What Really Moves the Stock Market? (With Visual Explanation)

The stock market doesn’t rise or fall randomly. It moves based on a powerful mix of data, emotions, news, and expectations. If you’ve ever wondered why the market suddenly drops or surges, you’re not alone. In this article, you’ll learn the most important forces behind stock market movements—clearly and simply—so you can invest with confidence.

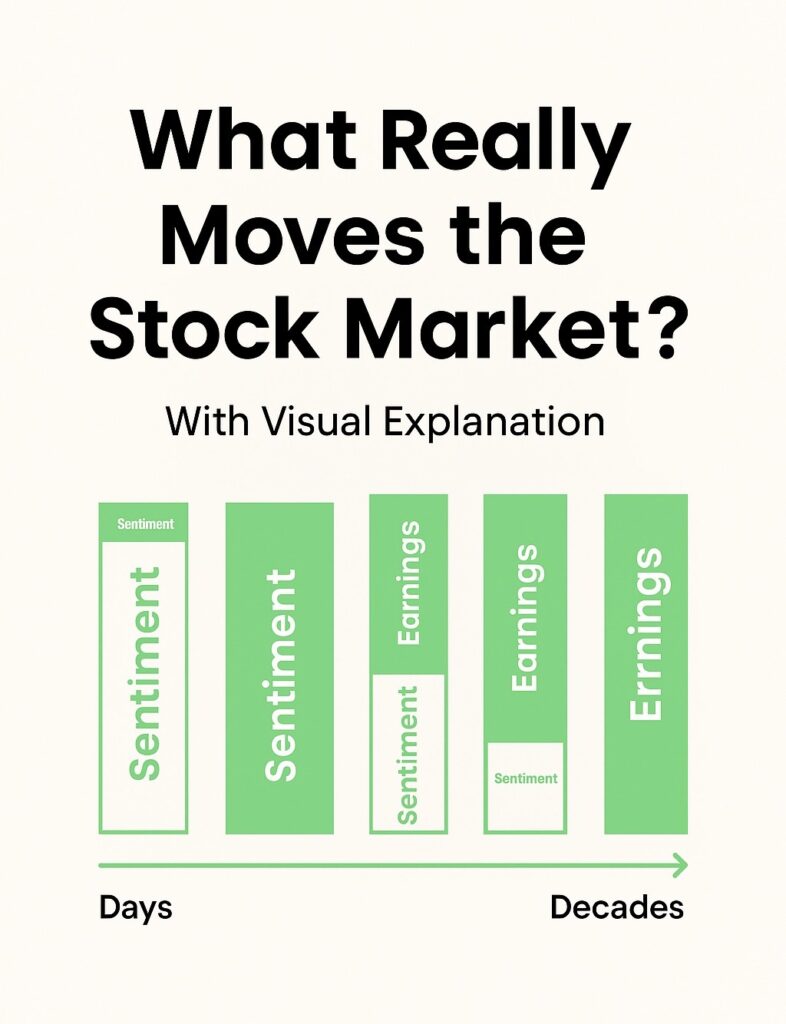

When it comes to investing, understanding what moves the stock market is crucial for long-term success. Many new investors believe that headlines and hype are the biggest drivers of stock prices. While that’s partially true in the short term, the long-term reality is very different.

What Moves the Stock Market?

- Investor Sentiment: Fear and greed create big market swings.

- Economic Data: Reports on inflation, interest rates, and jobs shape investor outlook.

- Company Earnings: Stocks rise or fall based on business performance.

- Global Events: News like elections, wars, or pandemics can shock the market.

- Federal Reserve Policy: Interest rate decisions directly influence market direction.

In this post, we’ll break down how sentiment and earnings influence stock prices over different timeframes—and why smart investors focus on the big picture.

Sentiment Dominates the Short Term

In the early days or weeks of market activity, investor sentiment is the dominant force. Market sentiment is driven by:

- Breaking news

- Economic reports

- Social media buzz

- Market speculation

- Fear and greed

This is why a stock might drop 10% in a single day, even if nothing has changed fundamentally. Emotions drive short-term volatility, not business performance.

Earnings Drive the Long Term

Over months and especially decades, the true engine behind stock prices becomes clear: company earnings.

As the graphic above illustrates, earnings play an increasingly larger role over time. Why?

Because over time:

- Profits compound.

- Strong businesses outperform.

- Valuations normalize.

- Fundamentals win.

Smart investors—like Warren Buffett—look past short-term noise and focus on earnings growth and long-term business performance.

What the Federal Reserve Has to Do with Stock Prices

The Federal Reserve (the Fed) influences the economy by raising or lowering interest rates. Here’s how that affects stocks:

- Higher rates → borrowing becomes expensive → stocks often fall

- Lower rates → borrowing is cheaper → stocks often rise

- When the Fed speaks, the market listens—and reacts quickly.

Why Economic Reports Matter to the Market

Investors pay close attention to government reports, such as:

- Inflation numbers (CPI/PPI)

- Unemployment rates

- GDP growth

- Interest rate announcements

These data points help predict how the economy—and corporate earnings—will perform, which affects stock values.

Why This Matters to You

If you’re a beginner investor or looking to build long-term wealth, the key takeaway is simple:

Don’t let short-term market sentiment scare you out of great investments.

Focus instead on:

- Companies with strong, growing earnings

- Diversified index funds like VTI or SCHD

- A long-term strategy and consistent investing habits

Final Thoughts: Understanding Market Movers Helps You Stay Calm

The stock market reacts to a mix of facts and feelings. Instead of guessing its next move, focus on what you can control: invest consistently, stay informed, and think long term. Understanding these core drivers will help you stay calm—even when the market isn’t. Understanding what moves the stock market is a powerful mindset shift. In the short run, it’s all about sentiment. But in the long run, earnings are what matter most.

Stay focused. Stay consistent. And let time do the heavy lifting.

Internal Links:

Investor sentiment, economic data, earnings reports, news events, and Federal Reserve policy.

News influences investor expectations about the economy or companies, which causes buying or selling.

The Fed raises or lowers interest rates, which affects borrowing, business profits, and investor behavior.

Yes. Market psychology—like fear or euphoria—can lead to irrational buying or selling in the short term.