Imagine waking up tomorrow morning to find money in your bank account—money you didn’t have to clock in for, didn’t have to trade hours for, and didn’t have to actively work to earn. Sounds like a dream, right? That’s the power of residual income, and it’s not just reserved for the wealthy elite or lucky lottery winners. In fact, building streams of residual income is one of the most reliable paths to financial freedom in 2025, and it’s more accessible than ever before.

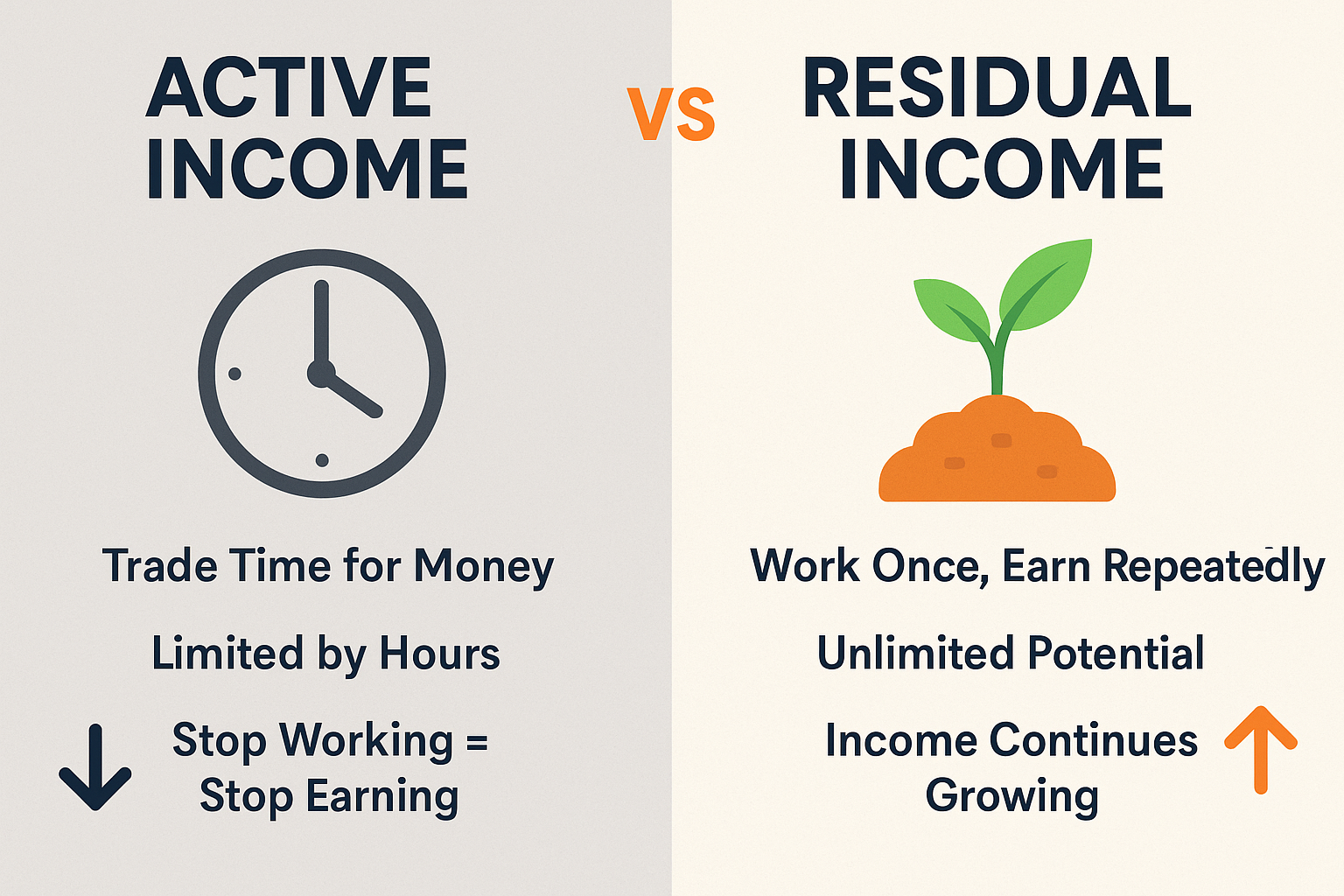

Residual income is money you continue to earn after the initial work is done. Unlike your typical 9-to-5 job, where you trade time for money, residual income keeps flowing even when you’re sleeping, spending time with family, or traveling the world. It’s the financial foundation that allows people to break free from the paycheck-to-paycheck cycle and build real wealth over time. Investopedia: Residual Income Definition

Whether you’re a complete beginner just starting your financial journey or someone looking to diversify your income streams, understanding residual income is crucial. This comprehensive guide will walk you through everything you need to know—from what residual income actually means to proven strategies for building it yourself.

TL;DR

- Residual income is money earned continuously from work completed once, creating a steady cash flow without constant active effort

- Building residual income requires upfront time, money, or effort, but pays dividends long-term through passive earnings

- Popular residual income streams include dividend-paying stocks, rental properties, digital products, royalties, and affiliate marketing

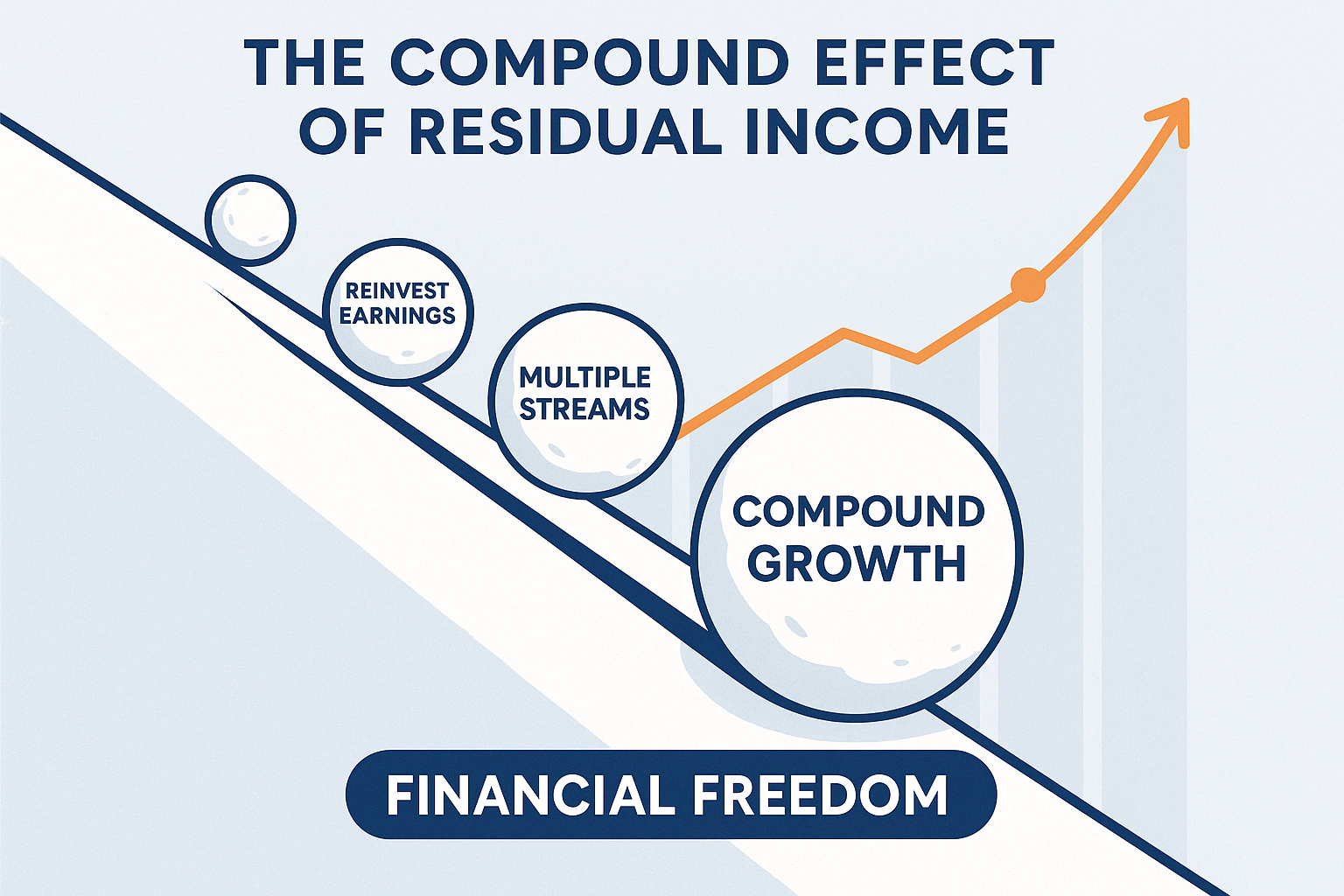

- The key to success is starting small, staying consistent, and reinvesting earnings to compound your income over time

- Most people need multiple residual income streams to achieve significant financial freedom—diversification is essential

What Is Residual Income?

In simple terms, residual income means money you earn repeatedly from work you’ve done once.

Think of it like planting a fruit tree. You put in the hard work upfront, digging the hole, planting the seed, watering it regularly, and nurturing its growth. But once that tree matures, it produces fruit year after year with minimal maintenance. That’s residual income in a nutshell. Morningstar: Dividend Investing Insights

The financial industry sometimes uses “residual income” in different contexts. Lenders might use it to describe the money you have left after paying all your debts and obligations. But for our purposes, and for most people building wealth, residual income refers to recurring revenue streams that continue generating money with little to no ongoing effort.

Residual Income vs Passive Income: What’s the Difference?

You’ve probably heard these terms used interchangeably, and while they’re closely related, there’s a subtle distinction:

- Passive income is a broader term that includes any earnings requiring minimal active participation—this could include truly hands-off investments like index funds

- Residual income specifically refers to ongoing payments from work completed in the past—like royalties from a book you wrote years ago

For practical purposes, most residual income streams are also passive income streams. The key characteristic both share is that your earnings aren’t directly tied to your active time and effort on an ongoing basis.

Why Residual Income Matters for Your Financial Future

Let’s talk about why building residual income should be a priority in 2025 and beyond.

The Time-Money Trade-Off Problem

Traditional employment operates on a simple principle: you trade your time for money. Work 40 hours, get paid for 40 hours (Active Income). Miss a week, lose a week’s pay. This model has a fundamental limitation—there are only 24 hours in a day, and you can only sell so many of them. SEC: Investor Education Resources

Residual income breaks this limitation. Once established, these income streams can generate money while you:

- Sleep

- Vacation

- Spend time with family

- Pursue passion projects

- Focus on other business ventures

Financial Security and Freedom

Here’s a sobering statistic: according to the Federal Reserve’s 2024 Report on the Economic Well-Being of U.S. Households, nearly 40% of Americans would struggle to cover an unexpected $400 expense. That’s a financial fragility crisis.

Building residual income creates a safety net that protects you from:

- Job loss or career transitions

- Medical emergencies

- Economic downturns

- Unexpected expenses

More importantly, it gives you freedom—freedom to make career choices based on passion rather than necessity, freedom to retire earlier, and freedom to live life on your own terms. Time Value Of Money (TVM)

Types of Residual Income: Proven Strategies That Work

Let’s explore the most effective ways to build residual income in 2025. Each method has different requirements for upfront investment (time, money, or both) and varying levels of ongoing maintenance.

1. Dividend-Paying Stocks and Index Funds

What it is: Investing in companies that share their profits with shareholders through regular dividend payments.

Upfront investment: Money (can start with as little as $100)

Ongoing effort: Minimal (especially with dividend reinvestment plans)

Dividend investing is one of the most accessible forms of residual income. When you own shares in dividend-paying companies, you receive regular payments (typically quarterly) simply for being a shareholder.

Example: If you invest $10,000 in a diversified portfolio of dividend stocks yielding 4% annually, you’d earn $400 per year in dividends—without selling a single share. As companies increase their dividends over time and you reinvest those payments, your income grows through compounding.

Start earning passive income through dividend investing by opening a brokerage account and selecting quality dividend stocks or low-cost index funds that focus on dividend growth.

Pros:

- Highly liquid—can sell anytime

- Historically proven wealth-building strategy

- Tax advantages (qualified dividends taxed at lower rates)

- Compounds over time through reinvestment

Cons:

- Requires initial capital

- Market volatility can affect stock prices

- Dividends aren’t guaranteed (companies can cut them)

Looking for opportunities? Check out these high dividend stocks that have consistently rewarded shareholders.

2. Real Estate Rental Income

What it is: Owning property and collecting rent from tenants.

Upfront investment: Significant capital (down payment, closing costs) or time (if house-hacking)

Ongoing effort: Low to moderate (depending on property management approach)

Real estate has created more millionaires than perhaps any other investment vehicle. Rental properties provide monthly income while the property potentially appreciates.

Real-world story: Sarah, a teacher in Austin, Texas, bought a duplex in 2019 for $280,000 with a 20% down payment ($56,000). She lives in one unit and rents the other for $1,500/month. After her mortgage payment of $1,100, insurance, taxes, and maintenance reserves, she nets about $200/month in cash flow—plus her tenants are essentially paying her mortgage, building her equity automatically.

Pros:

- A tangible asset that typically appreciates

- Multiple profit sources (rental income + appreciation + tax benefits)

- Leverage allows control of expensive assets with less capital

- Inflation hedge (rents typically rise with inflation)

Cons:

- High barrier to entry (capital required)

- Property management can be time-consuming

- Tenant issues, vacancies, and repairs

- Less liquid than stocks

Alternative: If direct ownership seems daunting, consider Real Estate Investment Trusts (REITs), which allow you to invest in real estate portfolios and receive dividend income without property management responsibilities.

3. Digital Products and Online Courses

What it is: Creating educational content, templates, software, or courses that customers can purchase repeatedly.

Upfront investment: Time and expertise (minimal money)

Ongoing effort: Low after initial creation (occasional updates)

The digital economy has democratized content creation. If you have knowledge or skills others want to learn, you can package that into products that sell while you sleep.

Examples of digital products:

- Online courses (video lessons, workbooks)

- E-books and guides

- Templates (spreadsheets, design files, business documents)

- Stock photography or graphics

- Mobile apps or software tools

- Membership sites with exclusive content

Case study: Jessica, a graphic designer, created a pack of 50 Instagram story templates and sells them for $29 on Etsy. After spending about 40 hours creating the templates, she’s sold over 1,200 copies in two years—earning over $34,000 from that initial time investment.

Pros:

- Extremely scalable (sell unlimited copies)

- Low overhead costs

- Creative freedom

- No inventory or shipping concerns

Cons:

- Significant upfront time investment

- Competitive marketplace

- Requires marketing skills

- May need periodic updates

4. Affiliate Marketing

What it is: Earning commissions by promoting other companies’ products or services.

Upfront investment: Time (building audience and content)

Ongoing effort: Moderate (content creation and audience engagement)

Affiliate marketing allows you to earn residual income by recommending products you believe in. When someone purchases through your unique affiliate link, you earn a commission.

How it works:

- Join affiliate programs (Amazon Associates, ShareASale, individual company programs)

- Create content (blog posts, videos, social media) featuring products

- Include your unique affiliate links

- Earn commissions when people purchase through your links

Example: A personal finance blogger writes a comprehensive review of budgeting apps. She includes affiliate links to her top three recommendations. That single blog post, written once, continues generating affiliate commissions months or years later as new readers discover it through search engines.

Pros:

- No product creation required

- No customer service responsibilities

- Wide variety of products to promote

- Can be combined with existing content creation

Cons:

- Income depends on audience size

- Commission rates vary widely

- Some programs have strict rules

- Requires disclosure and transparency

5. Royalties (Intellectual Property)

What it is: Earning ongoing payments from creative works like books, music, patents, or trademarks.

Upfront investment: Time, creativity, and sometimes legal fees

Ongoing effort: Minimal after creation

Royalties represent the classic form of residual income. Create something once, earn from it repeatedly.

Types of royalties:

- Book royalties: Authors earn 10-70% per book sold (higher for self-published)

- Music royalties: Songwriters and artists earn when their music is played, streamed, or licensed

- Patent royalties: Inventors earn when companies license their inventions

- Trademark licensing: Brand owners earn when others use their brands

Inspiration: J.K. Rowling wrote the first Harry Potter book as a struggling single mother. That creative work, and the series that followed, continues generating millions in royalties decades later through book sales, movie rights, merchandise licensing, and theme park attractions.

Pros:

- Can generate income for decades

- Potential for massive upside

- Creative fulfillment

- Can be passed to heirs

Cons:

- Highly competitive fields

- Success is unpredictable

- May require legal protection (patents, copyrights)

- Income can be inconsistent

6. Building a Blog or YouTube Channel

What it is: Creating content that generates income through advertising, sponsorships, and affiliate marketing.

Upfront investment: Time (significant)

Ongoing effort: Moderate to high initially, then decreasing

Content creation platforms allow you to build audiences and monetize through multiple streams simultaneously. For those interested in building wealth through content, explore these smart ways to make passive income.

Monetization methods:

- Display advertising (Google AdSense, Mediavine)

- Sponsored content

- Affiliate marketing

- Digital product sales

- Membership/subscription content

Reality check: Building a successful blog or YouTube channel takes time—typically 12-24 months before seeing significant income. But once established, older content continues generating revenue with minimal updates.

Pros:

- Multiple income streams from one platform

- Builds personal brand

- Low startup costs

- Creative outlet

Cons:

- Takes considerable time to build

- Algorithm changes can impact traffic

- Requires consistent content creation initially

- Income can fluctuate

How to Build Residual Income: A Step-by-Step Action Plan

Ready to start building your own residual income streams? Here’s a practical roadmap for beginners.

Step 1: Assess Your Resources (Time, Money, Skills)

Before diving in, honestly evaluate what you have to invest:

If you have more time than money:

- Focus on content creation (blogging, YouTube, digital products)

- Develop skills that can generate future income

- Consider affiliate marketing or freelancing that can transition to residual income

If you have more money than time:

- Invest in dividend stocks or index funds

- Consider REITs or crowdfunded real estate

- Hire others to create digital products for you

If you have specialized skills:

- Create online courses teaching your expertise

- Write an e-book in your field

- Develop tools or templates for your industry

Step 2: Start Small and Test

“The best time to plant a tree was 20 years ago. The second-best time is now.” — Chinese Proverb

Don’t wait for perfect conditions. Start with one manageable residual income project:

- Invest $100/month in dividend stocks

- Write one e-book

- Create one online course

- Start a blog and publish weekly

The goal is to learn by doing rather than getting paralyzed by analysis.

Step 3: Be Consistent and Patient

Here’s the truth about residual income that nobody likes to hear: it takes time.

Most successful residual income streams follow this pattern:

Months 1-6: Heavy effort, minimal income (the “planting” phase)

Months 6-12: Continued effort, small income starting (the “sprouting” phase)

Months 12-24: Decreasing effort, growing income (the “growing” phase)

24+ months: Minimal effort, significant income (the “harvesting” phase)

Understanding the cycle of market emotions can help you stay committed during the difficult early stages when results seem slow.

Step 4: Reinvest and Scale

When your residual income starts flowing, resist the temptation to spend it all. Instead:

- Reinvest dividends to buy more shares (compound growth)

- Use profits from one digital product to create another

- Expand successful affiliate partnerships

- Diversify into new income streams

This reinvestment accelerates your progress exponentially.

Step 5: Diversify Your Income Streams

The wealthiest individuals rarely rely on a single income source. Aim to build 3-5 different residual income streams over time.

Sample diversified residual income portfolio:

- 40% dividend stocks and index funds

- 25% rental property or REITs

- 20% digital products or online courses

- 10% affiliate marketing

- 5% royalties or other

This diversification protects you if one stream underperforms and creates multiple paths to financial freedom.

💰 Residual Income Growth Calculator

See how your residual income can grow over time with consistent investment

Common Mistakes to Avoid When Building Residual Income

Learning from others’ mistakes can save you years of frustration. Here are the most common pitfalls:

1: Expecting Overnight Results

The problem: Many beginners expect residual income to flow immediately and quit when it doesn’t happen within weeks.

The reality: Building meaningful residual income typically takes 12-24 months minimum. The most successful income streams often take 3-5 years to fully mature.

The solution: Set realistic expectations and focus on the process, not just the outcome. Celebrate small wins along the way.

2: Putting All Eggs in One Basket

The problem: Investing everything into a single residual income strategy.

The reality: Markets change, algorithms shift, and what works today might not work tomorrow. Diversification protects against these changes.

The solution: Build multiple income streams across different categories. If one underperforms, others can compensate.

3: Neglecting Quality for Quantity

The problem: Creating dozens of low-quality products or investments, hoping something sticks.

The reality: One high-quality residual income stream often outperforms ten mediocre ones. Quality attracts and retains customers, viewers, or tenants.

The solution: Focus on excellence in fewer areas rather than spreading yourself too thin.

4: Failing to Reinvest Early Earnings

The problem: Spending initial residual income instead of reinvesting it.

The reality: The power of compound growth is strongest in the early years. Spending early earnings significantly delays financial freedom.

The solution: Commit to reinvesting at least 80% of residual income for the first 3-5 years. Understanding why the stock market goes up over time can help you stay committed to reinvestment strategies.

5: Ignoring Tax Implications

The problem: Not understanding how different residual income streams are taxed.

The reality: Tax treatment varies significantly:

- Qualified dividends: 0-20% federal tax

- Rental income: Taxed as ordinary income (but with deductions)

- Royalties: Taxed as ordinary income

- Capital gains: 0-20% for long-term holdings

The solution: Consult with a tax professional to optimize your strategy. Use tax-advantaged accounts (IRAs, 401(k)s) when possible.

6: Not Tracking Performance

The problem: Building income streams without monitoring their performance.

The reality: You can’t improve what you don’t measure. Successful residual income builders track every stream’s ROI, time investment, and growth trajectory.

The solution: Create a simple spreadsheet tracking each income stream’s monthly performance. Review quarterly and adjust your strategy based on data.

Key Risks and Challenges in Building Residual Income

Every investment and business venture carries risks. Understanding these challenges helps you prepare and mitigate them.

Market and Economic Risks

Stock market volatility: Dividend stocks can lose value during downturns, even while paying dividends. Many people lose money in the stock market due to emotional reactions to volatility.

Mitigation strategy: Invest for the long term (10+ years), diversify across sectors, and don’t panic sell during downturns.

Real estate market cycles: Property values can decline, and rental markets can soften during recessions.

Mitigation strategy: Buy in strong markets with diverse economies, maintain cash reserves for vacancies, and focus on cash flow rather than appreciation.

Time and Effort Underestimation

Many residual income strategies require more upfront work than anticipated:

- A “simple” e-book might take 100+ hours to write, edit, and market

- Building a blog to monetization levels requires 50-100+ quality posts

- Creating a profitable online course demands significant time in production and marketing

Mitigation strategy: Start with realistic time estimates and add 50% buffer. Track your actual time investment to improve future planning.

Competition and Market Saturation

Popular residual income strategies attract competition:

- Thousands of new blogs launch daily

- Digital product marketplaces are crowded

- Quality dividend stocks are widely known

Mitigation strategy: Find your unique angle, serve a specific niche, and focus on building genuine value rather than copying others.

Regulatory and Platform Changes

External factors beyond your control can impact income:

- YouTube algorithm changes affecting ad revenue

- Amazon is reducing affiliate commission rates

- Tax law changes affecting dividend taxation

- Rental regulations limiting short-term rentals

Mitigation strategy: Stay informed about industry changes, diversify across platforms, and maintain flexibility to adapt your strategy.

How to Interpret and Use Residual Income in Financial Planning

Residual income isn’t just about earning extra money—it’s a tool for achieving specific financial goals. Here’s how to integrate it into your broader financial plan.

Setting Income Targets

Work backward from your goals:

Example goal: Replace $5,000/month employment income within 10 years

Required residual income: $5,000/month or $60,000/year

Possible portfolio mix:

- $300,000 in dividend stocks at 4% yield = $12,000/year ($1,000/month)

- $200,000 rental property equity generating 8% cash-on-cash return = $16,000/year ($1,333/month)

- Digital products generating $1,500/month = $18,000/year

- Affiliate marketing generating $800/month = $9,600/year

- Online course generating $500/month = $6,000/year

Total: $61,600/year ($5,133/month)

The 25x Rule for Financial Independence

A common benchmark in the FIRE (Financial Independence, Retire Early) community is the 25x rule:

To live off residual income indefinitely, you need 25 times your annual expenses invested in income-generating assets.

Example: If your annual expenses are $50,000, you’d need $1,250,000 in residual income-producing assets (assuming 4% withdrawal rate).

This might seem daunting, but remember:

- You don’t need to reach this all at once

- Every $1,000 invested is $40/year in residual income (at 4%)

- Compound growth accelerates over time

- Multiple income streams add up

Measuring Progress: Key Metrics

Track these metrics to gauge your residual income journey:

| Metric | What It Measures | Target |

|---|---|---|

| Monthly Residual Income | Total passive earnings per month | Gradually increasing |

| Income Coverage Ratio | Residual income ÷ Monthly expenses | 100%+ for financial freedom |

| Time to Income Ratio | Hours worked ÷ Income generated | Decreasing over time |

| Diversification Score | Number of independent income streams | 3-5 streams |

| Reinvestment Rate | % of residual income reinvested | 80%+ in early years |

| Year-over-Year Growth | This year’s income vs. last year’s | 20%+ annually |

Real-World Example: Building $3,000/Month in Residual Income

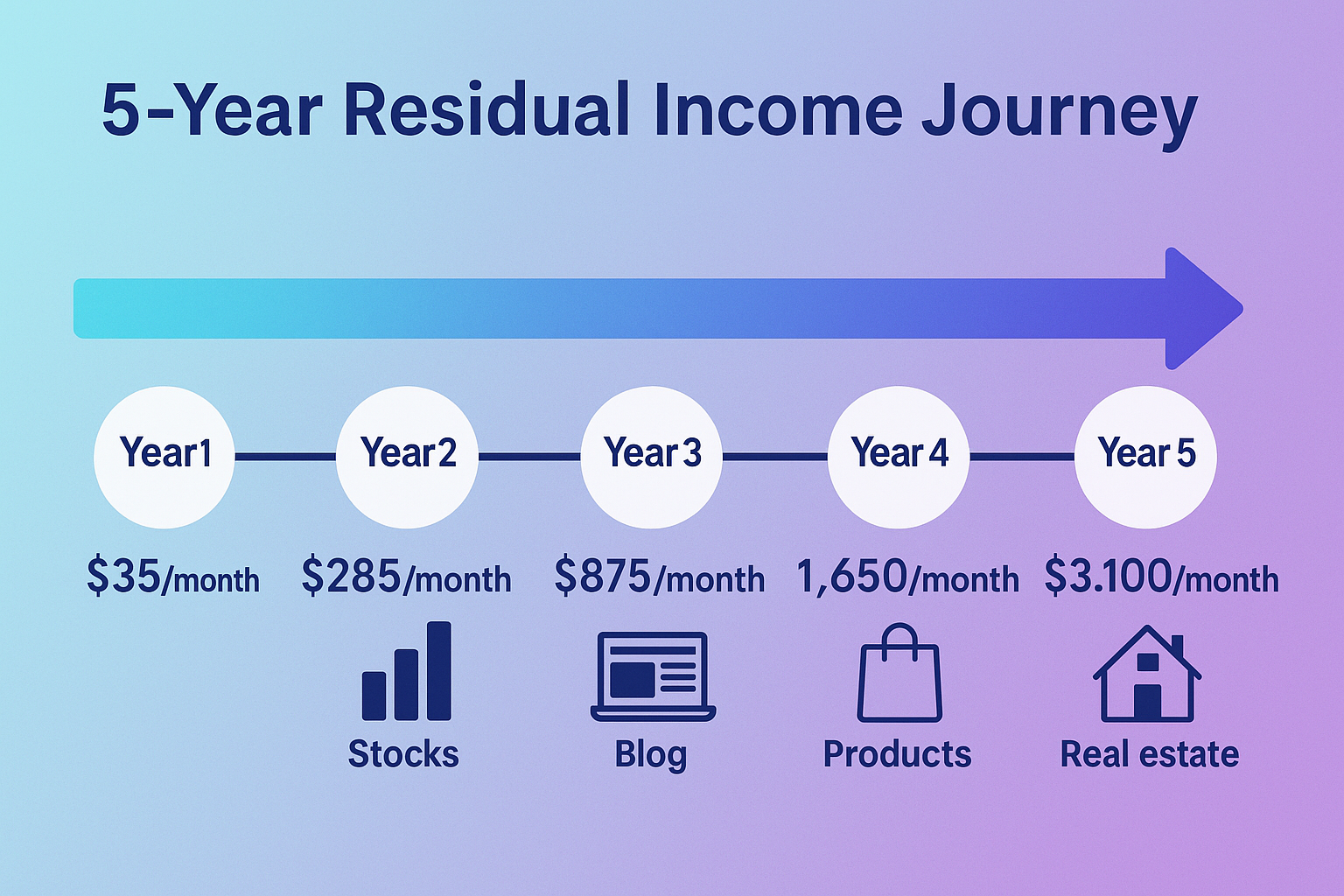

Let’s walk through a realistic scenario of someone building substantial residual income over five years.

Meet Alex: A 32-year-old marketing professional earning $65,000/year with $10,000 saved and the ability to invest $800/month.

Year 1: Foundation Building

- Action: Invested $10,000 in dividend ETFs + $500/month ongoing

- Action: Started a personal finance blog (10 hours/week)

- Action: Created first digital product (budgeting template)

- Residual Income: $35/month (dividends only)

- Total Invested: $16,000

Year 2: Expansion

- Action: Continued dividend investing ($600/month)

- Action: Blog reached 10,000 monthly visitors

- Action: Launched affiliate partnerships

- Action: Created second digital product (course)

- Residual Income: $285/month ($80 dividends + $150 affiliates + $55 digital products)

- Total Invested: $23,200

Year 3: Acceleration

- Action: Dividend portfolio now $30,000 ($600/month contributions)

- Action: Blog monetized with display ads

- Action: Digital products gaining traction

- Action: Started YouTube channel (repurposing blog content)

- Residual Income: $875/month ($100 dividends + $320 affiliates + $280 digital products + $175 ads)

- Total Invested: $37,400

Year 4: Diversification

- Action: Dividend portfolio $47,000 ($600/month contributions)

- Action: Purchased first rental property (house hack)

- Action: Blog and YouTube are both growing

- Action: Launched membership community

- Residual Income: $1,650/month ($157 dividends + $450 affiliates + $520 digital products + $300 ads + $223 rental income)

- Total Invested: $54,600 (stocks) + $40,000 (real estate down payment)

Year 5: Optimization

- Action: Dividend portfolio $65,000 ($700/month contributions)

- Action: Rental property cash-flowing well

- Action: Automated and optimized digital products

- Action: Multiple income streams established

- Residual Income: $3,100/month ($217 dividends + $780 affiliates + $950 digital products + $520 ads + $633 rental income)

- Total Portfolio: $73,400 (stocks) + ~$50,000 (real estate equity)

Key lessons from Alex’s journey:

- Started with what was available (time + modest capital)

- Stayed consistent despite slow initial progress

- Reinvested earnings to accelerate growth

- Diversified across multiple income types

- Leveraged skills (marketing) to create digital products

- Combined active income (job) with passive building

For parents thinking long-term, consider how these strategies could help you make your kid a millionaire through early financial education and smart investing.

Tax Considerations for Residual Income

Understanding the tax implications of your residual income is crucial for maximizing your actual take-home earnings.

Different Tax Treatments by Income Type

Qualified Dividend Income:

- Taxed at 0%, 15%, or 20% (based on income level)

- Significantly lower than ordinary income tax rates

- Requires holding stocks for specific periods

Rental Income:

- Taxed as ordinary income

- BUT can deduct: mortgage interest, property taxes, insurance, repairs, depreciation

- Depreciation is a “paper loss” that reduces taxable income without a cash outflow

- Potential for significant tax advantages

Royalties and Digital Product Sales:

- Generally taxed as ordinary income

- Can deduct business expenses (software, marketing, hosting)

- May qualify for 20% Qualified Business Income (QBI) deduction

Capital Gains (from selling appreciated assets):

- Short-term (< 1 year): Taxed as ordinary income

- Long-term (> 1 year): Taxed at 0%, 15%, or 20%

Tax-Advantaged Strategies

Use retirement accounts:

- Dividend stocks in a Roth IRA = tax-free growth and withdrawals

- Traditional IRA/401(k) = tax-deferred growth

- Health Savings Account (HSA) = triple tax advantage

Harvest tax losses:

- Sell losing investments to offset gains

- Reduces overall tax burden

- Can deduct up to $3,000 in net losses against ordinary income

Maximize deductions:

- Home office deduction for content creation

- Equipment and software for digital products

- Education expenses for skill development

Consult professionals:

- Tax laws change frequently

- A good CPA can save more than their fee

- Tax planning should be proactive, not reactive

Note: This is general information. Consult with a qualified tax professional for advice specific to your situation.

Conclusion: Your Roadmap to Financial Freedom Through Residual Income

Building residual income isn’t about getting rich quickly—it’s about getting rich for sure. It’s the difference between trading your time for money indefinitely and creating systems that generate money while you sleep, travel, spend time with loved ones, or pursue your passions.

The journey requires patience, consistency, and strategic thinking. But the payoff—true financial freedom—is worth every hour invested and every dollar saved.

Your Next Steps: Taking Action Today

Don’t let this be another article you read and forget. Take action with these concrete next steps:

This Week:

- Choose ONE residual income strategy that aligns with your current resources (time or money)

- Open a brokerage account if investing in dividends, or outline your first digital product if creating content

- Set up a simple tracking system (spreadsheet) to monitor your progress

This Month:

- Make your first investment or create your first piece of residual income content

- Set up automatic monthly contributions or schedule dedicated creation time

- Learn from others—read books, join communities, find mentors in your chosen strategy

This Year:

- Establish your first residual income stream generating at least $100/month

- Begin planning your second income stream for diversification

- Track your progress and celebrate milestones

Within 5 Years:

- Build 3-5 different residual income streams

- Reach 25-50% expense coverage from residual income

- Reinvest consistently to compound your growth

Remember: The best time to start building residual income was ten years ago. The second-best time is today.

The Power of Compounding Effort

Just as compound interest works on money, compound effort works on skills and systems. Every blog post you write improves your writing. Every investment you make teaches you about markets. Every digital product you create sharpens your marketing skills.

These compounding skills make each subsequent residual income stream easier and more profitable than the last.

Final Thoughts

Financial freedom isn’t about never working again—it’s about having the choice. Residual income gives you that choice. It’s the choice to pursue work you love rather than work you need. It’s the choice to spend Tuesday afternoon at your kid’s school play instead of in a meeting. It’s the choice to take a sabbatical, start a business, or retire early.

That choice is available to you. It starts with a single step, a single investment, a single piece of content. Start building your residual income today, and your future self will thank you.

For more strategies on building wealth and making smart moves with your money, explore additional resources on our blog.

FAQ

Residual income specifically refers to ongoing payments from work completed in the past (like royalties or recurring commissions), while passive income is a broader term encompassing any earnings requiring minimal active participation, including investments. In practice, most residual income streams are also passive income streams, and the terms are often used interchangeably.

You can start building residual income with as little as $0 if you choose time-based strategies like content creation or digital products. For investment-based approaches, you can begin dividend investing with $100-$500 through fractional shares. The key is starting with what you have—whether that’s time, money, or specialized skills.

Most residual income streams take 12-24 months to generate noticeable income and 3-5 years to produce substantial cash flow. The timeline depends on your chosen strategy, consistency, and reinvestment approach. Content-based strategies often take longer initially but can scale significantly. Investment-based strategies grow more predictably through compounding.

A healthy financial goal is to cover 25-50% of your expenses with residual income within 5 years, and 100% within 10-15 years. However, this varies based on income level, savings rate, and lifestyle. Track your “income coverage ratio” (residual income ÷ monthly expenses) as a key metric.

Absolutely—most people build residual income while maintaining full-time employment. In fact, having a stable employment income allows you to invest consistently and take a long-term approach without pressure. Start with strategies that require limited time (like dividend investing) or dedicate 5-10 hours weekly to content creation or digital products.

The best starter strategies are: (1) Dividend-paying index funds—simple, proven, and requires minimal expertise; (2) Affiliate marketing—leverages existing content or audience; (3) Digital templates or simple products—one-time creation, unlimited sales. Choose based on whether you have more time or money to invest initially.

Honest answer: Most “passive” income requires some ongoing maintenance—monitoring investments, updating content, managing tenants, or handling customer questions. However, the work-to-income ratio is dramatically better than active income. A well-established residual income stream might require 1-5 hours monthly compared to the 160+ hours of full-time employment.

Disclaimer

This article is for educational purposes only and does not constitute financial, investment, tax, or legal advice. Residual income strategies involve varying degrees of risk, and past performance does not guarantee future results. The examples and scenarios presented are for illustrative purposes and may not reflect actual results.

Before making any investment decisions or pursuing residual income strategies, consult with qualified financial advisors, tax professionals, and legal counsel who understand your specific situation. The author and publisher are not responsible for any financial decisions made based on this content.

Individual results will vary based on effort, market conditions, timing, and countless other factors. Building residual income requires patience, persistence, and often significant upfront investment of time or capital with no guarantee of success.

About the Author

Written by Max Fonji — With over a decade of experience in personal finance, investing, and wealth building, Max is your go-to source for clear, data-backed financial education. Through TheRichGuyMath.com, Max has helped thousands of readers understand complex financial concepts and take actionable steps toward financial freedom. His mission is to make sophisticated wealth-building strategies accessible to everyone, regardless of their starting point.