What Is an Investment Portfolio?

An investment portfolio is a collection of financial assets, including stocks, bonds, mutual funds, real estate, and other securities. It reflects your approach to growing wealth, managing risk, and achieving your long-term goals. A smart portfolio isn’t just about what you invest in—it’s about why and how.

Why Your Portfolio Matters More Than You Think

Your portfolio is your financial engine. Done right, it provides:

- Wealth growth through compounding

- Income streams via dividends and interest

- Diversification, which protects against market swings

- Alignment with short- and long-term goals (retirement, buying a home, etc.)

The structure and balance of your portfolio determine how resilient and profitable it will be over time.

Steps to Build a Winning Investment Portfolio

1. Define Your Financial Goals

Start with the why. Are you saving for retirement, a house, or early financial independence? Your timeline and goals will shape your entire portfolio strategy.

2. Know Your Risk Tolerance

Be honest: Can you handle watching your investments drop 20% during a market crash? Use tools like a risk tolerance questionnaire to find your comfort level.

- Aggressive: 80–100% in stocks

- Moderate: 60% stocks / 40% bonds

- Conservative: 40% stocks / 60% bonds

3. Choose a Diversified Asset Mix

Don’t put all your eggs in one basket. A well-diversified portfolio includes:

- Stocks (U.S., international, large/small-cap)

- Bonds (government, corporate, municipal)

- Real estate (REITs)

- Cash equivalents (savings, CDs, money market funds)

4. Use Low-Cost Investment Options

High fees eat into your returns. Choose:

- Index funds

- ETFs (Exchange-Traded Funds)

- No-load mutual funds

These options offer broad exposure at a fraction of the cost.

5. Rebalance Your Portfolio Regularly

As markets shift, your asset mix drifts. Set a schedule (quarterly or yearly) to bring your portfolio back to its target allocation.

6. Monitor and Adjust for Life Changes

Life evolves—so should your portfolio. Update your investment strategy after:

- Career shifts

- Marriage or children

- Buying a home

- Approaching retirement

Common Mistakes to Avoid in Portfolio Building

- Chasing performance (e.g., buying last year’s top fund)

- Neglecting diversification

- Ignoring fees

- Failing to rebalance

- Making emotional decisions during market swings

Avoiding these can save you thousands—and keep your portfolio on track.

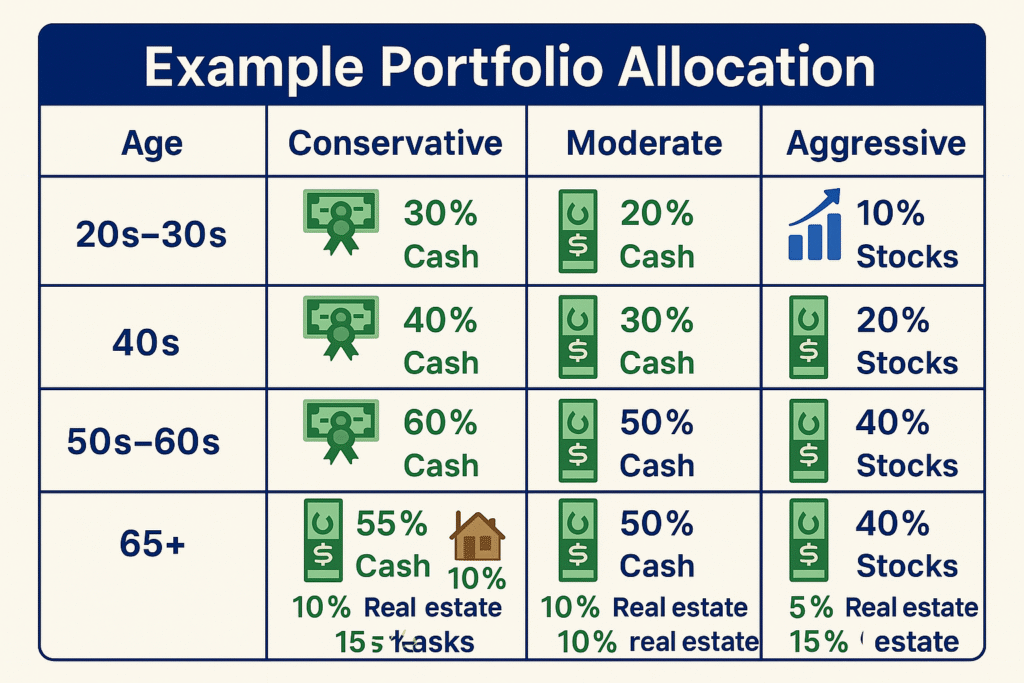

Sample Portfolio Allocations by Age & Risk Profile

| Age Range | Conservative | Moderate | Aggressive |

|---|---|---|---|

| 20s–30s | 30% Bonds / 70% Stocks | 20% Bonds / 80% Stocks | 10% Bonds / 90% Stocks |

| 40s | 40% Bonds / 60% Stocks | 30% Bonds / 70% Stocks | 20% Bonds / 80% Stocks |

| 50s–60s | 60% Bonds / 40% Stocks | 50% Bonds / 50% Stocks | 40% Bonds / 60% Stocks |

| 65+ | 70% Bonds / 30% Stocks | 60% Bonds / 40% Stocks | 50% Bonds / 50% Stocks |

FAQs About Building an Investment Portfolio

You can start with as little as $100 using ETFs or robo-advisors like Betterment or Wealthfront.

If you’re comfortable with research and rebalancing, yes. Otherwise, a robo-advisor or fee-only financial planner can help.

A simple 60/40 (stocks/bonds) or a Target Date Fund is a great starting point.

Typically, this occurs every 6–12 months, or whenever your allocation deviates by more than 5–10%.

Final Thoughts on Creating a Strong Portfolio

A strong portfolio is not a one-size-fits-all solution. It evolves with your life and financial goals. By staying diversified, keeping costs low, and reviewing regularly, you set yourself up for consistent growth and peace of mind. Start small, think long-term, and let your money work for you.