← Back to Budgeting and Saving

Picture this: it’s the middle of the month, your bank account is running on fumes, and an unexpected expense just landed in your lap. Sound familiar? You’re not alone. Nearly 69% of Americans have less than $1,000 in savings, according to recent Federal Reserve data. But here’s the good news: saving money fast isn’t about making six figures or living on ramen noodles. It’s about making smart, strategic moves that compound over time.

Whether you’re building an emergency fund, saving for a dream vacation, or creating a financial cushion to start investing in the stock market, this guide will show you exactly how to save money fast with actionable strategies that work in 2025. Investopedia

TL;DR

How to save money fast means implementing immediate cost-cutting strategies while building sustainable saving habits that generate results within 30-90 days.

- Automate your savings first: Set up automatic transfers of 10-20% of your income to a separate savings account before you can spend it

- Cut the “invisible” expenses: Cancel unused subscriptions, negotiate bills, and eliminate high-interest debt to free up $200-500+ monthly

- Boost your income quickly: Use side hustles, sell unused items, or monetize skills to accelerate savings by 50-100%

- Use the 50/30/20 rule: Allocate 50% to needs, 30% to wants, and 20% to savings and debt repayment for balanced money management

- Track every dollar: Use budgeting apps or spreadsheets to identify spending leaks and redirect that money toward your savings goals

What Does “Saving Money Fast” Really Mean?

In simple terms, saving money fast means maximizing the gap between your income and expenses in the shortest time possible while building sustainable financial habits.

Unlike traditional saving advice that focuses on long-term wealth building, fast saving prioritizes immediate results. It combines aggressive cost-cutting, income boosting, and strategic financial moves to accumulate $500, $1,000, or even $5,000 within weeks or months rather than years.

The key difference? Intensity and urgency. Fast saving requires deliberate action, not passive hope.

Why Fast Saving Matters in 2025

The financial landscape has shifted dramatically:

- Inflation has eroded purchasing power by 15-20% since 2020

- Emergency expenses average $1,200-$2,000 per household annually

- Economic uncertainty makes having liquid savings more critical than ever

- Investment opportunities require capital. The faster you save, the sooner you can start earning passive income through dividend investing

The Fast-Savings Framework: Your 90-Day Money Transformation

Step 1: Conduct a Financial Reality Check

Before you can save aggressively, you need to know exactly where you stand.

Action Items:

- Calculate your net worth (assets minus liabilities)

- Track every expense for one week using apps like Mint, YNAB, or a simple spreadsheet

- Identify your monthly income (after taxes)

- List all debts with interest rates and minimum payments

This reality check often reveals $200-$500 in monthly spending leaks that most people don’t even realize exist.

Step 2: Set a Specific, Measurable Savings Goal

Vague goals like “save more money” fail 87% of the time. Instead:

Good Goal: “Save $3,000 in 90 days for an emergency fund”

Bad Goal: “Try to save some money this year.”

Break your big goal into weekly targets:

- $3,000 in 90 days = $1,000/month = $250/week

This makes the goal feel achievable and allows you to track progress weekly.

10 Proven Strategies On How to Save Money Fast

1. Pay Yourself First (The Golden Rule)

The strategy: Automatically transfer 10-20% of every paycheck to a separate savings account before you pay bills or spend anything.

Why it works: You can’t spend what you don’t see. This leverages behavioral economics to make saving effortless.

Implementation:

- Set up automatic transfers on payday

- Use a high-yield savings account (earning 4-5% APY in 2025)

- Treat this transfer as a non-negotiable “bill”

Expected savings: $300-$600/month on a $3,000 monthly income

2. Execute the Subscription Purge

The average American pays for 12 subscriptions but only uses 4-5 regularly, wasting $200-$300 monthly.

Action plan:

- Review bank statements for recurring charges

- Cancel unused gym memberships, streaming services, and app subscriptions

- Negotiate lower rates on essential services (internet, phone, insurance)

- Use services like Truebill or Trim to automate this process

Expected savings: $150-$400/month

3. Implement the 30-Day Rule for Purchases

The rule: For any non-essential purchase over $50, wait 30 days before buying.

Psychology: 70% of impulse purchases are never completed when delayed. This cooling-off period separates wants from needs.

How to do it:

- Create a “wish list” for items you want

- Add the date you first wanted it

- Only buy if you still want it 30 days later

Expected savings: $200-$500/month

4. Master the Grocery Game

Food is the second-largest household expense after housing, averaging $600-$800 monthly for a family of four.

Fast-savings tactics:

- Meal plan every Sunday (saves 25-30% on groceries)

- Buy generic brands (identical quality, 30-50% cheaper)

- Use cashback apps (Ibotta, Fetch, Rakuten)

- Shop sales and use coupons strategically

- Reduce restaurant meals from 4x/week to 1x/week

Expected savings: $200-$400/month

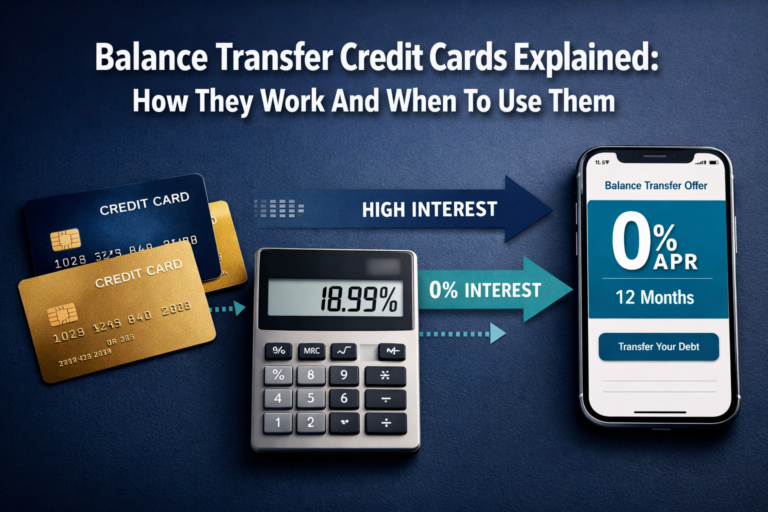

5. Eliminate or Reduce High-Interest Debt

Credit card debt at 18-24% APR is a wealth destroyer. Every dollar in interest is a dollar you can’t save.

Fast debt reduction strategy:

- Stop using credit cards (switch to debit/cash)

- Pay the minimum on all cards except the highest-interest one

- Attack the highest-interest card with every extra dollar

- Consider a balance transfer to a 0% APR card (12-18 months)

- Negotiate lower rates by calling credit card companies

Paying off $5,000 in credit card debt at 20% APR saves you $1,000+ annually in interest alone.

6. Boost Your Income with Strategic Side Hustles

The fastest way to save more is to earn more. Even an extra $500/month accelerates your savings timeline dramatically.

High-ROI side hustles for 2025:

- Freelance your skills (writing, design, coding) on Upwork or Fiverr

- Drive for rideshare (Uber, Lyft) during peak hours

- Deliver food (DoorDash, Uber Eats) in your spare time

- Rent out a room on Airbnb

- Sell digital products or online courses

- Tutor students in your area of expertise

For more income-generating ideas, check out these smart ways to make passive income.

Expected additional income: $300-$1,500/month

7. Sell What You Don’t Use

The average household has $3,000-$7,000 worth of unused items gathering dust.

Quick-cash items to sell:

- Electronics (old phones, tablets, laptops)

- Clothing and accessories

- Furniture you don’t use

- Books, DVDs, games

- Tools and equipment

- Collectibles

Best platforms:

- Facebook Marketplace (local, no shipping)

- eBay (highest prices for collectibles)

- Poshmark/Mercari (clothing and accessories)

- OfferUp (furniture and large items)

Expected one-time boost: $500-$2,000

8. Optimize Your Transportation Costs

Transportation is often the third-largest expense, averaging $700-$1,000 monthly.

Fast-savings moves:

- Refinance your auto loan (rates dropped in early 2025)

- Shop for cheaper car insurance (compare quotes annually)

- Carpool or use public transit 2-3 days/week

- Combine errands to reduce gas consumption

- Maintain your vehicle to prevent costly repairs

Expected savings: $100-$300/month

9. Use the Cash Envelope System

How it works: Allocate cash for variable expenses (groceries, entertainment, dining out) and when the envelope is empty, you stop spending in that category.

Why it’s effective: Spending physical cash triggers more emotional awareness than swiping cards, reducing spending by 15-20%.

Categories to use:

- Groceries

- Dining out

- Entertainment

- Personal care

- Miscellaneous

Expected savings: $150-$300/month

10. Leverage Employer Benefits Fully

Many people leave free money on the table by not maximizing employer benefits.

Check for:

- 401(k) matching (contribute enough to get the full match)

- Health Savings Account (HSA) (triple tax advantage)

- Flexible Spending Account (FSA) (reduce taxable income)

- Employee discounts (gym, phone, insurance)

- Tuition reimbursement (invest in skills that increase income)

Expected savings: $100-$500/month in tax savings and free money

The 50/30/20 Budget Rule: Your Savings Blueprint

One of the most effective frameworks for fast saving is the 50/30/20 rule, popularized by Senator Elizabeth Warren.

How It Works:

| Category | Percentage | Description | Example (on $4,000/month) |

|---|---|---|---|

| Needs | 50% | Essential expenses: rent, utilities, groceries, insurance, minimum debt payments | $2,000 |

| Wants | 30% | Non-essential spending: dining out, entertainment, hobbies, subscriptions | $1,200 |

| Savings & Debt | 20% | Emergency fund, retirement, extra debt payments, investments | $800 |

For aggressive fast saving, temporarily shift to a 60/20/20 or 70/10/20 split, cutting wants to accelerate savings.

The Savings Accelerator: Combining Strategies

The magic happens when you stack multiple strategies. Here’s a real-world example:

Starting point: $3,500 monthly income, $200 current savings rate

Strategy stack:

- Pay yourself first (15% = $525) → +$325/month

- Cancel 5 subscriptions → +$80/month

- Reduce dining out (3x/week to 1x/week) → +$200/month

- Side hustle (freelance writing 5 hours/week) → +$400/month

- Sell unused items → +$1,000 one-time

New monthly savings: $1,205 + $1,000 boost = $4,615 in month one, then $1,205/month

Result: $5,000 saved in 4 months instead of 25 months!

Common Savings Mistakes to Avoid

1. Saving Without a Purpose

The problem: Generic “savings” goals lack motivation.

The fix: Define specific goals (emergency fund, vacation, down payment, investing capital).

2. Keeping Savings Too Accessible

The problem: Easy access leads to “borrowing” from savings.

The fix: Use a separate bank with no debit card; create friction for withdrawals.

3. Neglecting Small Expenses

The problem: “$5 doesn’t matter” mentality; $5 daily = $1,825 annually.

The fix: Track every expense; small leaks sink financial ships.

4. Focusing Only on Cutting Expenses

The problem: There’s a limit to cutting; no limit to earning.

The fix: Balance expense reduction with income growth.

5. Not Adjusting for Life Changes

The problem: Using the same budget during different life phases.

The fix: Review and adjust your savings plan quarterly.

Building Your Emergency Fund: The First Savings Goal

Before investing or saving for wants, build an emergency fund of 3-6 months of expenses.

Why It Matters:

- 63% of Americans can’t cover a $500 emergency without borrowing

- Prevents debt spirals from unexpected expenses

- Provides peace of mind and financial security

- Creates a foundation for wealth building

Emergency Fund Roadmap:

Level 1: $1,000 starter fund (1-2 months)

Level 2: 1 month of expenses (2-4 months)

Level 3: 3 months of expenses (6-12 months)

Level 4: 6 months of expenses (12-24 months)

Keep this money in a high-yield savings account earning 4-5% APY (as of 2025), not in checking, where it earns nothing.

From Saving to Wealth Building: The Next Step

Once you’ve mastered saving money fast and built your emergency fund, the next step is putting that money to work. Securities and Exchange Commission

Smart Next Moves:

- Pay off high-interest debt (anything over 7-8%)

- Max out employer 401(k) match (free money)

- Open a Roth IRA and contribute regularly

- Start investing in index funds or dividend-paying stocks

- Build multiple income streams for financial independence

Understanding why the stock market goes up over time can help you feel confident about investing your savings rather than letting them sit idle.

However, be aware of why people lose money in the stock market and the cycle of market emotions to avoid common investing pitfalls.

How to Save Money Fast: Real-Life Success Story

Meet Sarah, a 28-year-old teacher earning $42,000 annually:

Starting point (January 2025):

- $150 in savings

- $3,500 monthly income (after taxes)

- $8,000 in credit card debt

- No budget or tracking

90-day transformation:

Month 1:

- Implemented pay-yourself-first (10% = $350)

- Canceled 6 unused subscriptions ($145 saved)

- Started meal planning ($180 saved)

- Sold unused items on Facebook Marketplace ($850 one-time)

- Month 1 savings: $1,525

Month 2:

- Increased pay-yourself-first to 15% ($525)

- Started tutoring side hustle ($400 extra)

- Refinanced car loan (saved $75/month)

- Reduced dining out ($200 saved)

- Month 2 savings: $1,200

Month 3:

- Maintained all habits

- Received tax refund ($1,200)

- Negotiated lower car insurance ($40/month saved)

- Month 3 savings: $1,240

Total 90-day result: $3,965 saved + $1,200 tax refund = $5,165 total

Sarah went from $150 to over $5,000 in just three months by stacking strategies and staying consistent.

Interactive Savings Calculator

💰 Fast Savings Calculator

Advanced Savings Strategies for Overachievers

The Savings Challenge Method

Gamify your savings with popular challenges:

52-Week Challenge:

- Week 1: Save $1

- Week 2: Save $2

- Week 52: Save $52

- Total saved: $1,378

Bi-weekly Challenge:

- Save $50 every payday (26 times/year)

- Total saved: $1,300

Round-Up Challenge:

- Round up every purchase to the nearest dollar

- Transfer the difference to savings

- Average savings: $50-$100/month

The No-Spend Challenge

Pick one category and spend $0 on it for 30 days:

- No dining out

- No new clothes

- No entertainment purchases

- No coffee shop visits

Average savings: $200-$400 per challenge

The Income Windfall Rule

When you receive unexpected money (tax refund, bonus, gift, raise), apply the 70/30 rule:

- 70% to savings/debt

- 30% for enjoyment

This balances financial progress with avoiding deprivation.

Savings Tools and Apps for 2025

Best High-Yield Savings Accounts:

- Marcus by Goldman Sachs (4.5% APY)

- Ally Bank (4.35% APY)

- American Express Personal Savings (4.4% APY)

- CIT Bank (4.6% APY on Platinum Savings)

Best Budgeting Apps:

- YNAB (You Need A Budget) – Zero-based budgeting

- Mint – Free comprehensive tracking

- PocketGuard – Shows how much you can safely spend

- Personal Capital – Best for net worth tracking

Best Cashback and Rewards:

- Rakuten – Up to 10% cashback shopping

- Ibotta – Grocery rebates

- Fetch Rewards – Scan any receipt for points

- Drop – Automatic cashback on linked cards

Teaching Kids to Save: Building Generational Wealth

Starting financial education early creates lasting money habits. If you have children, teaching them to save is one of the greatest gifts you can give. Federal Reserve

Age-appropriate savings lessons:

Ages 3-5:

- Use clear jars to show money growing

- Introduce the concept of saving for a toy

Ages 6-10:

- Give allowance with the required savings percentage

- Open a savings account in their name

- Teach the difference between needs and wants

Ages 11-15:

- Introduce compound interest concepts

- Match their savings (like a 401k match)

- Encourage earning money through chores or small jobs

Ages 16-18:

- Open a custodial investment account

- Teach budgeting for real expenses

- Discuss how to make your kid a millionaire through early investing

Your 7-Day Fast-Savings Kickstart Plan

Ready to start saving money fast? Here’s your week-by-week action plan:

Day 1: Financial Audit

- [ ] Calculate net worth

- [ ] Track all expenses for one day

- [ ] List all subscriptions and recurring charges

- [ ] Set specific savings goal

Day 2: Automate Savings

- [ ] Open a high-yield savings account

- [ ] Set up automatic transfer for payday

- [ ] Move existing savings to a high-yield account

Day 3: Cut Subscriptions

- [ ] Cancel unused subscriptions

- [ ] Negotiate lower rates on essential services

- [ ] Download budgeting app

Day 4: Optimize Food Spending

- [ ] Meal plan for the week

- [ ] Create grocery list from meal plan

- [ ] Shop with list (no impulse buys)

Day 5: Boost Income Research

- [ ] List skills you can monetize

- [ ] Research side hustle options

- [ ] Sign up for one gig platform

Day 6: Sell Unused Items

- [ ] Identify 10-20 items to sell

- [ ] Take photos and create listings

- [ ] Post on Facebook Marketplace/eBay

Day 7: Review and Commit

- [ ] Calculate potential monthly savings

- [ ] Review progress from week one

- [ ] Commit to continuing for 90 days

- [ ] Join online accountability group

Conclusion: Your Fast-Savings Journey Starts Now

Learning how to save money fast isn’t about deprivation or living a miserable, penny-pinching existence. It’s about making intentional choices that align your spending with your values and goals.

The strategies in this guide, from automating savings to boosting income to cutting invisible expenses, have helped thousands of people save their first $1,000, $5,000, or even $10,000 in a matter of months, not years.

Remember these key principles:

Start immediately – Perfect is the enemy of good; start with what you can do today

Stack strategies – Combine multiple tactics for exponential results

Track everything – You can’t improve what you don’t measure

Automate relentlessly – Remove willpower from the equation

Boost income – There’s a limit to cutting, no limit to earning

Stay consistent – Small actions compound into massive results

Your financial transformation doesn’t require a six-figure salary, inheritance, or lottery win. It requires decision, action, and consistency.

The best time to start saving was yesterday. The second-best time is right now.

Your Next Steps:

- Today: Set up automatic savings transfer

- This week: Complete the 7-day kickstart plan

- This month: Implement 3-5 strategies from this guide

- This quarter: Build your $1,000 emergency fund

- This year: Develop smart money habits that last a lifetime

Once you’ve mastered saving, the next step is making your money work for you through strategic investing. Start exploring options and building wealth that lasts.

FAQ

Financial experts recommend saving 20% of your gross income. On a $3,500 monthly income, that’s $700/month. However, if you’re starting from zero, begin with 10% ($350) and increase gradually. The key is consistency, not perfection.

The fastest way to save $1,000 is to combine income boosts with expense cuts. Sell unused items ($300-500), implement pay-yourself-first ($200-300), cancel subscriptions ($100-150), and start a quick side hustle ($400-600). This combination can generate $1,000 in 2-4 weeks.

Pay off high-interest debt (over 7-8% APR) while building a small emergency fund ($500-1,000) simultaneously. Once high-interest debt is eliminated, shift to aggressive saving. Low-interest debt (like mortgages under 4%) can be paid off slowly while you save and invest.

Focus on the big three expenses: housing, transportation, and food. Get a roommate, refinance loans, use public transit, a meal plan, and buy generic brands. These moves can free up $300-600 monthly, even on a tight budget. Small expenses matter, but big expenses make the biggest impact.

High-yield savings accounts from online banks offer 4-5% APY compared to traditional banks’ 0.01%. Look for accounts with no monthly fees, FDIC insurance, and easy transfers. Top options include Marcus by Goldman Sachs, Ally Bank, and American Express Personal Savings.

Make your goal visual and specific. Create a savings tracker, use apps that show progress, celebrate milestones, and connect your savings to a meaningful purpose (security, freedom, opportunity). Join online communities for accountability and share your progress with a trusted friend.

Yes, but it requires aggressive action. Start with a micro-goal ($25/week), automate even tiny amounts, focus on increasing income through side hustles, and ruthlessly eliminate non-essentials. The pay-yourself-first method works even with small amounts—$25/week becomes $1,300/year.

Financial Disclaimer

This article is for educational purposes only and does not constitute financial advice. Saving strategies should be tailored to your individual financial situation, goals, and risk tolerance. Before making significant financial decisions, consider consulting with a qualified financial advisor. Past performance of savings strategies does not guarantee future results. The author and TheRichGuyMath.com are not responsible for any financial decisions made based on this information.

About the Author

Written by Max Fonji — With over a decade of experience in personal finance education and wealth building, Max is your go-to source for clear, data-backed investing and savings education. Max has helped thousands of readers transform their financial lives through actionable strategies and proven frameworks. Visit TheRichGuyMath.com for more wealth-building insights