Tax planning is the process of evaluating your financial situation to apply legal tax-saving strategies.

Tax planning is one of the smartest ways to keep more of your hard-earned money. By strategically organizing your finances, you can minimize tax liability, maximize deductions, and invest more toward your future goals. Whether you’re an employee, business owner, or investor, effective tax planning ensures compliance while boosting wealth. Investopedia – Tax Planning Definition

TL;DR (Too Long; Didn’t Read)

- Tax planning is the legal strategy of organizing finances to minimize taxes.

- Start early in the year to maximize deductions and avoid surprises.

- Retirement contributions, charitable donations, and tax-loss harvesting reduce taxable income.

- Small business owners can optimize entity structure and expenses.

- Avoid mistakes like missing deductions, failing to document, or procrastinating until April.

What is Tax Planning?

Tax planning is the proactive process of organizing your finances to legally reduce tax liability while maximizing savings and investments. Unlike tax evasion, which is illegal, tax planning aligns your financial decisions with tax laws. It applies to individuals, investors, and business owners who want to keep more of their hard-earned money while staying compliant. How to Build Generational Wealth

Why Tax Planning is Important

- Reduce liability: Pay only what you owe, nothing more.

- Boost savings: Free up funds for investments, retirement, or emergencies.

- Stay compliant: Avoid penalties and audits by meeting all tax requirements.

- Maximize wealth growth: Strategic planning helps you invest more effectively.

Key Tax Planning Strategies

1. Income Splitting

Shifting income among family members in lower tax brackets can lower your overall taxes.

2. Retirement Contributions

Contributing to retirement accounts like a 401(k), IRA, or Roth IRA provides immediate deductions or future tax-free withdrawals.

3. Capital Gains Management

Holding investments longer than a year qualifies for lower long-term capital gains rates.

4. Tax-Loss Harvesting

Selling underperforming investments offsets gains and reduces taxable income.

5. Charitable Contributions

Donations to qualified charities not only support causes but also qualify for tax deductions.

6. Business Tax Planning

Small business owners can:

- Deduct legitimate business expenses

- Use depreciation benefits

- Choose the right entity structure (LLC, S-Corp, C-Corp) to optimize taxes

Case Study: How Smart Tax Planning Saved John $7,500

Background:

John, a 38-year-old marketing consultant, earns $95,000 annually from his business. He files as a sole proprietor and often feels overwhelmed by taxes. Last year, John owed nearly $24,000 in federal taxes.

Challenge:

John wanted to reduce his tax burden without breaking the law. He decided to work with a tax advisor to create a tax planning strategy.

Tax Planning Strategies Applied:

- Retirement Contributions

- John contributed $20,000 to a Solo 401(k).

- Result: Reduced taxable income from $95,000 → $75,000.

- Business Deductions

- He tracked home office expenses, internet, software, and travel.

- Total deductible expenses: $7,500.

- Health Savings Account (HSA)

- John contributed the maximum allowed $4,150.

- Triple benefit: tax deduction, tax-free growth, and tax-free withdrawals for health expenses.

- Charitable Contributions

- Donated $2,000 to qualified charities.

- Fully deductible.

Results:

- Taxable income before planning: $95,000

- Taxable income after planning: $61,350

- Tax savings: ~$7,500

Takeaway:

Through proactive tax planning, John not only reduced his taxable income but also built long-term savings for retirement and healthcare.

Case Study 2: The Smith Family – Maximizing Child Tax Credits

Background:

The Smiths are a married couple with two children. Their combined household income is $120,000.

Tax Planning Strategies Applied:

- Child Tax Credit: They claimed $2,000 per child = $4,000 in credits.

- Dependent Care Credit: They paid $6,000 in childcare costs and claimed $1,200 back.

- 529 College Savings Plan: Contributed $5,000, reducing taxable income.

Results:

- Credits and deductions saved the Smith family $5,200 in federal taxes.

Takeaway:

Families with children can lower taxes significantly by using available credits and education savings plans.

Short-Term vs Long-Term

- Short-term: Actions taken within the tax year (maximizing deductions, adjusting withholdings, planning charitable donations).

- Long-term: Retirement planning, estate planning, and investment strategies to minimize future tax burdens.

Common Tax Planning Mistakes to Avoid

- Forgetting deductions like student loan interest or HSA contributions

- Failing to keep proper documentation

- Waiting until April instead of planning year-round

- Overlooking tax-loss harvesting opportunities

Morningstar – Investment Tax Tips

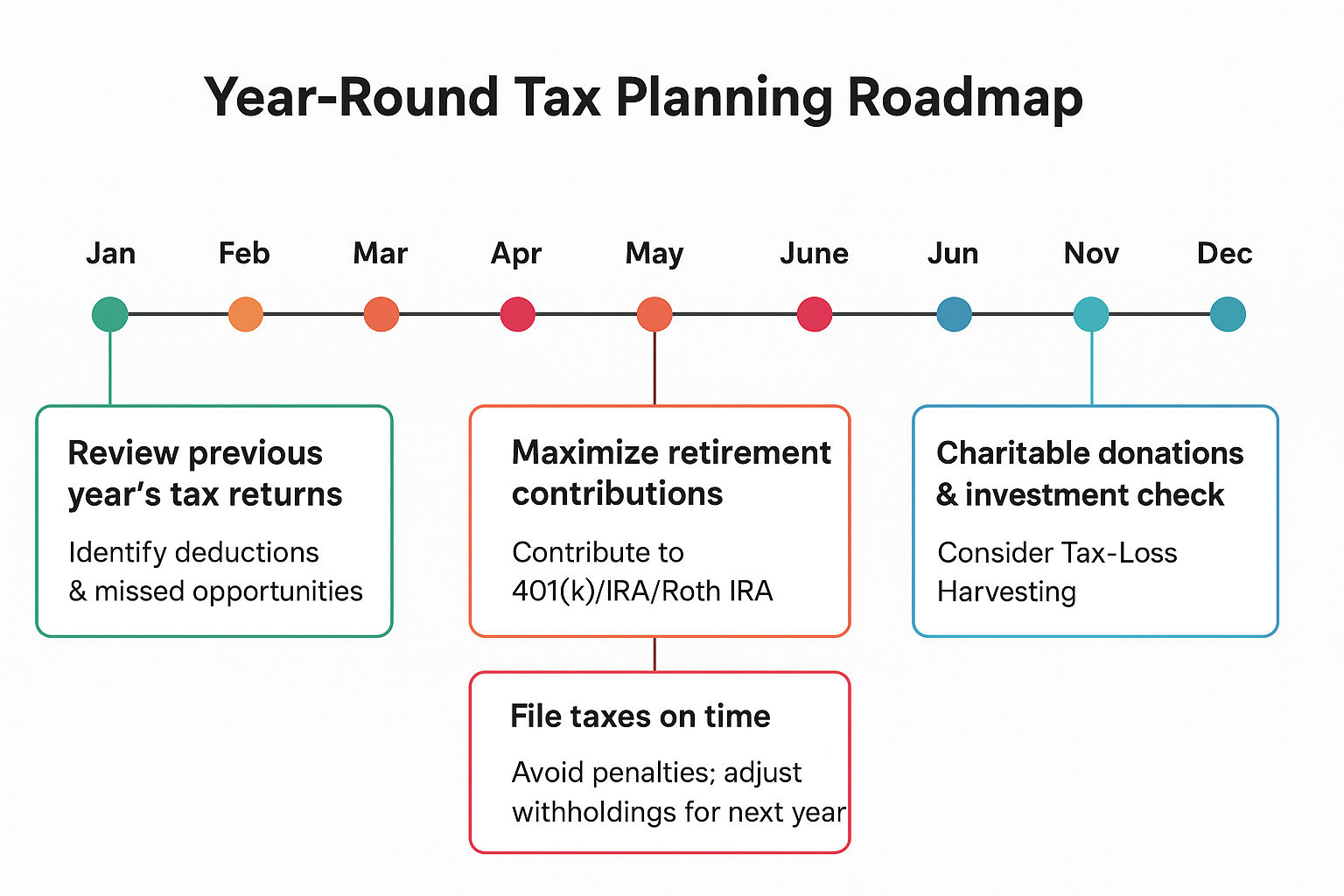

Step-by-Step Tax Planning Roadmap

| Month | Action | Notes |

|---|---|---|

| January | Review previous year’s tax returns | Identify deductions & missed opportunities |

| February–March | Maximize retirement contributions | Contribute to 401(k)/IRA/Roth IRA |

| April | File taxes on time | Avoid penalties; adjust withholdings for next year |

| June–September | Charitable donations & investment check | Consider tax-loss harvesting |

| October–December | Plan business expenses & charitable giving | Review the previous year’s tax returns |

Professional Help vs DIY

If your financial situation is complex, with multiple income sources, investments, or business ownership, consulting a tax professional ensures compliance and the uncovering of tax-saving opportunities. Simpler cases can use tax software, but a professional often finds strategies you might miss. How to Reduce Capital Gains Taxes

Conclusion

Tax planning is not about avoiding taxes; it’s about paying wisely. By using the right strategies, you’ll reduce liability, stay compliant, and grow long-term wealth.

Tax planning is proactive, focused on minimizing taxes throughout the year. Tax preparation is filing taxes at year-end based on past activity.

Yes — through deductions, retirement contributions, and entity structuring.

Start at the beginning of the tax year to maximize deductions and minimize surprises.

Selling underperforming investments to offset gains reduces taxable income, which lowers your tax bill.

Through strategic expense deductions, proper entity selection, and taking advantage of depreciation and retirement contributions.

Yes, donations to qualified organizations can be deducted within IRS guidelines.

Short-term focuses on actions within the year; long-term planning includes retirement, estate, and investment strategies to minimize future taxes.

Disclaimer

This article is for educational purposes only and does not constitute financial advice. For personal guidance, consult a licensed financial advisor.

Author Bio:

Written by Max Fonji

Founder of TheRichGuyMath.com, where I make personal finance and investing concepts simple for beginners with 8+ years of experience. I specialize in turning complex money topics into actionable, plain-English advice.