Imagine planting a single seed that grows into a tree, which then drops more seeds, which grow into more trees, and before you know it, you have an entire forest. That’s the magic of compound interest, the financial phenomenon that transforms modest savings into substantial wealth over time. While most people understand that saving money is important, few truly grasp how compound interest can turn even small, consistent contributions into life-changing amounts.

In simple terms, compound interest means earning interest on your interest. Unlike simple interest, which only calculates returns on your original investment, compound interest allows your money to grow exponentially by reinvesting the earnings back into your principal. This snowball effect is what legendary investor Warren Buffett calls “the eighth wonder of the world,” and understanding it is absolutely crucial for anyone serious about building wealth. Investor.gov

Whether you’re just starting your financial journey or looking to optimize your investment strategy, mastering compound interest will fundamentally change how you think about money, time, and financial freedom.

TL;DR Summary (Key Takeaways)

- Compound interest is interest calculated on both the initial principal and the accumulated interest from previous periods, creating exponential growth over time

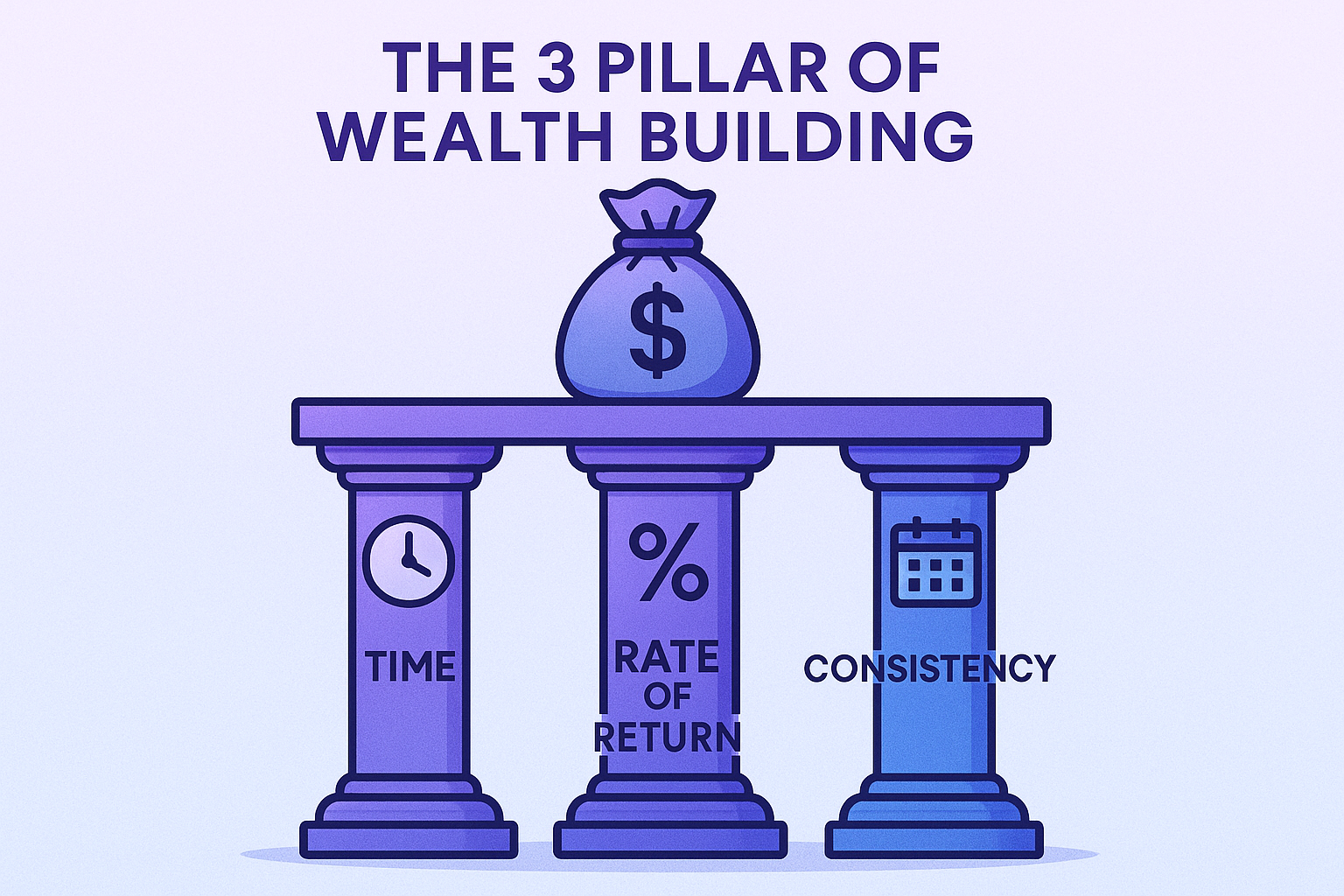

- The three key factors that maximize compound interest are: time (start early), rate of return (invest wisely), and consistency (contribute regularly)

- Starting to invest just 10 years earlier can result in 2-3 times more wealth at retirement, even with the same monthly contributions

- Compound interest works both for you (in investments) and against you (in debt), making it essential to invest early and pay off high-interest debt quickly

- Even modest monthly investments of $200-$500 can grow to $500,000-$1,000,000+ over 30-40 years with consistent compound growth

What Is Compound Interest? The Definition That Changes Everything

Compound interest is the interest you earn on both your original investment (the principal) and on the interest that investment has already generated. In other words, it’s “interest on interest,” and it causes your wealth to grow at an accelerating rate rather than a steady, linear pace.

Here’s the fundamental difference:

- Simple Interest: You earn returns only on your initial investment

- Compound Interest: You earn returns on your initial investment PLUS all the accumulated interest

The Compound Interest Formula

The mathematical formula for compound interest is:

A = P(1 + r/n)^(nt)

Where:

- A = Final amount

- P = Principal (initial investment)

- r = Annual interest rate (as a decimal)

- n = Number of times interest is compounded per year

- t = Number of years

While this formula might look intimidating, the concept is beautifully simple: your money grows faster and faster as time passes because you’re earning returns on an ever-increasing base amount. Investopedia

How Compound Interest Actually Works: A Real-World Example

Let’s bring this concept to life with a concrete example that shows the dramatic difference compound interest makes.

Scenario: You invest $10,000 and earn 8% annual returns.

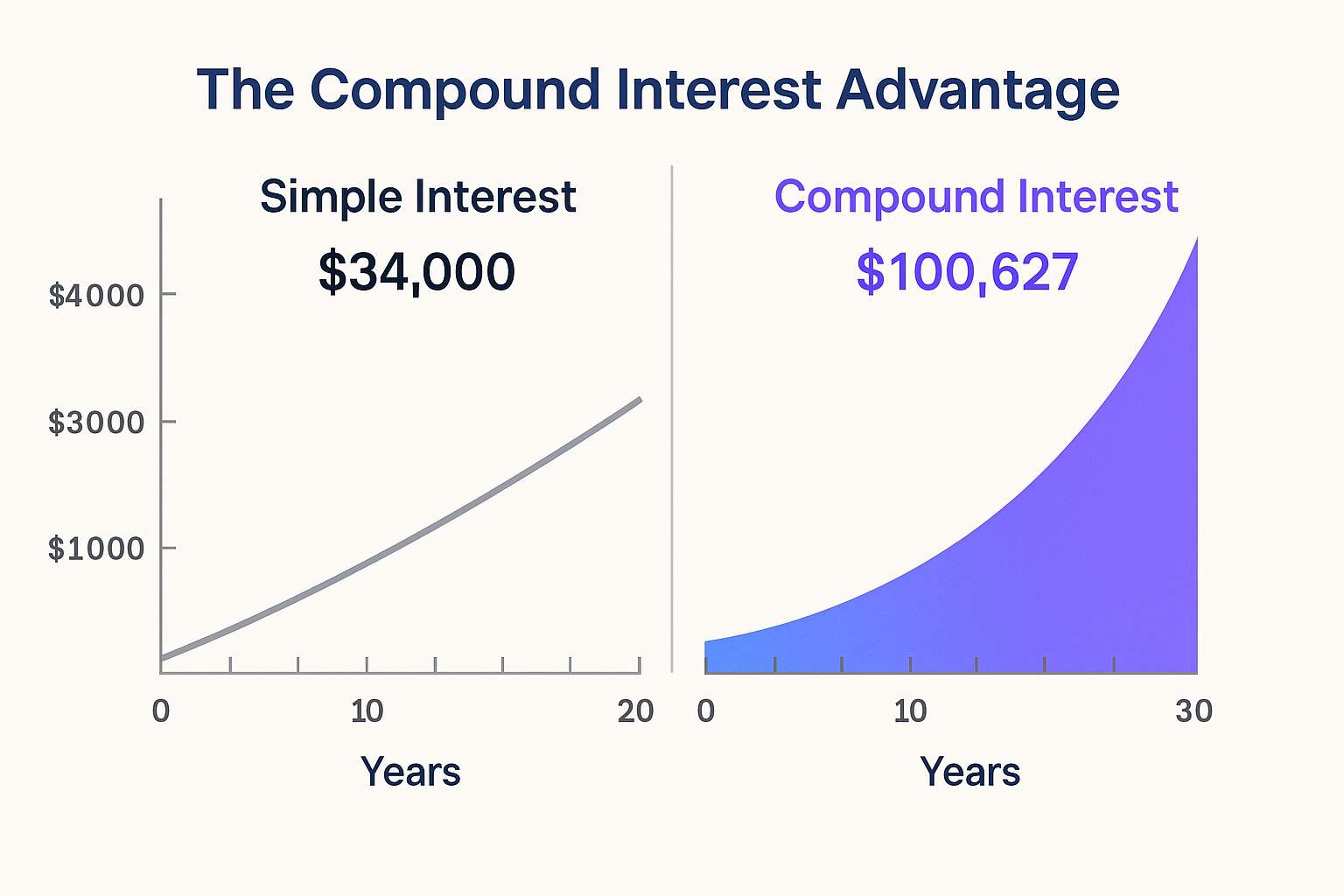

Simple Interest vs Compound Interest Over 30 Years

| Year | Simple Interest Balance | Compound Interest Balance | Difference |

|---|---|---|---|

| 1 | $10,800 | $10,800 | $0 |

| 5 | $14,000 | $14,693 | $693 |

| 10 | $18,000 | $21,589 | $3,589 |

| 20 | $26,000 | $46,610 | $20,610 |

| 30 | $34,000 | $100,627 | $66,627 |

The Result: With simple interest, your $10,000 grows to $34,000 after 30 years. With compound interest, it grows to over $100,000, nearly three times more, without you adding a single extra dollar.

This example illustrates why Albert Einstein allegedly called compound interest “the most powerful force in the universe.” The longer your money compounds, the more dramatic the growth becomes.

The Three Pillars of Compound Interest Growth

Understanding what drives compound interest helps you maximize its power in your financial life. Three critical factors determine how much wealth you’ll accumulate:

1. Time: Your Most Valuable Asset

Time is the most powerful variable in the compound interest equation. The earlier you start investing, the more time your money has to compound and grow exponentially.

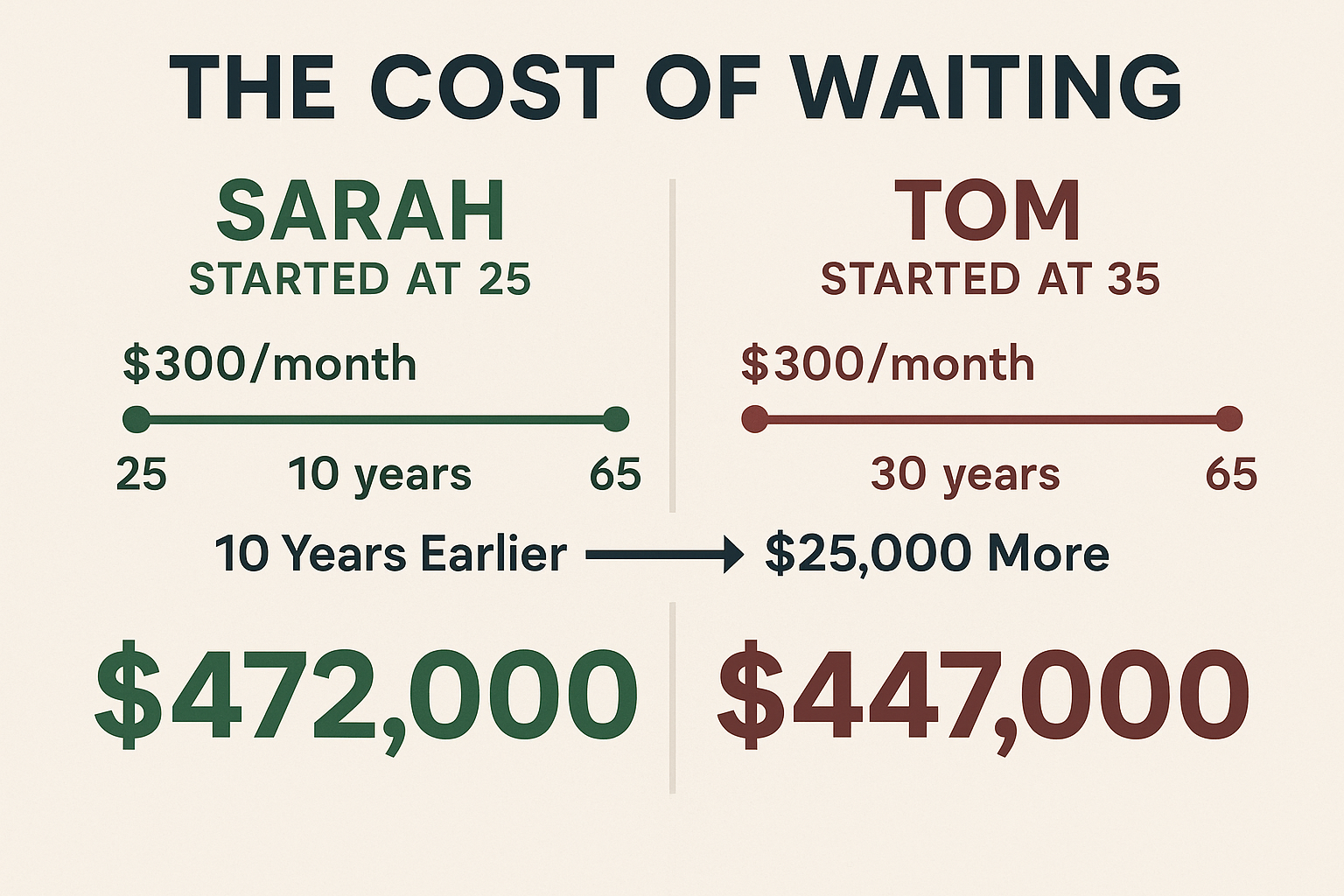

Real-World Story: Meet Sarah and Tom.

- Sarah starts investing $300 per month at age 25 and stops at age 35 (total contributions: $36,000)

- Tom starts investing $300 per month at age 35 and continues until age 65 (total contributions: $108,000)

Assuming both earn 8% annual returns:

- Sarah’s account at 65: $472,000

- Tom’s account at 65: $447,000

Even though Tom contributed three times more money, Sarah ends up with more wealth because she started 10 years earlier. Those extra years of compounding made all the difference.

2. Rate of Return: The Growth Accelerator

The interest rate or investment return you earn significantly impacts your final wealth. Even small differences in returns compound to massive differences over time.

Comparison: $10,000 invested for 30 years at different rates:

- 4% return: $32,434

- 7% return: $76,123

- 10% return: $174,494

A 6% difference in returns (4% vs. 10%) results in over $142,000 more wealth—that’s more than 5 times the difference!

This is why choosing the right investments matters. Understanding the stock market and investing in assets with historically strong returns can dramatically accelerate your wealth-building journey.

3. Consistency: The Compound Booster

Regular contributions supercharge compound interest. When you consistently add money to your investments, you’re not just saving more; you’re allowing more money to compound over time.

The Power of Monthly Contributions:

Starting with $0 and investing $500/month at 8% annual returns:

- After 10 years: $91,473

- After 20 years: $294,510

- After 30 years: $745,180

- After 40 years: $1,745,503

Your total contributions over 40 years would be just $240,000, but compound interest adds over $1.5 million in growth!

Compound Interest in Action: Where You’ll Encounter It

Compound interest isn’t just a theoretical concept; it’s working for (or against) you right now in multiple areas of your financial life.

Savings Accounts and CDs

Most savings accounts and certificates of deposit (CDs) use compound interest, though the rates are typically quite low (1-5% as of 2025). While these won’t make you wealthy, they’re safe places to store emergency funds while earning modest returns.

Compounding Frequency Matters: Banks may compound interest daily, monthly, or quarterly. More frequent compounding means slightly higher returns.

Investment Accounts (Stocks, Bonds, Mutual Funds)

This is where compound interest truly shines. When you invest in the stock market, your returns come from two sources:

- Capital appreciation (stock price increases)

- Dividends (company profit distributions)

When you reinvest dividends instead of taking them as cash, you’re harnessing compound interest. Those reinvested dividends buy more shares, which generate more dividends, which buy even more shares, creating a powerful wealth-building cycle.

Starting to earn passive income through dividend investing is one of the most effective ways to leverage compound interest for long-term wealth.

Real Estate Investments

Real estate compounds wealth through:

- Appreciation (property value increases)

- Rental income (when reinvested into more properties or improvements)

- Equity buildup (as you pay down mortgages)

Credit Card Debt (Compound Interest Working Against You)

Here’s the dark side: compound interest on debt works the same way, except it’s destroying your wealth instead of building it.

Credit cards typically compound interest daily at rates of 18-29%. If you carry a $5,000 balance at 22% APR and only make minimum payments, you could end up paying over $10,000 total—more than double what you borrowed.

Critical Action: Always prioritize paying off high-interest debt before investing. The “negative compound interest” on debt will outpace almost any investment return you could earn.

The Rule of 72: A Quick Compound Interest Shortcut

Want to quickly estimate how long it will take your money to double? Use the Rule of 72.

Formula: 72 ÷ Interest Rate = Years to Double

Examples:

- At 6% return: 72 ÷ 6 = 12 years to double

- At 8% return: 72 ÷ 8 = 9 years to double

- At 10% return: 72 ÷ 10 = 7.2 years to double

This simple mental math tool helps you quickly understand the power of different investment returns without complex calculations.

Maximizing Compound Interest: Strategies That Work

Now that you understand how compound interest works, here are actionable strategies to harness its full power:

Start Immediately (Even with Small Amounts)

Don’t wait until you have a “significant” amount to invest. Starting with just $50-100 per month in your 20s will outperform starting with $500 per month in your 40s.

Action Step: Open an investment account today, even if you can only contribute a small amount. The sooner you start, the more time compounds in your favor.

Automate Your Investments

Set up automatic monthly transfers from your checking account to your investment accounts. This ensures consistency, one of the three critical pillars of compound growth.

Automation also removes emotion from investing, helping you stay consistent even during market downturns. Understanding the cycle of market emotions can help you avoid the psychological pitfalls that derail many investors.

Reinvest All Dividends and Returns

Never take dividends as cash unless you need the income. Always choose the “reinvest dividends” option in your investment accounts. This ensures every dollar continues compounding.

Investors interested in high dividend stocks should particularly focus on dividend reinvestment to maximize compound growth.

Increase Contributions Over Time

As your income grows, increase your investment contributions. Even small increases, adding just $50-100 more per month each year, compound into substantial differences over decades.

Minimize Fees and Taxes

High investment fees and taxes eat away at your returns, reducing the power of compounding.

- Choose low-cost index funds and ETFs (fees under 0.20%)

- Use tax-advantaged accounts (401(k), IRA, Roth IRA) to defer or eliminate taxes

- Avoid frequent trading, which generates taxable events

A 1% difference in fees might seem small, but over 30 years, it can cost you hundreds of thousands of dollars in lost compound growth.

Stay Invested for the Long Term

Compound interest requires time to work its magic. Avoid the temptation to pull money out when markets decline or when you want to make a large purchase.

Understanding why the stock market goes up over time can give you the confidence to stay invested during short-term volatility.

Compound Interest vs Simple Interest: The Critical Comparison

Let’s dive deeper into why compound interest is so much more powerful than simple interest.

Here’s a table showing how $10,000 grows over time with 5% simple vs compound interest.

Simple Interest: Linear Growth

With simple interest, you earn the same dollar amount every period. If you invest $10,000 at 5% simple interest, you earn $500 every year, regardless of how long you invest.

Compound Interest: Exponential Growth

With compound interest at the same 5% rate, your earnings grow each year because you’re earning interest on a larger and larger base.

Simple Interest vs Compound Interest: Year-by-Year Comparison

| Year | Simple Interest (5%) | Compound Interest (5%) | Growth Type |

|---|---|---|---|

| 1 | $10,500 | $10,500 | Equal start |

| 2 | $11,000 | $11,025 | Compound slightly higher |

| 3 | $11,500 | $11,576 | Compounding accelerates |

| 10 | $15,000 | $16,289 | Noticeable gap grows |

| 30 | $25,000 | $43,219 | Exponential advantage |

See the full guide on Simple Interest vs Compound Interest

Summary:

- Simple interest grows linearly — you earn the same amount each year.

- Compound interest grows exponentially — you earn interest on both your principal and prior interest.

- Over 30 years, compounding turns $10,000 into $43,219 vs $25,000 with simple interest.

The difference? $18,219 more with compound interest, that’s 73% more wealth from the same initial investment and interest rate, simply by allowing interest to compound.

Common Mistakes That Sabotage Compound Interest

Even people who understand compound interest often make mistakes that severely limit its effectiveness. Avoid these pitfalls:

Starting Too Late

Every year you delay costs you exponentially more in lost compound growth. A 25-year-old who invests $300/month until 65 will accumulate significantly more than a 35-year-old investing $600/month for the same period.

Stopping Contributions During Market Downturns

When markets drop, many investors panic and stop contributing (or worse, sell their investments). This is precisely when you should keep investing—you’re buying assets at lower prices, which will compound even more when markets recover.

Many investors lose money in the stock market by making emotional decisions rather than staying the course.

Chasing High Returns Without Considering Risk

While higher returns accelerate compound growth, taking excessive risk can lead to devastating losses that set your compound growth back years or decades.

Balance is key: Seek reasonable returns (7-10% annually) through diversified investments rather than gambling on get-rich-quick schemes.

Withdrawing Money Prematurely

Every dollar you withdraw stops compounding. A $10,000 withdrawal from your investment account doesn’t just cost you $10,000—it costs you what that $10,000 would have grown to over the remaining years.

Example: Withdrawing $10,000 from your retirement account at age 35 doesn’t just cost you $10,000; at 8% returns, it costs you over $100,000 by age 65.

Ignoring Inflation

Compound interest is powerful, but if your returns don’t outpace inflation, you’re not actually building real wealth. Always consider “real returns” (returns minus inflation).

If you earn 6% but inflation is 3%, your real return is only 3%. Target investments that historically outpace inflation by a meaningful margin.

How to Calculate Compound Interest: Tools and Methods

While understanding the concept is most important, knowing how to calculate compound interest helps you make informed decisions.

Method 1: The Formula (For Math Enthusiasts)

A = P(1 + r/n)^(nt)

Let’s calculate: $5,000 invested for 15 years at 7% annual interest, compounded monthly.

- P = $5,000

- r = 0.07

- n = 12 (monthly compounding)

- t = 15

A = $5,000(1 + 0.07/12)^(12×15)

A = $5,000(1.00583)^180

A = $5,000(2.832)

A = $14,160

Method 2: Online Calculators (For Everyone Else)

Numerous free compound interest calculators are available online. Simply input your:

- Initial investment

- Monthly contribution

- Expected return rate

- Time horizon

The calculator instantly shows your projected growth, much easier than manual calculations!

Method 3: Interactive Tools (See Below)

The interactive calculator included in this article allows you to experiment with different scenarios and see how changing variables affects your compound growth.

💰 Compound Interest Calculator

Wealth Breakdown

Real-World Applications: Using Compound Interest to Build Wealth

Understanding compound interest is one thing; applying it strategically is what creates real wealth. Here are proven strategies:

Retirement Planning

Compound interest is the engine that powers retirement accounts. Whether you’re contributing to a 401(k), IRA, or Roth IRA, the tax advantages combined with decades of compound growth create substantial wealth.

Example: A 25-year-old contributing $500/month to a Roth IRA earning 8% annually will have approximately $1.7 million by age 65, completely tax-free.

Teaching your children these principles early can set them up for extraordinary financial success.

Building Passive Income Streams

Compound interest accelerates the creation of passive income. By reinvesting dividends and interest, you grow the principal that generates your passive income, creating an upward spiral of increasing cash flow.

Explore smart ways to make passive income that leverage compound growth.

Education Savings (529 Plans)

529 college savings plans use compound interest to grow education funds tax-free. Starting when your child is born and contributing consistently can fully fund their college education through compound growth.

Real Estate Wealth Building

Real estate investors use compound interest principles by:

- Reinvesting rental income into property improvements or additional properties

- Leveraging equity growth to acquire more assets

- Benefiting from appreciation compounding over time

The Psychology of Compound Interest: Why It’s Hard to Grasp

Despite its mathematical simplicity, compound interest is psychologically difficult for humans to understand intuitively. Here’s why:

The Exponential Growth Problem

Human brains evolved to think linearly, not exponentially. We naturally underestimate how quickly exponential growth accelerates.

When asked to estimate how much $1,000 growing at 10% annually will be worth in 30 years, most people guess far too low. The answer ($17,449) seems impossibly high because our linear thinking can’t grasp exponential curves.

The Delayed Gratification Challenge

Compound interest requires sacrificing immediate consumption for future wealth, something humans are notoriously bad at. The benefits feel abstract and distant, while the sacrifice feels concrete and immediate.

Reframe your thinking: Every $100 you invest in your 20s isn’t just $100; it’s potentially $1,000+ in retirement. You’re not giving up $100; you’re choosing between $100 now and $1,000 later.

The Invisibility of Early Growth

In the early years, compound interest growth feels disappointingly slow. This discourages many people from continuing.

Stay the course: The first decade of investing often feels like you’re getting nowhere. But you’re building the foundation that will explode in growth during decades two, three, and four.

Compound Interest Advantages and Limitations

Like any financial concept, compound interest has both strengths and constraints.

Advantages of Compound Interest

- Exponential wealth growth without additional effort once established

- Time works for you, making early investing incredibly powerful

- Passive wealth building through reinvested returns

- Reduces the burden of how much you need to save monthly

- Creates financial freedom and retirement security

- Works 24/7 without your active involvement

Limitations and Risks

- Requires time to generate substantial returns (not a get-rich-quick strategy)

- Market volatility can temporarily reduce your balance

- Inflation can erode real purchasing power if returns are too low

- Requires discipline to avoid withdrawals and stay invested

- Early withdrawals severely damage long-term growth

- No guarantees of specific returns (especially in market-based investments)

Key Risks and Common Mistakes to Avoid

Even with the best intentions, investors often sabotage their compound interest growth. Watch out for these pitfalls:

1: Insufficient Returns

If your investment returns don’t significantly exceed inflation, compound interest won’t build real wealth. A 3% return with 3% inflation means zero real growth.

Solution: Invest in assets with historical returns that outpace inflation by meaningful margins (stocks, real estate, diversified portfolios).

2: High Fees Eroding Returns

Investment fees compound negatively against you. A 1.5% annual fee on a portfolio earning 8% reduces your effective return to 6.5%, a 19% reduction in returns that compounds over decades.

Solution: Choose low-cost index funds, ETFs, and investment platforms with minimal fees.

3: Emotional Investing

Panic selling during market downturns or chasing hot investments interrupts compound growth and locks in losses.

Solution: Develop a long-term investment strategy and stick to it regardless of short-term market movements. Understanding smart moves can help you avoid emotional mistakes.

4: Lifestyle Inflation

As income increases, many people increase their spending proportionally, preventing them from increasing their investment contributions.

Solution: Commit to investing at least 50% of every raise or income increase.

How to Interpret Compound Interest in Your Investment Decisions

Understanding compound interest should fundamentally change how you evaluate financial decisions:

Decision Framework: The Compound Interest Lens

Before making any financial decision, ask:

- “What is this decision’s impact on my compound growth?”

- A $5,000 vacation today costs you $50,000+ in future compound wealth

- A $200/month car payment costs you $200,000+ over 30 years of investing

- “Am I optimizing for compound growth?”

- Are you in low-cost investments?

- Are dividends and returns automatically reinvested?

- Are you maximizing tax-advantaged accounts?

- “What’s my real rate of return?”

- Return minus fees minus taxes minus inflation = real compound growth rate

Comparing Investment Opportunities

When evaluating investments, compound interest helps you compare options:

Example: Which is better?

- Option A: 10% annual return with 1.5% fees = 8.5% net return

- Option B: 9% annual return with 0.1% fees = 8.9% net return

Over 30 years, Option B (the lower gross return but lower fees) will generate more wealth due to the compound effect of fee savings.

FAQ Compound Interest

A good compound interest rate depends on the investment type and risk level. Historically, the stock market has returned approximately 10% annually before inflation (about 7% after inflation). For conservative investments, 4-6% is reasonable. For retirement planning, using 7-8% annual returns is a prudent estimate for diversified stock portfolios.

The more frequently interest compounds, the better. Daily compounding produces slightly higher returns than monthly, which beats quarterly, which beats annual. However, the difference between daily and monthly compounding is minimal (usually less than 0.1% annually). The far more important factors are the interest rate itself, time invested, and consistency of contributions.

Yes, compound interest can absolutely make you wealthy, but it requires three things: time (ideally 20-40 years), consistent contributions, and reasonable returns (7-10% annually). Starting with modest monthly investments of $300-500 in your 20s can compound to $1 million+ by retirement. However, compound interest isn’t a “get rich quick” strategy—it’s a “get rich slowly and reliably” approach.

APR (Annual Percentage Rate) is the simple annual interest rate without compounding. APY (Annual Percentage Yield) includes the effect of compound interest. APY is always higher than APR (except when interest compounds annually, making them equal). When comparing investments, always look at APY for the true return.

Compound interest is always better than simple interest for investors and savers. With compound interest, your money grows exponentially rather than linearly. Over long periods, compound interest produces dramatically higher returns—often 2-3 times more wealth than simple interest with the same rate and principal.

Compound interest works the same way on debt, except it works against you. Credit card debt, for example, compounds (usually daily), causing your debt to grow exponentially if you don’t pay it off. A $5,000 credit card balance at 22% APR can balloon to over $10,000 if you only make minimum payments. This is why paying off high-interest debt should be a top financial priority.

The ideal age to start investing is as soon as you have earned income—even in your teens if possible. However, the most critical period is your 20s. Someone who invests from age 25-35 and then stops will typically accumulate more wealth than someone who invests from 35-65 with the same monthly contributions. That said, it’s never too late to start—beginning at 30, 40, or even 50 still gives compound interest time to work.

Real Data Example: The Power of Starting Early

Let’s examine real historical data to illustrate compound interest in action.

Scenario: Two investors, Emma and James, both invest in the S&P 500 index.

Emma’s Strategy:

- Starts investing at age 25

- Contributes $400/month for 10 years (until age 35)

- Then stops contributing but leaves the money invested

- Total contributions: $48,000

James’s Strategy:

- Starts investing at age 35

- Contributes $400/month for 30 years (until age 65)

- Total contributions: $144,000

Assuming 10% average annual returns (the historical S&P 500 average):

Results at age 65:

- Emma’s balance: $1,581,000

- James’s balance: $904,000

Even though James contributed three times more money ($144,000 vs. $48,000), Emma ended up with 75% more wealth ($1.58M vs. $904K) simply because she started 10 years earlier.

This real-world example demonstrates why time is the most valuable variable in the compound interest equation.

Taking Action: Your Compound Interest Roadmap

Understanding compound interest means nothing without action. Here’s your step-by-step roadmap to harness its power:

Step 1: Start Today (Not Tomorrow)

Open an investment account immediately. Even if you can only invest $50-100 per month, start now. Every month you delay costs you years of compound growth.

Action: Choose a low-cost brokerage (Vanguard, Fidelity, Schwab) and open an IRA or taxable investment account this week.

Step 2: Automate Everything

Set up automatic monthly transfers from your checking account to your investment account. Remove the decision-making and make investing effortless.

Action: Schedule automatic investments for the day after your paycheck arrives.

Step 3: Invest in Low-Cost, Diversified Funds

Choose broad-market index funds or ETFs with expense ratios under 0.20%. Avoid high-fee actively managed funds that erode compound growth.

Action: Consider funds like VTI (Total Stock Market), VOO (S&P 500), or target-date retirement funds.

Step 4: Reinvest All Dividends and Returns

Never take dividends as cash unless you’re in retirement and need the income. Always choose “reinvest dividends automatically.”

Action: Check your account settings and enable automatic dividend reinvestment (DRIP).

Step 5: Increase Contributions Annually

Commit to increasing your investment contributions by at least $50-100 per month each year as your income grows.

Action: Set a calendar reminder for your annual review to increase contributions.

Step 6: Stay the Course

Resist the urge to check your balance daily, panic during downturns, or chase hot investments. Compound interest rewards patience and consistency.

Action: Limit checking your investment accounts to quarterly reviews.

Conclusion: Compound Interest Is Your Wealth Superpower

Compound interest isn’t magic; it’s mathematics. But its power to transform modest, consistent investments into substantial wealth is nothing short of extraordinary.

The key insights to remember:

Time is your most valuable asset in the compound interest equation. Starting even a few years earlier can double or triple your final wealth.

Consistency beats timing. Regular monthly contributions, even small ones, compound into life-changing amounts over decades.

Reinvest everything. Every dollar of dividends or interest that you reinvest becomes part of your compound growth engine.

Start immediately. The cost of waiting is exponentially higher than the cost of starting small.

The difference between financial security and financial struggle often comes down to understanding and applying compound interest principles. Those who grasp this concept early and apply it consistently build wealth almost automatically. Those who don’t understand it struggle to save enough, no matter how much they earn.

You now understand how compound interest works, why it’s so powerful, and exactly how to harness it for your financial future. The only question remaining is: Will you take action?

The best time to start investing was 10 years ago. The second-best time is today.

Your future self, wealthy, secure, and financially free, is waiting for you to decide to start. Don’t make them wait any longer.

Disclaimer

This article is for educational purposes only and does not constitute financial advice. Investment decisions should be made based on your individual financial situation, risk tolerance, and goals. Past performance does not guarantee future results. Consider consulting with a qualified financial advisor before making investment decisions. The stock market involves risk, including the potential loss of principal.

Author Bio

Written by Max Fonji — With over a decade of experience in financial education and investing, Max is your go-to source for clear, data-backed investing education. Through TheRichGuyMath.com, Max helps thousands of readers build wealth through proven financial strategies, compound interest principles, and smart investment decisions. Max’s mission is to make complex financial concepts accessible to everyone, empowering readers to take control of their financial futures.