Picture this: It’s 2008, and two investors each have $100,000 in the stock market. When the market crashes 50%, the first investor panics and sells everything at the bottom, locking in a $50,000 loss. The second investor stays calm, keeps investing, and by 2015, their portfolio is worth over $200,000. Same market, same crash, completely different outcomes. What made the difference? The most important thing in investing isn’t picking the perfect stock or timing the market; it’s something far more powerful and completely within your control.

If you’ve ever wondered why some people build lasting wealth while others struggle despite following similar investment advice, you’re about to discover the answer. The secret isn’t complex algorithms or insider knowledge. It’s a fundamental principle that separates successful investors from everyone else, and it’s surprisingly simple once you understand it. SEC – Investor Education

Key Takeaways

- Time in the market beats timing the market – Staying invested long-term is more important than trying to predict market movements

- Emotional control is your superpower – The ability to manage fear and greed determines 80% of investment success

- Consistency compounds wealth – Regular investing, even in small amounts, creates exponential growth over time

- Risk management protects your gains – Understanding what you can lose is as important as knowing what you can gain

- Learning never stops – Continuous education about investing principles builds confidence and better decisions

What Is “The Most Important Thing” in Investing?

When legendary investor Howard Marks wrote his book The Most Important Thing, he revealed a secret that Wall Street professionals have known for decades: the most important thing in investing is understanding risk. But there’s an even deeper truth for beginner investors: the most important thing is actually developing the right mindset and behavior patterns. Investopedia – The Most Important Thing in Investing

Think of investing like learning to drive. You can study every traffic rule and know exactly how a car works, but until you develop the right instincts and emotional control behind the wheel, you’re not truly a good driver. Similarly, you can read every investing book and follow every expert, but without the right psychological foundation, you’ll struggle to build wealth.

The Three Pillars of Investment Success

The most important thing in investing rests on three interconnected pillars:

- Long-term thinking

- Emotional discipline

- Consistent action

These three elements work together like legs on a stool; remove any one, and the whole structure collapses. Let’s explore each one and discover why they matter more than any stock tip or market prediction you’ll ever receive.

Why Long-Term Thinking Is The Most Important Thing

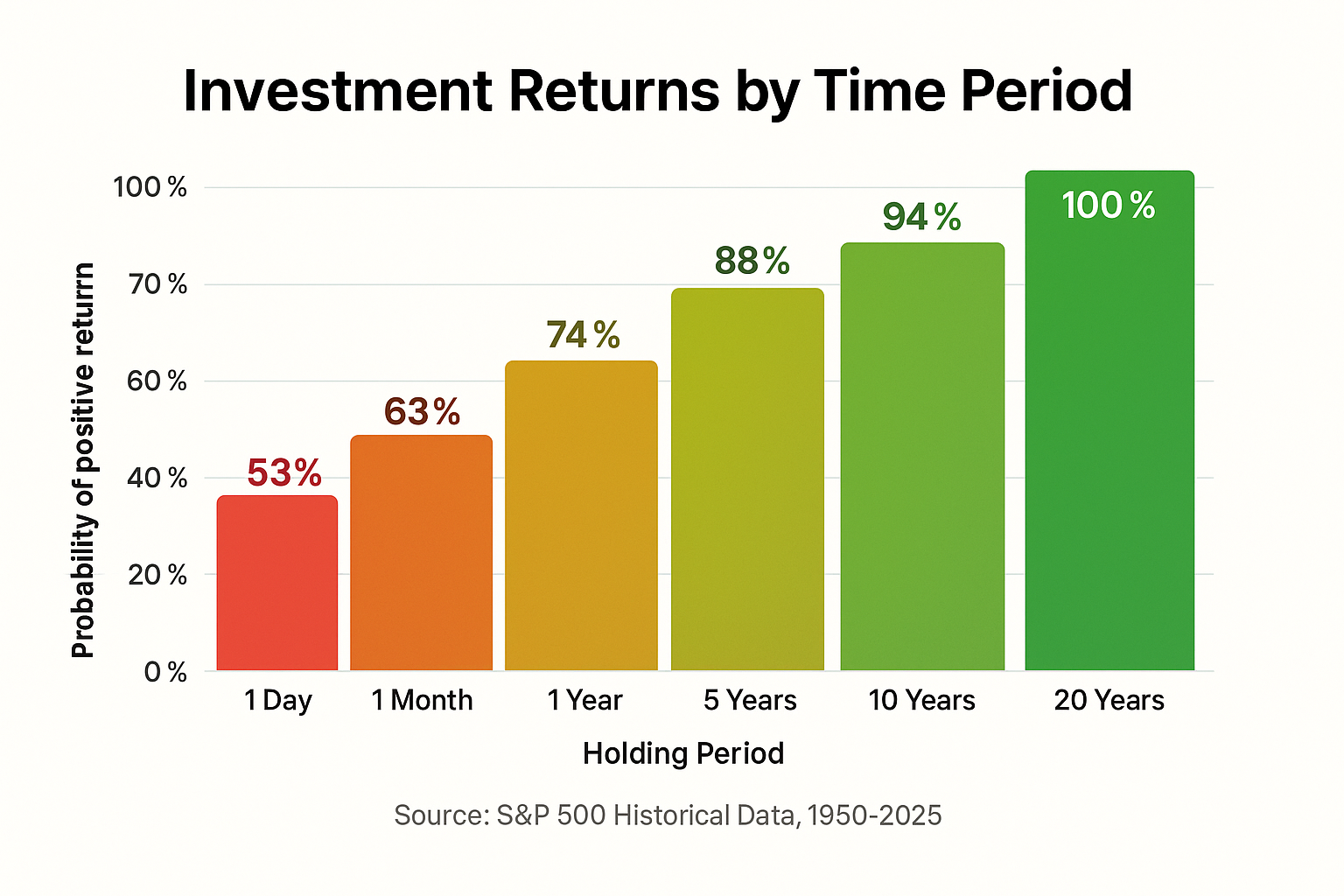

Here’s a fact that should change how you view investing forever: The S&P 500 has never had a negative 20-year period in its entire history. Never. Not during the Great Depression, not during the 2008 financial crisis, not during any market crash.

But over any single day? The market is essentially a coin flip; it goes up about 53% of the time and down 47% of the time. This statistical reality reveals why the stock market goes up over time despite short-term volatility.

The Power of Time in the Market

Consider this real-world example from Fidelity research: Between 2000 and 2020, if an investor missed just the 10 best days in the market, their returns would have been cut in half. Miss the best 30 days, and they would have actually lost money despite the market being up significantly over that period.

The problem? Those best days often occur during periods of extreme volatility, exactly when investors are most tempted to sell. This is why understanding the cycle of market emotions is crucial for maintaining your investment discipline.

| Investment Period | Probability of Positive Returns |

|---|---|

| 1 Day | 53% |

| 1 Month | 63% |

| 1 Year | 74% |

| 5 Years | 88% |

| 10 Years | 94% |

| 20 Years | 100% |

Source: S&P 500 historical data analysis, 1950-2025

The Compound Interest Miracle

Albert Einstein allegedly called compound interest “the eighth wonder of the world.” Whether he actually said it or not, the principle is undeniably powerful. When you invest $500 per month starting at age 25 with an average 10% annual return, you’ll have approximately $3.2 million by age 65. Wait until age 35 to start, and you’ll have only about $1.1 million, less than half the amount despite only waiting 10 years.

This mathematical reality makes time the most important thing in investing. You can’t buy more time, but you can start using the time you have right now. This is precisely why you should invest as early as possible, even if you can only start small.

Emotional Discipline: Your Secret Investing Superpower

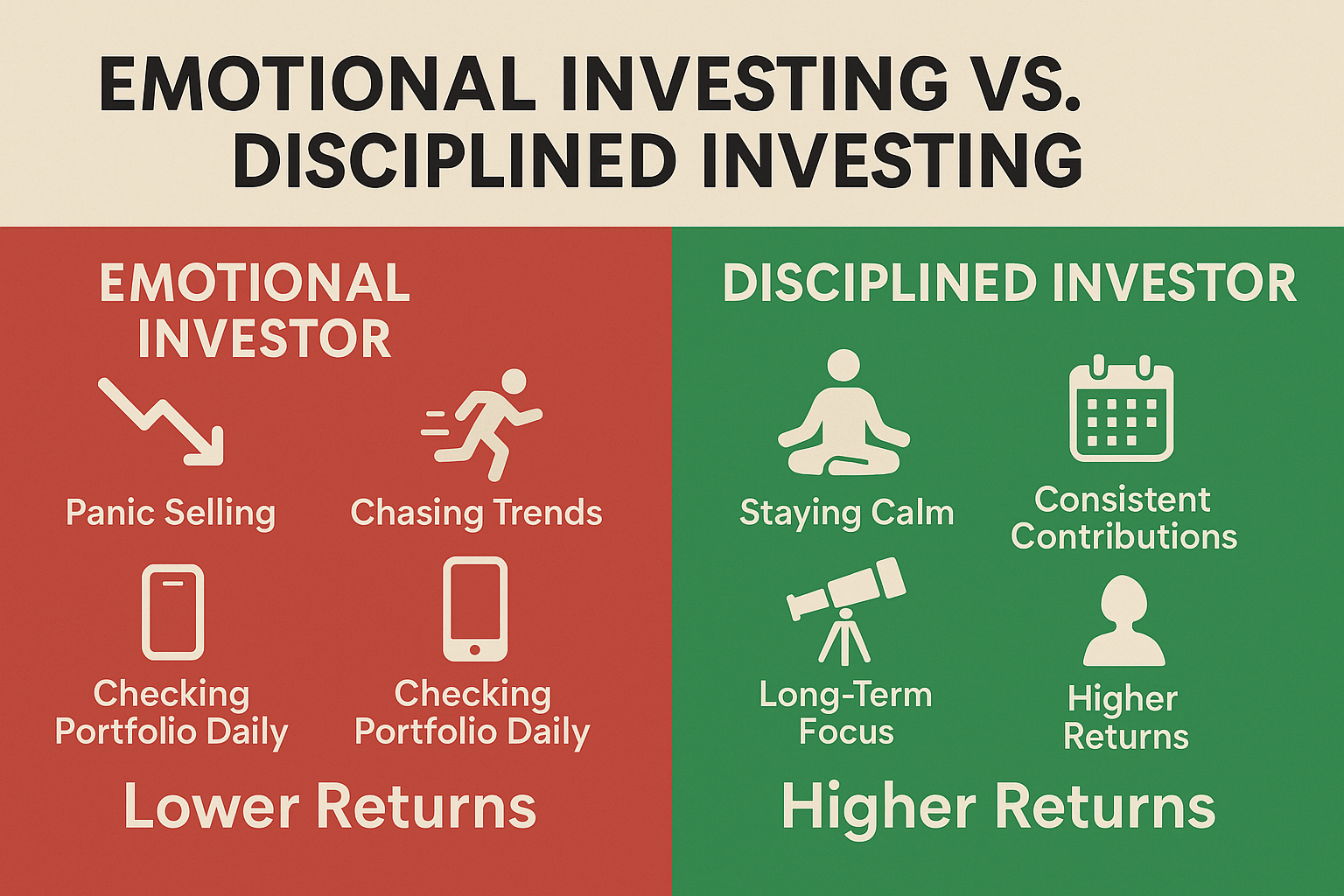

Warren Buffett once said, “The stock market is a device for transferring money from the impatient to the patient.” This transfer happens because most investors let emotions drive their decisions instead of logic and strategy. Morningstar – Investing Basics & Research Tools

The Fear and Greed Cycle

Every investor faces two powerful emotions:

- Fear – The urge to sell when markets drop

- Greed – The temptation to chase hot stocks or time the market

Both emotions destroy wealth. Fear causes investors to sell at market bottoms, locking in losses. Greed leads to buying overpriced assets or taking excessive risks. The most important thing successful investors do is recognize these emotions and refuse to act on them.

A Real Story: The 2020 COVID Crash

In March 2020, the stock market dropped 34% in just 23 days, the fastest bear market in history. Social media exploded with predictions of another Great Depression. Millions of investors sold everything, moving to cash “until things settled down.”

But here’s what happened: The market bottomed on March 23, 2020, and by August, just five months later, it had completely recovered. By the end of 2020, the S&P 500 was up 16% for the year. Those who sold in panic missed one of the greatest recoveries in market history.

The investors who stayed calm and kept investing? They bought stocks at 34% discounts and rode the recovery wave. Some even achieved their retirement goals years ahead of schedule. This demonstrates why understanding why people lose money in the stock market is essential for avoiding the same mistakes.

Building Your Emotional Defense System

So how do you develop emotional discipline? Here are proven strategies:

- Create an investment plan and write it down – When emotions run high, refer back to your written plan

- Automate your investments – Set up automatic monthly contributions so emotions can’t interfere

- Limit market checking – Checking your portfolio daily increases emotional reactions; monthly is plenty

- Focus on your goals, not daily prices – Remember why you’re investing and what you’re building toward

- Educate yourself continuously – Knowledge builds confidence, which reduces emotional reactions

Consistent Action: The Wealth-Building Habit

Knowledge without action is useless. The most important thing isn’t just understanding investing principles, it’s applying them consistently, month after month, year after year. This is where most people fail, not because they don’t know what to do, but because they don’t actually do it.

The Dollar-Cost Averaging Advantage

Dollar-cost averaging (DCA) is a fancy term for a simple concept: investing the same amount of money at regular intervals regardless of market conditions. This strategy removes emotion from the equation and provides a mathematical advantage.

When prices are high, your fixed investment buys fewer shares. When prices are low, the same amount buys more shares. Over time, this averages out your purchase price and typically results in better returns than trying to time the market.

Example of Dollar-Cost Averaging:

| Month | Investment Amount | Share Price | Shares Purchased |

|---|---|---|---|

| January | $500 | $50 | 10 shares |

| February | $500 | $40 | 12.5 shares |

| March | $500 | $45 | 11.1 shares |

| April | $500 | $55 | 9.1 shares |

| Total | $2,000 | Avg: $47.50 | 42.7 shares |

Average cost per share: $46.84 (better than the $47.50 average price!)

This approach works especially well with dividend investing strategies, where you’re building both capital appreciation and income streams simultaneously.

Starting Small Is Better Than Not Starting

Many beginners think they need thousands of dollars to start investing. This myth keeps people on the sidelines for years. The truth? You can start with as little as $50 or even $10 per month with many modern investment platforms.

Consider Maria, a 28-year-old teacher who started investing just $100 per month in a low-cost index fund. She felt it was too small to matter, but she stayed consistent. Ten years later, with average market returns, she had accumulated over $20,000, and that’s before considering any raises or increased contributions over those years.

The most important thing isn’t the amount you start with; it’s that you actually start and stay consistent. Making smart moves with whatever you have available is always better than waiting for the “perfect” time or amount.

Understanding Risk: The Foundation of Smart Investing

Howard Marks was right when he emphasized risk as the most important thing. But what exactly is investment risk, and how should beginners think about it?

Risk Isn’t Just Volatility

Many people confuse volatility (price fluctuations) with true risk. Volatility is a temporary price movement. True risk is the permanent loss of capital, losing money you can’t recover. Vanguard – Importance of Time in Investing

Here’s the critical distinction:

- If you invest $10,000 and it drops to $7,000 but you hold on and it eventually grows to $15,000, you experienced volatility, not loss

- If you invest $10,000, it drops to $7,000, you panic and sell, and that $3,000 is a permanent loss, true risk realized

This is why emotional discipline and long-term thinking are so interconnected with risk management. The most important thing is understanding that the time horizon transforms volatility into opportunity rather than risk.

The Risk-Return Relationship

A fundamental investing principle: higher potential returns come with higher risk. You can’t escape this relationship, but you can manage it intelligently.

Investment Risk Spectrum:

🟢 Lower Risk, Lower Return:

- Savings accounts (0.5-1% annually)

- Treasury bonds (3-5% annually)

- Investment-grade corporate bonds (4-6% annually)

🟡 Moderate Risk, Moderate Return:

- Balanced funds (60/40 stocks/bonds) (6-8% annually)

- Dividend stocks (7-9% annually)

- Real estate investment trusts (6-10% annually)

🔴 Higher Risk, Higher Return:

- Growth stocks (10-12% annually average, but highly variable)

- Small-cap stocks (variable, potentially 12-15% long-term)

- Emerging market stocks (highly variable)

The most important thing is matching your risk tolerance with your time horizon and goals. If you need money in 2 years, high-risk investments are inappropriate. If you’re investing for retirement 30 years away, being too conservative means missing growth opportunities. Learning about different investment vehicles, like high dividend stocks, can help you find the right balance.

Diversification: Your Risk Management Tool

“Don’t put all your eggs in one basket” isn’t just an old saying; it’s perhaps the only free lunch in investing. Diversification means spreading your money across different investments so that poor performance in one area doesn’t sink your entire portfolio.

Diversification strategies include:

- Asset class diversification – Stocks, bonds, real estate, commodities

- Geographic diversification – U.S. and international investments

- Sector diversification – Technology, healthcare, consumer goods, financial services, etc.

- Company diversification – Owning many companies rather than just a few

For beginners, low-cost index funds provide instant diversification across hundreds or thousands of companies. This is why many financial advisors recommend starting with broad market index funds before exploring individual stocks or specialized investments.

Building Your Investment Strategy: Practical Steps

Understanding the most important thing in investing is valuable, but only if you translate that knowledge into action. Here’s your practical roadmap to get started.

Step 1: Define Your Financial Goals

Before investing a single dollar, answer these questions:

- What are you investing in? (Retirement, home purchase, financial independence, children’s education)

- When will you need this money? (Your time horizon)

- How much risk can you emotionally handle? (Your risk tolerance)

- How much can you consistently invest? (Your contribution capacity)

Write down your answers. This becomes your investment policy statement, your north star when markets get turbulent.

Step 2: Build Your Emergency Fund First

The most important thing before investing is having 3-6 months of expenses in a high-yield savings account. This safety net prevents you from having to sell investments at the worst possible time when unexpected expenses arise.

Think of your emergency fund as the foundation of your financial house. You wouldn’t build a house without a foundation, and you shouldn’t invest without this safety buffer.

Step 3: Choose Your Investment Accounts

Different accounts offer different tax advantages:

- 401(k) – Employer-sponsored, often with company match (free money!)

- IRA (Traditional or Roth) – Individual retirement accounts with tax benefits

- Taxable brokerage account – Flexible access but no special tax advantages

- HSA – Health savings account with triple tax advantages (if eligible)

For beginners, the priority order is typically:

- 401(k) up to company match

- Max out Roth IRA

- Max out 401(k)

- Taxable brokerage account

Step 4: Select Your Investments

For beginners, simplicity beats complexity. Consider starting with:

- Target-date funds – Automatically adjust risk as you approach retirement

- Total market index funds – Owns a piece of the entire stock market

- S&P 500 index funds – Tracks the 500 largest U.S. companies

- Bond index funds – Provide stability and income

As you gain experience and knowledge, you might explore creating passive income through dividend investing or other strategies, but starting simple is the most important thing for long-term success.

Step 5: Automate and Stay Consistent

Set up automatic contributions from your paycheck or bank account. Automation removes emotion and ensures consistency, the most important thing for compound growth.

Review your portfolio quarterly (not daily or weekly) to ensure it aligns with your goals, but resist the urge to make frequent changes based on market noise.

Common Investing Mistakes to Avoid

Even understanding the most important thing in investing doesn’t make you immune to mistakes. Here are the most common pitfalls and how to avoid them:

1: Waiting for the “Right Time”

The market will never feel safe. There’s always a reason to wait: elections, inflation concerns, geopolitical tensions, or market highs. The best time to start investing was 10 years ago. The second-best time is today.

2: Chasing Performance

Last year’s top-performing fund or stock is rarely next year’s winner. Chasing hot investments typically results in buying high and selling low, the opposite of what builds wealth.

3: Checking Your Portfolio Too Often

Studies show that investors who check their portfolios daily make worse decisions than those who check monthly or quarterly. Constant monitoring increases emotional reactions and poor decisions.

4: Ignoring Fees

A 1% difference in fees might not sound like much, but over 30 years, it can cost you hundreds of thousands of dollars in lost returns. Always compare expense ratios and choose low-cost options when possible.

5: Trying to Time the Market

Even professional investors with teams of analysts can’t consistently time the market. For every person who successfully sold at the top, thousands missed the recovery. Understanding how the stock market actually works helps you avoid this costly mistake.

The Role of Education in Investment Success

The most important thing in investing evolves as you gain experience. What matters most as a beginner (getting started, building consistency) differs from what matters for intermediate investors (tax optimization, diversification strategies) and advanced investors (estate planning, alternative investments).

Continuous Learning Resources

Successful investors never stop learning. Here are valuable ways to expand your knowledge:

- Books – Start with classics like “The Intelligent Investor” by Benjamin Graham and “A Random Walk Down Wall Street” by Burton Malkiel

- Podcasts – Listen during commutes to make learning convenient

- Financial news – Follow reputable sources like The Wall Street Journal, Bloomberg, and Financial Times

- Online courses – Many are free or low-cost through platforms like Coursera or Khan Academy

- Investment blogs – Quality blogs like TheRichGuyMath.com provide practical, beginner-friendly guidance

The key is consistent, gradual learning rather than trying to master everything at once. Spend 15-30 minutes per week reading or listening to investment content, and you’ll be amazed at how much you know after just one year.

Real-World Success Stories

Understanding the most important thing in investing becomes more powerful when you see real examples of how these principles work in practice.

Story 1: The Power of Starting Early

Jessica started investing $200 per month at age 23, right after college. Her friends thought she was crazy, choosing to invest instead of enjoying her money. By age 35, she had accumulated over $75,000. At age 40, that had grown to $145,000. At age 50, she had over $400,000, and by retirement at 65, her consistent $200 monthly investment had grown to approximately $1.8 million.

Meanwhile, her friend Michael waited until age 33 to start investing, thinking he’d “catch up” by investing $400 per month, double Jessica’s amount. Despite investing twice as much each month, by age 65, Michael had accumulated only about $1.3 million, $500,000 less than Jessica, despite contributing more money overall.

The difference? Ten years of compound growth. Time was the most important thing.

Story 2: Staying Calm During a Crisis

Robert, a 45-year-old engineer, had been investing consistently for 15 years when the 2008 financial crisis hit. His portfolio dropped from $380,000 to $190,000, a loss of 50%. His coworkers panicked and sold everything, but Robert remembered the most important thing: long-term thinking and emotional discipline.

Not only did Robert not sell, but he actually increased his contributions, buying stocks at deep discounts. By 2013, his portfolio had recovered to $450,000. By 2020, it exceeded $900,000. His coworkers who sold in 2008? Most didn’t get back into the market until 2012 or later, missing the entire recovery and still trying to rebuild what they lost.

Story 3: The Consistency Champion

Linda was a single mother making $45,000 per year. She didn’t think she could afford to invest, but after learning about the most important thing in investing, she committed to investing just $75 per month, less than $20 per week.

She automated the investment and essentially forgot about it, focusing on her career and raising her daughter. Twenty-five years later, that $75 monthly investment had grown to over $95,000. It wasn’t life-changing wealth, but it was a substantial nest egg she created from what seemed like tiny contributions.

Linda’s story proves that the amount matters less than the consistency and time.

Advanced Concepts: Growing Beyond the Basics

Once you’ve mastered the fundamentals and built consistent investing habits, you can explore more sophisticated strategies:

Tax-Loss Harvesting

This strategy involves selling investments at a loss to offset capital gains taxes, then immediately buying a similar (but not identical) investment to maintain market exposure. This is more advanced but can save thousands in taxes over time.

Asset Location Optimization

Different investments belong in different account types for tax efficiency. For example, bonds and REITs (which generate ordinary income) work best in tax-advantaged accounts like IRAs, while growth stocks might be better in taxable accounts where long-term capital gains receive preferential tax treatment.

Rebalancing Strategies

Over time, your portfolio will drift from your target allocation as different investments perform differently. Rebalancing, selling some winners and buying some losers, maintains your desired risk level and forces you to “buy low, sell high” systematically.

These advanced strategies matter, but they’re not the most important thing. The fundamentals, long-term thinking, emotional discipline, and consistent action, remain the foundation of all investment success.

Creating Your Personal Investment Philosophy

The most important thing for your investing success is developing a personal investment philosophy that aligns with your values, goals, and personality. This philosophy becomes your decision-making framework when faced with market volatility or new investment opportunities.

Questions to Define Your Philosophy:

- Active vs. Passive: Do you want to actively pick stocks or passively invest in index funds?

- Growth vs. Income: Are you focused on capital appreciation or generating income?

- Risk tolerance: How much volatility can you emotionally handle?

- Values alignment: Do you want your investments to reflect your personal values (ESG investing)?

- Time commitment: How much time do you want to spend managing investments?

For most beginners, a philosophy centered on passive index investing, long-term holding, and consistent contributions offers the best balance of simplicity and effectiveness. As you gain experience, your philosophy may evolve, and that’s perfectly fine.

The Psychological Edge: Mastering Your Mind

Investment success is 80% psychology and 20% technical knowledge. The most important thing isn’t knowing which stocks to buy; it’s having the mental fortitude to stick with your strategy when everything feels uncertain.

Building Mental Resilience

Practice perspective thinking: When markets drop 20%, remind yourself that this is normal. Since 1950, the market has experienced a 10% correction almost every year on average, and 20% bear markets occur roughly every 3-4 years. These aren’t aberrations; they’re features of investing.

Develop an abundance mindset: View market drops as sales, not disasters. When your favorite store has a 30% off sale, you get excited. When stocks go on sale, you should feel the same way (assuming you have time for recovery).

Create emotional distance: Use percentage thinking instead of dollar thinking. A $10,000 drop in a $500,000 portfolio is just 2%, barely noticeable in the long run. But seeing “$10,000 loss” triggers emotional responses.

Celebrate the process, not just outcomes: Focus on the habits you control (consistent investing, staying educated, maintaining discipline) rather than market returns you don’t control.

Putting It All Together: Your Action Plan

You now understand that the most important thing in investing isn’t a single factor; it’s the integration of long-term thinking, emotional discipline, and consistent action, all built on a foundation of risk understanding.

Your 30-Day Action Plan

Week 1:

- Calculate your net worth and current expenses

- Determine how much you can invest monthly

- Research investment account options

Week 2:

- Open your investment account (401k, IRA, or brokerage)

- Set up your emergency fund if you haven’t already

- Write your investment goals and time horizon

Week 3:

- Choose your initial investments (index funds for simplicity)

- Set up automatic monthly contributions

- Create a calendar reminder for quarterly portfolio reviews

Week 4:

- Make your first investment

- Set up a learning schedule (15-30 minutes weekly)

- Join an investment community or find an accountability partner

The First Year and Beyond

Your first year of investing is about building the habit, not maximizing returns. Focus on consistency above all else. Don’t be discouraged by market fluctuations; they’re opportunities to test and strengthen your emotional discipline.

As you progress, continue learning and gradually increase your contributions as your income grows. Consider increasing your investment rate by 1% annually, or investing half of any raises you receive.

Remember: The most important thing isn’t perfection; it’s progress. Every dollar you invest today is working for you tomorrow, next year, and decades into the future.

The most important thing is a combination of long-term thinking, emotional discipline, and consistent action. Beginners should focus on starting early, staying invested, and avoiding emotional decisions like panic selling or chasing trends. Risk understanding and mindset matter more than picking “winning stocks.”

You can start with as little as $10–$50 per month using modern investment platforms. Consistency over time is far more important than starting with a large amount. Even small investments benefit from compound growth over decades.

No. Even professionals cannot consistently time the market. Instead, focus on staying invested, using index funds, and regular contributions. Dollar-cost averaging reduces the impact of market volatility and removes emotional decision-making.

Start by understanding your risk tolerance and time horizon. Diversify across asset classes, sectors, and geographies. Risk isn’t volatility—it’s the permanent loss of capital. Holding investments long-term turns short-term volatility into opportunity.

Studies show that 80% of investment success comes from psychology. Fear and greed drive most poor investment decisions, such as selling at market bottoms or buying overpriced assets. Developing mental resilience and following a written plan ensures long-term success.

Compound interest allows your money to grow exponentially over time. Regular contributions plus investment returns earn returns on top of returns. Starting even 10 years earlier can more than double your wealth, demonstrating that time is your most powerful investing asset.

Dollar-cost averaging means investing a fixed amount regularly, regardless of market price. When prices are high, you buy fewer shares; when prices are low, you buy more. Over time, this smooths out your average purchase price and reduces the temptation to time the market.

High-quality resources include:

Books: The Intelligent Investor, A Random Walk Down Wall Street

Podcasts: Beginner-friendly finance shows

Blogs: TheRichGuyMath.com

Courses: Free or low-cost options on Coursera, Khan Academy

Financial news: Wall Street Journal, Bloomberg, Financial Times

Regular, consistent learning builds confidence and improves decision-making.

Disclaimer

The information provided in this article is for educational and informational purposes only and should not be construed as financial advice. Investing involves risk, including the potential loss of principal. Past performance does not guarantee future results. Before making any investment decisions, consider your financial situation, investment objectives, and risk tolerance. Consider consulting with a qualified financial advisor who can provide personalized advice based on your individual circumstances. The author and TheRichGuyMath.com are not responsible for any financial decisions made based on the information provided in this article.

Conclusion: Your Investing Journey Starts Now

The most important thing in investing isn’t complicated, but it requires commitment. It’s not about finding the next Amazon or perfectly timing market tops and bottoms. It’s about understanding three fundamental truths:

- Time is your greatest asset – Start now, stay invested, and let compound growth work its magic

- Emotions are your greatest enemy – Develop the discipline to act rationally when everyone else is panicking

- Consistency is your greatest strategy – Regular investing beats perfect timing every single time

Thousands of people become millionaires through investing every year, not because they’re smarter or luckier than you, but because they understand and apply these principles consistently over decades.

The market will crash again. There will be scary headlines. You’ll be tempted to quit. But if you remember the most important thing, that long-term, disciplined, consistent investing has created more wealth than any other strategy in history, you’ll have the confidence to stay the course.

Your Next Steps Today:

- ✅ Choose one investment account to open this week

- ✅ Calculate how much you can invest monthly (even if it’s just $50)

- ✅ Set up automatic contributions so consistency is guaranteed

- ✅ Bookmark this article and reread it during your next moment of market doubt

- ✅ Commit to learning something new about investing every week

The journey to financial independence starts with a single step. The most important thing is that you take that step today, not tomorrow, not next month, not when conditions are “perfect.” Today.

Your future self, the one living comfortably in retirement, the one who achieved financial goals, the one who built generational wealth, is counting on the decisions you make right now.

Make them count. Start investing. Stay consistent. Build wealth.

About the Author

Max Fonji is a financial educator and the founder of TheRichGuyMath.com, where he helps beginners navigate the world of investing and wealth-building with clear, actionable advice. With over a decade of experience in personal finance and investing, Max is passionate about demystifying complex financial concepts and making them accessible to everyone. His mission is to empower individuals to take control of their financial futures through education, discipline, and smart investing strategies. When he’s not writing about finance, Max enjoys analyzing market trends, reading investment literature, and helping others achieve their financial goals.

💰 Investment Growth Calculator

See how consistent investing and compound interest build wealth over time