Each year, millions of taxpayers wait for their state refund to hit their bank account. Some search, “Where’s my refund?” Others wonder, “Do I need to pay federal tax on my state refund?” And some face delays with little guidance. Investopedia

This guide answers all three concerns:

- Taxability rules (with IRS guidance and examples).

- How to track refunds for every state (with links and screenshots).

- What to do if your refund is delayed (step-by-step troubleshooting).

Use the quick links below to jump to the section that matters most.

Table of Contents

- Is a State Tax Refund Taxable?

- How State Refunds Are Issued

- How to Check Your Refund — State by State

- Form 1099-G: What It Is and Why It Matters

- Common Refund Delays & Fixes

- Micro Case Studies

- FAQ

- Official State Refund Resources

Is a State Tax Refund Taxable?

The IRS rule is straightforward: a state tax refund is taxable on your federal return only if you itemized deductions in the previous year and your deduction gave you a tax benefit.

Quick summary:

- If you used the standard deduction → your refund is not taxable.

- If you itemized deductions (using Schedule A) → your refund may be taxable if you deducted state income taxes. Self-employment tax

IRS guidance: Refunds of state/local taxes are taxable only to the extent they reduced your federal tax liability in the prior year.

Pro tip: Always check to see if you received a Form 1099-G from your state. This form reports your refund and tells you if you need to consider it for federal taxes. Blog

How State Refunds Are Issued

Every state has its own system, but most issue refunds in one of two ways:

- Direct deposit (fastest, usually 2–3 weeks for e-filed returns).

- Paper check (slower, often 6–8 weeks).

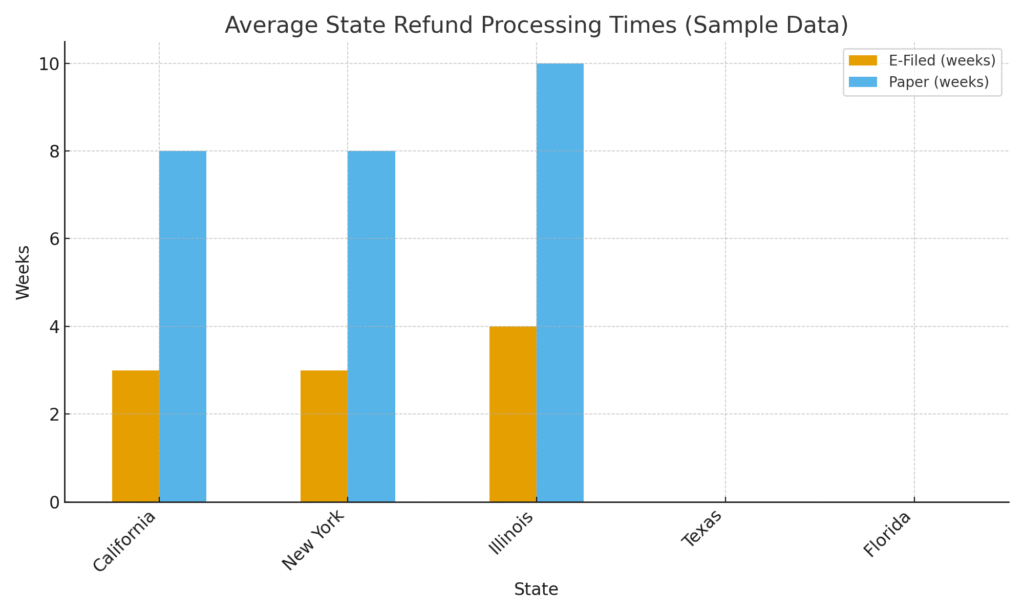

Table Placeholder: State Refund Processing Times

| State | E-Filed Return Avg. | Paper Return Avg. |

|---|---|---|

| CA | 2–3 weeks | 6–8 weeks |

| NY | 3 weeks | 8 weeks |

| TX | N/A (no state income tax) | N/A |

| … | … | … |

“State refund average processing times by state for e-filed and paper returns” State income tax

How to Check Your Refund — State by State

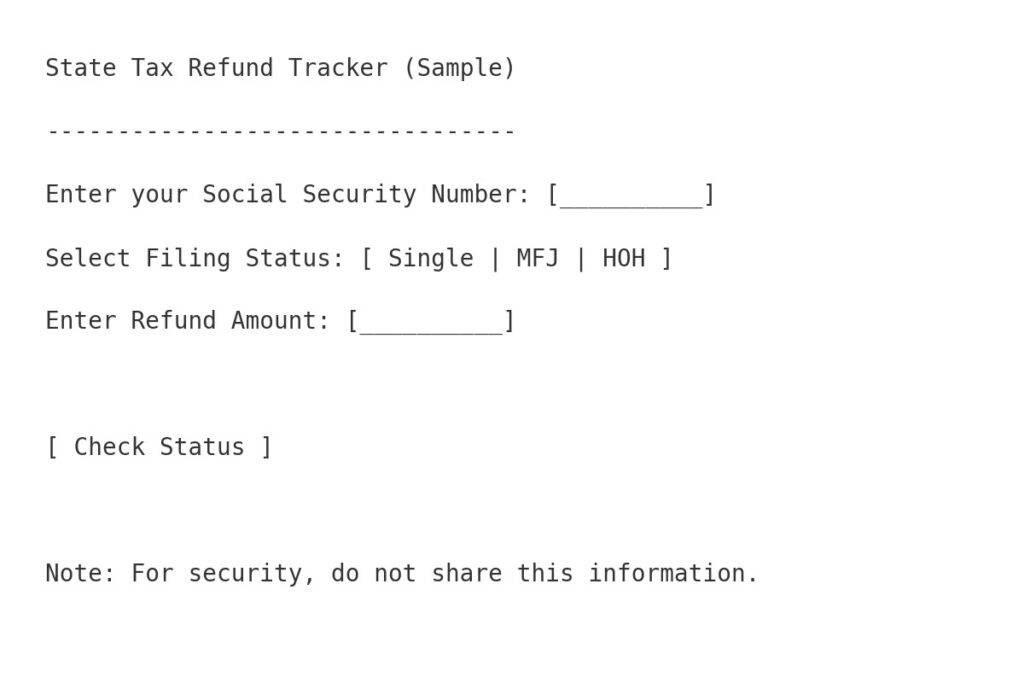

Every state with income tax offers an online “Where’s my refund?” tool. Typically, you’ll need:

- Your Social Security Number (SSN).

- Filing status (single, married filing jointly, etc.).

- Refund amount from your return.

- “Example state refund portal showing SSN, filing status, and refund amount fields”

| State | Refund Portal | Phone Number |

|---|---|---|

| California | Check CA Refund | 1-800-852-5711 |

| New York | Check NY Refund | 518-457-5181 |

| Florida | N/A (no state income tax) | N/A |

| … | … | … |

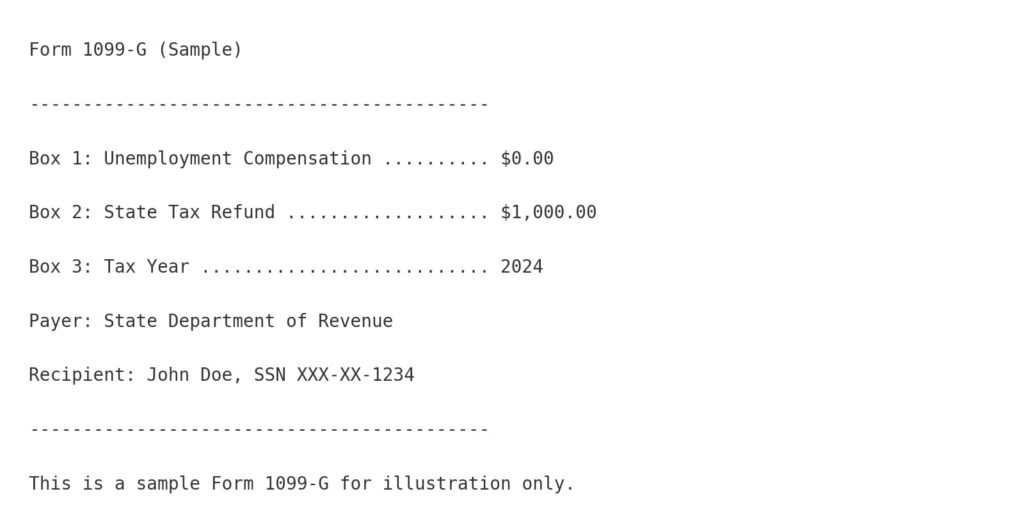

Form 1099-G: What It Is and Why It Matters

Form 1099-G is the IRS form that states are sent when you receive a refund, credit, or offset. It shows:

- Box 2: Refund amount.

- Box 3: Tax year to which it applies.

If you itemized last year, the IRS may expect you to report the amount on your current return. Tax refund

- “Sample Form 1099-G showing state refund in Box 2”

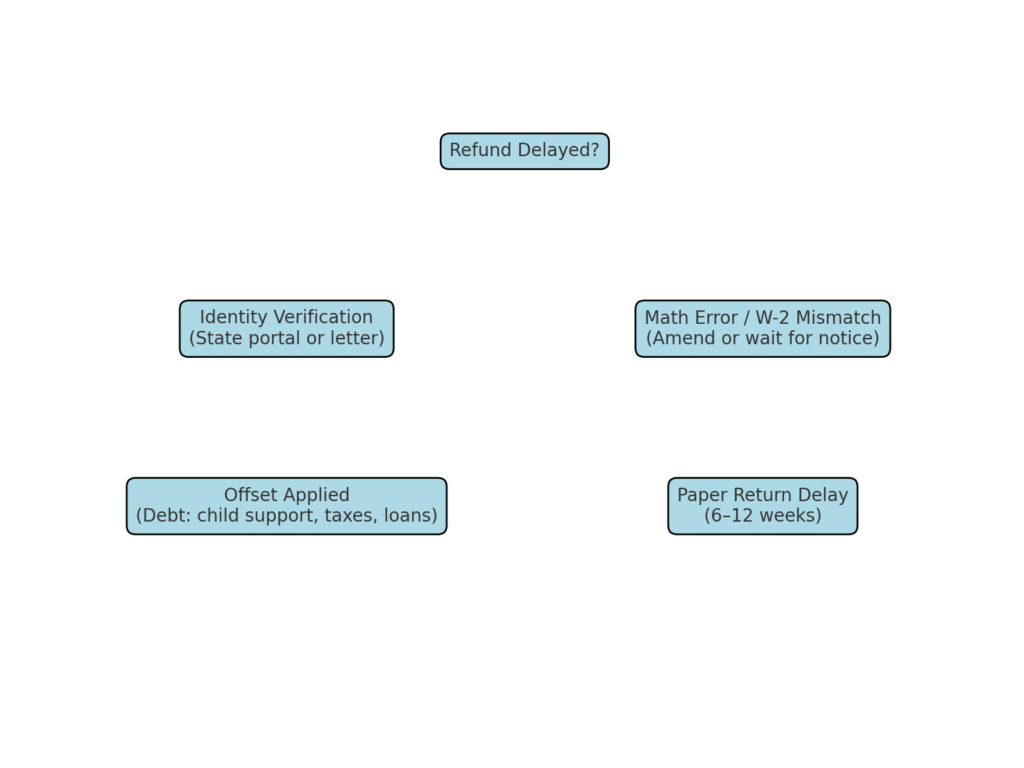

Common Refund Delays & Fixes

State refunds get delayed for many reasons. Here are the most common — and what to do:

- Identity verification required → Use the state’s ID verify portal or call the listed number.

- Math error or mismatched W-2s → Wait for state notice; amend if needed.

- Offset applied to debts (child support, student loans, state taxes owed) → Your refund may be reduced or eliminated.

- Paper filing → Expect delays of 6–12 weeks.

“Flowchart of refund delay reasons and next steps for taxpayers”

Micro Case Studies

Case Study 1: Itemized Deductions with Refund

- Scenario: Jane itemized in 2024, deducting $4,500 in state taxes. In 2025, she received a $1,000 state refund (Form 1099-G).

- Outcome: Because her itemized deduction reduced her federal tax, the $1,000 refund is taxable in 2025.

Case Study 2: Standard Deduction with Refund

- Scenario: Mark took the standard deduction in 2024 and received a $600 state refund.

- Outcome: His refund is not taxable; no tax benefit was received.

Study 3: Refund from a State Credit

- Scenario: Sara received a $700 refundable state child tax credit, creating a refund.

- Outcome: Refundable credits are not treated as taxable income; no federal tax owed.

Only if you itemized and got a federal tax benefit. Standard deduction taxpayers typically do not owe tax on refunds.

Use your state’s online refund tracker; most require SSN, filing status, and refund amount.

E-file: 2–4 weeks on average. Paper returns: 6–12 weeks.

Check your state’s portal, respond to ID requests, and review for math errors.

It reports your state refund to both you and the IRS; you may need it to file your federal return.

Official State Refund Resources

For fastest results, bookmark your state’s official refund page:

Disclaimer: This article is for educational purposes and does not constitute tax, legal, or financial advice. Consult a CPA for your specific situation.

Author Bio

Max Fonji is the Founder & lead writer at TheRichGuyMath.com. Specializing in practical tax and investing guides, Max Fonji helps beginners and intermediate investors navigate financial decisions with clarity and confidence.