Ever borrowed $100 from a friend and promised to pay back $110 next month? Congratulations, you’ve already experienced simple interest in action! While it might seem like basic math (and it is), understanding simple interest is the foundation for making smarter financial decisions, whether you’re saving money, taking out a loan, or building wealth through investing.

In simple terms, simple interest is the additional money you earn on savings or pay on a loan, calculated only on the original amount (called the principal). Unlike compound interest, which grows exponentially, simple interest stays straightforward and predictable, making it the perfect starting point for anyone learning about money management.

TL;DR Summary

- Simple interest is calculated only on the principal amount using the formula: I = P × R × T

- It’s commonly used for short-term loans, car loans, and some savings accounts—unlike compound interest, which builds on itself

- The formula requires three inputs: Principal (original amount), Rate (annual interest percentage), and Time (duration in years)

- Simple interest is easier to calculate and predict than compound interest, but generates less return on investments over long periods

- Understanding simple interest helps you compare loan offers, calculate borrowing costs, and make informed financial decisions

What Is Simple Interest?

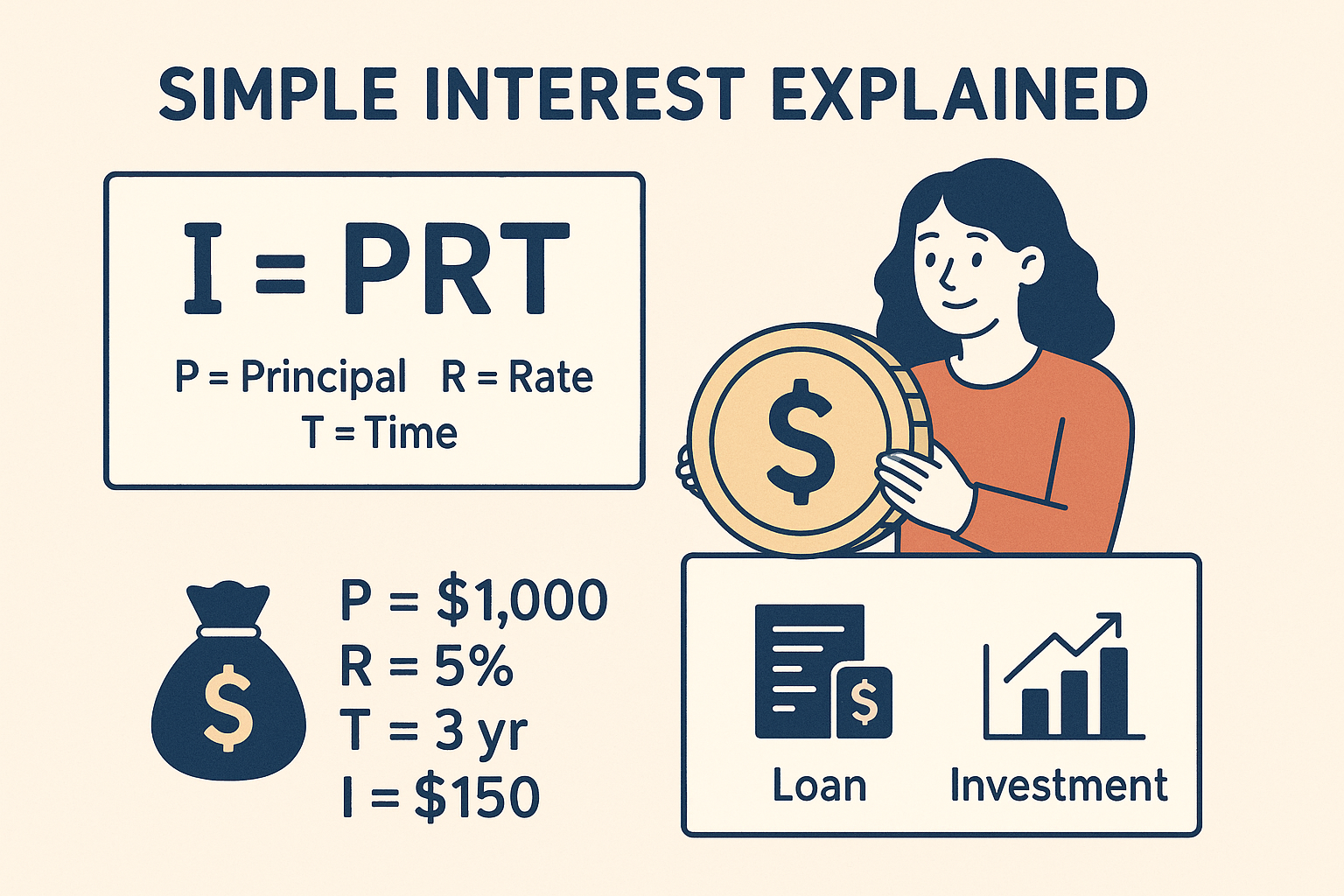

Simple interest is a method of calculating the interest charge on a loan or investment based solely on the original principal amount. The formula for simple interest is: I = P × R × T, where I represents interest, P is principal, R is the annual interest rate (as a decimal), and T is time in years.

Think of it this way: if you deposit $1,000 in a savings account that pays 5% simple interest annually, you’ll earn exactly $50 each year—no more, no less. The interest doesn’t change because it’s always calculated on that original $1,000, not on the growing balance.

Why Simple Interest Matters

Understanding simple interest is crucial for several reasons:

- Loan comparisons: Helps you evaluate different lending offers accurately

- Financial planning: Allows you to predict exactly how much you’ll pay or earn

- Foundation knowledge: Serves as the building block for understanding more complex interest calculations

- Real-world applications: Used in car loans, short-term personal loans, and certain investment products

According to the Federal Reserve, consumer credit reached over $4.9 trillion in 2025, with millions of Americans paying interest on various loans. Knowing how simple interest works can save you thousands of dollars over your lifetime. Investopedia

The Simple Interest Formula Explained

The simple interest formula is refreshingly straightforward:

I = P × R × T

Where:

- I = Interest amount (what you’ll pay or earn)

- P = Principal (the original amount borrowed or invested)

- R = Rate (annual interest rate expressed as a decimal)

- T = Time (duration in years)

Converting the Formula for Total Amount

Often, you’ll want to know the total amount you’ll pay back or receive, not just the interest. For that, use:

A = P + I or A = P(1 + RT)

Where A is the total amount after adding interest to the principal.

Breaking Down Each Component

Principal (P): This is your starting point—the original sum of money. If you borrow $5,000 for a car, that’s your principal.

Rate (R): The annual interest percentage, but you must convert it to decimal form. A 6% rate becomes 0.06 in the formula.

Time (T): The duration must be in years. If you have a 6-month loan, that’s 0.5 years; a 90-day loan is 90/365 = 0.247 years.

Step-by-Step Examples of Simple Interest Calculations

Let’s work through real-world scenarios to see simple interest in action.

Example 1: Basic Savings Account

Scenario: You deposit $2,000 in a savings account offering 4% simple interest annually. How much interest will you earn in 3 years?

Given:

- P = $2,000

- R = 4% = 0.04

- T = 3 years

Calculation:

I = P × R × T

I = $2,000 × 0.04 × 3

I = $240

Total Amount: A = $2,000 + $240 = $2,240

You’ll earn $240 in interest over three years, giving you a total of $2,240.

Example 2: Short-Term Personal Loan

Scenario: You borrow $8,000 at 7% simple interest for 2 years. What’s your total repayment amount?

Given:

- P = $8,000

- R = 7% = 0.07

- T = 2 years

Calculation:

I = $8,000 × 0.07 × 2

I = $1,120

Total Repayment: A = $8,000 + $1,120 = $9,120

You’ll pay back $9,120 total, with $1,120 being interest charges.

Example 3: Partial Year Calculation

Scenario: You invest $5,000 at 6% simple interest for 9 months. How much interest do you earn?

Given:

- P = $5,000

- R = 6% = 0.06

- T = 9 months = 9/12 = 0.75 years

Calculation:

I = $5,000 × 0.06 × 0.75

I = $225

You’ll earn $225 in interest over 9 months.

Example 4: Finding the Principal

Scenario: You want to earn $600 in interest over 2 years at 5% simple interest. How much should you invest?

Rearranged Formula: P = I ÷ (R × T)

Given:

- I = $600

- R = 5% = 0.05

- T = 2 years

Calculation:

P = $600 ÷ (0.05 × 2)

P = $600 ÷ 0.10

P = $6,000

You need to invest $6,000 to earn $600 in simple interest over 2 years.

Interactive Simple Interest Calculator

💰 Simple Interest Calculator

Simple Interest vs Compound Interest: Understanding the Difference

One of the most common questions beginners ask is: “What’s the difference between simple and compound interest?” The answer fundamentally changes how your money grows (or how much you owe).

Key Differences at a Glance

| Feature | Simple Interest | Compound Interest |

|---|---|---|

| Calculation Base | Only on principal | On principal + accumulated interest |

| Growth Pattern | Linear (steady) | Exponential (accelerating) |

| Formula Complexity | Simple: I = P × R × T | More complex: A = P(1 + r/n)^(nt) |

| Common Uses | Car loans, short-term loans | Savings accounts, credit cards, mortgages |

| Long-term Returns | Lower | Significantly higher |

| Predictability | Very predictable | Requires more calculation |

See the full guide on Simple Interest vs Compound Interest

Real-World Comparison

Let’s see how $10,000 grows over 5 years at 6% interest:

Assume you invest $10,000 over 5 years at a 6% annual rate.

Here’s how your balance grows under simple interest and compound interest:

| Year | Simple Interest ($) | Compound Interest ($) |

|---|---|---|

| 1 | $10,000 + $600 = $10,600 | $10,600 |

| 2 | $10,000 + $1,200 = $11,200 | $11,236 |

| 3 | $10,000 + $1,800 = $11,800 | $11,910 |

| 4 | $10,000 + $2,400 = $12,400 | $12,625 |

| 5 | $10,000 + $3,000 = $13,000 | $13,382 |

Key Takeaway

With simple interest, you earn a fixed $600 every year, resulting in linear growth.

With compound interest, you earn interest on interest, creating exponential growth that accelerates each year.

The difference? $382 more with compound interest over just 5 years. Over longer periods, this gap becomes enormous, which is why understanding both is crucial for making smart investing decisions.

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” — Often attributed to Albert Einstein

Advantages of Simple Interest

Despite being less powerful for long-term growth, simple interest has several benefits:

1. Transparency and Simplicity

Simple interest calculations are straightforward. You can quickly determine exactly what you’ll pay or earn without complex formulas or financial calculators. This makes it ideal for financial literacy education.

2. Predictable Payments

When you have a simple interest loan, your interest charges remain consistent. This makes budgeting easier since you know exactly what to expect each payment period.

3. Lower Total Interest on Loans

For borrowers, simple interest loans typically cost less than compound interest loans over the same period. This is especially beneficial for short-term borrowing.

4. Fair for Short-Term Transactions

Simple interest makes sense for brief financial arrangements, like a 90-day personal loan or a short-term business line of credit, where compound interest would be unnecessarily complex.

5. Easy to Verify

Anyone can check simple interest calculations with basic arithmetic. This transparency helps borrowers ensure they’re being charged correctly.

Limitations of Simple Interest

While simple interest has its place, it comes with notable drawbacks:

1. Lower Returns on Investments

If you’re saving or investing for the long term, simple interest significantly underperforms compound interest. The difference can be thousands or even hundreds of thousands of dollars over decades.

2. Not Realistic for Most Financial Products

Most modern savings accounts, investment vehicles, and credit products use compound interest. Simple interest is increasingly rare in retail banking.

3. Doesn’t Reflect Time Value of Money

Simple interest doesn’t account for the opportunity cost of money over time. In reality, money available today is worth more than the same amount in the future due to inflation and investment potential.

4. Limited Use in Modern Finance

According to Investopedia, most contemporary financial instruments—from mortgages to credit cards to dividend-paying stocks—utilize compound interest because it more accurately reflects economic reality.

Real-World Applications: Where Simple Interest Is Used

Understanding where simple interest appears in everyday life helps you recognize when you’re dealing with it. capitalone.com

1. Auto Loans

Many car loans use simple interest calculations. When you finance a vehicle, the lender typically charges simple interest on the outstanding principal balance. Making extra payments directly reduces the principal, lowering future interest charges.

2. Short-Term Personal Loans

Payday loans, personal installment loans, and some peer-to-peer lending arrangements use simple interest for transparency and ease of calculation.

3. Certain Savings Products

While rare, some promotional savings accounts or certificates of deposit (CDs) may offer simple interest, especially for very short terms (90 days or less).

4. Student Loans (Subsidized)

Some federal student loans calculate interest using simple interest methods during specific periods, though they may capitalize (convert to compound) at certain points.

5. Business Lines of Credit

Short-term business financing often employs simple interest, making it easier for business owners to calculate their borrowing costs.

6. Treasury Bills and Bonds

U.S. Treasury securities, considered among the safest investments according to SEC.gov, often use simple interest calculations for their short-term bills.

How to Use Simple Interest in Investment Decisions

Even though most investments use compound interest, understanding simple interest helps you make better financial choices.

Evaluating Loan Offers

When comparing loan offers, calculate the simple interest to get a baseline understanding of costs. Ask lenders:

- “Is this simple or compound interest?”

- “What’s the total interest I’ll pay over the loan term?”

- “How does making extra payments affect my interest charges?”

Quick Return Estimates

Simple interest provides a conservative estimate for short-term investment returns. If you’re considering a 6-month certificate of deposit, simple interest gives you a quick calculation of minimum expected returns.

Understanding Opportunity Cost

By calculating simple interest on the money you’re considering investing, you establish a baseline return. This helps when evaluating whether passive income opportunities are worth pursuing.

Negotiating Terms

Understanding simple interest empowers you during financial negotiations. If a lender quotes compound interest terms, you can calculate the simple interest equivalent to better understand the true cost difference.

Common Mistakes to Avoid When Calculating Simple Interest

Even with a straightforward formula, people make errors. Here are pitfalls to watch for:

1: Forgetting to Convert Percentages

Error: Using 5 instead of 0.05 for a 5% rate

Fix: Always divide the percentage by 100 (5% = 0.05)

2: Wrong Time Units

Error: Using months directly when the formula requires years

Fix: Convert months to years (6 months = 0.5 years) or days to years (90 days = 90/365 years)

3: Confusing Simple with Compound

Error: Assuming your savings account uses simple interest when it actually compounds

Fix: Always verify the interest type with your financial institution

4: Miscalculating Partial Years

Error: Rounding 9 months to 1 year

Fix: Use exact decimal conversions (9 months = 0.75 years)

5: Not Considering Fees

Error: Calculating only interest without including loan origination fees or account maintenance charges

Fix: Factor in all costs to determine true borrowing or investment costs

Step-by-Step Guide: Solving Simple Interest Problems

Let’s walk through a systematic approach to tackling any simple interest problem.

Step 1: Identify What You Know

Write down the given information:

- Principal (P) =?

- Rate (R) =?

- Time (T) =?

- Interest (I) or Total Amount (A) =?

Step 2: Convert Units

- Change percentages to decimals (divide by 100)

- Convert time to years if necessary

- Ensure all units are compatible

Step 3: Choose the Right Formula

- For interest only: I = P × R × T

- For total amount: A = P(1 + RT)

- To find principal: P = I ÷ (R × T)

- To find rate: R = I ÷ (P × T)

- To find time: T = I ÷ (P × R)

Step 4: Plug in Values and Calculate

Substitute your known values into the formula and solve step-by-step.

Step 5: Verify Your Answer

Does your result make logical sense? If you borrowed $1,000 at 5% for one year, you shouldn’t owe $10,000; that’s a red flag to recheck your work.

Simple Interest in the Context of Building Wealth

While simple interest alone won’t make you wealthy, understanding it is foundational for financial success.

The Role in Financial Education

Simple interest serves as the gateway to more advanced financial concepts. Before diving into how the stock market works or understanding why the stock market goes up, grasping simple interest builds essential numeracy skills.

Avoiding Debt Traps

Many predatory lenders advertise “simple” interest rates that seem low but hide fees and unfavorable terms. Understanding the real calculation helps you avoid these traps and recognize when you’re being misled.

Foundation for Compound Growth

Once you master simple interest, compound interest makes more sense. And compound interest is where real wealth building happens—whether through dividend investing or long-term stock market growth.

Teaching Financial Literacy

If you’re helping your children build wealth, starting with simple interest concepts makes math relatable and practical. It transforms abstract percentages into real-world money scenarios they can understand.

Key Risks and Considerations

Inflation Impact

Simple interest doesn’t account for inflation. If you earn 3% simple interest but inflation runs at 4%, you’re actually losing purchasing power. This is why long-term savers need investments that offer compound returns and potential appreciation.

Opportunity Cost

Money tied up in simple interest products might earn more elsewhere. According to Morningstar, diversified stock portfolios have historically returned about 10% annually over long periods—far exceeding typical simple interest returns.

Limited Availability

As mentioned, simple interest products are becoming rarer. Don’t assume a financial product uses simple interest without confirming—most don’t.

Not Suitable for Long-Term Goals

For retirement planning, education savings, or other long-term objectives, simple interest investments are inadequate. The linear growth can’t compete with compound interest’s exponential power over decades.

FAQ: Simple Interest

What is simple interest in simple terms?

Simple interest is the extra money you earn on savings or pay on a loan, calculated only on the original amount (principal) using the formula I = P × R × T. Unlike compound interest, it doesn’t grow on itself—you earn or pay the same amount each period based solely on the initial sum.

How do you calculate simple interest?

To calculate simple interest, multiply the principal amount by the interest rate (as a decimal) and the time in years: I = P × R × T. For example, $1,000 at 5% for 2 years equals $1,000 × 0.05 × 2 = $100 in interest.

What’s the difference between simple and compound interest?

Simple interest is calculated only on the principal, while compound interest is calculated on the principal plus previously earned interest. Compound interest grows exponentially over time, while simple interest grows linearly, making compound interest significantly more powerful for long-term investments.

Is simple interest better for borrowers or savers?

Simple interest is generally better for borrowers because it results in lower total interest charges compared to compound interest. For savers and investors, compound interest is better because it generates higher returns over time.

What is a good simple interest rate?

A “good” simple interest rate depends on the context. For savings, anything above 4-5% is competitive as of 2025. For loans, lower is better—auto loans might range from 4-8% depending on creditworthiness. Always compare rates across multiple institutions.

Can you pay off a simple interest loan early?

Yes, and it’s often advantageous. Since simple interest is calculated on the principal balance, paying extra or paying early reduces the principal, which reduces total interest charges. There’s typically no prepayment penalty on simple interest loans, but always verify with your lender.

Where is simple interest used in real life?

Simple interest appears in car loans, some short-term personal loans, certain savings accounts, U.S. Treasury bills, and some student loans. However, it’s becoming less common as most financial products now use compound interest.

How does time affect simple interest?

Time has a direct, linear relationship with simple interest. Double the time, and you double the interest earned or paid. The formula I = P × R × T shows that interest increases proportionally with time, unlike compound interest, which accelerates over time.

Practical Tips for Using Simple Interest Knowledge

1. Always Ask About Interest Type

When opening accounts or taking loans, explicitly ask: “Is this simple or compound interest?” Don’t assume—get it in writing.

2. Use Simple Interest for Quick Estimates

Even if an investment compounds, simple interest gives you a conservative baseline estimate for short periods.

3. Compare APR vs. APY

Annual Percentage Rate (APR) often reflects simple interest, while Annual Percentage Yield (APY) includes compounding. Understanding both helps you compare offers accurately.

4. Leverage Early Payments

On simple interest loans, every extra dollar paid goes directly to principal, immediately reducing future interest. This strategy can save significant money.

5. Teach Others

Financial literacy is a gift. Share simple interest concepts with family members, especially young people learning about money management.

The Psychology of Interest: Understanding Behavioral Finance

Interestingly, behavioral finance research shows that people often underestimate the impact of interest—both simple and compound—on their financial futures. This cognitive bias, known as “exponential growth bias,” causes individuals to dramatically underestimate how much debt can grow or how much savings can accumulate. Consumer Financial Protection Bureau

Understanding simple interest helps combat this bias by making the math transparent and accessible. When you can easily calculate that a $5,000 loan at 8% for 3 years costs $1,200 in interest, it becomes real and actionable.

This psychological clarity is why understanding market emotions matters too—emotional decisions often lead to financial mistakes, whether in investing or borrowing.

Real Data Example: Auto Loan Comparison

Let’s examine a real-world scenario using 2025 market data.

Scenario: You’re buying a $25,000 car and comparing two loan offers:

Offer A: 5-year simple interest loan at 6%

Offer B: 5-year compound interest loan at 5.5%

Offer A Calculation (Simple Interest):

- P = $25,000

- R = 6% = 0.06

- T = 5 years

- I = $25,000 × 0.06 × 5 = $7,500

- Total repayment: $32,500

Offer B Calculation (Compound Interest, monthly):

Using the compound interest formula:

- A = $25,000 × (1 + 0.055/12)^(12×5)

- A ≈ $32,900

- Total interest: $7,900

Result: Despite the lower stated rate, Offer B costs $400 more due to compounding. This demonstrates why understanding both interest types matters when making borrowing decisions.

How Simple Interest Fits Into Your Overall Financial Strategy

Short-Term Borrowing

Simple interest loans work well for short-term needs where you plan to repay quickly. The predictable costs help with budgeting.

Emergency Funds

While not ideal for long-term savings, simple interest accounts can serve as emergency funds where liquidity matters more than maximum returns.

Educational Foundation

Master simple interest before tackling more complex topics like why people lose money in the stock market or advanced investment strategies.

Debt Payoff Strategy

Understanding simple interest helps you prioritize which debts to pay first and calculate the exact savings from extra payments.

Advanced Applications: Beyond the Basics

Calculating Break-Even Points

Simple interest helps determine when an investment becomes profitable or when refinancing a loan makes sense.

Comparing Investment Vehicles

Use simple interest as a benchmark when evaluating more complex investments. If a complicated investment can’t beat simple interest returns, it’s probably not worth the additional risk.

Business Finance

Small businesses often use simple interest calculations for accounts receivable aging, short-term financing costs, and quick financial projections.

Legal Settlements

Courts sometimes use simple interest to calculate damages or interest on delayed payments in legal judgments.

Tools and Resources for Simple Interest Calculations

Online Calculators

Numerous free calculators are available online, including those from:

- Investopedia: Comprehensive financial calculators with educational content

- SEC.gov: Official calculators for various financial scenarios

- Bank websites: Most major banks offer free calculators for customers

Spreadsheet Templates

Microsoft Excel and Google Sheets have built-in formulas for simple interest:

=Principal * Rate * TimeMobile Apps

Financial literacy apps often include simple interest calculators alongside budgeting and tracking tools.

Financial Advisors

For complex situations, consulting with a certified financial planner can provide personalized guidance. According to the CFA Institute, professional advisors can help you understand how different interest calculations affect your specific financial goals.

Conclusion: Mastering Simple Interest for Financial Success

Simple interest might seem basic, and mathematically, it but its implications for your financial life are profound. Whether you’re taking out your first car loan, opening a savings account, or teaching your children about money, understanding how simple interest works empowers you to make informed decisions.

Key takeaways to remember:

Simple interest is calculated only on the principal using I = P × R × T

It’s more transparent and predictable than compound interest, making it ideal for short-term loans and financial education

While simple interest generates lower returns for savers, it results in lower costs for borrowers compared to compound interest

Always verify whether a financial product uses simple or compound interest—don’t assume

Use simple interest knowledge to compare loan offers, estimate returns, and avoid predatory lending

Your Next Steps

- Review your current loans and savings accounts: Determine which uses simple vs. compound interest

- Calculate your costs/returns: Use the formulas you’ve learned to understand exactly what you’re paying or earning

- Compare offers: Before taking any new loan or opening any account, calculate the true costs using simple interest principles

- Educate others: Share this knowledge with family members who might benefit

- Expand your knowledge: Move on to understanding compound interest and more advanced financial concepts

Remember, financial literacy is a journey, not a destination. Simple interest is your foundation; build on it by exploring compound interest, investment strategies, and wealth-building techniques. The time you invest in understanding these concepts today will pay dividends (literally!) for the rest of your life.

Disclaimer

This article is for educational purposes only and does not constitute financial advice. Simple interest calculations can vary based on the specific terms and conditions of financial products. Always read the complete terms of any loan or investment, and consult with a qualified financial advisor before making significant financial decisions. Interest rates, fees, and terms mentioned are examples and may not reflect current market conditions. Your individual circumstances may require different strategies.

About the Author

Written by Max Fonji — With over a decade of experience in financial education and investment analysis, Max is your go-to source for clear, data-backed investing education. As the founder of TheRichGuyMath.com, Max is passionate about making complex financial concepts accessible to everyone, from complete beginners to experienced investors. His mission is to empower readers with the knowledge and tools needed to build lasting wealth and financial independence.