Picture this: It’s 5:30 AM, and your alarm screams at you from across the room. Your bed feels like a warm cloud, and every fiber of your being wants to hit snooze. But you don’t. You swing your legs out of bed, lace up your running shoes, and head out the door. Six months later, you’ve lost 20 pounds, saved $5,000, and finally started that side business you’ve been dreaming about. What changed? The power of discipline.

Discipline isn’t about punishing yourself or living a joyless life. It’s the bridge between your goals and your accomplishments. It’s what separates people who dream from people who achieve. Whether you want to build wealth through dividend investing, get in shape, or master a new skill, discipline is the secret ingredient that makes lasting change possible.

In 2025, we’re bombarded with quick fixes and overnight success stories. But here’s the truth nobody wants to hear: sustainable success requires discipline. The good news? Discipline is a skill you can learn, practice, and master, just like riding a bike or playing an instrument. Shortform’s Power of Discipline summary

Key Takeaways

- Discipline is a learnable skill, not an innate personality trait; anyone can develop it through consistent practice

- Small, consistent actions compound over time to create massive results in wealth, health, and personal growth

- The 2-Minute Rule and habit stacking are proven strategies to build lasting habits without overwhelming yourself

- Environmental design matters more than willpower. Set up your surroundings to make good choices automatic

- Tracking progress and celebrating small wins creates momentum and reinforces disciplined behavior

What Is Discipline, Really?

Let’s clear up a common misconception. Discipline isn’t about being a robot or denying yourself pleasure. Discipline is choosing what you want most over what you want right now.

Think of it like this: You want the satisfaction of watching Netflix tonight, but you want financial freedom even more. You want the comfort of sleeping in, but you want a healthy body even more. Discipline is the muscle that helps you make the harder choice—the one that aligns with your long-term vision.

According to research from the American Psychological Association, people with higher self-discipline experience:

- Better academic and professional performance

- Improved physical and mental health

- Stronger relationships

- Greater financial stability

A 2013 study published in the Journal of Personality found that self-control was a better predictor of academic success than IQ. That’s powerful! It means your ability to delay gratification and stay committed matters more than raw talent.

The Science Behind Discipline

Your brain is wired for survival, not success. The prefrontal cortex, responsible for decision-making and self-control, is constantly battling with your limbic system, which craves immediate rewards. When you practice discipline, you’re literally strengthening the neural pathways in your prefrontal cortex.

Dr. Roy Baumeister, a leading researcher on willpower, discovered that self-control operates like a muscle. It can get tired (ego depletion), but it also gets stronger with regular exercise. This is why starting small is so crucial; you’re building your discipline muscle gradually.

Why Most People Struggle with Discipline

Before we dive into building habits, let’s talk about why discipline feels so hard for most people.

1. Unrealistic Expectations

People set massive goals without a roadmap. They want to save $50,000 this year, when they’ve never saved $5,000 before. They commit to working out seven days a week when they haven’t exercised in years. These all-or-nothing approaches set you up for failure.

2. Relying on Motivation

Motivation is like a fickle friend; it shows up when things are exciting but disappears when life gets tough. Discipline, on the other hand, is the reliable companion that sticks around even when you don’t feel like it.

As author Rory Vaden says, “Success is not about willpower. It’s about creating the right conditions so that good habits happen automatically.”

3. No Clear “Why”

Without a compelling reason, discipline feels like punishment. When you understand why you’re making sacrifices, whether it’s securing your family’s financial future or improving your health, discipline becomes easier.

4. Poor Environmental Design

If your pantry is stocked with junk food, you’ll eat junk food. If your phone is next to your bed, you’ll scroll before sleep. Your environment shapes your behavior more than your willpower ever will.

The Power of Discipline: Building Habits That Actually Stick

Now for the good stuff: how to harness the power of discipline to create habits that last a lifetime.

Start Ridiculously Small: The 2-Minute Rule

James Clear, author of Atomic Habits, popularized the 2-Minute Rule: Make your new habit so easy it takes less than two minutes to do.

Want to read more? Start with one page per night. Want to meditate? Begin with two minutes. Want to start investing in the stock market? Spend two minutes reading about it.

Here’s why this works: Starting is the hardest part. Once you’re in motion, continuing becomes easier. That one page often turns into a chapter. Those two minutes of meditation expand to ten. Before you know it, you’ve built a sustainable habit.

| Goal | 2-Minute Version | What It Becomes |

|---|---|---|

| Exercise daily | Put on workout clothes | 30-minute workout |

| Save money | Transfer $1 to savings | Automated savings plan |

| Learn investing | Read one paragraph about stocks | Understanding dividend investing |

| Eat healthier | Cut one vegetable | Cooking nutritious meals |

| Write a book | Write one sentence | Daily writing habit |

Use Habit Stacking

Habit stacking is attaching a new habit to an existing one. The formula is simple:

“After [CURRENT HABIT], I will [NEW HABIT].”

Examples:

- After I pour my morning coffee, I will review my investment portfolio.

- After I brush my teeth, I will do ten push-ups.

- After I sit down for lunch, I will write three things I’m grateful for.

- After I close my laptop for the day, I will transfer $10 to savings.

Your current habits are already ingrained in your brain’s neural pathways. By stacking new behaviors onto them, you’re hitching a ride on an existing routine.

Design Your Environment for Success

Make good habits obvious and bad habits invisible.

Want to drink more water? Place a full water bottle on your desk every morning. Want to stop scrolling social media? Delete the apps from your phone. Want to invest regularly? Set up automatic transfers to your investment account.

A Stanford University study found that environmental design is responsible for up to 70% of behavioral change. That means you can engineer success by changing your surroundings.

Environmental Design Checklist:

For better finances:

- Automate savings and investments

- Unsubscribe from shopping emails

- Use cash for discretionary spending

For better health:

- Prep healthy meals in advance

- Keep workout clothes visible

- Remove tempting foods from your home

For better productivity:

- Turn off phone notifications

- Create a dedicated workspace

- Use website blockers during focus time

Track Your Progress

What gets measured gets managed. Tracking creates accountability and provides visual proof of your progress.

Use a simple habit tracker, a calendar where you mark an X for each day you complete your habit. Jerry Seinfeld famously used this “don’t break the chain” method to write jokes every single day.

You can track:

- Days you exercised

- Amount saved each week

- Pages read

- Hours worked on your side business

- Days without spending on unnecessary items

Pro tip: Track the behavior, not just the outcome. Focus on “I invested $100 this week” rather than “My portfolio grew by X%.” You control the behavior; outcomes take time.

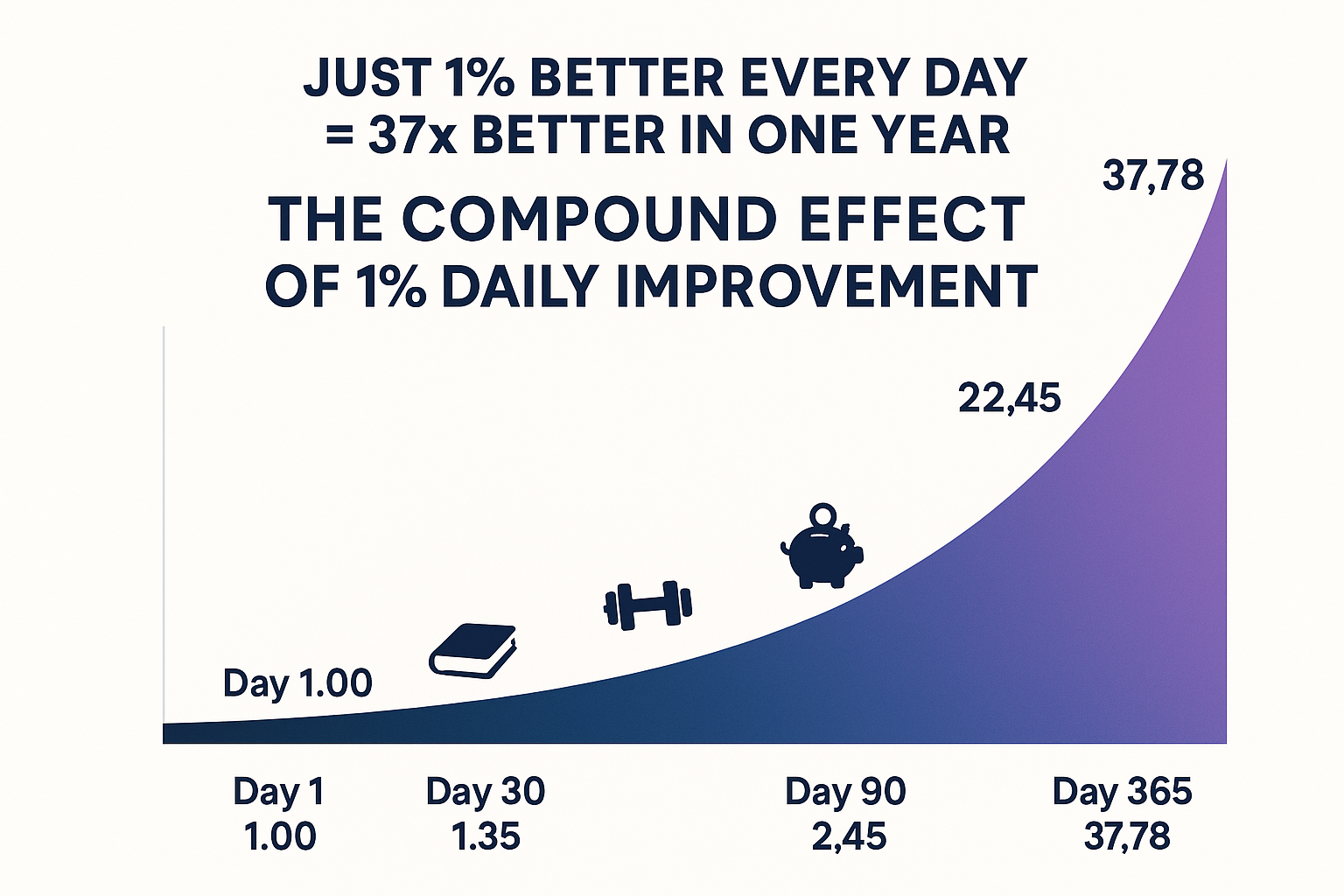

Embrace the Compound Effect

Here’s where the power of discipline truly shines: small actions compound into extraordinary results.

If you improve by just 1% every day, you’ll be 37 times better in a year. That’s the math:

- 1.01^365 = 37.78

This applies to everything:

- Saving $10 daily = $3,650 annually (plus compound interest if invested)

- Reading 10 pages daily = 12-18 books yearly

- Learning one new concept daily = 365 new ideas annually

The problem? Most people quit before the compound effect kicks in. They don’t see results after a week or a month and give up. But understanding market cycles teaches us that patience and consistency always win in the long run.

“We overestimate what we can accomplish in a day, and underestimate what we can accomplish in a year.” Unknown

Overcoming Common Discipline Obstacles

When You Miss a Day

Life happens. You’ll miss workouts, skip savings deposits, or break your diet. The key is never missing twice.

Missing once is an accident. Missing twice is the start of a new (bad) habit. Get back on track immediately, no guilt, no drama, just action.

When Progress Feels Slow

Remember the “Plateau of Latent Potential.” Your efforts aren’t wasted during the plateau; they’re building up beneath the surface. Think of an ice cube melting: the temperature rises from 25°F to 31°F with no visible change. But at 32°F, everything transforms.

Your habits work the same way. Keep going even when you don’t see immediate results.

When Motivation Disappears

Create a “motivation bank”, a collection of reasons why your goal matters. Write them down and review them when discipline wavers:

- “I’m building discipline to achieve financial independence.”

- “I’m doing this so my kids see what commitment looks like.”

- “I’m investing in my future self.”

Also, remember that people lose money in the stock market not because they lack knowledge, but because they lack the discipline to stick to their strategy during tough times.

The Discipline-Wealth Connection

Let’s talk money, because that’s why you’re reading TheRichGuyMath.com, right?

The power of discipline is the foundation of wealth building.

Warren Buffett didn’t become a billionaire through luck. He became wealthy through disciplined investing over decades. He:

- Reads 500 pages daily

- Sticks to his investment principles regardless of market noise

- Lives below his means despite vast wealth

You don’t need Buffett’s IQ to build wealth. You need his discipline.

Disciplined Wealth-Building Habits:

- Pay yourself first — Automate transfers to savings/investments before you see the money

- Live below your means — Spend less than you earn, always

- Invest consistently — Dollar-cost average into dividend stocks or index funds monthly

- Avoid lifestyle inflation — When income increases, increase savings proportionally

- Learn continuously — Spend 30 minutes daily learning about why the stock market goes up over time

A study by Fidelity found that the best-performing investment accounts belonged to people who either forgot about them or had passed away. Why? Because they weren’t tempted to make emotional decisions. Discipline beats intelligence in investing.

Creating Your Personal Discipline System

Here’s a practical framework to build discipline that lasts:

Step 1: Define Your “Why”

Write down exactly why this goal matters. Be specific and emotional:

- “I want to save money”

- “I want to save $50,000 so I can quit my soul-crushing job and start my own business”

Step 2: Start With ONE Habit

Don’t overhaul your entire life. Pick one keystone habit—a behavior that creates a ripple effect. Examples:

- Morning exercise (improves energy, mood, and decision-making)

- Daily investing education (builds wealth mindset)

- Evening planning (increases productivity)

Step 3: Make It Stupid Simple

Use the 2-Minute Rule. Make your habit so easy you can’t say no.

Step 4: Schedule It

Discipline happens when it’s on the calendar. Block time for your new habit like you would a doctor’s appointment.

Step 5: Create Accountability

Tell someone about your commitment. Join a community. Hire a coach. Public commitment increases follow-through by 65%, according to the American Society of Training and Development.

Step 6: Review and Adjust Weekly

Every Sunday, review:

- What went well this week?

- What obstacles did I face?

- What will I do differently next week?

Real-Life Discipline Success Stories

Sarah’s Story: From Debt to Financial Freedom

Sarah was $45,000 in debt at age 28. She felt overwhelmed and hopeless. Instead of trying to fix everything at once, she applied the power of discipline:

- Week 1: She tracked every expense (just tracked, didn’t change spending)

- Week 2: She cut one subscription service ($15/month)

- Month 2: She started the 2-Minute Rule, transferred $5 daily to savings

- Month 6: She was saving $200/month and had paid off $2,000 in debt

- Year 3: She was completely debt-free with $15,000 in savings

Sarah’s secret? She never tried to be perfect. She just refused to quit.

Mike’s Story: Building a Dividend Portfolio

Mike wanted to build passive income through dividend investing but knew nothing about stocks. He committed to learning:

- Daily habit: Read one article about investing (2-minute commitment)

- Weekly habit: Invest $50 (automated)

- Monthly habit: Review portfolio performance

Five years later, Mike’s portfolio generates $12,000 annually in dividends, all because he showed up consistently, even when he didn’t feel like it.

The 90-Day Discipline Challenge

Want to experience the transformative power of discipline? Commit to 90 days, the time it takes to cement a new habit.

Your 90-Day Framework:

Days 1-30: Foundation

- Choose ONE habit

- Do it daily, no exceptions

- Track every single day

- Celebrate small wins

Days 31-60: Expansion

- Continue habit #1

- Add ONE complementary habit

- Increase difficulty slightly

- Identify and remove obstacles

Days 61-90: Mastery

- Both habits should feel automatic

- Add a third habit if desired

- Reflect on your transformation

- Plan your next 90-day challenge

By day 90, you won’t recognize yourself. The person who couldn’t wake up early is now a morning person. The person who couldn’t save money now has a growing investment account. That’s the power of discipline.

🏆 90-Day Discipline Tracker

Build habits that last. Track your progress. Transform your life.

Add Your Habit

Discipline in Different Life Areas

The power of discipline extends far beyond personal finance. Here’s how it applies to various aspects of life:

Health & Fitness

- Morning routines: Waking up at the same time daily regulates your circadian rhythm

- Meal planning: Preparing meals in advance eliminates decision fatigue

- Consistent exercise: Even 20 minutes daily beats sporadic 2-hour sessions

Career & Business

- Skill development: Dedicating 30 minutes daily to learning compounds into expertise

- Networking: Reaching out to one new contact weekly builds a powerful network

- Side hustles: Working on smart money moves consistently creates additional income streams

Relationships

- Quality time: Scheduling regular date nights or family activities

- Communication: Daily check-ins with loved ones strengthen bonds

- Conflict resolution: Addressing issues promptly rather than letting them fester

Personal Growth

- Reading: 10 pages daily equals 12-18 books annually

- Meditation: Daily practice reduces stress and improves focus

- Journaling: Reflecting on experiences accelerates learning

The Dark Side of Discipline: What to Avoid

While discipline is powerful, it can become destructive if misapplied. Watch out for these pitfalls:

Over-Discipline (Burnout)

Being too rigid leads to exhaustion. Build in rest days and flexibility. Remember, discipline should enhance your life, not drain it.

Perfectionism

Missing one day doesn’t mean failure. The all-or-nothing mentality destroys more goals than laziness ever will. Progress, not perfection.

Ignoring Enjoyment

If your disciplined life feels like prison, you’re doing it wrong. Find ways to make good habits enjoyable. Listen to audiobooks while exercising. Invest in companies you believe in. Cook healthy meals you actually like.

Comparing Yourself to Others

Your discipline journey is unique. Someone else might be on day 500 while you’re on day 5. That’s okay. Compare yourself to who you were yesterday, not to someone else today.

Advanced Discipline Strategies

Once you’ve mastered the basics, level up with these advanced techniques:

Implementation Intentions

Research by psychologist Peter Gollwitzer shows that creating “if-then” plans increases success rates by 300%.

Instead of: “I’ll exercise more”

Try: “If it’s 6 AM on a weekday, then I will do 20 minutes of yoga in my living room”

Temptation Bundling

Pair something you need to do with something you want to do:

- Only listen to your favorite podcast while exercising

- Only watch Netflix while meal prepping

- Only get coffee from your favorite shop after completing your morning routine

The Seinfeld Strategy (Don’t Break the Chain)

Mark an X on a calendar for every day you complete your habit. Your only job is not to break the chain. The visual progress becomes its own motivation.

Habit Contracts

Create a written agreement with yourself (or a friend) that includes consequences for breaking your commitment. Research shows financial penalties are particularly effective. Donate $50 to a charity you dislike every time you miss your habit.

The 20-Second Rule

Make bad habits 20 seconds harder and good habits 20 seconds easier:

- Want to stop watching TV? Remove the batteries from the remote

- Want to exercise? Sleep in your workout clothes

- Want to save money? Delete shopping apps from your phone

Discipline for Long-Term Wealth Building

Let’s bring this full circle to what matters most at TheRichGuyMath.com, building lasting wealth.

The discipline required for financial success isn’t complicated, but it’s not easy:

The Discipline of Patience

The stock market rewards those who wait. A study by Fidelity found that the best-performing investors were either dead or had forgotten about their accounts. Why? They couldn’t panic sell during downturns.

Disciplined investing means:

- Not checking your portfolio obsessively

- Staying invested during market crashes

- Trusting the process even when it’s scary

The Discipline of Consistency

Investing $500 monthly at 8% annual returns for 30 years = $745,000. Miss just one year of contributions? You lose over $50,000 in final value.

Small, consistent actions create massive wealth.

The Discipline of Learning

The investment landscape changes constantly. Disciplined investors commit to continuous education:

- Reading annual reports

- Understanding market cycles and emotions

- Learning from mistakes without repeating them

The Discipline of Delayed Gratification

Every dollar you invest is a dollar you don’t spend today. The discipline to choose future wealth over present consumption separates the wealthy from everyone else.

Case Study: Two friends, both earning $60,000 annually:

- Friend A spends $58,000, saves $2,000 yearly

- Friend B spends $48,000, invests $12,000 yearly

After 30 years at 8% returns:

- Friend A has $244,000

- Friend B has $1,467,000

That’s the power of disciplined saving and investing.

Your Discipline Action Plan

Ready to harness the power of discipline? Here’s your step-by-step action plan:

Week 1: Foundation

- Choose ONE habit (start small, remember the 2-Minute Rule)

- Define your why (write it down and review it daily)

- Set up your environment (make good choices easy, bad choices hard)

- Create a tracking system (use the interactive tracker above)

Week 2-4: Consistency

- Do your habit daily (no exceptions, no excuses)

- Track your progress (mark an X for each successful day)

- Identify obstacles (what almost made you quit? How can you prevent it?)

- Celebrate small wins (acknowledge your progress)

Month 2-3: Expansion

- Continue habit #1 (it should feel easier now)

- Add a complementary habit (use habit stacking)

- Increase difficulty slightly (2 minutes becomes 5, then 10)

- Join a community (accountability accelerates progress)

Month 3+: Mastery

- Your habits are now automatic (they require less willpower)

- Reflect on your transformation (journal about the changes you’ve experienced)

- Help someone else (teaching reinforces your own discipline)

- Plan your next challenge (continuous growth is the goal)

Conclusion: Your Discipline Journey Starts Now

The power of discipline isn’t about becoming a different person. It’s about becoming the person you already are at your best, more often.

You don’t need superhuman willpower. You don’t need perfect conditions. You don’t need to wait for Monday, January 1st, or “the right time.”

You need to start small, stay consistent, and trust the process.

Remember:

- Discipline is a skill anyone can learn

- Small actions compound into extraordinary results

- Your environment matters more than your willpower

- Missing once is okay; missing twice is a pattern

- Progress beats perfection every single time

The habits you build today determine the life you live tomorrow. Whether you want to achieve financial freedom through smart passive income strategies, improve your health, or master a new skill, discipline is the bridge.

Your next steps:

- Use the 90-Day Discipline Tracker above to choose and track ONE habit

- Read about building wealth for future generations to understand why discipline matters

- Set up automatic transfers to start your investment journey today

- Share this article with someone who needs to hear it

The power of discipline transformed my life, and it can transform yours too. The question isn’t whether you can do it; it’s whether you will.

Start today. Start small. Start now.

Disclaimer

This article is for educational and informational purposes only and should not be construed as financial advice. While discipline is crucial for financial success, always conduct your own research and consider consulting with a qualified financial advisor before making investment decisions. Past performance does not guarantee future results. All investment strategies carry risk, including the potential loss of principal.

About the Author

Max Fonji is a financial educator and content strategist at TheRichGuyMath.com, dedicated to making investing and wealth-building accessible to everyone. With over a decade of experience in personal finance and behavioral psychology, Max specializes in helping beginners develop the habits and mindset needed for long-term financial success. His work has helped thousands of readers take control of their finances, build disciplined investing habits, and achieve their wealth-building goals. When he’s not writing about money, Max enjoys reading behavioral economics research, practicing martial arts, and experimenting with new productivity systems.