Getting denied for a credit card because of no credit history feels like an impossible loop. Lenders want proof you can handle credit, but you cannot get credit to prove it. Low credit scores or thin credit files create the same barrier. This is where secured credit cards solve the problem.

A secured credit card is a credit card backed by a refundable cash deposit that allows lenders to approve people with little or poor credit history. The deposit acts as collateral, not a fee—you get it back when you close the account in good standing or upgrade to an unsecured card.

The deposit is not spent. The bank does not charge you to use your own money. Instead, the deposit protects the lender while you build a payment history that credit bureaus track and report. This guide explains how secured cards work, who should use them, how to use them correctly, and how to upgrade to a normal card. Understanding credit fundamentals is the foundation for using these tools effectively.

Key Takeaways

- Secured credit cards require a refundable deposit that serves as collateral and typically equals your credit limit

- Payment activity is reported to all three credit bureaus, building your credit history just like regular cards

- Keep utilization under 10% and pay in full monthly to maximize credit score improvement

- Most users can upgrade to unsecured cards within 6-12 months with consistent on-time payments

- The deposit is returned when you close the account in good standing or graduate to an unsecured card

What Is a Secured Credit Card?

A secured credit card functions identically to a regular credit card in daily use. Cardholders make purchases, receive monthly statements, and pay bills. The card reports to credit bureaus each month, creating the payment history needed to establish or rebuild credit.

The difference lies in the approval process. Secured cards require an upfront cash deposit that reduces lender risk. This deposit typically ranges from $200 to $500, though some issuers allow deposits up to $5,000. The deposit amount usually becomes the credit limit.

Because the deposit protects the bank from loss, approval standards are significantly lower. People with no credit history, low credit scores, or past financial problems can qualify. The card builds credit through normal use—not through the deposit itself.

Secured Card vs Regular Credit Card

| Secured Card | Regular Credit Card |

|---|---|

| Requires deposit | No deposit |

| Easier approval | Harder approval |

| Builds credit | Builds credit |

| Lower credit limits | Higher credit limits |

| Refundable deposit | No deposit to refund |

Both card types report to credit bureaus. Both affect credit scores through payment history and utilization. The secured card simply removes the approval barrier by requiring collateral.

How Secured Credit Cards Work

The secured credit card process follows a straightforward sequence that protects both the cardholder and the lender.

Step 1: Application

Apply for a secured card through a bank or credit union. Most issuers perform a soft credit check initially, which does not affect credit scores. Some perform hard inquiries only after approval.

Step 2: Deposit Submission

Once approved, submit the required security deposit. This amount typically ranges from $200 to $500. The deposit transfers to a savings account held by the issuer as collateral.

Step 3: Credit Limit Assignment

The deposit amount becomes the credit limit in most cases. A $300 deposit creates a $300 credit limit. Some issuers offer higher limits than the deposit amount after reviewing creditworthiness.

Step 4: Card Usage

Use the card for purchases like any credit card. The deposit remains untouched in the collateral account. Purchases draw from the credit line, not the deposit.

Step 5: Monthly Statements

Receive monthly statements showing purchases, minimum payment, and due date. The statement closing date determines what transactions appear on each statement.

Step 6: Payment and Reporting

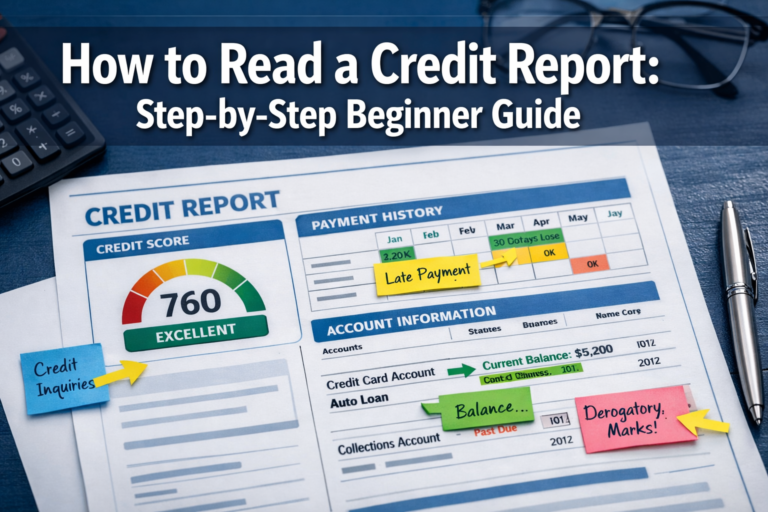

Make payments by the due date. The issuer reports payment activity to credit bureaus—typically Experian, Equifax, and TransUnion. This reporting builds credit history. Understanding what a credit report is helps clarify how this information affects credit scores.

Each on-time payment strengthens credit history. Each late payment damages it. The secured card functions as a trust-building tool that demonstrates financial responsibility to future lenders.

Why Banks Require a Deposit

Banks evaluate risk mathematically. Traditional credit cards expose lenders to loss if cardholders default. With no collateral, the bank must absorb unpaid balances through collections, legal action, or write-offs.

The deposit changes the risk equation. If a cardholder defaults, the bank can claim the deposit to cover outstanding balances. This collateral reduces loss probability to near zero, allowing banks to approve applicants they would otherwise reject.

The bank is not lending you your own money—it is lending you trust. The deposit sits in a separate account while the bank extends a credit line. Purchases use credit, not the deposit. Monthly payments go to the bank, not to the deposit account.

This structure creates a win-win scenario. Applicants gain access to credit-building tools. Banks minimize risk while earning interest and fees. The deposit serves as insurance, not payment.

Who Should Get a Secured Credit Card

Secured credit cards serve specific groups who face credit approval challenges. These cards provide the most value when traditional credit cards remain out of reach.

No Credit History

People with no credit history lack the payment records lenders use to assess risk. This group includes young adults who have never used credit, individuals who have only used cash or debit cards, and anyone without loans or credit accounts.

A secured card creates the first entry on a credit report. Even one account with six months of on-time payments establishes a credit score and demonstrates creditworthiness to future lenders.

Rebuilding After Collections or Bankruptcy

Past financial problems create long-lasting credit damage. Collections, charge-offs, bankruptcies, and foreclosures lower credit scores and trigger automatic denials from traditional card issuers.

Secured cards accept applicants with damaged credit because the deposit eliminates risk. Consistent use rebuilds credit scores over time, eventually qualifying cardholders for better products.

Young Adults and Students Without Scores

College students and recent high school graduates often have no credit history. While student credit cards exist, approval requirements can still exclude applicants with zero credit history.

Secured cards provide a guaranteed approval path. Students can build credit during college, creating a foundation for apartment rentals, car loans, and unsecured credit cards after graduation.

Recent Immigrants

Immigrants arriving in the United States bring no domestic credit history. Foreign credit records do not transfer to U.S. credit bureaus. This creates the same barrier as having no credit history.

Secured cards allow immigrants to establish U.S. credit profiles immediately. Combined with other credit-building tools, secured cards accelerate the path to mainstream financial products.

How Secured Cards Build Your Credit Score

Credit scores measure creditworthiness through mathematical models. FICO scores—the most widely used scoring system—weigh five factors with different importance levels.

Payment History (35%)

Payment history carries the most weight in credit scoring. Each on-time payment strengthens this factor. Each late payment damages it. Secured cards report payment activity monthly, creating a positive history when used responsibly.

Credit Utilization (30%)

Utilization measures the percentage of available credit currently in use. Lower utilization improves scores. Higher utilization lowers scores. A $300 limit with a $30 balance creates 10% utilization, which benefits scores.

Length of Credit History (15%)

Older accounts improve scores. Secured cards begin building account age immediately. The longer the account remains open, the more it contributes to this factor.

Credit Mix (10%)

Having different types of credit (cards, loans, mortgages) slightly improves scores. A secured card adds to the credit mix, though this factor carries less weight than payment history and utilization.

New Credit (10%)

Opening multiple accounts in a short period lowers scores temporarily. One secured card minimizes this impact while building the more important factors.

Secured cards directly influence the two most important factors: payment history and utilization. Consistent on-time payments and low balances create measurable score improvements within months. Learning how to build credit provides additional strategies that complement secured card use.

How to Use a Secured Card Correctly

Using a secured card correctly accelerates credit building. Misuse creates the opposite effect, damaging scores and wasting the opportunity.

Make 1-3 Small Purchases Monthly

Use the card for small, planned purchases like gas, groceries, or subscriptions. Avoid large purchases that consume the credit limit. Activity demonstrates responsible use without creating debt.

Keep Utilization Under 10%

Utilization below 10% maximizes score benefits. On a $300 limit, this means keeping balances below $30. On a $500 limit, keep balances below $50. Lower utilization signals responsible credit management to scoring models.

Pay the Statement Balance in Full

Pay the full statement balance by the due date every month. This avoids interest charges and maintains zero debt. Secured cards often carry high interest rates (18-25% APR), making full payment essential.

Understand Statement Closing Date vs Due Date

The statement closing date determines which transactions appear on the monthly statement. Transactions after this date appear on the next statement. The due date—typically 21-25 days after closing—is when payment must arrive to avoid late fees and credit damage.

Paying before the statement closing date lowers the balance reported to credit bureaus, improving utilization. Paying after the closing date but before the due date avoids late payments but reports higher utilization.

Set Up Autopay for at Least the Minimum

Autopay prevents missed payments. Set autopay for at least the minimum payment as a safety net. Make manual payments for the full balance, but keep autopay active to avoid accidental late payments.

Understanding the credit utilization ratio provides deeper insight into optimizing this crucial factor.

How Much Deposit Should You Choose?

Deposit amount decisions balance credit-building effectiveness with financial accessibility.

Start with $200-$300

Most people should start with the minimum deposit their chosen card allows, typically $200-$300. The primary purpose is building payment history, not spending power. A smaller deposit reduces upfront cost while achieving the same credit-building results.

Higher Limits Help Utilization Flexibility

Larger deposits create higher credit limits, making utilization management easier. A $500 limit allows $50 in charges while maintaining 10% utilization. A $200 limit allows only $20 in charges for the same utilization percentage.

If monthly expenses regularly exceed $20-30, consider a $500 deposit for utilization flexibility. If only using the card for one or two small purchases monthly, $200-300 suffices.

Deposit Must Be Affordable

Only deposit money that can remain untouched for 6-12 months. The deposit returns eventually, but it is inaccessible during the credit-building period. Do not deposit emergency fund money or cash needed for bills.

How Long You Should Keep a Secured Card

Secured cards serve as temporary credit-building tools, not permanent solutions.

Typical Timeline: 6-12 Months

Most users should keep secured cards for 6-12 months with consistent on-time payments. This period creates sufficient payment history for credit score improvement and qualification for better products.

Graduation to Unsecured Cards

Many secured card issuers offer “graduation” programs that convert secured cards to unsecured cards after demonstrating responsible use. The issuer returns the deposit and maintains the account, preserving account age.

Graduation typically requires:

- 6-12 months of on-time payments

- Responsible utilization patterns

- Credit score improvement to a specified threshold (often 650+)

Some issuers automatically review accounts for graduation. Others require cardholders to request a review.

When to Keep the Card Longer

If the secured card is the oldest account on a credit report, keeping it open preserves the length of credit history even after obtaining unsecured cards. Some users convert to unsecured status and keep the account active with occasional small purchases.

Can You Get Your Deposit Back?

The deposit is refundable under specific conditions.

When Deposits Are Returned:

Account Upgrade

When a secured card graduates to an unsecured card, the issuer returns the full deposit. The account remains open with the same account number and history. This is the ideal outcome.

Account Closure in Good Standing

Closing a secured card in good standing—meaning zero balance, no late payments, and no outstanding fees—triggers a deposit return. The issuer typically processes refunds within 1-2 billing cycles.

Late Payments Can Reduce Refunds

If the account carries an unpaid balance when closed, the issuer deducts the balance from the deposit. Late fees, interest charges, and other fees also reduce the refund amount.

Defaulting Forfeits the Deposit

Defaulting on a secured card—failing to make payments for 120-180 days—allows the issuer to claim the entire deposit to cover the debt. This defeats the purpose of the card and damages credit severely.

Treat the deposit as locked money that returns only through responsible use or account closure. This mindset prevents overspending and encourages proper card management.

Best Secured Credit Cards for Building Credit

Selecting the right secured card maximizes credit-building effectiveness while minimizing costs. Focus on approval reliability and reporting practices rather than rewards.

Discover it® Secured Credit Card

- Annual Fee: $0

- Minimum Deposit: $200

- Upgrade Path: Automatic reviews starting at 7 months

- Reporting: All three bureaus

- Benefits: Cash back rewards, no annual fee, FICO score access

Discover offers one of the best secured cards for building credit. The card reports to all three bureaus monthly and reviews accounts for graduation automatically. The cash back feature is unusual for secured cards.

Capital One Platinum Secured Credit Card

- Annual Fee: $0

- Minimum Deposit: $49, $99, or $200 (based on creditworthiness)

- Upgrade Path: Automatic reviews starting at 6 months

- Reporting: All three bureaus

- Benefits: Low minimum deposit, potential credit line increases without additional deposits

Capital One sometimes approves applicants for credit lines exceeding their deposit amount. The card offers upgrade opportunities relatively quickly with responsible use.

Secured Mastercard® from Capital One

- Annual Fee: $0

- Minimum Deposit: $49, $99, or $200

- Upgrade Path: Reviews after 6 months

- Reporting: All three bureaus

- Benefits: Similar to Platinum Secured, may offer higher initial limits

Another Capital One option with flexible deposit requirements and upgrade potential.

Citi® Secured Mastercard®

- Annual Fee: $0

- Minimum Deposit: $200

- Upgrade Path: Reviews after 18 months

- Reporting: All three bureaus

- Benefits: No annual fee, access to Citi benefits

Citi’s secured card takes longer to review for graduation, but it maintains zero annual fees and reports reliably.

OpenSky® Secured Visa® Credit Card

- Annual Fee: $35

- Minimum Deposit: $200-$3,000

- Upgrade Path: No automatic upgrade

- Reporting: All three bureaus

- Benefits: No credit check for approval

OpenSky approves applicants without credit checks, making it accessible for severely damaged credit. The annual fee and lack of upgrade path are downsides.

Self Visa® Credit Card

- Annual Fee: $0

- Minimum Deposit: $100-$5,000 (via credit builder account)

- Upgrade Path: Varies

- Reporting: All three bureaus

- Benefits: Builds credit through savings, low minimum deposit

Self combines a credit builder loan with a secured card, creating dual credit-building activity.

Selection Criteria:

Choose cards with no annual fees when possible. Verify the card reports to all three bureaus. Prioritize issuers with clear upgrade paths. Avoid cards with excessive fees or poor customer service reputations.

Secured vs Unsecured Credit Cards

Understanding the differences between secured and unsecured cards clarifies the path from credit building to mainstream credit access.

| Feature | Secured Credit Card | Unsecured Credit Card |

|---|---|---|

| Deposit Required | Yes ($200-$500 typical) | No |

| Approval Difficulty | Easy | Moderate to difficult |

| Credit Limit | Usually equals deposit | Based on creditworthiness |

| Interest Rates | Higher (18-25% APR) | Lower (15-20% APR typical) |

| Rewards | Rare | Common |

| Credit Building | Yes | Yes |

| Ideal For | Building/rebuilding credit | Established credit |

Secured Cards: Entry Point

Secured cards serve as entry-level products for people who cannot qualify for unsecured cards. The deposit requirement lowers approval standards, making these cards accessible to nearly everyone.

Unsecured Cards: Next Stage

Unsecured cards represent the next stage in credit development. These cards require no deposit, offer higher limits, and often include rewards programs. Qualification requires established credit history and acceptable credit scores (typically 650+).

The goal is to use a secured card to build the credit profile needed for unsecured card approval. This typically takes 6-12 months of responsible secured card use. Learn more about secured vs unsecured credit cards to understand the full comparison.

Common Mistakes to Avoid

Certain mistakes undermine credit-building efforts and waste the opportunity secured cards provide.

Maxing Out the Card

Using the entire credit limit creates 100% utilization, which severely damages credit scores. High utilization signals financial stress to scoring models. Keep balances well below 30% of the limit, ideally under 10%.

Missing Even One Payment

A single late payment can drop credit scores by 60-110 points, especially for people with thin credit files. Late payments remain on credit reports for seven years. Set up autopay and payment reminders to prevent this costly mistake.

Applying for Multiple Cards Simultaneously

Each credit card application typically triggers a hard inquiry, which lowers scores temporarily. Multiple applications in a short period signal credit-seeking behavior that concerns lenders. Apply for one secured card, use it responsibly for 6-12 months, then consider additional products.

Closing the Card Too Early

Closing a secured card immediately after obtaining an unsecured card can hurt credit scores by reducing total available credit and shortening average account age. If possible, upgrade the secured card to unsecured status rather than closing it.

Carrying a Balance to “Build Credit Faster”

This myth costs money without credit benefits. Credit scores do not improve faster when carrying balances and paying interest. Scores improve through on-time payments and low utilization, both achievable by paying in full monthly.

Ignoring the Statement Closing Date

Making purchases right before the statement closing date reports higher utilization to credit bureaus, even if the balance is paid in full by the due date. For optimal scores, make payments before the statement closing date to report lower balances.

How Fast a Secured Card Can Improve Credit

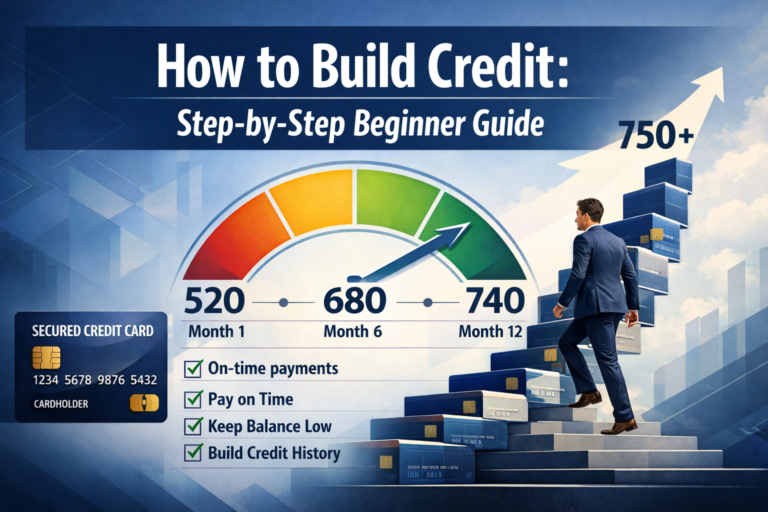

Credit improvement timelines vary based on starting credit profiles and usage patterns. Realistic expectations prevent frustration and encourage consistency.

| Time Period | Expected Change |

|---|---|

| 1-2 months | Credit score generated (if no previous score) |

| 3-6 months | Noticeable score increase (20-60 points typical) |

| 6-12 months | Significant improvement, approval chances for unsecured cards increase |

| 12+ months | Established credit history, qualification for better rates and products |

First 1-2 Months: Score Generation

People with no credit history will not see a score immediately. Credit bureaus require at least one account with six months of history to generate a FICO score. The secured card creates this foundation.

Months 3-6: Noticeable Increases

After three to six months of on-time payments and low utilization, scores typically increase by 20-60 points. The exact increase depends on other factors in the credit profile, such as past delinquencies or collections.

Months 6-12: Qualification Threshold

Between six and twelve months, many users cross the 650-680 score threshold that qualifies them for unsecured credit cards, better auto loan rates, and apartment approvals. This is when secured cards deliver tangible financial benefits.

Beyond 12 Months: Established Credit

After one year of consistent positive history, credit profiles become established. Users qualify for premium credit cards, lower interest rates on loans, and better insurance premiums.

Factors That Accelerate Improvement:

- Zero late payments

- Utilization consistently under 10%

- Multiple positive tradelines (secured card plus credit builder loan, for example)

- Removal of negative items through disputes or aging

Factors That Slow Improvement:

- Even one late payment

- High utilization (above 30%)

- New collections or negative items

- Frequent credit applications

Consistency matters more than credit limit size. A $200 secured card used perfectly builds credit faster than a $1,000 secured card used carelessly.

Secured Credit Cards vs Credit Builder Loans

Both secured credit cards and credit builder loans build credit, but they function differently and serve different needs.

Secured Credit Cards:

- Require upfront deposit

- Function as revolving credit

- Report monthly payment activity

- Build credit through utilization and payment history

- Provide spending flexibility

- Ideal for people who want access to credit for purchases

Credit Builder Loans:

- Require monthly payments into a savings account

- Function as installment loans

- Report monthly payment activity

- Build credit through payment history only

- Create forced savings

- Ideal for people who want to save money while building credit

Who Should Choose Secured Cards:

Choose secured cards if:

- You need a payment method for online purchases or emergencies

- You want to build credit while maintaining spending flexibility

- You can manage credit responsibly without overspending

- You want to eventually qualify for a rewards credit card

Who Should Choose Credit Builder Loans:

Choose credit builder loans if:

- You struggle with credit card overspending

- You want to build savings while building credit

- You prefer fixed monthly payments

- You want to add ian nstallment loan diversity to your credit mix

Optimal Strategy: Use Both

Using both products simultaneously builds credit faster by creating multiple positive tradelines and diversifying the credit mix. A secured card provides a revolving credit history, while a credit builder loan adds installment history. This combination addresses multiple FICO scoring factors.

💳 Secured Credit Card Calculator

Calculate your optimal deposit amount and projected credit score improvement timeline

Your Secured Card Analysis

Your utilization is excellent! Keep spending under $30 monthly and pay in full to maximize credit building.

Credit Score Improvement Timeline

Conclusion

A secured credit card is not a "bad credit card"—it is a starter account designed to establish trust with the credit system. The deposit requirement removes approval barriers while creating opportunities to demonstrate financial responsibility.

The math behind credit building is straightforward: consistent on-time payments plus low utilization equals credit score improvement. Secured cards provide the mechanism to execute this formula when traditional cards remain inaccessible.

Consistency matters more than credit limit size. A $200 secured card used perfectly—with on-time payments, low utilization, and full monthly payoffs—builds credit faster and more effectively than a $1,000 card used carelessly.

The path from secured to unsecured cards typically takes 6-12 months. During this period, focus on:

- Making every payment on time (set autopay)

- Keeping utilization under 10% (make payments before statement closing)

- Paying statement balances in full (avoid interest charges)

- Monitoring credit reports for accuracy (dispute errors immediately)

After building six to twelve months of positive history, apply for unsecured cards or request graduation from your secured card issuer. The deposit returns, the credit limit often increases, and access to better financial products opens.

Secured credit cards transform credit-building from an impossible barrier into a manageable process. The deposit is temporary. The credit history is permanent. Use the tool correctly, and the financial benefits compound over time.

Disclaimer

This article provides educational information about secured credit cards and credit-building strategies. It does not constitute financial advice, credit counseling, or recommendations for specific financial products. Credit card terms, fees, and approval criteria vary by issuer and change over time. Readers should verify current terms directly with card issuers before applying.

Credit-building results vary based on individual credit profiles, payment behavior, and other factors. The timelines and score improvements mentioned represent typical outcomes but are not guaranteed. Past performance of credit-building strategies does not guarantee future results.

Readers should consider their personal financial situations, credit goals, and risk tolerance when selecting credit products. Consulting with a qualified financial advisor or credit counselor may be appropriate for complex credit situations.

The Rich Guy Math provides data-driven financial education to help readers understand the math behind money. We may receive compensation from some card issuers mentioned, but this does not influence our educational content or recommendations.

Author Bio

Max Fonji is a data-driven financial educator and the voice behind The Rich Guy Math. With expertise in credit systems, investing fundamentals, and wealth-building strategies, Max translates complex financial concepts into clear, actionable insights. His approach combines analytical precision with educational clarity, helping readers understand the math behind money and build financial confidence through evidence-based strategies.

Frequently Asked Questions

Are secured credit cards bad?

No. Secured credit cards are legitimate credit-building tools, not inferior products. They function identically to regular cards in daily use and report to credit bureaus the same way. The deposit requirement makes them accessible to people who cannot qualify for unsecured cards. They serve as entry points to the credit system, not permanent solutions.

Do secured cards build credit fast?

Secured cards build credit at the same speed as unsecured cards—through monthly reporting of payment activity. Most users see noticeable score improvements within 3–6 months of consistent on-time payments and low utilization. Speed depends on starting credit profile and usage patterns, not the secured status of the card.

What credit score do you need for a secured credit card?

Most secured cards have no minimum credit score requirement. Some issuers approve applicants with scores as low as 300 or no score at all. The deposit eliminates the need for high credit scores. However, some secured cards from premium issuers may require scores above 550–600.

Can you be denied a secured credit card?

Yes, though denials are rare. Issuers may deny applications due to inability to verify identity, recent bankruptcy still in process, unpaid debts to the same issuer, or suspected fraud. Some issuers also deny applicants with extremely recent serious delinquencies. Most applicants with verifiable identity and deposit funds receive approval.

Should I carry a balance on my secured card to build credit faster?

No. This is a costly myth. Credit scores improve through on-time payments and low utilization, both achievable by paying in full monthly. Carrying balances only generates interest charges without credit benefits. Pay the full statement balance every month to build credit while avoiding unnecessary costs.

Can I have two secured credit cards at the same time?

Yes, but it is usually unnecessary. One secured card provides sufficient credit-building activity. Opening multiple secured cards requires multiple deposits and creates multiple hard inquiries. Focus on using one secured card perfectly for 6–12 months, then consider adding an unsecured card rather than a second secured card.