Emergency Fund: Life has a way of throwing surprises when you least expect them. A sudden medical bill, job loss, or broken car transmission can instantly derail your budget. That’s why financial experts stress the importance of having an emergency fund, money reserved for life’s unexpected expenses.

But here’s the challenge: many people aren’t sure when they should dip into it. According to the Federal Reserve’s 2023 Economic Well-Being Report, 37% of Americans would struggle to cover an unexpected $400 expense without borrowing. This highlights two problems:

- Millions don’t have adequate emergency savings.

- Those who do often misuse it for non-emergencies.

That’s why, before you spend a single dollar from your emergency fund, you should pause and ask yourself three essential questions. Doing so can help you protect your savings, avoid unnecessary debt, and keep your financial safety net intact. Investopedia – Emergency Fund Definition

TL;DR

Quick Takeaways — Three Questions to Ask Before Spending Your Emergency Fund

- Is this truly an emergency or just an inconvenience?

- Do I have alternative options before touching savings?

- How will this decision affect future financial stability?

Your emergency fund exists to protect your health, home, and income. Use it only when no other option works.

What Is an Emergency Fund?

An emergency fund is a dedicated pool of savings designed to cover urgent, unexpected expenses that could otherwise push you into debt. Think of it as a personal insurance policy — a buffer between you and high-interest credit cards or loans.

Key Features of an Emergency Fund:

- Purpose: Covers true emergencies like job loss, medical bills, or critical repairs.

- Recommended Size: Financial advisors suggest saving 3–6 months of essential living expenses. For freelancers or business owners, aiming for 6–12 months is even safer.

- Best Place to Keep It: In a high-yield savings account (HYSA) or money market account, safe, FDIC-insured, and easily accessible, but separate from everyday spending.

Bottom line: an emergency fund is not for vacations, new gadgets, or planned expenses like moving. It’s strictly for the “life happens” moments. Federal Reserve – Economic Well-Being Report

Why Your Emergency Fund Matters More Than You Think

An emergency fund isn’t just cash sitting idle in a bank account; it’s the financial airbag that protects you when life takes an unexpected turn.

According to a 2023 Federal Reserve report, 37% of Americans would struggle to cover a $400 emergency expense without borrowing. That means a flat tire, medical bill, or broken water heater could send nearly half the population into credit card debt.

This is why experts recommend having at least 3–6 months of essential expenses saved in a high-yield savings account (HYSA). But saving the money is only half the battle; the real challenge is knowing when to actually use it. Morningstar – Best Savings Accounts

Too often, people dip into their emergency fund for vacations, holiday shopping, or even “retail therapy.” That mistake can leave you unprotected when a real crisis hits.

So before touching your emergency fund, pause and ask yourself these three essential questions.

The 3 Essential Questions to Ask Yourself Before Spending Your Emergency Fund

1. Is This a Real Emergency or Just an Inconvenience?

This is the first and most important question. An emergency fund is meant to protect your health, housing, and income — not fund lifestyle wants.

True Emergencies Include:

- Job loss or sudden income reduction

- Medical expenses not fully covered by insurance

- Essential home repairs (e.g., leaking roof, broken furnace in winter)

- Car repairs that affect your ability to get to work

- Unexpected family emergencies (e.g., travel for illness or funeral)

Not Emergencies (a.k.a. Inconveniences):

- Holiday gifts

- Upgrading electronics or furniture

- Vacations or “mental health” trips

- Routine car maintenance (should be budgeted for separately)

- Taking advantage of a “limited-time sale”

Tip: Ask yourself, “If I don’t pay this today, will it threaten my safety, shelter, or ability to earn income?” If the answer is no, it’s not an emergency.

2. Do I Have Other Options Before Tapping the Fund?

Even if the expense feels urgent, your emergency funds shouldn’t be the first option. It should be the last resort.

Alternative Sources to Consider:

- Insurance Coverage — Check if health, car, renters, or homeowners insurance applies.

- Budget Adjustments — Can you cut nonessential spending this month to free up cash?

- Side Hustle or Extra Income — Could freelance work, overtime, or selling unused items cover it?

- Payment Plans — Many hospitals, utility companies, and even mechanics offer interest-free installment plans.

- 0% APR Credit Offers — If you’re disciplined and can pay it off before interest accrues, this may be safer than draining your emergency fund.

Your emergency fund is designed for unavoidable situations when no other solution works.

3. How Will Spending This Affect My Financial Stability Later?

Before withdrawing, consider the long-term ripple effects:

- Will this expense drop your savings below 3 months of expenses, leaving you vulnerable?

- How long will it realistically take you to rebuild the fund?

- If another crisis hits next month, would you be forced into high-interest debt?

Example:

- Emergency fund balance: $6,000 (3 months’ expenses)

- Expense: $2,000 car repair

- New balance: $4,000 (just 2 months’ expenses left)

If you lose your job a month later, you’re now short on coverage. Spending that $2,000 may feel small, but it puts your financial resilience at risk.

Rule of Thumb: Only use the fund if spending now prevents a bigger financial disaster later. CFPB – Money Basics

Case Studies: Emergency or Not?

| Situation | Use Emergency Fund? | Why |

|---|---|---|

| Lost job, need 3 months’ rent | Yes | Protects housing & stability |

| $1,500 medical bill after insurance | Yes | Health = core emergency |

| Broken water heater mid-winter | Yes | Essential home repair |

| Friend’s destination wedding | No | Optional, not survival |

| New laptop on sale | No | Upgrade, not necessity |

| Routine dental cleaning | Upgrade, not a necessity | Budgeted health expense |

The Hidden Cost of Using Your Emergency Fund

Many people forget that spending emergency savings has an opportunity cost.

Let’s say you pull $3,000 from a high-yield savings account earning 4% APY. If it takes you two years to rebuild, you’ve lost $240 in interest on top of the stress of being underfunded.

Worse, without that buffer, you may be forced to borrow at 20%+ APR on credit cards in your next emergency. That’s a huge financial step backward.

Pro Tips to Protect Your Emergency Fund

- Automate Your Rebuild

After dipping into your fund, set up automatic monthly transfers to restore it. - Separate It from Checking

Keep the money in a dedicated high-yield savings account (e.g., Ally, Marcus, Capital One 360). Easy access, but not too easy. - Name the Account Wisely

Label it “Do Not Touch Fund” in your banking app. Behavioral psychology shows that naming boosts discipline. - Revisit Your Insurance

The stronger your coverage, the less likely you’ll need to touch savings for medical, auto, or property-related expenses.

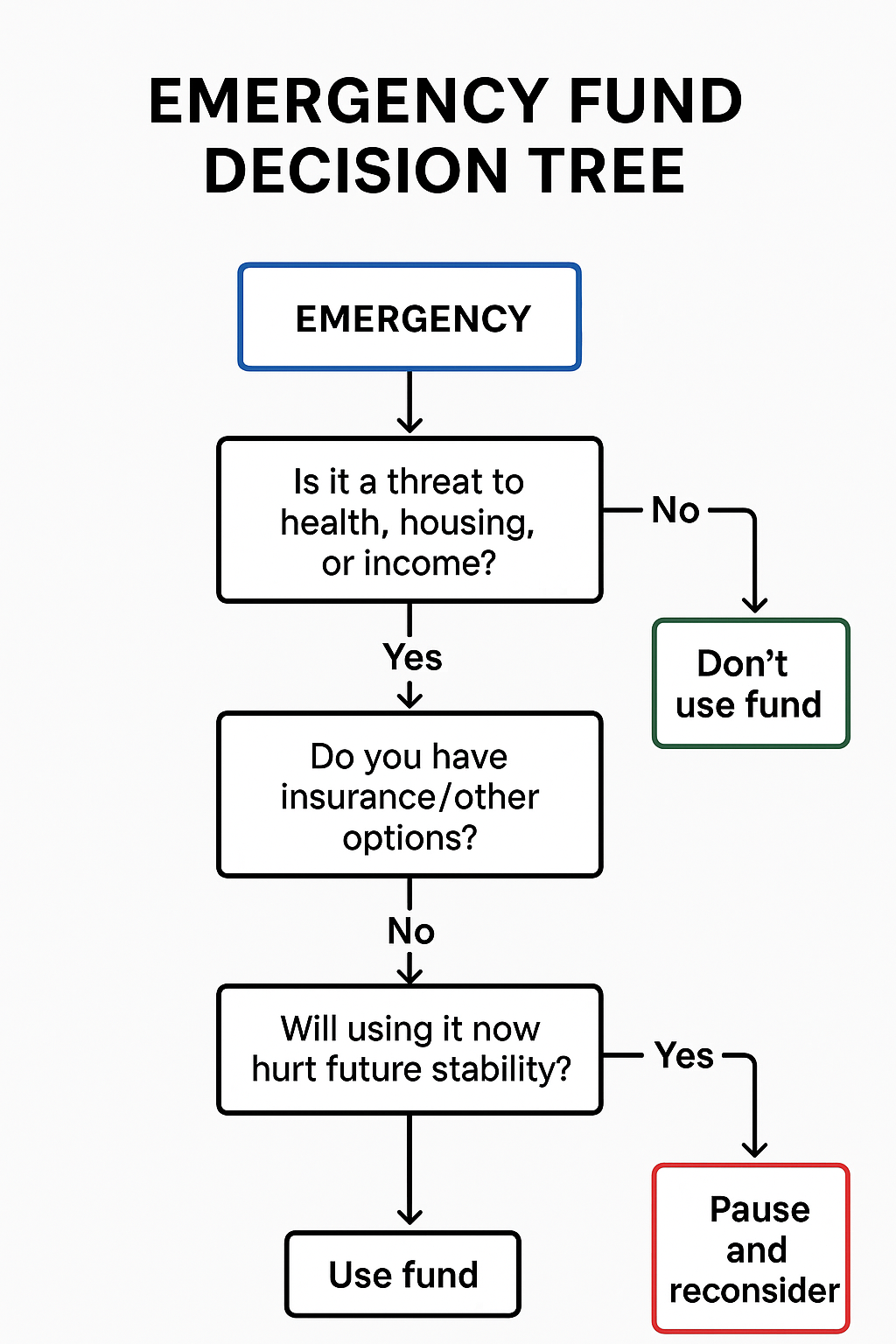

The “Emergency Fund Decision Tree”

Step 1: Is it a threat to health, housing, or income? → If no, don’t use the fund.

Step 2: Do you have insurance/other options? → If yes, explore first.

Step 3: Will using it now hurt future stability? → If yes, pause and reconsider.

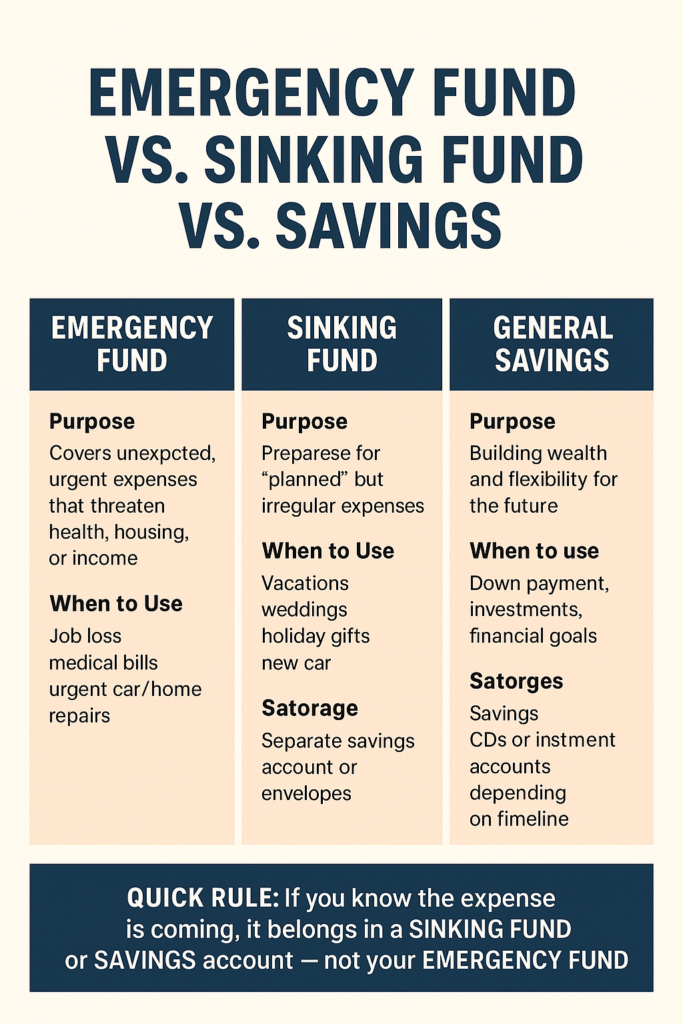

Emergency Fund vs Sinking Fund vs Savings

| Type of Fund | Purpose | When to Use | Where to Keep It |

|---|---|---|---|

| Emergency Fund | Covers unexpected, urgent expenses that threaten health, housing, or income | Job loss, medical bills, urgent car/home repairs | High-Yield Savings Account (HYSA) or money market account |

| Sinking Fund | Prepares for planned but irregular expenses | Vacations, weddings, holiday gifts, new car | Separate savings account or envelopes |

| General Savings | Builds wealth and flexibility for the future | Down payment, investments, financial goals | Savings, CDs, or investment accounts (depending on timeline) |

Only if the debt is unmanageable and the interest is spiraling. Otherwise, keep it for true emergencies.

Aim for 6–12 months of expenses since your income is less predictable.

No. Emergency funds should be liquid and safe (savings or money market accounts). Investing adds risk and volatility.

Start small; even $500 can prevent debt in a pinch. Grow it steadily over time.

Best options: High-yield savings accounts, money market accounts, or short-term CDs with no penalties.

No that’s a sinking fund. Emergency funds are for unplanned events only.

Cut discretionary spending temporarily, direct windfalls (tax refunds, bonuses), and automate transfers until replenished.

Disclaimer

This article is for educational purposes only and does not constitute financial advice. For personal guidance, consult a licensed financial advisor.

Author Bio

Written by Max Fonji

Founder of TheRichGuyMath.com, where I make personal finance and investing concepts simple for beginners with 8+ years of experience. I specialize in turning complex money topics into actionable, plain-English advice.