Most people believe paying their credit card bills early will hurt their credit score. Others think making multiple payments looks suspicious. Some even carry a balance intentionally, convinced it helps build credit faster.

All three beliefs are wrong.

The truth about when to pay your credit card is simpler than most people realize: You don’t build credit by spending more money. You build credit by controlling what gets reported to the credit bureaus.

Your credit score doesn’t see your daily spending habits or your payment frequency. It sees a single snapshot—the balance your card issuer reports once per month. Understanding when that snapshot happens changes everything about how you manage credit cards.

This article explains the exact timing strategy that reduces your reported utilization, protects your payment history, and improves your credit score, all without spending an extra dollar. For a complete foundation on how credit works, start with our complete credit basics guide.

Key Takeaways

- Your statement closing date determines what balance gets reported to credit bureaus—not your due date or payment date.

- The two-payment method works best: Pay most of your balance before the statement date, then pay the remainder before the due date.

- Credit utilization above 30% damages your score, but paying early keeps your reported balance low.

- Payment history accounts for 35% of your credit score—missing the due date by even one day can trigger late fees and damage.

- Carrying a balance does not help your credit score—it only costs you interest while providing zero scoring benefit.

Why Timing Matters More Than Amount

Credit cards are not judged by how much you pay. They are judged by what the bank reports.

Most people focus on paying their bills in full each month. That’s important for avoiding interest charges, but it doesn’t directly control what appears on your credit report.

The hidden truth: Your credit score sees a snapshot, not your daily balance.

Every month, your credit card issuer reports one number to the three major credit bureaus (Experian, Equifax, and TransUnion). That number is your balance on a specific day—usually your statement closing date.[1]

If your balance is high on that day, your credit utilization ratio appears high. If your balance is low, your utilization appears low. The credit bureaus don’t know what happened before or after that snapshot.

This creates a simple opportunity: Pay down your balance before the snapshot happens, and your credit report will show a lower utilization—even if you spend heavily throughout the month.

The amount you pay matters for avoiding interest. The timing of when you pay matters for your credit score.

The Three Dates You Must Understand

Credit card billing operates on three critical dates. Most people only know about one of them.

Statement Closing Date

This is the day your billing cycle ends, and your balance gets locked in for that month’s statement.

More importantly, this is typically the day your card issuer reports your balance to the credit bureaus.[2]

Your statement closing date appears on every credit card statement, usually at the top. It might say “Statement Date,” or “Closing Date,” or “Statement Period Ending.”

If your statement closing date is March 25th, your card issuer will report whatever balance you have on March 25th to the credit bureaus. That reported balance determines your credit utilization ratio for that month.

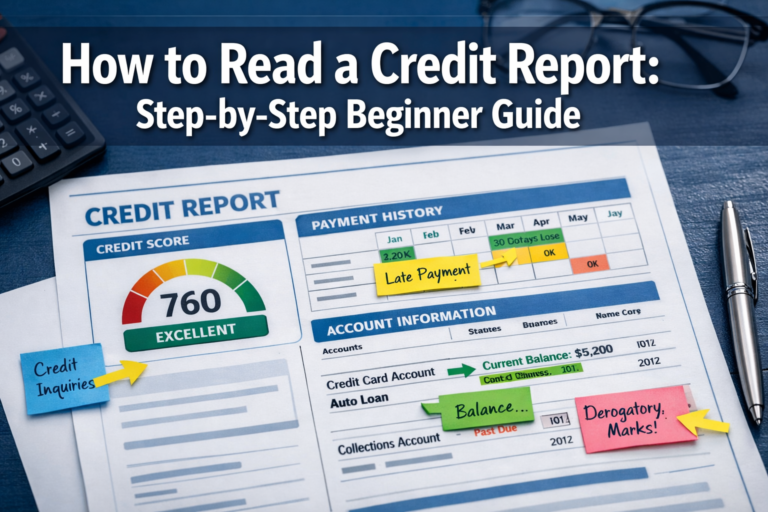

For more details on how this information appears and what else gets reported, read our credit report guide.

Payment Due Date

This is the deadline for making at least your minimum payment.

What it affects: Interest charges and late fees.

If you pay your full statement balance by the due date, you avoid interest charges entirely. If you pay at least the minimum by the due date, you avoid late fees and credit damage.

What it doesn’t affect: Your credit score (unless you miss it).

The due date typically falls 21-25 days after your statement closing date.[1] This gap is called the grace period.

Paying by the due date protects you from fees and interest. But if your balance was already reported high on the statement date, paying by the due date won’t fix the utilization that already appeared on your credit report.

Reporting Date

This is the day your card issuer actually transmits your balance information to the credit bureaus.

For most credit cards, the reporting date is the same as the statement closing date.[1] But not always.

Some issuers report a few days after the statement closes. Others report on a fixed day each month, regardless of your statement date.

The practical reality: Unless you call your card issuer and ask specifically, assume your reporting date matches your statement closing date. This assumption will be correct 90% of the time and keeps your strategy simple.

Statement Date vs Due Date

These two dates control different outcomes. Confusing them costs people points on their credit scores every month.

| Date | What It Affects |

|---|---|

| Statement closing date | Credit score (determines reported balance and utilization) |

| Payment due date | Interest charges and late fees (determines whether you pay interest or incur penalties) |

Visual explanation:

Imagine your billing cycle runs from February 1st to February 28th. Your statement closing date is February 28th. Your payment due date is March 25th.

On February 28th, you have a $500 balance. Your card issuer reports “$500” to the credit bureaus that day. Your credit report now shows $500 in utilization.

On March 20th, you pay the full $500. You paid before the due date, so you avoided interest. But the credit bureaus already received the $500 report on February 28th. Your credit score already calculated your utilization based on that $500.

The lesson: Paying before the due date protects you from fees. Paying before the statement date protects your credit score.

For a deeper comparison of these two critical dates, see our guide on statement date vs due date.

The Best Strategy: When to Pay Your Credit Card Using the Two-Payment Method

The optimal timing strategy uses two payments per billing cycle.

Step 1: Pay Most of Your Balance Before the Statement Closing Date

Check your current balance 3-5 days before your statement closes.

Calculate how much you need to pay to bring your balance below 10% of your credit limit. (Keeping utilization under 10% produces the best credit scores, though staying under 30% is the minimum threshold.)[1][2]

Make that payment. It will post within 1-3 business days, which is why you should check early.

Example: You have a $2,000 credit limit. Your statement closes on the 25th of each month. On the 22nd, you check your balance and see $800.

To get below 10% utilization, you need your balance under $200. You pay $600 on the 22nd.

On the 25th (statement closing date), your balance is $200. Your card issuer reports “10% utilization” to the credit bureaus.

Step 2: Pay the Remaining Balance Before the Due Date

After your statement closes, you’ll receive a statement showing your remaining balance (in the example above, $200).

Pay this amount before the due date to avoid interest charges.

Why this works:

- Low utilization gets reported (helps your credit score)

- You pay zero interest (helps your wallet)

- You maintain a perfect payment history (the most important scoring factor)[3]

This two-payment method takes advantage of the timing gap between the statement date and the due date. You control what gets reported, then you avoid interest charges.

For a complete understanding of how utilization affects your score and why keeping it low matters, read our guide on the credit utilization ratio basics.

Example: When to Pay Your Credit Card for Maximum Score Impact

Numbers make the strategy clear.

Scenario:

- Credit limit: $1,000

- Amount spent during the month: $400

- Statement closing date: 15th of each month

- Payment due date: 10th of the following month

Wrong Behavior (Score Drops)

You spend $400 throughout the month. On the 15th (statement date), your balance is $400.

Your card issuer reports $400 to the credit bureaus. Your utilization is 40% ($400 ÷ $1,000).

On the 8th of the next month, you pay the full $400 before the due date.

Result: You avoided interest, but your credit report shows 40% utilization for that month. Utilization above 30% damages credit scores.[1][2]

Correct Behavior (Score Rises)

You spend $400 throughout the month. On the 12th (three days before the statement date), you pay $350.

On the 15th (statement date), your balance is $50.

Your card issuer reports $50 to the credit bureaus. Your utilization is 5% ($50 ÷ $1,000).

On the 8th of the next month, you pay the remaining $50 before the due date.

Result: You avoided interest, AND your credit report shows 5% utilization. Your credit score improves or maintains its high level.

The difference: Same spending, same total payments, but the timing of the first payment changed what got reported. That timing difference can shift your credit score by 20-40 points.

Should You Pay in Full or Carry a Balance?

This myth refuses to die: “You need to carry a balance to build credit.”

The truth: Carrying a balance does NOT help your credit score. It only costs you money in interest.[1]

Credit scoring models evaluate five factors:

- Payment history (35%)

- Credit utilization (30%)

- Length of credit history (15%)

- Credit mix (10%)

- New credit inquiries (10%)[3][5]

None of these factors rewards you for paying interest. None of these factors even measures whether you carry a balance month-to-month.

What credit scoring models actually see:

- Did you pay at least the minimum by the due date? (Payment history)

- What balance was reported on your statement date? (Utilization)

Paying your balance in full every month gives you a perfect payment history while avoiding interest charges. Carrying a balance gives you the same payment history while costing you 15-25% APR in interest charges.

The math is simple: Pay in full, every month, before the due date. If you want to optimize your credit score, make an additional payment before the statement date to lower your reported utilization.

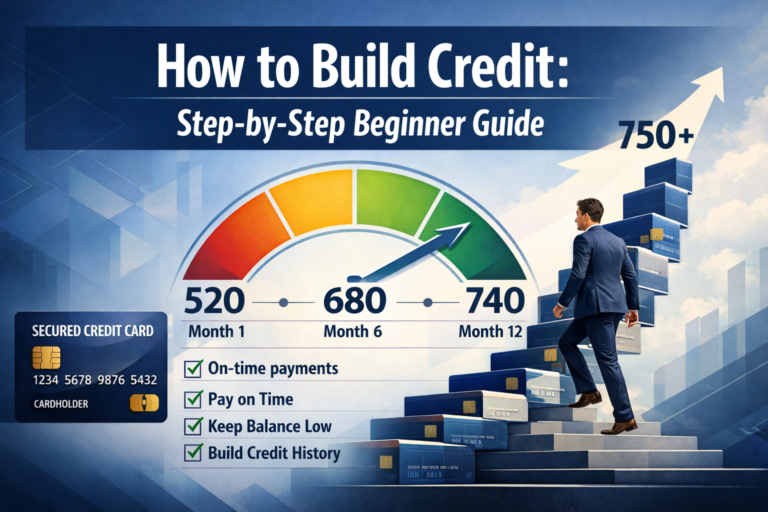

For comprehensive strategies on building credit the right way, see our complete guide on how to build credit.

What Happens If You Only Pay the Minimum

Paying only the minimum payment keeps your account in good standing. You avoid late fees, and your payment history stays clean.

But minimum payments create two problems:

Problem 1: Interest Compounds Against You

Credit card interest compounds daily. When you carry a balance, you pay interest on your purchases, then you pay interest on that interest.

Example: You have a $2,000 balance at 20% APR. Your minimum payment is $40 (2% of the balance).

If you pay only the minimum each month:

- Month 1: You pay $40. Interest charges add $33. Your new balance is $1,993.

- Month 2: You pay $40. Interest charges add $33. Your new balance is $1,986.

It will take you 7+ years to pay off the balance and cost you over $2,000 in interest—more than the original purchase amount.

Problem 2: High Utilization Stays High

If you only pay the minimum, your balance decreases very slowly. Your reported utilization stays high month after month, continuously damaging your credit score.

The takeaway: Minimum payments prevent immediate damage (late fees, missed payments), but they create long-term damage (interest costs, high utilization). Always pay more than the minimum when possible.

How Often Should You Pay Your Credit Card

Payment frequency is flexible. Credit card issuers don’t penalize you for paying early or paying often.

Once Per Month (Safe)

Pay your full statement balance once per month, before the due date.

This approach:

- Avoids interest charges

- Maintains perfect payment history

- Requires minimal effort

Limitation: Your reported utilization depends entirely on your balance on the statement date. If you spend heavily right before the statement closes, your utilization will appear high.

Twice Per Month (Optimal)

Pay once before the statement date (to lower reported utilization) and once before the due date (to avoid interest).

This is the two-payment method explained earlier. It gives you control over both your credit score and your interest charges.

Multiple Payments (Allowed)

You can pay your credit card daily, weekly, or whenever you want.

Some people pay immediately after each purchase to keep their balance at zero. This strategy works, but it requires significant time and attention.

Clarification: Banks do NOT penalize early payments. Your card issuer doesn’t care if you pay once per month or twenty times per month. Payment frequency has zero negative impact on your credit score.

The only consideration is your own time. More frequent payments give you more control over your reported balance, but they also require more active management.

Common Mistakes That Hurt Credit Scores

Small timing errors create measurable score damage. Avoid these four mistakes:

Mistake 1: Paying After the Statement Date

Many people wait until they receive their statement, then pay immediately.

The problem: By the time you receive your statement (usually 3-5 days after it closes), your balance has already been reported. Paying at that point doesn’t change what the credit bureaus received.

The fix: Pay before the statement closes, not after.

Mistake 2: Maxing Out Your Card Before the Reporting Date

Even if you plan to pay it off, letting your balance reach your credit limit creates 100% utilization.

If your statement closes while your balance is maxed out, that 100% utilization gets reported—even if you pay it off the next day.

The fix: Monitor your balance throughout the month. If it approaches 30% of your limit, make an early payment before the statement closes.

Mistake 3: Closing Your Card Immediately After Paying It Off

Paying off a credit card feels like an accomplishment. Many people close the account to “finish the job.”

The problem: Closing a credit card reduces your total available credit, which increases your utilization ratio on your remaining cards. It also reduces your average age of accounts, which can lower your score.

The fix: Keep the card open and use it occasionally for small purchases. Pay it off each month. This maintains your available credit and your credit history length.

Mistake 4: Missing Autopay by One Day

Setting up autopay protects against missed payments. But if your autopay is scheduled for the due date and a bank holiday delays processing, your payment can post one day late.

Payments more than 30 days late appear on your credit report and cause serious damage.[1] Late payments can remain on your report for seven years.[1]

The fix: Set autopay to process 2-3 days before the due date, not on the due date itself. This buffer protects against processing delays.

Autopay Strategy: When to Pay Your Credit Card Automatically

Autopay prevents missed payments, which is critical because payment history represents 35% of your credit score.[3]

But autopay alone doesn’t optimize your credit score.

The Hybrid Approach

Step 1: Set autopay to pay the minimum payment, scheduled for 3 days before your due date.

This creates a safety net. If you forget to make a manual payment, autopay ensures you avoid late fees and credit damage.

Step 2: Manually pay most of your balance before the statement closing date.

This controls your reported utilization and optimizes your credit score.

Step 3: Manually pay the remaining balance before the due date (if you want to avoid interest).

If you’ve already set autopay to pay the minimum, you can adjust it to pay the full statement balance instead. But keeping it at “minimum payment” as a backup while you make manual payments gives you the most flexibility.

Aligning Due Dates With Paydays

Many credit card issuers allow you to change your due date.[1]

If you get paid on the 1st and 15th of each month, you can request that your credit card due date fall on the 5th or 20th. This gives you a few days after receiving income to make your payment.

How to change your due date: Call your card issuer or log into your online account. Most issuers allow one due date change per year at no cost.

For more details on setting up and optimizing automatic payments, see our autopay guide.

Special Situations: When to Pay Your Credit Card in Unique Scenarios

New Credit Card Users

When you first open a credit card, you may not know your statement closing date.

Solution: Log in to your online account or call customer service. Ask: “What day does my statement close each month?” Write down that date and set a calendar reminder for 3 days before it.

For your first few months, check your balance weekly. This builds awareness of your spending patterns and helps you understand how quickly your balance grows.

Small Credit Limits

If your credit limit is $300-500, even small purchases create high utilization.

Example: $300 limit, $100 purchase = 33% utilization (above the 30% threshold).

Strategy: Make weekly payments to keep your balance low throughout the month. Pay your balance down to $0-20 before your statement closes.

Small limits require more active management, but the same principles apply: Control what gets reported on your statement date.

Multiple Credit Cards

If you have 3+ credit cards, tracking multiple statement dates becomes complex.

Strategy: Create a simple spreadsheet or note with three columns:

- Card name

- Statement closing date

- Payment due date

Set calendar reminders for 3 days before each statement closing date. Pay down each card individually before its statement closes.

Alternative strategy: Some people use one card for most spending and keep the others at zero balance. This simplifies tracking but reduces your total available credit (which can increase utilization if you spend heavily on the one active card).

Quick Rule to Remember: When to Pay Your Credit Card

If you remember nothing else, remember this:

Pay before the statement date to help your score.

Pay before the due date to avoid interest.

These two rules cover 90% of the credit card timing strategy.

The statement date controls what gets reported to credit bureaus. Paying before this date keeps your utilization low.

The due date controls whether you pay interest and fees. Paying before this date keeps your costs at zero.

Everything else—payment frequency, autopay settings, utilization thresholds—builds on these two foundational rules.

Credit Card Payment Timing Calculator

Find out when to pay to optimize your credit score

Conclusion

Credit scoring is not about spending more money. It is about predictability and control.

The banks want to see that you can borrow money and pay it back consistently. Your credit score measures that predictability through five factors, with payment history and credit utilization representing 65% of the total score.

When to pay your credit card is the single timing decision that affects both of those factors:

- Pay before the statement closing date → Low utilization gets reported → Credit score improves or maintains a high level

- Pay before the due date → Perfect payment history continues → Credit score protected from damage

The two-payment method combines both strategies: One payment before the statement date (for your score), one payment before the due date (for your wallet).

This approach requires minimal effort—two payments per month, scheduled around two dates you can find on any credit card statement. But the impact is measurable: lower reported utilization, zero interest charges, and a credit score that accurately reflects your responsible credit management.

Next steps:

- Find your statement closing date (check your most recent credit card statement or call your issuer)

- Set a calendar reminder for 3 days before that date

- Check your balance on that reminder date and pay it down to below 10% of your limit

- Set autopay to cover the minimum payment as a safety net

- Monitor your credit score over the next 2-3 months to see the impact

The math behind credit scoring rewards consistency, not complexity. Understanding when to pay your credit card gives you control over what gets reported—and control over what gets reported gives you control over your credit score.

References

[1] Credit Card Bill Best Time To Pay – https://www.nerdwallet.com/credit-cards/learn/credit-card-bill-best-time-to-pay

[2] Best Time To Pay Credit Card – https://www.citi.com/credit-cards/understanding-credit-cards/best-time-to-pay-credit-card

[3] How To Improve Your Credit Score In 2026 – https://elevatecu.com/blog/how-to-improve-your-credit-score-in-2026?hsLang=en

[4] Tips To Improve Your Credit Score In 2026 – https://www.spencersavings.com/tips-to-improve-your-credit-score-in-2026/

[5] Your 2026 Credit Score Playbook: The Biggest Changes and What They Mean for You – https://www.pheplefcu.org/blogmain/2026/1/18/your-2026-credit-score-playbook-the-biggest-changes-and-what-they-mean-for-you

[6] Ways To Improve Credit – https://www.experian.com/blogs/ask-experian/ways-to-improve-credit/

[7] Watch – https://www.youtube.com/watch?v=h2XaSOp_Llk

Frequently Asked Questions

Does paying early hurt credit?

No. Paying your credit card early does not hurt your credit score. Card issuers do not penalize early payments, and credit bureaus do not track payment frequency. Paying early can actually help your score by reducing your reported utilization if you pay before the statement closing date.

Can I pay my credit card the same day I use it?

Yes. You can pay your credit card immediately after making a purchase, or even multiple times per day. There is no penalty for frequent payments. However, this strategy requires significant time and attention without providing major benefits over the simpler two-payment method.

What if I pay after the statement date?

Paying after the statement closing date still helps you avoid interest charges if you pay before the due date, but it does not change the balance already reported to the credit bureaus. The reported balance determines your utilization for that month, so paying after the statement date will not improve your score until the next reporting cycle.

Do weekends affect due dates?

If your due date falls on a weekend or bank holiday, most credit card issuers treat the next business day as the effective due date. However, to be safe, always plan to pay one to two days early to account for processing delays.

Should I leave $1 on the card?

No. Leaving a small balance does not help your credit score. Credit scoring models do not distinguish between a $0 balance and a $1 balance—both indicate low utilization. Paying your balance to zero is the best way to avoid interest charges.

Why did my score drop after paying off my card?

If your score dropped after paying off a card, the most likely cause is a change in your credit profile. Closing the account may reduce total available credit, increasing utilization on other cards, or it may affect your credit mix. Credit utilization recalculates each month based only on current balances, so temporary drops are common and usually recover quickly.