Installment Credit: Definition, Examples, Pros & Cons, Costs, and Smart Alternatives

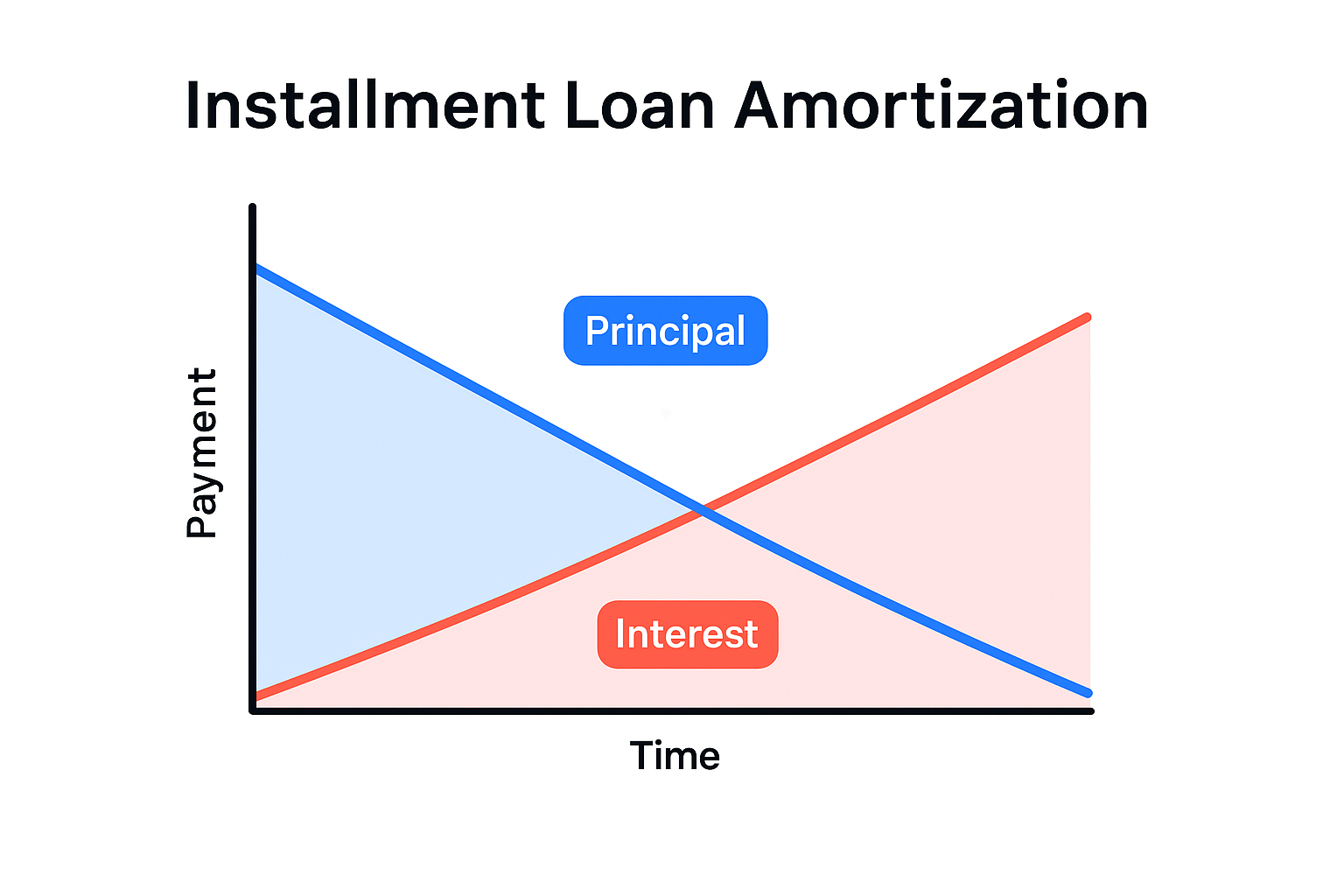

Definition: Installment credit is a type of loan where you borrow a lump sum and repay it in fixed monthly payments…

Definition: Installment credit is a type of loan where you borrow a lump sum and repay it in fixed monthly payments…

When you think of wealth, you probably picture tech billionaires, Wall Street investors, or real estate moguls. But weird wealth proves…

“Retire early” doesn’t always mean sipping margaritas on a beach at 40. It simply means leaving the traditional workforce before the…

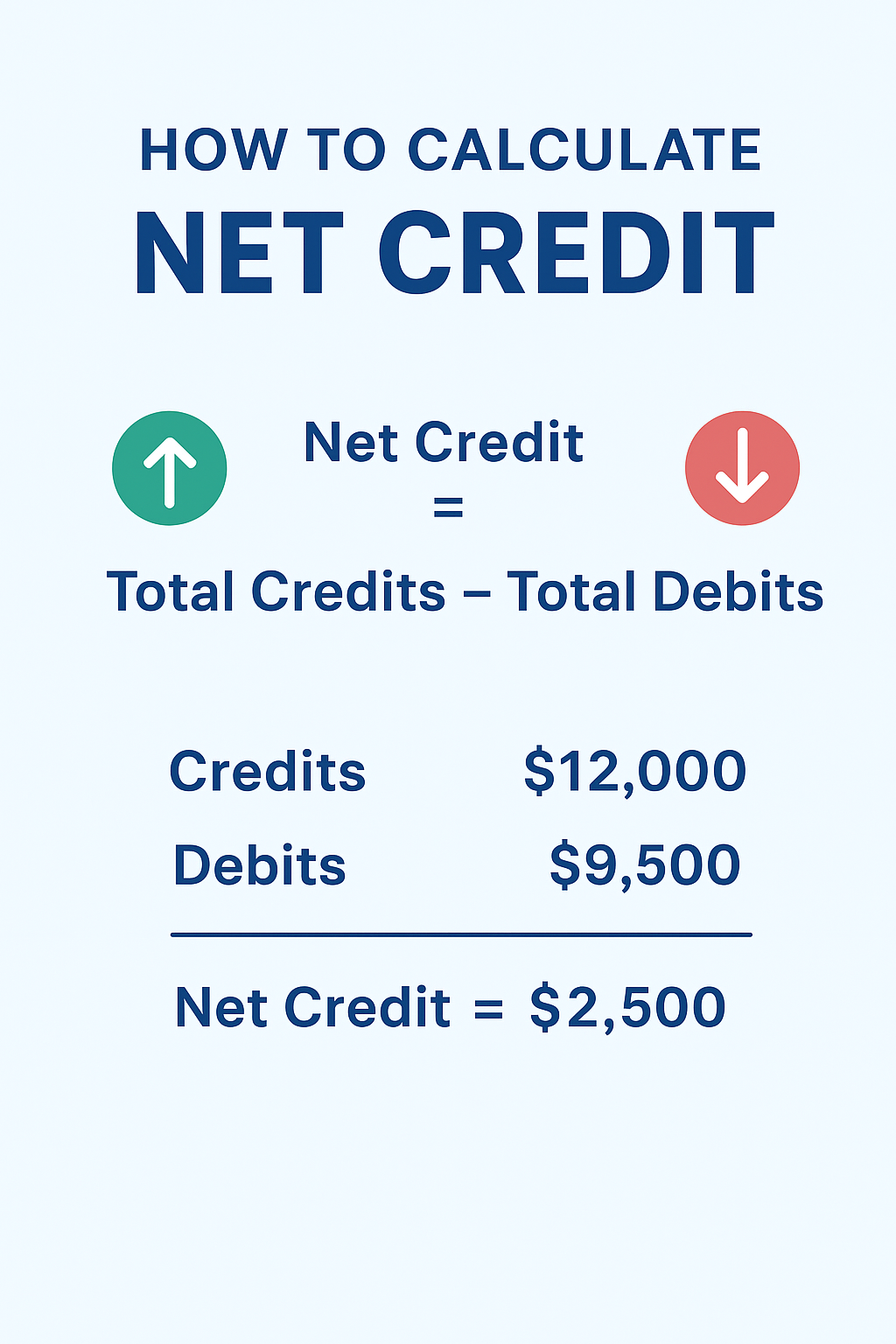

Net credit is a core concept in accounting, finance, and trading that reflects the difference between total credits and debits. For…

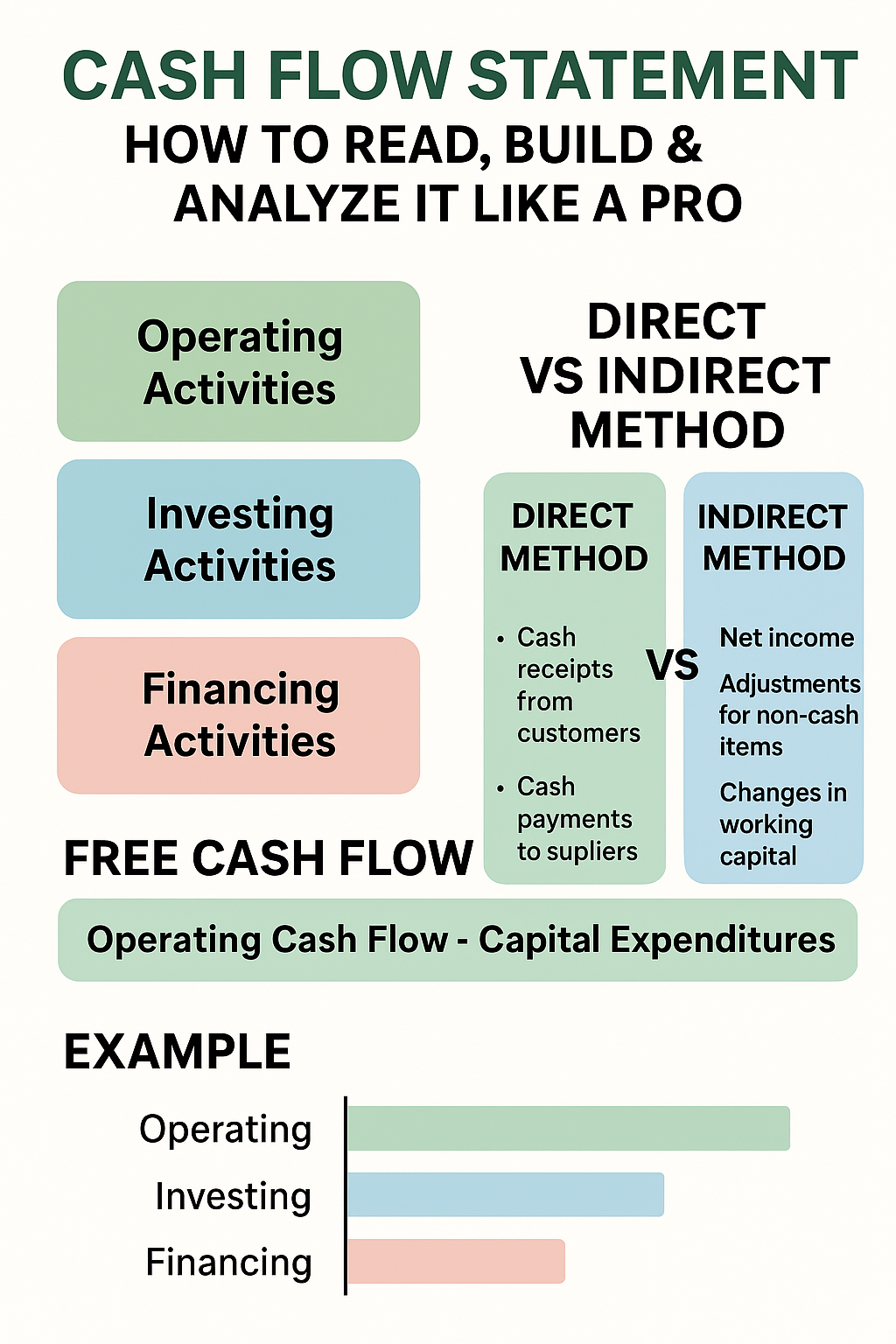

Cash Flow Statement: A financial report showing how cash moves in and out of a company during a period, split into…

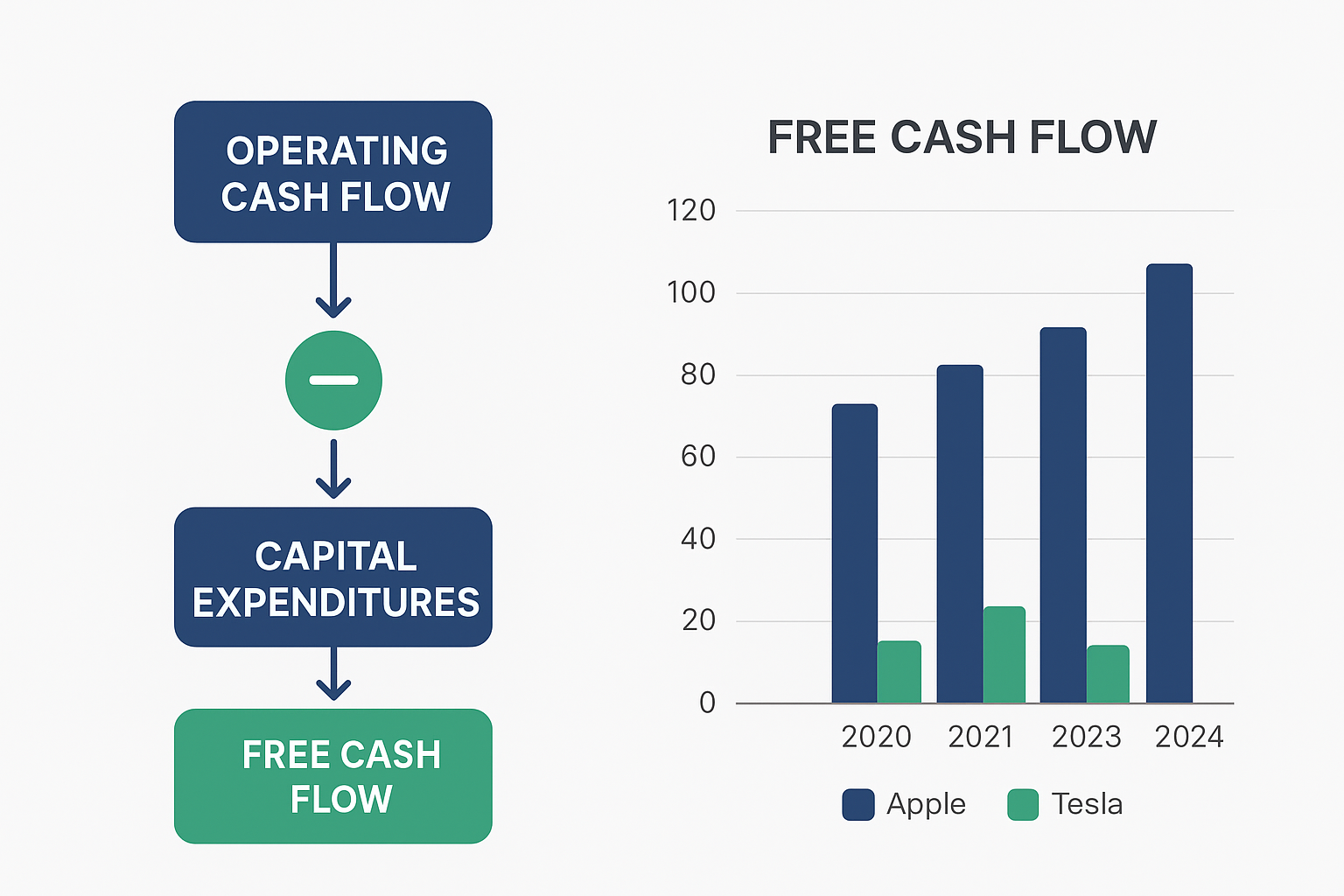

What Is Free Cash Flow (FCF)? Free Cash Flow (FCF) is the cash a company generates after covering its operating expenses…

Not all income is created equal. Some types of income provide steady cash flow but keep you tied to a 9–5…

Portfolio income is one of the three main types of income the IRS recognizes, alongside earned income (wages, salaries, tips) and…

A HELOC, or Home Equity Line of Credit, is one of the most flexible ways to borrow money using your home’s…