Imagine planting a single seed in your backyard and watching it grow into a sprawling tree that bears fruit year after year. That’s the power of a wealth multiplier, a financial strategy that doesn’t just preserve your money but actively grows it, creating more wealth from what you already have.

In 2025, with inflation eating away at savings accounts and traditional retirement plans struggling to keep pace with rising costs, understanding how to multiply your wealth isn’t just smart; it’s essential. The good news? You don’t need a finance degree or a six-figure salary to get started. Whether you’re working with $100 or $10,000, the principles of wealth multiplication can work for anyone willing to learn and take action.

This comprehensive guide will walk you through proven strategies, real-world examples, and actionable steps to transform your financial future. Let’s dive into the world of wealth multipliers and discover how ordinary people are building extraordinary wealth.

Key Takeaways

- Wealth multipliers are investment strategies and financial tools that exponentially grow your money through compound growth, leverage, and strategic asset allocation

- The power of compound interest can turn small, consistent investments into substantial wealth over time. Einstein called it the “eighth wonder of the world”

- Diversifying across multiple wealth multipliers (stocks, real estate, index funds, dividend investing) reduces risk while maximizing growth potential

- Starting early is the single most powerful wealth multiplier; time in the market beats timing the market every time

- Reinvesting returns and automating investments creates a self-sustaining wealth multiplication system that requires minimal ongoing effort

What Is a Wealth Multiplier?

A wealth multiplier is any investment vehicle, strategy, or financial principle that increases the value of your money over time at a rate significantly higher than inflation. Think of it as a financial accelerator, instead of your money sitting idle or slowly growing in a traditional savings account at 0.5% annual interest, a wealth multiplier puts your capital to work, generating returns that compound and grow exponentially.

The concept isn’t new. Wealthy families have used wealth multipliers for generations to preserve and grow their fortunes. What’s changed is accessibility. Thanks to technology, lower barriers to entry, and educational resources like this comprehensive finance blog, everyday investors can now access the same tools that were once reserved for the ultra-wealthy. Investopedia: What Is the Multiplier Effect?

The Mathematics Behind Wealth Multiplication

At its core, wealth multiplication relies on three fundamental principles:

1. Compound Growth

Your returns generate their own returns, creating a snowball effect. A $10,000 investment growing at 8% annually becomes $21,589 in 10 years, but that extra $11,589 isn’t just from the original investment. It’s from your gains earning their own gains.

2. Leverage 🔧

Using borrowed capital or other people’s resources to amplify your returns. Real estate investors do this when they put 20% down on a property and benefit from 100% of the appreciation.

3. Strategic Asset Allocation

Placing your money in assets that historically outpace inflation and generate positive real returns, such as stocks, real estate, businesses, and other productive assets.

Why Traditional Savings Aren’t Enough

Let’s be honest: that savings account at your local bank isn’t doing you any favors. In 2025, the average savings account offers around 0.4% to 0.5% annual interest. Meanwhile, inflation hovers between 2% and 4% annually. You’re actually losing purchasing power every year your money sits in a traditional savings account.

Here’s a sobering example: If you saved $50,000 in a savings account earning 0.5% interest, after 20 years, you’d have approximately $55,250. Sounds okay, right? Wrong. With 3% average annual inflation, you’d need $90,306 in 20 years just to maintain the same purchasing power you have today. Your “safe” savings strategy just cost you $35,056 in real value.

This is precisely why wealth multipliers matter. They’re not about getting rich quickly; they’re about protecting and growing your wealth faster than inflation erodes it.

The Top Wealth Multipliers for 2025

1. Stock Market Investing

The stock market has historically been one of the most powerful wealth multipliers available to individual investors. Since 1926, the S&P 500 has delivered an average annual return of approximately 10% before inflation.

Why it works:

- Companies grow their earnings over time

- You benefit from both price appreciation and dividends

- Highly liquid, you can access your money when needed

- Low barriers to entry (you can start with as little as $10)

Real-world example:

Sarah, a 28-year-old teacher, started investing $300 monthly into a diversified portfolio of index funds. At an average 9% annual return, by age 65, she’ll have accumulated approximately $1.2 million, despite only contributing $133,200 of her own money. That’s the wealth multiplier effect in action.

Understanding why the stock market goes up over time can help you stay committed during market downturns and avoid common mistakes that cause people to lose money.

2. Dividend Investing

Dividend investing is a wealth multiplier that generates passive income while your investments appreciate. When you own shares of dividend-paying companies, you receive regular cash payments (typically quarterly) simply for being a shareholder.

The double benefit:

- Regular income you can spend or reinvest

- Long-term price appreciation of the underlying stock

Power of dividend reinvestment:

When you reinvest dividends to purchase additional shares, you create a compounding machine. Those new shares generate their own dividends, which buy more shares, which generate more dividends, a perpetual wealth multiplication cycle.

According to Hartford Funds research, reinvested dividends have accounted for approximately 40% of the S&P 500’s total return since 1930. Investors focusing on high dividend stocks can potentially accelerate this wealth-building effect.

3. Real Estate Investment

Real estate has created more millionaires than perhaps any other asset class. It combines multiple wealth multipliers into a single investment:

- Appreciation: Property values typically increase over time

- Cash flow: Rental income provides monthly revenue

- Leverage: Mortgages let you control large assets with small down payments

- Tax advantages: Depreciation and other deductions reduce taxable income

- Inflation hedge: Rents and property values generally rise with inflation

Example calculation:

Purchase a $300,000 rental property with a $60,000 down payment (20%). If the property appreciates 4% annually, it’s worth $444,000 in 10 years. Your $60,000 investment became $144,000 in equity (before accounting for mortgage paydown and rental income), a 240% return, or roughly 9.2% annually.

4. Index Funds and ETFs

For beginners, index funds and exchange-traded funds (ETFs) represent the most accessible wealth multiplier. These investment vehicles pool money from many investors to buy a diversified portfolio of stocks or bonds, automatically spreading your risk across dozens or hundreds of companies.

Why they’re perfect for beginners:

- Instant diversification

- Low fees (often under 0.10% annually)

- Professionally managed

- A passive approach requires minimal knowledge or time

- Historically outperforms most actively managed funds

Warren Buffett’s advice:

The Oracle of Omaha has repeatedly recommended low-cost index funds for average investors. In his 2013 letter to Berkshire Hathaway shareholders, he instructed his estate trustees to invest 90% of his wife’s inheritance in a low-cost S&P 500 index fund.

5. Business Ownership and Side Hustles

Starting or investing in a business offers unlimited wealth multiplication potential. Unlike stocks or real estate, where returns are somewhat predictable, businesses can generate exponential returns or losses.

Scalable business models:

- E-commerce stores

- Digital products (courses, ebooks, software)

- Service businesses (consulting, freelancing)

- Content creation (YouTube, blogging, podcasting)

The key advantage? You control the variables. Work harder, improve your marketing, enhance your product, and you directly increase your returns. This isn’t possible with passive investments.

6. Retirement Accounts (401k, IRA, Roth IRA)

Tax-advantaged retirement accounts are wealth multipliers with a turbo boost. They combine market returns with significant tax benefits:

Traditional 401k/IRA:

- Contributions reduce current taxable income

- Investments grow tax-deferred

- Many employers offer matching contributions (free money!)

Roth IRA:

- After-tax contributions

- Tax-free growth

- Tax-free withdrawals in retirement

- No required minimum distributions

The employer match multiplier:

If your employer matches 50% of your 401k contributions up to 6% of your salary, you’re getting an instant 50% return before any market gains. On a $60,000 salary, that’s $1,800 in free money annually. Over 30 years at 8% growth, that employer match alone becomes $204,000.

Teaching these principles early can have profound effects—learn how to make your kid a millionaire by starting young.

The Power of Compound Interest: Your Greatest Wealth Multiplier

Albert Einstein allegedly called compound interest “the eighth wonder of the world” and “the most powerful force in the universe.” Whether he actually said it or not, the sentiment is absolutely true.

Compound interest means earning returns not just on your original investment, but on all the previous returns as well. It’s growth on top of growth, creating an exponential curve that becomes dramatically steeper over time. Yahoo Finance: Money Guy’s Wealth Multiplier Reminder

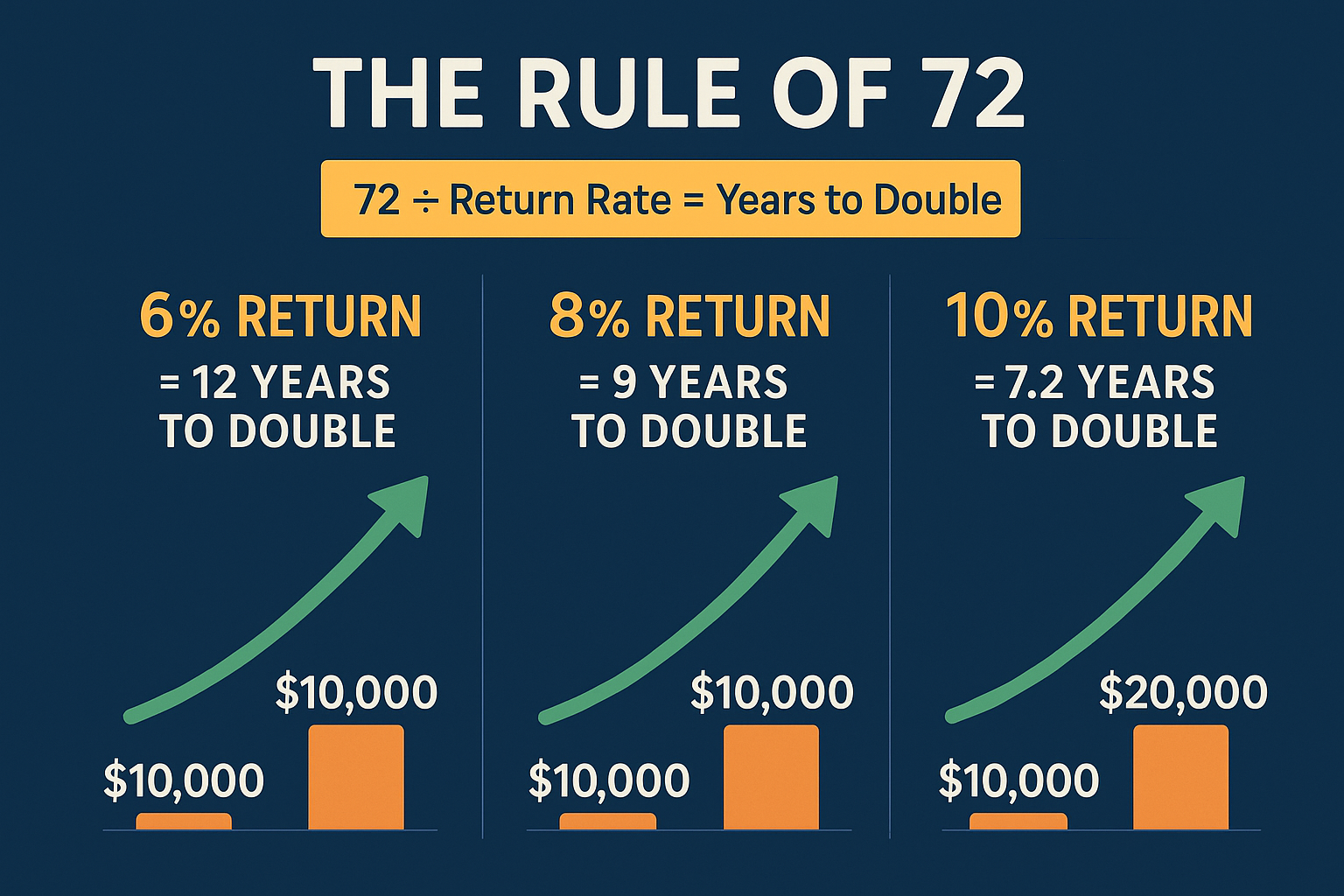

The Rule of 72

Want a quick way to calculate how long it takes your money to double? Use the Rule of 72: divide 72 by your annual return rate.

- At 6% annual return: 72 ÷ 6 = 12 years to double

- At 8% annual return: 72 ÷ 8 = 9 years to double

- At 10% annual return: 72 ÷ 10 = 7.2 years to double

Time Beats Timing

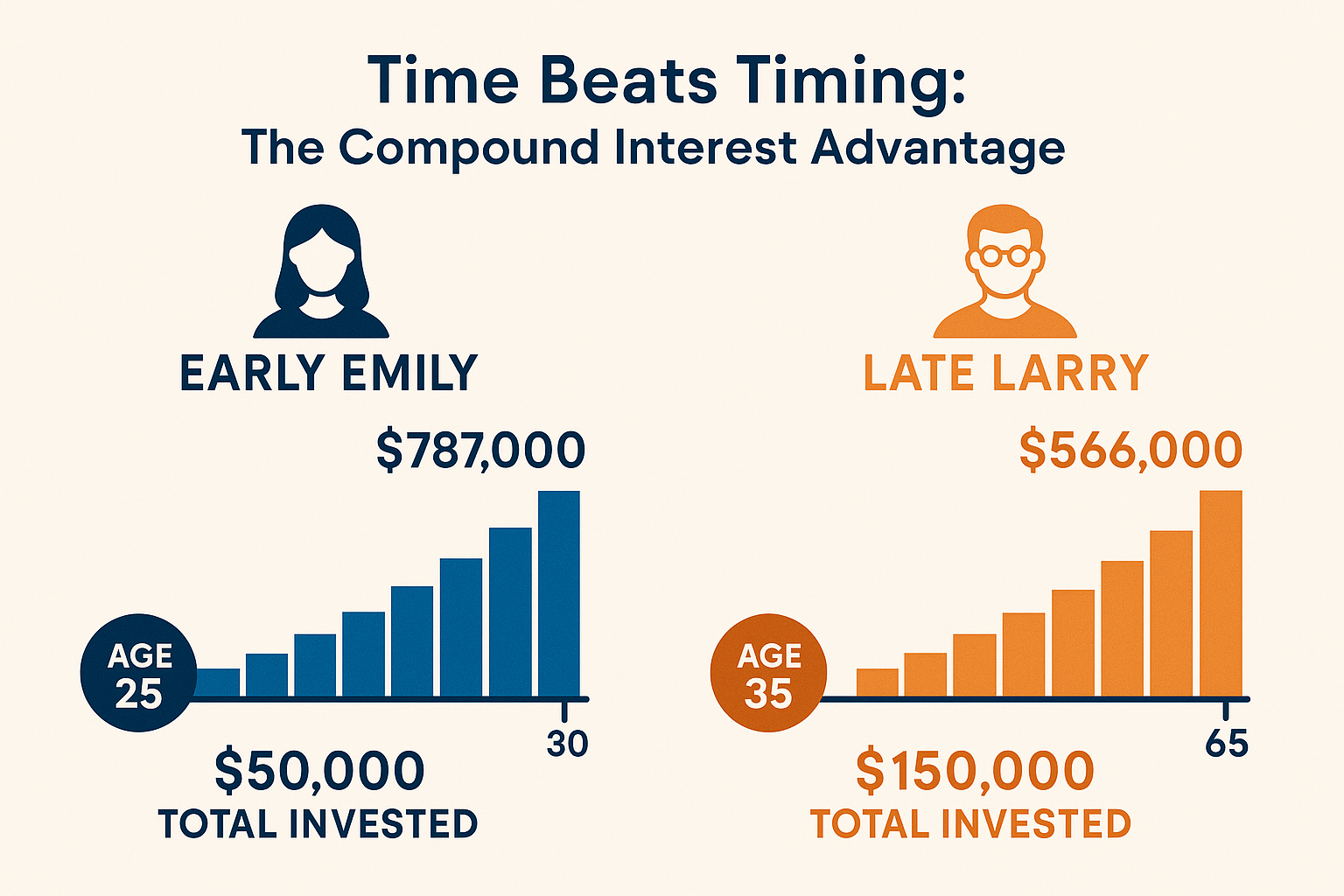

Consider two investors:

Early Emily starts investing $5,000 annually at age 25 and stops at age 35 (10 years, $50,000 total invested). She never adds another dollar but lets it grow until age 65.

Larry waits until age 35 to start investing. He invests $5,000 annually from age 35 to 65 (30 years, $150,000 total invested).

Assuming 8% annual returns:

- Early Emily ends with approximately $787,000

- Larry ends with approximately $566,000

Emily invested $100,000 less but ended with $221,000 more, all because she started 10 years earlier. That’s the wealth multiplier effect of time and compound interest.

Building Your Personal Wealth Multiplication Strategy

Now that you understand the major wealth multipliers, how do you actually build a personalized strategy? Follow these steps:

Step 1: Establish Your Financial Foundation

Before multiplying wealth, you need something to multiply. Start with these fundamentals:

✅ Emergency fund: Save 3-6 months of expenses in a high-yield savings account

✅ Eliminate high-interest debt: Pay off credit cards and personal loans (these are “wealth dividers”)

✅ Create a budget: Know where your money goes so you can redirect it toward wealth building

✅ Protect your assets: Get adequate insurance (health, auto, home, life)

Step 2: Determine Your Risk Tolerance and Time Horizon

Different wealth multipliers suit different situations:

Aggressive (20+ years until retirement):

- 80-90% stocks/equity investments

- 10-20% bonds or alternative investments

- Higher volatility, higher potential returns

Moderate (10-20 years until retirement):

- 60-70% stocks

- 30-40% bonds and other stable investments

- Balanced growth and stability

Conservative (0-10 years until retirement):

- 40-50% stocks

- 50-60% bonds and cash equivalents

- Capital preservation focus

Step 3: Diversify Across Multiple Wealth Multipliers

Don’t put all your eggs in one basket. A robust wealth multiplication strategy might include:

- 60% in stock market index funds

- 20% in dividend-paying stocks

- 15% in real estate (REIT or rental property)

- 5% in alternative investments or business ventures

This diversification protects you from any single investment category underperforming while maximizing your overall growth potential.

Step 4: Automate Your Investments

The best investment strategy is one you’ll actually stick to. Automation removes emotion and ensures consistency:

- Set up automatic transfers from checking to investment accounts

- Enable dividend reinvestment plans (DRIPs)

- Max out automatic 401k contributions to get the full employer match

- Use robo-advisors if you want hands-off portfolio management

Discover more smart ways to make passive income that can be automated for consistent wealth building.

Step 5: Rebalance Annually

As different investments grow at different rates, your portfolio allocation will drift. Once per year, rebalance by selling overweighted positions and buying underweighted ones. This forces you to “sell high and buy low” systematically.

Step 6: Stay the Course Through Market Cycles

Understanding the cycle of market emotions is crucial. Markets go up and down, but history shows they trend upward over time. The investors who panic and sell during downturns miss the subsequent recovery and lock in their losses.

During market downturns:

- Keep investing (you’re buying at discount prices)

- Don’t check your portfolio obsessively

- Remember your long-term goals

- Consider it a “sale” on future wealth

Common Wealth Multiplication Mistakes to Avoid

Even with the best intentions, investors often sabotage their wealth multiplication through these common errors:

1. Waiting for the “Perfect Time” to Start

There’s never a perfect time. The market might seem “too high,” or you might want to save a bit more first, or you’re waiting for that promotion. Meanwhile, time, your greatest wealth multiplier, slips away. Start now, even if small.

2. Trying to Time the Market

Study after study shows that timing the market is nearly impossible, even for professionals. A Fidelity study found that investors who stayed fully invested from 1980-2020 earned 10.2% annually, while those who missed just the 10 best days earned only 5.6% annually.

3. Paying Too Much in Fees

A 1% annual fee might seem small, but over 30 years it can reduce your portfolio value by 25% or more. Choose low-cost index funds and ETFs whenever possible.

4. Emotional Investing

Fear and greed are wealth destroyers. Making investment decisions based on market panic or euphoria typically results in buying high and selling low, the opposite of what builds wealth.

5. Lack of Diversification

Putting all your money in your employer’s stock, a single rental property, or one hot tech stock exposes you to catastrophic risk. Diversification is the only free lunch in investing.

6. Neglecting Tax Efficiency

Using tax-advantaged accounts, harvesting tax losses, and understanding the difference between long-term and short-term capital gains can save thousands annually—money that can be reinvested to multiply further.

Advanced Wealth Multiplication Strategies

Once you’ve mastered the basics, consider these advanced techniques:

Dollar-Cost Averaging (DCA)

Instead of investing a lump sum all at once, Dollar-Cost Averaging involves investing fixed amounts at regular intervals regardless of market conditions. This reduces the risk of investing everything right before a market crash and helps you buy more shares when prices are low.

Tax-Loss Harvesting

Strategically selling investments at a loss to offset capital gains taxes, then immediately buying a similar (but not identical) investment to maintain market exposure. This can save thousands in taxes annually.

Geographic Diversification

Don’t limit yourself to domestic investments. International stocks and emerging markets offer additional growth opportunities and further diversification benefits.

Asset Location Optimization

Place tax-inefficient investments (bonds, REITs) in tax-advantaged accounts and tax-efficient investments (index funds, growth stocks) in taxable accounts to minimize your tax burden.

The 4% Rule for Retirement

This guideline suggests you can safely withdraw 4% of your portfolio annually in retirement without running out of money. Understanding this helps you calculate how much wealth you need to multiply to achieve financial independence. See the full guide: The 4% rule

Measuring Your Wealth Multiplication Progress

You can’t improve what you don’t measure. Track these key metrics:

Net Worth: Assets minus liabilities should increase steadily over time

Savings Rate: Percentage of income saved/invested, aim for at least 15-20%

Investment Returns: Compare to relevant benchmarks (S&P 500, etc.)

Time to Financial Independence: Years until your investments can sustain your lifestyle

Passive Income: Money earned without active work should grow annually

Calculate your net worth quarterly and review your overall strategy annually. Celebrate milestones: first $10,000 invested, first $100,000 net worth, first $1,000 in annual dividend income. These victories fuel motivation for the journey ahead. Money Guy Wealth Multiplier Guide

Real-Life Wealth Multiplication Success Stories

The Janitor Who Became a Millionaire

Ronald Read worked as a gas station attendant and janitor his entire life, never earning more than modest wages. When he died in 2014 at age 92, his estate was worth over $8 million. His secret? He lived frugally, invested consistently in dividend-paying blue-chip stocks, and let compound interest work for decades. He never sold, always reinvested dividends, and trusted the wealth multiplication process.

The Teacher Who Retired at 38

Joe, a high school teacher, and his wife lived on half their combined income and invested the rest aggressively in index funds and rental properties. By maximizing their 401ks, investing in low-cost index funds, and acquiring three rental properties, they achieved financial independence in just 15 years. They didn’t earn six figures—they just multiplied what they had efficiently.

The Late Bloomer Who Caught Up

Maria didn’t start investing seriously until age 45 after a divorce left her financially starting over. She aggressively saved 30% of her income, maxed out catch-up contributions to her 401k, and invested in a balanced portfolio. By age 65, she had accumulated over $800,000, enough for a comfortable retirement. It’s never too late to start multiplying your wealth.

Your Wealth Multiplication Action Plan

Ready to start multiplying your wealth? Here’s your step-by-step action plan:

This Month:

- Calculate your current net worth

- Open a high-yield savings account and fund your emergency fund

- Sign up for your employer’s 401k and contribute at least enough to get the full match

- Open a Roth IRA with a low-cost brokerage (Vanguard, Fidelity, Schwab)

This Quarter:

- Create a budget and identify how much you can invest monthly

- Set up automatic monthly transfers to your investment accounts

- Choose a simple portfolio (such as a target-date fund or three-fund portfolio)

- Make your first investment

- Implement smart moves to optimize your financial strategy

This Year:

- Increase your savings rate by 1% every quarter

- Max out your IRA contribution ($7,000 in 2025, or $8,000 if over 50)

- Educate yourself, read books, follow reputable financial blogs, and take courses

- Review and rebalance your portfolio

- Consider additional wealth multipliers (real estate, side business, dividend stocks)

Long-term (5-10+ years):

- Stay consistent with contributions regardless of market conditions

- Increase contributions as your income grows

- Diversify into additional asset classes

- Teach these principles to your children

- Enjoy watching your wealth multiply exponentially through the power of compound growth

Conclusion: Your Wealth Multiplication Journey Starts Today

The concept of a wealth multiplier isn’t complicated; it’s simply putting your money to work in assets that grow faster than inflation, then letting time and compound interest work their magic. Whether you choose stock market investing, dividend stocks, real estate, index funds, or a combination of all these strategies, the key is to start now and stay consistent.

Remember Sarah, the teacher who started with just $300 monthly? Or Ronald Read, the janitor who became a multimillionaire? They weren’t financial geniuses with secret formulas. They understood that wealth multiplication is a marathon, not a sprint. They started where they were, with what they had, and trusted the process.

The wealth gap in America isn’t primarily about income; it’s about what people do with the income they have. Two people earning $60,000 annually can end up in vastly different financial situations based solely on their understanding and application of wealth multiplication principles.

You now know. The strategies are proven. The tools are accessible. The only question remaining is: Will you take action?

Your future self, the one enjoying financial security, freedom from money stress, and the ability to live life on your own terms, is counting on the decisions you make today. Start small if you must, but start. Open that investment account. Make that first contribution. Set up that automatic transfer.

The best time to start multiplying your wealth was 10 years ago. The second-best time is today.

💰 Wealth Multiplier Calculator

Portfolio Breakdown

A wealth multiplier is a financial concept or strategy that helps grow your money faster than traditional savings, often using compounding, smart investing, or leveraging assets.

Compound interest is one method of multiplying wealth over time, but a wealth multiplier may include other strategies like tax efficiency, reinvesting dividends, or using leverage to accelerate growth.

Yes, but the strategies vary by income, risk tolerance, and investment knowledge. Beginners can start with simple compound interest methods or dividend reinvestment plans.

Some strategies carry risk, especially those involving leverage or high-volatility investments. Using safer approaches like index funds or tax-advantaged accounts can reduce risk.

Time depends on the strategy, initial capital, and rate of return. Generally, the effects are more visible over 5–10+ years due to compounding.

Not necessarily. They can apply to any financial strategy that grows net worth, including real estate, business reinvestment, or tax-efficient retirement planning.

Disclaimer

This article is for educational and informational purposes only and should not be construed as financial, investment, or legal advice. The strategies discussed may not be suitable for all investors, and past performance does not guarantee future results. Before making any investment decisions, consult with a qualified financial advisor who understands your individual circumstances, goals, and risk tolerance. All investments carry risk, including the potential loss of principal.

About the Author

Max Fonji is a financial educator and senior content strategist with over 30 years of experience in personal finance, investing, and wealth building. He specializes in making complex financial concepts accessible to everyday investors and has helped thousands of people take control of their financial futures. Max writes for TheRichGuyMath.com, where he shares practical strategies for building wealth, understanding markets, and achieving financial independence. When he’s not writing about finance, Max enjoys teaching financial literacy to young adults and volunteering with community financial education programs