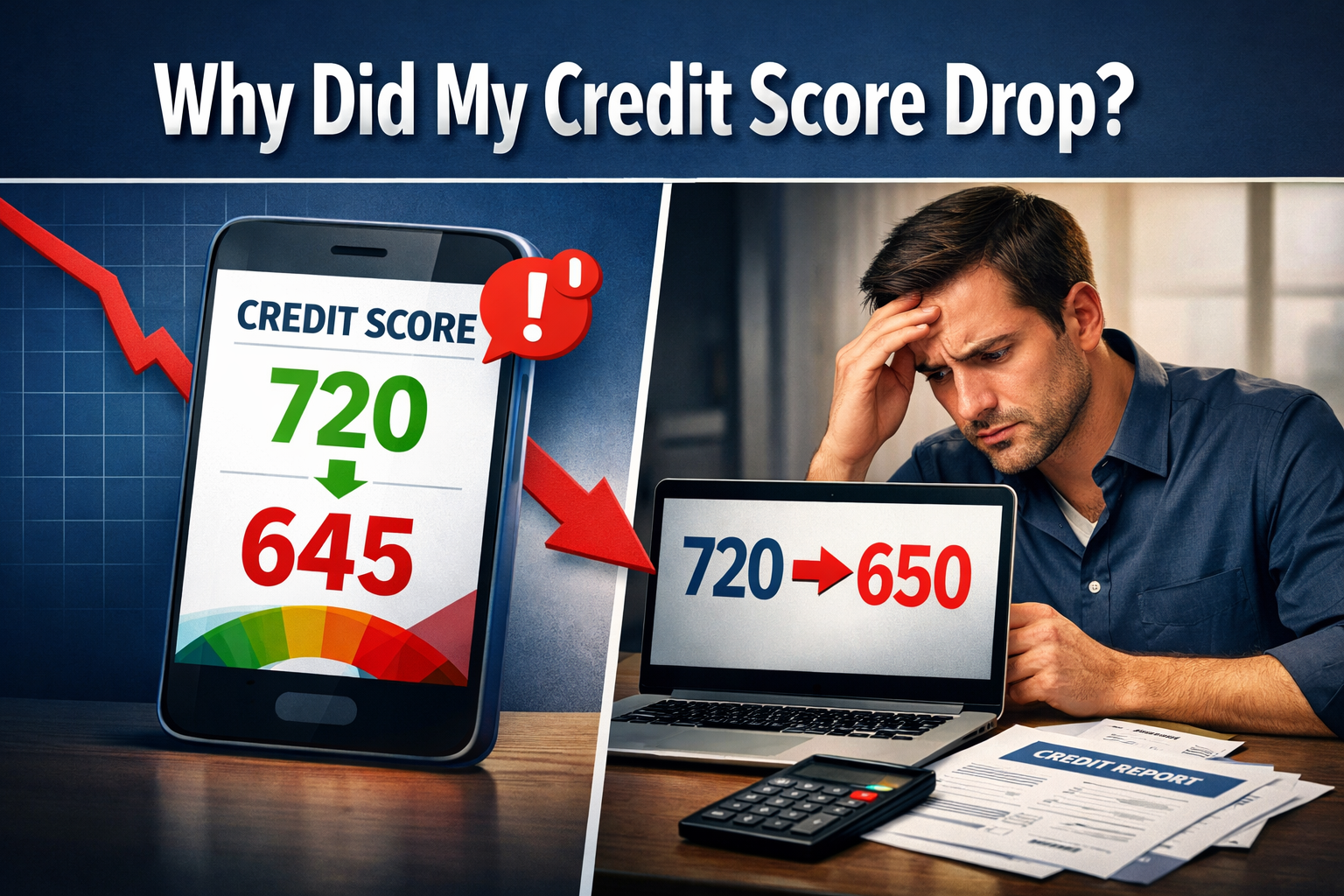

You checked your credit score, and your stomach dropped. The number fell maybe 20 points, maybe 80, maybe more, and you have no idea why.

Take a breath. You’re not alone, and this isn’t random.

Credit scores don’t change randomly. A score drop always comes from a change in your credit report. Something shifted in the data the credit bureaus track about you, and the scoring algorithm reacted.

The math behind money is logical, not mysterious. Your credit score measures one thing: how reliably you’ve managed borrowed money in the past. When that pattern changes, the score changes.

This guide explains exactly why your credit score dropped, what each cause means, and how to fix it. You’ll learn the complete credit basics that govern how scores work, what triggers drops, and how to recover faster.

By the end, you’ll understand the system well enough to prevent future surprises.

Key Takeaways

- Credit scores react to changes in your credit report—not random chance or bad luck

- Payment history and credit utilization cause the largest score drops, often 60–110 points for a single late payment

- Even positive actions like paying off loans can temporarily lower your score by changing your credit mix or account age

- Most score drops are fixable within 30–180 days through consistent behavior: lowering balances, making on-time payments, and stopping new applications

- Checking your credit report first is the only way to identify the real cause—the score is just a reaction to what’s in the report

Why Did My Credit Score Drop?

Credit scores drop when one or more of these changes appear on your credit report:

Late payment reported (30, 60, or 90 days past due)

Credit card balance increased (higher utilization ratio)

New credit application (hard inquiry added)

New account opened (average age of accounts decreased)

Credit card closed (available credit reduced)

Collection account added (unpaid debt sent to collections)

Loan paid off (credit mix or account age changed)

Credit limit decreased (utilization ratio increased)

Negative information added (charge-off, settlement, judgment)

Identity theft or reporting error (fraudulent account or inaccurate data)

Each of these triggers a recalculation of your FICO or VantageScore. The severity of the drop depends on your starting score and the type of change.

First: Check Your Credit Report Before Panicking

Your credit score is only a reaction. Your credit report contains the cause.

Think of it this way: the score is the fever, the report is the diagnosis. You can’t treat what you can’t see.

Pull your full credit report from all three bureaus (Equifax, Experian, TransUnion) at AnnualCreditReport.com—the only federally authorized free source. You’re entitled to one free report per bureau every 12 months.

Download all three reports and compare them side by side. Look for:

- New accounts you didn’t open

- Balances that increased recently

- Payment statuses marked as late

- Hard inquiries from lenders

- Accounts that closed

- Collections or public records

Understanding how to read a credit report is essential. The report lists every account, every payment, every inquiry. The score simply translates that data into a three-digit number.

Compare the report to your last statement or previous report. What changed? That’s your answer.

Once you identify the change, you can fix it. Without the report, you’re guessing.

10 Most Common Reasons Why Your Credit Score Dropped

Let’s break down each cause, why it happens, and exactly how to fix it.

1. A Late Payment Was Reported

This is the single largest score killer.

Payment history accounts for 35% of your FICO score—the biggest factor. When a creditor reports a late payment to the credit bureaus, your score drops immediately[1].

Here’s how it works:

- 30 days late: First reported late payment. Score drops 60–110 points depending on your starting score.

- 60 days late: Deeper delinquency. An additional drop of 20–40 points.

- 90+ days late: Severe delinquency. Score continues falling and may trigger a charge-off.

Even one late payment can remain on your Equifax credit report for up to 7 years, making it harder to qualify for new credit and resulting in higher interest rates when approved[1].

Why does it hurt so much?

Credit scoring models predict future behavior based on past behavior. A late payment signals increased risk. Lenders see you as less reliable.

How to fix it:

- Bring the account current immediately. Pay the past-due amount plus any late fees.

- Set up autopay for at least the minimum payment to prevent future lates.

- Write a goodwill letter to the creditor if this was your first late payment in years. Politely request removal as a one-time courtesy. It doesn’t always work, but it costs nothing to try.

- Understand what a credit report shows lenders, so you can see exactly how this late payment appears and how long it will remain.

Recovery timeline:

6–18 months of on-time payments to see meaningful improvement. The impact lessens over time as the late payment ages.

2. Your Credit Card Balance Increased

High balances trigger utilization penalties.

Credit utilization—the percentage of your available credit you’re using—accounts for 30% of your FICO score. When utilization approaches or climbs above 30% of your credit limit, it has a greater negative effect on scores[3].

Real example:

- Credit limit: $5,000

- Old balance: $500 (10% utilization)

- New balance: $3,000 (60% utilization)

- Score drop: 20–80 points

Consumers with the highest credit scores typically maintain utilization rates in the single digits[3].

Why it matters:

High utilization signals financial stress. Scoring models interpret it as increased risk—you’re leaning heavily on borrowed money.

How to fix it:

- Pay down the balance below 30% of your limit—preferably below 10%.

- Pay before the statement closing date. Your issuer reports the balance on your statement date, not your due date. Paying early reduces the reported balance.

- Request a credit limit increase (without a hard inquiry if possible). This lowers utilization even if your spending stays the same.

- Spread purchases across multiple cards to keep individual utilization low.

Learn more about the mechanics in our guide to the credit utilization ratio fundamentals.

Recovery timeline:

30–45 days. As soon as the lower balance reports to the bureaus, your score rebounds.

3. You Applied for New Credit

Hard inquiries signal credit-seeking behavior.

When you apply for a new loan or credit card, the lender pulls your credit report—a hard inquiry. Each hard inquiry can cause a temporary credit score decline of 3–10 points[1].

Why does it happen?

Scoring models interpret new credit applications as increased risk. People who apply for multiple accounts in a short period statistically default more often.

Important exception:

Multiple inquiries for the same type of loan (auto, mortgage, student) within a 14–45 day window count as a single inquiry. This allows rate shopping without penalty.

How to fix it:

- Stop applying for new credit until your score recovers.

- Only apply when necessary. Each application matters.

- Understand the difference between hard vs soft inquiry, soft inquiries (like checking your own score) don’t affect your credit.

Recovery timeline:

3–6 months. Hard inquiries remain on your report for 2 years, but stop affecting your score after 12 months. The impact fades quickly.

4. You Opened a New Account

New accounts lower your average account age.

When you open a new credit account, two things happen:

- Your average age of accounts decreases.

- You add a hard inquiry (covered above).

Length of credit history accounts for 15% of your FICO score. A shorter average age signals less experience managing credit.

Example:

- Old average age: 8 years (across 4 accounts)

- New account age: 0 years

- New average age: 6.4 years (across 5 accounts)

The drop is usually modest—10–20 points—but it’s real.

How to fix it:

Do nothing. Time heals this automatically. Keep the account open and in good standing. As it ages, your average age increases.

Pro tip:

This is why closing old accounts hurts (see #5). Older accounts raise your average age. Protect them.

Recovery timeline:

6–12 months as the new account ages and on-time payments accumulate.

5. You Closed a Credit Card

Closing accounts reduces available credit and can lower the average age.

This surprises many people. Closing a credit card, even one you don’t use, can drop your score.

Here’s why:

- Your total available credit decreases. If you carry balances on other cards, your overall utilization ratio increases.

- Your average age of accounts may drop if you close an old account (though FICO continues counting closed accounts in age calculations for 10 years; VantageScore does not).

Example:

- Total credit limit: $10,000 (across 3 cards)

- Total balance: $2,000 (20% utilization)

- You close a card with a $3,000 limit

- New total limit: $7,000

- New utilization: 28.6%

Your utilization jumped without spending a dollar.

How to fix it:

- Keep old accounts open even if you don’t use them. Put a small recurring charge on the card and set autopay.

- If you already closed an account, pay down balances on remaining cards to lower utilization.

- Understand how revolving credit accounts work to manage your available credit strategically.

Recovery timeline:

30–60 days once balances adjust and utilization drops.

6. A Collection Account Appeared

Unpaid debts sent to collections devastate scores.

When you don’t pay a bill—medical, utility, phone, credit card—the original creditor may sell or assign the debt to a collection agency. The collection account appears on your credit report as a serious delinquency.

Typical score drop: 80–150 points.

Collections signal severe financial distress. Lenders view them as high-risk red flags.

How to fix it:

- Verify the debt first. Request written validation from the collection agency. Ensure the debt is yours, the amount is correct, and it’s within the statute of limitations.

- Negotiate a pay-for-delete agreement if possible. Some collectors will remove the entry if you pay in full. Get it in writing before paying.

- Dispute inaccurate collections with the credit bureaus. If the collector can’t verify, the bureau must remove it.

- Pay the debt even if the collector won’t delete it. Paid collections hurt less than unpaid collections.

Important:

Medical collections under $500 no longer appear on credit reports as of 2023 (FICO 9 and VantageScore 3.0/4.0). Paid medical collections are also excluded.

Recovery timeline:

1–2 years for meaningful improvement. Collections remain on your report for 7 years from the original delinquency date.

7. A Loan Was Paid Off

This one shocks people: paying off debt can temporarily lower your score.

When you pay off an installment loan (auto, personal, student), two things change:

- Your credit mix changes. FICO rewards a mix of revolving credit (cards) and installment credit (loans). Losing an installment account can drop your score 5–15 points.

- The account stops reporting active payment history. You lose the positive impact of monthly on-time payments.

- The average age of accounts may decrease if the paid-off loan was old and you close it.

Why does it happen?

Scoring models prefer seeing you actively manage different types of credit. Closing a credit account after paying it off decreases your average age of accounts, which negatively impacts the length of your credit history factor in credit scoring models[1].

How to fix it:

Do nothing. This is a temporary, minor drop. Your score will recover as your remaining accounts age, and you maintain a good payment history.

Don’t let this discourage you from paying off debt. The long-term financial benefit of eliminating debt far outweighs a small, temporary score dip.

Learn more about installment credit and how it affects your credit profile.

Recovery timeline:

3–6 months. The impact is minimal and fades quickly.

8. Your Credit Limit Decreased

Issuers sometimes reduce limits during risk reassessments.

Credit card issuers periodically review accounts. If they see risk signals—late payments on other accounts, high utilization, income changes—they may reduce your credit limit to minimize their exposure.

This hurts your score the same way closing a card does: your utilization ratio increases.

Example:

- Card limit: $5,000

- Balance: $1,000 (20% utilization)

- Issuer reduces limit to $2,000

- New utilization: 50%

Your score drops even though you didn’t spend more.

How to fix it:

- Pay down the balance to get utilization below 30%.

- Call the issuer and ask why the limit was reduced. If it was a mistake or based on outdated information, they may restore it.

- Improve your credit profile overall to prevent future reductions.

Recovery timeline:

30–45 days once you lower the balance and it reports.

9. Negative Information Was Added or Updated

Charge-offs, settlements, judgments, and bankruptcies crush scores.

These are severe derogatory marks:

- Charge-off: The creditor writes off your debt as a loss (usually after 180 days of non-payment). Score drop: 100–150 points.

- Settlement: You pay less than the full amount owed. Score drop: 80–120 points.

- Judgment: A court rules you owe a debt. Score drop: 100+ points.

- Bankruptcy: Chapter 7 or 13 filing. Score drop: 150–240 points.

These entries remain on your report for 7–10 years and signal extreme credit risk.

How to fix it:

- Dispute inaccuracies immediately. If the information is wrong, file a dispute with the credit bureaus.

- Rebuild credit systematically. You can’t erase accurate negative information, but you can dilute its impact by adding positive payment history.

- Consider a secured credit card to start rebuilding.

- Consult a credit counselor or attorney for bankruptcies and judgments.

Recovery timeline:

2–4 years for substantial improvement. The impact lessens over time, but these marks leave lasting damage.

10. Identity Theft or Reporting Error

Fraudulent accounts or inaccurate data can tank your score overnight.

Credit scores can drop unexpectedly if someone steals your personal information and opens accounts in your name without making payments[1].

Warning signs:

- Accounts on your report you didn’t open

- Inquiries you don’t recognize

- Incorrect payment statuses

- Wrong balances or credit limits

- Missing accounts that should appear

How to fix it:

- File a fraud alert with one of the three credit bureaus (it automatically applies to all three). This makes it harder for identity thieves to open new accounts.

- Freeze your credit at all three bureaus to block new account openings entirely.

- Dispute fraudulent accounts in writing with the credit bureaus. Include a copy of your FTC Identity Theft Report.

- File a police report and keep a copy for your records.

- Monitor your credit regularly to catch future fraud early.

For reporting errors (not fraud):

- Dispute the error with the credit bureau in writing. Include documentation proving the error.

- Contact the creditor that reported the inaccurate information. They must investigate and correct it if it’s wrong.

Recovery timeline:

30–90 days for disputes to be resolved. Fraudulent accounts should be removed once verified as fraudulent.

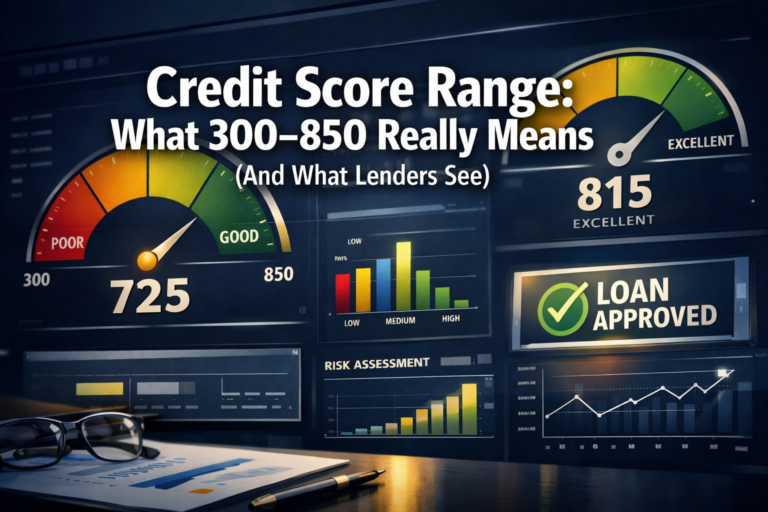

How Much a Credit Score Can Drop

Score drops vary based on your starting score and the severity of the negative event.

Here’s a data-driven breakdown:

| Event | Typical Score Drop |

|---|---|

| 30-day late payment | 60–110 points |

| 60-day late payment | 80–130 points |

| 90+ day late payment | 100–150 points |

| Maxed-out credit card (high utilization) | 20–80 points |

| Hard inquiry | 3–10 points |

| New account opened | 10–20 points |

| Account closed | 10–30 points |

| Collection account | 80–150 points |

| Charge-off | 100–150 points |

| Bankruptcy | 150–240 points |

Important context:

Higher starting scores drop more. A person with a 780 score loses more points from a late payment than someone with a 650 score. The algorithms penalize deviations from excellent behavior more severely.

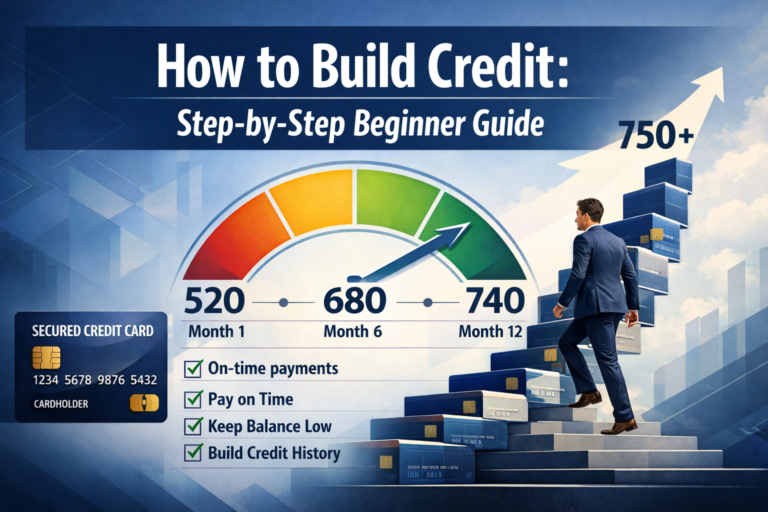

How to Recover Your Credit Score (Step-by-Step Plan)

Recovery isn’t instant, but it’s predictable. Follow this sequence:

Step 1 — Bring All Accounts Current

Nothing else matters if you’re behind on payments.

Pay every past-due account to the current status. This stops further damage and begins the recovery clock.

Set up autopay for at least the minimum payment on every account. Consistency matters more than speed.

Step 2 — Lower Balances Below 30% (Preferably 10%)

Utilization is the fastest lever you can pull.

Pay down credit card balances aggressively. Target:

- 30% utilization as a minimum threshold

- 10% utilization for optimal scores

This change reports within one billing cycle and can restore 20–50 points in 30–45 days.

Step 3 — Stop Applying for Credit

Every application adds a hard inquiry and signals risk.

Pause new credit applications for at least 6 months. Let existing inquiries age off, and your score stabilizes.

Step 4 — Set Autopay on Every Account

Automation prevents future late payments.

Configure autopay for at least the minimum payment on every revolving and installment account. This protects your payment history—the most important scoring factor.

Step 5 — Wait (and Understand Reporting Cycles)

Credit repair takes time.

Credit card issuers report to the bureaus once per month, usually on your statement closing date. Changes take 30–45 days to reflect in your score.

Late payments, collections, and other negatives fade in impact over time but remain on your report for 7–10 years.

Patience and consistency win. There are no shortcuts.

For a comprehensive approach, see our full credit-building guide.

How Long Does It Take for a Score to Recover

Recovery timelines depend on the severity of the damage and your subsequent behavior.

| Issue | Recovery Time |

|---|---|

| High credit utilization | 30–45 days |

| Hard inquiry | 3–6 months |

| New account opened | 6–12 months |

| Closed account | 3–6 months |

| 30-day late payment | 6–18 months |

| Collection account | 1–2 years (meaningful improvement) |

| Charge-off | 2–3 years |

| Bankruptcy | 3–5 years |

Key insight:

The impact of negative information decreases over time. A 2-year-old late payment hurts far less than a 2-month-old late payment.

Consistent positive behavior—on-time payments, low utilization, no new inquiries—accelerates recovery.

Why Did My Credit Score Drop? Understanding the Context

Recent data reveals troubling trends that explain why many consumers are seeing score drops.

Missouri experienced the largest credit score decline across all 50 states, with the average score dropping to 654—a 1.51% decrease from the year prior[2]. Missed payments and higher credit card debt (median $2,622) were primary drivers[2].

Georgia saw a 1.36% decline, with the average credit score dropping from 662 to 653. Above-average delinquency rates and missed payments contributed to the decline[2].

Delaware experienced a 1.2% decrease, with the average score falling from 669 to 661. The state ranked among those adding the most debt and carrying the seventh-highest delinquency rate nationally[2].

States with the strongest performance—Utah (0.14% decline), North Dakota (0.15%), and Iowa (0.28%)—had the smallest declines. Residents in these states carried lower debt than the national average and maintained lower credit card utilization[2].

The job market will determine the 2026 trajectory. Whether credit scores continue to decline in 2026 largely depends on employment conditions, as job loss immediately disrupts income and typically leads to credit damage[2]. Those with disciplined savings habits and emergency funds are better positioned to weather income disruptions[2].

Extended recovery timelines remain realistic. Credit recovery from missed payments, charge-offs, and extended nonpayment is a long process with no shortcuts, requiring consistency, patience, and persistence to rebuild credit profiles[2].

This context matters: if your score dropped in 2026, you’re part of a broader economic pattern. The causes remain the same (missed payments, high utilization), but external pressures (inflation, employment uncertainty) are making it harder for consumers to maintain perfect credit behavior.

When You Should Actually Worry

Not every score drop requires panic. Here’s when to take serious action:

Active collections with ongoing calls from collectors

Repeated late payments (multiple accounts, multiple months)

Accounts in default or charge-off status

Utilization above 80% on multiple cards

Accounts you didn’t open (identity theft)

Legal judgments or wage garnishments

These signals systemic financial distress that requires immediate intervention—possibly including credit counseling, debt consolidation, or legal advice.

Temporary drops from a single hard inquiry, a small utilization spike, or a paid-off loan are normal. They’re part of how credit scoring works. They recover quickly with consistent behavior.

The difference between a temporary dip and a crisis is pattern versus event. One late payment is an event. Six late payments across three accounts is a pattern.

💳 Credit Score Impact Calculator

Estimate how much your credit score might drop based on different negative events

Conclusion

Credit scores measure reliability, not income or wealth.

They answer one question: Based on your past behavior, how likely are you to repay borrowed money?

When your score drops, it’s because something in your credit report changed—a late payment appeared, a balance increased, an account closed, or a new inquiry posted.

The math behind money is logical. Scores don’t punish you randomly. They react to data.

Small, consistent behavior fixes most drops:

- Pay every bill on time, every month

- Keep balances below 30% of your limits (ideally below 10%)

- Stop applying for new credit unless necessary

- Protect old accounts—keep them open and active

- Check your credit report regularly for errors and fraud

Recovery takes time. A 30-day late payment doesn’t erase in 30 days. But the impact fades, and positive behavior compounds.

Your next step: Pull your credit report today. Identify what changed. Then apply the specific fix for that cause.

After identifying the cause, your next step is learning the system so drops don’t happen again. Return to our Credit Hub for the full framework on building and protecting your credit score.

Disclaimer

This article is for educational purposes only and does not constitute financial, legal, or credit repair advice. Credit scoring is complex and varies based on individual credit profiles, scoring models (FICO vs VantageScore), and the specific version of each model used by lenders.

The score drop estimates provided are based on industry research and typical ranges but may not reflect your specific situation. Actual credit score changes depend on your complete credit history, current score, and the specific scoring algorithm used.

Always verify information on your credit report directly with the credit bureaus (Equifax, Experian, TransUnion) and consult with qualified professionals—credit counselors, financial advisors, or attorneys—before making significant financial decisions.

The Rich Guy Math is not a credit repair organization and does not provide credit repair services. We provide educational content to help readers understand how credit scoring works and make informed financial decisions.

For disputes, legal issues, or complex credit problems, consult appropriate licensed professionals in your jurisdiction.

Author Bio

Max Fonji is a data-driven financial educator and the voice behind The Rich Guy Math. With a background in financial analysis and a passion for teaching the math behind money, Max translates complex credit, investing, and wealth-building concepts into clear, actionable insights.

Max’s approach combines analytical precision with educational warmth—explaining not just what works, but why it works, using data, logic, and evidence-based frameworks. His mission: to build financial literacy through understanding, not hype.

When not writing about credit scoring algorithms and compound growth, Max analyzes market data, studies valuation principles, and explores the intersection of behavioral finance and evidence-based investing.

References

[1] Why Did My Credit Score Drop – https://www.equifax.com/personal/education/loans/articles/-/learn/why-did-my-credit-score-drop/

[2] Credit Scores Plummet Across Multiple States Creating Perfect Storm American Wallets Expert Says – https://www.foxbusiness.com/personal-finance/credit-scores-plummet-across-multiple-states-creating-perfect-storm-american-wallets-expert-says

[3] Ways To Improve Credit – https://www.experian.com/blogs/ask-experian/ways-to-improve-credit/

Frequently Asked Questions

Why did my credit score drop 50 points overnight?

A 50-point overnight drop usually means a major negative item was added to your credit report, such as a 30-day late payment, a new collection account, or a maxed-out credit card that pushed your utilization above 80%.

Pull your credit report immediately to see what changed. The score is reacting to new data — the cause will always appear in the report.

How often do credit scores update?

Credit scores update whenever your credit report changes. Most creditors report account activity to the credit bureaus once per month, typically on your statement closing date.

This means your score usually updates monthly. Some scoring models calculate scores daily, but they still rely on the most recent monthly report data.

Can checking my credit cause a drop?

No. Checking your own credit score or credit report is a soft inquiry and does not affect your score.

Only hard inquiries — when a lender reviews your credit for a loan or credit card application — can lower your score, typically by about 3–10 points. You can safely check your credit as often as you want.

Will paying off debt raise my score immediately?

It depends on the type of debt. Paying down credit card balances can improve your score within 30–45 days after the lower balance is reported to the credit bureaus.

Paying off an installment loan (auto, personal, or student loan) may cause a small temporary drop because of changes in credit mix and average account age. However, the long-term benefit of eliminating debt is positive for your score.

How long does a late payment affect credit?

A late payment stays on your credit report for 7 years from the reporting date. Its impact decreases over time:

- First 12–24 months: strongest impact

- After 2 years: significantly reduced impact

- After 5 years: minimal effect

Consistent on-time payments after a late payment help your score recover faster.

Why are my FICO and Credit Karma scores different?

Credit Karma shows a VantageScore 3.0 score, while most lenders use FICO scores. These are different scoring models with different algorithms.

They may also use different credit bureaus. Credit Karma uses TransUnion and Equifax, while lenders may use any of the three bureaus. Because the data on each bureau can differ slightly, score differences of 20–50 points are completely normal.