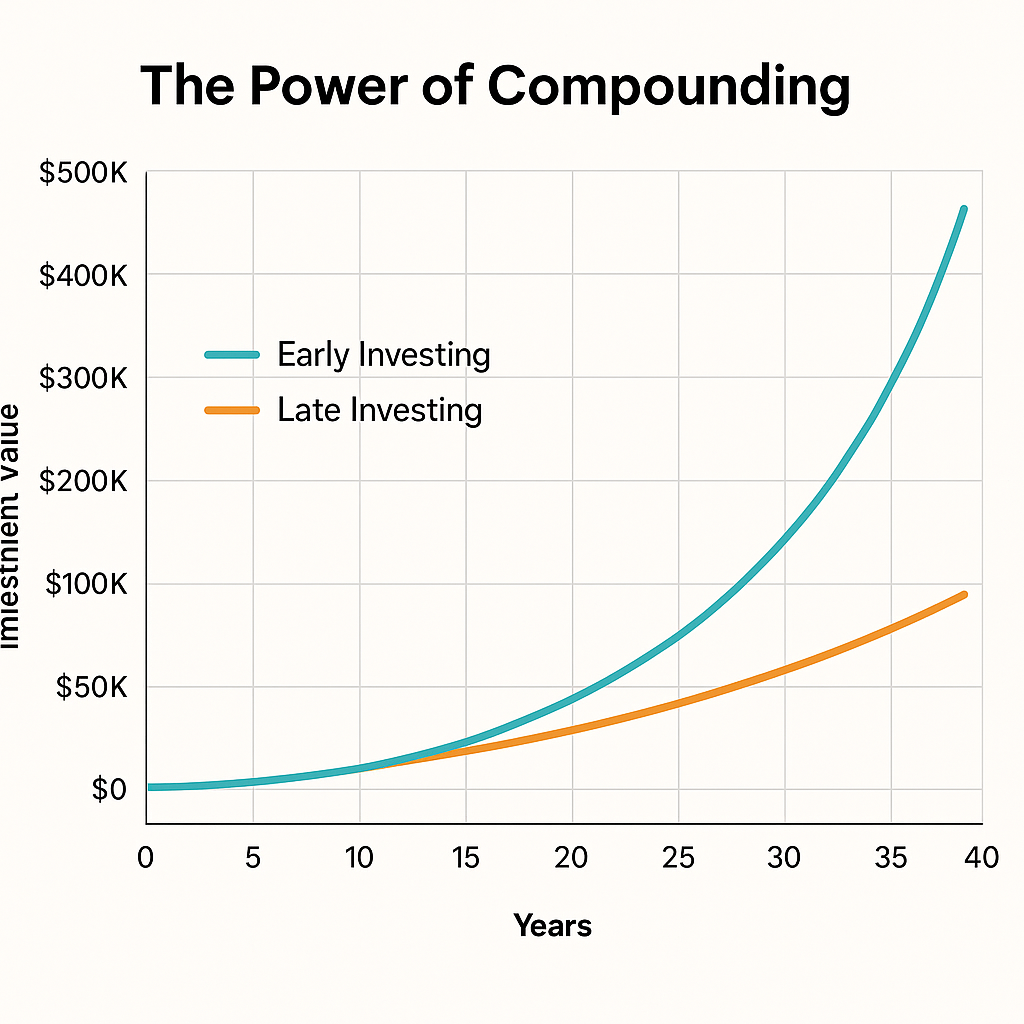

The Power of Compounding. When it comes to building wealth, compound interest is your most powerful ally. Whether you’re a seasoned investor or just getting started, understanding how compounding works can completely change how you approach money.

One of the most mind-blowing aspects of investing is that small, consistent contributions can turn into massive sums over time, without you having to work extra hours or take big risks.

Take a look at this visual breakdown: The Power of Compounding.

What Is the Power of Compounding?

The power of compounding is the process by which your money earns interest, and then that interest begins earning interest itself. Over time, this creates an exponential snowball effect where your investments grow not just linearly, but exponentially.

Here’s a simple way to understand it:

If you invest $1,000 at a 10% annual interest rate, after the first year, you have $1,100.

In year two, you earn 10% not just on $1,000, but on $1,100 — resulting in $1,210.

Fast-forward 20 years? That $1,000 becomes $6,727.

It’s not magic. It’s math and discipline.

What This Chart Tells Us

This chart illustrates the time required to accumulate $1 million by investing $10,000 annually at a 7% annualized return. Here’s the kicker: the first $300,000 takes over 16 years to accumulate—but the final $700,000 takes less than 10 years!

Why Time Is the Most Important Factor

The longer your money is invested, the more time compounding has to work. Starting early — even with small amounts — makes a dramatic difference.

Let’s compare two investors:

| Investor | Starts Investing At | Monthly Amount | Total Invested | Value After 30 Years (8% Return) |

|---|---|---|---|---|

| Sarah | Age 25 | $200 | $72,000 | $283,382 |

| Mike | Age 35 | $200 | $72,000 | $132,483 |

Sarah ends up with more than double, just because she gave her investments more time.

Characteristics Of The Power Of Compounding

Time Is Your Greatest Ally

The earlier you start investing, the greater the compounding effect over time. Giving your money more years to grow allows small gains to snowball into significant wealth. Even modest contributions made early can outperform larger investments made later.

The Role of Interest Rates

A higher interest rate can accelerate the compounding process, but you don’t need sky-high returns to see results. Even average rates can deliver impressive long-term growth — the key is consistency and time.

Why Compounding Frequency Matters

How often your returns are compounded — whether daily, monthly, or quarterly — influences how fast your investment grows. While the differences may seem small year-to-year, over decades, more frequent compounding can result in noticeably higher returns.

Real-Life Examples of Compounding in Action

- Warren Buffett’s Net Worth

Over 99% of Warren Buffett’s wealth came after his 50th birthday — not because of a change in strategy, but because of time. - 401(k) Plans

Employees who steadily invest in their 401(k) and reinvest dividends experience compounding across decades. - Dividend Reinvestment

Reinvesting dividends allows your shares to earn more shares — one of the most powerful compounding methods.

How to Start Using the Power of Compounding Today

- Start now: Even $50 a month matters if you give it time.

- Reinvest earnings: Don’t cash out dividends or interest.

- Be consistent: Regular investing beats timing the market.

- Use tax-advantaged accounts: IRAs and 401(k)s protect your gains.

- Avoid debt: Credit card interest works against compounding.

Compounding doesn’t require big money — just big patience.

Let’s break it down: The Power of Compounding.

- $100,000 takes 7.84 years to reach (only 25% of the way)

- $300,000 takes 12.62 years (already 54% of the way)

- The final jump from $700k to $1 million takes just 1.35 years

Why? Because of compounding—the growth on your growth.

Why Time Is Your Greatest Investment Tool

The earlier you start, the more powerful compounding becomes. Your money earns interest, that interest earns interest, and so on. Over time, the returns accelerate rapidly, especially in the final years.

Here’s a breakdown of time spent at each phase: The Power of Compounding.

- Early Years (up to $300k): 47% of the journey

- Later Years ($300k to $1M): Only 53%, but the gains are explosive

This shows that building wealth isn’t about fast wins—it’s about consistency and time in the market.

Mistakes That Sabotage Compounding Growth

Avoid these to protect your compounding advantage:

- Starting late: Waiting just a few years can cost you thousands.

- Pulling out early: You interrupt exponential growth when you sell too soon.

- Not reinvesting returns: Take dividends as cash? You miss out.

- High fees: Fund management fees eat into compounding power.

- Chasing trends: High-risk trades often reset your compounding clock.

Internal Links

Yes — even $25/month grows significantly over 20–30 years thanks to compounding.

Depends on the investment. Most compound annually, but some (like dividend stocks or savings accounts) do it quarterly or monthly.

Not exactly. Compound interest typically refers to fixed returns, while compounding returns can also include reinvested gains, dividends, or price appreciation.

Final Thoughts: Let Time and Discipline Build Your Wealth

The power of compounding rewards the patient, the disciplined, and the consistent. It doesn’t require perfect timing or huge investments — only a willingness to start early, stay steady, and let time do its work.

Want to build real wealth? Start investing today, automate your contributions, reinvest your gains, and then wait. Compounding will do the rest.