What Is a Tax Refund?

A tax refund is money the government returns to you if you’ve paid more in taxes than you actually owed throughout the year. In 2025, the IRS continues to process millions of refunds quickly, most within 21 days for electronic filers, but delays can still happen due to verification checks, offsets, or errors.

This guide covers how tax refunds work, timelines for receiving them, how to check your status, and step-by-step fixes if your refund is delayed or reduced. You’ll also find state-specific resources and expert tips to plan for next year. IRS

How a Tax Refund Works

A tax refund happens when your withholding (from paychecks) or estimated tax payments exceed your final tax liability.

- If you withheld too much, → IRS refunds the difference.

- If you withheld too little → you may owe taxes instead.

The IRS issues refunds after processing your return and verifying your income, credits, and deductions. Refunds can be deposited directly into your bank account, sent as a paper check, or applied to next year’s taxes. State income tax

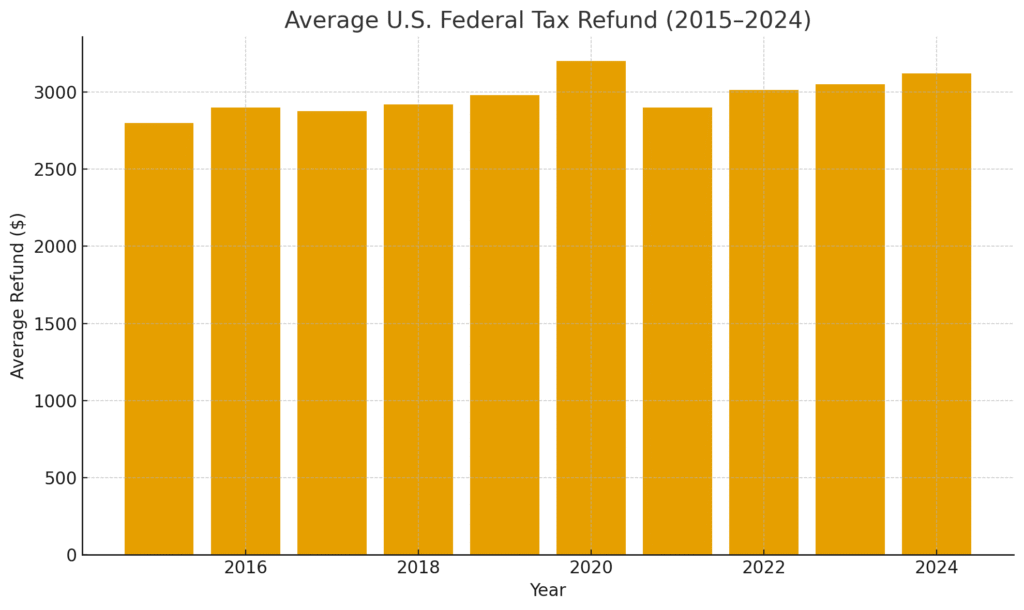

Average U.S. Federal Tax Refund (2015–2024)

Tax Refund Timelines for 2025

Here’s how long it typically takes to see your refund based on how you filed:

| Filing Method | When Status Appears | Typical Time to Receive Refund | Notes |

|---|---|---|---|

| E-file + Direct Deposit | 24 hours | 8–21 days | Fastest method; most refunds within 3 weeks. |

| E-file + Paper Check | 24 hours | 2–4 weeks | Slower due to mailing. |

| Paper return | 4+ weeks | 6–12 weeks | Paper requires manual processing. |

| Amended return (1040-X) | 3 weeks to show | Up to 16 weeks | Check via Where’s My Amended Return?. |

Pro Tip: Refund status updates once per day, not in real time. Refreshing multiple times won’t speed things up. Self-employment tax

Tax Refund Journey (Step-by-Step Flow)

How to Check Your Tax Refund Status

The IRS offers two official tools:

- Where’s My Refund? (for current-year returns)

- Requires SSN/ITIN, filing status, and exact refund amount.

- Updates daily.

Check status here

- Where’s My Amended Return? (for Form 1040-X)

- Shows amended refund status.

Check the amended refund

- Shows amended refund status.

Common Reasons Refunds Are Delayed

Even with electronic filing, not all refunds arrive in 21 days. Here are the top causes of delay:

- Identity verification: IRS flags potential fraud for extra checks.

- EITC/CTC claims: Refunds with Earned Income Tax Credit or Child Tax Credit may be held until late February.

- Debt offsets: Federal or state debts (child support, student loans, back taxes) can reduce or seize refunds.

- Math errors or mismatched info: Wrong SSN, filing status, or arithmetic mistakes.

- Paper returns: Always slower due to manual handling.

What If Your Refund Is Smaller Than Expected?

Refunds may be adjusted if:

- You had outstanding debts (child support, student loans, federal/state taxes).

- IRS corrected errors or miscalculations on your return.

- Certain credits were reduced or denied after review.

You’ll receive an IRS notice explaining adjustments. Always compare it with your return.

What If You Haven’t Received Your Refund?

If it’s past the expected window:

- Check Where’s My Refund daily.

- Look for IRS notices — adjustments or identity verification requests.

- Contact the IRS directly (after 21 days for e-filed, 6 weeks for paper).

- File Form 3911 (Taxpayer Statement Regarding Refund) if your refund check is missing.

Unclaimed or Expired Tax Refunds

If you don’t file a return, you can lose your refund. By law, you have three years to claim it. After that, the money becomes property of the U.S. Treasury. Tax filing

Example: To claim a 2021 refund, you must file by April 2025.

USA.gov: Unclaimed Tax Refunds

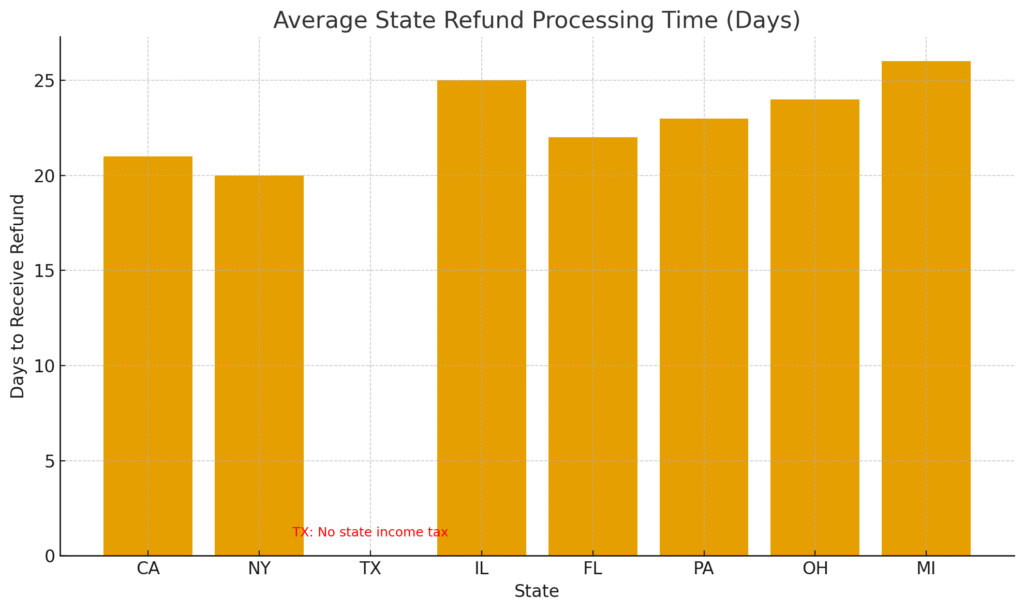

State Tax Refund

Each state has its own system for refund status. Most provide online portals similar to the IRS tool.

Here’s a quick overview (add links for internal subpages):

- California — FTB Refund Status

- New York — Check Refund

- Texas — No state income tax (no refund system).

- Illinois — Refund Status

For a full 50-state list, see our State Tax Refund Guide.

Average State Tax Refund Processing Times

How to Plan: Avoiding Surprises

Instead of waiting for a big refund check, adjust your withholding to match your actual tax liability. This way, you keep more of your paycheck throughout the year.

Tools:

Benefits:

- More cash flow during the year.

- Avoids long waits and dependency on refunds.

- Reduces the risk of refund delay stress.

Most refunds are issued within 21 days if filed electronically. Paper returns can take 6–12 weeks.

Yes, refunds can be reduced for federal/state debts like child support, taxes, or student loans.

The IRS tool updates once per day. If no change after 21 days (e-file) or 6 weeks (paper), contact the IRS.

File the missing return within 3 years. After that, the refund expires.

File Form 3911 to trace and request reissue.

Key Takeaways

- Most refunds arrive in 3 weeks or less for electronic filers.

- Always use the official IRS tool for updates.

- Delays often result from credits, verification, or debts.

- You have 3 years to claim unfiled refunds.

- Adjust withholding to avoid surprises next year.

Ready to track your refund?

Use the IRS Where’s My Refund Tool or check your state refund status.

Want to maximize next year’s refund (or reduce it to get more money each paycheck)? Try the IRS Withholding Estimator.