Drowning in debt feels like being trapped in quicksand—the harder you struggle, the deeper you sink. But here’s the truth: you don’t need to sacrifice every small joy or live on instant noodles for years to become debt-free. With the right strategy, you can pay off debt fast while still maintaining a life you actually enjoy. This isn’t about deprivation; it’s about making smarter financial moves that accelerate your debt payoff without draining your soul.

TL;DR

- How to pay off debt effectively combines strategic budgeting, income optimization, and the right repayment method (avalanche or snowball)

- You can accelerate debt payoff by 40-60% through side income, expense optimization, and automated payments—without extreme lifestyle sacrifices

- The debt snowball method (paying the smallest debts first) provides psychological wins, while the avalanche method (highest interest first) saves more money

- Negotiating lower interest rates and consolidating high-interest debt can reduce your total payoff time by 12-24 months

- Building a small emergency fund ($500-$1,000) before aggressive debt payoff prevents new debt from derailing your progress

What Does “Pay Off Debt Fast” Really Mean?

In simple terms, paying off debt fast means eliminating your outstanding balances in the shortest time possible while maintaining financial stability. It’s not about reckless sacrifice, it’s about strategic acceleration.

According to the Federal Reserve, the average American household carries approximately $155,000 in debt (including mortgages), with credit card debt averaging $6,270 per household. The key to fast debt payoff isn’t earning a massive salary; it’s optimizing what you already have and making intentional choices that compound over time.

Paying off debt quickly matters because:

You save thousands in interest payments

You free up cash flow for wealth-building activities like investing in dividend stocks

You reduce financial stress and improve mental health

You can start building real wealth sooner rather than funding your creditors’ profits

Understanding Your Debt: The Foundation of Fast Payoff

Before you can pay off debt strategically, you need a crystal-clear picture of what you’re dealing with. Not all debt is created equal, and treating it as such will cost you time and money.

Types of Debt and Their Priority

| Debt Type | Typical Interest Rate | Payoff Priority | Why |

|---|---|---|---|

| Credit Cards | 16-29% | HIGHEST | Highest interest; compounds daily |

| Personal Loans | 10-28% | HIGH | High interest; fixed terms |

| Auto Loans | 4-10% | MEDIUM | Moderate interest; depreciating asset |

| Student Loans | 3-7% | MEDIUM-LOW | Lower interest; tax-deductible |

| Mortgage | 3-7% | LOWEST | Lowest interest; appreciating asset |

The rule is simple: Pay minimum payments on everything, then attack the highest-interest debt with every extra dollar you can find.

Calculate Your Debt-to-Income Ratio

Your debt-to-income (DTI) ratio shows what percentage of your monthly income goes toward debt payments. Here’s the formula:

DTI = (Total Monthly Debt Payments ÷ Gross Monthly Income) × 100

- Below 36%: Healthy financial position

- 36-43%: Manageable but needs attention

- Above 43%: High risk; aggressive payoff needed

Understanding these numbers helps you set realistic timelines and identify whether you need to focus on increasing income or decreasing expenses—or both.

The Two Proven Methods to Pay Off Debt Fast

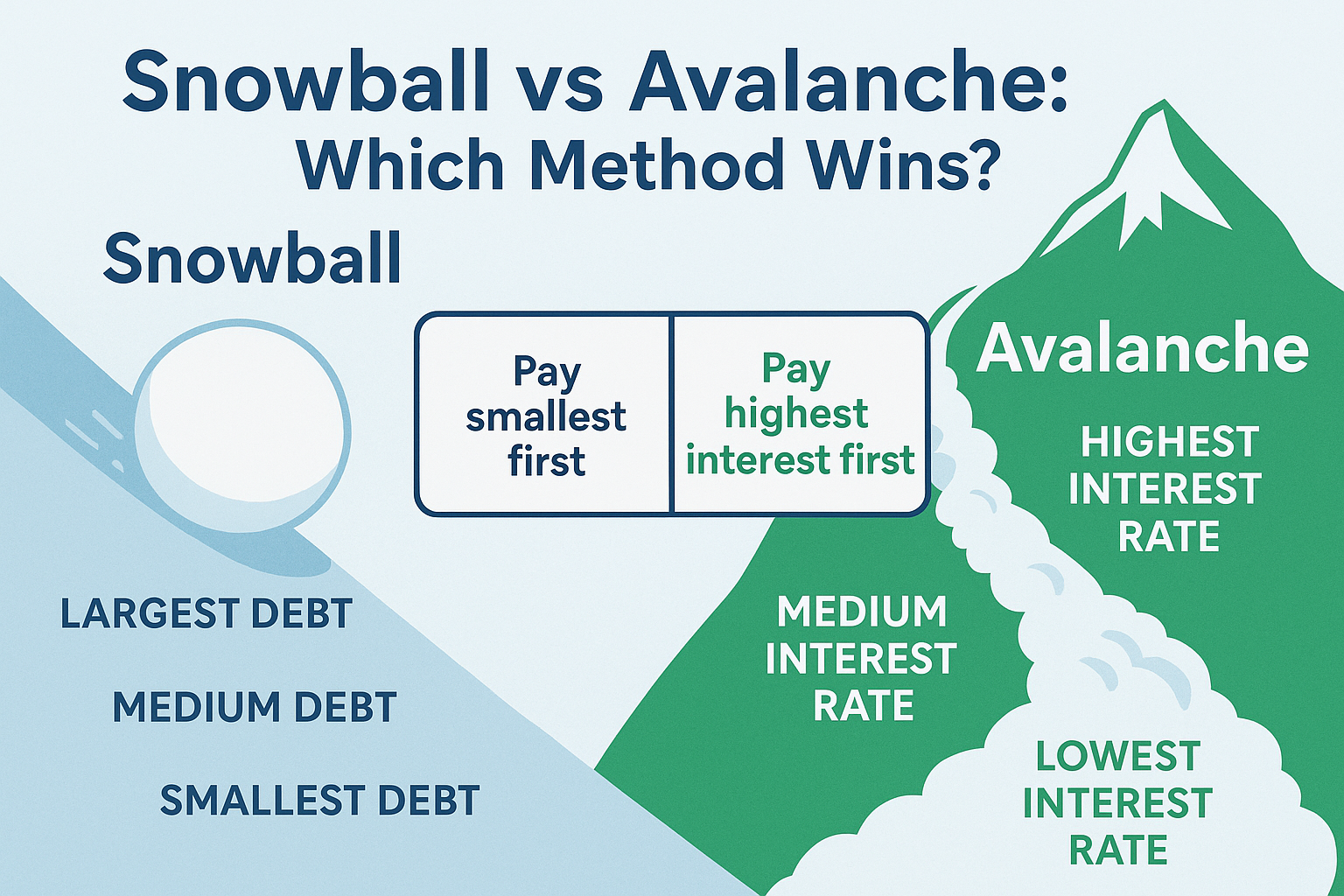

When it comes to how to pay off debt strategically, two methods dominate the landscape: the Debt Snowball and the Debt Avalanche. Both work, but they appeal to different psychological profiles.

The Debt Snowball Method

How it works: List your debts from smallest to largest balance (ignore interest rates). Pay minimums on everything except the smallest debt, which you attack with maximum force. When it’s gone, roll that payment to the next smallest debt.

Best for: People who need quick wins and psychological motivation

Example:

- Credit Card A: $500 (18% APR)

- Credit Card B: $2,000 (22% APR)

- Personal Loan: $8,000 (12% APR)

You’d pay off Card A first, even though Card B has a higher interest rate. The psychological boost of eliminating an entire debt keeps you motivated.

“What is lost in mathematical efficiency is gained in psychological momentum. Behavior change requires wins, not just optimal calculations.” — Financial research from Harvard Business Review

The Debt Avalanche Method

How it works: List debts by interest rate, highest to lowest. Pay minimums on everything except the highest-interest debt. Attack it relentlessly until it’s gone, then move to the next highest rate.

Best for: People motivated by numbers and maximum savings

Example:

Using the same debts:

- Credit Card B: $2,000 (22% APR) ← Attack first

- Credit Card A: $500 (18% APR)

- Personal Loan: $8,000 (12% APR)

This method saves more money in interest but takes longer to see that first debt disappear.

The verdict: If you’re disciplined and numbers-driven, use Avalanche. If you need motivation and quick wins, use snowball. Both work—the best method is the one you’ll actually stick with.

Step-by-Step: How to Pay Off Debt Without Feeling Broke

Step 1: Build a Mini Emergency Fund First ($500-$1,000)

This seems counterintuitive when you’re eager to attack debt, but a small emergency cushion prevents new debt when life happens. Without it, one car repair sends you back to the credit cards.

Action: Open a high-yield savings account and automate $50-100 per paycheck until you hit $1,000.

Step 2: Cut the Fat, Not the Joy

Traditional advice says, “cut everything and suffer.” That’s a recipe for burnout. Instead, use the 80/20 rule: identify the 20% of expenses that provide 80% of your happiness, and ruthlessly cut the rest.

High-impact cuts that don’t hurt:

- Negotiate your phone bill (average savings: $30-50/month)

- Cancel unused gym memberships (use free YouTube workouts)

- Rotate streaming services instead of having all simultaneously

- Meal prep instead of eating out (saves $200-400/month)

- Make coffee at home 5 days/week (saves $100-150/month)

Keep these happiness drivers:

- Weekly coffee with friends (budget it!)

- One streaming service you actually use

- Hobbies that provide real joy and connection

Step 3: Increase Your Income (The Accelerator)

Cutting expenses has a ceiling; earning has no limit. Every extra dollar earned can go straight to debt without affecting your lifestyle.

Side income ideas that actually work in 2025:

- Freelance your professional skills (writing, design, coding)

- Rideshare or delivery driving (flexible hours)

- Rent a spare room or parking space

- Tutoring or teaching online

- Resell items on eBay, Poshmark, or Facebook Marketplace

Even an extra $500/month cuts years off your debt payoff timeline. Consider how smart ways to make passive income can eventually supplement your active income.

Step 4: Negotiate Everything

Most people don’t realize that interest rates, payment terms, and balances are negotiable. A single phone call can save thousands.

What to negotiate:

Credit card interest rates: Call and ask for a lower APR. Success rate is 70-80% for people with decent payment histories. Script: “I’ve been a loyal customer for X years with on-time payments. I’ve received offers for cards with lower rates. Can you reduce my APR to help me pay this off faster?”

Medical bills: Hospitals often have financial assistance programs or will accept 40-60% of the bill as payment in full.

Collection accounts: Offer to pay 30-50% of the balance in exchange for deletion from your credit report (get it in writing first).

Step 5: Automate Your Debt Payments

Automation removes willpower from the equation. Set up automatic payments the day after your paycheck hits, so the money never sits in your checking account tempting you.

Automation strategy:

- Set automatic minimum payments on all debts

- Set an automatic extra payment on your target debt (snowball or avalanche)

- Set automatic transfer to the emergency fund

- What’s left is your spending money

This “pay yourself first” approach ensures debt payoff happens before discretionary spending.

Step 6: Use Windfalls Strategically

Tax refunds, bonuses, gifts, garage sale proceeds—every windfall is a debt-crushing opportunity.

The 50/30/20 windfall rule:

- 50% to debt payoff

- 30% to emergency fund/financial goals

- 20% to something you enjoy (prevents burnout)

This balance keeps you motivated while making serious progress.

Advanced Strategies: Accelerate Your Debt Payoff

Balance Transfer Cards (Use with Caution)

How it works: Transfer high-interest credit card debt to a card offering 0% APR for 12-21 months. This stops interest from accumulating while you pay down the principal.

The math: A $5,000 balance at 22% APR costs $1,100 in interest over one year. Transfer it to a 0% card (typical 3% fee = $150), and you save $950.

Critical rules:

- Have a payoff plan that clears the balance before 0% expires

- Stop using the old cards (don’t add new debt)

- Set up autopay to avoid missing payments

- Don’t use the new card for purchases

Recommended cards for 2025: Look for cards offering 15-21 months at 0% APR with balance transfer fees under 3%.

Debt Consolidation Loans

How it works: Take out one personal loan at a lower interest rate to pay off multiple high-interest debts. You’re left with one monthly payment at a better rate.

When it makes sense:

- You have good credit (660+) to qualify for rates below 10%

- You’re consolidating credit cards charging 18%+

- You’re disciplined enough not to run up the cards again

Example:

- Before: $15,000 across 3 credit cards at 21% average = $3,150/year in interest

- After: $15,000 consolidation loan at 9% = $1,350/year in interest

- Savings: $1,800/year

The Bi-Weekly Payment Hack

Instead of making one monthly payment, make half-payments every two weeks. You’ll make 26 half-payments per year (13 full payments) instead of 12, shaving months or years off your payoff timeline.

Why it works:

- Most people get paid bi-weekly, so it aligns with cash flow

- The extra payment goes entirely to the principal

- It’s psychologically easier than finding a lump sum

Example: A $10,000 loan at 8% normally takes 5 years with $202.76 monthly payments. Bi-weekly payments of $101.38 pay it off in 4.5 years, saving $400 in interest.

The Psychology of Staying Motivated

Paying off debt is a marathon, not a sprint. The average American takes 5-7 years to become debt-free, which means you need psychological strategies to maintain momentum.

Visual Progress Tracking

Create a visual representation of your debt payoff journey:

- Debt thermometer: Color in your progress as balances drop

- Chain method: Mark an X on your calendar for each day you don’t add new debt

- Milestone celebrations: Reward yourself (affordably) when you hit 25%, 50%, 75% paid off

Accountability Partners

Share your goal with someone who will check in regularly. Studies show that people with accountability partners are 65% more likely to achieve financial goals.

Join online communities:

- Reddit’s r/debtfree

- Facebook debt payoff groups

- Local financial peace groups

Reframe Your Mindset

Instead of “I can’t afford that,” say “I’m choosing to prioritize debt freedom.” The first creates a scarcity mindset; the second creates empowerment.

“Every dollar you send to debt is a dollar you’re paying your future self. You’re literally buying your freedom.” — Financial educator Dave Ramsey

Common Mistakes That Sabotage Debt Payoff

1: Not Addressing the Root Cause

Paying off debt without fixing the behaviors that created it is like bailing water from a boat without plugging the hole. Identify your spending triggers:

- Emotional spending (stress, boredom, sadness)

- Keeping up with peers

- Lack of budget awareness

- Impulse buying

Solution: Track every purchase for 30 days and note your emotional state. Patterns will emerge.

2: Sacrificing Retirement Contributions

Some debt payoff gurus say to stop all investing until debt-free. This is terrible advice if your employer matches 401(k) contributions. That match is instant 100% return—you can’t beat that paying off even 25% APR debt.

Smart rule: Always contribute enough to get the full employer match, then attack debt. Learn more about building wealth through smart investing.

3: Ignoring Small Debts

That $50 medical bill or $100 utility debt seems insignificant, but unpaid small debts go to collections, damaging your credit and costing you in higher interest rates on everything else.

Solution: Knock out anything under $100 immediately, even if it’s not part of your snowball/avalanche plan.

4: Lifestyle Inflation During Payoff

You get a raise, so you increase spending. This is the #1 reason debt payoff takes longer than necessary.

Solution: When income increases, send 70% of the raise to debt and enjoy 30%. This maintains motivation while accelerating progress.

How Long Will It Take? Setting Realistic Timelines

The timeline to pay off debt depends on three variables:

- Total debt amount

- Interest rates

- Monthly payment amount

Quick Reference Timeline

| Monthly Extra Payment | $5,000 Debt (18% APR) | $15,000 Debt (18% APR) | $30,000 Debt (18% APR) |

|---|---|---|---|

| $100 | 4.5 years | 11 years | 20+ years |

| $250 | 2.5 years | 6 years | 11 years |

| $500 | 1.5 years | 3.5 years | 6.5 years |

| $1,000 | 10 months | 2 years | 3.5 years |

The takeaway: Small increases in monthly payments create massive reductions in payoff time. An extra $100/month on $15,000 of debt saves you 5 years and thousands in interest.

After Debt Freedom: Building Wealth

Once you’re debt-free, don’t fall into the trap of lifestyle inflation. The habits that got you out of debt are the same habits that build wealth.

The Wealth-Building Sequence

- Boost emergency fund to 3-6 months of expenses (financial security)

- Max out retirement contributions (tax advantages + compound growth)

- Invest in index funds or dividend stocks for passive income generation

- Consider real estate or business opportunities (advanced wealth building)

Understanding why the stock market goes up over time helps you make confident investing decisions after debt freedom. Being aware of the cycle of market emotions prevents panic selling during volatility.

The money you were sending to creditors can now fund your financial future. A $500 monthly debt payment becomes $500 monthly investing, which at 8% annual returns becomes $367,000 in 20 years.

Real-World Case Study: The Martinez Family

Starting position (2023):

- Combined income: $75,000/year

- Credit card debt: $18,000 (avg 21% APR)

- Car loan: $12,000 (6% APR)

- Student loans: $25,000 (4.5% APR)

- Total debt: $55,000

Strategy implemented:

- Used the debt avalanche method (highest interest first)

- Wife started freelance graphic design ($800/month extra)

- Husband drove for Uber on weekends ($600/month extra)

- Cut cable and unused subscriptions ($120/month savings)

- Negotiated credit card APR down to 15% (saved $90/month in interest)

- Total extra toward debt: $1,610/month

Results:

- Credit cards paid off: 14 months (originally would have taken 8+ years)

- Car loan paid off: 24 months total

- Student loans: Paying minimums until credit cards and car are gone

- Projected debt-free date: 42 months (3.5 years)

- Interest saved: $28,000+

Key insight: They didn’t sacrifice everything. They kept one streaming service, monthly date nights (budgeted at $60), and small hobbies. The side income made the difference without feeling deprived.

Tools and Resources for Debt Payoff Success

Recommended Free Tools

Debt payoff calculators:

- Unbury.me (visualizes snowball vs. avalanche)

- Credit Karma (tracks debts and credit score)

- Mint or YNAB (budgeting and expense tracking)

Educational resources:

- Federal Reserve consumer credit resources (Fed.gov)

- Consumer Financial Protection Bureau (CFPB.gov)

- National Foundation for Credit Counseling (NFCC.org)

Income opportunities:

- Upwork, Fiverr (freelancing)

- TaskRabbit (local gigs)

- VIPKid (online tutoring)

The Emotional Journey: What to Expect

Paying off debt is as much an emotional journey as a financial one. Here’s what to expect:

Months 1-3: Excitement and motivation

You’re fired up, cutting expenses, maybe starting a side hustle. Everything feels possible.

Months 4-8: The grind sets in

Progress feels slow. You’re tired of saying no. This is where most people quit. Push through—this is temporary.

Months 9-18: Seeing real progress

Debts start disappearing. Your credit score improves. The finish line feels real.

Months 18+: The home stretch

You’ve built incredible financial habits. Debt freedom is close. Life feels different.

Debt freedom day: Pure relief

The weight lifts. You own your income. Your financial future belongs to you.

“The first step to getting somewhere is to decide you’re not going to stay where you are.” — Financial author J.P. Morgan

Conclusion: Your Debt-Free Future Starts Today

Learning how to pay off debt fast without feeling broke isn’t about extreme deprivation—it’s about strategic optimization, increased income, and sustainable habits. The methods outlined in this guide have helped millions of people eliminate debt while maintaining their sanity and quality of life.

Your action plan for the next 48 hours:

Today: List all debts with balances, interest rates, and minimum payments

Today: Calculate your debt-to-income ratio

Tomorrow: Choose your method (snowball or avalanche)

Tomorrow: Set up automated payments

This week: Negotiate one interest rate or bill

This week: Identify one income opportunity to explore

Remember: Every dollar sent to debt is a dollar buying your freedom. The sacrifice is temporary, but financial freedom is permanent.

You don’t need a six-figure income or a radical lifestyle change. You need a plan, consistency, and the willingness to make different choices than you made before. The path to debt freedom isn’t easy, but it’s simple—and absolutely worth it.

For those looking ahead to life after debt, consider exploring smart moves for financial growth and learning how to make your kid a millionaire to ensure generational wealth building.

Your debt-free journey starts with a single extra payment. Make it today.

Interactive Debt Payoff Calculator

💰 Debt Payoff Calculator

Compare Snowball vs Avalanche methods to find your fastest path to freedom

Debt #1

References and Sources

This article draws on research and data from the following authoritative sources:

- Federal Reserve: Consumer credit statistics and household debt data (FederalReserve.gov)

- Consumer Financial Protection Bureau: Debt management guidance and consumer protection information (ConsumerFinance.gov)

- Investopedia: Financial definitions and debt payoff strategies (Investopedia.com)

- National Foundation for Credit Counseling: Non-profit credit counseling resources (NFCC.org)

- Harvard Business Review: Behavioral finance research on debt payoff motivation

FAQ

The fastest way to pay off debt combines three elements: (1) using the debt avalanche method to minimize interest, (2) increasing income through side hustles or career advancement, and (3) temporarily cutting discretionary expenses. Paying even $100-200 extra monthly can cut years off your timeline.

Build a small emergency fund of $500-1,000 first, then focus on debt payoff. This prevents new debt when emergencies arise. After becoming debt-free, build your emergency fund to 3-6 months of expenses. Never sacrifice employer 401(k) matching—that’s free money you can’t get back.

Focus on the formula: Income – Expenses = Money for Debt. If income is fixed, optimize expenses ruthlessly. Look for assistance programs, negotiate bills, and explore micro-income opportunities like selling unused items. Even $25-50 extra per week ($100-200/month) makes a significant impact over time.

Debt consolidation works well if: (1) you qualify for an interest rate lower than your current average, (2) you don’t run up the paid-off cards again, and (3) fees don’t negate the savings. It simplifies payments and can save thousands in interest, but it requires discipline to avoid creating new debt.

A healthy debt-to-income ratio is below 36%, with no more than 28% going toward housing. Ratios between 36-43% are manageable but need attention. Above 43% indicates high financial stress and requires aggressive debt reduction or income increase. Lenders use this metric to assess creditworthiness.

Yes, and success rates are surprisingly high (70-80%) for customers with decent payment history. Call your credit card company, reference your loyalty and on-time payments, mention competing offers, and directly ask for a rate reduction. Even a 5% reduction saves hundreds annually.

Pay as much as you can without sacrificing basic needs or employer retirement matching. Start with 10-15% of your take-home income beyond minimum payments. As you optimize expenses and increase income, push this to 20-30%. The key is consistency—$200 every month beats $500 once in a while.

Disclaimer

This article is for educational purposes only and does not constitute financial advice. Every individual’s financial situation is unique, and what works for one person may not be appropriate for another. Before making significant financial decisions, consult with a qualified financial advisor, certified financial planner, or credit counselor who can assess your specific circumstances. The strategies outlined here are general recommendations based on widely accepted financial principles, but results may vary. TheRichGuyMath.com is not responsible for any financial decisions made based on this content.

About the Author

Written by Max Fonji, a financial educator with over a decade of experience helping individuals achieve financial freedom through practical, data-backed strategies. Max specializes in making complex financial concepts accessible to beginners and has helped thousands of readers transform their relationship with money. His mission is simple: empower everyday people with the knowledge and tools to build lasting wealth.

Connect with Max and explore more wealth-building strategies at TheRichGuyMath.com.