Personal loans are fixed-term installment loans that provide a lump sum of borrowed money, repaid through scheduled monthly payments with predetermined interest rates and timelines. Unlike credit cards or lines of credit, personal loans provide the full amount upfront and follow a structured repayment plan that typically ranges from 12 to 84 months.

Understanding the math behind money means recognizing that personal loans represent a specific financial tool with measurable costs, predictable outcomes, and quantifiable impacts on wealth building. The decision to borrow isn’t inherently good or bad—it depends entirely on the numbers, the purpose, and the borrower’s capacity to repay without disrupting long-term financial stability.

This guide breaks down exactly how personal loans function, what they cost, when they make mathematical sense, and when they create unnecessary financial friction. The goal is simple: equip readers with data-driven insights to evaluate borrowing decisions with the same analytical rigor applied to investing fundamentals.

Key Takeaways

- Personal loans provide lump-sum funding with fixed monthly payments, making costs predictable and budgeting straightforward.

- Interest rates vary significantly based on credit scores, ranging from 6% to 36% APR, directly affecting total borrowing costs.

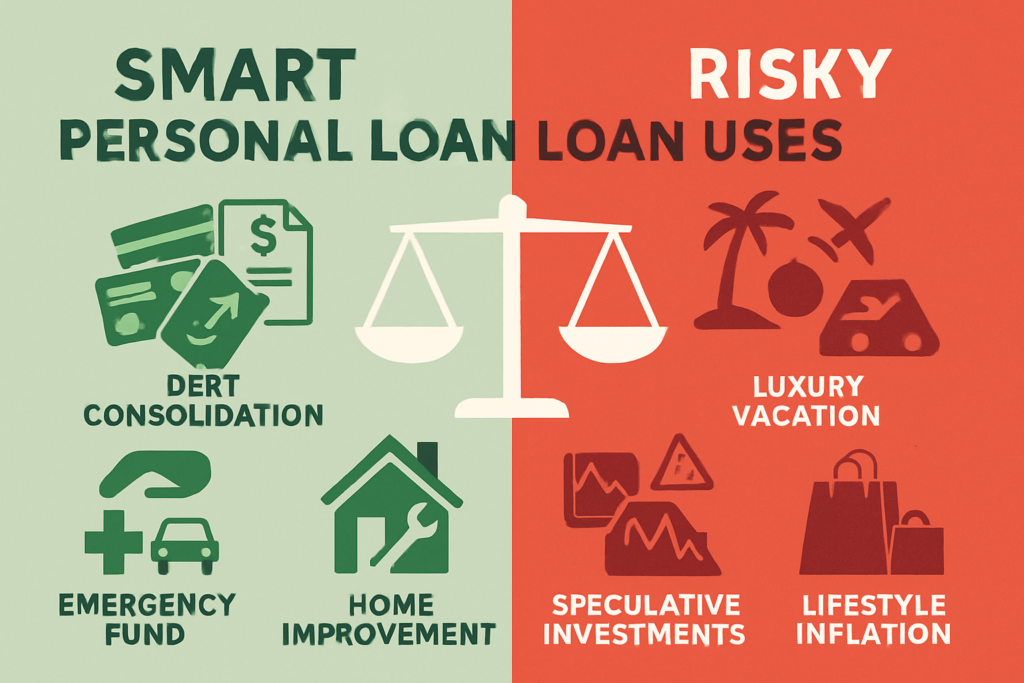

- Smart uses include debt consolidation at lower rates, emergency expenses, and necessary purchases—not lifestyle inflation or speculative ventures.

- Personal loans impact credit scores through hard inquiries, payment history, and credit mix, with both short-term and long-term effects.

- Strategic borrowing requires calculating total interest costs, comparing alternatives, and maintaining an exit plan before signing any loan agreement.

What Are Personal Loans?

A personal loan is a contract between a borrower and a lender, where the borrower receives a specific amount of money upfront and agrees to repay it over a defined period, along with interest.

The structure is simple: borrow $10,000, repay it over 36 months at 10% APR, and the total cost becomes $11,616—meaning $1,616 in interest paid for access to that capital[2].

Lump-Sum Borrowing

Unlike revolving credit, personal loans deliver the entire loan amount in a single disbursement. This creates immediate liquidity but also immediate obligation. The clock starts on day one, regardless of how quickly the borrower uses the funds.

Example: A $15,000 personal loan deposits $15,000 into the borrower’s account (minus any origination fees). The repayment schedule begins within 30 days, and the total amount owed is locked in from the start.

Fixed Payments and Timelines

Most personal loans use fixed interest rates and fixed payment amounts. This means:

- The monthly payment remains constant throughout the loan term

- Interest rate doesn’t fluctuate with market conditions

- The payoff date is predetermined at loan origination

This predictability allows for precise budgeting and eliminates the uncertainty common with variable-rate products.

The math: A $20,000 loan at 8% APR for 48 months equals a $488.26 monthly payment. That number doesn’t change unless the borrower refinances or pays extra toward principal.

Unsecured vs Secured Distinction

Unsecured personal loans don’t require collateral. The lender extends credit based on creditworthiness, income verification, and debt-to-income ratios. Because there’s no asset backing the loan, interest rates are typically higher to compensate for increased lender risk.

Secured personal loans require collateral—often a vehicle, savings account, or other valuable asset. If the borrower defaults, the lender can seize the collateral to recover losses. This reduces lender risk and often results in lower interest rates.

Risk transfer: Unsecured loans place risk on the lender; secured loans transfer risk to the borrower’s assets.

Related: Learn more about how personal loans work and explore personal finance fundamentals for a broader context.

How Personal Loans Work Step by Step

Understanding the personal loan process removes mystery and reveals exactly where costs, risks, and opportunities exist.

Step 1: Application

Borrowers submit an application that includes:

- Personal information: Name, address, Social Security number

- Income verification: Pay stubs, tax returns, bank statements

- Employment details: Current employer, length of employment

- Loan purpose: Stated reason for borrowing (some lenders require this)

Most applications take 15-30 minutes to complete online. Some lenders offer instant pre-qualification with soft credit checks that don’t impact credit scores.

Step 2: Credit Check and Underwriting

Lenders evaluate creditworthiness using:

- Credit score: FICO scores typically range from 300-850, with higher scores qualifying for lower rates

- Credit report: Payment history, credit utilization, account age, derogatory marks

- Debt-to-income ratio (DTI): Monthly debt payments divided by gross monthly income

- Income stability: Consistent employment and verifiable income streams

The underwriting formula: Lenders assess the probability of repayment using statistical models. A borrower with a 780 credit score, 20% DTI, and five years of stable employment presents lower risk than a borrower with a 620 score, 45% DTI, and six months at their current job.

This risk assessment directly determines:

- Approval or denial

- Interest rate offered

- Maximum loan amount

- Loan term options

Step 3: Approval and Loan Terms

Once approved, borrowers receive a loan offer specifying:

- Loan amount: Total funds to be disbursed

- Interest rate (APR): Annual percentage rate including interest and fees

- Loan term: Repayment period in months

- Monthly payment: Fixed amount due each month

- Total interest cost: Sum of all interest paid over the loan life

- Fees: Origination fees, prepayment penalties, late fees

Critical decision point: This is when borrowers must calculate whether the total cost justifies the borrowing need. A 24% APR on a $5,000 loan for 36 months costs $2,023 in interest—a 40% premium on the borrowed amount.

Step 4: Funding

After accepting the loan terms, funds typically arrive within 1-7 business days via:

- Direct deposit to the borrower’s bank account

- Check mailed to the borrower’s address

- Direct payment to creditors (common in debt consolidation loans)

Some online lenders offer same-day or next-day funding for approved applicants.

Step 5: Repayment Structure

Personal loans follow an amortization schedule where each payment includes:

- Principal portion: Reduces the outstanding loan balance

- Interest portion: Compensates the lender for extending credit

Early payments are interest-heavy; later payments apply more toward principal. This front-loaded interest structure means borrowers pay the most interest in the first months of the loan.

Amortization example: On a $10,000 loan at 12% APR for 36 months:

- Month 1 payment: $100 interest, $232.14 principal

- Month 18 payment: $52.50 interest, $279.64 principal

- Month 36 payment: $3.29 interest, $328.85 principal

Understanding this structure reveals why early repayment or extra principal payments generate significant interest savings.

Related: Use a personal loan calculator to model different scenarios.

Personal Loan Interest Rates and Fees Explained

The true cost of a personal loan extends beyond the advertised interest rate. Total expense includes interest, origination fees, and potential penalties.

APR vs Interest Rate

Interest rate represents the annual cost of borrowing expressed as a percentage of the principal.

Annual Percentage Rate (APR) includes the interest rate plus additional fees (primarily origination fees) expressed as an annualized cost.

Example:

- Loan amount: $10,000

- Interest rate: 10%

- Origination fee: 5% ($500)

- Actual amount received: $9,500

- APR: 11.62%

The APR provides a more accurate cost comparison between lenders because it captures fees that reduce the effective loan proceeds.

The math behind APR: A borrower pays interest on $10,000 but only receives $9,500 in usable funds. This increases the effective cost of borrowing beyond the stated interest rate.

Origination Fees

Origination fees typically range from 1% to 8% of the loan amount and cover the administrative costs of processing the loan[3].

Fee structure:

- Deducted from the loan proceeds at funding

- Included in the APR calculation

- Non-refundable, even if the loan is paid off early

Cost impact: A 5% origination fee on a $20,000 loan equals $1,000—money the borrower pays but never receives.

Negotiation opportunity: Some lenders waive or reduce origination fees for borrowers with excellent credit or existing customer relationships.

Late Payment Fees

Late fees typically range from $25 to $50 per occurrence or a percentage of the missed payment (usually 5%).

Compounding consequences:

- An immediate fee is charged to the account

- Potential credit score damage if payment is 30+ days late

- Possible default interest rate trigger (higher APR)

Prevention: Automated payments eliminate late fee risk.

Prepayment Penalties

Some lenders charge fees for paying off a personal loan early, compensating for lost interest income.

Penalty structures:

- Percentage of remaining balance: 2-5% of outstanding principal

- Fixed fee: Flat dollar amount regardless of payoff timing

- Declining penalty: Decreases over time (e.g., 5% in year one, 3% in year two, 0% in year three)

Strategic consideration: Prepayment penalties can eliminate the financial benefit of early payoff. A borrower who pays off a $15,000 loan one year early might save $800 in interest but pay a $750 prepayment penalty—net benefit of only $50.

Avoidance: Many lenders, particularly online lenders, don’t charge prepayment penalties. This should be a non-negotiable criterion when comparing loan offers.

Rate Determinants

Personal loan interest rates vary based on:

| Factor | Impact on Rate | Typical Range |

|---|---|---|

| Excellent credit (720+) | Lowest rates | 6-10% APR |

| Good credit (690-719) | Moderate rates | 10-15% APR |

| Fair credit (630-689) | Higher rates | 15-25% APR |

| Poor credit (below 630) | Highest rates | 25-36% APR |

| Secured vs unsecured | 2-5% difference | Varies |

| Loan term length | Longer = higher rate | Varies |

Data point: According to the Federal Reserve, the average personal loan interest rate in 2025 is approximately 12.17% for 24-month loans at commercial banks[4].

The Consumer Financial Protection Bureau provides detailed guidance on understanding loan costs and comparing offers.

Insight: The difference between a 10% and 20% APR on a $15,000 five-year loan is $4,242 in total interest—nearly 30% of the original loan amount. Rate shopping isn’t optional; it’s mathematically essential.

Common Uses for Personal Loans

Personal loans serve as neutral financial tools. Value depends entirely on the purpose, the cost, and the borrower’s repayment capacity.

Smart Uses

1. Debt Consolidation

Combining multiple high-interest debts into a single personal loan at a lower rate reduces total interest costs and simplifies repayment.

The math:

- Before: Three credit cards with balances of $5,000, $3,000, and $2,000 at 22% APR

- Combined minimum payments: $350/month

- Total interest over 5 years: $11,000+

After consolidation:

- Personal loan: $10,000 at 10% APR for 5 years

- Monthly payment: $212.47

- Total interest: $2,748

Net savings: $8,252 in interest plus simplified cash flow management.

Critical requirement: The borrower must stop accumulating new credit card debt. Consolidation only works if spending behavior changes.

Related: Compare options with a Debt Consolidation Loan.

2. Emergency Expenses

Unexpected medical bills, urgent home repairs, or emergency vehicle replacement often require immediate funding that exceeds available savings.

When it makes sense:

- The emergency fund is depleted or nonexistent

- Cost of delay exceeds borrowing cost (e.g., home flooding requires immediate repair)

- Alternative funding sources (family loans, 0% credit cards) aren’t available

When it doesn’t:

- The “emergency” is discretionary (vacation, entertainment)

- The borrower has adequate savings but wants to preserve liquidity

- Credit card 0% introductory offers provide cheaper short-term funding

3. Necessary Large Purchases

High-value purchases with clear utility and long useful lives can justify personal loan financing when:

- Purchase generates value exceeding borrowing cost

- Payment fits comfortably within the monthly budget

- Alternatives are more expensive (e.g., rent-to-own, payday loans)

Examples:

- Medical procedures not covered by insurance

- Professional certification or licensing costs that increase earning potential

- Essential home accessibility modifications

Non-examples:

- Electronics with rapid depreciation

- Furniture and home décor

- Elective cosmetic procedures

Risky Uses

1. Lifestyle Inflation

Borrowing to fund consumption that exceeds income creates a debt spiral where borrowed money finances current living expenses, requiring future borrowing to maintain the same lifestyle.

The cycle:

- Borrow $10,000 for vacation, wedding, or luxury purchases

- A monthly payment of $300 reduces discretionary income

- Reduced discretionary income creates future cash shortfalls

- Future shortfalls require additional borrowing

Result: Perpetual debt servicing with no wealth accumulation.

Alternative: Delay gratification, save in advance, and pay cash. A $10,000 vacation costs $10,000 in savings but $12,500+ when financed at typical personal loan rates.

2. Speculative Investing

Using borrowed money to invest in stocks, cryptocurrency, or other volatile assets introduces leverage risk where losses exceed the initial investment.

The math problem:

- Borrow $20,000 at 12% APR

- Invest in a speculative asset

- Asset declines 30% to $14,000

- Borrower still owes $20,000 plus interest

Loss: $6,000 in asset value plus $4,000+ in interest equals $10,000+ total loss—50% of the original borrowed amount.

Compounding risk: Investment losses don’t eliminate loan obligations. The borrower must repay the full amount regardless of investment performance.

Exception: This differs from strategic leverage in real estate or business, where cash flow from the asset services the debt. Personal consumption assets don’t generate income.

3. Ongoing Cash Flow Gaps

Using personal loans to cover recurring expenses (rent, groceries, utilities) signals fundamental income-expense misalignment that borrowing can’t solve.

Warning signs:

- Monthly expenses consistently exceed monthly income

- Previous loans were used for similar purposes

- No plan to increase income or reduce expenses

Outcome: Each loan temporarily patches the gap while adding new monthly obligations, accelerating the path to insolvency.

Solution: Address the root cause through income increase, expense reduction, or both—not additional borrowing.

Insight: Smart personal loan use involves borrowing for defined purposes with clear endpoints and measurable benefits. Risky use involves borrowing to sustain unsustainable spending patterns or to speculate on uncertain outcomes.

Personal Loans vs Other Borrowing Options

Personal loans exist within a broader borrowing ecosystem. Choosing the optimal tool requires comparing costs, terms, and strategic fit.

Personal Loans vs Credit Cards

| Factor | Personal Loans | Credit Cards |

|---|---|---|

| Interest rate | Fixed, typically 6-36% APR | Variable, typically 16-29% APR |

| Payment structure | Fixed monthly payment | Minimum payment (usually 2-3% of balance) |

| Borrowing limit | Fixed lump sum | Revolving credit line |

| Payoff timeline | Predetermined (12-84 months) | Open-ended |

| Impact on credit utilization | Installment loan (different scoring) | Revolving credit (high utilization hurts scores) |

When personal loans win:

- Large, one-time expense with a multi-year repayment need

- Lower interest rate than available credit card rates

- Desire for fixed payment and guaranteed payoff date

- Debt consolidation of high-interest credit card balances

When credit cards win:

- Short-term borrowing need (under 12 months)

- Access to 0% introductory APR offers

- Ongoing, variable expenses

- Rewards programs offset borrowing costs

Example scenario: A $8,000 home repair financed over 36 months:

- Personal loan at 11% APR: $262.23/month, $1,440 total interest

- Credit card at 22% APR (minimum payments): $160/month initially, $7,200+ total interest, 15+ years to pay off

The math: The personal loan costs $1,440 in interest and guarantees a payoff in three years. The credit card costs 5x more in interest and extends repayment indefinitely.

Related: Full comparison of personal loans vs credit cards.

Personal Loans vs Home Equity Loans

| Factor | Personal Loans | Home Equity Loans |

|---|---|---|

| Collateral | Usually unsecured | Home serves as collateral |

| Interest rate | Higher (6-36% APR) | Lower (6-12% APR typically) |

| Loan amount | Typically $1,000-$50,000 | Up to 80-90% of home equity |

| Approval speed | 1-7 days | 2-6 weeks |

| Tax deductibility | No | Possibly, if used for home improvements |

| Risk | Credit score damage if default | Foreclosure if default |

When personal loans win:

- Borrower doesn’t own a home

- Small loan amount (under $15,000)

- Need for quick funding

- Unwillingness to risk the home as collateral

When home equity wins:

- Large loan amount needed (over $25,000)

- Borrower has significant home equity

- Lower interest rate justifies a longer approval process

- Tax deduction applies (consult a tax professional)

Risk consideration: Home equity loans offer lower rates, but convert unsecured debt into secured debt. Defaulting on a personal loan damages credit; defaulting on a home equity loan results in foreclosure.

Strategic principle: Never convert unsecured debt to secured debt unless the interest savings significantly exceed the increased risk and the borrower has high confidence in repayment capacity.

Related: Detailed analysis of personal loans vs HELOC.

How Personal Loans Affect Your Credit

Personal loans impact credit scores through multiple mechanisms, creating both short-term decreases and potential long-term improvements.

Hard Inquiries

When a lender checks credit to evaluate a loan application, it generates a hard inquiry that:

- Reduces credit score by 5-10 points temporarily

- Remains on the credit report for two years

- Impact score for approximately 12 months

Multiple inquiries: Rate shopping within a 14-45 day window typically counts as a single inquiry for scoring purposes, allowing borrowers to compare offers without excessive score damage[5].

Recovery: Hard inquiry impact diminishes over time. Scores typically recover within 3-6 months if other credit behaviors remain positive.

Payment History (35% of FICO Score)

Payment history represents the largest component of credit scores. Personal loan payments create a track record that either builds or damages credit.

Positive impact:

- On-time payments strengthen payment history

- A consistent payment pattern demonstrates reliability

- Account aging contributes to credit history length

Negative impact:

- Late payments (30+ days) can decrease scores by 60-110 points

- Default or charge-off severely damages credit for seven years

- Collections compound credit damage and add additional negative marks

The compounding effect: A single 30-day late payment can reduce a 780 credit score to 670-720, increasing future borrowing costs by thousands of dollars.

Credit Mix (10% of FICO Score)

Credit scoring models favor diverse credit types. Adding an installment loan (personal loan) to a credit profile dominated by revolving credit (credit cards) can modestly improve scores.

Diversification benefit: Borrowers with only credit cards may see a 5-15 point score increase from adding a personal loan, demonstrating the ability to manage different credit types.

Caveat: This benefit only materializes with on-time payments. A poorly managed installment loan causes more damage than the credit mix benefit provides.

Credit Utilization Impact

Personal loans don’t directly affect credit utilization (which only applies to revolving credit), but using a personal loan to pay off credit cards can dramatically improve utilization ratios.

Example:

- Before: $8,000 credit card balance on $10,000 limit = 80% utilization

- After: $8,000 personal loan pays off cards, $0 credit card balance = 0% utilization

Result: Credit scores can increase 30-50+ points from utilization improvement alone, even with the new personal loan on the credit report.

New Account Impact

Opening a personal loan account:

- Decreases average account age (negative short-term impact)

- Adds to total accounts (neutral to slightly positive)

- Creates new payment obligation (neutral if managed well)

Timeline: The average account age impact diminishes as the account ages and other accounts continue to mature.

Long-term benefit: A personal loan paid in full creates a positive closed account that remains on the credit report for 10 years, contributing to credit history length and demonstrating successful debt management.

Insight: Personal loans can improve credit scores over time through consistent on-time payments, credit mix diversification, and utilization improvement (when used for debt consolidation). Short-term score decreases from hard inquiries and new account opening typically reverse within 6-12 months.

When You Should Avoid Personal Loans

Strategic borrowing requires knowing when to decline credit, even when approved.

High-Interest Environments

When personal loan rates exceed the expected return on alternative uses of capital or the cost of alternative funding sources, borrowing creates negative value.

Decision framework:

- Personal loan APR: 18%

- Credit card 0% introductory offer: 15 months interest-free

- Savings account depletion alternative: Opportunity cost of 4.5% high-yield savings rate

Analysis: The credit card offers superior terms for short-term needs. Depleting savings costs 4.5% in lost interest, far less than the 18% borrowing cost.

Threshold principle: Borrowing at rates significantly above inflation (currently 2-3%) for non-essential purposes transfers wealth from borrower to lender without creating offsetting value.

Unstable Income

Personal loans require consistent monthly payments regardless of income fluctuations. Borrowers with irregular income face disproportionate default risk.

High-risk profiles:

- Commission-based income with high variability

- Seasonal employment with multi-month gaps

- New business owners without established revenue

- Contract workers between assignments

Alternative: Build emergency reserves first, then borrow only when income stabilizes, and payment capacity becomes predictable.

Risk calculation: A $400 monthly loan payment requires confidence in $400+ monthly discretionary cash flow for the entire loan term. Income uncertainty makes this confidence misplaced.

Chronic Debt Cycles

Borrowers who repeatedly use personal loans to manage recurring cash shortfalls exhibit fundamental financial instability that additional borrowing exacerbates.

Warning pattern:

- Third or fourth personal loan in as many years

- Previous loans paid off with new loans (debt recycling)

- No increase in income or decrease in expenses between loans

- Growing total debt burden despite regular borrowing

Root cause: Expenses exceed income by a structural margin that borrowing temporarily masks but never solves.

Solution path:

- Stop borrowing to halt debt accumulation

- Audit expenses to identify reduction opportunities

- Increase income through additional work, skill development, or a career change

- Seek credit counseling for a debt management plan if overwhelmed

Reality: Borrowing doesn’t create wealth; it redistributes future income to current consumption. Chronic borrowing indicates consumption exceeding production—a mathematically unsustainable position.

Unclear Purpose or Weak Justification

Personal loans should solve specific, defined financial needs with measurable benefits. Vague purposes or weak justifications indicate poor decision-making.

Red flags:

- “I’ll figure out what to use it for.”

- “Everyone else has one.”

- “The rate seems good.”

- “I might need it later.”

Disciplined approach: Define the exact purpose, calculate total cost, evaluate alternatives, and ensure the benefit exceeds the cost before applying.

Insight: The best financial decision is often the decision not to borrow. Declining available credit demonstrates financial discipline and preserves future borrowing capacity for genuinely strategic uses.

Personal Loan Calculators and Tools

Data-driven decision-making requires accurate calculations and scenario modeling.

Loan Payment Calculator

Monthly payment calculations use the standard amortization formula:

M = P [ r(1 + r)^n ] / [ (1 + r)^n – 1 ]

Where:

- M = Monthly payment

- P = Principal loan amount

- r = Monthly interest rate (annual rate / 12)

- n = Number of payments (months)

Example calculation:

- Loan amount: $15,000

- APR: 10% (0.10 / 12 = 0.00833 monthly rate)

- Term: 48 months

M = 15,000 [ 0.00833(1 + 0.00833)^48 ] / [ (1 + 0.00833)^48 – 1 ]

M = $380.44

Total paid: $380.44 × 48 = $18,261.12

Total interest: $18,261.12 – $15,000 = $3,261.12

Related: Use the personal loan calculator to model different scenarios instantly.

Total Interest Calculator

Understanding total interest cost reveals the true expense of borrowing.

Comparison example:

| Loan Term | Monthly Payment | Total Interest |

|---|---|---|

| 24 months | $691.96 | $1,607.04 |

| 36 months | $483.32 | $2,399.52 |

| 48 months | $380.44 | $3,261.12 |

| 60 months | $318.71 | $4,122.60 |

Trade-off: Longer terms reduce monthly payments but dramatically increase total interest costs. The 60-month loan costs 2.6x more in interest than the 24-month loan.

Strategic insight: Borrowers should choose the shortest term they can afford to minimize total borrowing costs.

Early Payoff Calculator

Extra principal payments accelerate payoff and reduce total interest.

Scenario:

- Original loan: $10,000 at 12% APR, 36 months

- Standard payment: $332.14/month

- Total interest: $1,957.04

With $50 extra monthly:

- New payoff: 29 months

- Total interest: $1,558.23

- Savings: $398.81

With $100 extra monthly:

- New payoff: 25 months

- Total interest: $1,281.45

- Savings: $675.59

ROI on extra payments: Each additional dollar toward principal eliminates future interest at the loan’s APR—a guaranteed return equal to the borrowing rate.

Related: Model scenarios with the monthly payment estimator.

Insight: Calculators transform abstract borrowing decisions into concrete numbers, enabling comparison, optimization, and informed choice.

How Personal Loans Fit Into Your Bigger Financial Plan

Personal loans represent tactical tools within a broader wealth-building strategy, not standalone financial solutions.

Strategic Borrowing Framework

Effective borrowing aligns with long-term financial objectives and enhances rather than undermines wealth accumulation.

Four-question framework:

- Does this borrowing solve a specific problem?

- Yes: Emergency expense, high-interest debt consolidation

- No: Vague “extra cash” or lifestyle funding

- Does the benefit exceed the total cost?

- Yes: $10,000 loan at 8% saves $5,000 in credit card interest

- No: $5,000 loan at 20% funds a depreciating purchase

- Can I afford the monthly payment without financial strain?

- Yes: Payment is under 10% of take-home income

- No: Payment requires reducing essential expenses or accumulating other debt

- Do I have a clear exit plan?

- Yes: Defined payoff timeline, potential for early repayment

- No: Uncertain income, no plan for accelerated payoff

Pass all four: Borrowing may be strategically sound.

Fail anyone: Reconsider the decision.

Opportunity Cost Analysis

Every dollar paid in interest represents a dollar unavailable for wealth-building activities.

Example comparison:

- Option A: Borrow $10,000 at 12% for 5 years, pay $2,748 in interest

- Option B: Save $10,000 over 18 months, invest the $2,748 that would have gone to interest

Option B outcome: $2,748 invested at 8% annual return for 3.5 years (the remaining loan period) grows to $3,596—a $848 advantage over borrowing.

Compounding impact: Interest paid compounds negatively (wealth transferred to lender); interest earned compounds positively (wealth accumulated by investor).

Strategic principle: Minimize interest paid, maximize interest earned. The spread between these two rates determines wealth accumulation velocity.

Exit Plan Importance

Every personal loan should include a defined strategy for payoff, ideally faster than the standard term.

Exit plan components:

- Standard payment schedule: Baseline timeline

- Extra payment strategy: Additional principal payments when possible

- Windfall allocation: Plan for tax refunds, bonuses, or other irregular income

- Refinance trigger: Conditions that would justify refinancing to lower rates

- Payoff celebration: Defined milestone when the loan is eliminated

Psychological benefit: Exit plans transform loans from open-ended obligations into temporary tools with clear endpoints.

Financial benefit: Accelerated payoff reduces total interest and frees cash flow for wealth-building activities sooner.

🔗 Related: Understand broader context at personal finance basics.

Insight: Personal loans should serve financial goals, not define them. Strategic borrowing accelerates progress toward objectives; undisciplined borrowing creates obstacles that delay wealth building and financial independence.

💰 Personal Loan Calculator

Conclusion

Personal loans function as precise financial instruments with measurable costs, predictable timelines, and quantifiable impacts on both short-term cash flow and long-term wealth building.

The math behind money reveals that borrowing decisions aren’t moral judgments—they’re mathematical calculations. A personal loan at 8% APR that consolidates 22% credit card debt creates immediate positive value. The same loan at 24% APR funding discretionary consumption destroys value and transfers wealth from borrower to lender.

Key principles for strategic personal loan use:

- Calculate total cost, not just monthly payment — A $10,000 loan costs $10,000 plus interest; the total determines value

- Compare all alternatives — Credit cards, HELOCs, savings depletion, and delayed purchase each carry different costs

- Borrow for defined purposes with measurable benefits — Vague borrowing indicates weak decision-making

- Ensure payment fits comfortably within budget — Financial strain signals excessive leverage

- Create an exit plan before borrowing — Every loan should include a strategy for accelerated payoff

Actionable next steps:

- Use calculators to model exact costs before applying for any loan

- Check credit scores to understand likely interest rate ranges

- Compare at least three lenders to ensure competitive rates and terms

- Read loan agreements completely before signing, particularly the prepayment penalty and fee sections

- Build emergency reserves to reduce future borrowing needs

Personal loans serve those who use them strategically and burden those who use them reactively. The difference lies entirely in understanding the numbers, calculating the costs, and making evidence-based decisions aligned with long-term financial objectives.

The path to financial independence runs through minimizing interest paid and maximizing interest earned. Strategic personal loan use can accelerate progress; undisciplined use creates obstacles. The choice—and the math—belongs to the borrower.

Related Guides

References

[1] Consumer Financial Protection Bureau. “What is a personal loan?” CFPB.gov. Accessed 2025.

[2] Federal Reserve. “Consumer Credit – G.19.” FederalReserve.gov. Accessed 2025.

[3] Consumer Financial Protection Bureau. “What fees or charges are associated with a personal loan?” CFPB.gov. Accessed 2025.

[4] Federal Reserve Bank of St. Louis. “Commercial Bank Interest Rate on Personal Loan, 24 Month Loan.” FRED Economic Data. Accessed 2025.

[5] myFICO. “Credit Checks: What are credit inquiries and how do they affect your FICO Score?” myFICO.com. Accessed 2025.

Educational Disclaimer

This content is provided for educational and informational purposes only and does not constitute financial, lending, legal, or professional advice. Personal loan decisions involve individual circumstances, risk tolerance, and financial objectives that require personalized evaluation.

Interest rates, loan terms, and lending requirements vary by lender, borrower creditworthiness, and market conditions. The examples, calculations, and scenarios presented represent illustrative purposes and may not reflect actual loan offers or outcomes.

Before applying for any personal loan, readers should:

- Conduct thorough research on multiple lenders

- Compare total costs, including interest and fees

- Review complete loan agreements and disclosures

- Assess personal repayment capacity and budget impact

- Consider consulting with qualified financial advisors

The Rich Guy Math and its contributors assume no responsibility for financial decisions made based on this content. Borrowing decisions carry financial risk and should be made with a complete understanding of terms, costs, and obligations.

About the Author

Max Fonji is the founder of TheRichGuyMath.com, a financial education platform dedicated to explaining the math behind money through data-driven analysis and evidence-based insights.

With expertise in consumer debt strategy, investment fundamentals, and financial literacy education, Max translates complex financial concepts into clear, actionable guidance for beginners and intermediate learners.

His approach combines analytical precision with educational clarity, helping readers understand not just what to do with money, but why specific strategies work through numbers, logic, and cause-and-effect relationships.

Max’s work focuses on empowering financial learners to make informed decisions based on mathematical reality rather than marketing hype, building genuine wealth through compound growth, risk management, and disciplined capital allocation.

Connect with Max and explore more financial education resources at TheRichGuyMath.com.

Frequently Asked Questions

Is it bad to take out a personal loan?

Taking out a personal loan isn’t inherently bad or good—it depends on the purpose, cost, and your ability to repay it. A personal loan used to consolidate high-interest debt at a lower rate can create positive financial value. A loan used for discretionary spending at a high interest rate can create long-term financial strain.

Before borrowing, evaluate the total cost of the loan, compare alternatives, and ensure the financial benefit exceeds the interest expense.

Can I pay off a personal loan early?

Most personal loans allow early payoff, but some lenders charge prepayment penalties—typically 2% to 5% of the remaining balance. Always review the loan agreement before signing.

If no prepayment penalty applies, paying off a personal loan early reduces total interest costs and improves monthly cash flow. Each extra dollar paid toward principal eliminates future interest at the loan’s APR.

Do personal loans require collateral?

Most personal loans are unsecured, meaning they do not require collateral. Approval is based on credit score, income, and debt-to-income ratio.

Some lenders offer secured personal loans backed by assets such as vehicles or savings accounts. Secured loans may offer lower interest rates but carry the risk of asset loss if you default. Converting unsecured debt into secured debt should only be done when interest savings clearly outweigh the added risk.

Are online lenders safe?

Reputable online lenders are generally safe and often provide competitive rates compared to traditional banks. To verify legitimacy, confirm proper state licensing, read verified customer reviews, and ensure the lender reports to major credit bureaus.

Warning signs of predatory lenders include guaranteed approval regardless of credit, upfront fees before funding, and pressure to borrow more than needed. Stick with established lenders that clearly disclose rates, fees, and repayment terms.

What credit score do I need for a personal loan?

Credit score requirements vary by lender, but typical ranges include:

- Excellent credit (720+): Best rates, usually 6%–10% APR

- Good credit (690–719): Moderate rates, typically 10%–15% APR

- Fair credit (630–689): Higher rates, often 15%–25% APR

- Poor credit (below 630): Highest rates, 25%–36% APR or denial

Improving your credit score before applying—by paying bills on time, lowering credit utilization, and correcting report errors—can save thousands of dollars in interest over the life of a personal loan.