Imagine you’re a detective trying to solve the mystery of how a company’s ownership value changes over time. Every financial decision—from profits earned to dividends paid, from new shares issued to stock buybacks—leaves a trail. The Statement of Shareholders’ Equity is your magnifying glass, revealing exactly how every dollar of ownership value moved throughout the year. For investors trying to understand what’s really happening behind the scenes of their favorite companies, this financial statement is pure gold.

TL;DR

- The Statement of Shareholders’ Equity tracks all changes in a company’s ownership value over a specific period, showing how retained earnings, stock issuances, dividends, and other transactions affect shareholder wealth.

- It bridges the balance sheet and income statement, explaining why shareholders’ equity changed from the beginning to the end of the accounting period.

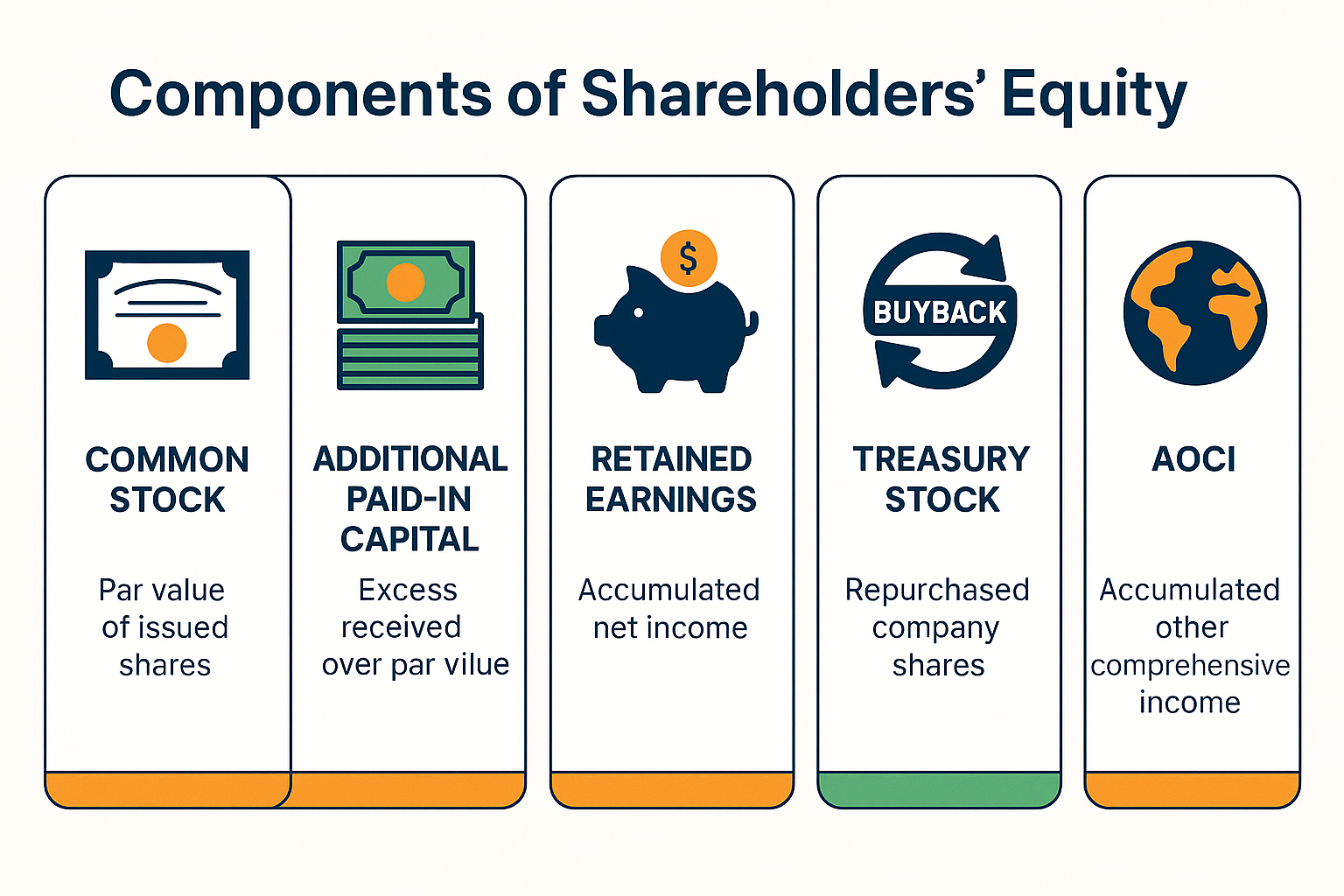

- Key components include common stock, preferred stock, additional paid-in capital, retained earnings, treasury stock, and accumulated other comprehensive income—each telling a different part of the ownership story.

- Investors use this statement to assess management decisions, dividend sustainability, share dilution risks, and overall financial health before making investment choices.

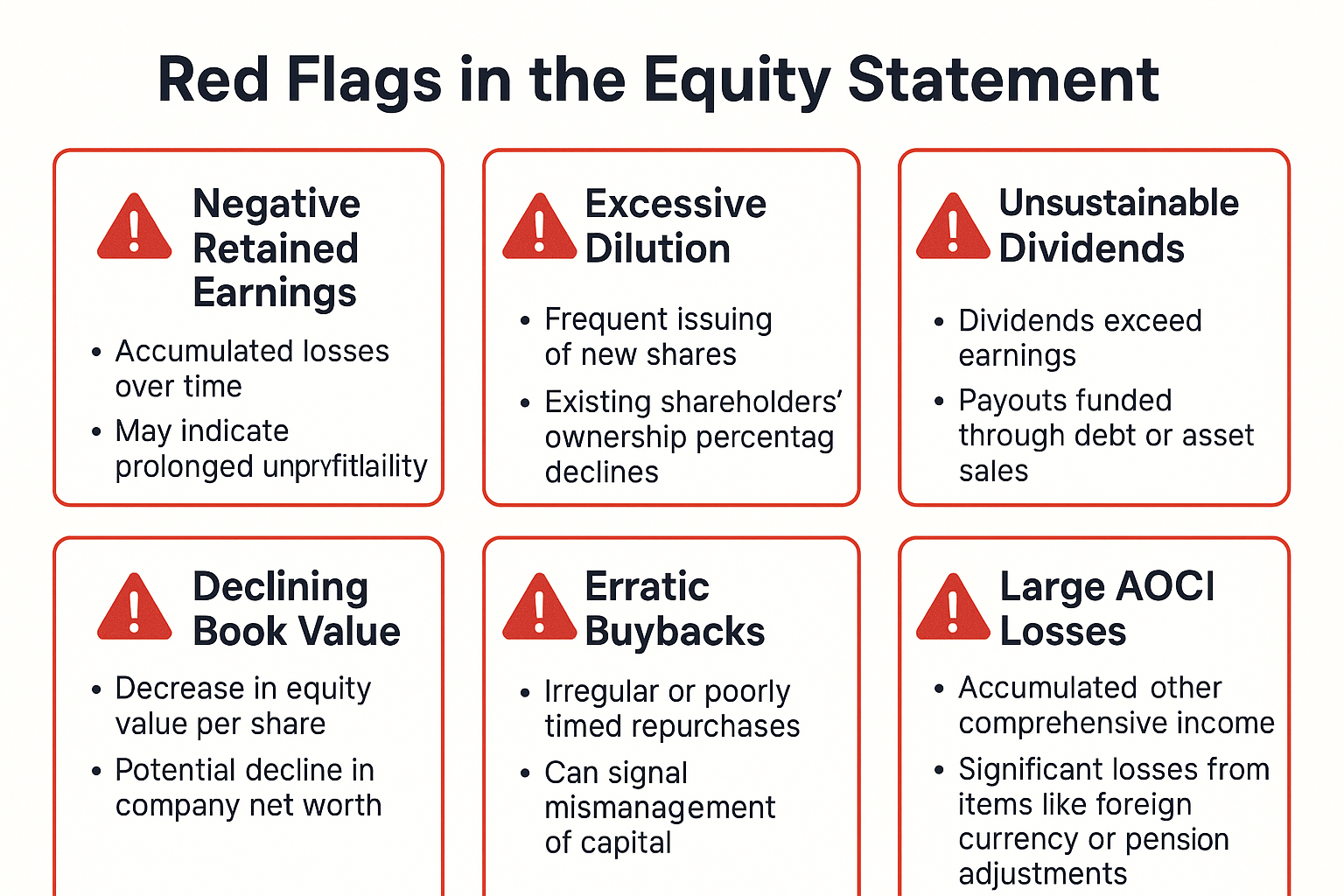

- A healthy statement shows growing retained earnings and strategic capital management, while red flags include consistent losses, excessive dilution, or unsustainable dividend payments.

What Is the Statement of Shareholders’ Equity?

In simple terms, the Statement of Shareholders’ Equity is a financial report that shows all changes in a company’s ownership value during a specific accounting period.

Think of it as a detailed transaction history for everything that affects what shareholders own in the company. While the balance sheet gives you a snapshot of shareholders’ equity at one moment in time, this statement explains the movie—how you got from last year’s number to this year’s number.

The Statement of Shareholders’ Equity appears as one of the four main financial statements required by Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), alongside the balance sheet, income statement, and cash flow statement. According to the SEC, publicly traded companies must include this statement in their quarterly (10-Q) and annual (10-K) filings.

Why Does This Statement Matter?

For investors exploring stock market opportunities, the Statement of Shareholders’ Equity reveals critical information that other financial statements don’t fully capture:

- Dividend sustainability: Can the company afford to keep paying dividends?

- Share dilution: Is management issuing too many new shares and diluting your ownership?

- Profit retention: How much money is the company reinvesting versus distributing?

- Financial strategy: What are management’s priorities regarding capital allocation?

Investors use the Statement of Shareholders’ Equity to measure how effectively management is building long-term shareholder value.

The Core Components of Shareholders’ Equity

The Statement of Shareholders’ Equity typically includes several key accounts that represent different aspects of ownership. Let’s break down each component:

1. Common Stock

Common stock represents the par value or stated value of shares issued to shareholders.

The par value is typically a nominal amount (often $0.01 or $1.00 per share) that has little relationship to the actual market value. This line item shows the total par value of all outstanding common shares.

Example: If a company has 10 million shares outstanding with a par value of $0.01, the common stock account would show $100,000.

2. Preferred Stock

Preferred stock is a class of ownership that typically pays fixed dividends and has priority over common shareholders in asset distributions.

Not all companies issue preferred stock, but when they do, it appears as a separate line item. Preferred shareholders usually receive dividends before common shareholders and have priority claims if the company liquidates.

3. Additional Paid-In Capital (APIC)

Additional paid-in capital represents the amount shareholders paid for shares above the par value.

This is where the real money from stock sales appears. If investors pay $50 per share for stock with a $0.01 par value, the additional $49.99 goes into APIC.

The formula for additional paid-in capital is: APIC = (Issue Price – Par Value) × Number of Shares Issued

4. Retained Earnings

Retained earnings represent the cumulative net income the company has earned and kept (not distributed as dividends) since inception.

This is arguably the most important component for long-term investors. Growing retained earnings signal that a company is profitable and reinvesting in growth. Those interested in dividend investing should pay special attention to this account.

A higher retained earnings balance usually indicates a mature, profitable company with a history of generating value.

5. Treasury Stock

Treasury stock represents shares the company has repurchased from shareholders but not retired.

This account appears as a negative (contra-equity) because it reduces total shareholders’ equity. Companies buy back stock for various reasons: to return cash to shareholders, to reduce share count and boost earnings per share, or to have shares available for employee compensation plans.

6. Accumulated Other Comprehensive Income (AOCI)

AOCI includes gains and losses that bypass the income statement but still affect shareholders’ equity.

Common items in AOCI include:

- Foreign currency translation adjustments

- Unrealized gains/losses on certain investments

- Pension plan adjustments

- Changes in the fair value of certain derivatives

How to Read a Statement of Shareholders’ Equity

The statement typically follows a columnar format, with each equity component in its own column and transactions listed in rows. Here’s the standard structure:

| Transaction | Common Stock | APIC | Retained Earnings | Treasury Stock | AOCI | Total Equity |

|---|---|---|---|---|---|---|

| Beginning Balance | XXX | XXX | XXX | (XXX) | XXX | XXX |

| Net Income | – | – | XXX | – | – | XXX |

| Dividends Paid | – | – | (XXX) | – | – | (XXX) |

| Stock Issued | XXX | XXX | – | – | – | XXX |

| Stock Repurchased | – | – | – | (XXX) | – | (XXX) |

| Other Comprehensive Income | – | – | – | – | XXX | XXX |

| Ending Balance | XXX | XXX | XXX | (XXX) | XXX | XXX |

Reading the Statement Step-by-Step

Step 1: Start with the beginning balance (carried over from last period’s ending balance)

Step 2: Add net income (or subtract net loss) to retained earnings

Step 3: Subtract dividends declared during the period from retained earnings

Step 4: Add any new stock issuances to common stock and APIC

Step 5: Subtract any treasury stock purchases

Step 6: Adjust for other comprehensive income items

Step 7: Arrive at the ending balance (which should match the equity section of the current balance sheet)

Real-World Example: ABC Corporation

Let’s walk through a simplified example to see how this works in practice.

ABC Corporation – Statement of Shareholders’ Equity for 2025

ABC Corporation started 2025 with the following equity balances:

- Common Stock: $1,000,000 (10 million shares at $0.10 par)

- Additional Paid-In Capital: $49,000,000

- Retained Earnings: $75,000,000

- Treasury Stock: ($5,000,000)

- Total Beginning Equity: $120,000,000

During 2025, the following transactions occurred:

- Net income for the year: $15,000,000

- This increases retained earnings by $15,000,000

- Dividends declared and paid: $6,000,000

- This decreases retained earnings by $6,000,000

- Issued 1 million new shares at $55 per share

- Common stock increases by $100,000 (1M × $0.10)

- APIC increases by $54,900,000 (1M × $54.90)

- Repurchased 500,000 shares at $60 per share

- Treasury stock increases by $30,000,000 (shown as negative)

- Foreign currency translation loss: $2,000,000

- AOCI decreases by $2,000,000

Ending balances:

- Common Stock: $1,100,000

- Additional Paid-In Capital: $103,900,000

- Retained Earnings: $84,000,000 ($75M + $15M – $6M)

- Treasury Stock: ($35,000,000)

- AOCI: ($2,000,000)

- Total Ending Equity: $152,000,000

ABC Corporation’s shareholders’ equity increased by $32,000,000 (26.7%) during 2025, primarily driven by profitable operations and a successful stock offering, partially offset by share repurchases.

Key Transactions That Affect Shareholders’ Equity

Understanding what causes changes in shareholders’ equity helps investors interpret the statement more effectively.

Transactions That Increase Equity

- Net Income: Profitable operations add to retained earnings

- Stock Issuance: Selling new shares adds to common stock and APIC

- Positive Comprehensive Income: Favorable currency translations, investment gains

- Stock-Based Compensation: Employee stock options increase APIC when exercised

Transactions That Decrease Equity

- Net Loss: Unprofitable operations reduce retained earnings

- Dividends: Cash or stock dividends reduce retained earnings

- Treasury Stock Purchases: Buying back shares reduces total equity

- Negative Comprehensive Income: Unfavorable currency translations, investment losses

Neutral Transactions (Reclassifications)

Some transactions move amounts between equity accounts without changing total equity:

- Converting preferred stock to common stock

- Stock splits (increase shares, decrease par value proportionally)

- Moving amounts from APIC to common stock

How Investors Use the Statement of Shareholders’ Equity

Smart investors don’t just glance at this statement—they mine it for actionable insights. Here’s what to look for:

1. Assessing Dividend Sustainability

Compare dividends paid to net income. If a company consistently pays out more in dividends than it earns, it’s not sustainable long-term.

Dividend Payout Ratio = Dividends Paid ÷ Net Income

A ratio consistently above 100% is a red flag. Investors seeking high dividend stocks should verify that dividend payments are backed by actual earnings, not just borrowed money or asset sales.

2. Evaluating Share Dilution Risk

Track the number of shares outstanding over time. Excessive share issuance dilutes existing shareholders’ ownership percentage.

Share Dilution % = (New Shares Issued ÷ Previous Shares Outstanding) × 100

Dilution above 5% annually without corresponding value creation is concerning.

3. Understanding Capital Allocation Philosophy

The statement reveals management’s priorities:

- High dividend payments + low retained earnings = Income-focused, mature company

- Low dividends + growing retained earnings = Growth-focused, reinvesting in business

- Significant share buybacks = Management believes stock is undervalued

- Frequent stock issuances = Company needs capital (could signal growth or financial stress)

Understanding why the stock market goes up often relates to how companies allocate capital shown in this statement.

4. Spotting Financial Distress Early

Warning signs include:

- Consecutive years of negative retained earnings

- Shrinking equity despite profitable operations (excessive dividends or buybacks)

- Frequent stock issuances at declining prices

- Large negative adjustments in AOCI

These patterns often precede the scenarios that cause investors to lose money in the stock market.

Advantages of the Statement of Shareholders’ Equity

Comprehensive Ownership Picture

Unlike the balance sheet’s single equity number, this statement shows the full story of how ownership value evolved.

Transparency in Management Decisions

Every capital allocation decision—dividends, buybacks, stock issuances—appears clearly, allowing investors to evaluate management effectiveness.

Reconciliation Tool

It reconciles the income statement’s net income with the balance sheet’s equity changes, ensuring consistency across financial statements.

Early Warning System

Unusual patterns often appear here before showing up in other statements, giving attentive investors an early advantage.

Limitations and Common Pitfalls

Complexity for Beginners

The statement can be intimidating with its multiple columns and accounting terminology. New investors may struggle to interpret the information without guidance.

Historical Focus

Like all financial statements, it reports past transactions. It doesn’t predict future performance or guarantee past trends will continue.

Accounting Assumptions

Many items depend on accounting estimates and judgments (like stock-based compensation valuation), which can vary between companies and reduce comparability.

Doesn’t Show Cash Impact

Some equity changes (like stock-based compensation) don’t involve cash. Investors must also consult the cash flow statement for a complete picture.

Statement of Shareholders’ Equity vs Other Financial Statements

Understanding how this statement relates to the other three main financial statements provides crucial context:

| Feature | Balance Sheet | Income Statement | Cash Flow Statement | Shareholders’ Equity Statement |

|---|---|---|---|---|

| Time Period | Point in time | Period of time | Period of time | Period of time |

| Primary Focus | Assets, liabilities, equity | Revenues and expenses | Cash inflows/outflows | Changes in ownership value |

| Key Question | What does the company own and owe? | Was the company profitable? | Did the company generate cash? | How did ownership value change? |

| Equity Information | Total equity only | Net income (affects equity) | No direct equity info | All equity changes detailed |

The Statement of Shareholders’ Equity bridges the balance sheet and income statement, explaining the equity changes that the other statements only partially address.

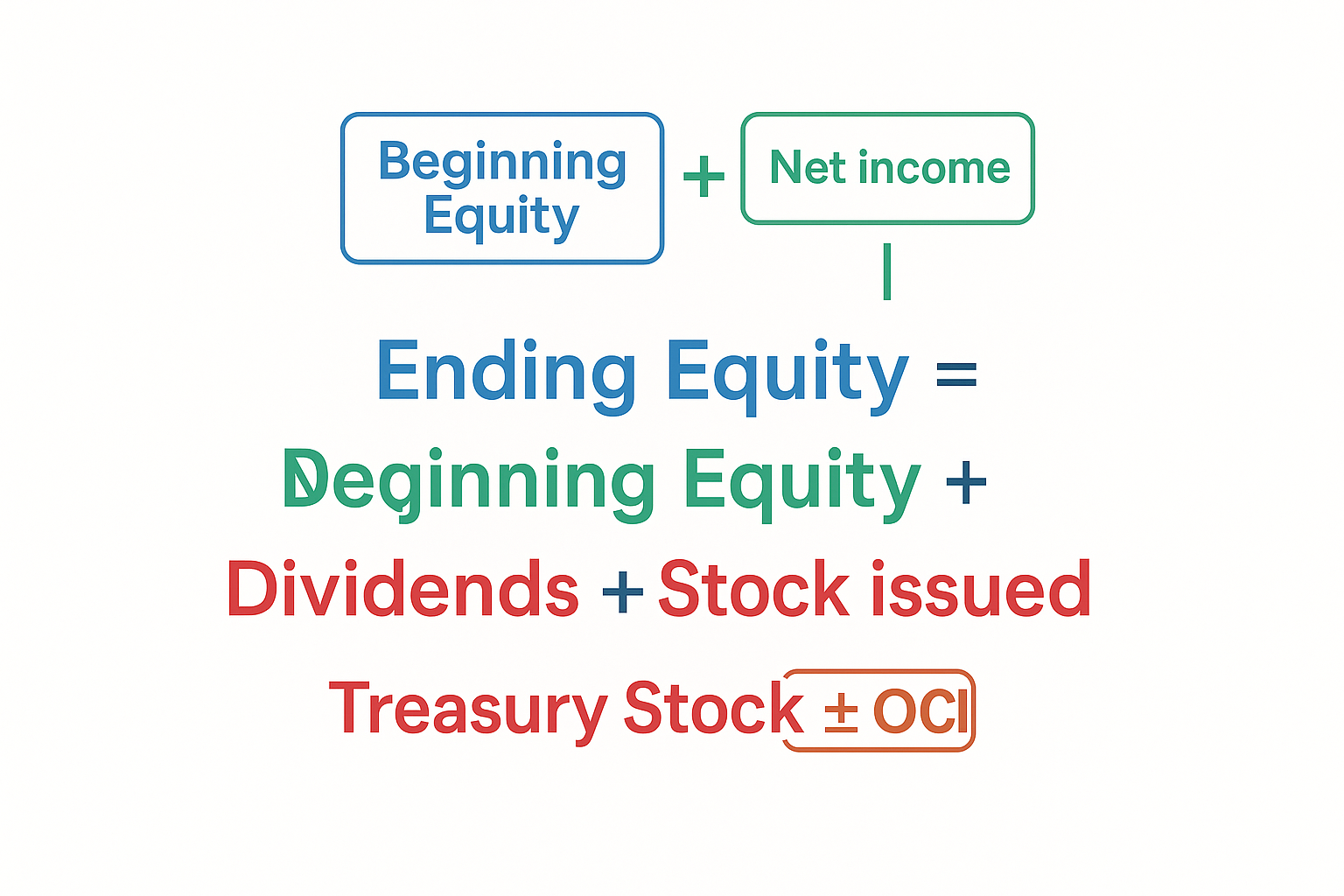

How to Calculate Changes in Shareholders’ Equity

While the statement presents all changes, you can verify the math with this fundamental equation:

Ending Shareholders’ Equity = Beginning Shareholders’ Equity + Net Income – Dividends + Stock Issued – Treasury Stock Purchased ± Other Comprehensive Income

Let’s use ABC Corporation’s example:

- Beginning Equity: $120,000,000

- Add Net Income: +$15,000,000

- Subtract Dividends: -$6,000,000

- Add Stock Issued: +$55,000,000

- Subtract Treasury Stock: -$30,000,000

- Subtract AOCI Loss: -$2,000,000

- Ending Equity: $152,000,000 ✓

This reconciliation ensures all changes are properly accounted for.

Common Mistakes Investors Make

Mistake #1: Ignoring Non-Cash Charges

Stock-based compensation increases equity without cash changing hands. Some investors incorrectly view this as “free” value creation when it actually dilutes existing shareholders.

Mistake #2: Focusing Only on Retained Earnings

While retained earnings are important, ignoring other components misses critical information. A company could have growing retained earnings while simultaneously diluting shareholders through excessive stock issuances.

Mistake #3: Not Comparing Year-Over-Year Trends

A single year’s statement provides limited insight. Tracking trends over 3-5 years reveals patterns in management behavior and financial health.

Mistake #4: Overlooking Treasury Stock

When companies repurchase shares, some investors celebrate without considering the price paid. Buying back overvalued stock destroys shareholder value even though it reduces share count.

Mistake #5: Confusing Book Value with Market Value

Shareholders’ equity represents book value (accounting value), which often differs significantly from market value (stock price × shares outstanding). The statement doesn’t tell you if the stock is a good investment at current prices.

Real-World Application: Analyzing a Company

Let’s apply these concepts to evaluate a hypothetical company, TechGrowth Inc., using its Statement of Shareholders’ Equity:

Key observations from TechGrowth’s 2025 statement:

- Retained earnings grew 25% – Strong profitability

- No dividends paid – Reinvesting for growth

- Issued 2 million shares – 8% dilution

- Stock issued at $75/share – Higher than $60 year-ago price

- No share buybacks – Not returning cash to shareholders

- Positive comprehensive income – Favorable currency/investment trends

Interpretation: TechGrowth appears to be a growth-stage company prioritizing reinvestment over shareholder distributions. The share dilution is concerning; it was done at favorable prices. This profile suits growth investors but not income-focused investors seeking passive income.

Regulatory Requirements and Standards

U.S. GAAP Requirements

According to the Financial Accounting Standards Board (FASB), U.S. companies must present a Statement of Shareholders’ Equity showing:

- Beginning balances for each equity component

- Changes during the period for each component

- Ending balances for each equity component

IFRS Requirements

International companies following IFRS have similar requirements under IAS 1, though terminology may differ slightly (e.g., “Statement of Changes in Equity”).

SEC Filing Requirements

Public companies must include this statement in:

- Form 10-K (annual report)

- Form 10-Q (quarterly report)

- Proxy statements (when relevant to shareholder votes)

The SEC requires three years of comparative data in annual filings, allowing investors to spot trends.

Advanced Concepts for Serious Investors

Comprehensive Income vs Net Income

Net income appears on the income statement and flows into retained earnings.

Comprehensive income = Net Income + Other Comprehensive Income

Comprehensive income provides a more complete picture of all changes affecting equity from business operations and market conditions.

Book Value Per Share

Using the ending equity balance, you can calculate:

Book Value Per Share = Total Shareholders’ Equity ÷ Shares Outstanding

This metric helps investors assess whether a stock trades above or below its accounting value. Value investors often seek stocks trading below book value.

Return on Equity (ROE) Analysis

The statement helps calculate ROE more accurately:

ROE = Net Income ÷ Average Shareholders’ Equity

Average Shareholders’ Equity = (Beginning Equity + Ending Equity) ÷ 2

Return on equity measures how efficiently a company generates profits from shareholders’ investments. According to Investopedia, an ROE above 15% is generally considered good, though this varies by industry.

Industry-Specific Considerations

Different industries show distinct patterns in their equity statements:

Technology Companies

- Heavy use of stock-based compensation (increases APIC, dilutes shareholders)

- Rarely pays dividends

- Rapidly growing retained earnings

- Occasional large equity raises for expansion

Financial Institutions

- Regulatory capital requirements affect equity management

- Moderate dividend payouts

- Periodic equity raises to maintain capital ratios

- Significant AOCI fluctuations from investment portfolios

Mature Industrial Companies

- Consistent dividend payments

- Stable retained earnings growth

- Regular share buyback programs

- Minimal equity issuances

Utilities

- High dividend payout ratios

- Slow retained earnings growth

- Occasional equity raises for infrastructure projects

- Stable equity structure

Understanding these patterns helps investors set appropriate expectations when analyzing companies in different sectors.

The Psychology of Equity Changes

The Statement of Shareholders’ Equity also reflects the cycle of market emotions through management actions:

- Euphoria phase: Companies issue shares at high prices, insiders sell

- Anxiety phase: Buyback programs slow or stop

- Depression phase: Companies conserve cash, cut dividends

- Hope phase: Opportunistic buybacks at low prices

- Optimism phase: Dividend restorations, strategic acquisitions

Savvy investors use these patterns to gauge market sentiment and identify contrarian opportunities.

Building Wealth Through Understanding Equity

For those interested in making smart financial moves, mastering the Statement of Shareholders’ Equity provides several advantages:

Better Stock Selection

Identify companies that consistently grow book value per share through profitable operations rather than accounting tricks.

Dividend Safety Assessment

Verify that dividend payments are sustainable and backed by real earnings, crucial for building passive income streams.

Management Quality Evaluation

Assess whether management makes shareholder-friendly decisions or prioritizes their own interests.

Risk Management

Spot financial deterioration early, before it becomes obvious to the broader market.

Long-Term Wealth Building

Understanding equity helps you think like a business owner, essential for building lasting wealth.

Practical Tips for Analyzing the Statement

Tip 1: Create a Trend Analysis Spreadsheet

Download 5 years of equity statements and track:

- Retained earnings growth rate

- Dividend payout ratio trend

- Net share issuance/repurchase

- Book value per share progression

Tip 2: Compare to Industry Peers

A company’s equity changes mean more in context. Compare metrics like dividend payout ratios and share dilution rates to competitors.

Tip 3: Read Management’s Discussion & Analysis (MD&A)

The MD&A section of 10-K filings often explains significant equity changes. Management should justify major decisions like large buybacks or dividend cuts.

Tip 4: Watch for Consistency

Erratic equity patterns—alternating between large buybacks and large issuances, or inconsistent dividend policies—often signal management confusion or financial instability.

Tip 5: Calculate Quality Metrics

Derive meaningful ratios:

- Equity Growth Rate = (Current Year Equity – Prior Year Equity) ÷ Prior Year Equity

- Organic Equity Growth = Retained Earnings Growth (excludes stock issuances)

- Shareholder Yield = (Dividends + Net Buybacks) ÷ Market Capitalization

Common Questions Answered

What happens to shareholders’ equity when a company loses money?

When a company reports a net loss, retained earnings decrease by the loss amount, which reduces total shareholders’ equity. If losses continue over multiple years, retained earnings can become negative (called an “accumulated deficit”), which is a serious warning sign.

Can shareholders’ equity be negative?

Yes. Negative shareholders’ equity (liabilities exceed assets) occurs when accumulated losses exceed contributed capital. This often signals severe financial distress and potential bankruptcy risk. Investors should generally avoid companies with negative equity unless there’s a clear turnaround plan.

How do stock splits affect the Statement of Shareholders’ Equity?

Stock splits increase the number of shares outstanding while proportionally decreasing the par value per share. Total shareholders’ equity remains unchanged—the split just rearranges the common stock and APIC accounts. For example, a 2-for-1 split doubles shares but halves the par value.

Why do some companies have large APIC balances?

Large APIC balances typically indicate that the company has successfully raised significant capital by issuing stock at prices well above par value. Technology companies that went public at high valuations often show massive APIC balances.

What’s the difference between treasury stock and retired stock?

Treasury stock represents shares repurchased but not cancelled—they could be reissued later. They reduce equity but remain authorized shares. Retired stock is permanently cancelled and reduces both equity and authorized shares. Retirement is more shareholder-friendly as it eliminates future dilution risk.

How does stock-based compensation affect equity?

When employees exercise stock options or receive stock grants, common stock and APIC increase (reflecting new shares issued), but no cash comes in. This dilutes existing shareholders but is considered an operating expense that has already reduced net income.

What’s a healthy rate of equity growth?

Healthy equity growth varies by industry and company maturity. Growth companies might target 15-25% annual equity growth through retained earnings. Mature companies might grow equity 5-10% annually while returning significant cash via dividends and buybacks. The key is consistency and quality—growth from profits beats growth from share issuances.

Conclusion: Your Equity Statement Action Plan

The Statement of Shareholders’ Equity is far more than an accounting requirement—it’s a powerful tool for understanding how companies create (or destroy) shareholder value. By revealing every transaction that affects ownership, this statement empowers investors to make informed decisions based on facts rather than hype.

Your Next Steps

- Pull up the latest 10-K filing for a company you own or are considering. Navigate to the Statement of Shareholders’ Equity (usually right after the balance sheet).

- Identify the major changes in each equity component. What drove the biggest increases or decreases?

- Calculate key metrics:

- Dividend payout ratio

- Book value per share

- Year-over-year equity growth rate

- Net dilution/accretion from share activity

- Compared to prior years. Are patterns consistent or erratic? Is management’s capital allocation strategy clear?

- Research management’s explanation in the MD&A section. Do their explanations for major equity changes make sense?

- Compare to competitors. How does this company’s equity management compare to industry peers?

- Make an informed decision. Does the equity statement support or challenge your investment thesis?

Remember, successful investing isn’t about finding perfect companies—it’s about understanding what you own and paying appropriate prices. The Statement of Shareholders’ Equity gives you X-ray vision into how management handles the capital you’re entrusting to them.

Whether you’re building a diversified stock portfolio or researching individual investments, this statement provides insights that separate informed investors from the crowd. Master it, and you’ll join the ranks of investors who truly understand what they own and why.

Interactive Tool: Statement of Shareholders’ Equity Calculator

📊 Shareholders’ Equity Calculator

Calculate ending equity and analyze key metrics

| Account | Beginning | Changes | Ending |

|---|

FAQ: Statement of Shareholders' Equity

The Statement of Shareholders' Equity is a financial report that details all changes in a company's ownership value during a specific accounting period. It shows how transactions like net income, dividends, stock issuances, and share buybacks affected the equity accounts from the beginning to the end of the period.

While the balance sheet shows a snapshot of shareholders' equity at a single point in time, the Statement of Shareholders' Equity explains all the changes that occurred during the period between two balance sheet dates. It's the bridge that reconciles last period's ending equity with this period's ending equity.

The main components include: common stock (par value of issued shares), additional paid-in capital (amount paid above par), retained earnings (cumulative profits kept in the business), treasury stock (repurchased shares), and accumulated other comprehensive income (certain gains/losses that bypass the income statement).

Investors use this statement to evaluate management's capital allocation decisions, assess dividend sustainability, identify share dilution risks, and understand how effectively the company is building shareholder value over time. It reveals patterns that other financial statements don't fully capture.

Negative retained earnings (also called an "accumulated deficit") means the company has lost more money cumulatively than it has earned since inception. This is a warning sign of financial distress, though some early-stage companies have negative retained earnings while investing heavily in growth.

Share buybacks reduce total shareholders' equity because cash (an asset) leaves the company, and treasury stock (a contra-equity account) increases. However, buybacks can benefit remaining shareholders by reducing share count and potentially increasing earnings per share and book value per share.

A sustainable dividend payout ratio typically ranges from 30-60% of net income, though this varies by industry. Ratios consistently above 80-100% may indicate unsustainable dividends, while very low ratios might suggest the company could afford to pay more or is reinvesting aggressively for growth.

Disclaimer:

This article is for educational purposes only and does not constitute financial advice. The information provided is based on general principles and should not be considered a recommendation to buy or sell any specific security. Always conduct your own research and consult with a qualified financial advisor before making investment decisions. Past performance does not guarantee future results.

About The Author

Written by Max Fonji — With a decade of experience in financial education and investment analysis, Max is your go-to source for clear, data-backed investing education. His mission is to demystify complex financial concepts and empower readers to make informed investment decisions. TheRichGuyMath.com