Picture this: It’s 2 a.m., and you’re staring at your phone screen, finger hovering over the “Transfer Funds” button. Your emergency fund sits there, $5,000 you’ve carefully saved over the past two years. Your car just broke down, your best friend is getting married across the country, and that “once-in-a-lifetime” investment opportunity your cousin mentioned keeps nagging at you. Should you tap into your emergency fund?

This scenario plays out thousands of times every day across America. According to the Federal Reserve’s 2024 Report on the Economic Well-Being of U.S. Households, nearly 37% of Americans would struggle to cover a $400 emergency expense. But here’s the twist: having emergency funds isn’t enough; knowing when (and when not) to use them is the real superpower. Fed Report on Economic Well-Being

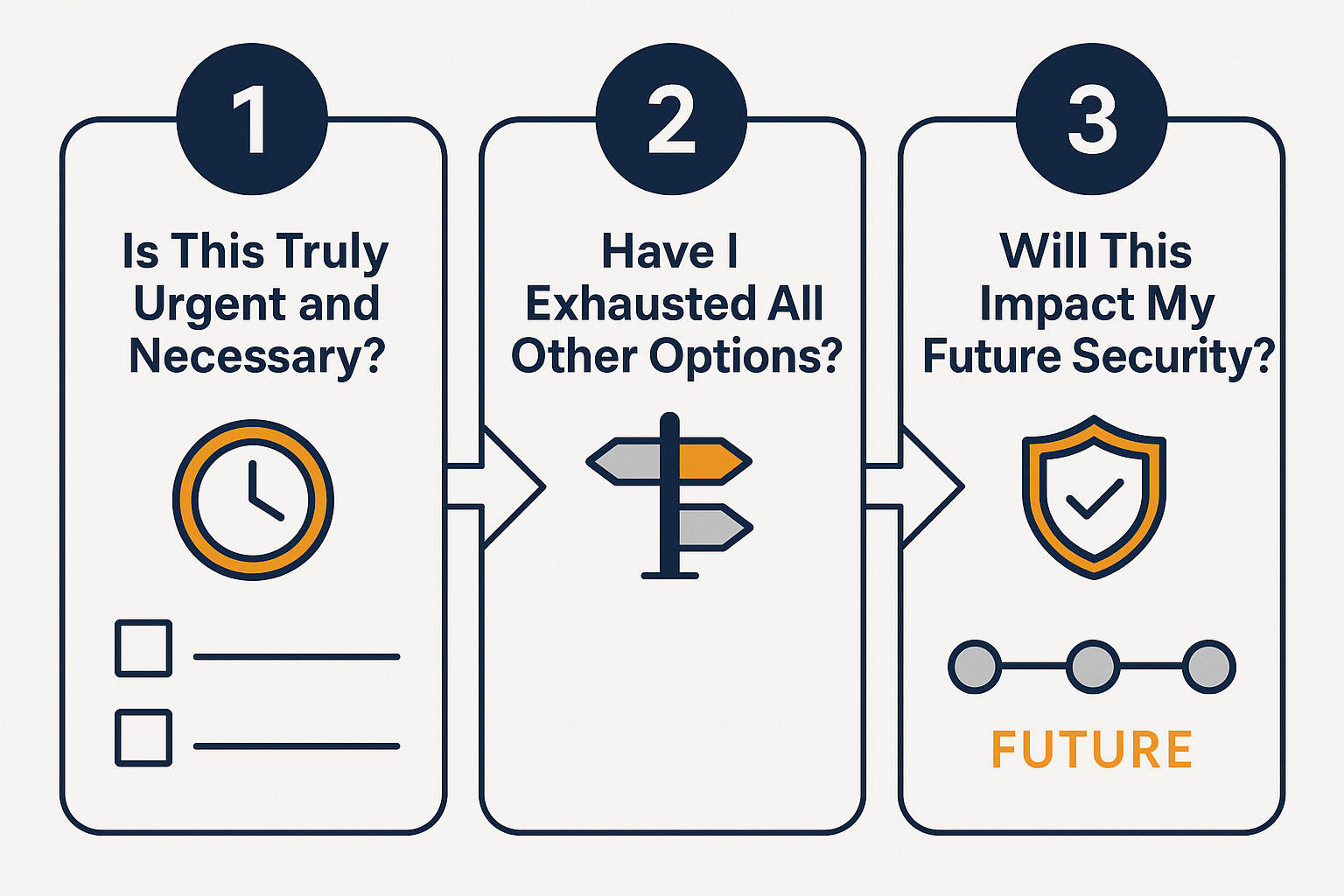

Your emergency fund is like a financial fire extinguisher. It’s there for real emergencies, not just any inconvenience. But in the heat of the moment, how do you tell the difference? The answer lies in asking yourself three critical questions before you make that transfer. These questions have saved countless people from financial regret and helped others confidently handle true emergencies.

Key Takeaways

Emergency funds should only be used for genuine emergencies, unexpected, necessary, and urgent expenses that threaten your financial stability or well-being

Ask three critical questions: Is this truly urgent? Have I explored all alternatives? Will this expense impact my long-term financial health?

Not all unexpected expenses qualify as emergencies; distinguish between wants, inconveniences, and true financial crises

Always have a replenishment plan before spending from your emergency fund to ensure you’re protected for future unexpected events

Your emergency fund is your financial safety net; protecting it means protecting your future stability and peace of mind

Understanding What Emergency Funds Really Are

Before diving into the three essential questions, let’s establish what emergency funds actually represent in your financial life.

An emergency fund is money set aside specifically for unexpected, urgent expenses that could otherwise derail your financial stability. Think of it as your personal insurance policy against life’s curveballs, job loss, medical emergencies, urgent home repairs, or sudden car breakdowns that prevent you from getting to work. U.S. Census / BEA data on household balance sheets

The Purpose of Emergency Funds

Financial experts typically recommend saving 3-6 months of essential living expenses in an easily accessible account. This isn’t money for vacations, holiday shopping, or even planned expenses like annual insurance premiums. It’s your financial cushion against the unknown.

According to Bankrate’s 2025 Emergency Savings Report, only 44% of Americans could cover a $1,000 emergency expense from their savings. This statistic reveals a troubling gap between financial security and reality. Building and maintaining emergency funds is one of the most fundamental steps toward financial stability and smart money management.

Why Emergency Funds Matter:

- Protection against debt: Prevents reliance on high-interest credit cards or loans

- Peace of mind: Reduces financial stress and anxiety

- Financial independence: Gives you options during difficult times

- Preserves long-term investments: Prevents you from selling stocks or retirement accounts at a loss

Understanding how banks work and manage your savings can help you choose the right place to keep your emergency fund, typically a high-yield savings account that offers both accessibility and modest growth.

The Three Critical Questions Before Spending Your Emergency Fund

Now let’s explore the three questions that should guide every decision about tapping into your emergency savings.

Question 1: Is This Truly Urgent and Necessary?

The first and most important question separates real emergencies from everything else.

An expense is truly urgent if:

- ✓ It cannot wait without serious consequences

- ✓ It threatens your health, safety, or ability to earn income

- ✓ Delaying it would result in significantly higher costs

- ✓ It’s completely unexpected and unplanned

Real Emergency Examples:

| Scenario | Why It’s an Emergency |

|---|---|

| Car accident requiring immediate repairs to get to work | Threatens income; urgent; unexpected |

| Broken furnace in winter | Health and safety issue; urgent |

| Emergency room visit | Health crisis; immediate need |

| Sudden job loss | Threatens financial stability; covers essential expenses |

| Major home leak causing structural damage | Prevents further damage; protects asset |

NOT Emergency Examples:

| Scenario | Why It’s NOT an Emergency |

|---|---|

| Holiday gift shopping | Planned expense; not urgent |

| Discretionary spending can save separately | Want, not need; not urgent |

| Vacation opportunity | Discretionary spending can be saved separately |

| Wedding invitation (with advance notice) | Planned event; time to save |

| Black Friday sale on TV | Want; not necessary; not urgent |

Sarah’s story illustrates this perfectly: When her laptop started running slowly, she initially considered it an emergency since she worked from home. However, after honest reflection, she realized it still functioned, just slower. She used the time to research options and save separately, discovering her company would reimburse 50% of a new work computer. By waiting three months, she avoided touching her emergency fund entirely.

Question 2: Have I Exhausted All Other Options?

Before touching your emergency fund, explore every alternative. This question ensures you’re not using your safety net prematurely.

Alternative Options to Consider:

- Adjust your current budget

- Cut discretionary spending temporarily

- Postpone non-essential purchases

- Reduce entertainment or dining out

- Generate quick income

- Sell unused items

- Take on temporary gig work

- Ask for overtime at work

- Freelance using existing skills

- Negotiate payment plans

- Medical bills often offer interest-free payment options

- Many service providers allow installment payments

- Discuss options with creditors before defaulting

- Tap other resources first

- Tax refunds

- Work bonuses

- Birthday or holiday money

- Rewards points or cashback

- Low-interest borrowing (use cautiously)

- 0% APR credit card (only if you can pay it off quickly)

- Personal loan with reasonable terms

- Borrow from family (with clear repayment terms)

Marcus faced a $1,200 dental emergency that insurance wouldn’t cover. Before using his emergency fund, he:

- Negotiated a 6-month payment plan with his dentist ($200/month, no interest)

- Picked up three weekend shifts at his part-time job ($450)

- Sold his rarely-used gaming console ($300)

- Adjusted his budget to find an extra $150/month

Result? He covered the expense without touching his emergency fund, which he later needed when his company had unexpected layoffs.

The key principle: Your emergency fund should be your last resort, not your first option. Understanding smart financial moves helps you identify these alternatives before dipping into savings.

Question 3: Will Using This Money Impact My Future Financial Security?

The third question forces you to think beyond the immediate need and consider long-term consequences.

Before spending your emergency fund, honestly assess:

Immediate Impact Questions:

- How much will this deplete my emergency fund?

- Will I still have enough left for another emergency?

- Am I creating a gap in my financial protection?

Recovery Planning Questions:

- How quickly can I replenish these funds?

- Do I have a concrete plan to rebuild my emergency savings?

- What happens if another emergency strikes before I rebuild?

Long-Term Consequences:

- Will this force me to take on debt later?

- Could this impact my ability to handle job loss?

- Am I creating a pattern of relying on emergency funds for non-emergencies?

Important Principle: Never spend your emergency fund without a replenishment plan. If you can’t afford to rebuild it within 3-6 months, the expense might not be a true emergency, or you need to find additional alternatives.

The 50% Rule: Some financial advisors recommend never depleting more than 50% of your emergency fund for a single expense unless it’s absolutely critical. This ensures you still have protection if another emergency occurs. Studies on financial stress/psychology (APA, behavioral economics)

Consider Jennifer’s situation: She had $8,000 in emergency savings when her roof started leaking. The repair quote was $5,000. She asked herself:

- Is it urgent? Yes, preventing water damage is critical

- Any alternatives? She got three quotes (found one for $4,200), applied for a 0% credit card, and used her tax refund ($1,500)

- Future impact? By using the credit card for half and paying it off over 12 months, plus her tax refund, she only needed $1,200 from her emergency fund

This strategic approach left her with $6,800 in emergency savings while addressing the urgent need.

Understanding the cycle of financial decisions and their long-term impact helps you make choices that protect both your present and future.

When It’s Absolutely Okay to Use Your Emergency Fund

After asking the three critical questions, some situations clearly warrant using your emergency fund. Let’s identify when you should feel confident accessing these savings.

Legitimate Emergency Fund Uses:

1. Job Loss or Income Reduction

This is the primary reason most people build emergency funds. If you lose your job or face a significant income reduction, your emergency fund covers essential expenses while you search for new employment.

What qualifies:

- Unexpected termination or layoff

- Company closure

- Significant hour reduction (not by choice)

- Medical leave without adequate disability coverage

What doesn’t qualify:

- Quitting without another job lined up (planned transition)

- Taking time off for personal projects

- Reducing hours by choice for lifestyle reasons

2. Medical Emergencies

Unexpected health issues that require immediate attention and create a financial burden.

Examples:

- Emergency room visits

- Urgent surgery or procedures

- Necessary medications not covered by insurance

- Emergency dental work affecting health or work ability

3. Essential Home Repairs

Repairs that protect your home’s structural integrity or make it safe and habitable.

Qualifying repairs:

- Roof leaks are causing interior damage

- Broken furnace or AC in extreme weather

- Plumbing emergencies (burst pipes, sewage backup)

- Electrical hazards

- Pest infestations threaten the structure

Non-qualifying projects:

- Cosmetic upgrades

- Landscaping

- Kitchen remodels

- Luxury additions

4. Vehicle Repairs (If Essential for Income)

Car repairs qualify as emergencies only if the vehicle is essential for earning income.

When it qualifies:

- You need the car to get to work

- No reasonable public transportation alternative exists

- The repair is necessary for safe operation

- The vehicle is your only reliable transportation

When it doesn’t:

- You have alternative transportation

- The repair is cosmetic or an upgrade

- You’re considering trading up to a newer model

5. Urgent Travel for Family Emergencies

Unexpected travel for serious family situations.

Examples:

- Traveling for a family member’s serious illness

- Attending a funeral

- Emergency childcare situations

- Urgent family crises requiring your presence

Common Mistakes People Make With Emergency Funds

Understanding what not to do is equally important as knowing the right approach.

Mistake #1: Using Emergency Funds for Predictable Expenses

The problem: Many people tap emergency funds for expenses they should have anticipated.

Common examples:

- Annual car insurance premiums

- Property taxes

- Holiday shopping

- Back-to-school expenses

- Annual subscriptions

The solution: Create a separate “sinking fund” for predictable irregular expenses. Calculate annual costs, divide by 12, and save that amount monthly.

Mistake #2: Not Replenishing After Use

The problem: After using emergency funds, people fail to prioritize rebuilding them, leaving themselves vulnerable.

Real-world impact: According to a 2024 study by the National Endowment for Financial Education, 68% of people who used emergency funds didn’t fully replenish them within a year, and 34% experienced another emergency during that time without adequate savings.

The solution: Treat replenishment as a non-negotiable priority. Redirect the money you were spending on the emergency toward rebuilding your fund.

Mistake #3: Keeping Emergency Funds in Risky Investments

The problem: Trying to earn higher returns by investing emergency funds in the stock market or volatile assets.

Why it’s risky: Emergencies don’t wait for market recoveries. If your emergency fund is invested and the market drops 30%, you might need to sell at a loss exactly when you need the money most. Understanding why people lose money in the stock market illustrates this danger clearly.

The solution: Keep emergency funds in:

- High-yield savings accounts

- Money market accounts

- Short-term certificates of deposit (with early withdrawal options)

Note: Once you have 6+ months of expenses saved, additional savings can be invested for long-term growth through dividend investing or other strategies, but your core emergency fund should remain liquid and stable.

Mistake #4: Setting the Bar Too Low (or Too High)

The problem: Either having inadequate savings or over-saving in low-yield accounts.

Too low: Saving only $500-1,000 when monthly expenses are $3,000 provides minimal protection.

Too high: Keeping $50,000 in a 0.01% savings account when you only need $15,000 for emergencies means missing out on better returns elsewhere.

The solution: Calculate 3-6 months of essential expenses (not total income). Once you hit that target, direct additional savings toward other financial goals like investing, retirement, or building passive income.

Mistake #5: Having No Clear Definition of “Emergency”

The problem: Without clear guidelines, everything feels like an emergency.

The solution: Write down your personal emergency fund rules. Be specific about what qualifies. Share these guidelines with your partner or accountability buddy. When tempted to use the funds, review your written criteria first.

Building Your Emergency Fund Decision Framework

Now that you understand the three questions and common pitfalls, let’s create a practical framework for decision-making.

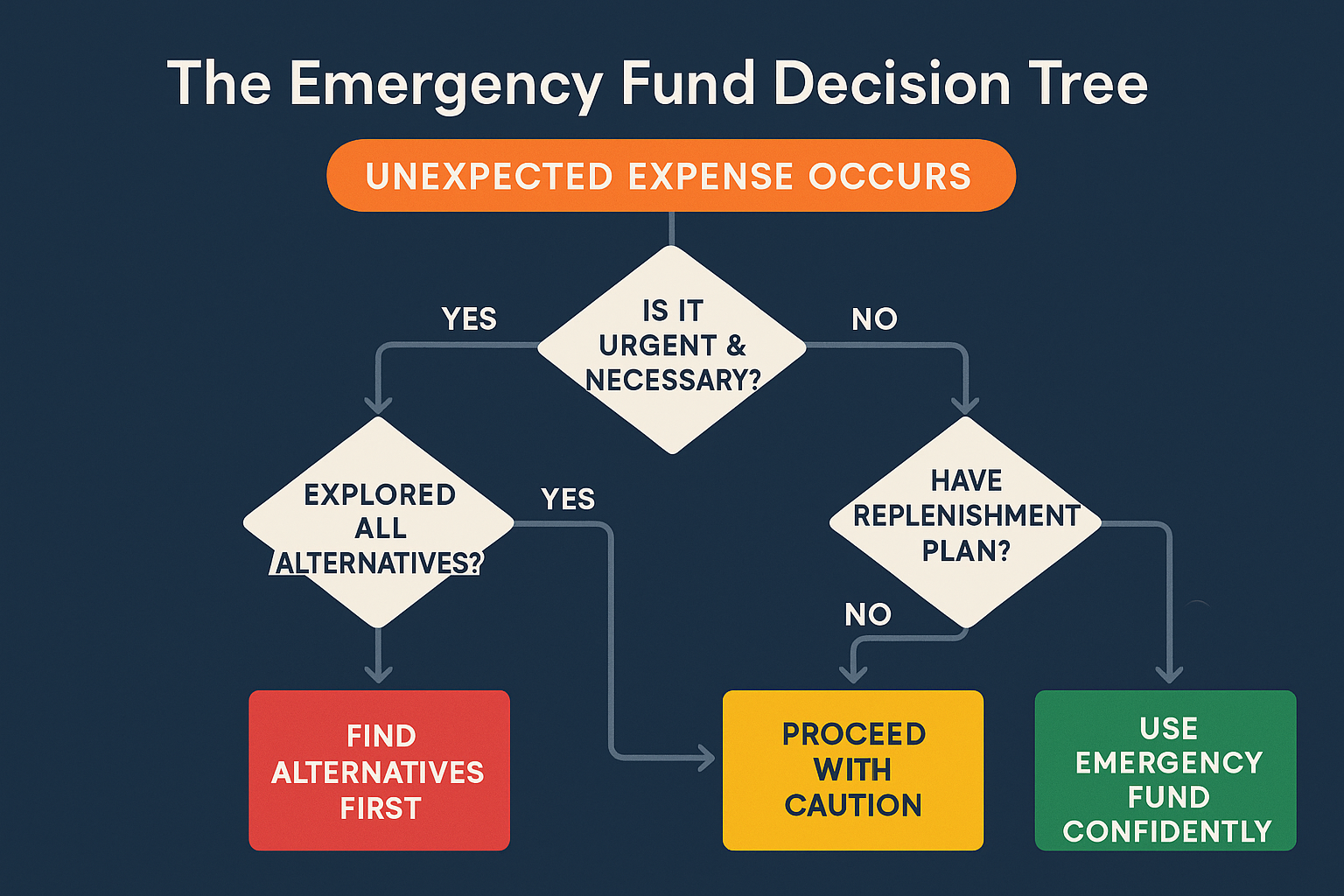

The Emergency Fund Decision Tree

Step 1: Identify the Expense

- What is the expense?

- How much does it cost?

- When must it be paid?

Step 2: Apply the Three Questions

Question 1 Test:

- Is it unexpected?

- Is it necessary (not just wanted)?

- Is it urgent (can’t wait without serious consequences)?

- Does it threaten health, safety, or income?

If you answered NO to any of these, it’s likely not an emergency. Stop here and explore alternatives.

Question 2 Test:

- Can I adjust my current budget to cover this?

- Can I generate quick income to cover part or all of this?

- Are payment plans available?

- Have I explored all other financial resources?

- Can I use low-interest credit and pay it off quickly?

If you answered YES to any of these, pursue those options first before touching your emergency fund.

Question 3 Test:

- How much of my emergency fund will this use?

- Will I have adequate protection remaining?

- Do I have a concrete replenishment plan?

- Can I rebuild within 3-6 months?

- What happens if another emergency occurs before I rebuild?

If you’re uncertain about any of these, reconsider the amount you’re withdrawing or explore partial alternatives.

Step 3: Make the Decision

If the expense passes all three question tests, you’ve identified a legitimate emergency. Use your emergency fund confidently, knowing you’ve made a thoughtful decision.

Step 4: Create a Replenishment Plan

Before making the withdrawal:

- Calculate the amount you’re taking

- Determine how much you can save monthly

- Set a target date for full replenishment

- Automate the rebuilding process

- Track your progress

Real-Life Scenarios: Emergency or Not?

Let’s apply the three-question framework to real situations people face.

Scenario 1: The Broken Water Heater

Situation: Your water heater breaks on Sunday morning. Repair estimate: $800. Replacement: $1,500.

Analysis:

- Question 1 (Urgent?): Yes, no hot water affects daily living, health, and hygiene

- Question 2 (Alternatives?): Get multiple quotes, check if repair is possible instead of replacement, ask about payment plans

- Question 3 (Future impact?): Moderate expense; leaves most emergency fund intact

Verdict: Legitimate emergency, but minimize cost through quotes and negotiation

Scenario 2: Friend’s Destination Wedding

Situation: Your best friend invites you to their wedding in Hawaii (6 months away). Total cost: $2,000.

Analysis:

- Question 1 (Urgent?): No, you have 6 months’ advance notice

- Question 2 (Alternatives?): Create a separate savings plan; reduce other expenses; find cheaper travel options

- Question 3 (Future impact?): Would significantly deplete the emergency fund for a discretionary expense

Verdict: Not an emergency, create a separate savings plan

Scenario 3: Unexpected Job Loss

Situation: Your company announces layoffs, and you’re affected. You have 2 weeks of severance pay.

Analysis:

- Question 1 (Urgent?): Yes, immediate threat to income and financial stability

- Question 2 (Alternatives?): Apply for unemployment benefits, but an emergency fund is needed for gap coverage

- Question 3 (Future impact?): This is exactly what emergency funds are for

Verdict: Primary reason emergency funds exist: use as needed while job searching

Scenario 4: “Investment Opportunity”

Situation: Your cousin tells you about a “can’t-miss” investment opportunity requiring $5,000 immediately.

Analysis:

- Question 1 (Urgent?): No, investments are not emergencies; pressure tactics are red flags

- Question 2 (Alternatives?): If it’s legitimate, save separately or research thoroughly

- Question 3 (Future impact?): Could lose both investment AND emergency protection

Verdict: ❌ Never use emergency funds for investments, even “guaranteed” ones

Understanding why the stock market goes up over time shows that legitimate investments don’t require emergency fund raids; they reward patient, planned investing.

Scenario 5: Dental Crown Breaks

Situation: Your dental crown breaks on Friday evening. It’s painful but not unbearable. The dentist can see you on Monday. Cost: $1,200, insurance covers $400.

Analysis:

- Question 1 (Urgent?): Yes, dental health affects overall health and work ability

- Question 2 (Alternatives?): Ask about payment plans; use dental discount plans; negotiate cash discount

- Question 3 (Future impact?): Moderate expense; explore partial emergency fund use with payment plan

Verdict: ✅ Legitimate emergency, but minimize emergency fund use through payment plans

Creating Your Personal Emergency Fund Policy

One of the most effective ways to protect your emergency fund is to create a written policy before emotions and stress cloud your judgment.

Your Emergency Fund Policy Template

My Emergency Fund Guidelines

Fund Target: $______ (3-6 months of essential expenses)

Current Balance: $______

Qualifies as Emergency If:

Does NOT Qualify:

Before Using Emergency Funds, I Will:

- Wait 24-48 hours (unless immediate safety issue)

- Get multiple quotes for services/repairs

- Explore all alternatives listed in Question 2

- Calculate the exact amount needed

- Create a replenishment plan

Replenishment Commitment:

- I will save $______ per month until fund is restored

- I will redirect ______ (bonus, tax refund, etc.) toward rebuilding

- I will not make other large purchases until the fund is restored to ______%

Accountability:

- I will discuss emergency fund use over $______ with _____________ (spouse, financial advisor, accountability partner)

Review Date: I will review and update this policy every ______ months

Sharing Your Policy

If you’re married or in a partnership, both people should agree on emergency fund guidelines. Different perspectives on what constitutes an “emergency” cause significant financial conflict. Having these conversations during calm times, not in the heat of a crisis, creates alignment and reduces stress.

After You Use Your Emergency Fund: The Replenishment Plan

Using your emergency fund isn’t a failure; it’s exactly what it’s designed for. But the work doesn’t stop once you’ve addressed the emergency.

Immediate Steps (Within 24 Hours)

- Document the expense

- Record what you spent

- Keep receipts and documentation

- Note the date and reason

- Calculate the remaining balance

- Know exactly what protection remains

- Assess your vulnerability to additional emergencies

- Create a replenishment timeline

- Set a target date for full restoration

- Calculate the monthly savings needed

- Identify one-time income sources (tax refunds, bonuses)

Short-Term Actions (Within 1 Week)

- Adjust your budget

- Identify areas to cut temporarily

- Redirect that money to the rebuilding emergency fund

- Set up automatic transfers

- Generate additional income (if needed)

- Sell unused items

- Take on temporary extra work

- Monetize skills or hobbies

- Set up tracking

- Create a visual tracker

- Celebrate milestones

- Monitor progress weekly

Long-Term Strategy (Ongoing)

- Prioritize replenishment

- Treat it like a bill that must be paid

- Don’t make other large purchases until restored

- Resist lifestyle inflation

- Learn from the experience

- Could you have prevented this emergency?

- Were there warning signs you missed?

- Do you need to increase your emergency fund target?

- Strengthen your overall financial position

- Build separate sinking funds for predictable expenses

- Increase income through passive income strategies

- Improve insurance coverage to reduce future emergency fund needs

Real Example: After using $3,000 from her $7,000 emergency fund for car repairs, Maria:

- Cut her entertainment budget by $200/month

- Sold items on Facebook Marketplace ($500)

- Redirected her annual bonus ($1,500)

- Set up automatic $250 monthly transfers

Result: She fully replenished her emergency fund in 6 months and then increased it to $10,000 over the following year.

Building Emergency Funds Into Your Overall Financial Strategy

Your emergency fund doesn’t exist in isolation; it’s one component of a comprehensive financial strategy.

The Financial Priority Pyramid

Level 1: Foundation (Emergency Fund)

- Build 1 month of expenses first

- Then work toward 3-6 months

- Keep in accessible, safe accounts

Level 2: Debt Management

- Pay off high-interest debt (credit cards)

- While maintaining a minimum emergency fund

- Balance debt payoff with emergency fund building

Level 3: Retirement & Long-Term Investing

- Once the emergency fund is solid, focus here

- Take advantage of employer matching

- Explore dividend investing strategies

Level 4: Wealth Building

- Additional investments beyond retirement

- Real estate, business ventures

- Advanced passive income strategies

Integrating Emergency Funds With Other Goals

The Balanced Approach:

Many people struggle with whether to build emergency funds or pay off debt first. The answer: do both, strategically.

Recommended Strategy:

- Save $1,000 emergency starter fund

- Aggressively pay off high-interest debt

- Build a full 3-6 month emergency fund

- Continue debt payoff while starting to invest

- Once debt-free, maximize investing and wealth building

This approach provides basic protection while tackling expensive debt, then builds full security before aggressive wealth building.

When to Increase Your Emergency Fund

Certain life situations warrant larger emergency funds:

Increase to 6-9 months if you:

- Work in a volatile industry

- Are you self-employed or have a variable income

- Have dependents

- Have chronic health conditions

- Own a home (more potential emergencies)

- Live in a single-income household

Increase to 9-12 months if you:

- Work in a highly specialized field (longer job search)

- Are nearing retirement

- Have significant family responsibilities

- Live in an expensive area with limited job options

Understanding your personal risk factors helps you set appropriate emergency fund targets that provide genuine security without over-saving in low-yield accounts.

Teaching Others About Emergency Funds

Financial literacy often starts at home. Teaching family members, especially children and young adults, about emergency funds creates generational financial wisdom.

For Young Children (Ages 5-10)

Concept: The “Uh-Oh Jar”

Create three jars: Spending, Saving, and Uh-Oh (emergency). When they receive money:

- 50% goes to Spending (for toys, treats)

- 30% goes to Saving (for bigger items)

- 20% goes to Uh-Oh (for when things break or unexpected needs)

Lesson: When their toy breaks or they need something unexpected, they use the Uh-Oh jar—teaching that emergencies happen and we prepare for them.

For Teens (Ages 13-18)

Concept: Real-World Scenarios

Discuss real emergencies you’ve faced and how emergency funds helped. Give them scenarios:

- “Your phone breaks, is this an emergency?”

- “Your friend’s birthday party requires a gift, emergency fund?”

- “You need new shoes because yours have holes. Emergency?”

Lesson: Critical thinking about needs vs. wants and planning.

For Young Adults (Ages 18-25)

Concept: The First Emergency Fund Challenge

Help them set a goal of $1,000 in emergency savings within 6 months. Discuss:

- Where to keep it (high-yield savings account)

- How to automate savings

- Real emergencies they might face

- The three questions before spending it

Lesson: Building the habit early creates lifelong financial security.

🚨 Emergency Fund Decision Calculator

Answer these questions to determine if you should use your emergency fund

1 Is This Truly Urgent and Necessary?

2 Have I Exhausted All Other Options?

3 Future Financial Security Check

The Psychology of Emergency Fund Decisions

Understanding the emotional and psychological factors that influence emergency fund decisions helps you make better choices when stress levels are high.

The Scarcity Mindset Trap

When facing an unexpected expense, many people experience a scarcity mindset, a psychological state where the immediate problem consumes all mental resources, making it difficult to think clearly about long-term consequences.

Signs you’re in a scarcity mindset:

- Feeling panicked or overwhelmed

- Unable to think of creative solutions

- Focusing only on the immediate problem

- Ignoring long-term consequences

- Making impulsive decisions

How to counter it:

- Take a pause: Unless it’s a genuine safety emergency, wait 24-48 hours before deciding

- Write it down: Document the expense, alternatives, and your reasoning

- Talk it through: Discuss with someone you trust

- Ask the three questions: Use the framework systematically, not emotionally

The “It’s There, So I’ll Use It” Problem

Having money available creates psychological pressure to use it. This is why some people struggle with emergency funds; the mere existence of the money makes it tempting for non-emergencies.

Solutions:

- Out of sight, out of mind: Keep emergency funds in a separate bank from your checking account

- Add friction: Require transfers to take 1-2 business days rather than being instant

- Label it clearly: Name the account “EMERGENCY ONLY – DO NOT TOUCH”

- Create visual reminders: Set account alerts or desktop wallpapers reminding you of the fund’s purpose

Decision Fatigue and Financial Stress

When you’re stressed about money, your decision-making quality decreases. Understanding this helps you create systems that work even when you’re not at your best.

Create decision systems in advance:

- Written emergency fund policy (discussed earlier)

- Pre-determined spending thresholds (amounts requiring extra consideration)

- Accountability partners for large decisions

- Automatic replenishment systems

Research from Cornell University found that people make better financial decisions when they’ve created rules and systems during calm periods rather than deciding case-by-case during stressful moments.

Emergency Funds for Different Life Stages

Your emergency fund needs and challenges change throughout life. Here’s how to adapt your approach.

Young Adults (Ages 18-25)

Challenges:

- Lower income

- Student loans

- Limited financial experience

- Irregular expenses (moving, job changes)

Emergency fund strategy:

- Start with $1,000 minimum

- Build to 3 months of expenses

- Keep in a high-yield savings account

- Focus on income growth alongside savings

Common “emergencies” to watch for:

- Car repairs (if you own a vehicle)

- Job transitions

- Moving expenses

- Medical costs not covered by insurance

Young Families (Ages 26-40)

Challenges:

- Childcare costs

- Mortgage or high rent

- Multiple dependents

- Career-building expenses

Emergency fund strategy:

- Target 6 months of expenses minimum

- Account for childcare in monthly expense calculations

- Consider separate funds for predictable kid expenses

- Review and adjust as the family grows

Common emergencies:

- Medical expenses for children

- Job loss affecting family income

- Home repairs (if you own)

- Vehicle replacement

Mid-Career (Ages 41-55)

Challenges:

- Aging parents may need support

- Teenagers’ expenses (college approaching)

- Peak earning years, but also peak expenses

- Home and vehicle maintenance

Emergency fund strategy:

- Maintain 6-9 months of expenses

- Consider a separate fund for aging parent emergencies

- Balance emergency savings with retirement contributions

- Review insurance coverage to reduce emergency fund pressure

Common emergencies:

- Major home repairs

- Supporting aging parents

- Job loss in a specialized field (longer replacement time)

- Health issues as you age

Pre-Retirement/Retirement (Ages 56+)

Challenges:

- Fixed or reduced income

- Healthcare costs increase

- Less time to recover from financial setbacks

- Potential cognitive decline affecting decisions

Emergency fund strategy:

- Target 12+ months of expenses

- Keep in ultra-safe, accessible accounts

- Consider long-term care insurance to protect emergency funds

- Involve a trusted family member or financial advisor in large decisions

Common emergencies:

- Medical expenses and prescriptions

- Home modifications for aging in place

- Unexpected healthcare needs

- Supporting adult children or grandchildren

Understanding financial planning across different life stages helps you adjust your emergency fund strategy appropriately.

Advanced Emergency Fund Strategies

Once you’ve mastered the basics, these advanced strategies can optimize your emergency fund approach.

The Tiered Emergency Fund Approach

Instead of keeping all emergency funds in one account, create tiers based on accessibility and return:

Tier 1: Immediate Access (1 month of expenses)

- Regular savings account or checking

- Instantly available

- Lower interest rate acceptable

- For true emergencies requiring immediate payment

Tier 2: Quick Access (2-3 months of expenses)

- High-yield savings account

- Available within 1-2 business days

- Better interest rate

- For emergencies with slight flexibility

Tier 3: Short-term Investment (2-3 months of expenses)

- Short-term CDs or Treasury bills

- Available within days to weeks

- Higher returns

- For extended emergencies or after exhausting Tiers 1-2

This approach balances accessibility with returns, ensuring you earn more on funds you’re less likely to need immediately.

The Emergency Fund + Insurance Strategy

Smart insurance coverage can reduce your emergency fund requirements:

Insurance types that protect emergency funds:

- Disability insurance: Replaces income if you can’t work

- Umbrella liability insurance: Protects against lawsuit expenses

- Adequate health insurance: Reduces medical emergency costs

- Home warranty: Covers major appliance/system failures

- Extended car warranty: Covers major vehicle repairs (evaluate cost vs. benefit)

The calculation: If you have robust insurance coverage, you might maintain a smaller emergency fund (3 months instead of 6) and invest the difference for higher long-term returns. However, this requires:

- Excellent insurance coverage with reasonable deductibles

- Stable employment in a secure industry

- Good health

- Well-maintained home and vehicle

The Emergency Fund Ladder

Similar to CD laddering, create a “ladder” of emergency funds with different availability timelines:

Month 1-2: Savings account (instant access) Month 3-4: 3-month CD (slightly higher rate) Month 5-6: 6-month CD (higher rate still)

As each CD matures, you can renew it or access the funds if needed. This strategy works best when you have a stable financial situation and aren’t likely to need the full emergency fund immediately.

The Self-Insurance Approach for High Net Worth

Once you’ve built substantial wealth, you might “self-insure” by maintaining larger emergency funds instead of buying certain insurance products:

When this makes sense:

- Net worth exceeds $500,000+

- Stable, high income

- Low debt or debt-free

- Ability to absorb $10,000+ expenses without stress

Example: Instead of buying an extended warranty on appliances ($500/year), keep that $500 in your emergency fund. Over 10 years, you’ve saved $5,000, likely more than you’d spend on repairs.

However, never self-insure for catastrophic risks (health, home, auto liability, life insurance with dependents).

Only if the debt is unmanageable and the interest is spiraling. Otherwise, keep it for true emergencies.

Aim for 6–12 months of expenses since your income is less predictable.

No. Emergency funds should be liquid and safe (savings or money market accounts). Investing adds risk and volatility.

Start small; even $500 can prevent debt in a pinch. Grow it steadily over time.

Best options: High-yield savings accounts, money market accounts, or short-term CDs with no penalties.

No, that’s a sinking fund. Emergency funds are for unplanned events only.

Cut discretionary spending temporarily, direct windfalls (tax refunds, bonuses), and automate transfers until replenished.

Common Questions About Emergency Fund Decisions

“What if I have debt? should I still build an emergency fund?”

Yes, but strategically. The recommended approach:

- Save $1,000 emergency starter fund

- Aggressively pay off high-interest debt (credit cards, payday loans)

- Build a full 3-6 month emergency fund

- Continue paying off remaining debt

- Invest for long-term wealth

Why this order? Without an emergency fund, you’ll go deeper into debt when emergencies strike. But carrying 20%+ interest credit card debt costs you significantly, so tackle that quickly after establishing basic protection.

“Can I invest my emergency fund for better returns?”

Not your core emergency fund. Emergency funds need three characteristics:

- Liquidity: Accessible within days

- Stability: No risk of losing value

- Predictability: Know exactly how much you have

Investments lack these qualities. The stock market can drop 30% exactly when you need your emergency fund. As discussed in understanding market volatility, markets don’t cooperate with your emergency timeline.

However, once you’ve built 6+ months of emergency expenses, additional savings can be invested for long-term growth. Just don’t compromise your core emergency fund.

“What if my emergency fund isn’t big enough for the emergency?”

This happens, and it’s okay. Here’s what to do:

- Use what you have: Withdraw what you can from emergency funds

- Combine with alternatives: Use payment plans, temporary income, and budget cuts

- Strategic borrowing: If needed, use the lowest-interest options available

- Prioritize replenishment: Pay yourself back first before other goals

Real example: James needed $8,000 for emergency surgery, but only had $4,000 in emergency savings. He:

- Used his $4,000 emergency fund

- Negotiated a 12-month payment plan for the remaining $4,000

- Picked up weekend work to cover the monthly payments

- Simultaneously rebuilt his emergency fund

The key is using your emergency fund as part of a larger strategy, not expecting it to cover every possible scenario alone.

“Should couples combine emergency funds or keep them separate?”

For married couples or committed long-term partnerships: combine them.

Benefits of combined emergency funds:

- Larger total protection

- Simpler to manage

- Reflects shared financial life

- More efficient (don’t need duplicate funds)

Requirements for success:

- Both partners agree on what constitutes an emergency

- Joint decision-making on large withdrawals

- Shared replenishment responsibility

- Complete financial transparency

For dating or early relationships: keep separate until you’re fully committed and sharing finances.

“How often should I review my emergency fund needs?”

Review annually or when major life changes occur:

Annual review checklist:

- ✓ Has your monthly expense level changed?

- ✓ Have you changed jobs or industries?

- ✓ Have you added dependents?

- ✓ Have you moved to a more/less expensive area?

- ✓ Has your income stability changed?

- ✓ Have you acquired major assets (home, car) requiring maintenance?

Immediate review triggers:

- Marriage or divorce

- Birth or adoption of a child

- Job change

- Home purchase

- Starting a business

- Major health diagnosis

- Retirement

Your emergency fund should grow with your life and responsibilities.

The Opportunity Cost of Emergency Funds

Let’s address the elephant in the room: keeping $20,000 in a savings account earning 4% feels painful when the stock market historically returns 10% annually.

Understanding the Trade-Off

What you’re “losing”:

- Potential for higher investment returns

- Compound growth over time

- Opportunity to build wealth faster

What you’re gaining:

- Peace of mind

- Financial stability

- Ability to handle emergencies without debt

- Protection of your long-term investments

- Flexibility during job loss or income reduction

The Math of Security

Consider this scenario:

Option A: Invest everything

- $20,000 invested at 10% annual return

- After 10 years: ~$51,875

- Risk: If an emergency strikes, you might sell during a downturn, losing 30%+ and missing recovery

Option B: Balanced approach

- $10,000 emergency fund at 4% = $14,802 after 10 years

- $10,000 invested at 10% = $25,937 after 10 years

- Total: $40,739

- Benefit: Protected through emergencies, never forced to sell investments at a loss

Option C: Emergency fund + investing

- Build $10,000 emergency fund first (Year 1)

- Then invest $10,000 starting Year 2

- Emergency fund grows to $14,802

- Investments grow to $23,579 (9 years of growth)

- Total: $38,381

- Benefit: Maximum protection with solid growth

The “lost” returns on your emergency fund are actually insurance premiums you’re paying for financial security. Just like you don’t regret paying for car insurance even if you don’t have an accident, you shouldn’t regret maintaining emergency funds even if you don’t use them.

When the Opportunity Cost Is Worth Reconsidering

You might reduce your emergency fund if:

- You have an extremely stable dual income

- You have excellent insurance coverage

- You’re debt-free with low fixed expenses

- You have access to a HELOC or other low-interest emergency credit

- Your net worth exceeds $500,000+

Even then, maintain at least 3 months of expenses in accessible savings. The peace of mind is worth more than the marginal return difference.

Emergency Funds and Entrepreneurship

Self-employed individuals and business owners face unique emergency fund challenges and needs.

Why Entrepreneurs Need Larger Emergency Funds

Income volatility:

- Revenue fluctuates monthly

- Seasonal business variations

- Client payment delays

- Economic downturns hit harder

Business emergencies overlap with personal:

- Equipment failures

- Key employee departures

- Unexpected business expenses

- Legal or regulatory issues

Recommendation: Self-employed individuals should maintain 9-12 months of personal expenses in emergency funds, plus a separate business emergency fund covering 3-6 months of business operating expenses.

The Dual Emergency Fund Strategy

Personal Emergency Fund:

- Covers household expenses

- Separate from business accounts

- Used only for personal emergencies

- Never commingled with business funds

Business Emergency Fund:

- Covers business operating expenses

- Separate business account

- Used for business emergencies only

- Protects against revenue gaps

This separation is crucial for both financial clarity and legal protection (maintaining the corporate veil for LLCs and corporations).

When Business Emergencies Tempt Personal Emergency Funds

The scenario: Your business faces an unexpected expense, and you’re tempted to use personal emergency funds to cover it.

Apply the three questions:

- Is this truly urgent? Or can the business operate while you find alternatives?

- Have you explored all alternatives? Business line of credit, payment plans, client advances, asset sales?

- Future impact? Will this leave your family unprotected if a personal emergency strikes?

Better alternatives:

- Small business line of credit

- Business credit card

- Invoice factoring

- Equipment financing

- Small Business Administration (SBA) loans

Mixing personal and business emergency funds creates dangerous vulnerability in both areas. Understanding smart money management includes maintaining clear boundaries between personal and business finances.

Teaching Emergency Fund Discipline to Your Future Self

The final piece of emergency fund wisdom is building systems that protect you from your own future impulses.

Automation Is Your Best Friend

Set up automatic systems:

- Automatic deposits: Transfer to emergency fund on payday (before you see the money)

- Separate bank: Keep emergency funds at a different bank from your daily checking account

- No debit card: Don’t have a debit card for the emergency fund account

- Transfer delays: Choose accounts requiring 1-2 days for transfers

- Alerts: Set up notifications for any withdrawal from emergency accounts

These “friction points” give you time to reconsider impulsive decisions without preventing legitimate emergency access.

The Written Commitment

Create a written emergency fund commitment and sign it:

My Emergency Fund Commitment

I, _____________, commit to maintaining an emergency fund for genuine emergencies only.

My emergency fund target: $_______

I will only use this fund for:

Before using my emergency fund, I will:

- Wait 24 hours (unless immediate safety issue)

- Ask myself the three critical questions

- Explore all alternatives

- Discuss with _____________ (accountability partner)

If I use my emergency fund, I will:

- Create a replenishment plan within 24 hours

- Begin rebuilding immediately

- Do not make other large purchases until the fund is restored to ____%

Signed: _________________ Date: _______

Place this document where you’ll see it when considering emergency fund use, perhaps take a photo and save it as your phone’s lock screen, or keep it in your wallet.

Accountability Partners

Share your emergency fund goals and guidelines with someone you trust:

- Spouse or partner

- Close friend

- Family member

- Financial advisor

The agreement: Before using more than $_______ from your emergency fund, you’ll discuss it with your accountability partner. They’ll help you think clearly when emotions are high.

This isn’t about asking permission; it’s about having someone help you apply the three questions objectively when you’re stressed.

Celebrating Milestones Without Spending

One reason people raid emergency funds is that they never celebrate building them. Create non-spending celebrations:

Milestone ideas:

- $1,000 saved: Special home-cooked meal

- 1 month of expenses: Movie night at home

- 3 months of expenses: Day trip to a free local attraction

- 6 months of expenses: Update your budget to increase investment contributions

Acknowledging progress without spending reinforces positive behavior.

The Emotional Freedom of a Solid Emergency Fund

Beyond the practical financial benefits, a fully-funded emergency fund provides something invaluable: peace of mind.

The Psychological Benefits

Reduced anxiety: Research from the American Psychological Association consistently shows that financial stress is Americans’ top source of anxiety. An adequate emergency fund directly addresses this stressor.

Better decision-making: When you know you’re protected, you make better decisions in other areas:

- You can negotiate salary from a position of strength

- You can leave toxic work environments

- You can invest for the long term without panic selling

- You can take calculated career risks

Improved relationships: Financial stress is a leading cause of relationship conflict. Emergency funds reduce this friction by providing security that both partners can rely on.

Better physical health: Financial stress contributes to high blood pressure, heart disease, and other health issues. Reducing financial anxiety through emergency fund security improves overall health.

The Confidence Factor

Having emergency funds creates a virtuous cycle:

- You feel more financially secure

- This confidence helps you make better money decisions

- Better decisions improve your financial situation

- Improved finances reinforce your confidence

This confidence extends beyond finances; people with adequate emergency funds report feeling more in control of their lives generally.

Freedom to Pursue Opportunities

An emergency fund isn’t just a defense; it’s also an offense. When you’re financially secure:

- You can pursue career changes or entrepreneurship

- You can invest in education or skill development

- You can relocate for better opportunities

- You can take calculated risks that improve your life

The same fund that protects you from disaster also empowers you to pursue advancement.

Conclusion: Making Emergency Fund Decisions With Confidence

Your emergency fund represents more than money in a savings account; it’s your financial foundation, your peace of mind, and your protection against life’s uncertainties.

The three questions we’ve explored in this guide provide a framework for making clear, confident decisions even in stressful moments:

- ✅ Is this truly urgent and necessary? Separates real emergencies from wants, inconveniences, and planned expenses

- ✅ Have I exhausted all other options? Ensures your emergency fund is your last resort, not your first option

- ✅ Will using this money impact my future financial security? Protects your long-term stability by requiring a replenishment plan

Remember these key principles:

Build your emergency fund first before aggressive investing or discretionary spending

Keep it accessible but separate from your daily banking to reduce temptation

Define “emergency” clearly in writing, during calm times, not during crises

Always have a replenishment plan before withdrawing funds

Review and adjust your emergency fund target as your life circumstances change

Celebrate building it without spending it, and acknowledge your progress

Your Next Steps:

- If you don’t have an emergency fund: Start today with whatever you can, even $25 creates momentum

- If you have a small emergency fund: Set a goal to reach $1,000, then 1 month of expenses, then 3-6 months

- If you have an adequate emergency fund, review your definition of “emergency” and create your written policy

- If you’re considering using your emergency fund, work through the interactive calculator above and honestly answer the three questions

Your emergency fund is one of the most powerful financial tools you’ll ever build. It won’t make you rich, but it will keep you from becoming poor. It won’t earn impressive returns, but it will protect the investments that do. It won’t feel exciting to build, but it will provide freedom and peace of mind that money in the stock market never can.

The next time you face an unexpected expense and your finger hovers over that “Transfer Funds” button, pause. Ask yourself the three questions. Make a thoughtful decision rather than an emotional one. Your future self, the one who remains financially secure through life’s inevitable storms, will thank you.

Financial security isn’t about never facing emergencies. It’s about being prepared when they arrive.

For more insights on building long-term wealth while maintaining financial security, explore our guides on smart money management and building passive income streams that complement your emergency fund strategy.

Disclaimer

This article is for educational and informational purposes only and should not be considered financial advice. Emergency fund needs vary based on individual circumstances, including income stability, family size, health status, and personal risk tolerance. Before making significant financial decisions, consult with a qualified financial advisor who understands your specific situation. The examples and scenarios provided are for illustrative purposes and may not reflect your personal circumstances. Past performance and historical data do not guarantee future results.

About the Author

Max Fonji is a financial educator and content strategist specializing in making complex financial concepts accessible to everyday investors. With over a decade of experience in personal finance education, Max has helped thousands of people build stronger financial foundations through practical, actionable advice. His work focuses on beginner-friendly strategies that create lasting financial security and wealth-building habits. When not writing about finance, Max enjoys analyzing market trends, reading behavioral economics research, and helping individuals achieve their financial goals through education and empowerment.