Why You Need a 21-Day Money Challenge

Most people want financial freedom, but few know where to start. This 21-day money challenge offers a structured, bite-sized path to transform your money habits and mindset. Whether you’re drowning in debt or just want better control of your spending, this challenge helps you build confidence and clarity, one day at a time.

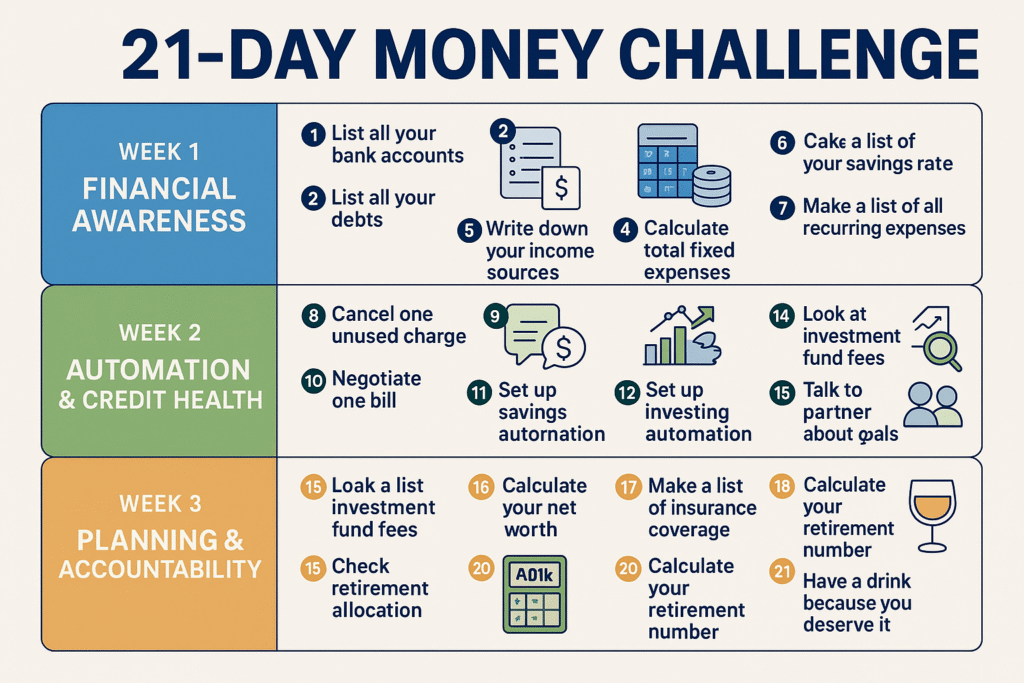

The Complete 21-Day Money Challenge Breakdown

Here’s how the challenge works—one simple, actionable task per day. No overwhelm, just progress.

Week 1 – Financial Awareness & Cleanup

List all recurring expenses

Streaming, gym, cloud storage—every monthly commitment counts.

List all your bank accounts

Gather your checking, savings, and any online accounts to get the full picture.

List all your debts

Include Credit cards, loans, and any “buy now, pay later” arrangements.

Write down your income sources

List your main job, side hustles, passive income, etc.

Calculate total fixed expenses

Rent, mortgage, subscriptions—anything that doesn’t change month to month.

Calculate variable expenses

Use your last 3 months to find the average spending on food, gas, shopping, etc.

Calculate your savings rate

What percentage of your income do you save? Use the past 3 months for accuracy.

Week 2 – Automation & Credit Health

- Cancel one unused recurring charge

Kill the zombie subscriptions draining your wallet. - Negotiate one bill

Call your phone, internet, or cable provider—you might score a discount. - Set up savings automation

Automate transfers to a savings or emergency fund. - Set up investing automation

Even $20 a week can compound into something meaningful. - Move emergency fund to a HYSA

A high-yield savings account earns you more with zero risk. - Pull your credit report

Check for accuracy and red flags (annualcreditreport.com is free).

Week 3 – Long-Term Planning & Accountability

- Look at investment fund fees

High fees eat into gains—consider switching to low-cost index funds. - Check your retirement account allocation

Are you too aggressive—or too conservative? - Calculate your net worth

Assets minus liabilities = your financial baseline. - List all your insurance coverage

Health, car, life, renters—know what’s protected and what’s not. - Review your insurance limits

Ensure your policies cover real-world scenarios. - Talk to your partner about goals

Money fights are a top cause of relationship stress—align your vision. - Calculate your retirement number

Use tools like Fidelity or NerdWallet to estimate your “freedom figure.” - Celebrate! Have a drink—you earned it!

Cheers to 21 days of growth, habits, and better financial literacy.

Benefits of the 21-Day Money Challenge

- Financial clarity in just 3 weeks

- Builds confidence with money decisions

- Boosts your savings, lowers expenses

- Kickstart investing and retirement planning

- Reduces financial stress and helps avoid future debt

FAQs: 21-Day Money Challenge

Yes! It’s designed for anyone wanting to improve their finances—no prior knowledge needed.

A spreadsheet or notebook is enough, but apps like Mint or YNAB can help.

You’ll have a strong financial foundation. From there, build on your momentum with monthly money goals.

Absolutely. Day 19 encourages you to align goals with your partner.

Final Thoughts on the 21-Day Money Challenge

If you’ve ever felt stuck, overwhelmed, or unsure about your money, this challenge is your reset button. The 21-day money challenge isn’t about perfection—it’s about progress. Small steps lead to massive change over time. So take the first step today—your future self will thank you.