Imagine waking up to find extra money in your brokerage account, money you didn’t have to work for. That’s the magic of dividend investing, and it’s exactly what drew Sarah, a 32-year-old teacher from Ohio, to start researching dividend ETFs. Like many beginners, she quickly found herself staring at two popular options: SCHD and VYM. Both promised steady income, both had stellar reputations, but which one was actually right for her goals? If you’re asking the same question, you’re in the right place.

TL;DR Summary

SCHD vs VYM — Here’s what you need to know:

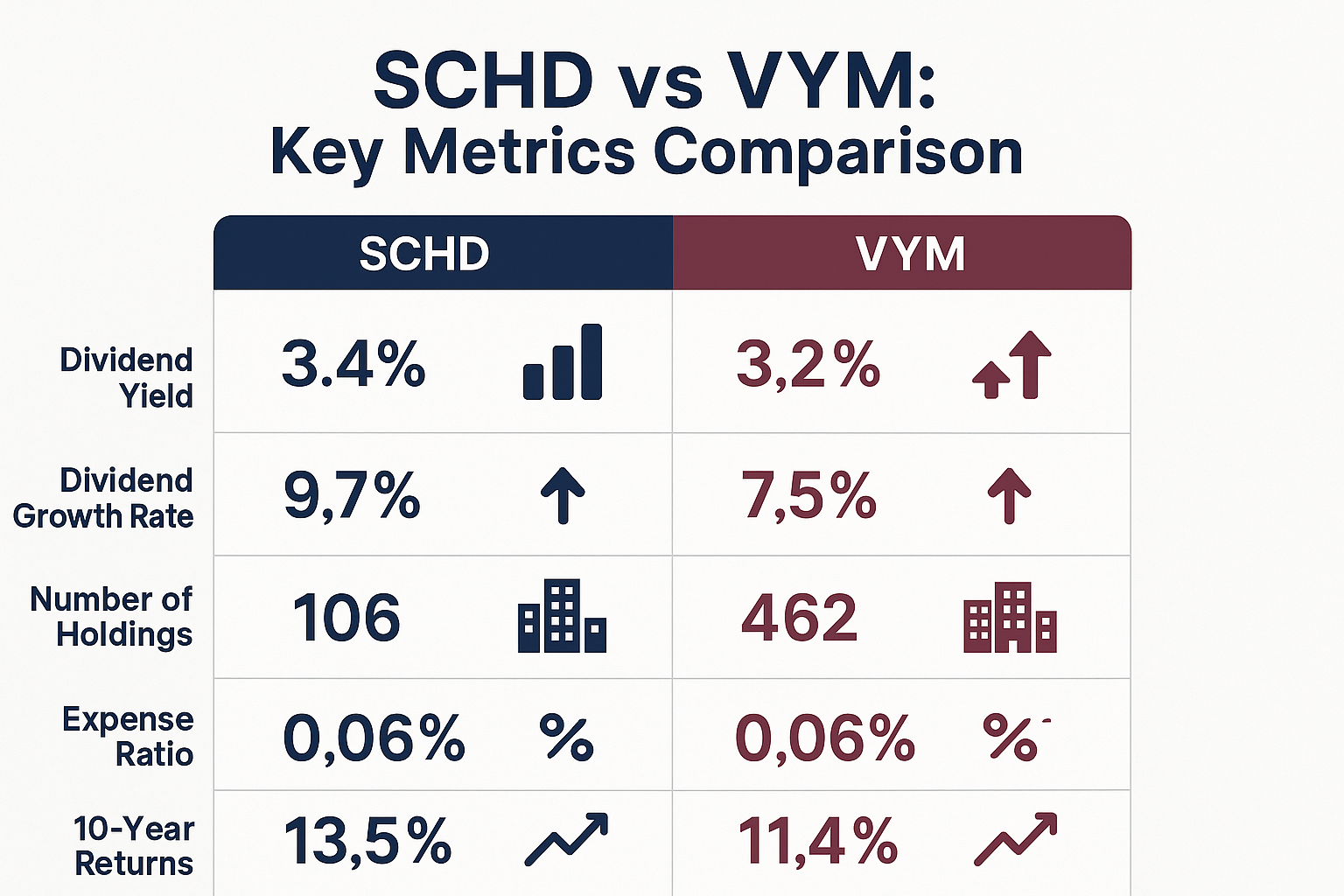

- SCHD focuses on dividend growth and quality, holding about 100 high-quality U.S. stocks with strong fundamentals

- VYM emphasizes high current yield, tracking approximately 450+ dividend-paying stocks for broader diversification

- SCHD typically offers better dividend growth potential (average 12-14% annually), while VYM provides higher immediate income

- Expense ratios: SCHD charges 0.06%, VYM charges 0.06%—both are extremely cost-effective

- Best choice: SCHD for long-term growth and quality; VYM for immediate income and maximum diversification

What Are SCHD and VYM? A Simple Introduction

In simple terms, SCHD vs VYM represents a choice between two excellent but different approaches to dividend investing.

SCHD (Schwab U.S. Dividend Equity ETF) is a dividend-focused exchange-traded fund that tracks the Dow Jones U.S. Dividend 100 Index. It concentrates on approximately 100 U.S. companies that have consistently paid dividends for at least 10 consecutive years and meet strict quality criteria.

VYM (Vanguard High Dividend Yield ETF) tracks the FTSE High Dividend Yield Index and holds around 450+ stocks, focusing on companies that pay above-average dividends.

Both ETFs help investors start earning passive income through dividend investing, but they take different paths to get there.

Key Takeaways

What you’ll learn in this guide:

- The fundamental differences between SCHD and VYM’s investment strategies

- How each ETF’s holdings, performance, and dividend yields compare

- Which dividend ETF aligns better with your financial goals and timeline

- Real-world scenarios showing when to choose one over the other

- Actionable steps to start investing in either (or both) dividend ETFs

Understanding the Core Differences: SCHD vs VYM

Investment Philosophy and Strategy

The battle between SCHD vs VYM really comes down to quality versus quantity.

SCHD’s Approach:

- Focuses on dividend growth and quality metrics

- Screens for companies with strong financial health

- Requires 10+ years of consecutive dividend payments

- Evaluates cash flow to debt, return on equity, dividend yield, and 5-year dividend growth rate

- Concentrates holdings in roughly 100 stocks

VYM’s Approach:

- Emphasizes high current yield

- Casts a wider net with 450+ holdings

- Focuses on companies forecasted to pay above-average dividends

- Provides broader market exposure

- Less stringent quality requirements

Think of it this way: SCHD is like a carefully curated wine collection with only the finest bottles, while VYM is like a well-stocked wine cellar with excellent variety and depth.

Number of Holdings and Diversification

| Feature | SCHD | VYM |

|---|---|---|

| Number of Holdings | ~100 stocks | ~450+ stocks |

| Diversification Level | Concentrated quality | Broad market coverage |

| Top 10 Holdings Weight | ~40-45% | ~25-30% |

| Sector Concentration | More focused | More balanced |

VYM clearly wins on pure diversification numbers. With over 450 holdings, you’re spreading your risk across a much larger basket of companies. However, SCHD’s concentrated approach means each holding has been vetted for quality and dividend sustainability.

Expense Ratios and Costs

Both ETFs are incredibly cost-effective, which is fantastic news for beginner investors:

- SCHD: 0.06% expense ratio

- VYM: 0.06% expense ratio

This means for every $10,000 invested, you’ll pay just $6 annually in management fees. Compare this to actively managed mutual funds that often charge 0.50% to 1.00% or more, and you can see why ETFs have become so popular.

Lower costs mean more money stays invested and compounds over time, a critical advantage when building wealth through passive income strategies.

Deep Dive: SCHD (Schwab U.S. Dividend Equity ETF)

What Makes SCHD Special?

SCHD launched in October 2011 and has quickly become a favorite among dividend growth investors. The fund’s secret sauce lies in its rigorous screening process.

SCHD’s Four-Factor Quality Screen:

- Cash Flow to Total Debt – Measures financial stability. Return on Equity (ROE) – Evaluates profitability efficiency

- Dividend Yield – Ensures meaningful income

- 5-Year Dividend Growth Rate – Confirms commitment to increasing payouts

This multi-factor approach filters out companies that might have high yields today but lack the fundamentals to sustain them tomorrow.

SCHD’s Top Holdings (2025)

As of early 2025, SCHD’s top holdings typically include:

- Verizon Communications (VZ)

- Amgen (AMGN)

- PepsiCo (PEP)

- Coca-Cola (KO)

- Merck & Co. (MRK)

- Pfizer (PFI)

- Cisco Systems (CSCO)

- AbbVie (ABBV)

- Texas Instruments (TXN)

- Chevron (CVX)

These are household names with proven track records of rewarding shareholders through thick and thin.

Historical Performance and Returns

SCHD has delivered impressive results since its inception:

- Average Annual Return (2011-2024): Approximately 12-13%

- Dividend Growth Rate: Average 12-14% annually

- Total Return: Capital appreciation + reinvested dividends

During market downturns, SCHD has shown resilience. For example, during the 2022 bear market, when the S&P 500 fell approximately 18%, SCHD’s focus on quality helped limit losses.

Current Dividend Yield and Growth

As of 2025, SCHD typically offers:

- Current Dividend Yield: 3.3-3.8% (varies with price)

- Distribution Frequency: Quarterly

- Dividend Growth Track Record: Consistent increases year-over-year

The beauty of SCHD isn’t just the yield; it’s the growth trajectory. A 3.5% yield that grows 12% annually becomes much more attractive than a static 4% yield over time.

Deep Dive: VYM (Vanguard High Dividend Yield ETF)

What Makes VYM Special?

VYM launched in November 2006, making it a more established fund than SCHD. Backed by Vanguard’s legendary reputation for low-cost investing, VYM offers a straightforward approach: own a broad basket of dividend-paying stocks.

VYM’s Investment Criteria:

- Companies forecasted to pay above-average dividends

- Excludes REITs (Real Estate Investment Trusts)

- Market-cap weighted (larger companies have bigger positions)

- Broad sector representation

The fund doesn’t apply SCHD’s rigorous quality filters, which means it includes more companies but with less stringent fundamental requirements.

VYM’s Top Holdings (2025)

VYM’s top holdings as of early 2025 typically include:

- Broadcom (AVGO)

- JPMorgan Chase (JPM)

- ExxonMobil (XOM)

- Johnson & Johnson (JNJ)

- Procter & Gamble (PG)

- Walmart (WMT)

- Home Depot (HD)

- Chevron (CVX)

- AbbVie (ABBV)

- Merck & Co. (MRK)

Notice some overlap with SCHD, but VYM’s broader approach means these represent a smaller percentage of the overall fund.

Historical Performance and Returns

VYM’s longer track record provides valuable insights:

- Average Annual Return (2006-2024): Approximately 9-10%

- Performance During 2008 Financial Crisis: Declined but recovered steadily

- Total Return: Competitive with broader market indices

VYM’s broader diversification has historically meant slightly lower volatility compared to more concentrated funds, though returns have also been somewhat more modest.

Current Dividend Yield and Growth

As of 2025, VYM typically offers:

- Current Dividend Yield: 2.8-3.2%

- Distribution Frequency: Quarterly

- Dividend Growth: Steady but more modest (6-8% annually)

VYM’s yield is typically slightly lower than SCHD’s, reflecting its broader composition that includes some lower-yielding but high-quality companies.

📊 SCHD vs VYM Interactive Comparison

Select metrics below to compare these popular dividend ETFs

Pros & Cons at a Glance

- Higher dividend growth rate

- Quality-focused screening

- Better historical returns

- Strong fundamental metrics

- Less diversification (100 stocks)

- Higher concentration risk

- Shorter track record

- Maximum diversification (450+ stocks)

- Lower volatility

- Longer track record (since 2006)

- Vanguard’s reputation

- Lower dividend growth

- Slightly lower current yield

- Less quality screening

🎯 Quick Recommendation

Based on typical investor goals, SCHD is ideal for long-term growth and quality-focused dividend investing, while VYM excels for maximum diversification and lower volatility.

Side-by-Side Comparison: SCHD vs VYM

Performance Comparison Table

| Metric | SCHD | VYM | Winner |

|---|---|---|---|

| Current Dividend Yield (2025) | 3.3-3.8% | 2.8-3.2% | 🏆 SCHD |

| Dividend Growth Rate | 12-14% annually | 6-8% annually | 🏆 SCHD |

| Number of Holdings | ~100 | ~450+ | 🏆 VYM |

| Expense Ratio | 0.06% | 0.06% | 🤝 Tie |

| 10-Year Average Return | ~12-13% | ~9-10% | 🏆 SCHD |

| Inception Date | October 2011 | November 2006 | 🏆 VYM |

| Assets Under Management | $60+ billion | $50+ billion | 🏆 SCHD |

| Volatility | Moderate | Lower | 🏆 VYM |

Sector Allocation Differences

Both ETFs have different sector weightings that impact their risk and return profiles:

SCHD Sector Breakdown (Approximate):

- Healthcare: ~18%

- Financials: ~17%

- Industrials: ~15%

- Energy: ~13%

- Consumer Staples: ~12%

- Technology: ~10%

- Real Estate: ~8%

- Others: ~7%

VYM Sector Breakdown (Approximate):

- Financials: ~20%

- Healthcare: ~14%

- Consumer Staples: ~13%

- Industrials: ~12%

- Technology: ~11%

- Energy: ~9%

- Real Estate: ~8%

- Others: ~13%

SCHD tends to have higher exposure to energy and consumer staples, while VYM leans more heavily into financials. Understanding the stock market and sector rotations can help you appreciate these differences.

Dividend Yield and Growth: The Critical Difference

Understanding Dividend Yield vs Dividend Growth

Here’s where the SCHD vs VYM debate gets really interesting. Let me share a quick story:

Meet Tom and Lisa, two investors who each invested $10,000 in 2015. Tom chose VYM for its diversification, while Lisa picked SCHD for its growth potential. Both reinvested their dividends. etf.com

Year 1 (2015):

- Tom (VYM): Received $300 in dividends (3.0% yield)

- Lisa (SCHD): Received $320 in dividends (3.2% yield)

Year 5 (2020):

- Tom (VYM): Receiving ~$385 annually (dividend grew ~5% yearly)

- Lisa (SCHD): Receiving ~$545 annually (dividend grew ~12% yearly)

Year 10 (2025):

- Tom (VYM): Receiving ~$489 annually

- Lisa (SCHD): Receiving ~$995 annually

This simplified example illustrates the power of dividend growth. While VYM’s broader diversification provides stability, SCHD’s focus on dividend growth creates a compounding effect that can significantly outpace slower-growing alternatives over time.

The Compounding Effect

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” — Often attributed to Albert Einstein

When you reinvest dividends that grow 12-14% annually (SCHD’s historical average), you’re not just earning on your principal, you’re earning on your earnings. This creates exponential growth.

$10,000 invested with dividends reinvested over 20 years:

- VYM (3.0% starting yield, 7% growth): ~$38,700

- SCHD (3.5% starting yield, 13% growth): ~$52,400

The difference becomes dramatic over decades, which is why many younger investors gravitate toward SCHD’s growth-oriented approach.

Risk and Volatility Analysis

Concentration Risk: SCHD’s Achilles Heel?

With only 100 holdings, SCHD carries a higher concentration risk than VYM. If one of SCHD’s top holdings cuts its dividend or experiences financial trouble, it could have a more noticeable impact on the fund’s performance.

For example, if a company representing 2% of SCHD’s portfolio cuts its dividend by 50%, the impact is more significant than if the same happened to a company representing 0.5% of VYM’s portfolio.

However, SCHD’s rigorous quality screening helps mitigate this risk. The fund’s focus on strong fundamentals means holdings are less likely to experience dividend cuts in the first place.

Market Downturn Performance

How did these ETFs perform during recent market stress?

2020 COVID-19 Crash:

- SCHD: Declined approximately 33% peak-to-trough

- VYM: Declined approximately 35% peak-to-trough

- Both recovered strongly with reinvested dividends

2022 Bear Market:

- SCHD: Outperformed the S&P 500, declining only ~8%

- VYM: Also outperformed, declining ~10%

During downturns, dividend-paying stocks often provide a cushion. Understanding the cycle of market emotions can help you stay rational during these periods.

Volatility Metrics

- SCHD Beta: Approximately 0.85-0.90 (less volatile than the overall market)

- VYM Beta: Approximately 0.80-0.85 (even less volatile)

Both ETFs are less volatile than the broader market, but VYM’s broader diversification gives it a slight edge in stability.

Tax Efficiency and Qualified Dividends

Understanding Qualified Dividends

Both SCHD and VYM primarily distribute qualified dividends, which are taxed at the more favorable long-term capital gains rates rather than ordinary income rates.

2025 Qualified Dividend Tax Rates:

- 0% for single filers earning up to $47,025 (married: $94,050)

- 15% for single filers earning $47,026-$518,900 (married: $94,051-$583,750)

- 20% for single filers earning over $518,900 (married: over $583,750)

This tax advantage makes dividend ETFs particularly attractive for taxable accounts, though they work great in tax-advantaged accounts like IRAs, too.

Tax-Loss Harvesting Opportunities

The SCHD vs VYM comparison also presents a tax-loss harvesting opportunity. Because these ETFs track different indices and have different holdings, they’re not considered “substantially identical” by the IRS.

This means you could sell one at a loss for tax purposes and immediately buy the other without triggering the wash-sale rule, a strategy sophisticated investors use to reduce their tax burden.

Who Should Choose SCHD?

Ideal Investor Profile for SCHD

Choose SCHD if you:

Have a long time horizon (10+ years)

Prioritize dividend growth over current income

Want quality-focused holdings with strong fundamentals

Can tolerate slightly higher concentration risk

Seek higher total returns over time

Are you building wealth for retirement in your 20s-40s

Want to start earning passive income that grows substantially

Real-World SCHD Scenarios

Scenario 1: Young Professional

Maria, 28, is a software engineer earning $95,000 annually. She maxes out her 401(k) and has an additional $500/month to invest. She chooses SCHD because:

- She won’t need the income for 30+ years

- She wants her dividends to grow faster than inflation

- She appreciates the quality screening process

- She’s comfortable with 100 holdings given the long timeline

Scenario 2: Early Retiree

James, 45, achieved financial independence and plans to retire at 50. He’s building a dividend portfolio to supplement his other income. He chooses SCHD because:

- He still has a 40+ year time horizon

- He wants a growing income to combat inflation

- He values quality over quantity in holdings

- He can reinvest dividends for another 5 years before needing income

Who Should Choose VYM?

Ideal Investor Profile for VYM

Choose VYM if you:

Prioritize maximum diversification

Prefer lower volatility and smoother returns

Want exposure to more sectors and companies

Value Vanguard’s reputation and track record

Are you closer to retirement or already retired

Want a “set it and forget it” broad market approach

Prefer steady, predictable income over aggressive growth

Real-World VYM Scenarios

Scenario 1: Conservative Investor

Robert, 55, is 10 years from retirement. He’s shifting from growth stocks to income-generating investments. He chooses VYM because:

- He wants broad diversification across 450+ companies

- He values stability as he approaches retirement

- He appreciates Vanguard’s long history and reputation

- He’s less concerned with maximum growth than preservation

Scenario 2: Beginner Investor

Ashley, 35, is new to investing beyond her 401(k). She wants to start building a dividend portfolio but feels overwhelmed. She chooses VYM because:

- The broad diversification feels safer as a beginner

- She doesn’t have to worry about concentration risk

- She trusts Vanguard’s brand and low-cost approach

- She wants a simple, hands-off investment

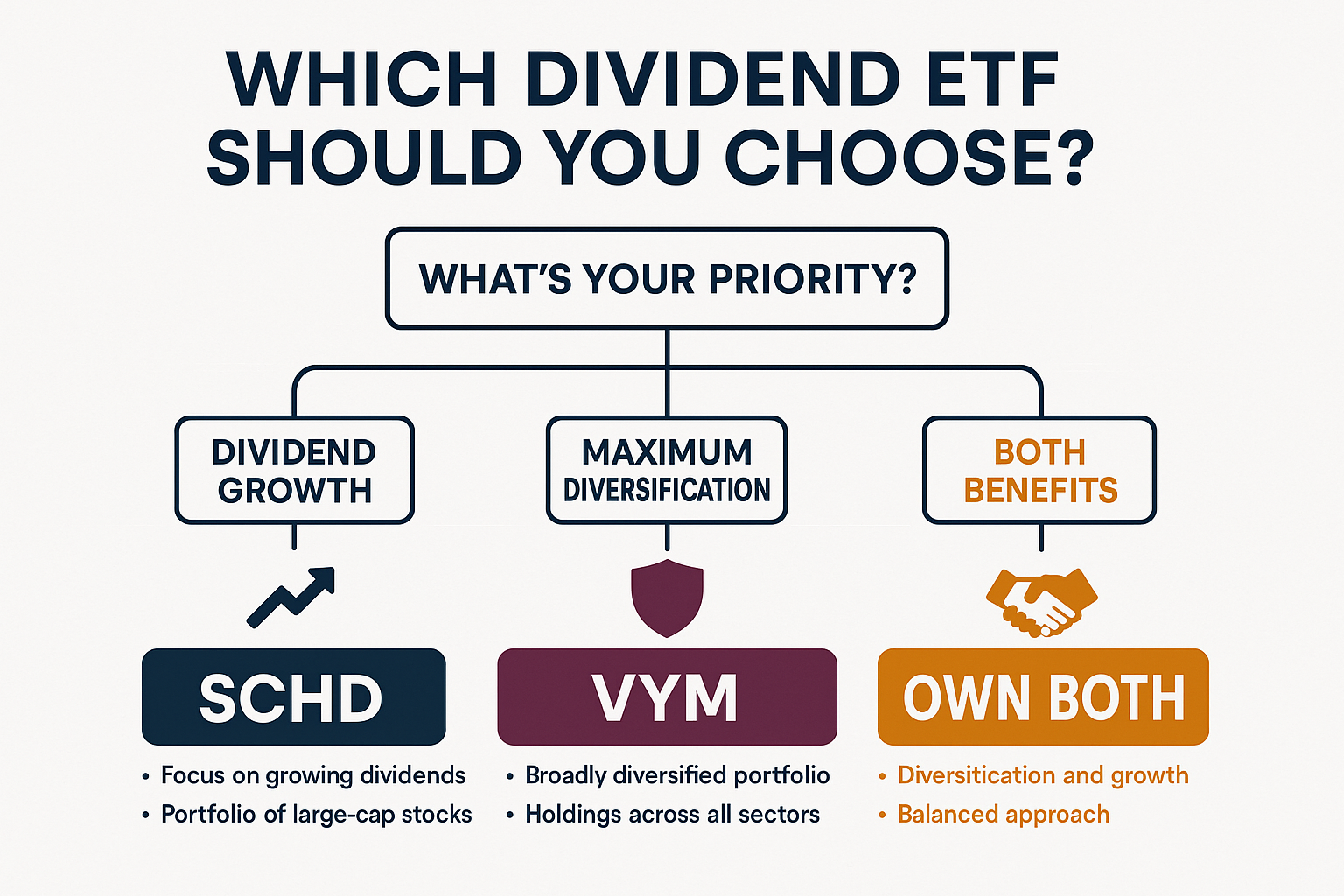

Can You Own Both? The Hybrid Approach

The Best of Both Worlds Strategy

Here’s something many investors don’t consider: you don’t have to choose. Many sophisticated investors own both SCHD and VYM, creating a hybrid dividend portfolio that captures the benefits of each.

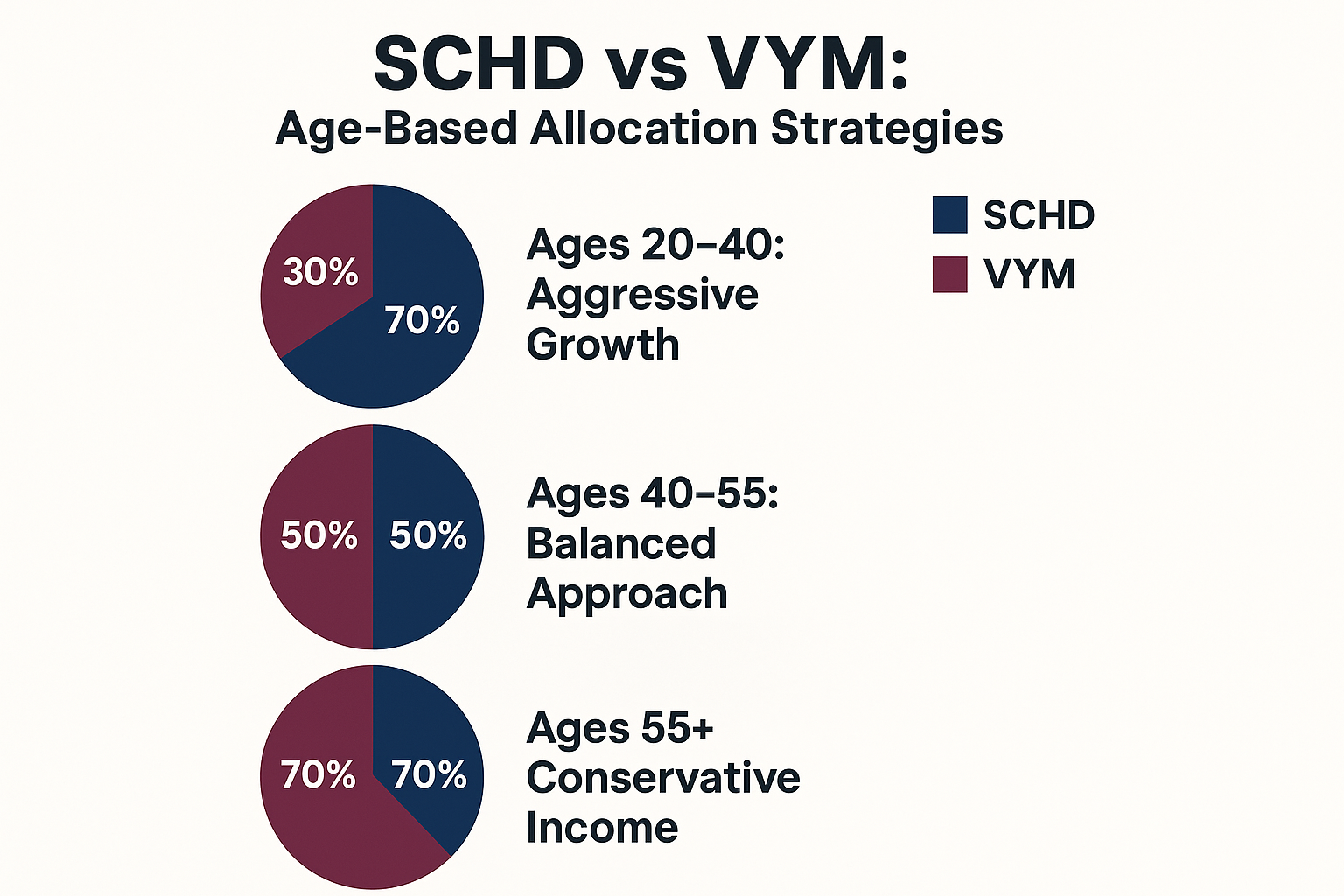

Sample Allocation Strategies:

Aggressive Growth (Ages 20-40):

- 70% SCHD (quality + growth)

- 30% VYM (diversification + stability)

Balanced Approach (Ages 40-55):

- 50% SCHD

- 50% VYM

Conservative Income (Ages 55+):

- 30% SCHD

- 70% VYM (prioritizing stability)

This approach gives you SCHD’s superior dividend growth while VYM’s broader diversification reduces overall portfolio risk.

Complementary Holdings

Interestingly, SCHD and VYM have only about 60-70% overlap in holdings. This means combining them actually increases your diversification beyond what either offers individually.

You get:

- SCHD’s quality-screened companies

- VYM’s broader market coverage

- Reduced concentration risk

- Balanced growth and stability

Many investors find this hybrid approach provides peace of mind—they’re not leaving anything on the table.

How to Start Investing in SCHD or VYM

Step-by-Step Investment Guide

Step 1: Choose Your Brokerage

Both SCHD and VYM are available through virtually every major brokerage:

- Fidelity (commission-free)

- Charles Schwab (commission-free, SCHD’s home)

- Vanguard (commission-free, VYM’s home)

- TD Ameritrade (commission-free)

- E*TRADE (commission-free)

- Robinhood (commission-free)

Most brokerages now offer commission-free ETF trading, so choose based on overall platform features rather than trading costs.

Step 2: Determine Your Investment Amount

Unlike mutual funds, ETFs trade like stocks, meaning you buy whole shares. As of 2025:

- SCHD: Trading around $75-85 per share

- VYM: Trading around $110-120 per share

Many brokerages now offer fractional shares, allowing you to invest any dollar amount, even if it doesn’t buy a whole share.

Step 3: Set Up Automatic Dividend Reinvestment (DRIP)

Enable DRIP (Dividend Reinvestment Plan) in your brokerage account. This automatically uses your dividend payments to purchase more shares, accelerating your compound growth.

Step 4: Consider Dollar-Cost Averaging

Rather than investing a lump sum all at once, consider spreading your investment over several months. This reduces the risk of buying at a market peak and helps you avoid emotional decisions.

Example:

- $6,000 to invest → Invest $500/month for 12 months

- This approach helps you navigate market volatility more smoothly

Step 5: Monitor and Rebalance Annually

Set a calendar reminder to review your holdings once per year. You don’t need to check daily or even monthly—dividend investing is a long-term strategy.

Common Mistakes to Avoid

Mistake #1: Chasing Yield Without Considering Growth

Many beginners make the mistake of choosing investments purely based on current yield. A 5% yield that doesn’t grow is less valuable long-term than a 3% yield growing at 12% annually.

Remember: Yield isn’t everything. Focus on the total return equation: current yield + dividend growth + price appreciation.

Mistake #2: Ignoring Expense Ratios

While both SCHD and VYM have identical 0.06% expense ratios, some investors get tempted by high dividend stocks or funds with much higher fees. A 1% expense ratio might not sound like much, but it can cost you hundreds of thousands over a lifetime.

Mistake #3: Panic Selling During Downturns

During the 2020 crash, many investors sold their dividend ETFs at the worst possible time. Those who held on, or better yet, bought more, saw their investments recover and continue growing.

Dividend investing requires patience and emotional discipline. Understanding why the stock market goes up over time can help you stay the course.

Mistake #4: Forgetting About Tax Location

Holding dividend-paying investments in taxable accounts means paying taxes on dividends annually. For high earners, consider prioritizing dividend ETFs in tax-advantaged accounts (IRA, 401k) and growth stocks in taxable accounts.

Mistake #5: Over-Diversification

Some investors own SCHD, VYM, and 5 other dividend ETFs, thinking they’re being smart. In reality, they’re creating unnecessary overlap and complexity. Two well-chosen dividend ETFs are often better than six mediocre ones.

FAQ

The main difference between SCHD and VYM is their investment approach: SCHD focuses on dividend quality and growth with approximately 100 rigorously screened holdings, while VYM emphasizes broad diversification with 450+ dividend-paying stocks. SCHD typically offers higher dividend growth (12-14% annually) while VYM provides lower volatility and maximum diversification

As of 2025, SCHD typically has a higher current dividend yield (3.3-3.8%) compared to VYM (2.8-3.2%). However, yields fluctuate based on share price and market conditions. More importantly, SCHD’s dividend growth rate significantly exceeds VYM’s, meaning the yield-on-cost grows much faster over time.

For immediate retirement income, VYM’s broader diversification and lower volatility might be preferable. However, for pre-retirement investors or those with 10+ years until needing income, SCHD’s superior dividend growth creates higher future income streams. Many retirees use a combination of both to balance current income with growth.

Yes, absolutely! Many investors hold both SCHD and VYM to capture the benefits of each. The funds have only 60-70% overlap in holdings, meaning combining them actually increases diversification. A common approach is 50/50 allocation or weighting based on age and risk tolerance.

Both SCHD and VYM have an identical expense ratio of 0.06%, meaning you pay just $6 annually for every $10,000 invested. This makes both extremely cost-effective choices for long-term dividend investing.

Both SCHD and VYM pay dividends quarterly (four times per year), typically in March, June, September, and December. The exact payment dates vary slightly, but both maintain consistent quarterly distribution schedules.

SCHD has delivered superior historical returns, averaging approximately 12-13% annually since inception (2011) compared to VYM’s 9-10% average since 2006. However, VYM has a longer track record and demonstrated resilience through the 2008 financial crisis. Past performance doesn’t guarantee future results.

Yes, both are tax-efficient for taxable accounts. They primarily distribute qualified dividends taxed at favorable long-term capital gains rates (0%, 15%, or 20% depending on income) rather than ordinary income rates. Both also have low turnover, minimizing capital gains distributions.

The minimum investment equals the price of one share: approximately $75-85 for SCHD and $110-120 for VYM as of 2025. However, many brokerages now offer fractional shares, allowing you to invest any dollar amount, even as little as $10.

Both are excellent for beginners. VYM’s broader diversification (450+ holdings) might feel safer for those new to investing, while SCHD’s quality focus and superior growth appeal to those willing to accept slightly higher concentration. For complete beginners, VYM’s simplicity and Vanguard’s reputation might provide more confidence.

Advanced Strategies: Maximizing Your Dividend ETF Returns

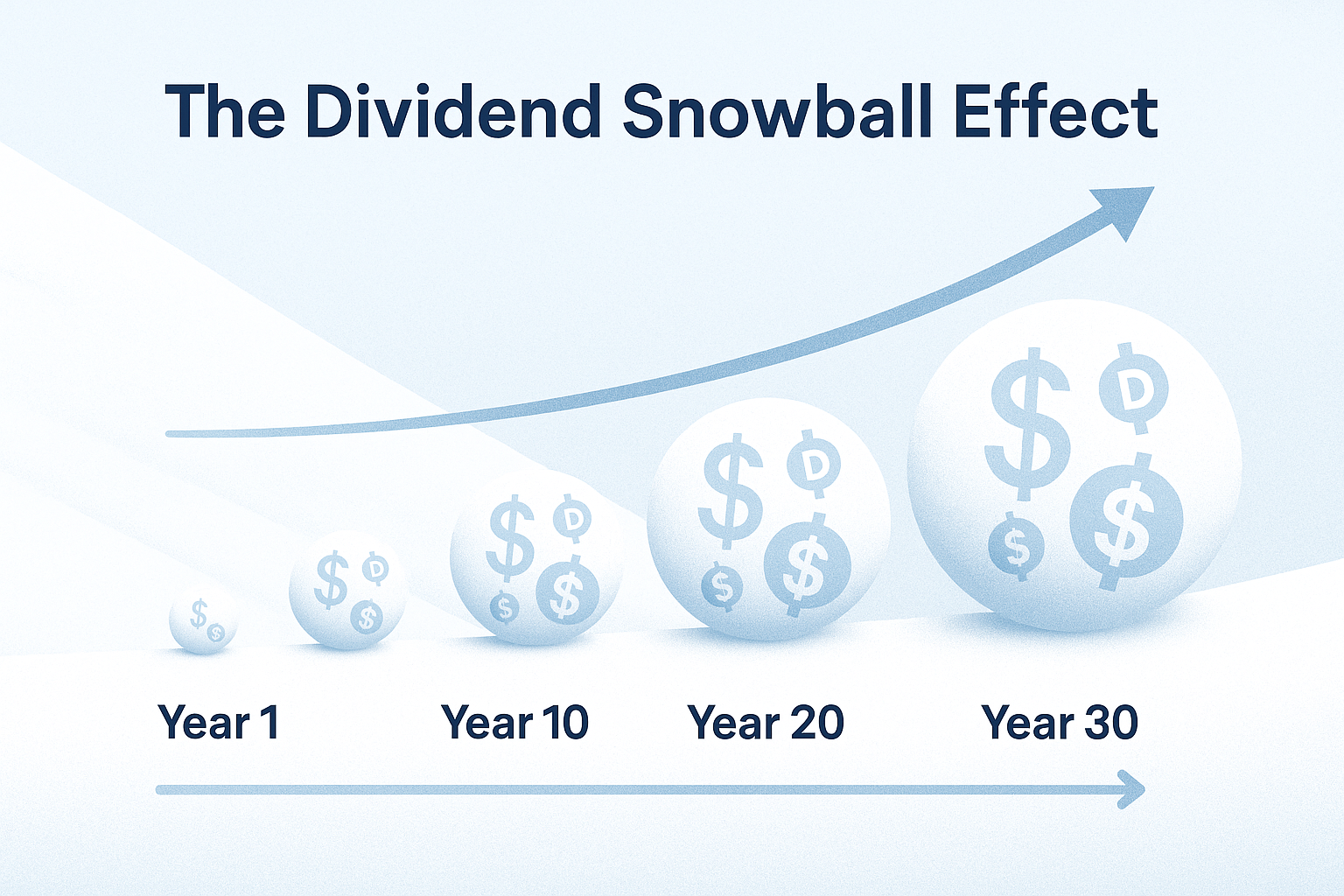

The Dividend Snowball Effect

One powerful strategy is visualizing your dividend growth as a snowball rolling downhill. Each quarter, your dividends buy more shares. Those shares generate more dividends. Those dividends buy even more shares. The snowball grows exponentially.

Example: $10,000 initial investment in SCHD

- Year 1: Earn ~$350 in dividends, reinvest to buy ~4.4 shares

- Year 5: Portfolio worth ~$15,200, earning ~$595 annually

- Year 10: Portfolio worth ~$26,500, earning ~$1,100 annually

- Year 20: Portfolio worth ~$75,000, earning ~$3,200 annually

- Year 30: Portfolio worth ~$200,000, earning ~$9,500 annually

This assumes no additional contributions—just the initial $10,000 compounding through dividend reinvestment and growth.

Combining with Other Income Strategies

Savvy investors often combine dividend ETFs with other smart ways to make passive income:

- Real Estate Investment Trusts (REITs) for property exposure

- Bond ETFs for fixed-income stability

- Growth stocks for capital appreciation

- Covered call strategies for additional income

This diversified approach creates multiple income streams while managing risk.

Teaching the Next Generation

If you have children, dividend ETFs offer an incredible teaching opportunity. You could make your kid a millionaire by starting them early with dividend investing.

Opening a custodial brokerage account and investing in SCHD or VYM demonstrates:

- The power of compound interest

- Patience and long-term thinking

- How businesses reward shareholders

- Basic financial literacy concepts

A $5,000 investment at birth growing at 12% annually becomes $480,000 by age 40—all from a one-time gift.

The Verdict: SCHD vs VYM Final Recommendation

After analyzing every aspect of the SCHD vs VYM comparison, here’s the bottom line:

Choose SCHD if:

- You’re under 50 and have time for growth to compound

- You prioritize dividend growth over current yield

- You want quality-screened, fundamentally strong companies

- You seek maximum long-term total returns

- You’re comfortable with concentrated (100-stock) portfolios

Choose VYM if:

- You prioritize diversification and stability

- You prefer broad market exposure (450+ stocks)

- You value Vanguard’s reputation and longer track record

- You want lower volatility and smoother returns

- You’re a beginner seeking simplicity

Choose Both if:

- You want the best of both worlds

- You can allocate funds to multiple positions

- You want to balance growth with stability

- You’re building a comprehensive dividend portfolio

The Truth: There’s no wrong choice between these two exceptional ETFs. Both offer:

- Identical low expense ratios (0.06%)

- Quarterly dividend payments

- Tax-efficient qualified dividends

- Proven track records

- Excellent long-term prospects

The “best” choice depends entirely on your personal situation, goals, timeline, and risk tolerance.

Taking Action: Your Next Steps

Now that you understand the SCHD vs VYM comparison inside and out, it’s time to take action. Here’s your roadmap:

Immediate Actions (This Week):

- Open a brokerage account if you don’t have one (Fidelity, Schwab, or Vanguard are excellent choices)

- Determine your investment amount and whether you’ll invest a lump sum or dollar-cost average

- Enable dividend reinvestment (DRIP) in your account settings

- Make your first purchase of SCHD, VYM, or both

Short-Term Actions (This Month):

- Set up automatic monthly investments if possible

- Review your overall portfolio allocation to ensure dividends fit your strategy

- Learn more about smart investment moves to complement your dividend strategy

- Track your first dividend payment and celebrate this milestone!

Long-Term Actions (This Year):

- Stay consistent with contributions regardless of market conditions

- Review performance quarterly, but resist the urge to make frequent changes

- Increase contributions when possible (raises, bonuses, windfalls)

- Educate yourself continuously about dividend investing and market dynamics

Remember: The best investment strategy is the one you’ll actually stick with. Whether you choose SCHD, VYM, or both, the most important decision is to start now and remain consistent.

Conclusion

The SCHD vs VYM debate ultimately represents a choice between two excellent paths to dividend investing success. SCHD offers superior dividend growth and quality-focused holdings perfect for long-term wealth building, while VYM provides maximum diversification and stability ideal for conservative investors or those seeking broad market exposure.

Both ETFs charge rock-bottom fees (0.06%), pay qualified dividends quarterly, and have proven track records of delivering reliable income to shareholders. The “winner” depends entirely on your unique financial situation, investment timeline, and personal preferences.

For most investors under 50 with long-term horizons, SCHD’s dividend growth advantage makes it the more compelling choice; the compounding effect of 12-14% annual dividend increases creates exponentially higher future income. For those prioritizing stability, diversification, or approaching retirement, VYM’s 450+ holdings provide unmatched breadth and lower volatility.

The hybrid approach, owning both, offers an elegant solution that captures the benefits of each while minimizing their respective limitations.

Whatever you choose, the most important step is starting today. Every day you delay is a day of potential compound growth lost forever. Open that brokerage account, make that first investment, and join the millions of investors building wealth through dividend investing.

Your future self will thank you for the decision you make today.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Investing involves risk, including possible loss of principal. Past performance does not guarantee future results. Before investing, consider your financial situation, risk tolerance, and investment objectives. Consult with a qualified financial advisor for personalized recommendations. The author may hold positions in securities discussed in this article.

Written by Max Fonji — With over a decade of experience in financial education and investment analysis, Max is your go-to source for clear, data-backed investing education. Max specializes in making complex financial concepts accessible to everyday investors, helping thousands build wealth through smart, evidence-based strategies.