Self-employment tax is the federal tax that covers Social Security and Medicare contributions for people who work for themselves, such as freelancers, gig workers, and small business owners.

If you earn money outside of a W-2 job, you’re responsible for paying both the employer and employee share of payroll taxes. That’s called self-employment tax, and in 2025, it equals 15.3% of your net earnings. It’s separate from federal income tax and is reported on Schedule SE with your annual tax return.

TL;DR — Quick Takeaways

Self-employment tax is a federal tax that covers Social Security and Medicare contributions for freelancers, gig workers, and small business owners.

- The rate is 15.3% on net earnings (12.4% Social Security + 2.9% Medicare).

- You pay it if you earn $400 or more in net self-employment income.

- It’s reported on Schedule SE and filed with Form 1040.

- You may need to make quarterly estimated payments using Form 1040-ES.

- Deductions and retirement contributions can help lower your taxable income

What Is Self-Employment Tax?

When you’re self-employed — whether as a freelancer, consultant, rideshare driver, or small business owner — you’re responsible for paying both the employer and employee portion of Social Security and Medicare taxes. That’s where self-employment tax (SE tax) comes in.

Unlike federal income tax, which depends on your income bracket, SE tax is a flat rate of 15.3% applied to your net earnings (after business expenses).

In other words, if you earn money independently, you’re your own boss and your own payroll department. Tax filing

Who Must Pay Self-Employment Tax?

The IRS makes it simple: if your net earnings from self-employment are $400 or more in a year, you must file Schedule SE and pay SE tax.

- Applies to sole proprietors, freelancers, gig workers, and independent contractors.

- Includes part-time side hustlers (even if you also have a W-2 job).

- Farmers and certain church employees may have special rules.

IRS source: Self-Employment Tax page.

Self-Employment Tax Rates in 2025

The current SE tax rate is 15.3%, broken down as:

| Tax Component | Rate | Applies To | Notes |

|---|---|---|---|

| Social Security | 12.4% | Net earnings up to $168,600 (2025 wage base) | Stops after the cap |

| Medicare | 2.9% | All net earnings | No cap |

| Additional Medicare | 0.9% | Income above $200,000 (single) / $250,000 (joint) | Only on high earners |

Important: You don’t pay SE tax on 100% of your profit. Instead, the IRS says you pay it on 92.35% of your net earnings. This adjustment accounts for the “employer side” of FICA.

How to Calculate Self-Employment Tax (Step by Step)

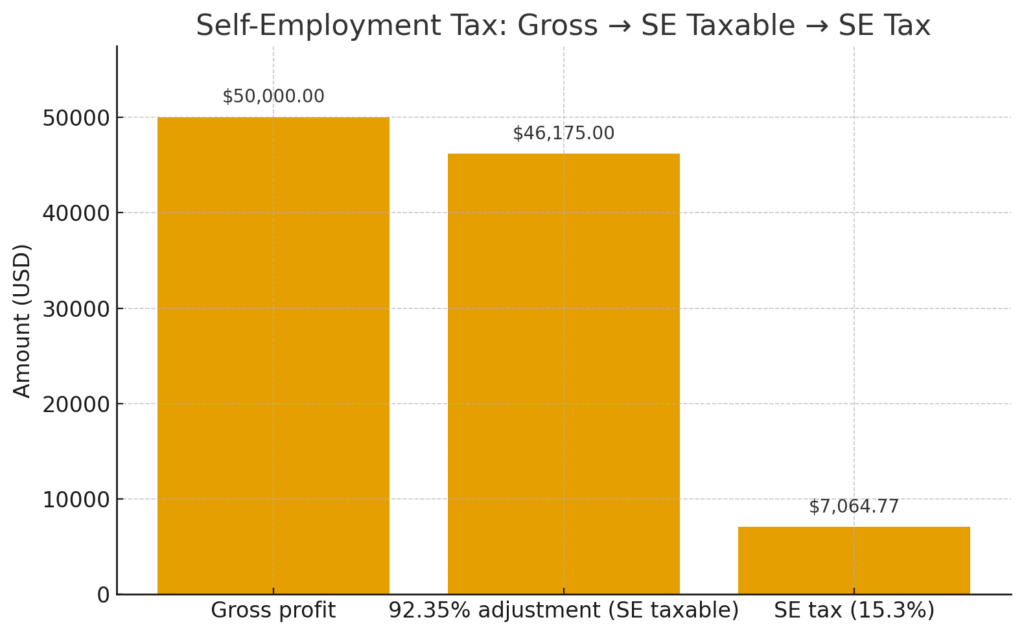

Let’s run through an example with $50,000 net profit from freelancing:

- Multiply by 92.35% → $50,000 × 0.9235 = $46,175 SE taxable income.

- Apply 15.3% → $46,175 × 0.153 = $7,066 SE tax owed.

- Deduction benefit: You can deduct half ($3,533) on your Form 1040, reducing your adjusted gross income (AGI). Tax refund

Bar chart showing gross profit → 92.35% adjustment → SE tax.

How to File and Pay Self-Employment Tax

- Annual Filing:

- Report your net profit on Schedule C (Profit or Loss from Business).

- Complete Schedule SE to calculate SE tax.

- Transfer results to Form 1040.

- Quarterly Estimated Payments:

- If you expect to owe $1,000+ in tax, the IRS requires quarterly estimated tax payments.

- Use Form 1040-ES to calculate and submit.

- Deadlines: April 15, June 15, Sept. 15, Jan. 15.

- Payment Methods:

- IRS Direct Pay

- Electronic Federal Tax Payment System (EFTPS)

- Credit/debit card

Think of it as paying your own “withholding,” since no employer is doing it for you. s:

Schedule SE Instructions (PDF)

Deductions and Credits That Reduce SE Tax

Self-employed taxpayers get some powerful deductions:

- 50% SE Tax Deduction is built into the adjustment on Form 1040.

- Business Expenses: home office, supplies, mileage, software, internet, professional services.

- Retirement Contributions: SEP IRA, Solo 401(k), SIMPLE IRA.

- Health Insurance Premiums: if you’re paying your own.

Tip: Keeping detailed records of deductible expenses saves you about $153 in SE tax (plus income tax savings) for every $1,000.

Self-Employment Tax vs State Taxes

Self-employment tax is federal only. Your state may also require income tax filings, depending on where you live. state income tax

For example:

- No state tax: Florida, Texas, Washington.

- High tax states: California, New York.

Learn more: State income tax guide.

Pros and Cons of Self-Employment Taxes

Pros:

- Contributions go toward future Social Security & Medicare benefits.

- Eligible for deductions and tax planning strategies.

- Flexibility to structure income through S-Corps or retirement accounts.

Cons:

- Higher burden (you pay both sides of the payroll tax).

- Need to handle quarterly payments yourself.

- Complexity increases the risk of IRS penalties if you miss payments.

Common Mistakes to Avoid

- Forgetting to make estimated quarterly payments → penalty + interest.

- Not deducting legitimate expenses.

- Confusing SE tax with federal income tax (they’re separate).

- Ignoring the additional 0.9% Medicare surtax if you’re a high earner.

No. If your net earnings are under $400, you generally don’t owe SE tax.

You may still owe SE tax on your freelance profit, but W-2 wages already count toward the Social Security cap.

Yes, even $500 of net profit means filing Schedule SE.

An LLC doesn’t reduce SE tax by itself, but electing S-Corp status may allow you to take part of your income as distributions (not subject to SE tax).

It depends on your state. Some states allow it, others don’t.

No, only on trade or business income.

You must combine all self-employment income and file one Schedule SE.

The IRS can assess penalties, interest, and reduce future Social Security credits.

Bottom Line

Self-employment tax is often the biggest surprise for new freelancers and small business owners. While it feels like a burden, it funds your future Social Security and Medicare benefits, and with smart planning (deductions, retirement accounts, maybe even an S-Corp election), you can reduce the sting.

Next step: check out our Complete Guide to Tax Filing to see how self-employment tax fits into your overall return.

Disclaimer

This article is for educational purposes only. It is not tax, legal, or financial advice. Please consult a qualified CPA or tax professional for advice specific to your situation.

Author Bio

Max Fonji is the founder of TheRichGuyMath.com, a finance and investing education site dedicated to making money, taxes, and investing simple for everyone. With over 30 years of SEO and financial writing expertise, he helps readers cut through the jargon and make confident money decisions.