What Is a Roth IRA? A Beginner’s Guide to Tax-Free Retirement Savings.

What Is a Roth IRA?

A Roth IRA (Individual Retirement Account) is a type of retirement savings account that lets your money grow tax-free. That’s right—unlike traditional retirement accounts, you won’t owe taxes on your investment gains when you withdraw the money in retirement (as long as you follow the rules).

Key Benefits of a Roth IRA:

- Tax-Free Growth: Pay taxes now, enjoy tax-free income later.

- No Required Minimum Distributions (RMDs): You’re not forced to withdraw at a certain age.

- Flexible Withdrawals: You can withdraw your contributions (not earnings) anytime without penalty.

With a Roth IRA, even small monthly contributions can snowball into a life-changing retirement fund. Thanks to the power of compound interest, a simple $10 to $583 monthly investment can grow into hundreds of thousands — even millions — over time. Let’s break down how it works and why you should start now, even if you’re just beginning your financial journey.

If you’re new to investing and wondering how to secure a better financial future, you’ve probably heard of a Roth IRA. But what is it really? How do you open one? And how does it work?

In this post, we’ll break down what a Roth IRA is, how it works, and exactly how you can open one—even if you’re just starting out. Whether you’re 18 or 38, this beginner-friendly guide is here to help you get started with confidence.

What Is a Roth IRA and Why Should You Care?

A Roth IRA (Individual Retirement Account) is a tax-advantaged investment account that allows your money to grow tax-free. That means all the interest, dividends, and capital gains you earn — you keep 100% of it when you withdraw in retirement.

Key Advantage: Unlike a traditional IRA, withdrawals from a Roth IRA during retirement are completely tax-free, as long as you meet basic rules.

Who Can Open One?

- Anyone with earned income (W-2 or self-employment)

- Income under $161,000 for single filers or $240,000 for married couples (2025 limits)

Want to learn more? Check out our full guide: Beginner’s Guide to Roth IRAs

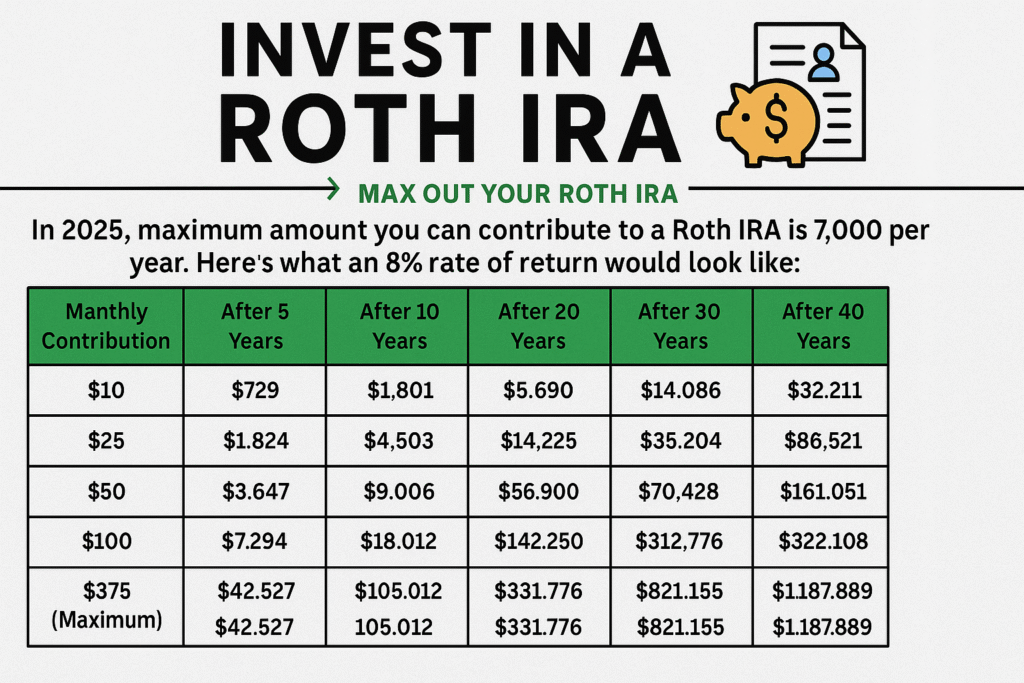

How Much Can You Really Grow?

Here’s where things get exciting. According to this chart by Brian Feroldi from LongTermMindset.co, contributing as little as $10 a month at an 8% annual return can grow to $32,211 over 40 years. But if you max out your Roth IRA at $583 per month? You could end up with $1,877,889 by retirement.

Yes, that’s nearly $2 million — just by staying consistent.

Why Most People Miss Out

The sad reality is most Americans either delay or avoid investing altogether. Here’s why:

- They think they don’t have enough money

- They’re overwhelmed by too many options

- They don’t understand how powerful time and compound growth are

- If you can budget even $50 a month, you can take full advantage of this powerful retirement tool.

How Does a Roth IRA Work?

Let’s say you invest $200 per month into a Roth IRA starting at age 25. If you average an 8% return, you could have over $500,000 by retirement—completely tax-free. That’s the power of consistent investing and compound growth.

Here’s how it works:

- You contribute after-tax income to your Roth IRA (meaning, you already paid taxes on the money).

- Your money grows through investments like index funds, ETFs, or dividend stocks.

You withdraw tax-free after age 59½, as long as your account has been open for 5+ years.

How to Open a Roth IRA in 5 Easy Steps

You don’t need to be a financial expert to open a Roth IRA. Just follow these beginner-friendly steps:

1. Check if You’re Eligible

In 2025, you can contribute up to $7,000/year to a Roth IRA if your income is under:

- $161,000 for single filers

- $240,000 for married couples filing jointly

If you’re within those limits and have earned income (from a job), you’re good to go.

2. Pick a Roth IRA Provider

Choose a trusted broker that offers Roth IRAs with low fees and strong support. Great beginner-friendly options include:

- Fidelity

- Charles Schwab

- Vanguard

- Betterment (automated investing)

3. Open Your Account Online

It takes about 10–15 minutes to open a Roth IRA online. You’ll need:

- Social Security Number

- Employment info

- Bank account for funding

4. Choose Your Investments

A Roth IRA is not an investment itself—it’s a container that holds investments. You can invest in:

- Low-cost index funds (like VTI, VOO, or SCHD)

- ETFs

- Individual stocks

For beginners, a target-date retirement fund or total market index fund is a solid choice.

5. Start Contributing Regularly

Start with what you can. Even $50/month is better than nothing. Over time, it adds up—especially with compound growth. Automate your contributions to stay consistent.

Roth IRA Rules & Restrictions

- You can’t deduct contributions on your tax return.

- Early withdrawals of earnings (not contributions) before age 59½ may be penalized.

- Contributions must come from earned income (not gifts, investments, etc.).

- You can withdraw your original contributions at any time, penalty-free.

Roth IRA vs. Traditional IRA

| Feature | Roth IRA | Traditional IRA |

|---|---|---|

| Tax on Contributions | After-tax | Pre-tax (usually deductible) |

| Tax on Withdrawals | Tax-free | Taxed as income |

| Income Limits | Yes | No (but limits for deduction may apply) |

| RMDs (Required Minimum Distributions) | None | Required starting at age 73 |

Pro Tip: Use Dollar Cost Averaging

Instead of trying to “time the market,” invest a fixed amount each month. This strategy, called Dollar Cost Averaging, helps you buy more shares when prices are low and fewer when prices are high—minimizing risk and stress.

Final Thoughts

Opening a Roth IRA is one of the smartest financial moves you can make in your 20s, 30s, or even later. It’s simple to set up, flexible, and offers unbeatable tax-free growth.

You don’t need thousands to start—just the motivation to take control of your future, one small step at a time.

FAQ: Common Roth IRA Questions

Can I withdraw money early from my Roth IRA?

Yes, you can withdraw contributions anytime without penalty. But withdrawing earnings early may result in taxes and penalties unless it’s for a qualified reason (like a first-time home purchase).

Can I have a Roth IRA and a 401(k)?

Absolutely! Many people use both to maximize their retirement savings.What if I make too much money to contribute?

You can explore a Backdoor Roth IRA, a legal workaround for high earners.

Internal Links:

Ready to start your Roth IRA today?

Take action now—your future self will thank you.

It depends. If you expect to be in a higher tax bracket in retirement, the Roth IRA may be better. If you want a tax break today, consider a traditional IRA.

Yes! You can contribute to both a Roth IRA and a 401(k) if you meet the income and contribution limits.

You can withdraw contributions at any time. Earnings can be withdrawn tax-free after age 59½ and once the account has been open for at least 5 years.

Early withdrawals of earnings may be subject to income taxes and a 10% penalty. Contributions can be withdrawn any time penalty-free.

You can invest in stocks, bonds, ETFs, mutual funds, REITs, and more — just like a regular brokerage account.