Most people never learn how Personal Finance actually works—not in school, not at home, and not from their first employer. As a result, they make financial decisions based on guesswork, emotion, or what friends are doing. The math behind money remains a mystery, and the consequences compound silently over decades.

Personal finance isn’t about getting rich quickly or following trendy investment advice. It’s about building a system that controls cash flow, eliminates destructive debt, grows wealth through compounding, and protects what you’ve built. It’s the difference between reacting to financial emergencies and designing a life where money serves your goals instead of controlling your choices.

This comprehensive guide breaks down the core principles of personal finance into clear, actionable frameworks. Whether you’re earning your first paycheck or approaching retirement, understanding these fundamentals will transform how you earn, spend, save, invest, and protect your financial future.

Key Takeaways

- Personal finance is a system, not a single tactic—it encompasses budgeting, debt management, investing, retirement planning, taxes, and risk protection working together.

- Behavior matters more than income—high earners with poor financial habits often struggle more than modest earners with disciplined systems.

- Time is your greatest asset—starting early with small, consistent actions creates exponential results through compound growth.

- Financial literacy is learnable—the math behind money follows predictable patterns that anyone can understand and apply.

- Protection is as important as growth—building wealth without proper insurance and emergency reserves creates catastrophic risk.

What Is Personal Finance?

Personal finance is the complete system of how you earn, spend, save, borrow, invest, and protect money throughout your lifetime. It’s not a single skill or decision—it’s an integrated framework that governs every financial choice you make, from daily coffee purchases to retirement account contributions.

At its core, personal finance addresses three fundamental questions:

- How do you manage money today? (Short-term cash flow and spending control)

- How do you build wealth for tomorrow? (Long-term investing and compound growth)

- How do you protect what you have? (Risk management and insurance)

Most people approach these questions in isolation, budgeting without investing, or investing without proper emergency reserves. The result is financial fragility—a system that works during good times but collapses under stress.

Personal finance integrates all these components into a coherent strategy. It means tracking income and expenses, maintaining emergency funds, eliminating high-interest debt, investing consistently for long-term goals, planning for retirement, optimizing taxes, and protecting assets with appropriate insurance.

The goal isn’t necessarily becoming wealthy in absolute terms. The goal is achieving financial control—the ability to make life decisions without being constrained by money, to weather unexpected expenses without crisis, and to build security that compounds over time.

Mini Takeaway

Personal finance isn’t about being rich—it’s about being in control. Control means having systems that work automatically, decisions based on data rather than emotion, and the freedom to pursue goals without financial anxiety.

Why Personal Finance Matters More Than Income

A common misconception is that financial success depends primarily on how much you earn. The data tells a different story.

According to the Federal Reserve’s Survey of Consumer Finances, approximately 37% of Americans couldn’t cover a $400 emergency expense using cash or savings in 2023.[1] This statistic spans all income levels, including households earning six figures. High income doesn’t automatically create financial stability because behavior determines outcomes more than salary.

Consider two scenarios:

Person A earns $60,000 annually, saves 15% consistently, avoids high-interest debt, invests in low-cost index funds, and maintains a six-month emergency fund. After 30 years with average market returns (10% annually), they accumulate approximately $1.36 million.

Person B earns $120,000 annually but saves nothing due to lifestyle inflation, carries $25,000 in credit card debt at 18% interest, and has no investment accounts. Despite earning double the income, Person B faces financial stress, wealth erosion from interest payments, and zero retirement security.

The math behind money reveals why small mistakes compound destructively:

- Credit card debt at 18% APR doubles every four years if left unpaid

- Missing the first 10 years of investing (ages 25-35) can reduce retirement wealth by 50% or more

- Lifestyle inflation that matches income growth eliminates the primary benefit of raises and promotions

Personal finance matters because it determines what you keep and grow, not just what you earn. A disciplined system applied to modest income outperforms chaotic spending applied to high income—every single time.

The stress of financial instability also creates measurable health consequences. Studies show that financial anxiety correlates with higher rates of depression, cardiovascular disease, and relationship conflict.[2] Learning personal finance isn’t just about wealth—it’s about reducing stress and increasing life quality through control and predictability.

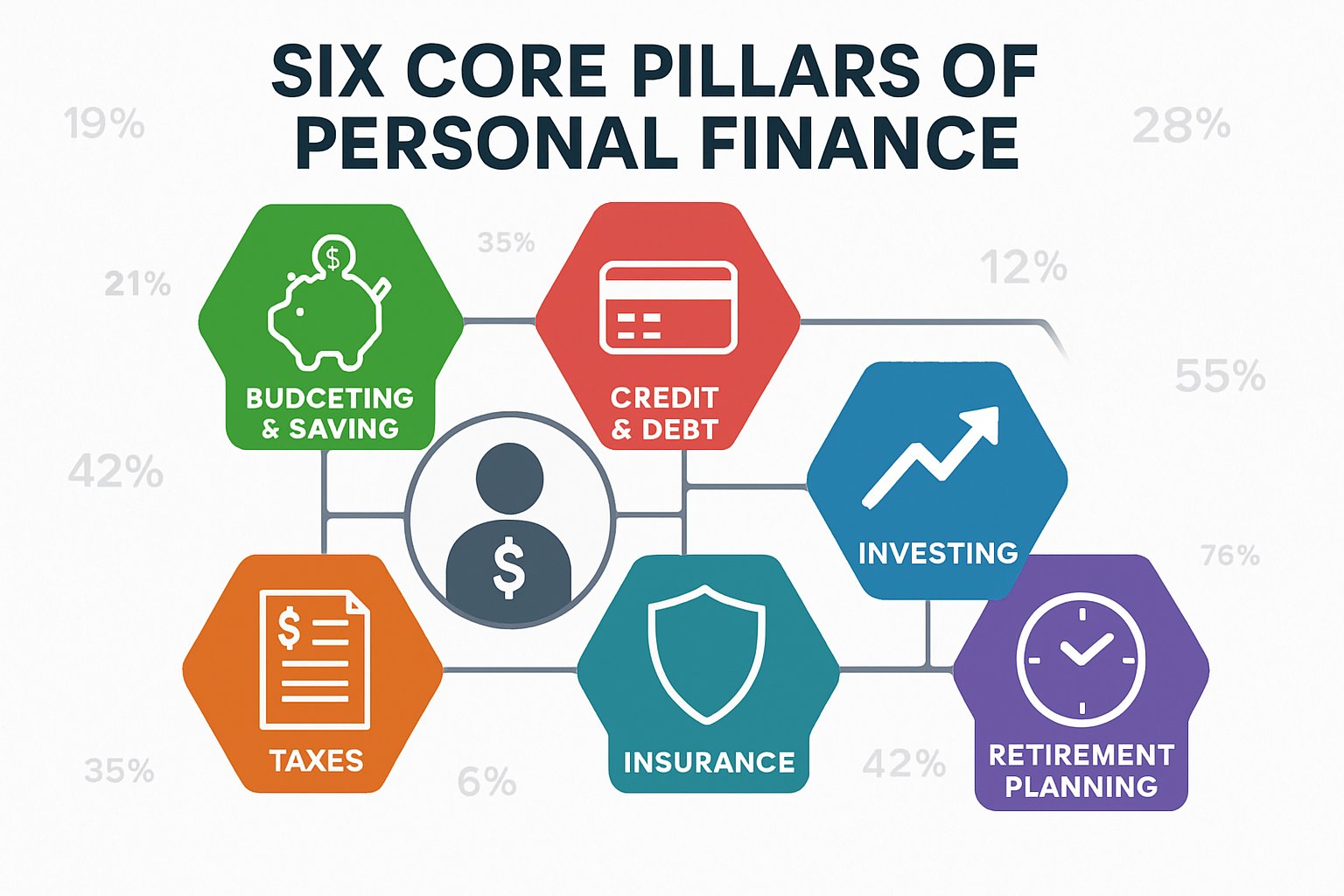

The 6 Core Areas of Personal Finance

Personal finance operates across six interconnected domains. Mastering one area while ignoring others creates imbalance and vulnerability. The following framework shows how each component contributes to overall financial health.

1. Budgeting and Saving

Budgeting is the foundation of personal finance—it’s the system that tracks cash flow, controls spending, and allocates resources toward specific goals. Without a budget, you’re managing money through guesswork rather than data.

A functional budget answers three questions:

- Where does money come from? (Income sources and amounts)

- Where does money go? (Fixed expenses, variable costs, discretionary spending)

- What’s left for goals? (Savings, investments, debt payoff)

The most effective budgeting frameworks include:

- 50/30/20 Rule: 50% needs, 30% wants, 20% savings/debt payoff

- Zero-Based Budgeting: Every dollar is assigned a specific purpose before the month begins

- Pay Yourself First: Automatic transfers to savings before discretionary spending

Saving serves multiple purposes within personal finance:

- Emergency Fund: 3-6 months of expenses in liquid accounts (high-yield savings)

- Goal-Based Saving: Specific targets like down payments, vacations, or major purchases

- Cash Reserves: Buffer against income volatility or unexpected expenses

The Federal Reserve data shows that households with emergency savings experience significantly less financial stress and recover faster from economic shocks.[1] Building reserves isn’t about pessimism—it’s about creating resilience through preparation.

Key metrics to track:

- Savings rate (percentage of income saved monthly)

- Emergency fund coverage (months of expenses)

- Budget variance (actual vs. planned spending)

🔗 Learn more: Budgeting and Saving Hub

2. Credit and Debt

Credit represents your ability to borrow money based on demonstrated repayment reliability. Your credit score (typically FICO scores ranging from 300-850) determines borrowing costs, rental applications, and sometimes employment opportunities.

Credit scores are calculated using five factors:

- Payment History (35%): On-time vs. late payments

- Credit Utilization (30%): Percentage of available credit used

- Credit History Length (15%): Age of oldest and average accounts

- Credit Mix (10%): Diversity of account types

- New Credit (10%): Recent applications and inquiries

Debt comes in two categories with vastly different financial impacts:

High-Interest Debt (Destructive)

- Credit cards (15-25% APR)

- Payday loans (400%+ APR)

- Personal loans (10-30% APR)

This debt compounds against you. A $5,000 credit card balance at 18% APR costs $900 annually in interest alone if you only make minimum payments. Over 10 years, you’ll pay $8,000+ in interest on the original $5,000 borrowed.

Low-Interest Debt (Strategic)

- Mortgages (3-7% APR, tax-deductible)

- Student loans (3-6% APR, income-driven repayment options)

- Auto loans (3-8% APR, secured by asset)

The math behind money shows that debt payoff should be prioritized by interest rate. The “avalanche method” (highest rate first) saves the most money mathematically, while the “snowball method” (smallest balance first) provides psychological wins.

Debt-to-Income Ratio (DTI) is a critical metric lenders use:

DTI = (Total Monthly Debt Payments / Gross Monthly Income) × 100

Lenders prefer DTI below 36%, with housing costs under 28% of income.

🔗 Learn more: Credit and Debt Hub

3. Investing

Investing is how you build long-term wealth through compound growth—the process where returns generate additional returns over time. While saving preserves purchasing power, investing grows it exponentially.

The fundamental principle is simple: money invested in productive assets grows faster than inflation over long periods. Historical data show the S&P 500 has returned approximately 10% annually over the past century, despite short-term volatility.[3]

Core investment concepts:

Compound Growth

The mathematical force that transforms modest contributions into substantial wealth. The formula:

FV = PV × (1 + r)^n

Where:

- FV = Future Value

- PV = Present Value

- r = Return rate

- n = Number of periods

Example: $10,000 invested at 8% annually becomes:

- $21,589 after 10 years

- $46,610 after 20 years

- $100,627 after 30 years

The same $10,000 with monthly contributions of $500 becomes $745,179 after 30 years. Time and consistency create exponential results.

Asset Allocation

Diversifying investments across asset classes to balance growth and risk:

- Stocks: High growth potential, high volatility

- Bonds: Lower growth, lower volatility, income generation

- Real Estate: Inflation hedge, income through rent

- Cash Equivalents: Liquidity, stability, minimal growth

Tax-Advantaged Accounts

Vehicles that reduce tax burden while building wealth:

- 401(k)/403(b): Employer-sponsored, pre-tax contributions, employer match

- Traditional IRA: Pre-tax contributions, tax-deferred growth

- Roth IRA: After-tax contributions, tax-free growth, and withdrawals

- HSA: Triple tax advantage for healthcare expenses

Dollar-Cost Averaging

Investing fixed amounts regularly, regardless of market conditions, reduces timing risk and emotional decision-making.

The math behind money shows that starting early matters more than investing large amounts later. A 25-year-old investing $200/month until 65 accumulates more wealth than a 35-year-old investing $400/month until 65 (assuming 8% returns).

🔗 Learn more: Investing Hub

4. Retirement Planning

Retirement planning addresses the challenge of replacing employment income when you stop working. The fundamental question is: How much do you need to maintain your lifestyle without a paycheck?

The “4% Rule” provides a starting framework: You can withdraw 4% of your retirement portfolio annually with high confidence it will last 30+ years. This means:

- Retirement Goal = Annual Expenses ÷ 0.04

- Need $50,000/year? Target portfolio: $1,250,000

- Need $80,000/year? Target portfolio: $2,000,000

Retirement accounts offer powerful tax advantages:

Tax-Deferred Growth (Traditional 401k/IRA)

- Contributions reduce current taxable income

- Growth compounds tax-free

- Withdrawals taxed as ordinary income

- Required Minimum Distributions (RMDs) begin at age 73

Tax-Free Growth (Roth 401k/IRA)

- Contributions made with after-tax dollars

- Growth compounds tax-free

- Qualified withdrawals are completely tax-free

- No RMDs during the owner’s lifetime

Employer Match = Free Money

If your employer offers 401(k) matching (e.g., 50% match up to 6% of salary), not contributing means leaving guaranteed 50% returns on the table. This is the highest-return “investment” available.

Longevity Risk

The possibility of outliving your savings. With life expectancies increasing, planning for 30-40 years of retirement isn’t excessive—it’s prudent. Social Security provides a foundation, but it typically replaces only 40% of pre-retirement income.[4]

Healthcare Costs

Fidelity estimates the average 65-year-old couple will need approximately $315,000 for healthcare expenses in retirement (2023 data).[5] Medicare covers many costs, but not all—planning for premiums, deductibles, and long-term care is essential.

🔗 Learn more: Retirement Hub

5. Taxes

Taxes represent the difference between what you earn and what you keep. Understanding tax optimization isn’t about evasion—it’s about using legal strategies to reduce tax burden and increase wealth accumulation.

Income Types and Tax Treatment:

Ordinary Income (Highest Tax Rates)

- Wages, salaries, bonuses

- Short-term capital gains (assets held <1 year)

- Interest income

- Taxed at marginal rates: 10%, 12%, 22%, 24%, 32%, 35%, 37% (2025)

Qualified Dividends and Long-Term Capital Gains (Lower Rates)

- Assets held >1 year

- Taxed at preferential rates: 0%, 15%, 20%

- Significant savings compared to ordinary income

Tax-Exempt Income

- Municipal bond interest

- Roth IRA withdrawals (qualified)

- HSA withdrawals for medical expenses

Key Tax Optimization Strategies:

- Maximize tax-advantaged accounts (401k, IRA, HSA)

- Hold investments long-term to access capital gains rates

- Tax-loss harvesting to offset gains with losses

- Strategic Roth conversions during low-income years

- Charitable contributions for itemized deductions

Marginal vs. Effective Tax Rate:

- Marginal Rate: Tax on your next dollar earned

- Effective Rate: Average tax on all income

Understanding this distinction prevents common mistakes like refusing raises due to “moving into a higher bracket.” Only income above the threshold is taxed at the higher rate, not all income.

🔗 Learn more: Taxes Hub

6. Insurance and Risk Protection

Insurance transfers catastrophic financial risk to insurance companies in exchange for predictable premium payments. It protects the wealth you’ve built from being wiped out by events beyond your control.

Essential Insurance Types:

Health Insurance

- Protects against medical bankruptcy (leading cause of personal bankruptcy in the U.S.)

- Understand deductibles, out-of-pocket maximums, and networks

- HSA-eligible high-deductible plans offer tax advantages

Life Insurance

- Term Life: Pure death benefit, affordable, covers a specific period

- Permanent Life: Death benefit plus cash value, expensive, complex

- Rule of thumb: 10-12× annual income in coverage if you have dependents

Disability Insurance

- Replaces income if you cannot work due to injury/illness

- Often overlooked despite being more likely than premature death for working-age adults

- Aim for 60-70% income replacement

Property Insurance

- Homeowners/Renters: Protects dwelling and possessions

- Auto: Liability (covers damage you cause) and Comprehensive/Collision (covers your vehicle)

- Umbrella: Additional liability coverage beyond standard policies

Long-Term Care Insurance

- Covers extended care needs (nursing homes, in-home care)

- Expensive but potentially essential given healthcare costs

- Consider the 50s-60s, when premiums were more affordable

The math behind money shows that self-insuring against catastrophic risk is mathematically irrational. A $500,000 medical bill or lawsuit can destroy decades of wealth accumulation. Insurance premiums represent a small, predictable cost to eliminate devastating tail risk.

🔗 Learn more: Insurance Hub

7. Credit Cards

Credit cards are powerful financial tools when used strategically, but destructive when mismanaged. They represent revolving credit—the ability to borrow up to a limit and repay over time.

Strategic Benefits:

- Rewards: Cash back (1-5%), travel points, purchase protections

- Credit Building: Positive payment history improves credit scores

- Float: 21-25 day grace period between purchase and payment

- Fraud Protection: Better than debit cards for unauthorized charges

- Purchase Benefits: Extended warranties, price protection, travel insurance

Destructive Patterns:

- Carrying Balances: Interest rates (15-25% APR) destroy wealth faster than most investments create it

- Minimum Payments: Designed to maximize interest paid, minimize principal reduction

- Lifestyle Inflation: Spending increases because credit feels like “available money.”

Optimal Credit Card Strategy:

- Pay full balance monthly (zero interest charges)

- Keep utilization under 30% (ideally under 10% for score optimization)

- Maximize rewards on categories you already spend in

- Never pay annual fees unless rewards exceed the cost

- Set up autopay to avoid missed payments

The difference between strategic and destructive credit card use is simple: Do you pay interest? If yes, you’re losing money. If not, you’re gaining rewards and building credit at zero cost.

🔗 Learn more: Credit Cards Hub

8. Financial Literacy

Financial literacy is the foundation that makes all other personal finance components work. It’s the ability to understand financial concepts, make informed decisions, and recognize how money decisions create long-term consequences.

The data reveals a crisis: According to the National Financial Educators Council, the average American loses approximately $1,819 annually due to a lack of financial knowledge.[6] These losses come from:

- High-interest debt from misunderstanding APR

- Investment fees that erode returns

- Missed tax optimization opportunities

- Poor insurance decisions

- Failure to negotiate salaries

Core Financial Literacy Concepts:

Time Value of Money

Understanding that money today is worth more than money tomorrow because of earning potential. This principle underlies all investing, lending, and retirement planning decisions.

Compound Interest

The exponential growth (or decay) that occurs when returns generate additional returns. Works for you in investments, against you in debt.

Inflation

The gradual increase in prices reduces purchasing power. Currently averaging 2-3% annually, meaning $100 today buys what $97-98 buys next year. Investments must outpace inflation to build real wealth.

Risk vs. Return

Higher potential returns require accepting higher risk (volatility). Understanding this relationship prevents both excessive risk-taking and excessive conservatism.

Diversification

Spreading investments across multiple assets to reduce risk without proportionally reducing returns. The only “free lunch” in investing.

Financial literacy isn’t innate—it’s learned through study, practice, and sometimes mistakes. The goal is understanding the math behind money well enough to make rational decisions based on data rather than emotion or marketing.

🔗 Learn more: Financial Literacy Hub

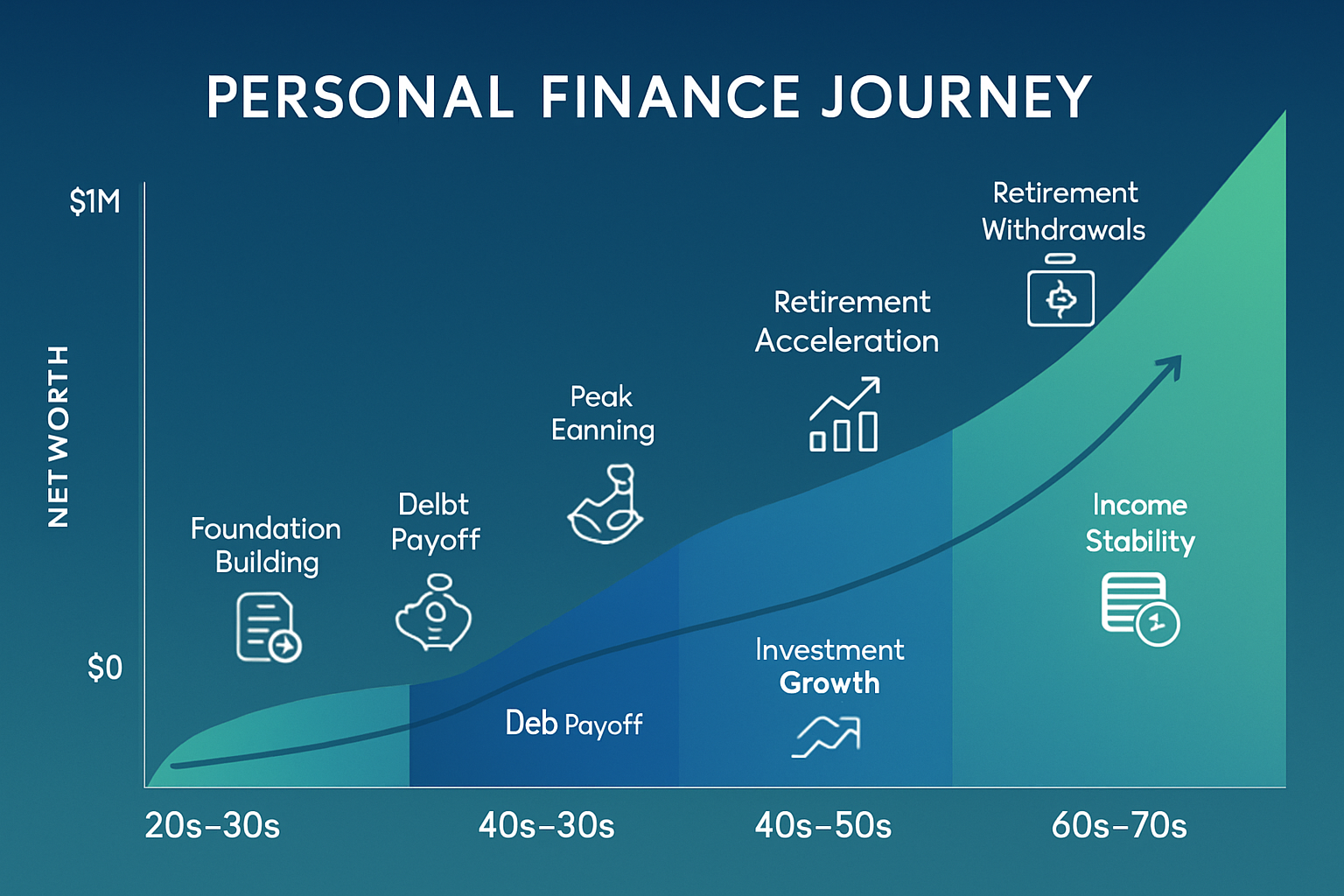

Personal Finance by Life Stage

Financial priorities shift across life stages. What matters at 25 differs dramatically from what matters at 55. Understanding these stage-specific focuses optimizes decision-making and resource allocation.

Personal Finance for Beginners

First Paycheck Priorities:

When you receive your first regular income, three actions matter most:

- Open a checking and savings account with no monthly fees

- Set up direct deposit to automate income

- Create a simple budget tracking income vs. expenses

First Budget Framework:

Start with the 50/30/20 rule:

- 50% Needs: Rent, utilities, groceries, transportation, minimum debt payments

- 30% Wants: Entertainment, dining out, hobbies, subscriptions

- 20% Savings/Debt: Emergency fund, retirement contributions, extra debt payments

First Credit Card Strategy:

- Choose a no-annual-fee card with cash back rewards

- Set credit limit low initially ($500-1,000)

- Pay the full balance monthly to avoid interest

- Use for regular purchases you’d make anyway (groceries, gas)

- Never spend more than you can pay off immediately

First Emergency Fund:

Start with $1,000 in a high-yield savings account. This covers most minor emergencies (car repair, medical copay, unexpected bill) without resorting to credit cards. Once established, build toward 3-6 months of expenses.

Common Beginner Mistakes:

- Lifestyle inflation with first “real” paycheck

- Ignoring the employer 401(k) match (leaving free money unclaimed)

- Carrying credit card balances “to build credit” (myth—payment history builds credit, not interest payments)

- No budget or expense tracking

- Delaying investing because “I’ll start when I earn more.”

The math behind money shows that financial habits established early persist for decades. Starting with disciplined systems—even on modest income—creates patterns that compound into significant wealth over time.

🔗 Learn more: Financial Literacy Hub

Personal Finance in Your 20s and 30s

Foundation Building Phase:

These decades represent maximum time advantage for compound growth. A dollar invested at 25 grows exponentially more than a dollar invested at 45 due to additional compounding periods.

Debt Management Priority:

- Eliminate high-interest debt aggressively (credit cards, personal loans)

- Manage student loans strategically (income-driven repayment, refinancing if rates drop)

- Avoid car loans when possible; buy reliable used vehicles with cash

- Save for a home down payment if homeownership aligns with goals (20% down avoids PMI)

Investing Early Advantage:

Consider two scenarios:

Early Starter (Age 25-35):

- Invests $5,000/year for 10 years ($50,000 total)

- Then stops contributing but leaves invested

- At age 65 with 8% returns: $787,176

Late Starter (Age 35-65):

- Invests $5,000/year for 30 years ($150,000 total)

- At age 65 with 8% returns: $566,416

The early starter invested $100,000 less but accumulated $220,760 more due to compound growth. This demonstrates why starting immediately—even with small amounts—matters more than waiting to invest larger sums.

Income Growth Focus:

Your 20s and 30s offer maximum career advancement potential:

- Invest in skills that increase earning power

- Change jobs strategically (job-hoppers earn 10-20% more than those who stay put)

- Negotiate every offer (most employers expect negotiation)

- Build side income if primary income plateaus

Key Metrics to Track:

- Net worth growth (assets minus liabilities)

- Savings rate (percentage of income saved)

- Investment returns vs. benchmarks

- Debt-to-income ratio (trending downward)

Personal Finance in Your 40s and 50s

Peak Earning Years:

Statistically, income peaks in the late 40s to early 50s for most professionals.[7] These years offer maximum wealth accumulation potential—but also maximum lifestyle inflation risk.

Retirement Acceleration:

With 10-20 years until retirement, aggressive saving becomes critical:

- Max out 401(k) contributions ($23,000 limit in 2025, plus $7,500 catch-up if 50+)

- Max out IRA contributions ($7,000 limit in 2025, plus $1,000 catch-up if 50+)

- Consider backdoor Roth conversions if income exceeds direct Roth IRA limits

- Increase savings rate to 20-25% of gross income if possible

College Planning:

If you have children approaching college age:

- 529 Plans: Tax-advantaged education savings

- FAFSA Strategy: Understanding Expected Family Contribution (EFC)

- Merit vs. Need Aid: Positioning for maximum aid

- Community College + Transfer: Reducing total cost by 40-60%

Critical Rule: Never sacrifice retirement for college funding. Students can borrow for education; you cannot borrow for retirement.

Insurance Review:

- Life insurance needs may decrease as children become independent and assets grow

- Disability insurance remains critical until retirement

- Long-term care insurance consideration (premiums increase significantly after 60)

- Umbrella liability coverage to protect accumulated wealth

Estate Planning Basics:

- Will and/or living trust

- Power of attorney (financial and healthcare)

- Beneficiary designations updated

- Guardianship designations for minor children

Debt Elimination Target:

Goal: Enter retirement debt-free. Prioritize paying off:

- Credit cards (highest interest)

- Auto loans (moderate interest)

- Mortgage (lowest interest, but psychological benefit of no housing payment)

Personal Finance in Retirement

Withdrawal Phase:

Retirement shifts from accumulation to distribution—converting assets into sustainable income.

Withdrawal Strategies:

4% Rule (Traditional)

- Withdraw 4% of the portfolio in year one

- Adjust subsequent withdrawals for inflation

- Historically successful 95%+ of the time over 30 years

Dynamic Withdrawal

- Adjust withdrawals based on portfolio performance

- Reduce spending in down markets to preserve principal

- Increase spending in strong markets

Bucket Strategy

- Bucket 1: 2-3 years expenses in cash/bonds (safety)

- Bucket 2: 5-10 years in a balanced portfolio (moderate growth)

- Bucket 3: 10+ years in stocks (maximum growth)

Tax-Efficient Withdrawal Order:

- Taxable accounts first (most flexible, potentially lower capital gains rates)

- Tax-deferred accounts (Traditional IRA/401k) before RMDs force withdrawals

- Tax-free accounts (Roth IRA) last (maximum tax-free growth)

Healthcare Costs:

- Medicare enrollment at 65 (Parts A, B, D, plus Medigap or Advantage)

- HSA funds for medical expenses (triple tax advantage continues)

- Long-term care planning (Medicaid spend-down vs. insurance vs. self-funding)

Social Security Optimization:

Claiming age dramatically affects lifetime benefits:

- Age 62 (Earliest): Reduced benefit (70% of full amount)

- Age 67 (Full Retirement Age): 100% of calculated benefit

- Age 70 (Maximum): Increased benefit (124% of full amount)

Delaying from 62 to 70 increases the monthly benefit by approximately 77%. For healthy individuals with longevity in family history, delay maximizes lifetime income.

Income Stability:

Create multiple income streams:

- Social Security (guaranteed, inflation-adjusted)

- Pension (if available)

- Portfolio withdrawals (variable)

- Part-time work (optional, extends portfolio longevity)

- Rental income (if real estate investor)

Required Minimum Distributions (RMDs):

Beginning at age 73, you must withdraw minimum amounts from tax-deferred accounts:

RMD = Account Balance ÷ Distribution Period

(Distribution period from IRS tables based on age)

Failure to take RMDs results in a 25% penalty on the amount not withdrawn—one of the harshest IRS penalties.

Longevity Risk Management:

- Plan for 30-40 year retirement (age 65 to 95-105)

- Consider annuities for a guaranteed lifetime income floor

- Maintain equity exposure for inflation protection (40-60% stocks even in retirement)

- Review and adjust annually based on portfolio performance and spending

Common Personal Finance Mistakes to Avoid

Understanding what not to do is as valuable as knowing what to do. These mistakes destroy wealth, create stress, and compound over time.

Lifestyle Inflation

The Mistake: Increasing spending proportionally with income increases.

Why It Matters: A $10,000 raise with lifestyle inflation produces zero wealth gain. The raise disappears into nicer cars, larger apartments, and expensive habits.

The Math:

- Salary increases from $60,000 to $70,000

- Lifestyle inflation consumes the full $10,000

- Savings rate remains unchanged

- Wealth accumulation remains unchanged despite higher income

The Solution: Increase savings rate with raises. Save 50-100% of raises and bonuses before lifestyle adjustments.

Ignoring Credit Score

The Mistake: Not monitoring credit reports or understanding score impacts.

Why It Matters: Credit scores affect:

- Mortgage rates (1% difference on $300,000 = $60,000+ over loan life)

- Auto loan rates

- Credit card approvals and limits

- Rental applications

- Sometimes employment (financial sector jobs)

The Math:

- 760+ Score: 6.5% mortgage rate

- 660 Score: 8.0% mortgage rate

- On $300,000 30-year mortgage: $115,000 more in interest for a lower score

The Solution:

- Check credit reports annually (free at AnnualCreditReport.com)

- Pay all bills on time (35% of score)

- Keep credit utilization under 30% (30% of score)

- Maintain old accounts (15% of score)

Not Investing Early

The Mistake: Delaying investment contributions until “later, when I earn more.”

Why It Matters: Compound growth requires time. Each delayed year costs exponentially more than the contributions themselves.

The Math:

- Start at 25: $200/month at 8% = $622,000 at 65

- Start at 35: $200/month at 8% = $263,000 at 65

- 10-year delay cost: $359,000 (despite only $24,000 in additional contributions)

The Solution: Start immediately with whatever amount is possible. $50/month is infinitely better than $0/month. Increase contributions as income grows.

No Emergency Fund

The Mistake: Living paycheck-to-paycheck with zero cash reserves.

Why It Matters: Unexpected expenses (car repair, medical bill, job loss) force high-interest debt, creating a downward spiral.

The Math:

- Car repair: $1,200

- No emergency fund → credit card at 18% APR

- Minimum payments over 2 years = $1,200 + $250 interest

- Emergency fund → pay cash, zero interest

The Solution: Build $1,000 minimum emergency fund immediately. Then expand to 3-6 months of expenses. Keep in a high-yield savings account (currently 4-5% APY).

Overconfidence in Investing

The Mistake: Believing you can consistently beat the market through stock picking or timing.

Why It Matters: Data shows 90%+ of active fund managers underperform index funds over 15-year periods.[8] Individual investors perform even worse due to emotional buying and selling.

The Math:

- Index fund investor: 10% average annual return

- Active trader: 6% average return (after fees, taxes, poor timing)

- Over 30 years on $100,000: $1,745,000 vs. $574,000

The Solution:

- Invest in low-cost index funds (expense ratios <0.10%)

- Buy and hold through market volatility

- Rebalance annually to maintain target allocation

- Ignore market predictions and financial media noise

Paying Only Minimum Payments on Debt

The Mistake: Making minimum credit card payments while carrying balances.

Why It Matters: Minimum payments are designed to maximize interest paid and minimize principal reduction.

The Math:

- $10,000 credit card balance at 18% APR

- Minimum payment (2% of balance): $200/month initially

- Time to payoff: 30+ years

- Total interest paid: $18,000+

- Total cost: $28,000 for $10,000 borrowed

The Solution: Always pay more than the minimum. Use the avalanche method (highest rate first) or the snowball method (smallest balance first). Consider a balance transfer to 0% APR card while aggressively paying down.

Not Understanding Investment Fees

The Mistake: Ignoring expense ratios, management fees, and advisor commissions.

Why It Matters: A 1% fee may seem small, but it compounds to a substantial wealth reduction over decades.

The Math:

- $100,000 invested for 30 years at 8% returns

- 0.10% fee (index fund): $943,000 final value

- 1.00% fee (actively managed fund): $761,000 final value

- Fee cost: $182,000 (19% of potential wealth)

The Solution: Prioritize low-cost index funds. Avoid funds with expense ratios above 0.20%. Question any advisor charging more than 0.50-1.00% AUM.

Mixing Insurance and Investment Products

The Mistake: Purchasing whole life insurance, variable annuities, or other complex products combining insurance and investment.

Why It Matters: These products typically have:

- High fees (2-3%+ annually)

- Poor returns compared to separate term insurance + index fund investing

- Complex terms that obscure costs

- High commissions create biased sales incentives

The Math:

- Whole Life: $500/month = $100/month insurance + $400/month investment with 2% fees

- Term + Index Fund: $50/month term insurance + $450/month index fund with 0.10% fees

- Over 30 years: Separate approach accumulates $200,000+ more

The Solution: Buy term life insurance for protection. Invest separately in low-cost index funds. Keep insurance and investing completely separate.

Personal Finance Tools and Calculators

Why calculators matter: Personal finance is fundamentally mathematical. Calculators transform abstract concepts into concrete numbers, showing exactly how decisions compound over time.

Planning with calculators beats guessing every time. They reveal:

- How much do you need to save for specific goals

- When you can afford to retire

- How long does debt payoff take

- Whether you’re on track or need adjustments

Essential Financial Calculators

Budget Calculator

Input income and expenses to identify surplus or deficit. Shows exactly where money goes and how much remains for savings/investing.

🔗 Use tool: Budget Calculator

Retirement Calculator

Portfolio value at retirement based on current savings, contribution rate, expected returns, and time horizon. Reveals if you’re on track or need to increase savings.

🔗 Use tool: Retirement Calculator

Debt Payoff Calculator

Compares payoff strategies (avalanche vs. snowball), shows total interest costs, and calculates freedom date. Demonstrates how extra payments dramatically accelerate payoff.

🔗 Use tool: Debt Payoff Calculator

Savings Calculator

Shows how regular contributions grow with compound interest. Demonstrates the time value of money and the importance of starting early.

🔗 Use tool: Savings Calculator

Compound Interest Calculator

Visualizes exponential growth over time. Adjusts for different contribution frequencies, return rates, and time periods.

Use tool: Compound Interest Calculator

Investment Fee Calculator

Reveals the long-term cost of expense ratios and management fees. Shows the wealth difference between low-cost and high-cost investments.

Mortgage Calculator

Calculates monthly payments, total interest, and amortization schedules. Compares different loan terms and down payment scenarios.

Use tool: Mortgage Calculator

Emergency Fund Calculator

Determines target emergency fund based on monthly expenses and risk factors (job stability, dependents, health).

These tools transform personal finance from abstract theory into actionable data. Use them before major financial decisions to understand long-term implications.

Use tool: Emergency Fund Calculator

How to Build a Simple Personal Finance System

Systems beat motivation every time. Motivation fluctuates; systems run automatically. Here’s a step-by-step framework for building a personal finance system that works without constant attention.

Step 1: Track Income & Expenses (30 Days)

Action: Record every dollar earned and spent for one month.

Tools:

- Spreadsheet (free, flexible)

- Budgeting apps (Mint, YNAB, Personal Capital)

- Bank/credit card transaction exports

Goal: Understand actual spending patterns vs. perceived spending. Most people underestimate spending by 20-30%.

Outcome: Baseline data showing:

- Fixed expenses (rent, utilities, insurance)

- Variable expenses (groceries, gas, entertainment)

- Discretionary spending (dining out, subscriptions, shopping)

- Savings rate (if any)

Step 2: Build Emergency Fund ($1,000 Minimum)

Action: Open a high-yield savings account and accumulate $1,000 as fast as possible.

Method:

- Cut discretionary spending temporarily

- Sell unused items

- Direct any windfalls (tax refunds, bonuses)

- Side gig income

Timeline: 1-3 months for most people

Why First: An Emergency fund prevents high-interest debt when unexpected expenses occur. It’s financial insurance before building wealth.

Step 3: Pay Off High-Interest Debt

Action: Eliminate all debt above 8% APR using the avalanche or snowball method.

Avalanche Method (Mathematically Optimal):

- List all debts by interest rate (highest to lowest)

- Pay minimums on everything

- Put all extra money toward the highest-rate debt

- When paid off, roll the payment to the next highest rate

- Repeat until debt-free

Snowball Method (Psychological Wins):

- List all debts by balance (smallest to largest)

- Pay minimums on everything

- Put all extra money toward the smallest balance

- When paid off, roll the payment to the next smallest

- Repeat until debt-free

Timeline: Varies by debt amount, but aggressive payoff typically takes 12-36 months.

Step 4: Invest Consistently (Automate)

Action: Set up automatic monthly investments to retirement and taxable accounts.

Priority Order:

- 401(k) to employer match (free money, immediate 50-100% return)

- Max Roth IRA ($7,000/year in 2025, $8,000 if 50+)

- Max 401(k) ($23,000/year in 2025, $30,500 if 50+)

- Taxable brokerage account (if retirement accounts maxed)

Investment Selection:

- Target-date funds (automatic rebalancing)

- Total market index funds (VTI, VTSAX)

- S&P 500 index funds (VOO, VFIAX)

- Three-fund portfolio (US stocks, international stocks, bonds)

Automation Setup:

- Direct deposit splits (% to checking, % to savings/investment)

- Automatic transfers on payday

- Auto-increase contributions with raises

Goal: Invest before you see the money. Manual investing relies on discipline; automatic investing runs regardless of motivation.

Step 5: Protect with Insurance

Action: Ensure adequate coverage across essential insurance types.

Required Coverage:

- Health insurance (through employer or marketplace)

- Auto insurance (liability minimum: 100/300/100)

- Renters/homeowners insurance (replace possessions + liability)

- Life insurance (if dependents rely on your income)

- Disability insurance (60-70% income replacement)

Optional Coverage:

- Umbrella liability ($1-2M additional coverage)

- Long-term care (consider in 50s-60s)

Review Annually: Life changes (marriage, children, home purchase) require coverage adjustments.

Step 6: Optimize Taxes

Action: Implement legal tax reduction strategies.

Immediate Actions:

- Max tax-advantaged accounts (401k, IRA, HSA)

- Harvest tax losses in taxable accounts

- Hold investments >1 year for long-term capital gains rates

- Contribute to 529 plans if applicable (state tax deduction)

Annual Actions:

- Review withholding (avoid large refunds = interest-free loan to IRS)

- Bunch charitable deductions in high-income years

- Consider Roth conversions in low-income years

- Track deductible expenses (home office, business expenses if self-employed)

Professional Help: Consider a CPA if:

- Self-employed

- Multiple income streams

- Significant investment income

- Complex deductions

System Maintenance (Quarterly Review)

Every 3 Months:

- Review budget vs. actual spending

- Check investment performance vs. benchmarks

- Rebalance if allocations drift >5%

- Update net worth tracking

- Adjust contributions if income has changed

Annual Deep Review:

- Calculate savings rate

- Project retirement readiness

- Review insurance coverage

- Tax optimization planning

- Set next year’s financial goals

The system runs automatically 90% of the time. Quarterly reviews ensure it stays aligned with goals and adapts to life changes.

Trusted Personal Finance Resource

Learning personal finance requires trusted, authoritative sources. These resources provide data-driven insights, regulatory information, and evidence-based guidance.

Government Resources

Federal Reserve

federalreserve.gov

Economic data, consumer finance surveys, and monetary policy information. The Survey of Consumer Finances provides comprehensive data on American household finances.

SEC Investor.gov

investor.gov

Investment education, fraud prevention, and regulatory filings. Essential for understanding investment products and avoiding scams.

IRS

irs.gov

Tax law, forms, publications, and retirement account rules. IRS Publication 590 (IRAs) and Publication 560 (retirement plans) are comprehensive references.

Consumer Financial Protection Bureau (CFPB)

consumerfinance.gov

Consumer protection, complaint filing, and financial education. Excellent resources on credit, mortgages, and debt.

Social Security Administration

ssa.gov

Benefit calculators, claiming strategies, retirement planning. Create an account to view projected benefits.

Financial Education Organizations

CFA Institute

cfainstitute.org

Professional investment standards, research, and ethics. High-quality investment education from a credential organization.

Financial Planning Association (FPA)

onefpa.org

Financial planning resources, CFP professional directory.

National Endowment for Financial Education (NEFE)

nefe.org

Free financial literacy resources, research, and educator tools.

Data and Research

Morningstar

morningstar.com

Investment research, fund analysis, portfolio tools. Gold standard for mutual fund and ETF data.

Vanguard Research

vanguard.com/research

Evidence-based investing research, white papers, and market commentary. No-nonsense, data-driven insights.

Federal Reserve Economic Data (FRED)

fred.stlouisfed.org

Economic statistics, historical data, and visualization tools. Comprehensive economic database.

Calculators and Tools

Bankrate

bankrate.com

Financial calculators, rate comparisons, and educational content.

Investopedia

investopedia.com

Financial definitions, tutorials, exam prep. Best for understanding terminology.

Books (Evidence-Based)

- “The Simple Path to Wealth” by JL Collins – Straightforward investing philosophy

- “A Random Walk Down Wall Street” by Burton Malkiel – Investment theory and evidence

- “The Millionaire Next Door” by Thomas Stanley – Wealth accumulation behaviors

- “Your Money or Your Life” by Vicki Robin – Financial independence framework

- “The Bogleheads’ Guide to Investing” by Taylor Larimore – Index investing principles

These resources prioritize data over opinion, evidence over anecdote, and education over marketing.

💰 Personal Finance Priority Calculator

Enter your financial situation to get a personalized action plan based on data-driven principles

📊 Your Personalized Financial Action Plan

Conclusion

Personal finance isn’t a mystery reserved for the wealthy or financially sophisticated. It’s a learnable system based on mathematical principles that work predictably when applied consistently.

The core framework is simple:

Control cash flow through budgeting and intentional spending

Build emergency reserves to prevent debt spirals

Eliminate high-interest debt that compounds against you

Invest consistently to harness compound growth working for you

Protect what you build with appropriate insurance

Optimize taxes to keep more of what you earn

Financial success doesn’t require a high income, perfect timing, or complex strategies. It requires understanding the math behind money and building systems that run automatically regardless of motivation or market conditions.

The difference between financial stress and financial security isn’t luck—it’s the compound effect of small, disciplined decisions made consistently over years and decades.

Next Steps

This Week:

- Track all spending for 7 days

- Calculate the current savings rate

- Check credit score (free at AnnualCreditReport.com)

- List all debts with interest rates

This Month:

- Create the first budget using the 50/30/20 framework

- Open a high-yield savings account for an emergency fund

- Sign up for an employer 401(k) (at a minimum to get a full match)

- Set up one automatic transfer to savings

This Quarter:

- Build $1,000 emergency fund

- Create a debt payoff plan (avalanche or snowball)

- Review insurance coverage for gaps

- Calculate retirement needs using a calculator

This Year:

- Eliminate the highest-interest debt

- Max Roth IRA contribution ($7,000)

- Build a 3-month emergency fund

- Increase savings rate to 15%+

The math behind money rewards those who start early, act consistently, and let compound growth work over time. Your financial future isn’t determined by where you start—it’s determined by the systems you build and maintain.

Start today. Start small. Start with what you have. The compound effect of disciplined personal finance creates wealth, security, and freedom that transform lives.

Disclaimer

This article provides educational information about personal finance principles and strategies. It is not personalized financial advice, investment recommendations, or tax guidance for your specific situation.

Financial decisions should be based on your individual circumstances, goals, risk tolerance, and time horizon. Before making significant financial decisions, consider consulting with qualified professionals:

- Certified Financial Planner (CFP) for comprehensive financial planning

- Certified Public Accountant (CPA) for tax strategy

- Licensed insurance professional for coverage needs

- Attorney for estate planning and legal matters

Investment performance is not guaranteed. Past returns do not predict future results. All investing involves risk, including potential loss of principal. Market conditions, economic factors, and individual circumstances affect outcomes.

Tax laws change frequently. Information presented reflects 2025 tax rules but may not apply in future years or to your specific situation.

The Rich Guy Math offers data-driven financial education to help readers understand the math behind money management. We do not provide personalized advice, manage investments, or sell financial products.

Always verify information with authoritative sources and conduct your own research before making financial decisions.

Author Bio

Max Fonji is the founder of The Rich Guy Math, a data-driven financial education platform that explains the math behind money with precision and clarity. With expertise in financial analysis and evidence-based investing, Max translates complex financial concepts into actionable frameworks that empower readers to build wealth through understanding rather than guesswork.

Max’s approach combines analytical rigor with educational warmth, teaching financial literacy through cause-and-effect relationships, mathematical principles, and real-world applications. His work focuses on helping beginners and intermediate investors understand how wealth, risk management, and financial systems truly work—through numbers, logic, and evidence.

The Rich Guy Math serves thousands of readers seeking to master personal finance fundamentals, investment principles, and the compound growth strategies that create long-term financial security.

References

[1] Federal Reserve. (2023). Report on the Economic Well-Being of U.S. Households. Board of Governors of the Federal Reserve System. https://www.federalreserve.gov/publications/2023-economic-well-being-of-us-households-in-2022-dealing-with-unexpected-expenses.htm

[2] American Psychological Association. (2023). Stress in America: Money, Inflation, and the Economy. https://www.apa.org/news/press/releases/stress/2023/collective-trauma-money

[3] Damodaran, A. (2024). Annual Returns on Stock, T.Bonds and T.Bills: 1928 – Current. NYU Stern School of Business. https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html

[4] Social Security Administration. (2024). Retirement Benefits. https://www.ssa.gov/benefits/retirement/

[5] Fidelity Investments. (2023). How to Plan for Rising Health Care Costs. https://www.fidelity.com/viewpoints/personal-finance/plan-for-rising-health-care-costs

[6] National Financial Educators Council. (2024). Financial Literacy Statistics. https://www.financialeducatorscouncil.org/financial-literacy-statistics/

[7] U.S. Bureau of Labor Statistics. (2024). Usual Weekly Earnings by Age. https://www.bls.gov/news.release/wkyeng.htm

[8] S&P Dow Jones Indices. (2023). SPIVA U.S. Scorecard. https://www.spglobal.com/spdji/en/research-insights/spiva/

Frequently Asked Questions About Personal Finance

What is the difference between personal finance and financial planning?

Personal finance is the broad discipline that covers all aspects of money management, including budgeting, saving, investing, debt management, taxes, and insurance. It represents the full system of day-to-day and long-term financial decision-making.

Financial planning is a structured, often professional process that creates a comprehensive strategy around specific goals such as retirement, education funding, or estate planning. Think of personal finance as the subject, and financial planning as the formal methodology.

You can practice personal finance independently using frameworks and tools, while financial planning typically involves working with a Certified Financial Planner (CFP) who builds a personalized plan.

How much should I save each month?

The evidence-based guideline is to save at least 20% of your gross income, with higher savings rates accelerating wealth building and financial independence.

- 15% toward retirement accounts (401(k), IRA, taxable investments)

- 5% toward other goals (emergency fund, down payment, education)

If 20% isn’t currently possible, start with whatever you can and increase your savings rate gradually. Even a 5% savings rate is far better than saving nothing, and habit formation matters more than the initial amount.

For aggressive wealth building or early retirement, savings rates of 30–50% are common among high earners and disciplined savers.

Is personal finance more about math or behavior?

Both matter, but behavior determines whether the math actually works.

The math of personal finance is straightforward: spend less than you earn, invest the difference, avoid high-interest debt, and allow compound growth to work over time.

Behavioral challenges—emotional spending, lifestyle inflation, impatience, fear during market volatility, and overconfidence—are what prevent most people from applying the math consistently.

Financial success requires understanding what to do and having the discipline to do it consistently. The math is simple; behavior is the hard part.

Can you fix your finances on a low income?

Yes. Financial stability is driven more by systems and savings rates than by absolute income.

Someone earning $35,000 who saves 15%, avoids debt, and invests consistently can outperform someone earning $100,000 who saves nothing and carries high-interest debt.

- Focus on savings rate percentage, not dollar amount

- Eliminate high-interest debt to free up cash flow

- Increase income through skills, side work, or job changes

- Reduce fixed expenses like housing and transportation

- Maximize employer benefits such as 401(k) matches and HSAs

Lower income makes progress slower, but the principles of personal finance still apply. Many millionaires built wealth over decades starting with modest earnings.

What comes first: saving or investing?

Order matters. A sound personal finance sequence looks like this:

- Build a starter emergency fund ($1,000 minimum)

- Capture employer 401(k) match

- Pay off high-interest debt (typically above 8% APR)

- Build a full emergency fund (3–6 months of expenses)

- Max retirement accounts (Roth IRA, then 401(k))

- Invest for other goals (taxable accounts, real estate, education)

Saving creates stability; investing creates growth. Doing one without the other leads to either unnecessary risk or lost purchasing power.

How long does it take to become financially stable?

The timeline depends on income, debt, and starting point, but most people follow a predictable progression:

Phase 1: Foundation (6–12 months)

- Build a $1,000 emergency fund

- Create a working budget

- Stop accumulating new debt

Phase 2: Debt Freedom (12–36 months)

- Eliminate high-interest debt

- Build a full emergency fund

- Begin consistent retirement contributions

Phase 3: Wealth Building (3–10 years)

- Max retirement accounts

- Build taxable investments

- Increase net worth steadily

Phase 4: Financial Independence (10–30 years)

- Investment income covers expenses

- Work becomes optional

- Wealth compounds exponentially

Many people reach basic financial stability within 2–3 years of disciplined action. Long-term independence requires consistency over time. Starting sooner dramatically shortens the timeline.