakes to Avoid

1: Waiting for the “Right Time” to Start

The problem: Parents wait until they “have more money” or until the market “settles down.”

The reality: There’s never a perfect time. Every year you wait costs tens or hundreds of thousands in compound growth. Start with whatever you can afford today, even if it’s just $50/month.

The fix: Open an account this week and set up automatic contributions. Increase the amount later as income grows.

2: Being Too Conservative with a Long Time Horizon

The problem: Keeping a child’s 40-year investment in “safe” savings accounts or bonds earning 1-3%.

The reality: At 2% returns, $200/month for 40 years becomes $147,000. At 10% returns (stock market average), it becomes $1,265,000. “Safe” investments are actually the riskiest choice for long-term goals because they guarantee you won’t reach your target.

The fix: For time horizons of 15+ years, invest heavily in stock index funds. Time eliminates risk—you have decades to recover from market downturns.

3: Panic Selling During Market Crashes

The problem: Selling investments when the market drops 20-40%, locking in losses.

The reality: Market crashes are temporary. Selling during crashes means you miss the recovery, which is often rapid and substantial. The 2020 crash recovered completely in just 5 months.

The fix: Never sell during crashes. Better yet, increase contributions when the market is down—you’re buying investments on sale. Review the cycle of market emotions to recognize and resist panic.

4: Neglecting Financial Education

The problem: Building wealth for your child, but not teaching them how to manage it.

The reality: Without financial literacy, inherited wealth often disappears quickly. Studies show 70% of wealthy families lose their wealth by the second generation, and 90% by the third.

The fix: Start age-appropriate money conversations early. Involve older children in reviewing investment accounts. Teach budgeting, saving, and investing as core life skills.

5: Paying High Fees

The problem: Investing in funds with 1-2% annual expense ratios or paying high advisor fees.

The reality: A 1% fee might seem small, but it compounds negatively. Over 40 years, a 1% annual fee can reduce your final balance by 25% or more—that’s hundreds of thousands of dollars.

The fix: Choose low-cost index funds with expense ratios under 0.10%. Avoid actively managed funds with high fees. Every dollar saved in fees is a dollar that compounds for your child.

6: Making the Account Too Accessible

The problem: Using accounts where funds can be easily withdrawn for non-emergencies.

The reality: Easy access creates temptation. Using investment funds for a new car or vacation destroys decades of compound growth.

The fix: Use accounts with restrictions (like Roth IRAs) or create personal rules about withdrawal conditions. Make accessing funds deliberately difficult to prevent impulse decisions.

Creating a Sustainable Investment Plan: Your Action Checklist

Ready to start building your child’s millionaire future? Follow this step-by-step checklist:

Month 1: Research and Setup

- [ ] Calculate how much you can realistically contribute monthly

- [ ] Research account types (Custodial Roth IRA, 529, UTMA/UGMA)

- [ ] Choose a brokerage (Vanguard, Fidelity, Schwab are excellent low-cost options)

- [ ] Open your chosen account(s)

- [ ] Set up automatic monthly transfers from checking to investment account

Month 2: Investment Selection

- [ ] Research low-cost index funds (S&P 500, Total Stock Market)

- [ ] Check expense ratios (aim for under 0.10%)

- [ ] Make initial investment

- [ ] Set up automatic investment of contributions

- [ ] Create a simple spreadsheet to track contributions and growth

Month 3: Education and Planning

- [ ] Start age-appropriate money conversations with your child

- [ ] Create a long-term contribution plan

- [ ] Identify additional contribution sources (birthday money, bonuses, etc.)

- [ ] Set calendar reminders for quarterly reviews

- [ ] Share the plan with grandparents/relatives who might want to contribute

Ongoing: Consistency and Optimization

- [ ] Never miss a monthly contribution

- [ ] Increase contributions with raises/bonuses (aim for 1% increase annually)

- [ ] Review account quarterly (no more frequently)

- [ ] Rebalance annually if needed

- [ ] Teach increasingly sophisticated financial concepts as the child ages

- [ ] Resist the urge to sell during market downturns

- [ ] Celebrate milestones ($10k, $25k, $50k, $100k)

Annual Tasks:

- [ ] Review and increase contributions if possible

- [ ] Check expense ratios and switch funds if better options emerge

- [ ] Rebalance portfolio to target allocation

- [ ] Update beneficiary information if needed

- [ ] Document contributions for tax purposes

- [ ] Teach the child about account growth and investing concepts

The Power of Multiple Income Streams for Kids

While investing is the foundation, teaching children about creating passive income multiplies the wealth-building effect. See our full guide on Multiple Income Streams

Age-Appropriate Income Opportunities

Ages 8-12:

- Lemonade stand (teaches entrepreneurship basics)

- Pet sitting for neighbors

- Lawn mowing/yard work

- Selling crafts online (with parent supervision)

Ages 13-16:

- Tutoring younger students

- Social media management for local businesses

- Creating digital products (printables, templates)

- Starting a YouTube channel or blog

- Babysitting

Ages 17-18:

- Freelancing (writing, design, coding)

- Part-time job

- Starting a small business

- Creating and selling online courses

- Investing earned income in dividend stocks

The strategy: Help your child invest 50-75% of earned income. This creates a powerful habit and dramatically accelerates wealth building. A teenager investing $200/month from age 16-65 accumulates approximately $2.5 million.

Adapting the Plan for Different Starting Points

Starting at Birth: Maximum Advantage

Strategy:

- Open a UTMA/UGMA account immediately

- Contribute $250-300/month

- Invest 100% in stock index funds

- Add birthday/holiday money

- When a child has earned income, open a Custodial Roth IRA

Expected outcome: $1-2 million by retirement age with consistent contributions.

Starting at Age 5-10: Still Excellent Timing

Strategy:

- Open an appropriate account based on the income situation

- Contribute $300-400/month to compensate for a later start

- Invest aggressively (90-100% stocks)

- Plan for Roth IRA when child begins earning income

Expected outcome: $800,000-1.5 million by retirement with consistent contributions.

Starting at Age 11-15: Aggressive Catch-Up Required

Strategy:

- Open accounts immediately

- Contribute $400-500/month

- Find ways for the child to earn income for the Roth IRA

- Maximize all contributions

- Teach the child to continue contributions independently as an adult

Expected outcome: $600,000-1 million by retirement, with child continuing contributions in adulthood, pushing toward multi-million dollar outcomes.

Starting at Age 16-18: Every Bit Helps

Strategy:

- Open a Roth IRA using the child’s earned income

- Contribute maximum allowed ($7,000 in 2025)

- Invest 100% in stock index funds

- Teach intensive financial literacy

- Create a plan for the child to continue aggressive saving as an adult

Expected outcome: $500,000-800,000 by retirement with maximum contributions through age 18, assuming the child continues modest contributions as an adult.

Key insight: Even starting at 16, a fully funded Roth IRA ($7,000/year for 3 years = $21,000 total) becomes approximately $2.9 million by age 65 with zero additional contributions. Starting late still works—but start NOW.

Beyond Money: The Intangible Inheritance

Making your kid a millionaire isn’t ultimately about the money; it’s about the options, security, and freedom wealth provides.

What Financial Security Really Gives Your Child

Freedom to pursue passion over paychecks:

With a solid financial foundation, your child can choose careers based on fulfillment rather than desperation. They can be a teacher, artist, or nonprofit worker without financial stress.

Reduced stress and improved health:

Financial stress is linked to numerous health problems, relationship issues, and reduced life satisfaction. Financial security literally improves the quality and length of life.

Ability to take calculated risks:

Entrepreneurs with financial cushions are more likely to succeed because they can make strategic decisions rather than desperate ones. Your child might start the next great company—because they can afford to try.

Generational wealth building:

Your child can provide the same advantage to their children, creating multi-generational prosperity. Wealth building becomes a family culture, not a one-time event.

Power to help others:

Financial security enables generosity. Your child can support causes they care about, help family members, and make a meaningful impact on the world.

The Real ROI: Life Outcomes

Studies consistently show that financial literacy and security correlate with:

- Better educational outcomes

- Healthier relationships

- Lower stress and anxiety

- Greater life satisfaction

- Longer life expectancy

- Higher career achievement

You’re not just building a portfolio, you’re building a better life for your child.

Conclusion: Your Child’s Million-Dollar Future Starts Today

Making your kid a millionaire isn’t a pipe dream reserved for the wealthy. It’s a realistic goal achievable through early action, consistent contributions, smart account selection, and patient long-term investing.

The mathematics are simple: start early, invest in low-cost index funds, contribute consistently, and let compound interest do the heavy lifting. A modest $200-300 monthly investment from birth creates millionaire status by retirement—without requiring any financial wizardry or lucky stock picks.

But remember: the real inheritance isn’t the money itself. It’s the financial literacy, delayed gratification, and wealth-building mindset you instill. Money without wisdom disappears. Wisdom creates money that lasts generations.

Your Next Steps (Do These This Week):

- Calculate your contribution capacity: Review your budget and determine a realistic monthly investment amount. Start with whatever you can afford—even $50/month is infinitely better than $0.

- Choose and open an account: Select the appropriate account type for your situation (Custodial Roth IRA if child has income, UTMA/UGMA if not, or 529 for education focus). Open it with a reputable low-cost brokerage.

- Set up automation: Schedule automatic monthly transfers from your checking account to the investment account. Automation ensures consistency regardless of market conditions or busy schedules.

- Make your first investment: Purchase a low-cost index fund (S&P 500 or Total Stock Market). Keep it simple—complexity is the enemy of execution.

- Start the conversation: Have your first age-appropriate money discussion with your child. Plant the seeds of financial literacy that will grow alongside their investment account.

- Commit to the long-term: Write down your commitment to never panic-sell during market crashes and to maintain contributions through all market conditions. This mental contract will serve you well during inevitable volatility.

The journey to making your kid a millionaire begins with a single decision: starting today instead of tomorrow. Every day you wait costs your child thousands in future wealth.

Your child’s millionaire future is waiting. The question isn’t whether it’s possible—the question is whether you’ll take action.

For more strategies on building wealth and understanding markets, explore our comprehensive guides on financial education and investing.

💰 Child Millionaire Calculator

Discover how much your child could have by retirement

📊 Breakdown

FAQ

The minimum depends on when you start and your time horizon. Starting at birth, contributing just $135/month with a 10% annual return reaches $1 million by age 65. Starting at age 10 requires about $220/month. The earlier you start, the less you need to contribute monthly.

Absolutely. Making your kid a millionaire is about time and consistency, not current wealth. A family investing $200-300 monthly can achieve millionaire status for their child through the power of compound interest over decades. You're leveraging time, not large sums.

This depends on age and maturity. For young children, keep it simple or private. For teenagers, transparency combined with financial education is powerful—it makes wealth-building real and tangible. However, ensure they understand the money isn't for immediate spending and discuss the importance of long-term thinking.

This is why asset allocation matters. If your child will need funds for college at 18, shift money from stocks to bonds/cash starting around age 14-15. For true long-term wealth (retirement), market timing is irrelevant—they have decades to recover. Never keep long-term money (20+ years) in "safe" low-return investments.

They serve different purposes. A 529 plan is ideal for education expenses with tax-free growth and potential state tax deductions. A Custodial Roth IRA (requires earned income) is better for long-term wealth building with tax-free growth and retirement benefits. Many parents use both—529 for education and, Roth IRA for lifetime wealth.

Legitimate options include: working in your family business (if you own one), modeling for business marketing, lawn mowing, babysitting, tutoring, or any other real work. The work must be legitimate, age-appropriate, and properly documented. Consult a tax professional for guidance.

Life happens. If you must pause contributions, don't panic and don't withdraw the investments. Even without new contributions, existing investments continue growing. A $20,000 balance at age 10 becomes $315,000 by age 65 at 10% returns—even with zero additional contributions. Resume when possible, but never withdraw early.

For most parents, index funds are the superior choice. They offer instant diversification, low fees, require no expertise, and historically outperform most professional investors. Individual stocks require ongoing research, carry company-specific risk, and introduce emotional decision-making. If you choose individual stocks, limit them to a small portion (10-20%) of the portfolio.

Financial Disclaimer

This article is for educational purposes only and does not constitute financial advice. Investment decisions should be made based on individual circumstances, risk tolerance, and financial goals. Past performance does not guarantee future results. The stock market involves risk, including possible loss of principal. Before making any investment decisions, consult with a qualified financial advisor or tax professional who understands your specific situation. The author and TheRichGuyMath.com are not responsible for any financial decisions made based on this content.

About the Author

Written by Max Fonji — With over a decade of experience in financial education and investment strategy, Max is your go-to source for clear, data-backed investing education. At TheRichGuyMath.com, Max breaks down complex financial concepts into actionable strategies that everyday people can use to build lasting wealth. His mission: making financial freedom accessible to everyone, regardless of starting point.