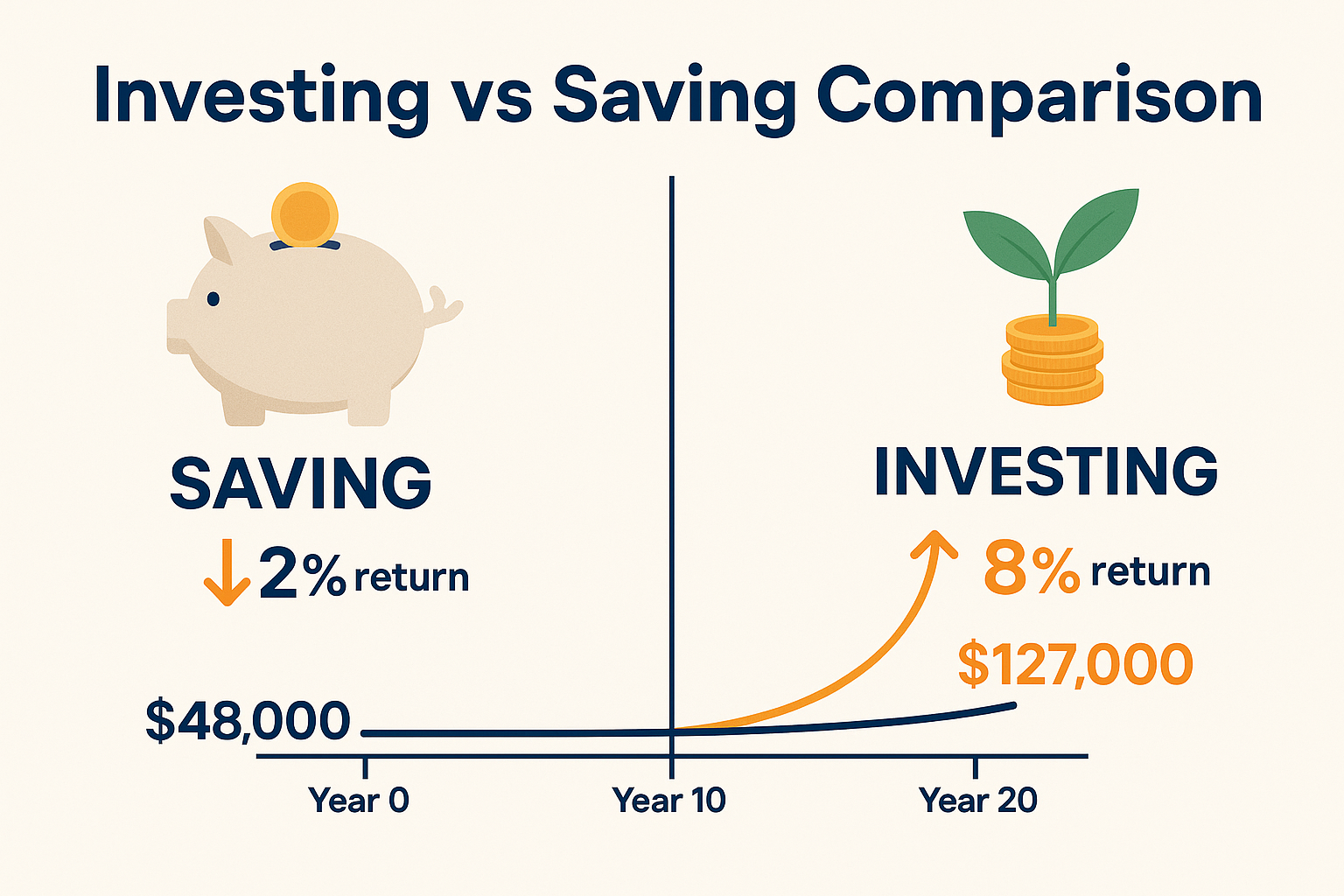

Imagine two friends who graduated from college together in 2005. Sarah started investing $200 monthly into a diversified portfolio. Mike kept his money in a savings account, convinced the stock market was “too risky.” Twenty years later, Sarah’s portfolio has grown to over $127,000, while Mike has roughly $48,000—despite both saving the same amount. The difference? Investing.

This single financial decision, understanding what investing is and acting on it, separates those who build meaningful wealth from those who simply save. Yet for millions of people, investing remains shrouded in mystery, perceived as something only Wall Street professionals or the wealthy can master.

The truth is far simpler. Investing is the systematic deployment of capital into assets that generate returns over time, and it’s the most reliable path to financial independence available to ordinary people. According to the Federal Reserve’s Survey of Consumer Finances, households that invest in the stock market have a median net worth nearly five times higher than those that don’t.

This guide breaks down exactly what investing is, why it matters, how it works, and how beginners can start building wealth using proven, time-tested strategies. By the end, the math behind money will be clear, actionable, and entirely within reach.

Key Takeaways

- Investing is the process of allocating money into assets that generate returns through appreciation, income, or both—fundamentally different from saving, which preserves capital but doesn’t grow it meaningfully.

- Compounding returns are the mathematical engine of wealth creation, turning modest, consistent contributions into substantial portfolios over decades.

- Risk and return are inseparable: higher potential returns require accepting greater volatility, but diversification and time horizon management reduce downside exposure.

- Asset allocation—the mix of stocks, bonds, and other investments—determines roughly 90% of portfolio performance over the long term, according to research published in the Financial Analysts Journal.

- Starting early matters exponentially: a 25-year-old investing $300 monthly until age 65 accumulates approximately $1.1 million at 8% annual returns, while a 35-year-old investing the same amount reaches only $440,000.

What Is Investing? The Core Definition

Investing is the act of committing money or capital to an asset, enterprise, or financial instrument with the expectation of generating a positive return over time. Unlike spending, which exchanges money for immediate consumption or saving, which stores money for future use, investing deploys capital into productive assets designed to grow in value or produce income.

At its core, investing is about purchasing future cash flows. When someone buys a stock, they’re acquiring ownership in a company’s future profits. When they purchase a bond, they’re lending money in exchange for interest payments. When they buy real estate, they’re securing rental income and potential appreciation.

The Economic Purpose of Investing

From an economic perspective, investing serves as the bridge between savers (those with excess capital) and users of capital (businesses, governments, and entrepreneurs who need funding to grow). This capital allocation process drives innovation, job creation, and economic expansion.

For individuals, investing transforms labor income into passive income and capital appreciation. As noted by the CFA Institute, “the primary objective of investing is to increase purchasing power over time by earning returns that exceed inflation.”

Investing vs Saving: Understanding the Distinction

While both involve setting money aside, the mechanisms and outcomes differ fundamentally:

| Aspect | Saving | Investing |

|---|---|---|

| Purpose | Preserve capital, maintain liquidity | Grow wealth, generate returns |

| Time Horizon | Short-term (emergency funds, near-term goals) | Long-term (retirement, wealth building) |

| Risk Level | Minimal (FDIC-insured up to $250,000) | Variable (market fluctuations, asset-specific risks) |

| Expected Return | 0.5%–5% annually (high-yield savings, CDs) | 7%–10% annually (historical stock market average) |

| Inflation Impact | Often negative real returns after inflation | Designed to outpace inflation significantly |

Insight: Savings protect against short-term uncertainty. Investing protects against long-term erosion of purchasing power. Both serve essential but distinct roles in a complete financial strategy. See our full guide on why investing is a more powerful tool to build long-term wealth than saving.

Why Investing Matters: The Math Behind Wealth Creation

The difference between saving and investing isn’t just philosophical—it’s mathematical. The primary force that makes investing indispensable is compound growth.

The Power of Compounding Returns

Compounding occurs when investment returns generate their own returns. Instead of earning a fixed amount each year, investors earn returns on both their original principal and all accumulated gains.

Consider this example:

- Scenario A (Saving): $10,000 in a savings account earning 2% annual interest generates $200 per year. After 30 years: $18,114.

- Scenario B (Investing): $10,000 invested in a diversified portfolio earning 8% annually compounds to $100,627 after 30 years.

The difference—$82,513—comes entirely from compounding. As Albert Einstein allegedly said, “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

Inflation: The Silent Wealth Destroyer

Inflation—the gradual increase in prices over time—erodes purchasing power. The Federal Reserve targets approximately 2% annual inflation. At this rate, $100 today will have the purchasing power of just $55 in 30 years.

Savings accounts rarely outpace inflation, especially after taxes. A 3% savings rate minus 2% inflation and 20% taxes leaves a real return of just 0.4%; barely preserving wealth, certainly not building it.

Investing in appreciating assets provides the only reliable hedge against inflation. Stocks, real estate, and commodities historically rise with or above inflation, protecting and growing purchasing power.

Historical Evidence: Long-Term Market Performance

According to data from NYU Stern School of Business and Professor Aswath Damodaran:

- The S&P 500 has delivered an average annual return of approximately 10.2% since 1928.

- Even accounting for inflation, the real return averages around 7%–8% annually.

- Over any 20-year rolling period since 1926, the stock market has never produced a negative return.

This doesn’t mean investing is risk-free; short-term volatility is inevitable. But over appropriate time horizons, the stock market has consistently rewarded patient investors.

Takeaway: Investing isn’t about getting rich quickly. It’s about leveraging time, compounding, and market growth to systematically build wealth that outpaces inflation and creates financial security.

How Investing Works: The Fundamental Mechanisms

Understanding what investing is requires grasping the basic mechanics of how returns are generated and how markets facilitate capital allocation.

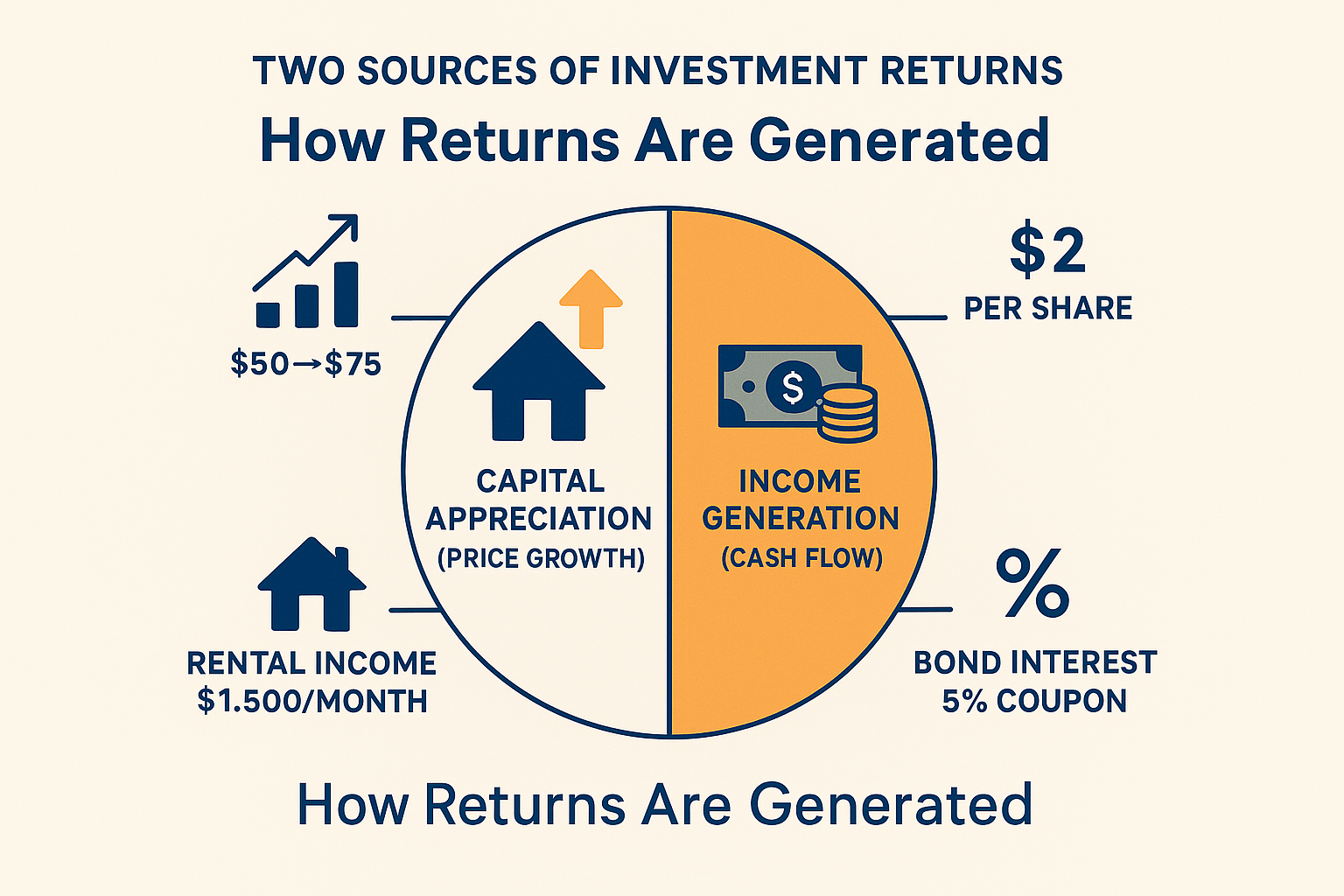

Two Primary Sources of Investment Returns

Investment returns come from two fundamental sources:

1. Capital Appreciation (Price Growth)

Capital appreciation occurs when an asset increases in value over time. An investor buys a stock at $50 per share and sells it at $75, realizing a $25 gain (50% return).

Drivers of appreciation include:

- Company earnings growth (for stocks)

- Economic expansion

- Supply and demand dynamics

- Investor sentiment and market conditions

2. Income Generation (Cash Flow)

Many assets produce regular income payments:

- Stocks: Dividends (distributions of company profits to shareholders)

- Bonds: Interest payments (coupon payments)

- Real Estate: Rental income

- REITs: Dividend distributions from property income

For example, dividend investing allows investors to build streams of passive income that can be reinvested or used to cover living expenses.

Total return equals capital appreciation plus income. A stock that rises 6% and pays a 2% dividend delivers an 8% total return.

How Markets Facilitate Investing

Financial markets, stock exchanges, bond markets, and real estate platforms serve as intermediaries connecting buyers and sellers. These markets provide:

- Price discovery: Continuous trading establishes fair market values

- Liquidity: The ability to convert investments to cash quickly

- Transparency: Regulated disclosure requirements ensure investors have access to material information

- Efficiency: Competition among millions of participants drives prices toward intrinsic value

The New York Stock Exchange, NASDAQ, and other exchanges process trillions of dollars in transactions annually, enabling ordinary investors to participate in global economic growth with a few clicks.

Risk and Return: The Fundamental Trade-Off

One of the most important principles in finance is the risk-return trade-off: higher expected returns require accepting higher levels of risk (volatility, uncertainty, potential loss).

Risk in investing refers to the probability and magnitude of losses, typically measured by:

- Volatility: How much prices fluctuate

- Standard deviation: A Statistical measure of return dispersion

- Maximum drawdown: Largest peak-to-trough decline

Different asset classes occupy different positions on the risk-return spectrum:

| Asset Class | Expected Annual Return | Risk Level | Volatility (Std Dev) |

|---|---|---|---|

| Cash/Money Market | 1%–3% | Very Low | ~1% |

| Bonds (Investment Grade) | 3%–5% | Low to Moderate | ~5%–8% |

| Real Estate | 6%–9% | Moderate | ~10%–15% |

| Stocks (Large Cap) | 8%–10% | Moderate to High | ~15%–20% |

| Small-Cap Stocks | 10%–12% | High | ~20%–30% |

Insight: Risk cannot be eliminated, but it can be managed through diversification, asset allocation, and time horizon alignment. Understanding what moves the stock market helps investors contextualize volatility and make rational decisions during turbulent periods.

Types of Investments: Building Blocks of a Portfolio

A well-constructed portfolio typically includes multiple asset classes, each serving different purposes and exhibiting different risk-return characteristics.

Stocks (Equities)

Stocks represent ownership shares in publicly traded companies. When someone buys Apple stock, they own a fractional piece of Apple Inc. and are entitled to a proportional share of its future profits.

How stocks generate returns:

- Price appreciation: As companies grow revenues and earnings, stock prices typically rise

- Dividends: Many established companies distribute a portion of profits to shareholders (high dividend stocks can provide steady income streams)

Risk profile: High volatility, especially in the short term. Individual stocks can lose 50%+ of value or even become worthless. However, diversified stock portfolios have historically delivered superior long-term returns.

Best for: Long-term growth, investors with 10+ year time horizons, those seeking to outpace inflation significantly.

Bonds (Fixed Income)

Bonds are debt instruments—essentially loans made by investors to corporations or governments in exchange for regular interest payments and return of principal at maturity.

How bonds generate returns:

- Interest payments: Regular coupon payments (e.g., a 5% bond pays $50 annually per $1,000 invested)

- Price appreciation: Bond prices rise when interest rates fall

Risk profile: Lower volatility than stocks, but still subject to interest rate risk, credit risk (default), and inflation risk.

Best for: Income generation, capital preservation, portfolio diversification, investors nearing or in retirement.

Real Estate

Real estate investing involves purchasing physical properties (residential, commercial, industrial) or shares in real estate investment trusts (REITs).

How real estate generates returns:

- Rental income: Monthly cash flow from tenants

- Appreciation: Property values increase over time

- Tax advantages: Depreciation deductions, 1031 exchanges

Risk profile: Moderate to high. Requires significant capital, involves maintenance costs, is subject to local market conditions, less liquid than stocks or bonds.

Best for: Diversification, inflation hedging, income generation, investors comfortable with active management or REIT investing.

Mutual Funds and ETFs

Mutual funds and exchange-traded funds (ETFs) pool money from many investors to purchase diversified portfolios of stocks, bonds, or other assets.

Key differences:

- Mutual funds: Actively or passively managed, priced once daily, often have minimum investments

- ETFs: Trade like stocks throughout the day, typically lower fees, no minimums

Advantages:

- Instant diversification (one fund can hold hundreds or thousands of securities)

- Professional management (for actively managed funds)

- Low cost (especially index funds and ETFs)

- Accessibility (fractional shares available on many platforms)

Best for: Beginners, hands-off investors, those seeking broad market exposure with minimal effort.

Alternative Investments

Alternative investments include assets outside traditional stocks, bonds, and cash:

- Commodities: Gold, oil, agricultural products

- Cryptocurrencies: Bitcoin, Ethereum (highly speculative)

- Private equity: Ownership in non-public companies

- Hedge funds: Sophisticated strategies using leverage and derivatives

- Collectibles: Art, wine, rare coins

Risk profile: Varies widely, often high volatility, limited liquidity, and requires specialized knowledge.

Best for: Experienced investors seeking diversification beyond traditional assets, those with high risk tolerance, and long-term horizons.

Takeaway: Most beginners should focus on stocks, bonds, and real estate (or REITs) through low-cost index funds and ETFs. These provide sufficient diversification, proven track records, and accessibility without requiring specialized expertise.

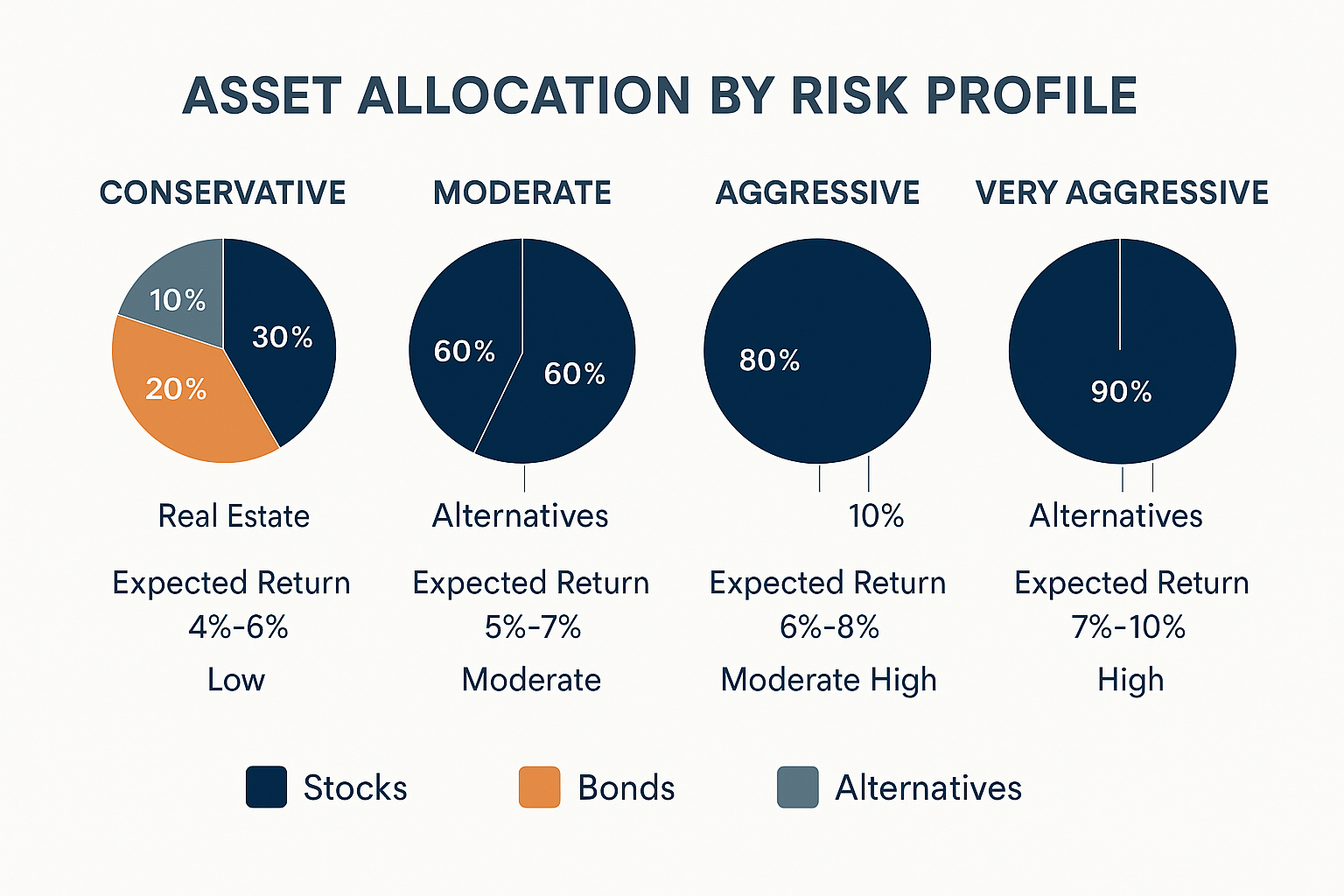

Asset Allocation: The Single Most Important Investment Decision

Asset allocation—the distribution of capital across different asset classes—determines the vast majority of portfolio performance and risk characteristics.

The Research: Why Asset Allocation Matters Most

A landmark 1986 study by Brinson, Hood, and Beebower, published in the Financial Analysts Journal, found that asset allocation explains approximately 90% of portfolio return variability over time. Individual security selection and market timing contribute far less.

This means deciding what percentage to allocate to stocks versus bonds matters far more than picking which specific stocks or bonds to buy.

Sample Asset Allocations by Risk Tolerance

| Risk Profile | Stocks | Bonds | Real Estate/Alternatives | Expected Return | Expected Volatility |

|---|---|---|---|---|---|

| Conservative | 30% | 60% | 10% | 4%–5% | Low |

| Moderate | 60% | 30% | 10% | 6%–7% | Moderate |

| Aggressive | 80% | 10% | 10% | 8%–9% | High |

| Very Aggressive | 90% | 5% | 5% | 9%–10% | Very High |

Age-Based Allocation: The “100 Minus Age” Rule

A traditional rule of thumb suggests subtracting your age from 100 to determine the percentage allocated to stocks:

- Age 25: 75% stocks, 25% bonds

- Age 45: 55% stocks, 45% bonds

- Age 65: 35% stocks, 65% bonds

Given increasing life expectancies and historically low bond yields, many advisors now use “110 or 120 minus age” to maintain higher equity exposure.

Rebalancing: Maintaining Target Allocation

Over time, market movements cause portfolios to drift from target allocations. If stocks outperform, a 60/40 portfolio might become 70/30.

Rebalancing involves periodically selling outperforming assets and buying underperforming ones to restore target weights. This disciplined approach:

- Controls risk by preventing overexposure to volatile assets

- Enforces “buy low, sell high” behavior

- Maintains alignment with risk tolerance and goals

Most investors rebalance annually or when allocations drift 5%+ from targets.

Insight: Asset allocation isn’t a one-time decision. It should evolve with age, income, risk tolerance, and market conditions. The right allocation balances growth potential with sleep-at-night comfort.

Risk Management: Protecting Capital While Pursuing Returns

Investing inherently involves risk, but intelligent risk management transforms uncertainty into manageable probability.

Diversification: The Only Free Lunch in Finance

Diversification spreads capital across multiple assets, sectors, and geographies to reduce exposure to any single point of failure.

Why it works: Different assets respond differently to economic conditions. When stocks fall, bonds often rise. When U.S. markets struggle, international markets may thrive. When growth stocks decline, value stocks might hold steady.

Levels of diversification:

- Across asset classes: Stocks, bonds, real estate, commodities

- Within asset classes: Large-cap, mid-cap, small-cap stocks; corporate and government bonds

- Across sectors: Technology, healthcare, financials, consumer goods

- Across geographies: Domestic and international markets

- Across time: Dollar-cost averaging (discussed below)

Example: A portfolio holding only technology stocks faces catastrophic risk if the tech sector crashes. A portfolio holding stocks, bonds, real estate, and international assets experiences smoother returns.

According to Morningstar research, a diversified portfolio of 60% stocks and 40% bonds experienced a maximum drawdown of approximately 32% during the 2008 financial crisis, compared to 51% for a 100% stock portfolio.

Time Horizon: The Great Risk Reducer

Time horizon: the length of time capital remains invested, is one of the most powerful risk management tools available.

Short time horizons (< 5 years) magnify risk. Markets can decline 20%–50% in any given year, and recovery may take several years. Investors needing capital soon cannot afford to wait out downturns.

Long time horizons (10+ years) smooth volatility. Historical data show that over any 20 years, diversified stock portfolios have never produced negative returns, despite numerous crashes, recessions, and crises.

Practical application:

- Emergency funds: Keep 3–6 months’ expenses in cash or money market accounts

- Short-term goals (house down payment in 3 years): Bonds, CDs, high-yield savings

- Long-term goals (retirement in 30 years): Stock-heavy portfolios

Understanding Market Volatility

Market volatility refers to the frequency and magnitude of price fluctuations. While unsettling, volatility is the price investors pay for superior long-term returns.

Key principles for managing volatility:

- Volatility ≠ Risk: Temporary price swings don’t equal permanent loss if investments are sound and the time horizon is appropriate

- Volatility creates opportunity: Market declines allow investors to buy quality assets at discounted prices

- Emotional discipline matters: Panic selling during downturns locks in losses and forfeits recovery gains

Historical context: Since 1980, the S&P 500 has experienced an average intra-year decline of approximately 14%, yet ended the year positive in roughly 75% of those years. Short-term volatility rarely predicts long-term outcomes.

Dollar-Cost Averaging: Reducing Timing Risk

Dollar-cost averaging (DCA) involves investing fixed amounts at regular intervals (monthly, quarterly) regardless of market conditions.

Benefits:

- Eliminates timing risk: No need to predict market tops or bottoms

- Automatic discipline: Removes emotion from investment decisions

- Buys more shares when prices are low: Fixed dollar amounts purchase more shares during declines, lowering the average cost per share

Example: Investing $500 monthly buys 10 shares when the price is $50, but 12.5 shares when the price falls to $40. Over time, this averaging effect smooths entry points and reduces the impact of volatility.

Takeaway: Risk cannot be eliminated, but diversification, appropriate time horizons, emotional discipline, and systematic investing transform risk from an obstacle into a manageable component of wealth building.

Getting Started: A Step-by-Step Guide for Beginners

Understanding what investing is provides the foundation. Taking action builds wealth. Here’s a systematic approach for beginners.

Step 1: Establish Financial Foundations

Before investing, ensure basic financial health:

Build an emergency fund: 3–6 months of living expenses in a high-yield savings account

Eliminate high-interest debt: Credit card balances, payday loans (interest rates often exceed 20%)

Secure employer 401(k) match: Free money—always capture the full match before investing elsewhere

Understand your budget: Know your income, expenses, and how much capital is available for investing

Rationale: Investing while carrying 20% credit card debt makes no mathematical sense. Even exceptional investment returns (10%) can’t overcome 20% interest charges. Secure the foundation first.

Step 2: Define Investment Goals and Time Horizon

Clear goals drive appropriate strategy:

- Retirement (30+ years away): Aggressive stock allocation, maximize growth

- Home down payment (5 years away): Conservative allocation, prioritize capital preservation

- Children’s education (15 years away): Moderate allocation, balance growth and stability

Questions to answer:

- What am I investing in?

- When will I need this money?

- How much risk can I tolerate emotionally?

- What returns do I need to achieve my goals?

Step 3: Choose an Investment Account

Different account types offer different tax advantages:

Tax-Advantaged Retirement Accounts

- 401(k): Employer-sponsored, pre-tax contributions often include an employer match, $23,000 contribution limit (2025)

- Traditional IRA: Pre-tax contributions, tax-deferred growth, $7,000 limit (2025)

- Roth IRA: After-tax contributions, tax-free growth and withdrawals, $7,000 limit (2025)

Tax advantage: Traditional accounts reduce taxable income today; Roth accounts eliminate taxes on future withdrawals. Over decades, tax savings compound significantly.

Taxable Brokerage Accounts

- No contribution limits

- No withdrawal restrictions

- Capital gains taxed (preferentially if held > 1 year)

- Best for goals beyond retirement or after maxing tax-advantaged accounts

Recommended approach: Max out tax-advantaged accounts first, then use taxable accounts for additional investing.

Step 4: Select Investments

For most beginners, low-cost index funds and ETFs provide optimal risk-adjusted returns with minimal effort.

Index Funds: The Beginner’s Best Friend

Index funds track market benchmarks (S&P 500, total stock market, total bond market) rather than attempting to beat them.

Advantages:

- Lower costs: Expense ratios as low as 0.03%–0.10% (compared to 1%+ for actively managed funds)

- Broad diversification: A Single fund provides exposure to hundreds or thousands of companies

- Consistent performance: Matches market returns, which historically outperform most active managers

- Simplicity: No need to research individual stocks or time markets

Recommended core holdings for beginners:

- Total U.S. Stock Market Index (e.g., VTSAX, VTI): Broad exposure to the entire U.S. equity market

- Total International Stock Index (e.g., VTIAX, VXUS): Diversification beyond U.S. borders

- Total Bond Market Index (e.g., VBTLX, BND): Fixed income for stability and income

Sample beginner portfolio (moderate risk):

- 50% U.S. stocks

- 20% International stocks

- 30% Bonds

Target-date funds: All-in-one funds that automatically adjust allocation based on the target retirement year. Ideal for hands-off investors.

Step 5: Implement Dollar-Cost Averaging

Rather than investing a lump sum, commit to regular contributions:

- Set up automatic transfers from checking to investment account

- Invest the same amount monthly or with each paycheck

- Never try to time the market—consistency beats timing

Example: $500 monthly invested at 8% annual returns accumulates to approximately $730,000 over 30 years.

Step 6: Monitor, Rebalance, and Stay the Course

Quarterly or annual reviews:

- Check account balances and performance

- Rebalance if allocations drift significantly

- Increase contributions as income grows

- Resist the urge to panic during downturns

The most common investing mistake: Selling during market declines. According to DALBAR’s Quantitative Analysis of Investor Behavior, the average investor significantly underperforms market returns due to poor timing decisions driven by emotion.

Insight: Smart moves in investing often mean doing nothing—staying invested, ignoring short-term noise, and trusting the process.

Common Investing Mistakes to Avoid

Even experienced investors make errors. Awareness prevents costly mistakes.

Trying to Time the Market

Market timing—attempting to buy at bottoms and sell at tops—is extraordinarily difficult. Even professional fund managers consistently fail.

Why it fails: Markets move unpredictably in the short term. Missing just the 10 best days over 20 years can cut total returns nearly in half.

Better approach: Stay invested, use dollar-cost averaging, and focus on time in the market rather than timing the market.

Chasing Performance

Performance chasing—buying last year’s top-performing funds or stocks—leads to buying high and selling low.

Why it fails: Past performance doesn’t predict future results. Assets that surged often revert to the mean, while underperformers rebound.

Better approach: Invest in diversified, low-cost index funds regardless of recent performance. Consistency beats speculation.

Paying Excessive Fees

High fees erode returns dramatically over time. A 1% annual fee may seem small, but over 30 years, it can consume 25%+ of total portfolio value.

Example:

- Portfolio A: $500 monthly, 8% return, 0.10% fee = $710,000 after 30 years

- Portfolio B: $500 monthly, 8% return, 1.00% fee = $610,000 after 30 years

- Cost of fees: $100,000

Better approach: Prioritize low-cost index funds and ETFs with expense ratios below 0.20%.

Lack of Diversification

Concentration risk—holding too much in a single stock, sector, or asset class—exposes portfolios to catastrophic losses.

Historical examples: Enron employees lost retirement savings when company’s stock collapsed. Tech investors lost 70%+ during the dot-com crash.

Better approach: Diversify across asset classes, sectors, geographies, and time (dollar-cost averaging).

Emotional Decision-Making

Fear and greed drive poor decisions:

- Fear: Selling during downturns locks in losses

- Greed: Chasing speculative assets leads to buying at peaks

Better approach: Establish a written investment plan, automate contributions, and commit to ignoring short-term market movements.

Ignoring Taxes

Tax inefficiency—holding tax-inefficient investments in taxable accounts—unnecessarily increases tax liability.

Better approach:

- Hold stocks in taxable accounts (preferential long-term capital gains rates)

- Hold bonds and REITs in tax-advantaged accounts (ordinary income tax rates)

- Tax-loss harvest in taxable accounts to offset gains

Takeaway: Avoiding mistakes matters as much as making smart decisions. Discipline, consistency, and simplicity beat complexity and speculation.

The Psychology of Investing: Mastering the Mental Game

Behavioral finance: the study of how psychology affects financial decisions, reveals that emotions, biases, and cognitive errors often sabotage investment success.

Common Psychological Biases

Loss Aversion

People feel the pain of losses roughly twice as intensely as the pleasure of equivalent gains. This leads to:

- Selling winners too early (to “lock in” gains)

- Holding losers too long (to avoid realizing losses)

- Avoiding stocks entirely due to fear of declines

Solution: Focus on long-term goals, not short-term account fluctuations. Understand that temporary declines are the price of superior long-term returns.

Recency Bias

Investors are overweight recent events when predicting the future:

- After bull markets, they expect continued gains and buy aggressively

- After bear markets, they expect continued losses and sell or avoid stocks

Solution: Study long-term historical data. Markets are cyclical. Recessions and bear markets always end; bull markets always resume.

Confirmation Bias

Investors seek information that confirms existing beliefs and ignore contradictory evidence.

Solution: Actively seek opposing viewpoints. Challenge assumptions. Base decisions on data, not narratives.

Overconfidence

Many investors believe they can outperform markets through superior stock picking or timing.

Reality: Over 90% of actively managed funds underperform their benchmarks over 15-year periods, according to S&P Dow Jones Indices.

Solution: Embrace humility. Accept that consistent outperformance is extraordinarily difficult. Focus on what’s controllable: costs, diversification, discipline.

Building Emotional Resilience

Strategies for maintaining discipline:

- Automate everything: Set up automatic contributions and rebalancing to remove emotion

- Limit account checking: Quarterly reviews suffice; daily monitoring increases anxiety and impulsive decisions

- Focus on process, not outcomes: Control what’s controllable (savings rate, asset allocation, costs), accept that markets are uncontrollable

- Maintain perspective: Zoom out. View portfolios on 5-year charts, not daily movements

- Educate continuously: Understanding why the stock market goes up over time builds confidence during downturns

Insight: Successful investing is 90% behavior, 10% knowledge. The investor who earns 8% and stays invested outperforms the investor who earns 12% but panics and sells during downturns.

Advanced Concepts: Deepening Your Understanding

As investing knowledge grows, several advanced concepts become relevant.

Tax-Efficient Investing Strategies

Tax optimization can add 1%–2% to annual after-tax returns—a massive difference over decades.

Key strategies:

- Asset location: Place tax-inefficient assets (bonds, REITs) in tax-advantaged accounts; hold stocks in taxable accounts

- Tax-loss harvesting: Sell losing positions to offset gains, reducing tax liability

- Long-term capital gains: Hold investments > 1 year to qualify for preferential tax rates (0%, 15%, or 20% vs. ordinary income rates up to 37%)

- Roth conversions: Convert traditional IRA assets to Roth during low-income years to lock in low tax rates

- Qualified dividends: Prioritize stocks paying qualified dividends (taxed at capital gains rates, not ordinary income rates)

Understanding Valuation Metrics

Valuation determines whether an asset is overpriced, underpriced, or fairly priced.

Key metrics:

- Price-to-Earnings (P/E) Ratio: Stock price divided by earnings per share. A higher P/E suggests higher growth expectations or overvaluation.

- Price-to-Book (P/B) Ratio: Stock price divided by book value (net assets). Value investors favor low P/B stocks.

- Dividend Yield: Annual dividend divided by stock price. Higher yields suggest an income focus or potential value.

- Free Cash Flow: Cash generated after capital expenditures. Strong free cash flow indicates financial health.

Application: While beginners should focus on index funds, understanding valuation helps contextualize market conditions and avoid speculation.

The Role of Passive Income

Passive income earnings requiring minimal ongoing effort accelerate wealth building and financial independence.

Investment sources of passive income:

- Dividend stocks: Regular cash distributions from profitable companies

- Bonds: Interest payments

- Real estate: Rental income

- REITs: Dividend distributions from property portfolios

Compounding passive income: Reinvesting dividends and interest accelerates portfolio growth. A $100,000 portfolio yielding 3% and reinvesting dividends grows to approximately $325,000 over 20 years at 6% total return, compared to $280,000 without reinvestment.

Rebalancing Strategies

Rebalancing methods:

- Calendar-based: Rebalance annually or quarterly regardless of drift

- Threshold-based: Rebalance when allocations drift 5%+ from targets

- Hybrid: Review quarterly, rebalance only if thresholds are breached

Tax considerations: In taxable accounts, rebalancing triggers capital gains taxes. Strategies to minimize:

- Use new contributions to buy underweighted assets

- Rebalance within tax-advantaged accounts first

- Tax-loss harvest to offset rebalancing gains

Takeaway: Advanced strategies can enhance returns, but beginners should master fundamentals first. Simplicity and consistency trump complexity.

Building a Personalized Investment Plan

A written investment plan transforms abstract knowledge into concrete action.

Components of an Effective Investment Plan

1. Financial Goals

- Specific, measurable objectives (e.g., “$1 million retirement portfolio by age 65”)

- Time horizons for each goal

- Required savings and return rates

2. Risk Tolerance Assessment

- Emotional capacity to withstand volatility

- Financial capacity to absorb losses

- Time horizon (longer horizons allow higher risk)

3. Asset Allocation Strategy

- Target percentages for each asset class

- Rationale for allocation choices

- Plan for adjusting allocation over time

4. Investment Selection

- Specific funds or securities

- Expense ratios and costs

- Diversification across asset classes, sectors, and geographies

5. Contribution Schedule

- Monthly or per-paycheck contribution amounts

- Automatic transfer setup

- Plan for increasing contributions as income grows

6. Rebalancing Protocol

- Frequency (annual, quarterly)

- Thresholds for action (5% drift)

- Method (new contributions, selling/buying)

7. Review and Adjustment Process

- Annual comprehensive reviews

- Triggers for plan modifications (job change, marriage, children)

- Commitment to staying the course during volatility

Sample Investment Plan (Age 30, Moderate Risk)

Goal: Accumulate $2 million by age 65 for retirement

Time Horizon: 35 years

Risk Tolerance: Moderate—can tolerate 30% portfolio declines

Asset Allocation:

- 70% Stocks (50% U.S., 20% International)

- 25% Bonds (Total bond market)

- 5% Real Estate (REIT index)

Investment Vehicles:

- Vanguard Total Stock Market Index (VTSAX)

- Vanguard Total International Stock Index (VTIAX)

- Vanguard Total Bond Market Index (VBTLX)

- Vanguard Real Estate Index (VGSLX)

Contribution Strategy:

- $1,000 monthly automatic investment

- Increase contributions 3% annually with raises

- Maximize Roth IRA ($7,000/year), then taxable brokerage

Rebalancing: Annual review each January, rebalance if allocations drift >5%

Review Schedule: Comprehensive annual review each birthday, adjust allocation toward bonds starting at age 50

Insight: A written plan provides clarity, accountability, and an emotional anchor during market turbulence. It transforms investing from reactive to proactive.

Resources for Continued Learning

Investing mastery requires continuous education. Quality resources accelerate learning.

Recommended Books

- “The Intelligent Investor” by Benjamin Graham: Classic value investing principles

- “A Random Walk Down Wall Street” by Burton Malkiel: Evidence for index investing

- “The Little Book of Common Sense Investing” by John Bogle: Index fund philosophy from Vanguard’s founder

- “Your Money or Your Life” by Vicki Robin: Financial independence and intentional living

- “The Psychology of Money” by Morgan Housel: Behavioral finance and wealth-building mindset

Trusted Online Resources

- Investopedia: Comprehensive financial education and definitions

- Morningstar: Fund research, analysis, and portfolio tools

- The Rich Guy Math Blog: Data-driven analysis of investing, wealth-building, and financial decision-making

- Bogleheads Forum: Community of index investing advocates

- SEC Investor Education: Regulatory guidance and investor protection information

Courses and Certifications

- Khan Academy Personal Finance: Free, comprehensive financial education

- Coursera/edX Finance Courses: University-level instruction from top institutions

- CFA Institute: Professional-level investment education (advanced)

Takeaway: Investing knowledge compounds like returns. Consistent learning builds expertise, confidence, and better decision-making over time.

Interactive HTML Element

💰 Investment Growth Calculator

See how your money can grow over time with consistent investing

📊 Your Investment Projection

Conclusion: Taking the First Step Toward Financial Independence

What is investing? It’s the systematic deployment of capital into assets that generate returns over time—the most reliable path to building wealth, achieving financial independence, and securing long-term prosperity.

The math is unambiguous. Investors who start early, contribute consistently, diversify broadly, minimize costs, and maintain discipline accumulate wealth that transforms lives. Those who delay, speculate, chase performance, or succumb to fear and greed struggle to build meaningful financial security.

The difference between these outcomes isn’t intelligence, luck, or access to secret strategies. It’s understanding the fundamental principles outlined in this guide and acting on them consistently over decades.

Your Next Steps

This week:

- Open an investment account (IRA or taxable brokerage)

- Set up automatic monthly contributions

- Select one low-cost target-date fund or three-fund portfolio (U.S. stocks, international stocks, bonds)

This month:

- Calculate retirement needs and required savings rate

- Maximize employer 401(k) match

- Create a written investment plan

This year:

- Increase savings rate with each raise

- Read two investing books from the recommended list

- Conduct annual portfolio review and rebalance

Over your lifetime:

- Stay invested through market cycles

- Ignore short-term noise and media panic

- Trust the process and let compounding work

The journey from financial uncertainty to financial independence begins with a single decision: to invest. The best time to start was twenty years ago. The second-best time is today.

Understanding what investing is provides the foundation. Taking action builds wealth. The math works for everyone willing to apply it.

About the Author

Written by Max Fonji, founder of TheRichGuyMath.com, a finance educator and investor who explains the “math behind money” in simple, actionable terms. With experience in investment strategy, personal finance, and wealth-building systems, Max helps readers understand how financial decisions create lasting results. His evidence-based approach combines data analysis with clear teaching to demystify investing and empower individuals to build meaningful wealth.

Disclaimer

Disclaimer: The content on TheRichGuyMath.com is for educational purposes only and does not constitute financial or investment advice. Markets involve risk, and past performance does not guarantee future results. Always consult a qualified financial professional before making investment decisions. The author and website assume no responsibility for investment outcomes based on information presented in this article

FAQ

What is investing?

Investing is the process of allocating money into assets such as stocks, bonds, or real estate with the expectation of generating returns through appreciation, income, or both over time.

Why does investing matter for individuals?

Investing matters because it’s the only reliable method to outpace inflation and build meaningful wealth over time. While savings accounts preserve capital, they rarely generate real returns after accounting for inflation and taxes. Investing in appreciating assets historically delivers 7%–10% annual returns, transforming modest contributions into substantial portfolios through compounding.

How can someone start investing as a complete beginner?

Beginners should start by establishing an emergency fund, eliminating high-interest debt, and opening a tax-advantaged account (IRA or 401(k)). Then, invest in low-cost index funds or target-date funds, set up automatic monthly contributions, and maintain discipline by staying invested regardless of short-term market fluctuations. Focus on time in the market, not timing the market.