Stock Market Corrections and Crashes: What They Are and How to Prepare

Market drops are a natural part of investing. However, when the drop is steep or sudden, it can trigger fear among investors. Understanding stock market corrections and crashes is key to managing your emotions and your portfolio.

What Is a Stock Market Correction?

A market correction occurs when a major index like the S&P 500 falls 10% to 20% from its recent high. Corrections happen regularly—about once every 1–2 years—and are usually short-lived.

They often result from:

- Rising interest rates

- Inflation fears

- Overvaluation of stocks

- Geopolitical tensions

Corrections offer long-term investors a chance to buy quality assets at lower prices.

What Is a Stock Market Crash?

A stock market crash is a sudden, severe drop of 20% or more in a very short time, often in days or weeks. Crashes are less common but more dramatic.

Famous examples include:

- 1929 Great Depression

- 1987 Black Monday

- 2008 Financial Crisis

- 2020 COVID-19 Crash

Crashes usually signal systemic fear or widespread financial instability, and they may trigger recessions or economic turmoil.

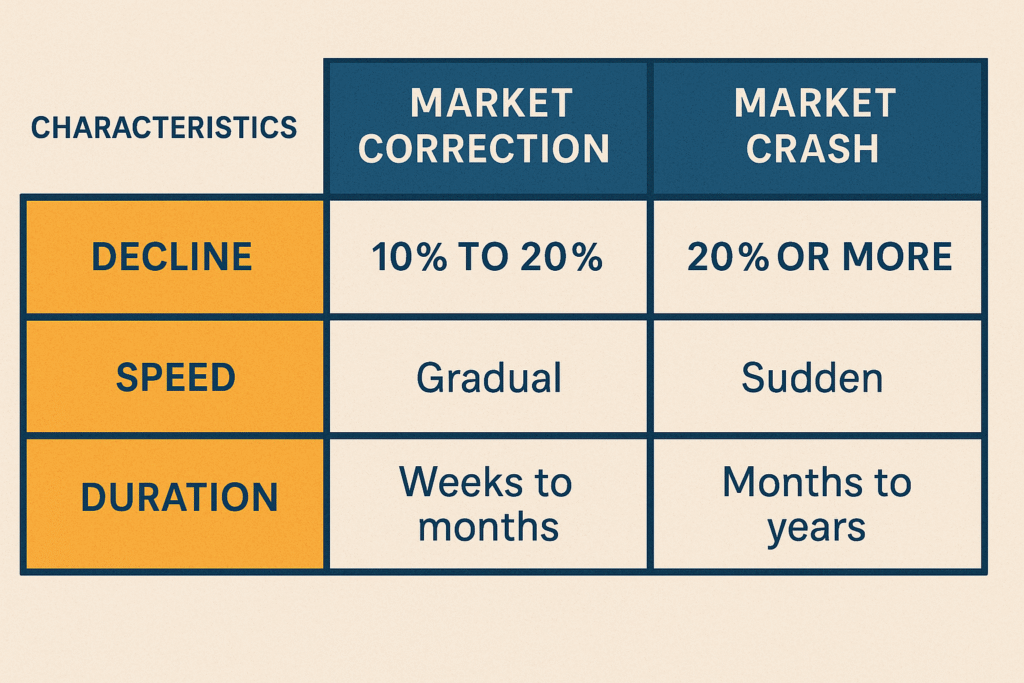

Key Differences Between Corrections and Crashes

Speed and Severity

- Corrections: Gradual drop of 10–20%

- Crashes: Sharp, fast drop of 20%+

Duration and Recovery

- Corrections often recover within months

- Crashes can take years to rebound

Causes and Triggers

- Corrections are driven by technical or economic adjustments

- Crashes are triggered by crisis-level events, panic selling, or asset bubbles bursting

Historical Examples of Corrections and Crashes

- 1998 Russian Default: A correction caused by emerging market fears

- Dot-com Bubble (2000-2002): A crash led by tech stock overvaluation

- COVID-19 Crash: The market fell over 30% in weeks due to pandemic fears, but rebounded quickly thanks to stimulus and tech resilience

How Investors Should Respond

✅ Stay Diversified

Spread your investments across sectors and asset classes to reduce risk.

✅ Stick to Your Long-Term Plan

Corrections and crashes are temporary. Don’t abandon your strategy out of fear.

✅ Avoid Panic Selling

Selling in a downturn locks in losses. Instead, rebalance or use dollar-cost averaging.

Final Thoughts on Market Volatility

Stock market corrections and crashes are inevitable. They can be scary, but are often followed by strong recoveries. With the right mindset and strategy, you can turn market downturns into opportunities for long-term growth.