State income tax is the tax a state levies on income earned by residents and on income earned within the state by non-residents. Whether you’re a salaried employee, freelancer, retiree, or small business owner, understanding state income tax is critical to planning your finances. This guide will walk you through what state income tax is, which states have no income tax, how to calculate it, and strategies to minimize surprises. We’ll also provide downloadable resources, interactive tools, and practical case studies. Investopedia: State Income Tax

TL;DR — Quick Answers and Key Takeaways

- Who pays: Most U.S. residents pay state income tax unless they live in one of eight states with no broad-based individual income tax.

- How it’s charged: States use flat or graduated rates; non-residents pay taxes on income earned in that state.

- Actionable steps: Download the state-rate CSV, run the move/comparison calculator, and review your state’s residency rules before relocating.

- Why it matters: Proper planning can save thousands in taxes, avoid penalties, and help make informed relocation or career decisions. Tax filing

What is State Income Tax?

State income tax is the tax that state governments impose on the income you earn. It is separate from federal income tax and varies widely across states. Some states use flat rates, some have progressive brackets, and a handful impose no income tax at all.

States typically base their tax system on federal taxable income with adjustments. These adjustments can include adding back certain deductions or excluding specific types of income, like retirement benefits. Understanding your state’s rules is crucial to avoid surprises at tax time. Tax refund

Quick Fact: As of 2025, eight states have no broad-based individual income tax: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, and Wyoming. (Some of these states may still tax dividends or interest income.) TurboTax: State Income Taxes Explained

Which States Have No Income Tax — And What That Really Means

While eight states don’t impose an individual income tax, that doesn’t mean residents avoid taxes altogether. States without income tax often make up the revenue with higher sales, property, or excise taxes. IRS: State Income Tax Resources

States with No Broad-Based Individual Income Tax

| State | Notes |

|---|---|

| Alaska | Funded largely by oil revenue; no income tax on wages. |

| Florida | Relies on sales and tourism taxes; no personal income tax. |

| Nevada | Tourism-heavy economy; no income tax. |

| New Hampshire | Taxes dividends/interest only; recently repealed interest tax. |

| South Dakota | No individual income tax; property taxes are above average. |

| Tennessee | Phasing out dividend/interest tax; wages exempt. |

| Texas | High property taxes; no income tax. |

| Wyoming | Funded by energy production; no income tax. |

Tradeoffs: Living in a no-income-tax state may mean higher sales or property taxes, or fewer public services. For individuals considering relocation, it’s essential to compare the total tax burden, not just income taxes. Self-employment tax

How State Income Tax Is Calculated

Flat vs. Graduated Rates

States generally use one of three models:

- Flat tax: A single rate applies to all income.

Example: $100,000 taxable income × 5% = $5,000 state tax. - Graduated tax: Rates rise with income brackets.

Example: If a state has brackets at 3%, 5%, and 7%, income is taxed incrementally across brackets. - No tax: Some states impose no income tax but may levy other taxes.

Residency and Nonresident Rules

- Residency: Your home state usually taxes all your income. Moving mid-year may require filing part-year returns in two states.

- Nonresident income: If you earn money in a state where you don’t live, that state may tax you. Many states have reciprocal agreements to avoid double taxation.

- Credits for taxes paid to other states: Most states offer a credit for taxes paid elsewhere. Court rulings, like the Wynne decision, have clarified limits.

Actionable Tip: Keep meticulous records of days worked and income allocation for multi-state work. Wikipedia: State Income Tax

Common Situations & Mini Case Studies

- The Remote Worker

Works in State B one day a week while residing in State A. Taxation depends on the states’ rules, often requiring careful day-count tracking. - Moving Mid-Year (NY → FL Example)

File part-year returns in both states. Calculate prorated taxes and consider cost-of-living and sales/property taxes before concluding a financial benefit. - Retiree with Social Security & Pension

Some states exempt Social Security; others tax pensions differently. Check the state revenue website for specific rules. - Small Business Owner with Multi-State Nexus

Business income apportionment may depend on sales, payroll, or property factors. Consult a CPA for accurate filings. State tax refund

Tip: Each case study can be enhanced with downloadable spreadsheets detailing calculations. Tax Foundation: State Tax Rates

Practical Checklist: Filing, Forms, Deadlines, and Tools

- Filing thresholds: Check your state’s minimum income requirement before filing.

- Deadlines: Most states follow federal deadlines (April 15), but verify each state’s schedule.

- Tools:

- Download the state-rate CSV for comparisons.

- Use the move/comparison calculator for hypothetical income changes.

- Access forms directly from state revenue departments.

How to Compare State Tax Burdens

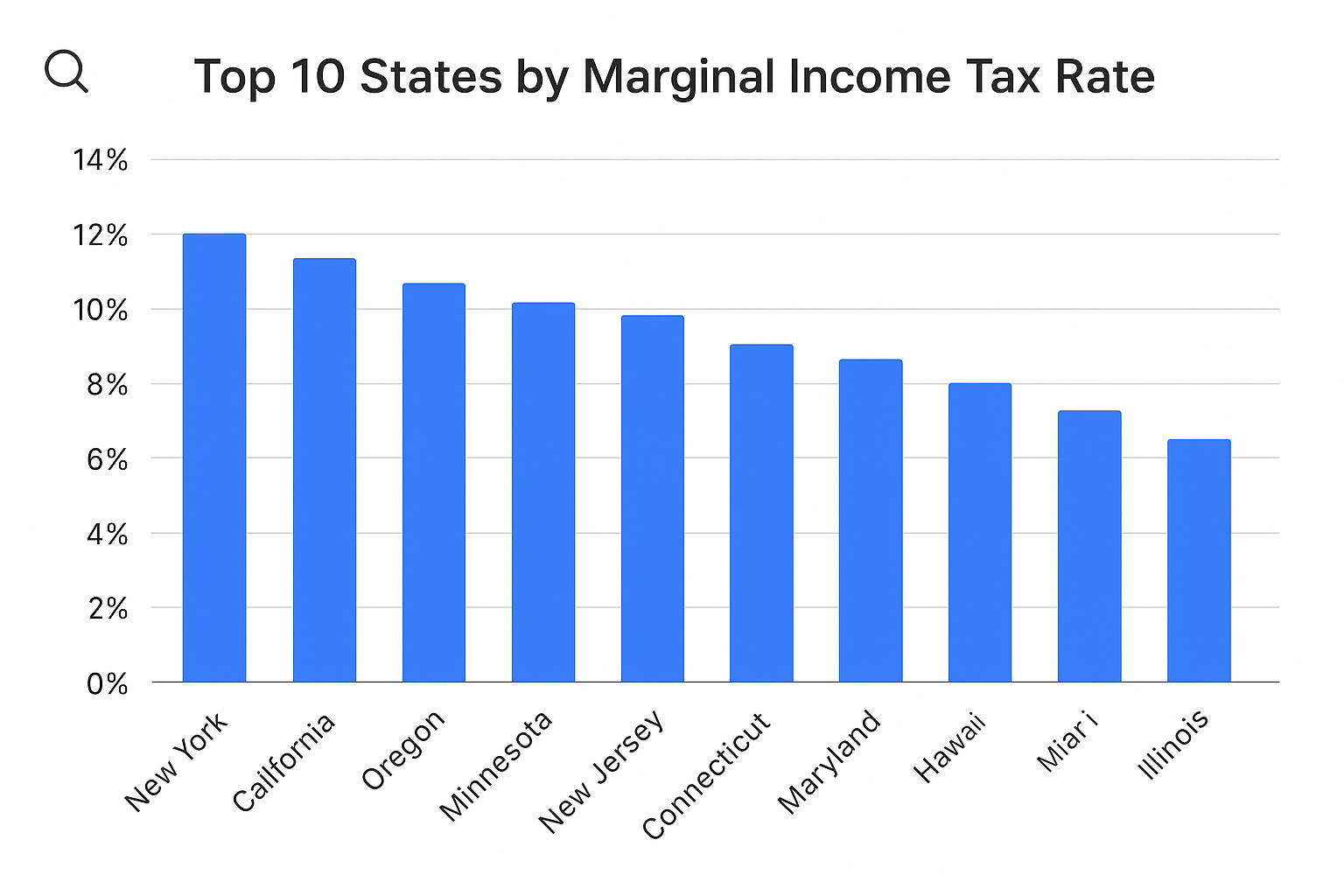

Don’t focus only on the top marginal rate. Consider the effective tax burden, including sales, property, and other local taxes. Interactive visuals, like state maps or bar charts, help quickly identify states with higher total tax burdens

Key Planning Tips & Red Flags

- Red flag: Moving for a tax break without comparing the total tax burden or cost of living.

- Tip: Track days and income allocation for multi-state work.

- Tip: Explore state tax credits, refunds, and property/sales tax offsets.

- Tip: If you own a business, check multi-state nexus rules early.

States may tax income based on work location. Track your days and check reciprocal agreements.

Residency tests vary; documentation like leases and utility bills can prove domicile.

Rules vary; check your state’s revenue site. Timing distributions can affect tax liability.

Yes, taxpayers must consider how deductions interact with federal limits.

State-specific rules dictate allocation. Consult state forms for guidance.

Usually based on the location of work performed. Maintain travel logs.

Keep thorough documentation on sales, payroll, and property allocations.

States follow federal laws like the Servicemembers Civil Relief Act; some income may remain taxable only in the home state.

Bottom Line

State income tax rules may seem straightforward, but in practice, they can be complex. Start by downloading the state-rate CSV, using the move/comparison calculator, and reviewing your personal situation against multi-state rules. For business owners or multi-state earners, consult a tax professional.

Disclaimer: This article is for educational purposes and does not constitute tax, legal, or financial advice. Consult a CPA for your specific situation.

Author Bio

Max Fonji is the Founder & lead writer at TheRichGuyMath.com. Specializing in practical tax and investing guides, Max Fonji helps beginners and intermediate investors navigate financial decisions with clarity and confidence.