Picture this: You just launched your first side hustle selling handmade candles. You made $5,000 in sales last month, amazing! But after paying for wax, wicks, jars, shipping, website hosting, and advertising, you’re left with just $800. That $800? That’s your net profit, and it’s the single most important number that tells you whether your business is truly making money or just spinning its wheels.

Whether you’re running a lemonade stand, analyzing companies for stock market investments, or simply trying to understand business finances, grasping net profit is essential. It’s the ultimate measure of financial health, the bottom line that separates thriving businesses from those barely staying afloat. SEC

In this guide, we’ll break down everything you need to know about net profit in plain English: what it really means, how to calculate it, why it matters more than revenue, and how to use it to make smarter financial decisions.

Key Takeaways

- Net profit is what remains after subtracting all expenses, taxes, and costs from total revenue; it’s the true measure of profitability

- The basic formula is simple: Net Profit = Total Revenue – Total Expenses

- Net profit margin (expressed as a percentage) shows how efficiently a company converts sales into actual profit

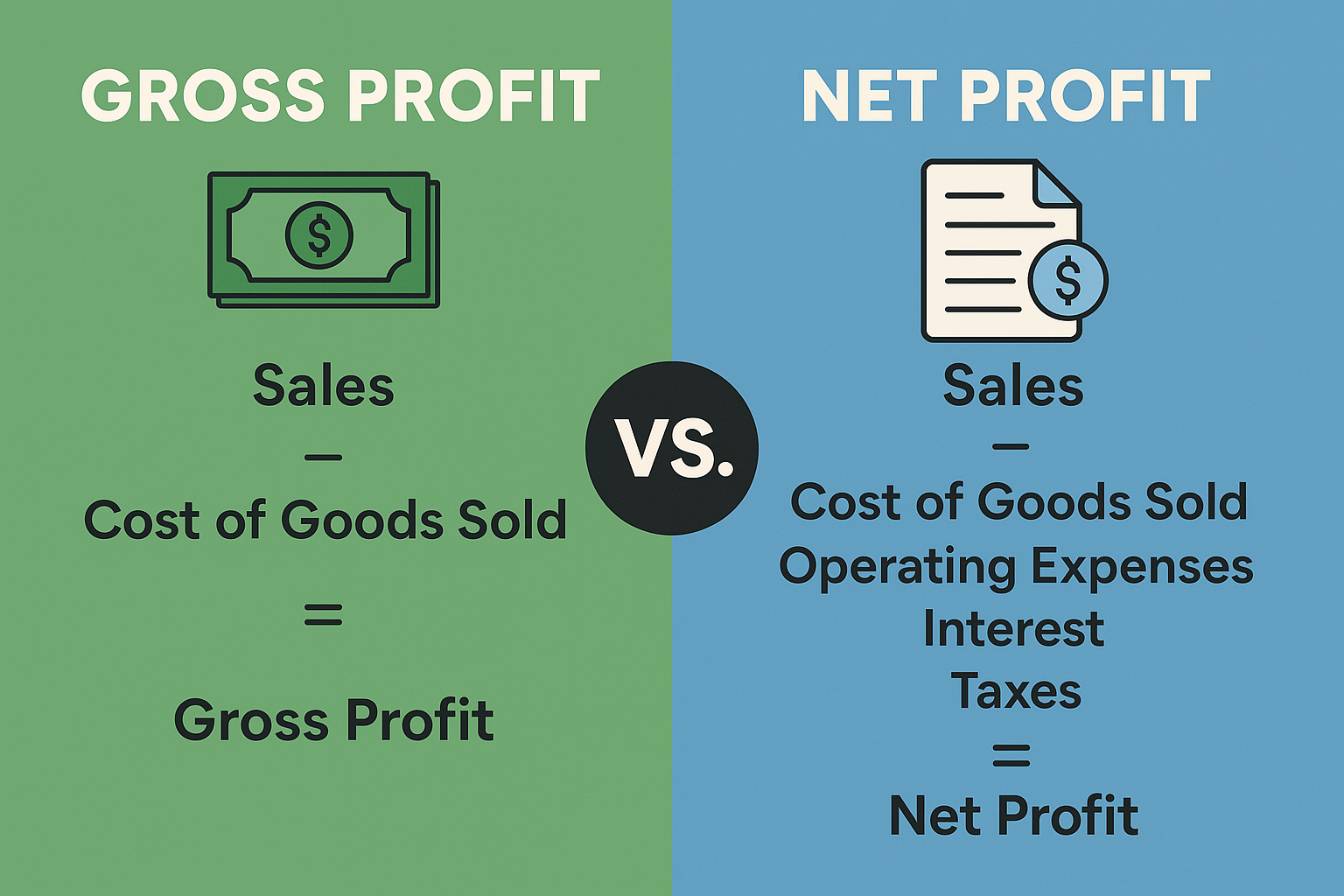

- It differs from gross profit, which only accounts for direct production costs, not operating expenses, taxes, or interest

- Understanding net profit helps investors evaluate company performance and make informed decisions about where to invest

What Is Net Profit? The Real Definition

Net profit (also called net income, net earnings, or “the bottom line”) represents the actual profit a business keeps after paying absolutely everything: the cost of goods sold, operating expenses, interest on loans, taxes, and any other costs.

Think of it this way: If your business were a person, revenue would be your gross salary before anything gets taken out. Net profit would be what actually hits your bank account after taxes, insurance, rent, food, and all other bills are paid. It’s the money you can truly call yours. Investopedia

Why “Bottom Line” Matters

You’ll often hear net profit called the “bottom line” because it literally appears at the bottom of an income statement. This position isn’t arbitrary; it represents the final verdict on a company’s financial performance after everything else has been accounted for.

According to the U.S. Securities and Exchange Commission (SEC), net income is one of the most critical metrics investors examine when evaluating publicly traded companies. It directly impacts stock prices, dividend payments, and investor confidence.

Net Profit vs Gross Profit: What’s the Difference?

Many beginners confuse net profit with gross profit, but they’re fundamentally different:

See our full guide on Gross Profit vs Net Profit

| Metric | What It Measures | Formula | What It Tells You |

|---|---|---|---|

| Gross Profit | Profit after direct production costs | Revenue – Cost of Goods Sold (COGS) | How efficiently you produce/acquire products |

| Net Profit | Profit after ALL expenses | Revenue – All Expenses (COGS + Operating + Interest + Taxes) | True profitability and financial health |

Example: A bakery sells $10,000 worth of cakes in a month. The ingredients and labor cost $4,000 (COGS). Their gross profit is $6,000. But they also pay $2,500 in rent, $1,000 in utilities, $500 in marketing, and $500 in taxes. Their net profit is only $1,500.

The gross profit looked great at $6,000, but the net profit of $1,500 tells the real story. Understanding both metrics helps you see where money flows through a business, crucial knowledge for anyone interested in smart investing moves.

The Net Profit Formula: How to Calculate It

The basic net profit formula is refreshingly simple:

Net Profit = Total Revenue – Total Expenses

But to be more precise, here’s the expanded version that shows exactly what gets subtracted:

Net Profit = Total Revenue – (COGS + Operating Expenses + Interest + Taxes + Depreciation)

Let’s break down each component:

Components of the Formula

Total Revenue

- All money coming in from sales and services

- Also called “top line” or gross revenue

- Before any deductions

Cost of Goods Sold (COGS)

- Direct costs of producing products or services

- Raw materials, manufacturing labor, and packaging

- For service businesses, this might be minimal

Operating Expenses

- Rent, utilities, salaries (non-production)

- Marketing and advertising

- Office supplies, insurance, software subscriptions

- Everything needed to run the business day-to-day

Interest

- Interest paid on business loans

- Credit card interest

- Any financing costs

Taxes

- Income taxes owed to federal, state, and local governments

- Does not include sales tax collected from customers

Depreciation

- Accounting for the declining value of assets over time

- Equipment, vehicles, buildings

- Non-cash expense, but impacts net profit

Step-by-Step Calculation Example

Let’s calculate net profit for a fictional online t-shirt business:

Monthly Financials:

- Revenue from t-shirt sales: $50,000

- Cost of t-shirts and printing: $20,000 (COGS)

- Employee salaries: $8,000

- Rent for warehouse: $2,000

- Marketing and ads: $5,000

- Website and software: $500

- Utilities: $300

- Interest on business loan: $400

- Depreciation on equipment: $200

- Taxes: $4,000

Calculation:

Net Profit = $50,000 - ($20,000 + $8,000 + $2,000 + $5,000 + $500 + $300 + $400 + $200 + $4,000)

Net Profit = $50,000 - $40,400

Net Profit = $9,600This business has a monthly net profit of $9,600. That’s what the owner can reinvest, save, or take home.

What Is Net Profit Margin?

While the dollar amount of net profit is important, net profit margin is often more useful because it shows profitability as a percentage of revenue. This makes it easy to compare companies of different sizes or track your own business over time.

Net Profit Margin Formula

Net Profit Margin = (Net Profit ÷ Total Revenue) × 100

Using our t-shirt business example:

Net Profit Margin = ($9,600 ÷ $50,000) × 100 = 19.2%This means for every dollar of sales, the business keeps 19.2 cents as profit after all expenses. The rest goes to costs.

What’s a “Good” Net Profit Margin?

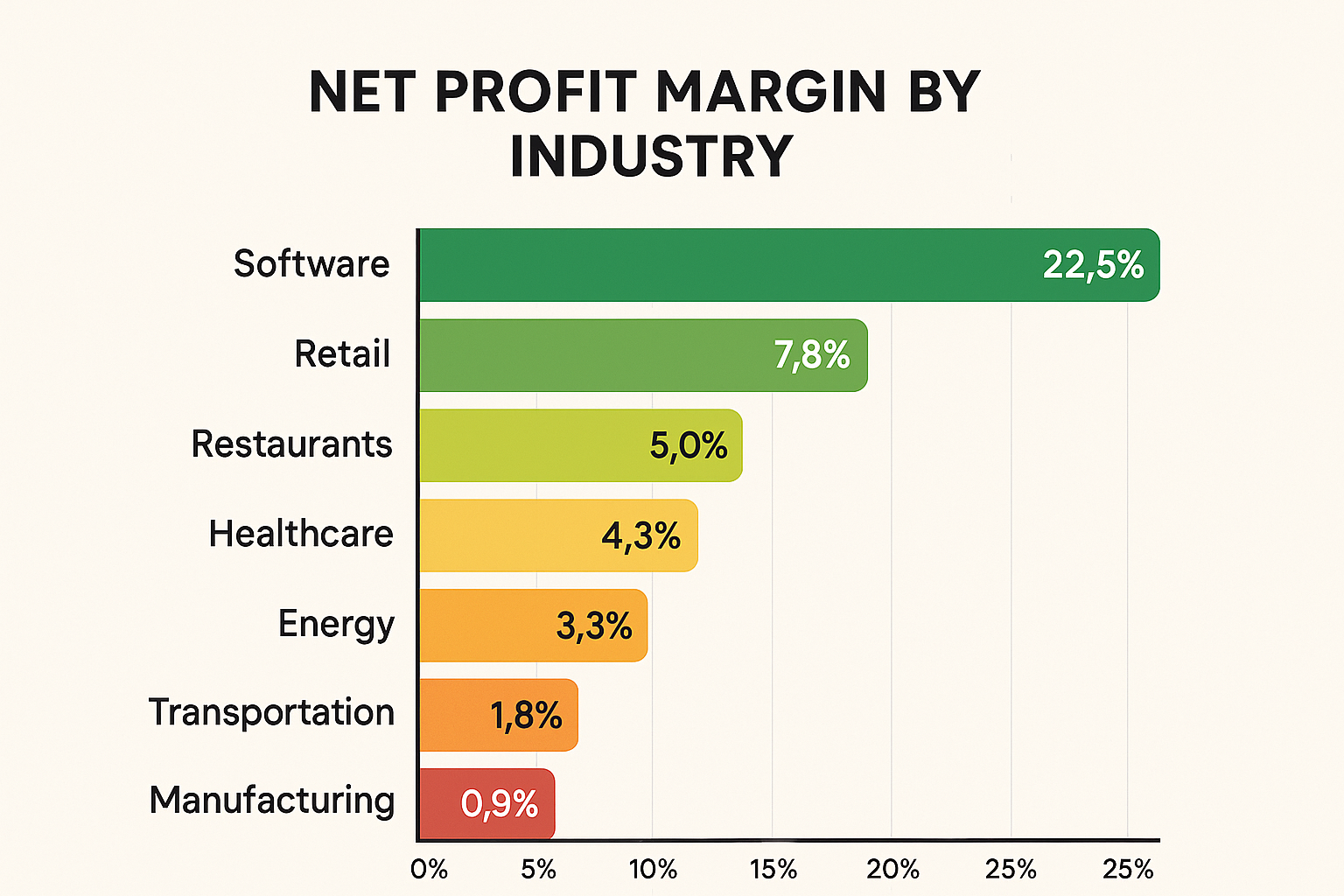

This varies dramatically by industry. According to data from NYU Stern School of Business and CSIMarket:

- Software companies: 15-25% (high margins due to low COGS)

- Retail: 2-5% (thin margins, high competition)

- Restaurants: 3-6% (high operating costs)

- Healthcare: 5-10%

- Financial services: 10-20%

- Grocery stores: 1-3% (extremely competitive)

A company with a 5% margin in the grocery industry might be doing great, while a software company with the same margin would be struggling. Context matters!

For investors evaluating high dividend stocks, companies with consistently high net profit margins often make better candidates because they generate more cash to distribute to shareholders.

Why Net Profit Matters: Real-World Applications

For Business Owners

Net profit tells you whether your business model actually works. You might have impressive revenue, but if expenses consume it all, you’re running on a treadmill going nowhere.

Real story: Sarah started a boutique clothing store with $200,000 in first-year sales. She was thrilled until her accountant showed her a net loss of $15,000. Her rent was too high, and she was overspending on inventory. By relocating to a cheaper space and improving inventory management, she turned a $25,000 net profit the following year, same revenue, smarter expenses.

For Investors

When you’re researching stocks, net profit (and net profit margin) helps you:

- Compare companies: A $1 billion company with $100 million net profit (10% margin) is more efficient than one with $50 million net profit (5% margin)

- Spot trends: Is net profit growing, shrinking, or stable?

- Assess dividend sustainability: Companies need strong net profits to maintain passive income through dividend investing

- Understand valuation: The P/E ratio (Price-to-Earnings) uses net profit as the “E”

Understanding why the stock market goes up over time largely comes down to companies increasing their net profits year after year.

For Employees

Even if you don’t own the business, understanding net profit helps you:

- Evaluate job security (unprofitable companies often lay off workers)

- Negotiate raises (profitable companies can afford to pay more)

- Understand company decisions about benefits, bonuses, and growth

For Lenders and Creditors

Banks examine net profit before approving loans. Consistent profitability signals you can repay borrowed money. According to the Federal Reserve, lenders typically want to see at least two years of positive net income for business loan approval.

How to Improve Net Profit: Practical Strategies

Increasing net profit requires either boosting revenue, cutting expenses, or ideally both. Here are proven strategies:

Revenue-Side Improvements

1. Raise Prices Strategically

- Test small increases (3-5%) on less price-sensitive products

- Add premium options for customers willing to pay more

- Bundle products/services for a higher average order value

2. Increase Sales Volume

- Improve marketing effectiveness

- Expand to new customer segments

- Launch complementary products

- Enhance customer retention (repeat buyers cost less to acquire)

3. Improve Conversion Rates

- Optimize your website or sales process

- Better product descriptions and images

- Streamline checkout process

- Offer payment plans

Expense-Side Improvements

1. Reduce COGS

- Negotiate better supplier rates

- Buy in larger quantities (if cash flow allows)

- Find alternative suppliers

- Reduce waste and defects

2. Cut Operating Expenses

- Renegotiate rent or relocate

- Switch to energy-efficient equipment

- Automate repetitive tasks

- Eliminate underperforming marketing channels

- Use free or cheaper software alternatives

3. Optimize Tax Strategy

- Work with a qualified accountant

- Take all legitimate deductions

- Consider business structure (LLC, S-Corp, etc.)

- Maximize retirement contributions (tax-deductible)

4. Reduce Interest Costs

- Refinance high-interest debt

- Pay down balances faster

- Improve your credit score for better rates

The 80/20 Rule Applied to Profit

Often, 20% of your products, customers, or activities generate 80% of your net profit. Identify these high-performers and focus resources there while eliminating or fixing the unprofitable 80%.

Common Net Profit Mistakes to Avoid

1: Confusing Revenue with Profit

“We made $100,000 this year!” sounds great, but if expenses were $105,000, you actually lost $5,000. Always look beyond the top line.

2: Ignoring Non-Cash Expenses

Depreciation doesn’t require writing a check, but it’s a real expense that reduces net profit and reflects asset value decline.

3: Forgetting Owner Compensation

Small business owners sometimes forget to pay themselves a reasonable salary when calculating true profitability. If you work 60 hours a week but take no salary, your “profit” isn’t real; it’s partially unpaid wages.

4: Not Tracking Regularly

Checking net profit only at tax time is like checking your car’s oil once a year. Monthly or quarterly reviews help you spot problems early and make timely adjustments.

5: Comparing Apples to Oranges

A 3% margin might be excellent for a grocery store but terrible for a consulting firm. Always compare within the same industry.

Many investors lose money in the stock market because they don’t properly analyze net profit trends before buying stocks. Don’t make the same mistake!

Net Profit in Financial Statements: Where to Find It

Net profit appears on the income statement (also called profit and loss statement or P&L). Here’s the typical structure:

INCOME STATEMENT

-----------------

Revenue $100,000

- Cost of Goods Sold -$40,000

= Gross Profit $60,000

- Operating Expenses -$35,000

= Operating Income (EBIT) $25,000

- Interest Expense -$2,000

= Earnings Before Tax $23,000

- Income Tax -$5,000

= NET INCOME (NET PROFIT) $18,000For publicly traded companies, you’ll find this in their 10-K (annual report) or 10-Q (quarterly report) filed with the SEC. These documents are free to access on the SEC’s EDGAR database.

Net Profit and Business Decisions

Understanding net profit empowers better business decisions:

Should You Expand?

If your net profit margin is healthy (10%+) and growing, expansion might make sense. If it’s thin or declining, fix profitability before scaling up. Expansion multiplies whatever you’re already doing, including losses.

Is a Discount Worth It?

A 20% discount sounds customer-friendly, but if your net margin is only 15%, you’ll lose money on every sale. Run the numbers first.

Hire or Outsource?

Compare the cost of hiring an employee (salary + benefits + taxes = often 1.25-1.4× base salary) against outsourcing. Which option leaves more net profit?

Equipment Purchase vs. Lease?

Buying equipment creates depreciation expense spread over the years. Leasing creates immediate operating expenses. Model both scenarios to see which protects net profit better.

Net Profit Calculator

💰 Net Profit Calculator

Calculate your business’s net profit and profit margin

The Psychology of Profit: Emotional Considerations

Understanding net profit isn’t just about numbers; it’s about mindset. Many entrepreneurs experience what psychologists call “revenue euphoria,” where high sales numbers create a false sense of success while expenses quietly drain profits.

The cycle of market emotions applies to business ownership, too. Early excitement about revenue can turn to anxiety when bills pile up, then despair if net profit disappears, and finally hope as you implement fixes.

Real story: Marcus ran a successful-looking food truck with $15,000 monthly revenue. He felt like a success until he tracked expenses properly and discovered he was netting only $1,200 monthly, less than minimum wage for his 70-hour weeks. This reality check was painful but necessary. He raised prices 15%, cut food waste by 30%, and relocated to a better spot. Six months later, his net profit hit $4,500 monthly on the same revenue. The difference? Awareness and action.

Net Profit and Long-Term Wealth Building

For those interested in building wealth through smart passive income strategies, understanding net profit is foundational.

Companies with consistently growing net profits tend to:

- Increase stock prices over time

- Pay higher dividends

- Survive economic downturns better

- Attract more investment

- Have resources for innovation

When you understand what drives net profit, you can better evaluate whether a company deserves your investment dollars or if your own business can generate the cash flow needed for financial independence.

Advanced Concepts: EBITDA vs Net Profit

As you advance in financial knowledge, you’ll encounter EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). This metric sits between operating profit and net profit.

Why EBITDA matters: It shows operational profitability without the effects of financing decisions, tax strategies, or accounting choices. Some analysts prefer it for comparing companies across different tax jurisdictions or capital structures.

However, EBITDA can be misleading because interest, taxes, depreciation, and amortization are real costs that affect cash flow. Net profit remains the ultimate measure of what shareholders actually earn.

According to Warren Buffett, one of history’s most successful investors, “People who talk about EBITDA are either trying to con you or themselves. Interest and taxes are real expenses, and depreciation is a real expense.”

Industry Benchmarks: How Does Your Net Profit Compare?

Here’s a more detailed breakdown of net profit margins by industry (2025 data from various sources, including CSIMarket and Morningstar):

High-Margin Industries:

- Software & SaaS: 15-30%

- Pharmaceuticals: 15-25%

- Payment Processing: 15-20%

- Investment Banking: 15-25%

Medium-Margin Industries:

- Healthcare Services: 8-12%

- Construction: 5-10%

- Professional Services: 10-15%

- Automotive: 5-8%

Low-Margin Industries:

- Grocery Stores: 1-3%

- Airlines: 2-5%

- Restaurants: 3-6%

- Gas Stations: 1-4%

- Retail Clothing: 4-7%

Use these benchmarks to set realistic expectations and goals for your business or investment analysis.

Tax Implications of Net Profit

Important: Net profit shown on an income statement is pre-tax income. After calculating net profit, businesses still owe taxes on it (unless they’re structured as pass-through entities where owners pay on personal returns).

Tax Strategies to Protect Net Profit

- Maximize Deductions: Ensure you’re claiming all legitimate business expenses

- Retirement Contributions: 401(k) and SEP-IRA contributions reduce taxable income

- Equipment Purchases: Section 179 allows immediate deduction of equipment costs (up to limits)

- Business Structure: S-Corps and LLCs offer different tax treatments

- Tax-Loss Harvesting: For investment portfolios, strategically realize losses to offset gains

Consult a CPA: Tax law is complex and changes frequently. Professional advice from a Certified Public Accountant can save far more than it costs.

Common Questions About Net Profit

Absolutely, and it happens frequently. This means the company is losing money despite making sales. Startups often operate this way intentionally while building market share, but it’s unsustainable long term.

Generally, yes, but context matters. A company might strategically accept lower net profit to:

Invest in growth (R&D, new markets)

Build brand awareness

Undercut competitors temporarily

Weather temporary market conditions

For mature companies, consistently grow

Monthly: Minimum for any active business

Quarterly: Standard for investors analyzing public companies

Annually: Tax time, but too infrequent for management decisions

Weekly/Daily: For cash-intensive businesses or during critical periods

Don’t panic, but do act. A negative net profit (net loss) means you’re spending more than you earn. Steps to take:

Analyze: Which expense categories are too high?

Prioritize: Which expenses can be cut immediately without killing the business?

Revenue: Can you increase prices or sales volume quickly?

Timeline: How long can you sustain losses before running out of cash?

Pivot: Does your business model need fundamental changes?

Many now-successful companies had early losses. Amazon operated

Net Profit in the Digital Age

Modern accounting software has made tracking net profit easier than ever:

- QuickBooks: Automatically categorizes expenses and generates profit reports

- Xero: Cloud-based with real-time profit tracking

- FreshBooks: Simple interface for small businesses and freelancers

- Wave: Free option for very small businesses

These tools sync with bank accounts and credit cards, reducing manual data entry and improving accuracy. Many generate profit and loss statements with a single click.

Case Study: Turning Net Profit Around

The Scenario: A small marketing agency had $500,000 in annual revenue but only $25,000 net profit (5% margin), below the 10-15% industry standard.

The Analysis:

- Employee utilization was only 60% (lots of paid downtime)

- Office space was too expensive for actual needs

- Some clients required disproportionate work for low fees

- No pricing increase in three years despite rising costs

The Solutions Implemented:

- Raised prices 12% across the board (lost 2 of 30 clients)

- Moved to a smaller office, saving $18,000 annually

- Fired the bottom 20% of clients by profitability

- Improved project management to boost utilization to 75%

- Automated invoicing and administrative tasks

The Results After 12 Months:

- Revenue: $520,000 (slight increase despite fewer clients)

- Net Profit: $78,000 (15% margin)

- Owner stress: Significantly reduced

- Team morale: Improved (working with better clients)

This 212% increase in net profit came from a strategic focus on profitability over vanity metrics like revenue or client count.

Net Profit and Business Valuation

When selling a business, net profit directly impacts valuation. Most businesses sell for a multiple of net profit (or EBITDA):

- Service businesses: 2-4× annual net profit

- E-commerce: 2-4× annual net profit

- SaaS companies: 4-8× annual net profit (or more for fast-growing ones)

- Manufacturing: 3-6× annual net profit

A business with $100,000 net profit might sell for $200,000-$400,000 depending on industry, growth trajectory, and other factors. Doubling the net profit could double the sale price.

The Relationship Between Net Profit and Cash Flow

Important distinction: Net profit and cash flow aren’t the same thing. You can be profitable on paper but cash-poor:

- Accounts Receivable: You made a sale (counts as revenue) but haven’t collected payment yet

- Inventory: You bought products (expense) but haven’t sold them yet

- Depreciation: Reduces net profit but doesn’t require a cash outflow

- Loan Principal: Paying down loans uses cash but doesn’t affect net profit (only interest does)

Cash flow management is crucial even with a healthy net profit. According to the U.S. Bureau of Labor Statistics, 82% of small business failures are due to cash flow problems, not lack of profitability.

Building a Profit-First Mindset

Author Mike Michalowicz popularized the “Profit First” methodology, which flips the traditional formula:

Traditional: Revenue – Expenses = Profit (whatever’s left)

Profit First: Revenue – Profit = Expenses (what you’re allowed to spend)

This approach involves:

- Setting aside profit percentage first (start with 5%, increase over time)

- Allocating percentages to different expense categories

- Operating within what remains

- Forcing efficiency and preventing lifestyle creep

Many business owners report that this mindset shift has dramatically improved their net profit within months.

Tools and Resources for Tracking Net Profit

Free Resources:

- SCORE: Free business mentoring and templates

- SBA.gov: Small Business Administration resources and calculators

- IRS.gov: Tax guidance and business expense categories

- Excel/Google Sheets: Free templates for profit and loss statements

Paid Tools:

- QuickBooks ($15-$150/month): Industry-standard accounting software

- Xero ($13-$70/month): Cloud-based alternative

- FreshBooks ($15-$50/month): Great for service businesses

- Bench ($249-$549/month): Bookkeeping service with software

Educational Resources;

- Investopedia: Comprehensive financial education

- Khan Academy: Free finance courses

- Coursera: University-level accounting courses

- TheRichGuyMath.com blog: Practical finance and investing guides

Conclusion: Your Net Profit Action Plan

Net profit isn’t just an accounting term; it’s the heartbeat of business success and the foundation of wealth building. Whether you’re running a side hustle, managing a growing company, or analyzing stocks for investment, understanding net profit gives you a competitive advantage most people lack.

Here’s your action plan moving forward:

For Business Owners:

- Calculate your current net profit and margin using the formula and calculator above

- Compare to industry benchmarks to see where you stand

- Identify your top 3 expense categories and brainstorm reduction strategies

- Set a realistic profit improvement goal (e.g., increase margin by 2% this quarter)

- Track monthly and adjust strategies based on results

For Investors:

- Review net profit trends for any company before investing

- Compare net profit margins across competitors in the same industry

- Look for consistent growth in net profit over 3-5 years

- Evaluate dividend sustainability by checking if net profit covers dividend payments

- Read quarterly reports (10-Q) and annual reports (10-K) for deeper insights

For Employees and Career Builders:

- Research your employer’s profitability to assess job security

- Understand how your role impacts the company’s net profit

- Use profit knowledge to negotiate raises at profitable companies

- Consider profit-sharing or equity as part of compensation

- Learn financial literacy to advance in your career

Universal Next Steps:

- Start tracking if you’re not already (you can’t improve what you don’t measure)

- Set up monthly reviews to catch problems early

- Educate yourself continuously about finance and business

- Seek expert help when needed (accountants, financial advisors)

- Think long-term while acting short-term

Remember the candle business from our opening? That $800 net profit on $5,000 revenue represents a 16% margin, actually quite healthy for a physical product business. But without understanding net profit, you might have thought you were rich at $5,000 monthly revenue, only to be confused when you couldn’t pay your bills.

Knowledge is power, but applied knowledge is wealth. Take what you’ve learned about net profit today and put it into action. Whether you’re building a business, growing your investments, or simply making smarter financial decisions, understanding the bottom line will serve you for life.

The difference between those who build lasting wealth and those who struggle financially often comes down to one thing: understanding where money really goes and what actually stays. Now you have that understanding. The question is: what will you do with it?

Disclaimer

This article is for educational and informational purposes only and should not be construed as financial, investment, tax, or legal advice. While we strive for accuracy, financial regulations, tax laws, and market conditions change frequently. The examples and figures provided are for illustration purposes only and may not reflect current market conditions. Always consult with a qualified financial advisor, certified public accountant, or other appropriate professional before making financial decisions. Past performance does not guarantee future results. Investing and business ownership involve risk, including the potential loss of principal.

About the Author

Max Fonji is a financial educator and content strategist specializing in making complex financial concepts accessible to everyday investors and entrepreneurs. With over a decade of experience in finance and business analysis, Max has helped thousands of readers build financial literacy and make smarter money decisions. When not writing about finance, Max enjoys analyzing market trends, mentoring young entrepreneurs, and exploring the intersection of technology and personal finance. Connect with more insights at TheRichGuyMath.com.