Imagine waking up one day and realizing that money is no longer a source of stress—it’s a tool that works for you while you sleep. That’s the power of wealth building. But here’s the truth: wealth doesn’t happen by accident. It’s not about winning the lottery or inheriting a fortune. It’s about making smart, consistent decisions that compound over time. Whether you’re living paycheck to paycheck or already have some savings, this practical 10-step plan will show you exactly how to grow your net worth and build lasting financial security.

TL;DR

- Wealth building is the process of systematically growing your net worth through smart saving, investing, and financial management over time

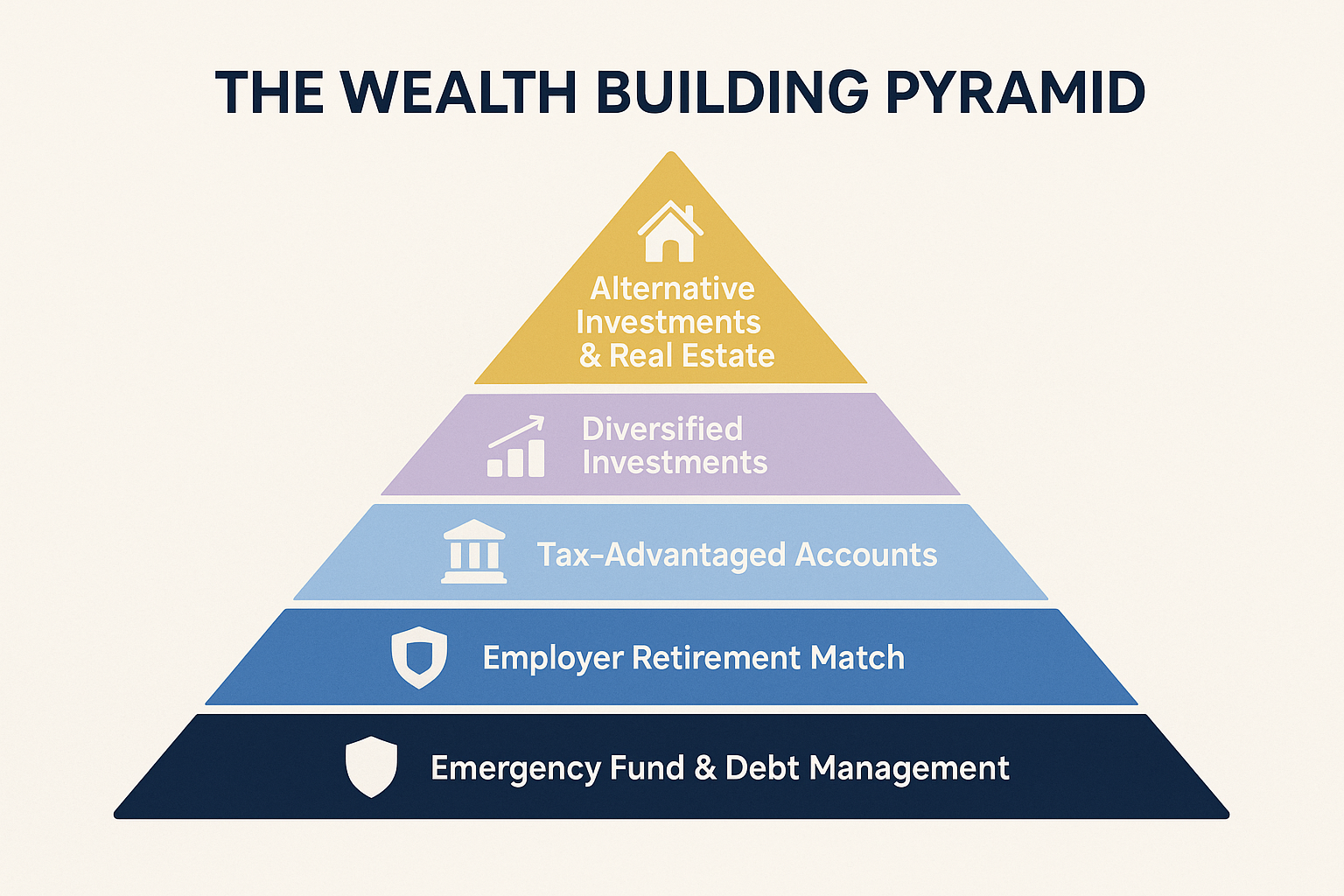

- Start by understanding your current financial position, then create a plan that includes emergency savings, debt elimination, and strategic investments

- Consistency matters more than perfection—even small steps taken regularly can create significant wealth over decades

- Diversification across multiple asset classes (stocks, real estate, bonds) reduces risk while maximizing growth potential

- The earlier you start, the more time compound interest has to work its magic—but it’s never too late to begin

What Is Wealth Building?

Wealth building is the deliberate process of increasing your net worth through a combination of earning, saving, investing, and managing money wisely. In simple terms, wealth building means creating a financial foundation that grows over time, providing security, freedom, and opportunities for you and your family.

Your net worth is calculated by subtracting your total liabilities (debts) from your total assets (what you own). The goal of wealth building is to consistently increase this number through strategic financial decisions.

Why does wealth building matter? Because it gives you:

Financial security during emergencies and retirement

Freedom to make life choices without money stress

Opportunities to pursue dreams and help others

Legacy to pass on to future generations

The beauty of wealth building is that anyone can do it, regardless of their starting point. It’s not about how much you make—it’s about what you do with what you make.

Understanding Your Starting Point: Calculate Your Net Worth

Before you can build wealth, you need to know where you stand today. Think of this as taking a financial selfie—it might not be pretty, but it’s essential.

How to Calculate Your Net Worth

The formula is simple:

Net Worth = Total Assets – Total Liabilities

Assets include:

- Cash in checking and savings accounts

- Investment accounts (401k, IRA, brokerage accounts)

- Real estate (current market value)

- Vehicles

- Valuable possessions (jewelry, art, collectibles)

- Business ownership value

Liabilities include:

- Credit card debt

- Student loans

- Car loans

- Mortgage balance

- Personal loans

- Any other debts

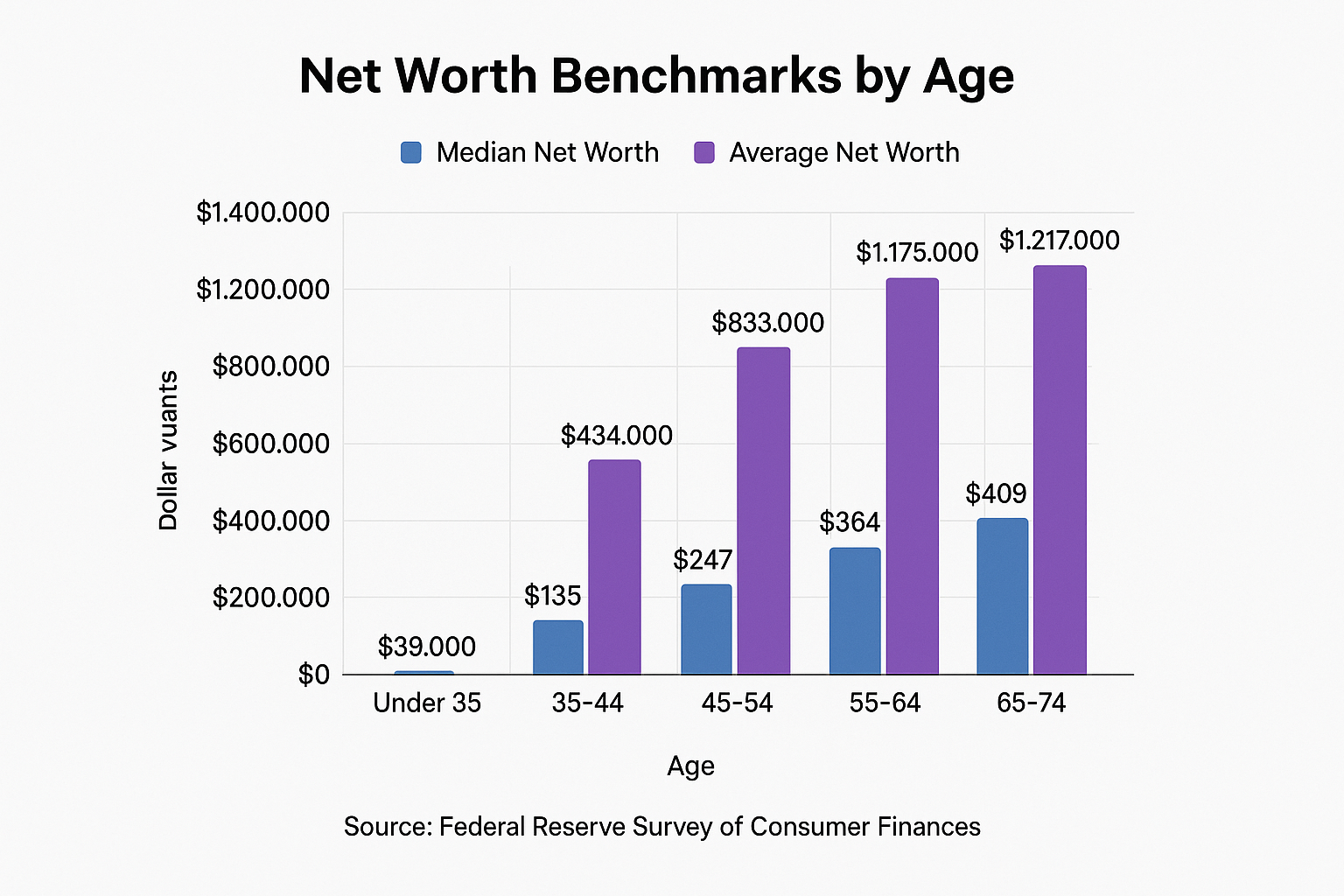

Net Worth by Age Benchmarks

| Age Range | Median Net Worth | Average Net Worth |

|---|---|---|

| Under 35 | $13,900 | $76,300 |

| 35-44 | $91,300 | $436,200 |

| 45-54 | $168,600 | $833,200 |

| 55-64 | $212,500 | $1,175,900 |

| 65-74 | $266,400 | $1,217,700 |

Source: Federal Reserve Survey of Consumer Finances

Don’t panic if your number is negative or lower than the benchmarks. The point isn’t where you are—it’s the direction you’re heading. Tracking your net worth quarterly or annually helps you measure progress and stay motivated.

Step 1: Master Your Cash Flow and Create a Budget

Wealth building starts with controlling what comes in and what goes out. You can’t build wealth if you’re spending more than you earn—it’s that simple.

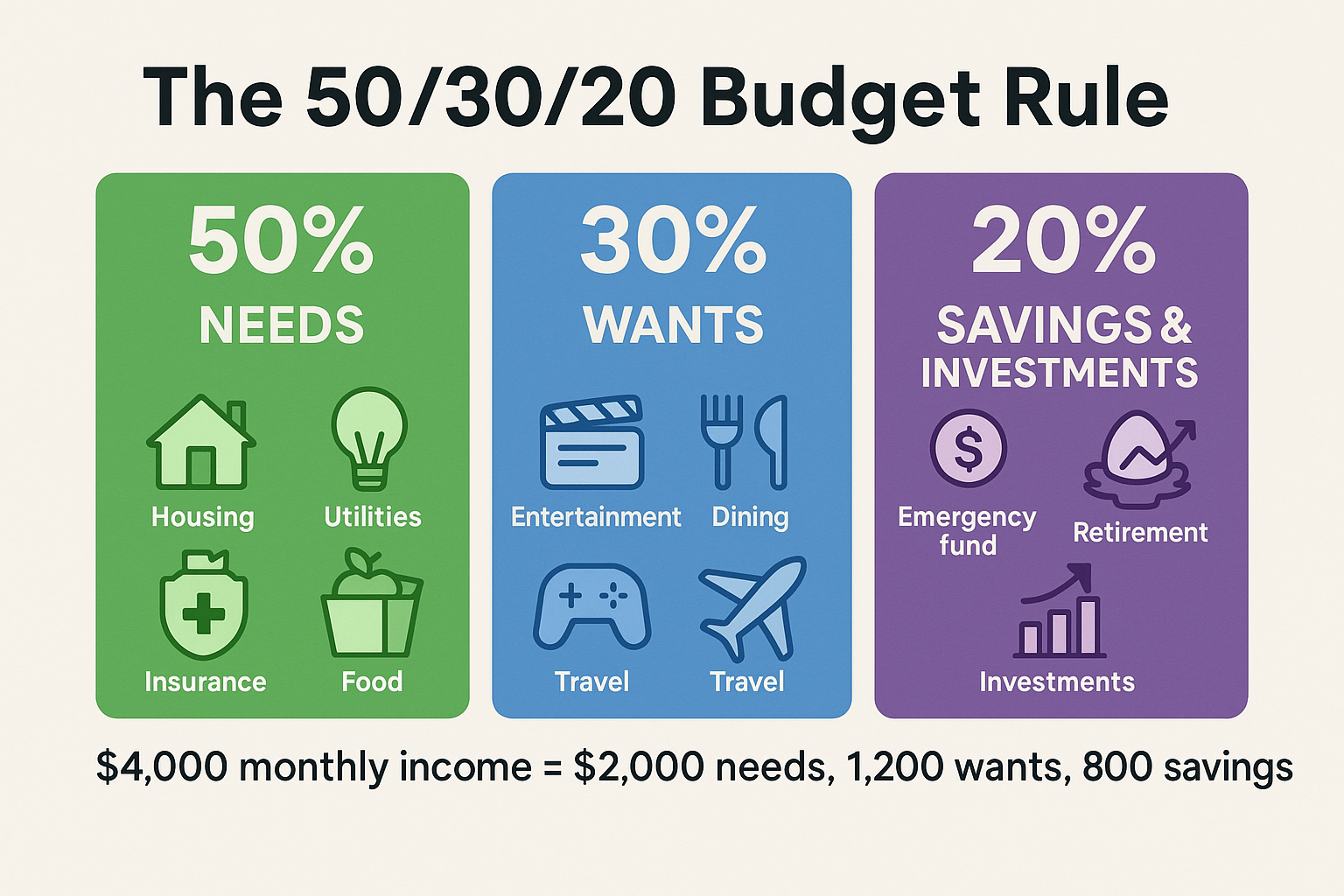

The 50/30/20 Budget Rule

This proven budgeting framework divides your after-tax income into three categories:

- 50% Needs: Housing, utilities, groceries, insurance, minimum debt payments

- 30% Wants: Dining out, entertainment, hobbies, subscriptions

- 20% Savings & Investments: Emergency fund, retirement accounts, paying off debt

Example: If you earn $4,000 per month after taxes:

- $2,000 for needs

- $1,200 for wants

- $800 for savings and investments

Track Every Dollar

Use budgeting apps like Mint, YNAB (You Need A Budget), or even a simple spreadsheet. The goal is awareness. Most people are shocked when they see where their money actually goes.

Pro tip: Review your last three months of bank and credit card statements. Highlight expenses that surprised you or that you could reduce. See our full guide on The 50/30/20 Budget Rule

Step 2: Build Your Emergency Fund First

Before you invest a single dollar in the stock market, you need a financial safety net. An emergency fund is cash set aside for unexpected expenses like job loss, medical bills, or car repairs.

How Much Do You Need?

Minimum goal: 3-6 months of essential living expenses

Calculate your monthly essentials (rent/mortgage, utilities, food, insurance, minimum debt payments) and multiply by 3-6.

Example: If your essential monthly expenses are $2,500:

- Minimum emergency fund: $7,500 (3 months)

- Ideal emergency fund: $15,000 (6 months)

Where to Keep Your Emergency Fund

Keep this money liquid and safe—not invested in stocks. Best options:

- High-yield savings accounts (currently offering 4-5% APY in 2025)

- Money market accounts

- Short-term certificates of deposit (CDs)

Why this matters: An emergency fund prevents you from going into debt when life happens. It’s the foundation of financial stability and reduces stress significantly.

Step 3: Eliminate High-Interest Debt

Debt is the enemy of wealth building. While you’re paying 18-24% interest on credit cards, it’s nearly impossible to build wealth through investments that return 8-10% annually.

The Debt Avalanche vs Debt Snowball Methods

Debt Avalanche (mathematically optimal):

- List all debts by interest rate (highest to lowest)

- Pay minimums on everything

- Put extra money toward the highest-interest debt

- Once paid off, move to the next highest

Debt Snowball (psychologically motivating):

- List all debts by balance (smallest to largest)

- Pay minimums on everything

- Put extra money toward the smallest debt

- Once paid off, move to the next smallest

Both methods work—choose the one that keeps you motivated. The average American household carries $6,270 in credit card debt. Eliminating this could save thousands in interest annually.

Good Debt vs Bad Debt

Not all debt is created equal:

Good debt (potentially builds wealth):

- Mortgage on an appreciating property

- Student loans for valuable education

- Business loans that generate income

Bad debt (destroys wealth):

- Credit card balances

- Payday loans

- Car loans on depreciating vehicles

- Consumer debt for wants

Focus on eliminating bad debt first while making consistent payments on good debt.

Step 4: Maximize Employer Retirement Benefits

If your employer offers a 401(k) match, contributing enough to get the full match is the easiest money you’ll ever make. It’s literally free money.

How 401(k) Matching Works

Example: Your employer offers a 50% match on contributions up to 6% of your salary.

If you earn $60,000 and contribute 6% ($3,600):

- Your contribution: $3,600

- Employer match: $1,800

- Total invested: $5,400

That’s an instant 50% return on your money—no investment can beat that guaranteed return.

2025 Contribution Limits

- 401(k) contribution limit: $23,500 (under 50)

- 401(k) catch-up contribution: Additional $7,500 (age 50+)

- IRA contribution limit: $7,000 (under 50)

- IRA catch-up contribution: Additional $1,000 (age 50+)

Action step: Contact HR today and ensure you’re contributing at least enough to get the full employer match. If you’re not, you’re leaving money on the table.

Step 5: Open and Fund Tax-Advantaged Investment Accounts

Tax-advantaged accounts are powerful wealth-building tools because they help your money grow faster by reducing or eliminating taxes.

Types of Tax-Advantaged Accounts

Traditional IRA:

- Contributions may be tax-deductible

- Money grows tax-deferred

- Pay taxes when you withdraw in retirement

- Best for: Those who expect to be in a lower tax bracket in retirement

Roth IRA:

- Contributions made with after-tax dollars

- Money grows tax-free

- Withdrawals in retirement are tax-free

- Best for: Younger investors and those expecting higher income later

Health Savings Account (HSA):

- Triple tax advantage: tax-deductible contributions, tax-free growth, tax-free withdrawals for medical expenses

- Contribution limit (2025): $4,300 (individual), $8,550 (family)

- Often called the “secret retirement account”

The Power of Tax-Advantaged Growth

Example: Investing $6,000 annually for 30 years at 8% average return:

- Taxable account (paying 22% tax on gains): ~$566,000

- Tax-advantaged account: ~$679,000

- Difference: $113,000+ more in your pocket

Understanding why the stock market goes up over time helps you stay committed to long-term investing through these accounts.

Step 6: Invest in Index Funds and Diversified Assets

Once you’ve built your emergency fund and maximized tax-advantaged accounts, it’s time to invest for growth. For most beginners, index funds are the smartest choice.

What Are Index Funds?

Index funds are investment funds that track a specific market index (like the S&P 500). Instead of trying to pick individual winning stocks, you own a tiny piece of hundreds or thousands of companies.

Benefits:

- Low cost: Expense ratios as low as 0.03%

- Diversification: One fund = hundreds of companies

- Simplicity: No need to research individual stocks

- Performance: Most actively managed funds underperform index funds over time

Sample Beginner Portfolio

Aggressive (20s-30s):

- 80% Stock index funds (60% U.S., 20% International)

- 20% Bond index funds

Moderate (40s-50s):

- 60% Stock index funds (45% U.S., 15% International)

- 40% Bond index funds

Conservative (60s+):

- 40% Stock index funds (30% U.S., 10% International)

- 60% Bond index funds

Dollar-Cost Averaging

Invest the same amount regularly (weekly, monthly) regardless of market conditions. This strategy:

- Removes emotion from investing

- Buys more shares when prices are low

- Buys fewer shares when prices are high

- Reduces the impact of market volatility

Learning about the cycle of market emotions helps you avoid panic selling during downturns. See our full guide on Dollar-Cost Averaging

Step 7: Create Multiple Income Streams

Relying on a single income source is risky. Wealthy people typically have multiple streams of income that work together to build net worth faster.

Types of Income Streams

1. Earned Income

Your primary job or salary—the foundation for most people.

2. Investment Income

Money your investments generate:

- Stock dividends

- Bond interest

- Capital gains from selling appreciated assets

Starting dividend investing can create reliable passive income, especially with high dividend stocks.

3. Side Hustle Income

- Freelancing (writing, design, consulting)

- E-commerce or online business

- Gig economy work (Uber, TaskRabbit, DoorDash)

4. Rental Income

Real estate that generates monthly cash flow from tenants.

5. Business Income

Owning a business (online or offline) that generates profit.

6. Royalty Income

Creating something once that pays repeatedly:

- Books or e-books

- Online courses

- Music or art

- Patents or intellectual property

The Power of Multiple Streams

Example:

- Job salary: $60,000/year

- Dividend income: $3,000/year

- Side hustle: $12,000/year

- Total: $75,000/year

That’s a 25% increase in income without changing your primary job. Explore smart ways to make passive income to diversify your income sources.

Step 8: Invest in Real Estate (When Ready)

Real estate has created more millionaires than any other asset class. It offers unique benefits like leverage, tax advantages, and tangible value.

Ways to Invest in Real Estate

Primary Residence:

- Build equity as you pay down your mortgage

- Potential appreciation over time

- Tax benefits (mortgage interest deduction)

Rental Properties:

- Monthly cash flow from tenants

- Appreciation potential

- Tax deductions (depreciation, repairs, expenses)

- Requires active management or a property manager

Real Estate Investment Trusts (REITs):

- Own shares in commercial real estate portfolios

- Liquid (can buy/sell like stocks)

- Regular dividend payments

- No property management hassle

- Minimum investment as low as one share

Real Estate Crowdfunding:

- Platforms like Fundrise or RealtyMogul

- Invest in commercial properties with small amounts

- Passive investment

- Less liquidity than REITs

The 1% Rule for Rental Properties

A quick screening tool: monthly rent should equal at least 1% of the property’s purchase price.

Example: $200,000 property should rent for at least $2,000/month to potentially be a good investment.

Important: Real estate requires significant capital, research, and often debt. Don’t rush into it until you’ve mastered steps 1-7.

Step 9: Continuously Increase Your Earning Power

Your ability to earn income is your most valuable asset. Investing in yourself generates the highest return of all.

Ways to Increase Your Earning Power

1. Develop High-Value Skills

- Technical skills (coding, data analysis, digital marketing)

- Communication and leadership

- Sales and negotiation

- Financial literacy

2. Pursue Strategic Education

- Certifications in your field

- Advanced degrees (if ROI justifies cost)

- Online courses and bootcamps

- Industry conferences and networking

3. Negotiate Salary Increases

Research shows that people who negotiate their first salary earn over $500,000 more during their career than those who don’t.

Tips:

- Research market rates for your role

- Document your achievements and value

- Practice your pitch

- Be willing to walk away

4. Switch Jobs Strategically

External hires typically earn 10-20% more than internal promotions. Every 2-3 years, assess whether staying or moving serves your financial goals better.

5. Build a Personal Brand

- Share expertise on LinkedIn

- Start a blog or YouTube channel

- Speak at industry events

- Become known as an expert

The Compounding Effect of Income Growth

Example: Starting salary of $50,000 with different annual raise scenarios over 30 years:

- 2% annual raises: $90,568 final salary

- 5% annual raises: $216,097 final salary

- 8% annual raises: $503,133 final salary

Even a few percentage points make a massive difference over time.

Step 10: Protect Your Wealth with Insurance and Estate Planning

Building wealth is only half the battle—protecting it is equally important. One lawsuit, illness, or accident can wipe out years of progress without proper protection.

Essential Insurance Coverage

1. Health Insurance

Medical bankruptcy is a leading cause of financial ruin. Ensure you have adequate coverage through employer plans or the marketplace.

2. Disability Insurance

Replaces 50-70% of income if you can’t work due to illness or injury. Your ability to earn is your biggest asset—protect it.

3. Life Insurance

If others depend on your income:

- Term life: Affordable, covers a specific period (20-30 years)

- Whole life: More expensive, builds cash value (usually unnecessary for most people)

Coverage rule of thumb: 10-12 times your annual income

4. Homeowners/Renters Insurance

Protects your property and liability. Renters insurance costs only $15-30/month.

5. Umbrella Insurance

Extra liability coverage beyond home and auto policies. Costs ~$200-400/year for $1-2 million in coverage.

Estate Planning Basics

Even if you’re not wealthy (yet), you need:

Will:

Specifies who gets your assets and who cares for minor children.

Power of Attorney:

Designates someone to make financial decisions if you’re incapacitated.

Healthcare Proxy:

Designates someone to make medical decisions if you can’t.

Beneficiary Designations:

Review and update on all retirement accounts, life insurance, and bank accounts.

Action step: Many online services (LegalZoom, Nolo) offer affordable estate planning documents. For complex situations, consult an estate planning attorney.

The Psychology of Wealth Building: Mindset Matters

Technical knowledge is important, but mindset often determines success or failure in wealth building.

Common Mental Barriers

1. Scarcity Mindset

Believing there’s never enough leads to fear-based decisions and hoarding rather than strategic investing.

Solution: Practice gratitude and focus on abundance. There’s enough wealth for everyone.

2. Comparison Trap

Constantly comparing your financial journey to others creates dissatisfaction and poor decisions.

Solution: Focus on your own progress. Compare yourself to where you were last year, not to someone else’s highlight reel.

3. Instant Gratification

Wanting results now leads to risky investments, debt, and abandoned plans.

Solution: Embrace delayed gratification. Wealth building is a marathon, not a sprint.

4. Fear of Investing

Many people avoid investing in the stock market because of fear, often due to not understanding what moves the stock market.

Solution: Education reduces fear. Learn the basics, start small, and increase as confidence grows.

Wealthy Habits to Adopt

Pay yourself first: Save/invest before spending

Live below your means: Spend less than you earn

Think long-term: Make decisions based on 10-year goals

Stay curious: Continuously learn about money

Surround yourself with growth-minded people: Your network influences your net worth

Understanding why people lose money in the stock market helps you avoid common pitfalls and make smart moves instead.

Measuring Progress: Track Your Wealth Building Journey

What gets measured gets managed. Tracking your progress keeps you motivated and accountable.

Key Metrics to Monitor

1. Net Worth

Calculate quarterly or annually. The trend matters more than the absolute number.

2. Savings Rate

Percentage of income you save/invest monthly.

Formula: (Amount Saved ÷ Gross Income) × 100

Benchmarks:

- 10-15%: Good start

- 20%: Excellent

- 50%+: Financial independence fast track

3. Investment Returns

Track your portfolio performance annually, but don’t obsess over short-term fluctuations.

4. Debt-to-Income Ratio

Total monthly debt payments ÷ gross monthly income

Healthy: Below 36%

Concerning: Above 43%

5. Emergency Fund Ratio

Months of expenses covered by emergency savings

Goal: 3-6 months minimum

Celebrate Milestones

Wealth building takes years, so celebrate small wins:

First $1,000 saved

First $10,000 net worth

Debt-free (except mortgage)

First $100,000 invested

Positive net worth

Six-month emergency fund complete

These celebrations reinforce positive behavior and keep you motivated for the long journey.

💰 Wealth Building Calculator

Common Wealth Building Mistakes to Avoid

Even with the best intentions, many people sabotage their wealth-building journey. Avoid these common pitfalls:

1. Lifestyle Inflation

As income increases, spending increases proportionally (or more). This keeps you on the same financial treadmill despite earning more.

Solution: When you get a raise, immediately increase your savings rate. Save at least 50% of any income increase.

2. Not Starting Early Enough

The most expensive mistake is waiting to invest. Every year you delay costs tens or hundreds of thousands in lost compound growth.

Example: Starting at age 25 vs. 35 (investing $500/month at 8% return):

- Start at 25: $1,745,503 at age 65

- Start at 35: $745,179 at age 65

- Cost of waiting: $1,000,324

3. Trying to Time the Market

Research shows that time in the market beats timing the market. Missing just the 10 best days in the market over 30 years can cut returns by 50%.

Solution: Stay invested through ups and downs. Use dollar-cost averaging.

4. Paying High Fees

A 1% fee difference doesn't sound like much, but over 30 years it can cost hundreds of thousands.

Example: $100,000 invested for 30 years at 8% return:

- 0.1% fee: $938,905

- 1.0% fee: $761,225

- Cost: $177,680

Solution: Choose low-cost index funds with expense ratios under 0.20%.

5. Not Diversifying

Putting all your money in one stock, one sector, or one asset class is gambling, not investing.

Solution: Spread investments across stocks, bonds, real estate, and potentially other asset classes based on your risk tolerance.

6. Emotional Investing

Making decisions based on fear (selling during crashes) or greed (buying during bubbles) destroys wealth.

Solution: Create an investment plan and stick to it regardless of market emotions. Review the cycle of market emotions to recognize when emotions are driving decisions.

7. Ignoring Inflation

Keeping all your money in savings accounts means losing purchasing power to inflation over time.

Solution: Keep only emergency funds in savings. Invest the rest for growth that outpaces inflation.

Real-World Wealth Building Success Stories

The Teacher Who Became a Millionaire

Ronald Read worked as a gas station attendant and janitor, never earning more than $20,000 per year. When he died at age 92, he left an $8 million estate. His secret? Living frugally, investing consistently in dividend-paying stocks, and letting compound interest work for decades.

Key lessons:

- Income matters less than savings rate and consistency

- Time is your greatest asset

- Simple strategies work best

The Couple Who Retired at 38

Joe and Ali retired with over $1 million at age 38 after working regular middle-class jobs. They saved 70% of their income by living in a modest home, cooking at home, and avoiding lifestyle inflation.

Key lessons:

- Extreme savings rates accelerate wealth building dramatically

- Lifestyle choices have more impact than income level

- Financial independence is achievable in 10-15 years with discipline

The Single Mom Who Built a Real Estate Empire

After a divorce left her with $50,000 in debt, this single mother started house-hacking (renting out rooms in her home). She used the rental income to pay off debt, then bought her first rental property. Twenty years later, she owns 15 properties worth over $3 million.

Key lessons:

- Creative strategies can overcome financial setbacks

- Real estate offers unique wealth-building opportunities

- Starting small and scaling works

The Power of Compound Interest: Your Secret Weapon

Albert Einstein allegedly called compound interest "the eighth wonder of the world." Understanding this concept is crucial to wealth building.

What Is Compound Interest?

Compound interest is earning returns on your returns. Your money grows exponentially rather than linearly.

Simple interest example:

$10,000 at 8% simple interest for 30 years = $34,000

Compound interest example:

$10,000 at 8% compound interest for 30 years = $100,627

The difference: $66,627 in extra wealth from compounding

The Rule of 72

A quick way to estimate how long it takes to double your money:

Formula: 72 ÷ Annual Return Rate = Years to Double

Examples:

- 6% return: 72 ÷ 6 = 12 years to double

- 8% return: 72 ÷ 8 = 9 years to double

- 10% return: 72 ÷ 10 = 7.2 years to double

The Power of Time

The difference between starting at 25 vs. 35 vs. 45:

| Starting Age | Monthly Investment | Years Invested | Total Contributed | Value at 65 (8% return) |

|---|---|---|---|---|

| 25 | $500 | 40 | $240,000 | $1,745,503 |

| 35 | $500 | 30 | $180,000 | $745,179 |

| 45 | $500 | 20 | $120,000 | $294,510 |

The person who started at 25 contributed only $60,000 more than the person who started at 35, but ended up with over $1 million more. That's the power of time and compound interest.

Taking Action: Your Next Steps

Knowledge without action is worthless. Here's your action plan for the next 30 days:

Week 1: Assess

- [ ] Calculate your current net worth

- [ ] Review the last 3 months of spending

- [ ] List all debts with interest rates

- [ ] Check if employer offers 401(k) matching

- [ ] Determine your current savings rate

Week 2: Plan

- [ ] Create a budget using the 50/30/20 rule

- [ ] Set specific financial goals (1-year, 5-year, 10-year)

- [ ] Calculate emergency fund target

- [ ] Research high-yield savings accounts

- [ ] Review current insurance coverage

Week 3: Act

- [ ] Open a high-yield savings account

- [ ] Set up automatic transfers to savings

- [ ] Increase 401(k) contribution to get full match

- [ ] Apply the debt avalanche or snowball method

- [ ] Cut one unnecessary subscription or expense

Week 4: Optimize

- [ ] Open IRA account if eligible

- [ ] Research index funds for investing

- [ ] Set up automatic investment contributions

- [ ] Schedule quarterly net worth reviews

- [ ] Identify one way to increase income

Remember: Perfect is the enemy of good. Start with what you can do today, even if it's small. Building wealth is about progress, not perfection.

Conclusion

Wealth building isn't rocket science—it's discipline, consistency, and time working together. The 10-step plan outlined in this guide provides a proven roadmap that anyone can follow, regardless of income level or starting point.

The key principles to remember:

Start where you are with what you have—waiting for the "perfect time" means never starting

Pay yourself first by automating savings and investments before you can spend the money

Embrace compound interest as your most powerful ally—time in the market beats timing the market

Diversify your assets across stocks, bonds, real estate, and income streams to reduce risk

Invest in yourself continuously to increase your earning power and financial knowledge

Protect what you build with proper insurance and estate planning

Stay the course through market ups and downs—wealth building is a marathon, not a sprint

The difference between those who build wealth and those who don't isn't intelligence, luck, or even income—it's making the decision to start and having the discipline to continue. Every wealthy person started at zero. Every millionaire made their first investment. Every financially independent person took that first step.

Your future self will thank you for the actions you take today. The best time to start building wealth was 20 years ago. The second-best time is right now.

For more insights on making smart financial decisions, explore our guide on smart moves and learn from our comprehensive finance blog.

FAQ: Wealth Building

Wealth building is the systematic process of growing your net worth through saving, investing, and smart financial management. Start by calculating your current net worth, creating a budget, building a 3-6 month emergency fund, and then beginning to invest in tax-advantaged accounts like a 401(k) or IRA.

You can start building wealth with any amount. Even $25-50 per month invested consistently can grow to significant sums over decades thanks to compound interest. The key is starting now, not waiting until you have a large sum.

Financial benchmarks suggest your net worth should equal your age multiplied by your annual income divided by 10. For example, a 40-year-old earning $60,000 should aim for a net worth of $240,000. However, these are guidelines—focus on your personal progress rather than comparisons.

Pay off high-interest debt (credit cards, payday loans) before investing. For low-interest debt (mortgages, student loans below 5%), it often makes sense to invest simultaneously while making regular debt payments, especially if you get an employer 401(k) match.

Building significant wealth typically takes 10-30 years of consistent saving and investing. The timeline depends on your income, savings rate, investment returns, and starting point. Someone saving 20% of income with good investment returns can build substantial wealth in 15-20 years.

Being rich means having a high income, while being wealthy means having substantial assets and net worth. You can be rich but not wealthy (high income, high spending, no savings) or wealthy but not rich (moderate income, high savings rate, substantial investments).

Yes, though it takes longer and requires discipline. Focus on maximizing your savings rate (even if the dollar amount is small), taking advantage of employer retirement matches, developing skills to increase income, and living below your means. Many millionaires started with modest incomes.

Disclaimer

This article is for educational purposes only and does not constitute financial advice. Investing involves risk, including the potential loss of principal. Past performance does not guarantee future results. Before making any investment decisions, consider your financial situation, risk tolerance, and investment objectives. Consult with a qualified financial advisor or tax professional for personalized guidance. The examples and scenarios presented are hypothetical and for illustration purposes only. Individual results will vary based on personal circumstances, market conditions, and investment choices.

About the Author

Written by Max Fonji — With over a decade of experience in personal finance education and investment strategy, Max is dedicated to making wealth-building accessible to everyone. Through clear, data-backed content and practical guidance, Max has helped thousands of readers take control of their financial futures. Max's mission is simple: demystify money, empower people, and prove that anyone can build wealth with the right knowledge and consistent action. TheRichGuyMath.com