Imagine planting a tiny acorn in your backyard. You water it occasionally, give it some sunlight, and mostly just leave it alone. Years later, you walk outside to find a massive oak tree towering over your home. That’s compounding in action, and it works the same way with your money. The power of compounding transforms modest, regular investments into substantial wealth over time, and understanding this concept might be the most important financial lesson you’ll ever learn.

TL;DR

The power of compounding means earning returns on your initial investment plus all the returns you’ve already earned—your money grows exponentially, not linearly.

Starting early is the biggest advantage: even small amounts invested in your 20s can outperform larger investments started in your 40s due to compound growth.

Time, consistent contributions, and reinvested earnings are the three essential ingredients that make compounding work its magic.

Even modest returns of 7-10% annually can turn $200/month into over $500,000 in 30 years through the power of compounding.

The biggest mistake is waiting to start—every year you delay costs you thousands in potential compound growth.

What Is the Power of Compounding?

In simple terms, the power of compounding means earning returns not just on your original investment, but also on all the growth that investment has already generated. It’s the snowball effect of finance, your money makes money, and then that money makes even more money.

The formula for compound interest is:

A = P(1 + r/n)^(nt)

Where:

- A = Final amount

- P = Principal (initial investment)

- r = Annual interest rate (as a decimal)

- n = Number of times interest compounds per year

- t = Time in years

But don’t worry, you don’t need to be a math wizard to benefit from compounding. The key takeaway is this: the longer your money stays invested, the more dramatically it grows.

Unlike simple interest (which only pays returns on your initial investment), compound interest creates a multiplying effect. That’s why Albert Einstein allegedly called compounding “the eighth wonder of the world” and said, “He who understands it, earns it; he who doesn’t, pays it.”

Why the Power of Compounding Matters for Beginners

If you’re just starting your investment journey, compounding is your secret weapon. You might think, “I only have $50 or $100 to invest each month, will that really make a difference?” The answer is a resounding yes.

The power of compounding rewards patience and consistency over large lump sums. Here’s why it matters:

- Time is more valuable than timing: You don’t need to pick the perfect stock or time the market. Starting early and staying consistent beats trying to be clever.

- Small amounts add up: Regular contributions, even modest ones, compound into significant wealth over decades.

- It works while you sleep: Once you set up automatic investments, compounding does the heavy lifting without requiring constant attention.

- It levels the playing field: You don’t need to be wealthy to benefit; anyone can harness compounding’s power.

Understanding why the stock market goes up over time helps you appreciate how compounding accelerates wealth-building through equity investments.

The Three Ingredients of Powerful Compounding

1. Time: Your Greatest Asset

Time is the most critical factor in the compounding equation. The longer your money compounds, the more exponential the growth becomes.

Consider this example:

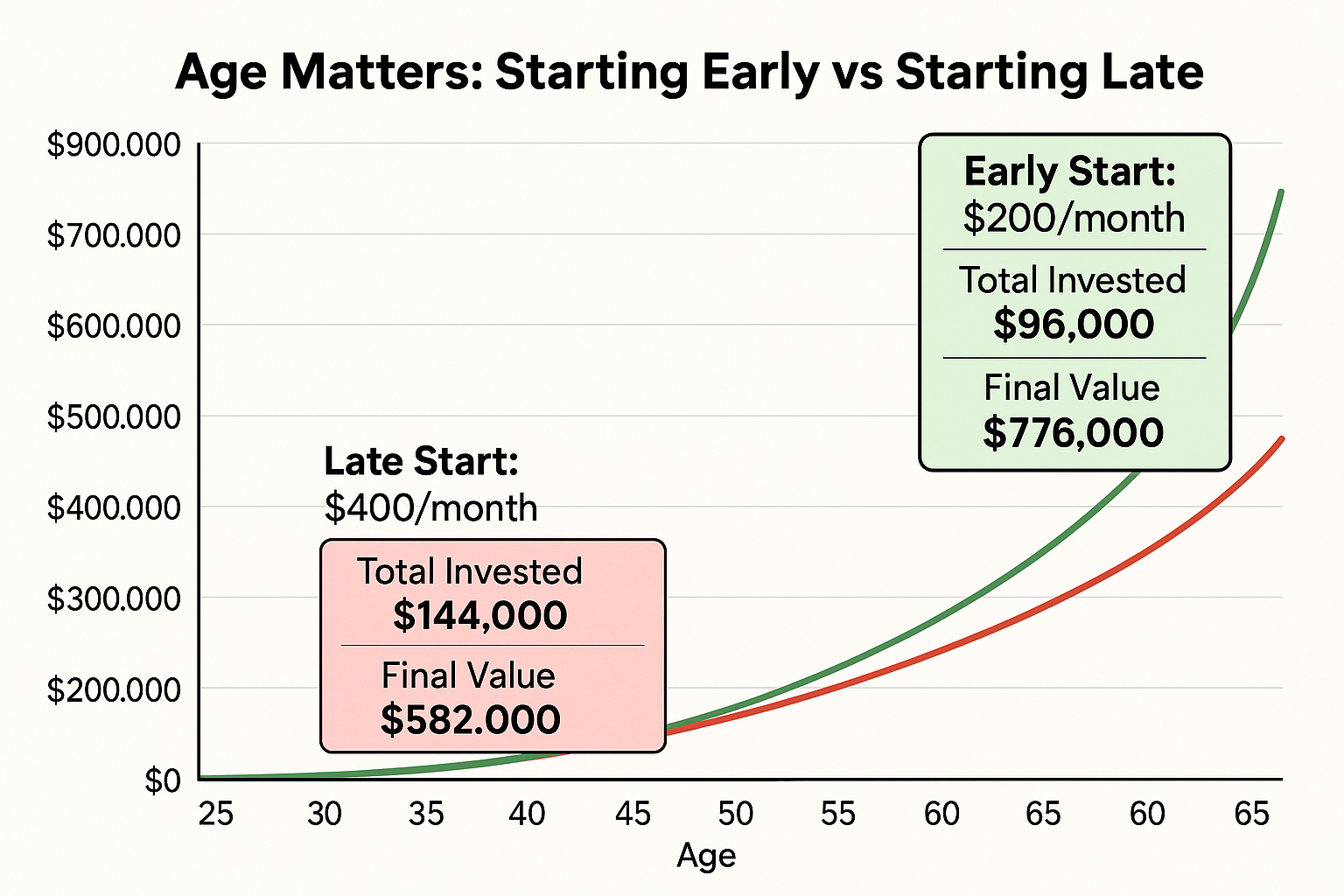

- Sarah starts investing $200/month at age 25

- Mike starts investing $400/month at age 35

Assuming both earn 8% annual returns and invest until age 65:

- Sarah invests $96,000 total and ends up with approximately $622,000

- Mike invests $144,000 total and ends up with approximately $351,000

Sarah invested $48,000 less than Mike, but ended up with $271,000 more—all because she had 10 extra years of compounding. That’s the power of starting early.

2. Consistent Contributions: The Fuel for Growth

Regular contributions supercharge the power of compounding. This strategy is called dollar-cost averaging, and it means investing a fixed amount at regular intervals regardless of market conditions.

Benefits of consistent contributions:

- Reduces the impact of market volatility

- Builds the investing habit

- Increases your principal, giving compounding more to work with

- Takes emotion out of investing decisions

Even during market downturns, consistent contributions buy more shares at lower prices, positioning you for stronger growth when markets recover. Understanding the cycle of market emotions helps you stay consistent during volatile times.

3. Reinvested Earnings: Accelerating the Snowball

The third ingredient is reinvesting all dividends, interest, and capital gains rather than spending them. This is where compounding truly accelerates.

When you reinvest:

- Dividends buy more shares

- Those new shares generate their own dividends

- The cycle repeats, creating exponential growth

Many investment accounts offer automatic dividend reinvestment plans (DRIPs), making this process effortless. For more on this strategy, check out our guide on starting to earn passive income through dividend investing.

Real-World Examples: The Power of Compounding in Action

Example 1: The Coffee Shop Investment

Let’s say you spend $5 daily on coffee—that’s $150 per month or $1,800 annually. What if you invested that money instead?

Scenario: Invest $150/month for 30 years at 8% annual return

| Year | Total Invested | Account Value |

|---|---|---|

| 5 | $9,000 | $11,107 |

| 10 | $18,000 | $27,566 |

| 15 | $27,000 | $52,128 |

| 20 | $36,000 | $88,074 |

| 25 | $45,000 | $142,036 |

| 30 | $54,000 | $226,566 |

You’d invest $54,000 but end up with over $226,000—that’s more than 4x your contributions! The extra $172,000+ came purely from the power of compounding.

Example 2: The Early Bird vs The Late Starter

Emma (The Early Bird):

- Invests $5,000/year from age 25 to 35 (10 years)

- Then stops contributing but leaves money invested until 65

- Total invested: $50,000

James (The Late Starter):

- Invests $5,000/year from age 35 to 65 (30 years)

- Total invested: $150,000

Assuming both earn 8% annual returns:

- Emma’s account at 65: ~$787,000

- James’s account at 65: ~$611,000

Emma invested $100,000 less but ended up with $176,000 more—all because she gave compounding an extra 10 years to work. This perfectly illustrates why time is the most valuable component.

Example 3: The Power of Higher Returns

Small differences in return rates create massive differences over time due to compounding.

Investment: $10,000 initial + $500/month for 30 years

| Annual Return | Final Value | Total Gain |

|---|---|---|

| 5% | $432,194 | $252,194 |

| 7% | $622,614 | $442,614 |

| 10% | $1,130,244 | $950,244 |

The difference between 5% and 10% returns is over $698,000—that’s why choosing the right investment vehicles matters. Understanding high dividend stocks can help you achieve better long-term returns.

Where to Harness the Power of Compounding

Stock Market Investments

Historically, the stock market has returned approximately 10% annually (before inflation). Through index funds or ETFs, you can capture these returns with minimal effort.

Advantages:

- Higher long-term returns than most alternatives

- Liquidity (can access funds when needed)

- Diversification options

- Tax-advantaged accounts available (401k, IRA)

Considerations:

- Short-term volatility

- Requires patience and discipline

- Not FDIC insured

Learn more about how the stock market works to build confidence in this powerful compounding vehicle.

Retirement Accounts (401k, IRA, Roth IRA)

Tax-advantaged retirement accounts supercharge compounding through:

- Tax-deferred growth (traditional 401k/IRA): Pay no taxes on gains until withdrawal

- Tax-free growth (Roth IRA): Pay taxes now, then all future growth is tax-free

- Employer matching (401k): Free money that compounds alongside your contributions

Example: A $6,000 annual Roth IRA contribution from age 25 to 65 at 8% return grows to approximately $1.75 million—and you’d never pay taxes on that growth.

Dividend Reinvestment Plans (DRIPs)

DRIPs automatically use dividend payments to purchase more shares, creating a powerful compounding loop. This strategy works especially well with dividend investing strategies.

How it works:

- You own shares of a dividend-paying stock

- The company pays quarterly dividends

- Dividends automatically buy fractional shares

- More shares generate more dividends

- Cycle repeats indefinitely

High-Yield Savings Accounts & CDs

While offering lower returns (typically 4-5% as of 2025), these options provide:

- FDIC insurance (up to $250,000)

- No market risk

- Guaranteed returns

- Good for emergency funds or short-term goals

Note: These are better for preserving capital than building wealth due to lower returns that may barely outpace inflation.

Real Estate Investment Trusts (REITs)

REITs allow you to invest in real estate without buying property directly. They’re required to distribute 90% of taxable income as dividends, making them excellent compounding vehicles when dividends are reinvested.

Common Mistakes That Kill Compounding Power

1. Starting Too Late

The Problem: Waiting until your 30s or 40s to start investing dramatically reduces compounding’s effectiveness.

The Solution: Start now, even with small amounts. $50/month starting today beats $500/month starting in 10 years.

2. Withdrawing Early

The Problem: Taking money out interrupts the compounding cycle and often triggers taxes and penalties.

The Solution: Treat investments as untouchable except for true emergencies. Build a separate emergency fund for unexpected expenses.

3. Not Reinvesting Dividends

The Problem: Spending dividends instead of reinvesting them eliminates half the power of compounding.

The Solution: Enable automatic dividend reinvestment on all accounts. Live off your salary, not your investment income.

4. Trying to Time the Market

The Problem: Waiting for the “perfect” time to invest or selling during downturns interrupts compounding and usually reduces returns.

The Solution: Invest consistently regardless of market conditions. Time in the market beats timing the market. Understand why people lose money in the stock market to avoid common pitfalls.

5. Paying High Fees

The Problem: Investment fees of 1-2% annually seem small, but dramatically reduce compound growth over decades.

Example: $100,000 growing at 8% for 30 years:

- With 0.1% fees: $983,000

- With 1% fees: $761,000

- Difference: $222,000 lost to fees

The Solution: Choose low-cost index funds and ETFs with expense ratios under 0.2%.

6. Emotional Investing

The Problem: Making investment decisions based on fear or greed leads to buying high and selling low, the opposite of successful investing.

The Solution: Create an investment plan and stick to it. Automate contributions so emotions don’t interfere. The cycle of market emotions explains why discipline matters.

How to Calculate the Power of Compounding

While the mathematical formula can seem intimidating, several tools make calculations easy:

Manual Calculation Method

Using the formula: A = P(1 + r/n)^(nt)

Example: $5,000 invested at 7% annually for 20 years, compounded monthly

- P = $5,000

- r = 0.07

- n = 12 (monthly)

- t = 20

A = $5,000(1 + 0.07/12)^(12×20)

A = $5,000(1.00583)^240

A = $5,000 × 4.038

A = $20,190

The Rule of 72

A quick mental math trick: Divide 72 by your annual return to find how many years it takes to double your money.

Examples:

- 6% return: 72 ÷ 6 = 12 years to double

- 8% return: 72 ÷ 8 = 9 years to double

- 10% return: 72 ÷ 10 = 7.2 years to double

This simple rule helps you quickly understand the power of compounding without complex calculations. See our full guide on The rule of 72

Online Calculators

Numerous free compound interest calculators are available online. Simply input:

- Initial investment amount

- Monthly contribution

- Expected annual return

- Investment timeline

The calculator instantly shows your projected growth—a great way to visualize the power of compounding and stay motivated.

The Power of Compounding at Different Life Stages

In Your 20s: Maximum Compounding Potential

Advantages:

- 40+ years of compounding time

- Can afford higher risk for higher returns

- Small contributions grow enormously

- Mistakes have time to recover

Action Steps:

- Start with any amount, even $25/month

- Maximize employer 401k match (free money!)

- Open a Roth IRA for tax-free compounding

- Invest in growth-focused index funds

- Automate everything

Reality Check: Investing $200/month from age 25 to 65 at 8% return = $622,000. That’s the power of compounding in your 20s.

In Your 30s: Building Momentum

Advantages:

- Still have 30+ years of compounding

- Likely earning more than in your 20s

- Can increase contribution amounts

- Financial habits are becoming established

Action Steps:

- Increase contributions by 1% annually

- Diversify across different account types

- Review and rebalance portfolio annually

- Avoid lifestyle inflation—invest raises

- Consider tax-loss harvesting strategies

Reality Check: Starting at 30 instead of 25 means you’ll need to invest approximately 50% more monthly to reach the same retirement goal—time matters that much.

In Your 40s: Catching Up

Advantages:

- Peak earning years are approaching

- Can make larger contributions

- Catch-up contributions allowed (age 50+)

- Financial priorities clearer

Action Steps:

- Maximize retirement account contributions

- Eliminate high-interest debt first

- Consider aggressive catch-up contributions

- Reduce investment fees aggressively

- Explore smart moves to accelerate growth

Reality Check: You’ll need to save significantly more monthly than someone who started in their 20s, but the power of compounding still works—it just requires larger contributions.

In Your 50s & Beyond: Maximizing Final Years

Advantages:

- Highest earning potential

- Catch-up contributions ($7,500 extra for 401k, $1,000 extra for IRA as of 2025)

- Fewer financial obligations (kids are independent)

- Clear retirement timeline

Action Steps:

- Max out all catch-up contributions

- Shift gradually toward more conservative investments

- Plan tax-efficient withdrawal strategies

- Consider Roth conversions

- Calculate required minimum distributions (RMDs)

Reality Check: Even at 50, you have 15+ years until retirement—that’s still significant compounding time if you act aggressively.

Compounding vs Simple Interest: The Critical Difference

Understanding the difference between simple and compound interest reveals why compounding is so powerful.

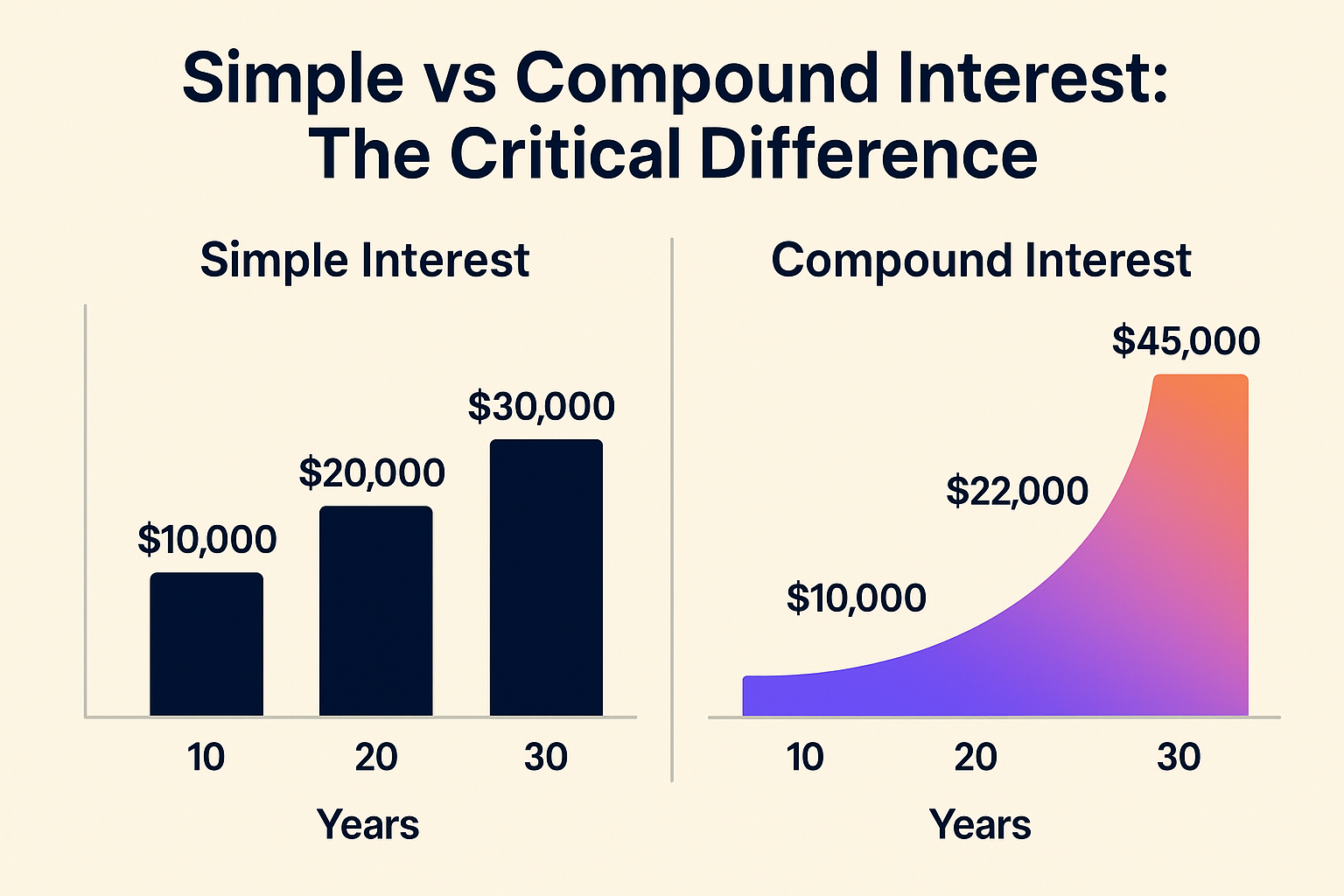

Simple Interest

Formula: A = P(1 + rt)

Simple interest only pays returns on your original principal, never on accumulated interest.

Example: $10,000 at 5% simple interest for 20 years

- Annual interest: $500

- Total after 20 years: $10,000 + ($500 × 20) = $20,000

Compound Interest

Formula: A = P(1 + r)^t

Compound interest pays returns on principal plus all accumulated interest.

Example: $10,000 at 5% compound interest for 20 years

- Total after 20 years: $10,000 × (1.05)^20 = $26,533

The Comparison

| Years | Simple Interest | Compound Interest | Difference |

|---|---|---|---|

| 5 | $12,500 | $12,763 | $263 |

| 10 | $15,000 | $16,289 | $1,289 |

| 15 | $17,500 | $20,789 | $3,289 |

| 20 | $20,000 | $26,533 | $6,533 |

| 30 | $25,000 | $43,219 | $18,219 |

The gap widens dramatically over time; that’s the exponential power of compounding at work. See our full guide on Compounding Interest vs Simple Interest

Advanced Compounding Strategies

Strategy 1: The Bucket Approach

Divide investments into three time-based buckets:

- Short-term (0-5 years): High-yield savings, CDs, bonds

- Medium-term (5-15 years): Balanced funds, dividend stocks

- Long-term (15+ years): Growth stocks, aggressive index funds

This approach maximizes compounding while managing risk based on when you’ll need the money.

Strategy 2: Tax-Location Optimization

Place investments strategically across account types:

- Tax-deferred accounts (401k, traditional IRA): Bonds, REITs, actively managed funds

- Tax-free accounts (Roth IRA): Highest-growth investments

- Taxable accounts: Tax-efficient index funds, long-term holdings

Proper tax location can add 0.5-1% to annual returns—that compounds to significant wealth over decades.

Strategy 3: The Roth Conversion Ladder

Convert traditional IRA funds to Roth IRA during low-income years:

- Pay taxes on conversions at lower rates

- Future growth compounds tax-free forever

- Reduces required minimum distributions

- Leaves a tax-free inheritance for heirs

This advanced strategy maximizes the power of compounding by eliminating future taxes.

Strategy 4: Dividend Growth Investing

Focus on companies that consistently increase dividend payments:

- Rising dividends compound faster than fixed dividends

- Quality companies tend to appreciate in value

- Creates an inflation-protected income stream

- Reinvested growing dividends accelerate compounding

Explore smart ways to make passive income through dividend strategies.

The Power of Compounding for Your Children

One of the greatest gifts you can give your children is early exposure to compounding. Even small amounts invested when they’re young can grow into substantial wealth by adulthood.

Custodial Accounts (UTMA/UGMA)

These accounts allow you to invest on behalf of minors:

- Control transfers at age 18-21 (depending on state)

- First $1,250 of gains tax-free (2025)

- Next $1,250 taxed at child’s rate

- Can invest in stocks, bonds, and funds

Example: $5,000 invested at birth, growing at 8% annually, becomes $160,000 by age 40—from a single initial investment.

Custodial Roth IRA

If your child has earned income (from jobs, modeling, acting, etc.), they can contribute to a Roth IRA:

- Contributions up to their earned income or $7,000 (2025 limit)

- Decades of tax-free compounding

- Can withdraw contributions anytime (not gains)

- Massive retirement head start

Example: $3,000 annually from age 15-18 (4 years), then left untouched until 65 at 8% return = $525,000 tax-free.

Learn more about how to make your kid a millionaire through strategic early investing.

529 Education Savings Plans

While designed for education, 529 plans offer powerful compounding:

- Tax-free growth for education expenses

- High contribution limits

- Can change beneficiaries

- Some states offer tax deductions

Reality Check: $200/month from birth to age 18 at 7% return = $86,000 for college expenses—all growth tax-free.

Real Data: Historical Market Returns and Compounding

Understanding actual historical returns helps set realistic expectations for the power of compounding.

S&P 500 Historical Returns (1926-2024)

- Average annual return: ~10%

- Average with inflation adjusted: ~7%

- Best year: +54% (1933)

- Worst year: -43% (1931)

- Positive years: 74% of all years

- Positive 10-year periods: 95%

- Positive 20-year periods: 100%

Source: Based on data from the Federal Reserve and historical market analysis.

The Impact of Staying Invested

Missing just the best market days dramatically impacts compounding:

$10,000 invested in S&P 500 (1993-2023):

- Fully invested: $174,000

- Missed best 10 days: $87,000

- Missed best 20 days: $52,000

- Missed best 30 days: $34,000

This data shows why staying invested and letting compounding work is crucial—you can’t predict the best days, so you must be there for all of them.

Asset Class Comparison (30-Year Returns)

| Asset Class | Average Annual Return | $10,000 Grows To |

|---|---|---|

| Large-cap stocks | 10.0% | $174,494 |

| Small-cap stocks | 11.5% | $254,926 |

| Corporate bonds | 6.0% | $57,435 |

| Treasury bonds | 5.0% | $43,219 |

| Cash/Savings | 2.5% | $21,137 |

Source: Historical data compiled from Morningstar and Investopedia research.

The difference between stock market returns and cash savings is staggering when compounding over decades; this is why asset allocation matters enormously.

💰 Compound Interest Calculator

Growth Over Time

Pros and Cons of Relying on Compounding

Advantages of Compounding

Passive Wealth Building

Once you set up automatic investments, compounding works 24/7 without requiring active management or constant attention.

Accessible to Everyone

You don't need to be wealthy to benefit—anyone can start with small amounts and harness the power of compounding.

Mathematically Guaranteed

Unlike trying to pick winning stocks or time markets, compounding is a mathematical certainty that works regardless of market conditions over long periods.

Inflation Protection

Stock market returns historically outpace inflation, meaning compounding helps preserve and grow purchasing power over decades.

Tax Advantages

Tax-advantaged accounts (401k, IRA, Roth IRA) amplify compounding by eliminating or deferring taxes on growth.

Reduces Stress

A long-term compounding strategy eliminates the stress of daily market watching and short-term volatility.

Limitations and Considerations

Requires Patience

Compounding works slowly at first—you won't see dramatic results for years, which tests many investors' patience.

Market Risk

In market-based investments, short-term volatility is inevitable. You must stay invested through downturns for compounding to work.

Inflation Impact

While nominal returns may be high, real (inflation-adjusted) returns are lower. A 10% return with 3% inflation equals 7% real growth.

Opportunity Cost

Money locked in long-term investments isn't available for other opportunities or emergencies without penalties.

Tax Implications

In taxable accounts, you'll pay taxes on dividends and capital gains annually, which reduces the power of compounding somewhat.

Not a Get-Rich-Quick Strategy

Compounding builds wealth steadily over decades, not overnight. It won't help with immediate financial needs.

How to Interpret Compound Growth Results

When you calculate the power of compounding, understanding what the numbers mean helps you make better decisions:

What "Good" Growth Looks Like

Healthy compound growth typically shows:

- Final value at least 3-4x total contributions over 30 years

- Growth acceleration in later years (more growth in years 20-30 than 0-20)

- Consistent upward trajectory despite market volatility

- Real (inflation-adjusted) returns of 4-7% annually

Red Flags to Watch For

Concerning signs include:

- Returns consistently below 4-5% (may not beat inflation)

- High fees are eating into compound growth (over 1% annually)

- Frequent withdrawals interrupt compounding

- Excessive risk leading to major losses that take years to recover

Adjusting Your Strategy

If projections don't meet your goals:

- Increase contributions: Even small increases compound significantly

- Extend timeline: Each extra year adds substantial growth

- Optimize asset allocation: Higher growth potential (with appropriate risk)

- Reduce fees: Every 0.5% saved compounds to thousands over decades

- Maximize tax advantages: Use Roth accounts for the highest-growth investments

Common Misconceptions About Compounding

Myth 1: "I Need a Lot of Money to Start"

Reality: The power of compounding works with any amount. Starting with $50/month is infinitely better than waiting until you can invest $500/month. Time matters more than amount.

Myth 2: "Compounding Only Works in the Stock Market"

Reality: While the stock market offers the highest returns, compounding works in savings accounts, bonds, real estate, and any investment that generates returns. The rate differs, but the principle is the same.

Myth 3: "I Can Make Up for Lost Time by Investing More Later"

Reality: While you can partially compensate, you can never fully replace lost compounding years. Someone starting at 25 with $100/month will likely outperform someone starting at 35 with $300/month.

Myth 4: "Compounding Guarantees Wealth"

Reality: Compounding is powerful but not magic. It requires consistency, time, reasonable returns, and staying invested. Poor investment choices or withdrawing early can undermine compounding.

Myth 5: "Market Timing Beats Long-Term Compounding"

Reality: Studies consistently show that time in the market beats timing the market. Missing just the 10 best market days over 30 years can cut returns in half, destroying compounding's power.

Myth 6: "High Returns Are Always Better"

Reality: Chasing high returns often means higher risk and volatility. Moderate, consistent returns (7-10%) with lower volatility often produce better long-term compound growth than volatile high-return investments.

Creating Your Personal Compounding Plan

Step 1: Define Your Goals

Be specific about what you want to achieve:

- Retirement: How much do you need? When do you want to retire?

- Major purchases: House down payment, education, etc.

- Financial independence: What income level do you need?

Example Goal: "Accumulate $1 million by age 65 for retirement"

Step 2: Calculate Required Contributions

Use the compound interest formula or calculator to determine the monthly investment needed:

- Current age and target age

- Expected return rate (be conservative: 7-8%)

- Current savings amount

- Target amount

Example: To reach $1 million in 30 years, starting from $0 at 8% return, requires approximately $670/month.

Step 3: Choose Investment Vehicles

Select appropriate accounts and investments:

- Tax-advantaged accounts first: 401 (k) (especially with a match), IRA, Roth IRA

- Asset allocation: Age-appropriate mix of stocks, bonds, etc.

- Low-cost index funds: Minimize fees to maximize compounding

- Automatic dividend reinvestment: Ensure all earnings compound

Explore the stock market basics to understand your options.

Step 4: Automate Everything

Remove emotion and forgetfulness from the equation:

- Set up automatic transfers from checking to investment accounts

- Enable automatic dividend reinvestment

- Schedule annual contribution increases (1% of salary)

- Set calendar reminders for annual rebalancing

Step 5: Monitor and Adjust

Review your plan regularly, but don't obsess:

- Quarterly: Check that automatic contributions are working

- Annually: Rebalance portfolio, increase contributions, review goals

- Major life changes: Adjust plan for marriage, children, job changes, etc.

Step 6: Stay the Course

The power of compounding requires discipline:

- Don't panic during market downturns

- Resist the urge to withdraw early

- Ignore market noise and stay focused on long-term goals

- Remember that time in the market beats timing the market

Understanding smart financial moves helps you stay disciplined during challenging times.

The Psychology of Compounding: Staying Committed

The Early Years Challenge

The first 5-10 years of investing can be psychologically tough because:

- Growth seems slow compared to contributions

- Market volatility feels scary

- Friends may be spending while you're saving

- Results don't match the exciting projections

Solution: Focus on the habit, not the balance. Celebrate consistency, not just growth. Remember that you're planting seeds that will become massive trees.

The Mid-Journey Motivation

Years 10-20 are when compounding becomes visible:

- Balance starts growing faster than contributions

- You see real wealth accumulation

- Confidence in the strategy builds

- Motivation increases naturally

Strategy: This is the time to increase contributions if possible—adding to an already-compounding base accelerates growth dramatically.

The Final Stretch

The last 10 years before retirement show compounding's true power:

- Growth explodes exponentially

- Each year adds more than the early years combined

- Financial goals come into clear focus

- Retirement becomes tangible

Caution: Don't get overconfident and take excessive risks. Protect your gains while still allowing compounding to work.

Behavioral Strategies for Success

Create visual reminders: Charts showing projected vs. actual growth

Celebrate milestones: First $10k, $50k, $100k, etc.

Find accountability partners: Share goals with trusted friends or family

Educate yourself: Understanding deepens commitment

Automate decisions: Remove emotion from the process

Avoid comparison: Your journey is unique—don't measure against others

Compounding Beyond Money: Life Applications

The power of compounding extends beyond finance into every area of life:

Knowledge and Skills

Learning compounds just like money:

- Reading 20 pages daily = 30+ books yearly

- Practicing a skill 30 minutes daily = mastery in years

- Small improvements compound into expertise

Health and Fitness

Healthy habits compound over time:

- Daily exercise creates cumulative fitness gains

- Consistent good nutrition compounds to long-term health

- Small weight loss (1 lb/week) = 52 lbs/year

Relationships

Relationship investments compound:

- Daily small kindnesses build deep bonds

- Regular quality time compounds into strong relationships

- Consistent communication prevents compounding problems

Career Growth

Professional development compounds:

- Learning new skills opens compounding opportunities

- Building a professional network creates compounding connections

- Quality work builds a compounding reputation

The principle is universal: small, consistent actions compound into extraordinary results over time.

Conclusion: Your Compounding Journey Starts Today

The power of compounding is the closest thing to magic in the financial world—but it's not actually magic. It's mathematics, patience, and consistency working together to transform modest investments into substantial wealth.

Here's what you need to remember:

Start immediately. Every day you wait costs you money. Even $25/month starting today beats $100/month starting next year.

Stay consistent. The power of compounding rewards steady contributions far more than sporadic large investments.

Think long-term. Compounding is a marathon, not a sprint. Short-term volatility is irrelevant when you're investing for decades.

Reinvest everything. Dividends, interest, and gains should all compound—never spend your investment returns during the accumulation phase.

Minimize fees. Every percentage point in fees is a percentage point less compounding. Choose low-cost index funds.

Increase contributions over time. As your income grows, increase your investment rate—compounding accelerates dramatically with larger contributions.

The difference between financial security and financial stress often comes down to understanding and applying the power of compounding. You now have the knowledge—the only question is whether you'll take action.

Your Next Steps

- Today: Open an investment account if you don't have one (IRA, 401k, or taxable brokerage)

- This week: Set up automatic monthly contributions, even if small

- This month: Calculate your specific compounding goals using the calculator above

- This year: Increase contributions by at least 1% and enable dividend reinvestment

- Every year: Review progress, rebalance, and increase contributions

Remember: The best time to start was 10 years ago. The second-best time is today.

Your future self will thank you for harnessing the power of compounding starting right now. Every dollar you invest today is a seed that will grow into a mighty oak tree of wealth over the coming decades.

Start small if you must, but start today. The power of compounding is waiting to work for you.

FAQ: Power Of Compounding

A good compound interest rate depends on the investment vehicle and risk level. For stock market investments, 7-10% annually is realistic based on historical averages. For safer options like high-yield savings accounts, 4-5% is competitive as of 2025. The key is consistency—even modest rates create substantial wealth through the power of compounding over decades.

Any amount benefits from compounding—the power works the same whether you invest $10 or $10,000. However, financial experts typically recommend saving 15-20% of gross income for retirement. Start with whatever you can afford today, then increase contributions by 1% annually. Even $50/month invested from age 25-65 at 8% return grows to over $175,000.

Yes, and that's why high-interest debt is so dangerous. Credit card debt at 20% APR compounds against you, making balances grow exponentially if you only make minimum payments. A $5,000 credit card balance with 20% APR and minimum payments takes over 20 years to pay off and costs over $10,000 in interest, compounding working against you instead of for you.

More frequent compounding creates slightly better results. Daily compounding beats monthly, which beats annually. However, the difference is usually small compared to the impact of time and contribution amount. For example, $10,000 at 8% for 20 years compounded annually = $46,610, while daily compounding = $49,268—a difference of about 5.7%.

In guaranteed accounts (FDIC-insured savings, CDs), you cannot lose principal, though returns may not beat inflation. In market-based investments (stocks, mutual funds), short-term losses are possible, but historically the stock market has always recovered and grown over 15+ year periods. The power of compounding works best when you stay invested through market cycles.

APR (Annual Percentage Rate) shows simple annual interest without compounding. APY (Annual Percentage Yield) includes compounding effects and shows true annual return. For example, 5% APR compounded monthly equals 5.12% APY. Always compare APY when evaluating investment or savings accounts—it reveals the actual power of compounding.

It's never too late—compounding works at any age, though earlier is always better. Even starting at 50, you have 15+ years until retirement and potentially 30+ years of life expectancy. A $500/month investment from age 50-65 at 7% return grows to approximately $153,000. While starting at 25 would have produced more, $153,000 is still significantly better than $0

Disclaimer

This article is for educational purposes only and does not constitute financial advice. The power of compounding is a mathematical principle, but investment results vary based on market conditions, asset allocation, fees, and individual circumstances. Past performance does not guarantee future results.

All examples and projections in this article are hypothetical and for illustration purposes only. Actual investment returns will differ. Before making investment decisions, consult with a qualified financial advisor who understands your specific situation, risk tolerance, and goals.

The author and TheRichGuyMath.com are not responsible for investment decisions made based on this content. Always conduct your own research and due diligence before investing.

About the Author

Written by Max Fonji — your go-to source for clear, data-backed investing education. With over a decade of experience in personal finance and investment education, Max specializes in breaking down complex financial concepts into actionable strategies that anyone can understand and implement.

Max's mission is to democratize financial knowledge and help everyday people build wealth through proven principles like the power of compounding. When not writing about finance, Max enjoys analyzing market trends, testing investment strategies, and helping readers achieve financial independence.

For more practical investing guidance, explore our comprehensive resources on building wealth through smart investing.