How to Remove Collections from Your Credit Report: A Data-Driven Guide to Restoring Your Financial Standing

A single collection account can reduce your credit score by 50 to 100 points, costing you thousands in higher interest rates…

A single collection account can reduce your credit score by 50 to 100 points, costing you thousands in higher interest rates…

Understanding your credit card or bank account balances is more than just checking numbers; it’s about managing your money wisely and…

A single number on your credit card determines whether you build wealth or damage your financial future, yet most cardholders never…

Missing a single payment deadline can cost you hundreds of dollars in interest charges and tank your credit score by over…

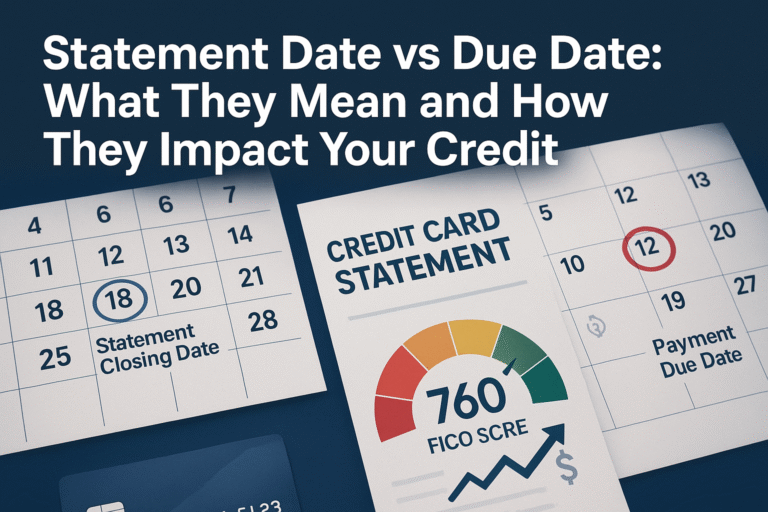

Statement Date vs Due Date is one of the most misunderstood credit card concepts, and confusing the two can cost you…

Statement closing date is the day your credit card issuer ends a billing cycle and calculates your statement balance. All purchases,…

Revolving credit allows ongoing borrowing and flexible repayment; installment credit requires set payments for a fixed term. Both impact credit differently,…