Picture this: You’ve just finished your first full year running a small online business. After paying all your expenses, you made $50,000 in profit. Now comes the big question: do you pocket all that cash, or do you reinvest some of it back into growing the business? This exact dilemma plays out in boardrooms across America every single day, from tiny startups to massive corporations like Apple and Microsoft.

The money that companies choose to keep rather than distribute to shareholders is called retained earnings, and understanding this concept is absolutely crucial whether you’re an investor, business owner, or just someone trying to make smarter financial decisions.

Retained earnings represent the cumulative net income a company has kept and reinvested in the business rather than paying out as dividends. Think of it as the company’s savings account, money set aside to fuel future growth, pay down debt, or cushion against tough times. For investors looking to build wealth through the stock market, understanding retained earnings can reveal whether a company is positioned for long-term growth or simply treading water. Investopedia – Retained Earnings

Key Takeaways

- Retained earnings are the cumulative profits a company has kept and reinvested rather than distributed to shareholders as dividends.

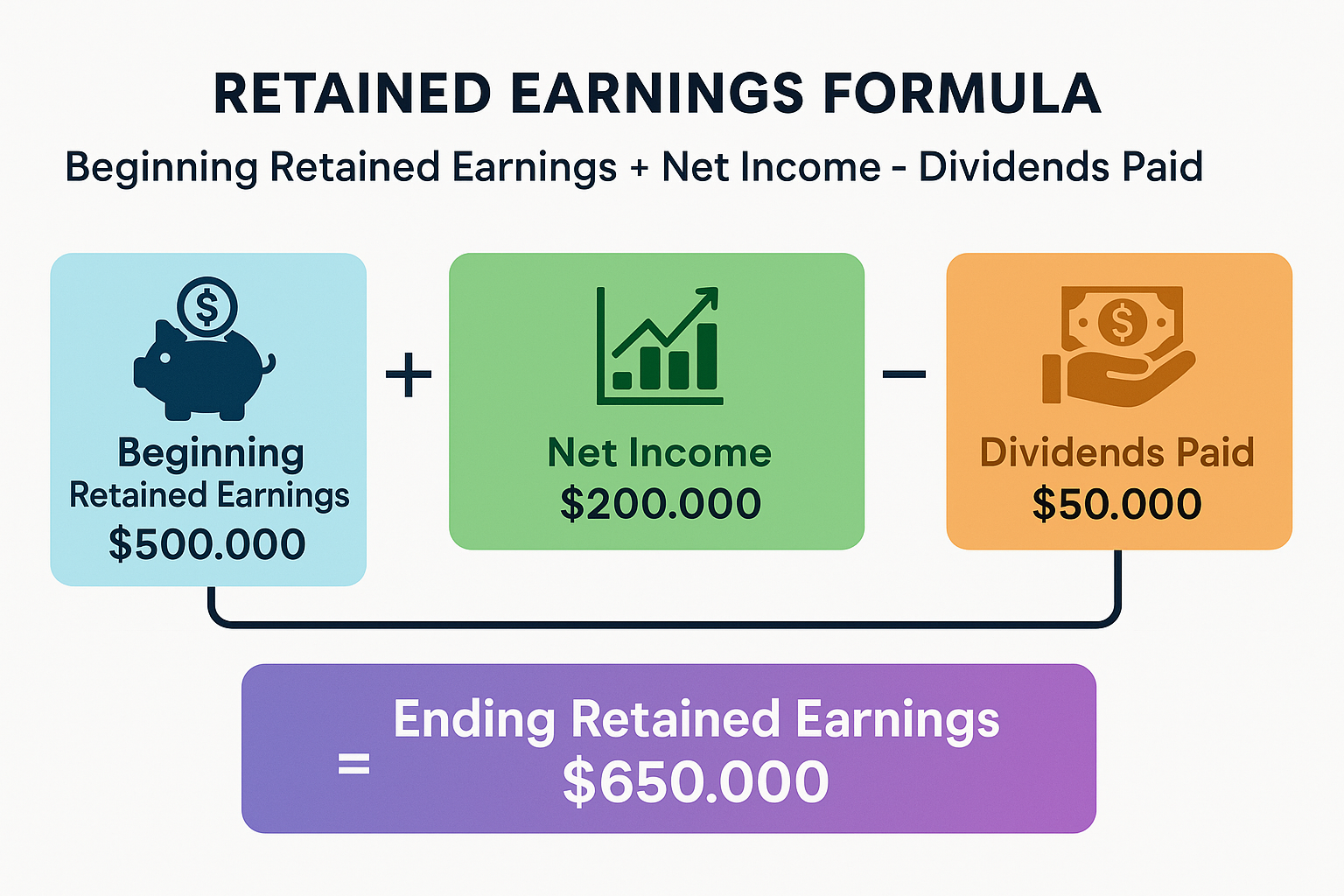

- The retained earnings formula is: Beginning RE + Net Income – Dividends Paid = Ending RE..

- Positive retained earnings typically signal financial health and growth potential, while negative retained earnings (accumulated deficit) may indicate ongoing loss

- Companies use retained earnings to fund expansion, research and development, debt repayment, and building cash reserves.

- Investors should analyze retained earnings alongside other metrics to evaluate a company’s financial strength and management effectiveness.

What Are Retained Earnings?

Retained earnings (sometimes called accumulated earnings or earned surplus) represent the portion of a company’s net profit that isn’t distributed to shareholders as dividends. Instead, this money stays within the company to be reinvested in business operations, expansion, debt reduction, or held as a financial cushion.

Every time a company closes its books at the end of a quarter or year, it must decide what to do with its profits. The company has essentially two choices:

- Distribute profits to shareholders in the form of dividends

- Retain profits within the business for future use

The money that gets retained accumulates over time, creating a running total that appears on the company’s balance sheet under shareholders’ equity. This cumulative figure represents all the profits the company has kept since its inception, minus any losses and dividends paid out.

Where Do Retained Earnings Appear?

You’ll find retained earnings on a company’s balance sheet under the shareholders’ equity section. This placement is significant; retained earnings are part of what the company “owes” to its shareholders, even though the money stays in the business.

Here’s a simplified example of how it appears:

| Balance Sheet Section | Item | Amount |

|---|---|---|

| Shareholders’ Equity | Common Stock | $100,000 |

| Additional Paid-In Capital | $250,000 | |

| Retained Earnings | $450,000 | |

| Total Shareholders’ Equity | $800,000 |

The Retained Earnings Formula: How to Calculate It

The retained earnings formula is refreshingly straightforward, making it accessible even for beginners. Here’s the basic equation:

Retained Earnings Formula

Retained Earnings (Ending) = Retained Earnings (Beginning) + Net Income - Dividends PaidLet’s break down each component:

- Beginning Retained Earnings: The retained earnings balance from the end of the previous period (this becomes your starting point)

- Net Income: The company’s total profit for the current period (found on the income statement)

- Dividends Paid: Any cash or stock dividends distributed to shareholders during the period

Retained Earnings Calculation Example

Let’s walk through a real-world scenario. Imagine a company called TechStart Inc. with the following financials for 2025:

- Beginning retained earnings (from Dec 31, 2024): $500,000

- Net income for 2025: $200,000

- Dividends paid in 2025: $50,000

Using our formula:

Retained Earnings (Ending) = $500,000 + $200,000 – $50,000 = $650,000

TechStart Inc. would report $650,000 in retained earnings on its December 31, 2025, balance sheet. This $150,000 increase ($650,000 – $500,000) represents the company’s profit that was reinvested rather than distributed.

What If There’s a Net Loss?

The formula works the same way, but a net loss (negative net income) will reduce retained earnings. For example:

- Beginning retained earnings: $500,000

- Net loss for the period: -$100,000

- Dividends paid: $0

Retained Earnings (Ending) = $500,000 + (-$100,000) – $0 = $400,000

The company’s retained earnings decreased by $100,000 due to the loss.

Understanding the Statement of Retained Earnings

The statement of retained earnings is a financial document that shows how retained earnings changed during a specific accounting period. While it’s one of the shorter financial statements, it provides valuable insights into a company’s profit distribution strategy.

Components of a Statement of Retained Earnings

Here’s what you’ll typically see:

- Beginning retained earnings balance

- Add: Net income (or subtract net loss)

- Subtract: Dividends declared

- Subtract: Prior period adjustments (if any)

- Ending retained earnings balance

Sample Statement of Retained Earnings

TechStart Inc.

Statement of Retained Earnings

For the Year Ended December 31, 2025

| Item | Amount |

|---|---|

| Retained Earnings, January 1, 2025 | $500,000 |

| Add: Net Income for 2025 | $200,000 |

| Less: Cash Dividends Declared | ($50,000) |

| Retained Earnings, December 31, 2025 | $650,000 |

This statement connects the income statement (through net income) to the balance sheet (where the ending retained earnings appear), making it a crucial bridge in understanding a company’s complete financial picture.

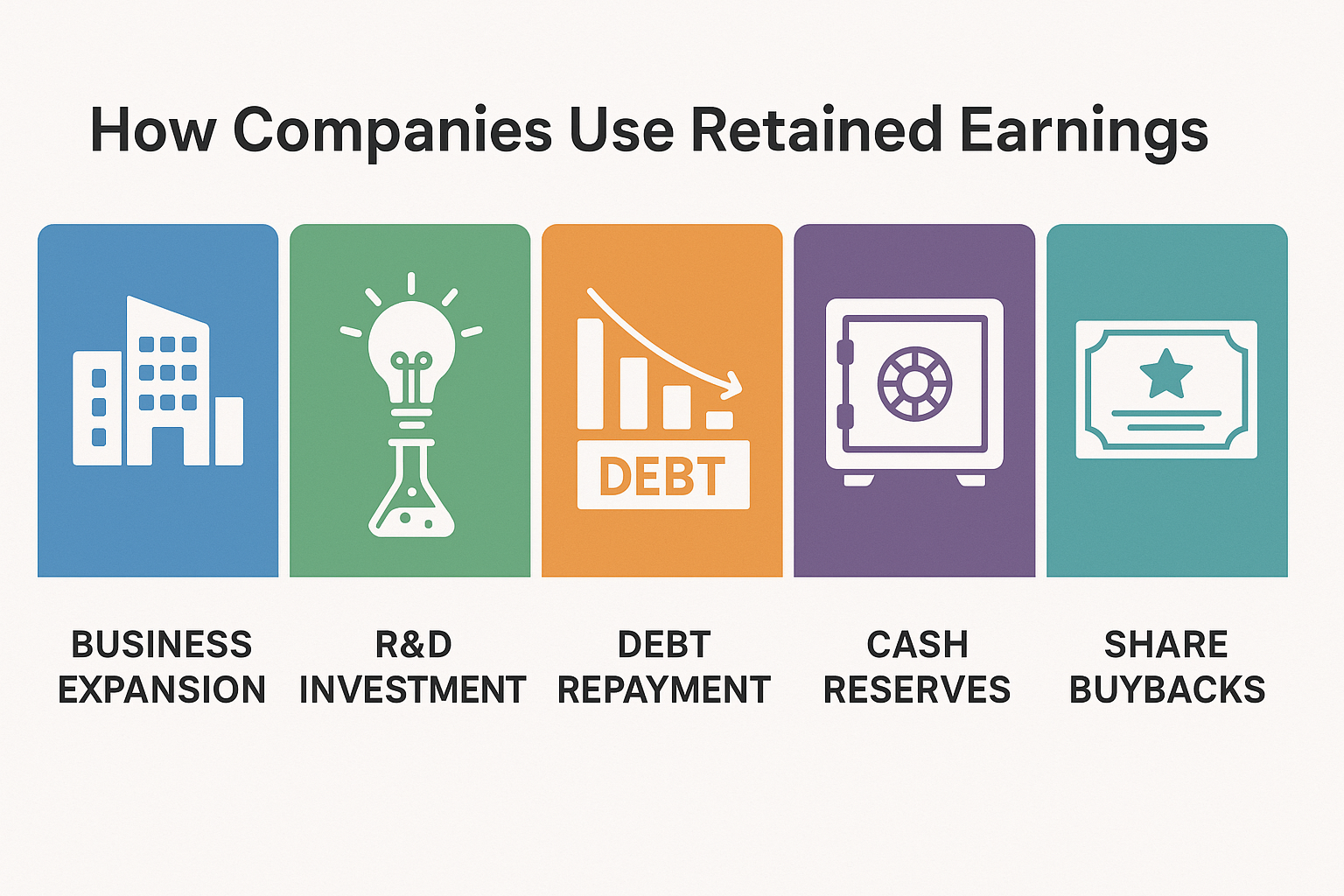

What Are Retained Earnings Used For?

Understanding how companies use retained earnings is just as important as knowing what they are. Smart deployment of retained earnings can create tremendous shareholder value, while poor use can signal management problems. www.sec.gov

1. Business Expansion and Growth

Companies often use retained earnings to fund expansion projects without taking on debt or diluting existing shareholders by issuing new stock. This might include:

- Opening new locations or facilities

- Entering new markets or geographic regions

- Launching new product lines

- Acquiring other businesses

Real-world example: Amazon famously reinvested nearly all its profits for decades to build its massive logistics network, cloud computing infrastructure, and expand into new markets. This strategy of retaining earnings rather than paying dividends created enormous long-term value for shareholders.

2. Research and Development (R&D)

Technology and pharmaceutical companies especially rely on retained earnings to fund R&D initiatives that might not pay off for years. This investment is critical for maintaining competitive advantages and developing future revenue streams.

Companies like Apple, Google, and Pfizer allocate billions from retained earnings annually to develop new products, improve existing ones, and stay ahead of competitors.

3. Debt Repayment

Using retained earnings to pay down debt improves a company’s financial health by:

- Reducing interest expenses

- Improving debt-to-equity ratios

- Increasing financial flexibility

- Lowering financial risk

This conservative approach can be particularly attractive during economic uncertainty or when interest rates are high.

4. Building Cash Reserves

Some companies prefer to hold retained earnings as cash or cash equivalents, creating a financial cushion for:

- Economic downturns

- Unexpected opportunities

- Operational emergencies

- Competitive threats

Berkshire Hathaway, led by Warren Buffett, is famous for maintaining massive cash reserves from retained earnings, waiting patiently for attractive investment opportunities.

5. Share Buyback Programs

Instead of paying dividends, many companies use retained earnings to repurchase their own shares. This strategy:

- Reduces the number of outstanding shares

- Increases earnings per share (EPS)

- Can boost stock prices

- Provides tax advantages over dividends for shareholders

This has become increasingly popular among major corporations, particularly in the technology sector.

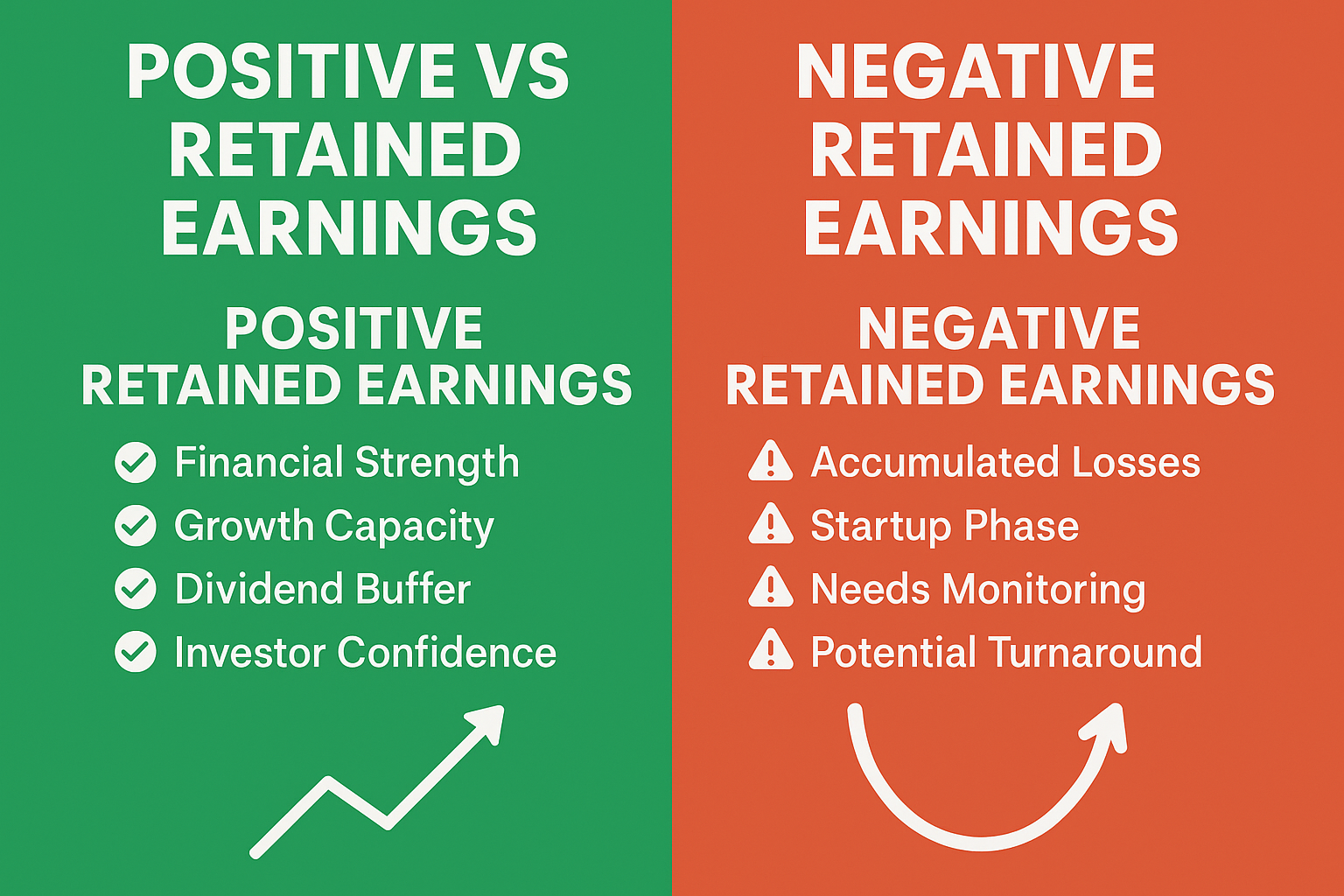

Positive vs Negative Retained Earnings: What They Mean

The sign (positive or negative) and size of retained earnings tell an important story about a company’s financial history and health.

Positive Retained Earnings

Positive retained earnings indicate that a company has generated cumulative profits over its lifetime that exceed any losses and dividends paid. This is generally a healthy sign suggesting:

- The business is profitable overall

- Management has successfully grown the company

- There are resources available for reinvestment

- The company has financial flexibility

Most established, successful companies have substantial positive retained earnings. For example, as of recent reports, Apple has retained earnings exceeding $100 billion.

Negative Retained Earnings (Accumulated Deficit)

Negative retained earnings, also called an accumulated deficit, occur when a company’s cumulative losses exceed its cumulative profits. This appears as a negative number on the balance sheet and can indicate:

- The company has experienced significant losses

- It’s a young startup still in growth mode

- The business model may be struggling

- Dividends may have exceeded total profits (rare)

Important context: Negative retained earnings aren’t always a red flag. Many successful companies started with years of losses before becoming profitable. Amazon, Tesla, and Uber all operated with negative retained earnings for years while building their businesses.

However, for mature companies, persistent negative retained earnings warrant scrutiny. Understanding why companies succeed or fail in the market can help investors spot warning signs early.

The Retained Earnings Trend Matters Most

Rather than focusing solely on whether retained earnings are positive or negative, smart investors look at the trend over time:

- Growing retained earnings: Suggests consistent profitability and reinvestment

- Declining retained earnings: May indicate losses, increased dividend payments, or share buybacks

- Volatile retained earnings: Could signal inconsistent profitability or changing dividend policies

How Investors Should Interpret Retained Earnings

For investors evaluating potential stock purchases or monitoring current holdings, retained earnings provide valuable clues about a company’s financial health and management strategy. Here’s how to analyze them effectively:

1. Compare to Industry Peers

Retained earnings figures are most meaningful when compared to similar companies in the same industry. A tech startup might reasonably have negative retained earnings while growing, but a mature utility company with negative retained earnings would be concerning.

2. Examine the Retention Ratio

The retention ratio (also called the plowback ratio) shows what percentage of earnings a company retains:

Retention Ratio = (Net Income - Dividends) / Net IncomeA high retention ratio suggests the company is reinvesting heavily in growth, while a low ratio indicates more cash is being returned to shareholders. Neither is inherently better; it depends on the company’s stage and industry.

3. Evaluate Return on Retained Earnings

The critical question isn’t just whether a company retains earnings, but how effectively it deploys them. Look at whether retained earnings are generating growth in:

- Revenue

- Profit margins

- Market share

- Stock price

- Shareholder value

If a company retains significant earnings but shows little growth, management may not be allocating capital effectively. Understanding market dynamics can help contextualize whether a company’s growth strategy makes sense.

4. Consider Your Investment Goals

Your investment strategy should influence how you view retained earnings:

- Income investors: May prefer companies with lower retained earnings and higher dividend payouts. Dividend investing strategies focus on companies that regularly distribute profits.

- Growth investors: Often favor companies that retain most earnings to fund expansion and innovation.

- Balanced investors: Look for companies that balance reinvestment with reasonable dividend payments.

5. Watch for Red Flags

Be cautious when you see:

- Retained earnings are growing, but revenue/profits are stagnant

- Large accumulated deficits in mature companies

- Frequent restatements of retained earnings

- Inconsistent dividend policies without a clear explanation

Retained Earnings vs Revenue vs Profit: Key Differences

Beginners often confuse retained earnings with revenue or profit. Let’s clarify these important distinctions:

Revenue (Sales)

Revenue is the total amount of money a company receives from selling goods or services before any expenses are deducted. It’s the “top line” on the income statement.

Example: A bakery sells $100,000 worth of bread and pastries in a year; that’s its revenue.

Net Income (Profit)

Net income is what remains after subtracting all expenses, taxes, and costs from revenue. It’s the “bottom line” on the income statement.

Example: The bakery had $100,000 in revenue but $70,000 in expenses (ingredients, rent, wages, etc.), leaving $30,000 in net income.

Retained Earnings

Retained earnings are the cumulative net income that has been retained in the business over time, minus dividends paid.

Example: The bakery’s $30,000 net income gets added to retained earnings. If the owners take $10,000 as dividends, retained earnings increase by $20,000 that year.

Quick Comparison Table

| Term | Definition | Where It Appears | Time Frame |

|---|---|---|---|

| Revenue | Total sales before expenses | Income Statement | Single period |

| Net Income | Profit after all expenses | Income Statement | Single period |

| Retained Earnings | Cumulative profits kept in business | Balance Sheet | Cumulative (all-time) |

Understanding these differences is fundamental to making smart investment decisions based on financial statements.

Retained Earnings and Dividends: The Balancing Act

One of management’s most important decisions is how to balance retaining earnings for growth versus distributing them as dividends to shareholders. This choice reflects the company’s priorities and growth stage.

The Dividend Payout Ratio

The dividend payout ratio shows what percentage of net income is paid out as dividends:

Dividend Payout Ratio = Dividends Paid / Net IncomeFor example:

- Net income: $1,000,000

- Dividends paid: $400,000

- Dividend payout ratio: 40%

This means 40% of profits go to shareholders, while 60% is retained (the retention ratio).

Different Dividend Strategies

High-growth companies (like many tech firms) typically:

- Retain most or all earnings

- Pay little or no dividends

- Prioritize reinvestment for rapid expansion

- Appeal to growth-oriented investors

Mature, stable companies (like utilities or consumer staples) typically:

- Distribute a larger portion of earnings as dividends

- Have slower growth rates

- Provide a steady income to shareholders

- Appeal to income-focused investors

Balanced companies maintain a middle ground, paying modest dividends while retaining enough for growth opportunities.

Can a Company Pay Dividends Without Retained Earnings?

Technically, yes, but it’s generally not advisable. Some companies may pay dividends even with negative retained earnings by:

- Using current period profits (even if cumulative earnings are negative)

- Borrowing money (risky and unsustainable)

- Returning capital to shareholders (different from dividend income)

However, paying dividends while carrying an accumulated deficit is often viewed as financially irresponsible and may even be restricted by loan covenants or regulations.

For investors seeking passive income through dividends, understanding a company’s retained earnings position is crucial for evaluating dividend sustainability.

Real-World Examples: Retained Earnings in Action

Let’s examine how different companies approach retained earnings to see these concepts in practice.

Example 1: Growth-Focused Tech Company

Company Profile: A software-as-a-service (SaaS) company in rapid expansion mode.

Financial Snapshot (2025):

- Beginning retained earnings: -$50,000,000 (accumulated deficit from startup years)

- Net income for 2025: $25,000,000 (first profitable year!)

- Dividends paid: $0

Calculation:

Ending retained earnings = -$50,000,000 + $25,000,000 – $0 = -$25,000,000

Interpretation: Despite turning profitable, this company still has negative retained earnings due to years of losses while building its platform. The trend is positive, and retaining all profits to fund growth makes sense at this stage. Investors would focus on revenue growth rates and the path to sustained profitability rather than the negative retained earnings figure.

Example 2: Mature Dividend-Paying Company

Company Profile: An established consumer goods manufacturer with steady sales.

Financial Snapshot (2025):

- Beginning retained earnings: $2,000,000,000

- Net income for 2025: $300,000,000

- Dividends paid: $180,000,000

Calculation:

Ending retained earnings = $2,000,000,000 + $300,000,000 – $180,000,000 = $2,120,000,000

Interpretation: This company pays out 60% of its profits as dividends while retaining 40% for maintenance, modest growth, and a financial cushion. The substantial positive retained earnings reflect decades of profitability. This profile appeals to investors seeking high dividend stocks with stable payouts.

Example 3: Turnaround Story

Company Profile: A retail chain recovering from several years of losses.

Financial Snapshot (2025):

- Beginning retained earnings: -$400,000,000

- Net income for 2025: $50,000,000 (third consecutive profitable year)

- Dividends paid: $0

Calculation:

Ending retained earnings = -$400,000,000 + $50,000,000 – $0 = -$350,000,000

Interpretation: While still showing an accumulated deficit, the improving trend suggests the turnaround strategy is working. The company wisely retains all profits to strengthen its balance sheet and fund modernization efforts. Investors would monitor whether profitability continues and how quickly the accumulated deficit shrinks.

Common Mistakes When Analyzing Retained Earnings

Even experienced investors sometimes misinterpret retained earnings. Avoid these common pitfalls:

1: Assuming Retained Earnings Equal Cash

The Reality: Retained earnings are an accounting measure, not a cash account. A company with $10 million in retained earnings might have very little cash if those earnings were used to buy equipment, inventory, or other assets.

What to do instead: Check the cash flow statement and balance sheet to see actual cash positions.

2: Thinking Negative Retained Earnings Always Mean Trouble

The Reality: Many successful companies started with years of accumulated deficits. Startups, in particular, often invest heavily before becoming profitable.

What to do instead: Consider the company’s stage, industry, and trend direction. Is the accumulated deficit shrinking or growing?

3: Ignoring Industry Context

The Reality: What’s normal for retained earnings varies dramatically by industry. Comparing a biotech startup to a utility company is like comparing apples to oranges.

What to do instead: Compare companies to industry peers and consider sector-specific factors.

4: Focusing Only on the Absolute Number

The Reality: A company with $1 billion in retained earnings might be doing worse than one with $100 million, depending on size, growth rate, and capital efficiency.

What to do instead: Look at retained earnings relative to total equity, total assets, and market capitalization. Examine trends over multiple periods.

5: Overlooking How Retained Earnings Are Used

The Reality: Simply retaining earnings doesn’t create value; how they’re deployed matters enormously.

What to do instead: Research what the company does with retained earnings. Are they funding profitable growth, or is the money sitting idle?

Retained Earnings and Business Life Cycle Stages

A company’s approach to retained earnings typically evolves through different life cycle stages:

Startup Stage

- Typical pattern: Negative retained earnings (accumulated deficit)

- Why: Heavy investment in product development, market entry, and infrastructure before revenue scales

- Investor focus: Growth metrics, market opportunity, path to profitability

Growth Stage

- Typical pattern: Retained earnings turning positive and growing rapidly

- Why: Revenue accelerating, profitability achieved, but reinvestment is still prioritized over dividends

- Investor focus: Revenue growth rates, market share gains, scalability

Maturity Stage

- Typical pattern: Large positive retained earnings, balanced dividend policy

- Why: Stable profitability, slower growth, focus on efficiency, and shareholder returns

- Investor focus: Dividend yield, stability, competitive moat strength

Decline Stage

- Typical pattern: Stagnant or declining retained earnings

- Why: Shrinking revenues, competitive pressures, and potentially increased dividends to return capital

- Investor focus: Turnaround potential, liquidation value, risk management

Understanding where a company sits in this lifecycle helps contextualize its retained earnings strategy. Recognizing market cycles and company stages is essential for making informed investment decisions.

How Retained Earnings Impact Stock Valuation

Retained earnings influence stock prices through several mechanisms:

1. Book Value Per Share

Retained earnings are a major component of shareholders’ equity, which determines book value:

Book Value Per Share = Shareholders' Equity / Shares OutstandingGrowing retained earnings increase book value, potentially supporting higher stock prices.

2. Future Dividend Capacity

Strong retained earnings provide a cushion that enables companies to maintain or increase dividends during temporary downturns, making the stock more attractive to income investors.

3. Growth Potential Signal

Companies that effectively reinvest retained earnings demonstrate management’s ability to create value, which can command higher valuation multiples (higher P/E ratios).

4. Financial Stability Indicator

Substantial positive retained earnings suggest financial resilience, reducing perceived risk and potentially lowering the company’s cost of capital.

5. Return on Equity (ROE) Component

ROE, a key profitability metric, uses shareholders’ equity (which includes retained earnings) in its denominator:

ROE = Net Income / Shareholders' EquityThe relationship between retained earnings growth and ROE reveals capital efficiency.

Practical Tips for Using Retained Earnings in Investment Analysis

Here’s how to incorporate retained earnings analysis into your investment research process:

✅ Step 1: Pull 5-10 Years of Data

Don’t rely on a single year’s snapshot. Download historical financial statements to see how retained earnings have trended over time.

✅ Step 2: Calculate Year-Over-Year Changes

Look at both absolute changes and percentage changes in retained earnings. Consistent growth is generally positive, while volatility or decline warrants investigation.

✅ Step 3: Compare to Competitors

Identify 3-5 comparable companies in the same industry and compare their retained earnings patterns, payout ratios, and growth rates.

✅ Step 4: Read Management Commentary

Company annual reports (10-K filings) and earnings calls often explain management’s capital allocation philosophy and plans for retained earnings.

✅ Step 5: Assess Capital Efficiency

Calculate how much shareholder value was created per dollar of retained earnings. If a company retained $100 million but the market cap only increased $50 million, that’s a red flag.

✅ Step 6: Consider Your Investment Timeline

Short-term traders might care less about retained earnings than long-term investors who benefit from compounded reinvestment over years or decades.

Understanding why you should invest and defining your personal financial goals will guide how you weigh retained earnings in your analysis.

Interactive Retained Earnings Calculator

To help you better understand how retained earnings work in practice, here’s an interactive calculator you can use to experiment with different scenarios:

💰 Retained Earnings Calculator

Calculate ending retained earnings and analyze financial trends

📊 Your Results

Yes, especially for younger companies or those in high-growth industries. Many successful companies like Amazon and Tesla operated with negative retained earnings for years while building their businesses. The key is whether the company is moving toward profitability and using capital efficiently. However, for mature companies, persistent negative retained earnings are a red flag.

Retained earnings represent the total cumulative profits kept in the business. Reserves are specific portions of retained earnings set aside for particular purposes (like expansion, debt repayment, or contingencies). Think of retained earnings as the whole pie, and reserves as specific slices designated for specific uses.

No, retained earnings themselves don’t earn interest; they’re an accounting concept, not a cash account. However, if a company uses retained earnings to buy interest-bearing investments or assets that generate returns, those returns will eventually flow back through the income statement and increase future retained earnings.

Retained earnings are updated every accounting period—typically quarterly and annually. Public companies report them in their quarterly (10-Q) and annual (10-K) SEC filings.

In corporations, shareholders cannot directly withdraw retained earnings. The board of directors must declare dividends, which are then distributed as a portion of retained earnings to shareholders. In smaller businesses (LLCs, partnerships), owners may have more flexibility to withdraw earnings based on their operating agreements.

When a company is acquired, retained earnings become part of the purchase price calculation. Shareholders receive their proportional share of the company’s value, which includes retained earnings. The acquiring company then consolidates the target’s financials, and retained earnings are essentially absorbed into the acquirer’s equity accounts.

Conclusion

Understanding retained earnings transforms you from a passive observer of financial statements into an informed analyst who can evaluate a company’s financial health, management quality, and growth potential.

Here’s what to remember:

Retained earnings represent the cumulative profits a company has chosen to reinvest rather than distribute; they’re the financial fuel for growth, innovation, and stability. The simple formula (Beginning RE + Net Income – Dividends = Ending RE) tells a powerful story about management’s priorities and the company’s trajectory.

Whether you’re analyzing dividend stocks for passive income or growth companies that reinvest aggressively, retained earnings provide crucial context for investment decisions. They help answer fundamental questions: Is management creating value with the capital entrusted to them? Is the company building financial strength? Does the dividend policy align with your investment goals?

Your Next Steps

- Review your current holdings: Pull up the balance sheets for stocks you own and examine their retained earnings trends over the past 5 years.

- Compare to competitors: See how your companies stack up against industry peers in terms of retained earnings growth and capital efficiency.

- Align with your goals: If you’re seeking income, look for companies with strong retained earnings supporting sustainable dividends. If you’re focused on growth, seek companies that effectively reinvest retained earnings for expansion.

- Read the full story: Don’t analyze retained earnings in isolation; combine them with revenue trends, profit margins, cash flow, and other metrics for a complete picture.

- Keep learning: Understanding retained earnings is just one piece of becoming a sophisticated investor. Continue building your financial knowledge through resources that explain why you should invest and smart financial moves for long-term wealth building.

Remember, successful investing isn’t about finding perfect companies; it’s about understanding what you own, why you own it, and how different financial metrics like retained earnings reveal the underlying health and potential of your investments. Armed with this knowledge, you’re better equipped to build a portfolio that aligns with your financial goals and risk tolerance.

Disclaimer

This article is for educational and informational purposes only and should not be construed as financial, investment, legal, or tax advice. The content presented here represents general information about retained earnings and financial analysis concepts. Individual investment decisions should be made based on your personal financial situation, goals, risk tolerance, and time horizon.

Before making any investment decisions, you should consult with qualified financial, legal, and tax professionals who can provide personalized advice based on your specific circumstances. Past performance does not guarantee future results. All investments carry risk, including the potential loss of principal.

The examples and scenarios presented in this article are hypothetical and for illustrative purposes only. They do not represent actual companies or guaranteed outcomes. Market conditions, company performance, and economic factors can vary significantly and impact investment results.

TheRichGuyMath.com and its authors do not assume any liability for financial decisions made based on the information provided in this article. Always conduct your own research and due diligence before investing.

About the Author

Max Fonji is a financial educator and investment strategist with over 15 years of experience helping everyday investors understand complex financial concepts. Through TheRichGuyMath.com, Max breaks down intimidating financial topics into accessible, actionable insights that empower readers to take control of their financial futures.

Max’s approach combines rigorous financial analysis with real-world practicality, making sophisticated investment concepts understandable for beginners while providing valuable insights for experienced investors. When not writing about finance, Max enjoys analyzing market trends, reading annual reports, and helping individuals build sustainable wealth through smart investing.

Connect with Max and explore more beginner-friendly investing guides at TheRichGuyMath.com.