Ever stared at a company’s financial reports and felt completely lost? You’re not alone. Picture this: you’re about to invest your hard-earned money into a stock, but the numbers on those financial statements look like they’re written in a foreign language. Here’s the truth—understanding income statement vs balance sheet is the difference between making informed investment decisions and gambling with your money. These two financial statements are the backbone of every successful investor’s toolkit, yet most beginners don’t know where to start.

Think of it this way: if a company were a person, the balance sheet would be their net worth statement (what they own and owe), while the income statement would be their paycheck stub (how much they earned and spent). Both tell completely different stories, but together, they paint a complete picture of financial health.

In this comprehensive guide, we’ll break down everything you need to know about these essential financial documents in plain English, no accounting degree required.

TL;DR

- The income statement shows profitability over time (usually quarterly or annually), revealing how much revenue a company generated and whether it turned a profit or loss during that period.

- The balance sheet is a snapshot of financial position at a specific moment, displaying what a company owns (assets), what it owes (liabilities), and the owners’ stake (equity).

- Income statements answer “How well did we perform?” while balance sheets answer “What do we have right now?”

- Both statements are interconnected: profits from the income statement flow into retained earnings on the balance sheet, creating a financial story that unfolds over time.

- Smart investors analyze both together to understand not just if a company is profitable, but also if it’s financially stable and can sustain that profitability long-term.

What Is an Income Statement?

In simple terms, an income statement (also called a profit and loss statement or P&L) shows how much money a company made or lost during a specific period of time. It’s like a report card for a company’s financial performance, covering a set timeframe; typically a quarter (three months) or a full year.

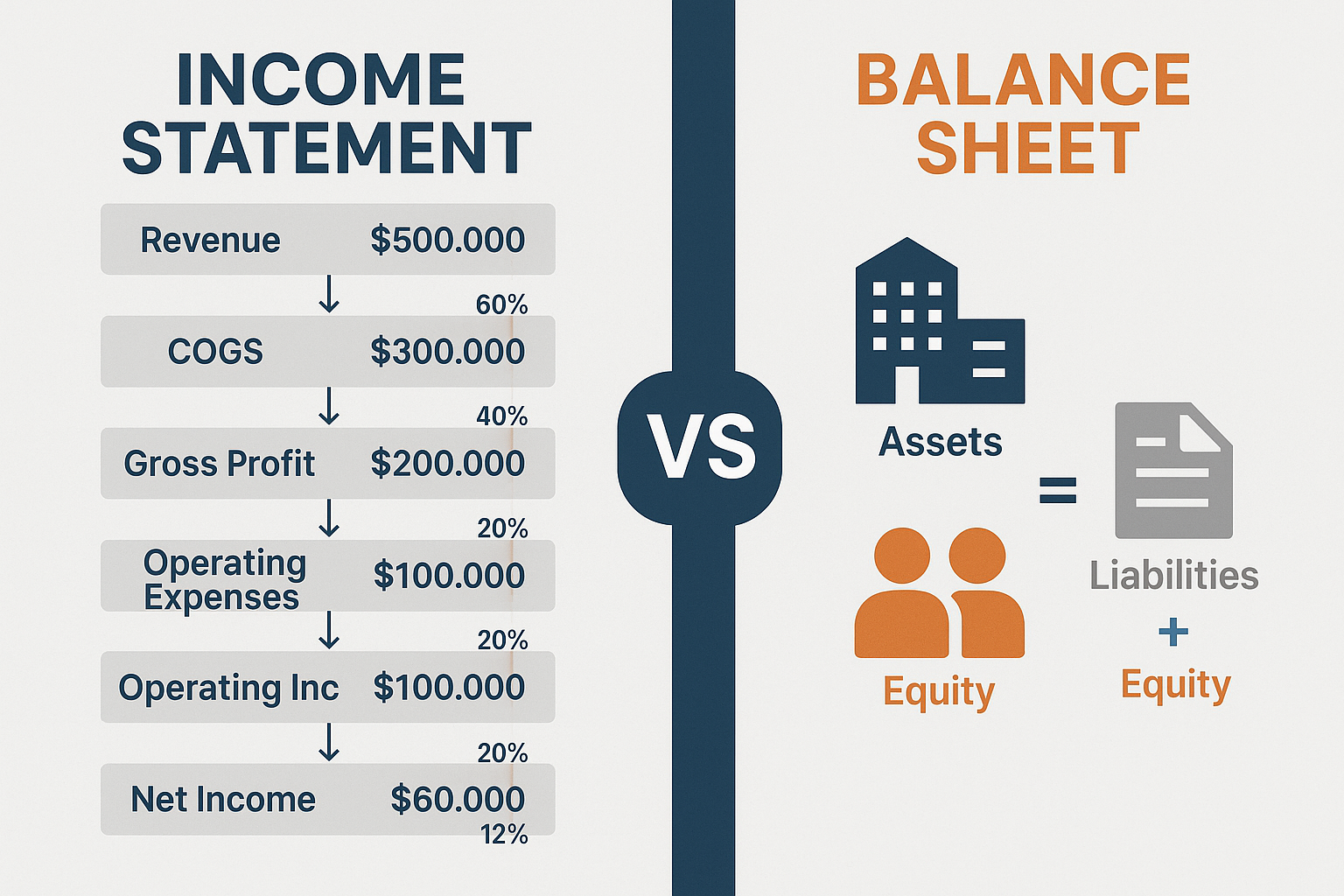

The income statement follows a straightforward formula:

Revenue – Expenses = Net Income (or Net Loss)

This financial statement tells you:

- How much money the company brought in (revenue/sales)

- How much does it cost to run the business (expenses)

- Whether the company made a profit or suffered a loss

- How efficiently the company operates

Key Components of an Income Statement

Let’s break down the main sections you’ll find on every income statement:

1. Revenue (Top Line)

- Also called “sales” or “gross receipts”

- The total amount of money earned from selling products or services

- This is the starting point of the income statement

2. Cost of Goods Sold (COGS)

- Direct costs associated with producing goods or services

- Includes raw materials, labor directly tied to production, and manufacturing overhead

- Subtracted from revenue to get gross profit

3. Gross Profit

- Revenue minus COGS

- Shows how profitable the core business operations are

- Formula: Gross Profit = Revenue – COGS

4. Operating Expenses

- Costs required to run the business that aren’t directly tied to production

- Includes salaries, rent, marketing, utilities, and administrative costs

- Also called “overhead” or “SG&A” (Selling, General, and Administrative expenses)

5. Operating Income

- Gross profit minus operating expenses

- Shows profit from core business operations before interest and taxes

- Also called “EBIT” (Earnings Before Interest and Taxes)

6. Other Income and Expenses

- Interest income or expense

- Gains or losses from investments

- One-time items like lawsuit settlements

7. Net Income (Bottom Line)

- The final profit or loss after all expenses, interest, and taxes

- This is what investors watch most closely

- Formula: Net Income = Revenue – All Expenses

“The income statement is like a movie, it shows the action over time. The balance sheet is like a photograph, it captures a single moment.” – Warren Buffett

What Is a Balance Sheet?

A balance sheet is a financial snapshot that shows what a company owns (assets), what it owes (liabilities), and what’s left over for the owners (equity) at a specific point in time. Unlike the income statement, which covers a period, the balance sheet represents a single moment, usually the last day of a quarter or fiscal year.

The balance sheet follows the fundamental accounting equation:

Assets = Liabilities + Shareholders’ Equity

This equation must always balance (hence the name “balance sheet”). It’s the golden rule of accounting and helps ensure the numbers are accurate.

Key Components of a Balance Sheet

The balance sheet is divided into three main sections:

1. Assets

Everything the company owns that has value. Assets are typically listed in order of liquidity (how quickly they can be converted to cash):

Current Assets (can be converted to cash within one year):

- Cash and cash equivalents

- Accounts receivable (money owed by customers)

- Inventory (products ready to sell)

- Short-term investments

- Prepaid expenses

Non-Current Assets (long-term holdings):

- Property, plant, and equipment (PP&E)

- Long-term investments

- Intangible assets (patents, trademarks, goodwill)

- Other long-term assets

2. Liabilities

Everything the company owes to others. Also listed by how soon they need to be paid:

Current Liabilities (due within one year):

- Accounts payable (money owed to suppliers)

- Short-term debt

- Accrued expenses (wages, taxes owed)

- Unearned revenue (customer prepayments)

Non-Current Liabilities (long-term obligations):

- Long-term debt (bonds, loans)

- Deferred tax liabilities

- Pension obligations

- Other long-term liabilities

3. Shareholders’ Equity

What’s left over for the owners after subtracting liabilities from assets:

- Common stock (money raised by selling shares)

- Retained earnings (cumulative profits kept in the business)

- Treasury stock (shares the company bought back)

- Additional paid-in capital

“The balance sheet tells you where a company stands financially at a precise moment—it’s the foundation of financial analysis.”

Income Statement vs Balance Sheet: The Core Differences

Now that we understand each statement individually, let’s compare them side-by-side to highlight the key differences:

| Aspect | Income Statement | Balance Sheet |

|---|---|---|

| Purpose | Shows profitability and performance | Shows financial position and stability |

| Time Frame | Period of time (quarter, year) | Single point in time (snapshot) |

| Question Answered | “How did we perform?” | “What do we have?” |

| Key Formula | Revenue – Expenses = Net Income | Assets = Liabilities + Equity |

| Focus | Flow of money (income and expenses) | Stock of resources (what’s owned/owed) |

| Main Metric | Net income (bottom line) | Total assets or equity |

| Analogy | A movie (shows action over time) | A photograph (captures one moment) |

| Investor Use | Assess profitability and efficiency | Evaluate financial health and solvency |

See our full guide on Statement of Shareholders’ Equity

Different Stories, Same Company

Think of it this way:

The Income Statement tells you how well a company performed during the game—how many points they scored (revenue), how many they gave up (expenses), and whether they won or lost (profit or loss).

The Balance Sheet shows you what equipment and resources the team has in the locker room right now—their uniforms, training facilities, and contracts (assets), what they owe to others like stadium leases (liabilities), and what the team is actually worth to its owners (equity).

Both are essential. A team might win games (profitable income statement) but be drowning in debt (unhealthy balance sheet). Or they might have great facilities (strong balance sheet) but keep losing games (unprofitable income statement).

When evaluating investment opportunities, understanding why the stock market goes up requires analyzing both statements together to get the complete picture.

How the Income Statement and Balance Sheet Work Together

Here’s where things get interesting: these two statements aren’t separate islands; they’re deeply connected. Understanding how they interact is crucial for making smart financial moves.

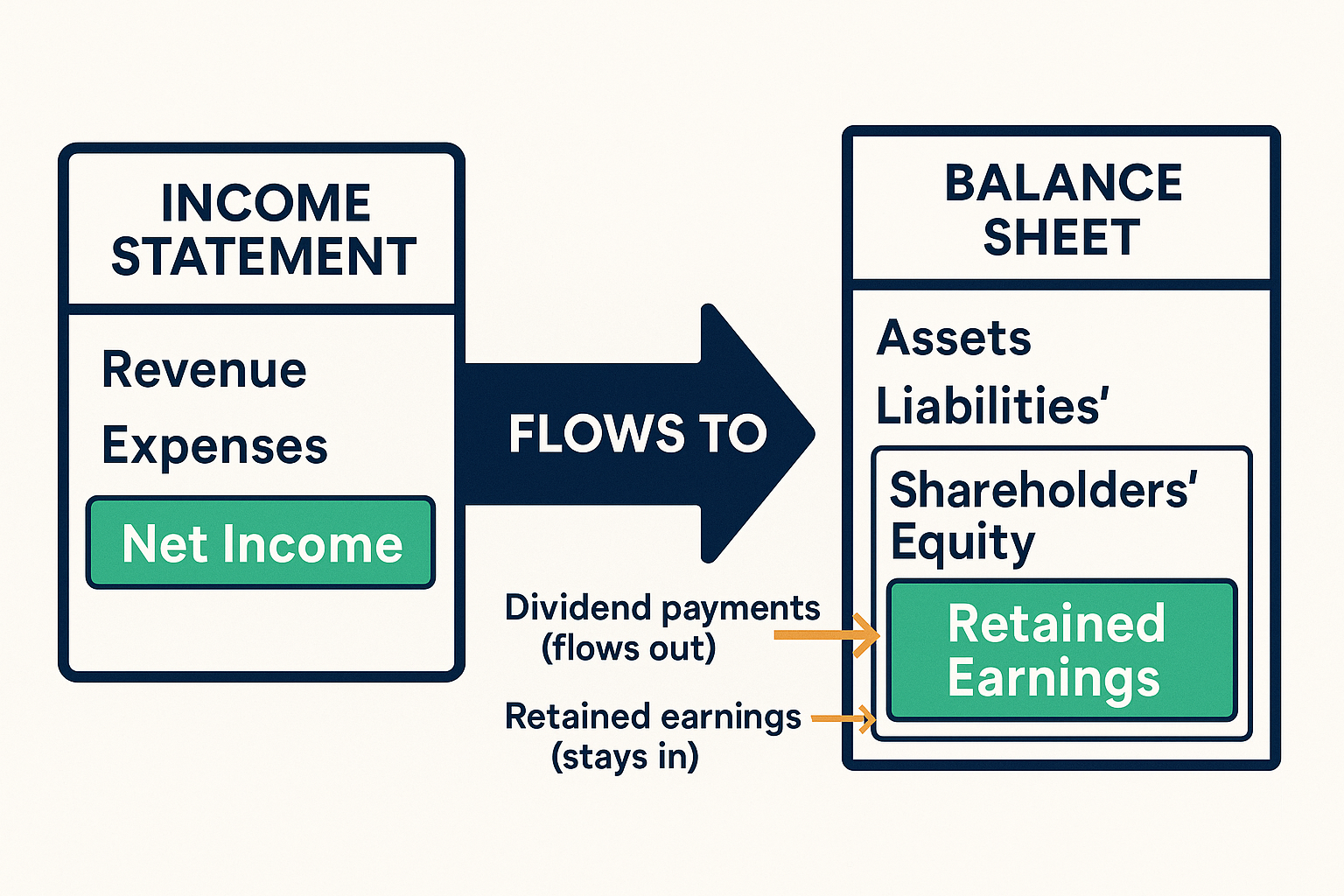

The Connection: Net Income Flows to Retained Earnings

The most important link between these statements is this:

Net income from the income statement flows into retained earnings on the balance sheet.

Here’s how it works:

- During the period, a company generates revenue and incurs expenses (captured on the income statement)

- At the end of the period, the net income (profit) is calculated

- This net income is then added to the retained earnings section of shareholders’ equity on the balance sheet

- If dividends are paid, they’re subtracted from retained earnings

- The remaining amount stays on the balance sheet as accumulated retained earnings

Formula:

Ending Retained Earnings = Beginning Retained Earnings + Net Income - Dividends PaidReal-World Example: Coffee Shop Inc.

Let’s make this concrete with a simple example:

Starting Point (Balance Sheet – January 1, 2025):

- Assets: $100,000

- Liabilities: $40,000

- Equity: $60,000 (including $20,000 in retained earnings)

During the Year (Income Statement – 2025):

- Revenue: $200,000

- Expenses: $150,000

- Net Income: $50,000

The company pays dividends: $10,000

Ending Point (Balance Sheet – December 31, 2025):

- Retained Earnings: $20,000 (beginning) + $50,000 (net income) – $10,000 (dividends) = $60,000

- New Equity: $100,000 ($60,000 retained earnings + $40,000 other equity)

- Assets grew to: $150,000 (assuming the profit was reinvested)

- Liabilities: $40,000 (unchanged)

- Total Equity: $110,000

Notice how the $50,000 profit from the income statement increased the equity on the balance sheet by $40,000 (after paying $10,000 in dividends).

Other Important Connections

1. Depreciation:

- Shows up as an expense on the income statement

- Reduces the value of assets (PP&E) on the balance sheet

2. Accounts Receivable:

- Revenue is recorded on the income statement when earned

- But if customers haven’t paid yet, it shows up as accounts receivable (asset) on the balance sheet

3. Inventory:

- Listed as an asset on the balance sheet

- When sold, it becomes COGS (expense) on the income statement

4. Debt:

- Interest payments appear as expenses on the income statement

- The principal amount owed appears as a liability on the balance sheet

Understanding these connections helps investors see how dividend investing impacts both profitability and financial stability.

Why Both Statements Matter for Investors

If you’re serious about investing in the stock market, you can’t afford to ignore either statement. Here’s why each matters:

Income Statement: The Profitability Test

Why investors care:

- Revenue growth shows whether the business is expanding

- Profit margins reveal operational efficiency

- Consistent profitability indicates a sustainable business model

- Earnings trends help predict future performance

Red flags to watch:

- Declining revenue over multiple quarters

- Shrinking profit margins

- Inconsistent earnings (big swings up and down)

- Revenue growth without profit growth

Balance Sheet: The Stability Test

Why investors care:

- Asset quality shows what resources the company has

- Debt levels indicate financial risk

- Liquidity reveals whether the company can pay its bills

- Equity growth demonstrates long-term value creation

Red flags to watch:

- Debt is growing faster than assets

- Low cash reserves

- Current liabilities exceeding current assets

- Declining equity over time

The Power of Combined Analysis

Smart investors look at both statements together:

Scenario 1: Profitable but Unstable

- The income statement shows consistent profits

- The balance sheet shows massive debt and shrinking cash

- Verdict: Risky investment—one bad quarter could cause bankruptcy

Scenario 2: Stable but Unprofitable

- The balance sheet shows strong assets and low debt

- The income statement shows consistent losses

- Verdict: Concerning—burning through resources without generating returns

Scenario 3: The Sweet Spot

- The income statement shows growing revenue and profits

- The balance sheet shows manageable debt and growing equity

- Verdict: Healthy company worth investigating further

This comprehensive analysis is essential when researching high dividend stocks because you need both profitability (to pay dividends) and stability (to sustain them).

How to Read an Income Statement: Step-by-Step Guide

Let’s walk through how to actually read and analyze an income statement like a pro:

Step 1: Start at the Top (Revenue)

Look at the revenue line first:

- Is revenue growing compared to previous periods?

- How does it compare to competitors?

- Is growth accelerating or slowing?

What to calculate:

- Year-over-year growth rate: (This Year Revenue – Last Year Revenue) / Last Year Revenue × 100

- Quarter-over-quarter growth: Same formula, but comparing consecutive quarters

Step 2: Check the Gross Profit Margin

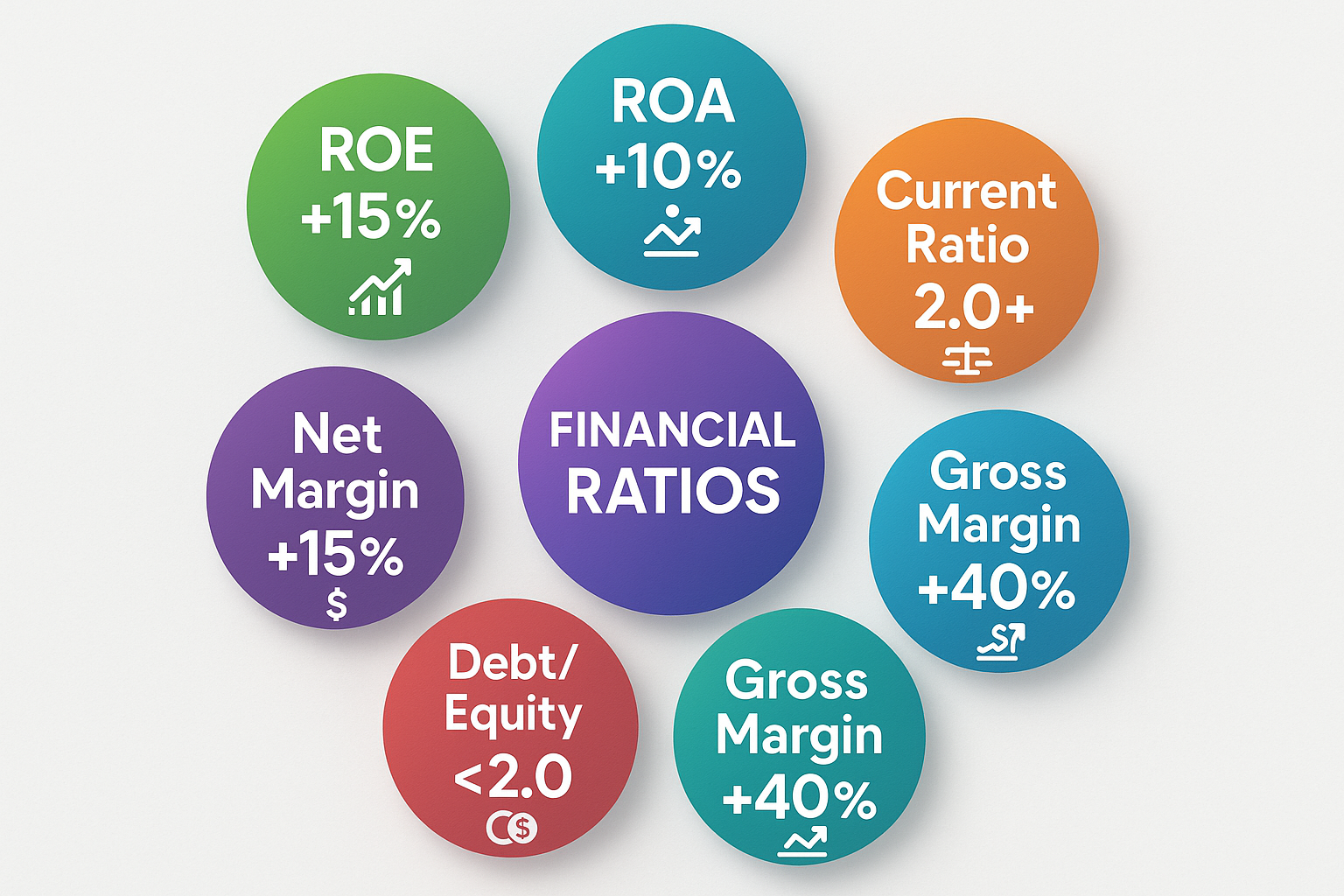

Calculate: Gross Profit Margin = (Gross Profit / Revenue) × 100

This tells you how much profit the company makes on each dollar of sales before operating expenses.

Industry benchmarks:

- Software companies: 70-90%

- Retail: 20-40%

- Manufacturing: 25-35%

A declining gross margin might indicate:

- Rising production costs

- Pricing pressure from competitors

- Product mix shifting to lower-margin items

Step 3: Examine Operating Expenses

Look at operating expenses as a percentage of revenue:

Operating Expense Ratio = (Operating Expenses / Revenue) × 100

- Are expenses growing faster than revenue?

- Is the company investing in growth (marketing, R&D)?

- Are there one-time unusual expenses?

Step 4: Calculate Operating Margin

Operating Margin = (Operating Income / Revenue) × 100

This shows how profitable the core business is before interest and taxes. Higher is better.

Good operating margins:

- Tech companies: 20-30%+

- Consumer goods: 10-15%

- Retail: 5-10%

Step 5: Analyze the Bottom Line (Net Income)

Finally, look at net income:

- Is the company profitable?

- Is net income growing faster than revenue?

- How much of the revenue becomes profit?

Net Profit Margin = (Net Income / Revenue) × 100

Step 6: Look for Trends Over Time

Don’t just look at one period; compare at least 3-5 years:

- Is profitability improving or declining?

- Are margins expanding or contracting?

- Is growth sustainable?

“Investors use the income statement to measure a company’s ability to generate profits from its operations.”

How to Read a Balance Sheet: Step-by-Step Guide

Now let’s tackle the balance sheet with the same systematic approach:

Step 1: Check Liquidity (Can They Pay Bills?)

Current Ratio = Current Assets / Current Liabilities

This tells you if the company can pay its short-term obligations.

Interpretation:

- Above 2.0: Very healthy, plenty of cushion

- 1.5 – 2.0: Good, adequate liquidity

- 1.0 – 1.5: Acceptable but watch closely

- Below 1.0: Warning sign—may struggle to pay bills

Quick Ratio (Acid Test) = (Current Assets – Inventory) / Current Liabilities

More conservative than the current ratio because inventory can be hard to sell quickly.

Target: Above 1.0 is generally healthy

Step 2: Evaluate Debt Levels

Debt-to-Equity Ratio = Total Liabilities / Shareholders’ Equity

Shows how much the company relies on debt versus owner investment.

Interpretation:

- Below 1.0: Conservative, low risk

- 1.0 – 2.0: Moderate leverage, typical for many industries

- Above 2.0: High leverage, higher risk

Industry matters:

- Capital-intensive businesses (utilities, telecom) often have higher ratios

- Tech companies typically have lower ratios

Step 3: Analyze Asset Quality

Look at what the company owns:

- Cash and equivalents: More is better—provides flexibility

- Accounts receivable: Growing too fast might indicate collection problems

- Inventory: Growing faster than sales could mean products aren’t selling

- PP&E: Heavy investment might indicate growth plans

Asset Turnover = Revenue / Total Assets

Shows how efficiently the company uses assets to generate sales.

Step 4: Examine Equity Growth

Track shareholders’ equity over time:

- Is it growing? (Good sign—company is building value)

- Is it shrinking? (Warning—losses or excessive dividends)

- What’s driving changes? (Retained earnings vs. new stock issuance)

Return on Equity (ROE) = Net Income / Shareholders’ Equity × 100

Shows how much profit the company generates with shareholders’ money.

Good ROE:

- 15%+: Excellent

- 10-15%: Good

- Below 10%: Mediocre

Step 5: Check the Balance

Verify: Assets = Liabilities + Equity

If this doesn’t balance, there’s an error in the statement.

Step 6: Compare to Industry Peers

Context matters—compare ratios to:

- Direct competitors

- Industry averages

- The company’s own historical performance

Understanding balance sheet health is crucial when exploring passive income strategies through investing.

Common Mistakes When Analyzing Financial Statements

Even experienced investors make these errors. Avoid them:

1: Looking at Only One Statement

The problem: You get an incomplete picture.

The fix: Always analyze the income statement and the balance sheet together. A profitable company (income statement) might be drowning in debt (balance sheet).

2: Ignoring Cash Flow

The problem: Profit doesn’t equal cash. A company can be “profitable” on paper but run out of cash.

The fix: Also review the cash flow statement (the third major financial statement). It shows actual cash moving in and out.

3: Not Comparing to Previous Periods

The problem: One quarter’s numbers mean nothing in isolation.

The fix: Look at trends over at least 3-5 years. Is the company improving or deteriorating?

4: Ignoring Industry Context

The problem: A 5% profit margin might be excellent in grocery retail but terrible in software.

The fix: Compare metrics to industry peers and benchmarks, not absolute standards.

5: Taking Numbers at Face Value

The problem: Companies can use accounting tricks to make numbers look better temporarily.

The fix: Look for:

- One-time gains that inflate income

- Changes in accounting methods

- Growing accounts receivable (might indicate aggressive revenue recognition)

- Footnotes explaining unusual items

6: Focusing Only on the Bottom Line

The problem: Net income can be manipulated through one-time items, tax strategies, and accounting choices.

The fix: Also examine:

- Revenue growth (harder to fake)

- Operating income (shows core business performance)

- Cash flow from operations (shows real cash generation)

7: Forgetting About Quality of Earnings

The problem: Not all profits are created equal.

The fix: Ask:

- Is profit growing because of sales growth or cost-cutting?

- Are earnings consistent or volatile?

- Is the company generating cash or just accounting profits?

Understanding these pitfalls helps you avoid common reasons people lose money in the stock market.

Real-World Example: Analyzing Apple Inc.

Let’s put everything together with a real company example. We’ll look at Apple Inc.’s simplified financials to see how the income statement vs balance sheet comparison works in practice.

Apple’s Income Statement (Simplified – Fiscal Year 2024)

| Line Item | Amount (Billions) |

|---|---|

| Revenue | $385.0 |

| Cost of Goods Sold | $214.0 |

| Gross Profit | $171.0 |

| Operating Expenses | $55.0 |

| Operating Income | $116.0 |

| Other Income/Expenses | $1.0 |

| Income Before Taxes | $117.0 |

| Income Tax | $18.0 |

| Net Income | $99.0 |

Key Metrics:

- Gross Margin: 44.4% ($171B / $385B)

- Operating Margin: 30.1% ($116B / $385B)

- Net Margin: 25.7% ($99B / $385B)

What this tells us:

Extremely healthy margins—Apple keeps over 25 cents of every dollar as profit

Strong pricing power and brand value

Efficient operations with controlled expenses

Apple’s Balance Sheet (Simplified – End of Fiscal 2024)

| Assets | Amount (Billions) | Liabilities & Equity | Amount (Billions) |

|---|---|---|---|

| Current Assets | Current Liabilities | ||

| Cash | $30.0 | Accounts Payable | $65.0 |

| Marketable Securities | $35.0 | Short-term Debt | $15.0 |

| Accounts Receivable | $30.0 | Other Current | $60.0 |

| Inventory | $7.0 | Total Current | $140.0 |

| Other Current | $15.0 | ||

| Total Current | $117.0 | Long-term Debt | $95.0 |

| Other Long-term | $50.0 | ||

| Non-Current Assets | Total Liabilities | $285.0 | |

| PP&E | $45.0 | ||

| Intangibles | $50.0 | Shareholders’ Equity | $65.0 |

| Other | $138.0 | ||

| Total Non-Current | $233.0 | ||

| TOTAL ASSETS | $350.0 | TOTAL LIAB. + EQUITY | $350.0 |

Key Metrics:

- Current Ratio: 0.84 ($117B / $140B)

- Debt-to-Equity: 4.38 ($285B / $65B)

- Cash Position: $65B in cash and marketable securities

What this tells us:

Current ratio below 1.0—but Apple has massive cash reserves and generates huge cash flow

High debt-to-equity—but this is strategic (cheap debt financing buybacks and dividends)

Strong cash position provides flexibility

Valuable intangible assets (brand, patents, ecosystem)

Combined Analysis: The Complete Picture

Strengths:

- Incredible profitability (26% net margin)

- Strong revenue base ($385B)

- Significant cash reserves ($65B)

- Valuable brand and ecosystem (intangibles)

Considerations:

- High leverage (debt-to-equity of 4.38)

- Current ratio below 1.0

- But: Massive cash flow generation mitigates both concerns

Investor Verdict:

Despite some balance sheet metrics that might look concerning in isolation, Apple’s incredible profitability and cash generation make it financially sound. The company deliberately uses debt for financial engineering (buybacks, dividends) while maintaining strong operational performance.

This is why you need BOTH statements: the income statement shows why Apple can afford the debt (massive profits), while the balance sheet shows the company’s financial structure and resources.

Industry-Specific Considerations

Different industries have different “normal” financial statement characteristics. Here’s what to expect:

Technology Companies

Income Statement:

- High gross margins (60-80%+)

- Significant R&D expenses

- Often, high operating margins

- Revenue can be volatile (subscription vs. product)

Balance Sheet:

- Lots of intangible assets (patents, software)

- Low inventory (digital products)

- High cash balances

- Often low debt

Example companies: Microsoft, Google, Adobe

Retail Companies

Income Statement:

- Lower gross margins (20-40%)

- High operating expenses (stores, staff)

- Thin net margins (2-5% typical)

- Revenue highly seasonal

Balance Sheet:

- Significant inventory

- Lots of PP&E (stores, distribution centers)

- Accounts payable often exceed receivables

- Moderate to high debt

Example companies: Walmart, Target, Costco

Manufacturing Companies

Income Statement:

- Moderate gross margins (25-35%)

- Cyclical revenue (tied to economic conditions)

- Significant COGS

- Operating leverage (margins improve when busy)

Balance Sheet:

- Heavy PP&E (factories, equipment)

- Significant inventory (raw materials, work-in-progress, finished goods)

- Moderate to high debt

- Working capital intensive

Example companies: General Electric, 3M, Caterpillar

Financial Services

Income Statement:

- Different structure (interest income vs. revenue)

- Focus on net interest margin

- Non-interest income (fees)

- Credit losses are a key expense

Balance Sheet:

- Loans as primary assets

- Deposits as primary liabilities

- High leverage is normal

- Regulatory capital requirements are important

Example companies: JPMorgan Chase, Bank of America

Understanding these differences prevents you from making unfair comparisons. A 5% net margin might be excellent for a retailer but concerning for a software company.

Using Financial Statements to Make Investment Decisions

Now, let’s get practical: how do you actually use the income statement vs balance sheet knowledge to make better investment choices?

Step 1: Screen for Quality Companies

Use both statements to filter out weak companies:

Income Statement Filters:

- Positive net income (profitable)

- Revenue growth >5% annually

- Improving or stable profit margins

- Consistent earnings (not wildly volatile)

Balance Sheet Filters:

- Current ratio >1.0

- Debt-to-equity <2.0 (or industry-appropriate)

- Positive shareholders’ equity

- Growing equity over time

Step 2: Dig Deeper into Finalists

For companies that pass initial screening:

Profitability Analysis (Income Statement):

- Calculate ROE, ROA, and profit margins

- Compare to competitors

- Look for improving trends

- Identify profit drivers

Financial Health Analysis (Balance Sheet):

- Assess liquidity (can they pay bills?)

- Evaluate leverage (too much debt?)

- Check asset quality (valuable resources?)

- Examine equity trends (building value?)

Step 3: Look for Warning Signs

Income Statement Red Flags:

- Revenue declining for 2+ consecutive quarters

- Profit margins shrinking

- Revenue is growing, but profits are shrinking

- Huge one-time gains propping up earnings

- Operating losses despite revenue growth

Balance Sheet Red Flags:

- Cash declining rapidly

- Debt is growing faster than assets

- Current liabilities exceeding current assets

- Negative equity

- Accounts receivable are growing much faster than revenue

- Inventory ballooning

Step 4: Consider the Investment Thesis

Match financial statement analysis to your investment goals:

For Dividend Investors:

- Check the income statement for consistent profitability (to fund dividends)

- Check balance sheet for manageable debt (won’t force dividend cuts)

- Calculate payout ratio: Dividends / Net Income

- Ensure retained earnings are growing (sustainable dividends)

Learn more about earning passive income through dividend investing.

For Growth Investors:

- Focus on revenue growth rate (income statement)

- Accept lower current profitability if investing in growth

- Check the balance sheet for resources to fund growth

- Look for positive equity trends despite reinvestment

For Value Investors:

- Look for a strong balance sheet (assets > liabilities)

- Seek to improve income statement trends

- Calculate price-to-book and price-to-earnings ratios

- Find companies trading below their intrinsic value

Step 5: Monitor Over Time

Once invested:

- Review statements quarterly

- Track key metrics (margins, ratios, growth rates)

- Watch for deteriorating trends

- Reassess when major changes occur

This systematic approach helps you make informed decisions and avoid the cycle of market emotions that leads to poor investment outcomes.

Key Financial Ratios Using Both Statements

Some of the most powerful analytical tools use data from BOTH the income statement and balance sheet:

Return on Assets (ROA)

Formula: ROA = (Net Income / Total Assets) × 100

What it measures: How efficiently a company uses its assets to generate profit

Uses data from:

- Net Income (income statement)

- Total Assets (balance sheet)

Good ROA:

- >5%: Generally good

- >10%: Excellent

- Varies by industry (asset-light businesses like software have higher ROA)

Return on Equity (ROE)

Formula: ROE = (Net Income / Shareholders’ Equity) × 100

What it measures: How much profit a company generates with shareholders’ investment

Uses data from:

- Net Income (income statement)

- Shareholders’ Equity (balance sheet)

Good ROE:

- >15%: Excellent

- 10-15%: Good

- <10%: Mediocre

Warren Buffett’s favorite metric for assessing management effectiveness

Asset Turnover Ratio

Formula: Asset Turnover = Revenue / Total Assets

What it measures: How efficiently a company uses assets to generate sales

Uses data from:

- Revenue (income statement)

- Total Assets (balance sheet)

Interpretation:

- Higher is better (more sales per dollar of assets)

- Varies widely by industry (retailers are higher than manufacturers)

Interest Coverage Ratio

Formula: Interest Coverage = Operating Income / Interest Expense

What it measures: How easily a company can pay interest on its debt

Uses data from:

- Operating Income (income statement)

- Interest Expense (income statement)

- But interpreted alongside debt levels (balance sheet)

Safe levels:

- >5: Very safe

- 3-5: Adequate

- <3: Concerning

- <1: Company can’t cover interest from operations

DuPont Analysis

This breaks down ROE into three components:

ROE = Net Profit Margin × Asset Turnover × Equity Multiplier

Or: ROE = (Net Income/Revenue) × (Revenue/Assets) × (Assets/Equity)

Uses data from:

- All three components use both statements

- Shows whether ROE comes from profitability, efficiency, or leverage

Why it matters: Helps identify the source of returns—is it operational excellence or just financial leverage?

These cross-statement ratios provide insights that neither statement alone could reveal, making them essential for smart investing decisions.

The Third Statement: Cash Flow Statement

While we’ve focused on the income statement vs balance sheet comparison, there’s actually a third crucial financial statement: the cash flow statement.

Why Cash Flow Matters

Here’s a critical truth: a company can be profitable on the income statement but still go bankrupt if it runs out of cash.

How? Because of timing differences:

- Revenue is recorded when earned (not when cash is received)

- Expenses are recorded when incurred (not when cash is paid)

- Non-cash expenses (like depreciation) reduce income without affecting cash

The cash flow statement bridges this gap by showing actual cash moving in and out of the business.

Three Sections of the Cash Flow Statement

1. Operating Activities

- Cash from core business operations

- Adjusts net income for non-cash items

- Shows if the business generates cash

2. Investing Activities

- Cash spent on or received from investments

- Purchases of equipment, property

- Buying or selling other companies

3. Financing Activities

- Cash from or paid to investors and creditors

- Issuing or buying back stock

- Borrowing or repaying debt

- Paying dividends

How It Connects to the Other Statements

Cash Flow ↔ Income Statement:

- Starts with net income

- Adjusts for non-cash expenses (depreciation)

- Adjusts for timing differences (receivables, payables)

Cash Flow ↔ Balance Sheet:

- Explains changes in cash between two balance sheet dates

- Shows why cash increased or decreased

The Complete Picture: All Three Together

Think of it this way:

- Income Statement: Did we make money? (profitability)

- Balance Sheet: What do we have? (financial position)

- Cash Flow Statement: Can we pay our bills? (liquidity)

All three together tell the complete financial story.

For serious investors, analyzing all three statements is essential. You can learn more about comprehensive financial analysis in our detailed investment guides.

📊 Financial Statement Analysis Calculator

Calculate key financial ratios using Income Statement & Balance Sheet data

Income Statement

Balance Sheet

FAQ

Real-World Applications: Putting It All Together

Let’s explore how understanding income statement vs balance sheet helps in real investment scenarios:

Scenario 1: Evaluating a Dividend Stock

You’re considering investing in a company that pays a 5% dividend yield. Should you invest?

Income Statement Analysis:

- Check if the company is consistently profitable

- Calculate payout ratio: Dividends / Net Income

- If payout ratio is >80%, dividends might not be sustainable

- Look for growing or stable earnings

Balance Sheet Analysis:

- Check the debt-to-equity ratio (high debt might force dividend cuts)

- Verify current ratio >1.0 (ensures cash to pay dividends)

- Look at the retained earnings trend (should be growing)

Combined Verdict:

Only invest if BOTH statements show strength. High yields mean nothing if the company can’t sustain them. Learn more about high dividend stocks and sustainable dividend investing.

Scenario 2: Identifying Growth Stocks

You’re looking for high-growth companies to invest in.

Income Statement Focus:

- Revenue growth rate (looking for 15%+ annually)

- Gross margin trends (should be stable or improving)

- Can accept current losses if investing heavily in growth

- Operating leverage (margins improving as revenue grows)

Balance Sheet Focus:

- Cash reserves (fuel for growth)

- Manageable debt (won’t constrain growth investments)

- Growing equity (building long-term value)

- Reasonable current ratio (won’t run out of cash)

Combined Verdict:

Growth stocks often sacrifice current profitability for future gains, so balance sheet strength becomes even more critical. The company needs resources to fund growth until profitability arrives.

Scenario 3: Value Investing

You’re hunting for undervalued companies trading below intrinsic value.

Income Statement Analysis:

- Look for improving profitability trends

- Identify companies emerging from temporary setbacks

- Calculate price-to-earnings ratio

- Assess if current earnings are sustainable

Balance Sheet Analysis:

- Calculate book value (total equity)

- Look for a strong asset base

- Check for hidden assets (real estate, investments)

- Calculate price-to-book ratio

Combined Verdict:

Value investors want companies with strong balance sheets (lots of assets, manageable debt) that are temporarily undervalued, often due to short-term income statement challenges that will improve.

Scenario 4: Avoiding Value Traps

A stock looks cheap based on the P/E ratio. Is it a bargain or a trap?

Warning Signs on Income Statement:

- Declining revenue for multiple periods

- Shrinking profit margins

- One-time gains inflate current earnings

- Inconsistent profitability

Warning Signs on Balance Sheet:

- Rapidly growing debt

- Declining cash reserves

- Current liabilities exceeding current assets

- Negative equity or shrinking equity

Combined Verdict:

A low P/E ratio might indicate a value trap rather than a bargain if both statements show deteriorating fundamentals. Cheap stocks often deserve to be cheap. Understanding why people lose money in the stock market often comes down to ignoring these warning signs.

Teaching Financial Literacy to the Next Generation

Understanding financial statements isn’t just for investors—it’s a crucial life skill. If you’re interested in making your kid a millionaire, teaching them to read financial statements early provides a massive advantage.

Age-Appropriate Financial Statement Lessons

Ages 8-12: The Lemonade Stand

- Income Statement: Track how much money the lemonade stand made (revenue), how much lemons and sugar cost (expenses), and what’s left over (profit)

- Balance Sheet: List what the stand owns (pitcher, table, cash box) and what it owes (money borrowed from parents)

Ages 13-17: Paper Trading

- Set up a mock investment portfolio

- Research real companies’ financial statements

- Track performance and learn from mistakes

- Discuss why some investments succeed and others fail

Ages 18+: Real Investing

- Open a real investment account

- Analyze financial statements before buying

- Build a diversified portfolio

- Learn about different investment strategies

Free Resources for Learning

Official Sources:

- SEC EDGAR Database (sec.gov/edgar) – All public company filings

- Company Investor Relations Pages – Often have simplified presentations

- Federal Reserve Economic Data (FRED) – Economic context

Educational Resources:

- Investopedia – Definitions and tutorials

- Morningstar – Company analysis and ratings

- CFA Institute – Professional financial education

Practice Tools:

- Paper trading platforms

- Financial statement simulators

- Investment clubs and communities

For more comprehensive financial education, explore our complete guide to smart investing.

Advanced Topics: Beyond the Basics

Once you’ve mastered the fundamentals of income statement vs balance sheet analysis, consider these advanced concepts:

Quality of Earnings

Not all earnings are created equal. High-quality earnings are:

- Cash-based (not just accounting profits)

- Sustainable (from core operations, not one-time events)

- Conservative (using prudent accounting methods)

- Transparent (clearly explained in footnotes)

Red flags for low-quality earnings:

- Growing accounts receivable faster than revenue

- Frequent “non-recurring” charges that recur every year

- Aggressive revenue recognition

- Capitalizing expenses that should be expensed

Off-Balance-Sheet Items

Some obligations don’t appear on the balance sheet:

- Operating leases (though new rules have changed this)

- Contingent liabilities

- Special-purpose entities

- Guarantees and commitments

Why it matters: Companies can hide debt and obligations, making the balance sheet look healthier than reality. Always read the footnotes.

Segment Reporting

Large companies often operate multiple business lines. Segment reporting breaks down:

- Revenue by business unit

- Profit by segment

- Assets by division

Why it matters: One profitable segment might hide losses in others. Understanding each business unit’s performance provides deeper insights.

International Accounting Standards

US GAAP vs. IFRS:

- US companies use Generally Accepted Accounting Principles (GAAP)

- International companies often use International Financial Reporting Standards (IFRS)

- Key differences in revenue recognition, inventory valuation, and more

Why it matters: When comparing international companies, accounting differences can make comparisons misleading.

Forensic Accounting Red Flags

Watch for signs of accounting manipulation:

- Frequent restatements of prior financials

- Auditor changes (especially if the new auditor is less reputable)

- Complex organizational structures

- Discrepancies between income and cash flow

- Management compensation is heavily tied to short-term metrics

These advanced topics become important as your investing sophistication grows.

Building Your Financial Analysis Toolkit

To effectively analyze income statements and balance sheets, build a systematic approach:

Create a Financial Analysis Checklist

Income Statement Review:

- [ ] Revenue growth rate (compare to prior periods)

- [ ] Gross profit margin (and trend)

- [ ] Operating margin (and trend)

- [ ] Net profit margin (and trend)

- [ ] Unusual or one-time items identified

- [ ] Comparison to competitors completed

Balance Sheet Review:

- [ ] Current ratio calculated

- [ ] Debt-to-equity ratio calculated

- [ ] Cash position assessed

- [ ] Asset quality evaluated

- [ ] Equity trend analyzed

- [ ] Working capital changes noted

Combined Analysis:

- [ ] ROE calculated and compared

- [ ] ROA calculated and compared

- [ ] Interest coverage assessed

- [ ] Quality of earnings evaluated

- [ ] Cash flow statement reviewed

- [ ] Industry context considered

Set Up a Tracking Spreadsheet

Create a simple spreadsheet to track key metrics over time:

| Quarter | Revenue | Net Income | Total Assets | Equity | ROE | Current Ratio |

|---|---|---|---|---|---|---|

| Q1 2024 | ||||||

| Q2 2024 | ||||||

| Q3 2024 | ||||||

| Q4 2024 |

Benefits:

- Spot trends quickly

- Compare quarters easily

- Track improvement or deterioration

- Build your investment thesis

Develop Your Investment Process

Step 1: Initial Screen

- Use basic metrics to filter thousands of stocks down to a manageable list

- Focus on profitability, growth, and financial health

Step 2: Deep Dive

- Thoroughly analyze the financial statements of finalists

- Read annual reports and earnings calls

- Understand the business model

Step 3: Valuation

- Determine if the stock is fairly priced

- Compare to intrinsic value estimates

- Consider the margin of safety

Step 4: Monitor

- Track quarterly results

- Watch for deteriorating metrics

- Reassess investment thesis regularly

Step 5: Act

- Buy when undervalued with strong fundamentals

- Sell when overvalued or fundamentals deteriorate

- Hold when fairly valued with an intact thesis

This systematic approach removes emotion and improves decision-making quality.

The Bottom Line: Why This Matters for Your Financial Future

Understanding the income statement vs the balance sheet isn’t just academic knowledge; it’s a practical skill that can dramatically improve your investment returns and financial security.

Here’s what mastering these statements enables you to do:

Make informed investment decisions based on data rather than hype or emotion

Identify quality companies that can generate sustainable returns over decades

Avoid financial disasters by spotting warning signs before they become crises

Build wealth systematically through intelligent stock selection

Protect your capital by understanding the risks you’re taking

See through marketing spin to understand the real financial health of companies

The reality is simple: Companies that consistently show strong performance on BOTH the income statement and balance sheet tend to create wealth for their shareholders over time. Companies that excel at one but fail at the other often disappoint investors.

By learning to read and analyze both statements together, you gain a superpower that most individual investors lack—the ability to truly understand what you’re investing in.

Conclusion

The income statement and balance sheet are two sides of the same coin, each telling part of a company’s financial story. The income statement reveals how well a company performed over time—whether it generated profits or losses, how efficiently it operates, and whether profitability is growing or shrinking. The balance sheet shows what a company has right now—its assets, liabilities, and the equity that belongs to shareholders.

Neither statement alone provides a complete picture. A company might show impressive profits on its income statement while drowning in debt on its balance sheet. Or it might have a fortress balance sheet but struggle to generate consistent profits. Only by analyzing both together can you truly assess a company’s financial health and investment potential.

Key principles to remember:

- The income statement is a movie; the balance sheet is a photograph – One shows action over time, the other captures a moment

- Net income flows into retained earnings – These statements are interconnected, not separate

- Context matters – Always compare to industry peers and historical performance

- Quality matters more than quantity – Sustainable, cash-based earnings beat accounting tricks

- Both profitability and stability are essential – You need both to build long-term wealth

Your Next Steps

Ready to put this knowledge into action? Here’s what to do next:

Continue Your Education:

- Read actual financial statements from companies you know

- Practice calculating key ratios

- Follow quarterly earnings releases

- Explore our comprehensive investment guides

Start Analyzing:

- Pick 3-5 companies in your area of interest

- Download their latest 10-K and 10-Q reports

- Create a comparison spreadsheet

- Track their performance over the next year

Begin Investing:

- Start with a small amount you can afford to lose

- Apply your financial statement analysis skills

- Learn from both successes and mistakes

- Gradually build your portfolio as your skills improve

Share Your Knowledge:

- Teach family members about financial statements

- Discuss investments with friends

- Join investment clubs or online communities

- Help the next generation build financial literacy

Remember: Every master investor started as a beginner. Warren Buffett, Peter Lynch, and other legendary investors all learned to read financial statements before they built their fortunes. You’re now equipped with the same fundamental knowledge they used.

The difference between successful investors and unsuccessful ones often comes down to doing the homework—actually reading and understanding financial statements rather than relying on tips, hunches, or emotions. You now have the tools to do that homework.

Your financial future is built one informed decision at a time. Start analyzing those statements, and watch your investment skills—and your wealth—grow over time.

FAQ

The income statement shows profitability over a period of time (like a quarter or year), displaying revenue, expenses, and net income. The balance sheet shows the financial position at a specific point in time, listing assets, liabilities, and equity. Think of the income statement as a movie (showing performance over time) and the balance sheet as a photograph (capturing one moment).

Neither is more important—both are essential for complete financial analysis. The income statement reveals profitability and operational efficiency, while the balance sheet shows financial stability and resources. A company might be profitable (good income statement) but drowning in debt (poor balance sheet), or vice versa. Smart investors analyze both together.

Public companies must publish both statements quarterly (every three months) and annually. These are included in Form 10-Q (quarterly reports) and Form 10-K (annual reports) filed with the SEC. Most companies also provide these in their investor relations sections on their websites.

A company cannot have a “negative” balance sheet in the traditional sense, but it can have negative shareholders’ equity, which occurs when total liabilities exceed total assets. This often happens when a company has accumulated losses over time (shown on income statements) that have depleted equity on the balance sheet. This is a serious warning sign.

Good profit margins vary significantly by industry. Software companies often have 20-30%+ net margins, while grocery retailers might have 2-3% margins. Generally, net margins above 10% are considered good, but always compare to industry peers rather than absolute standards. Consistent or improving margins are more important than the absolute number.

Dividends reduce both cash (an asset) and retained earnings (part of equity) on the balance sheet. When a company pays dividends, cash goes out, and retained earnings decrease by the same amount. This is why dividend sustainability requires both strong income statement performance (to generate profits) and a healthy balance sheet position (to have the cash available).

This means the current ratio is below 1.0, indicating the company might struggle to pay short-term obligations with short-term resources. While concerning, context matters—some companies (like Apple) operate successfully with current ratios below 1.0 because they generate massive cash flow. However, for most companies, this is a red flag worth investigating.

Disclaimer

This article is for educational purposes only and does not constitute financial advice. The information provided is based on general principles of financial statement analysis and should not be considered as personalized investment recommendations.

Financial markets involve risk, and past performance does not guarantee future results. Before making any investment decisions, you should:

- Conduct your own thorough research

- Consider your personal financial situation, goals, and risk tolerance

- Consult with qualified financial advisors, accountants, or other professionals

- Read complete financial statements and regulatory filings

- Understand that all investments carry the risk of loss

The examples and scenarios presented in this article are for illustrative purposes only and may not reflect actual company performance or market conditions. Financial ratios and benchmarks discussed should be considered as general guidelines rather than absolute standards, as appropriate levels vary by industry, company size, and market conditions.

TheRichGuyMath.com and its authors are not registered investment advisors and do not provide personalized investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information provided, and we are not responsible for any investment decisions made based on this content.

Always verify information from official sources such as SEC filings, company investor relations pages, and other authoritative financial data providers.

About the Author

Written by Max Fonji — Your go-to source for clear, data-backed investing education.

Max brings over a decade of experience in financial analysis and investment education, helping thousands of beginners understand the fundamentals of smart investing. With a passion for breaking down complex financial concepts into actionable insights, Max has dedicated his career to democratizing financial literacy and empowering individuals to take control of their financial futures.

At TheRichGuyMath.com, Max combines rigorous research, real-world experience, and a conversational teaching style to make investing accessible to everyone—regardless of their background or experience level. His mission is simple: help you build wealth through informed, intelligent investment decisions.

Connect with Max and explore more educational content at TheRichGuyMath.com.