Stocks vs Bonds: Which Investment Is Right for You?

When it comes to building wealth, one of the most common questions is: “Should I invest in stocks or bonds?” Understanding the differences between stocks and bonds is essential for making informed investment decisions that align with your financial goals.

What Are Stocks?

Stocks represent ownership in a company. When you buy a stock, you become a shareholder, meaning you own a small piece of that business.

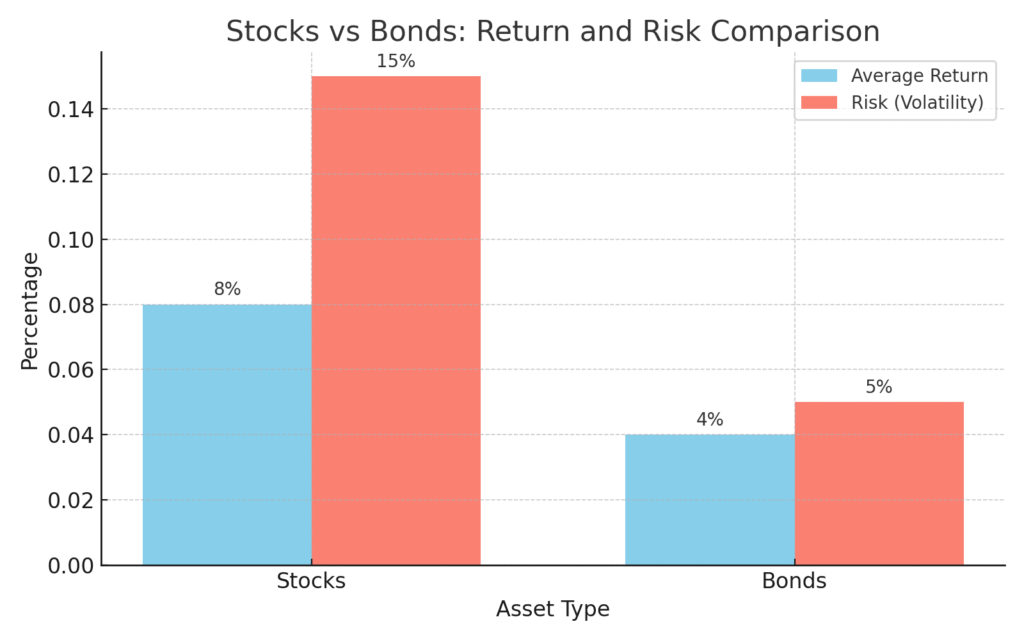

- Higher Risk, Higher Return: Stocks are generally more volatile but can offer higher long-term returns.

- Capital Appreciation: Investors benefit when stock prices rise.

- Dividends: Some companies pay out profits to shareholders in the form of dividends.

Example: If you invested in Apple (AAPL) stock in 2010, your returns today would be substantial compared to bonds.

What Are Bonds?

Bonds are loans made to governments or corporations. When you purchase a bond, you’re essentially lending money in exchange for regular interest payments and eventual return of the principal.

- Lower Risk, Lower Return: Bonds are generally more stable but offer modest returns.

- Fixed Income: They provide regular, predictable payments.

- Priority in Bankruptcy: Bondholders are paid before stockholders if the company fails.

Example: U.S. Treasury bonds are considered one of the safest investments in the world.

Key Differences Between Stocks and Bonds

| Feature | Stocks | Bonds |

|---|---|---|

| Ownership | Yes | No |

| Risk Level | High | Low to Medium |

| Returns | Variable, potentially high | Fixed, generally lower |

| Income Source | Dividends + growth | Interest payments |

| Liquidity | High | Moderate |

Which One Should You Choose?

Your ideal investment depends on your:

- Risk Tolerance: Younger investors may favor stocks; conservative investors may prefer bonds.

- Time Horizon: Longer horizons favor stocks; shorter-term needs lean toward bonds.

- Income Needs: Retirees may prefer the steady income from bonds.

Tip: Many investors balance both through a diversified portfolio or mutual funds.

Final Thoughts on Stocks vs Bonds

Understanding the stocks vs bonds debate isn’t about choosing one over the other—it’s about balance. Both asset types play a role in a healthy investment strategy. For long-term growth, stocks may lead. For stability and income, bonds have their place.

Whether you’re a beginner or an experienced investor, the smartest approach is to define your goals and build a portfolio that reflects your comfort with risk and need for return.