Marginal cost refers to the additional cost incurred when producing one more unit. Understanding it helps you set prices that maximize profits and avoid costly overproduction. This single metric is one of the most important tools in a business owner’s decision-making toolbox, and it directly influences profitability, scalability, and long-term sustainability.

In this guide, we’ll break down what marginal cost is, how to calculate it, what affects it, and why it’s so crucial in making smart pricing and production decisions. We’ll also look at real-world examples so you can put this concept to work immediately.

What Is Marginal Cost?

Marginal cost measures the change in total cost that results from producing one additional unit of a product or service.

The formula is: Marginal Cost (MC)=Change in Total CostChange in Quantity\text{Marginal Cost (MC)} = \frac{\text{Change in Total Cost}}{\text{Change in Quantity}}Marginal Cost (MC)=Change in QuantityChange in Total Cost

- Change in Total Cost includes only the extra costs needed to produce that extra unit — usually variable costs like raw materials, direct labor, and energy.

- Change in Quantity is the number of extra units produced (often just 1 in simple calculations).

Example:

If it costs $1,000 to produce 100 units, and $1,015 to produce 101 units: MC=101−1001,015−1,000=115=$15

This means it costs $15 to produce that extra unit.

Key takeaway: Fixed costs (like rent or salaries for permanent staff) are not part of marginal cost, because they don’t change with production volume.

How to Calculate Marginal Cost: Step-by-Step Example

Let’s break down the steps:

- Find the total cost before and after the production change

- Before: $1,000 (for 100 units)

- After: $1,015 (for 101 units)

- Calculate the difference in total cost: 1,015−1,000=15

- Calculate the difference in quantity produced: 101−100=1

- Apply the formula MC=151=15MC = \frac{15}{1} = 15MC=115=15

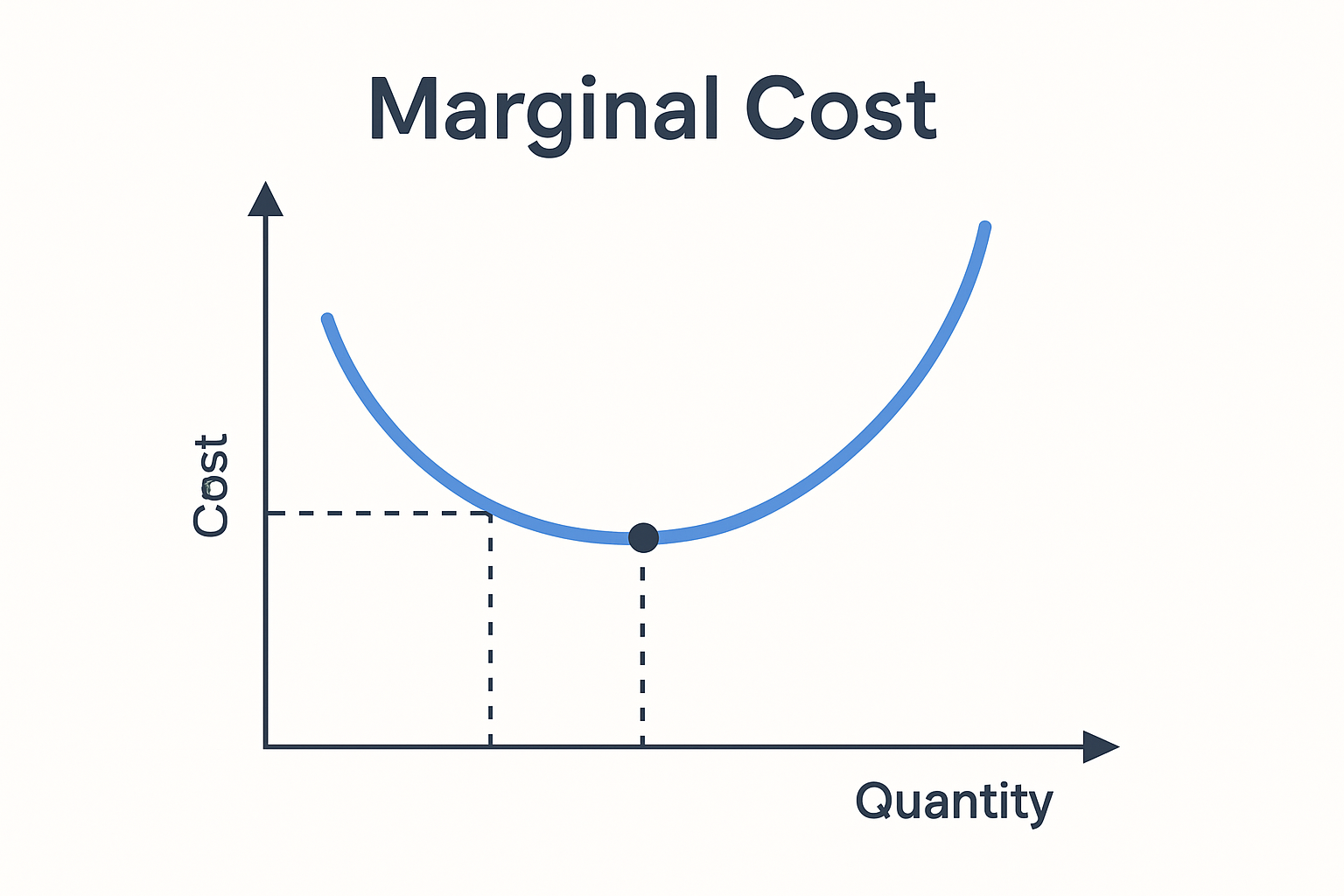

Graphical Illustration:

We can represent marginal cost with a U-shaped curve. In most industries:

- At low production levels, marginal cost decreases due to efficiency gains.

- At high production levels, marginal cost rises due to inefficiencies, overtime pay, or machine wear-and-tear.

What Influences Marginal Cost?

Several factors can cause marginal cost to rise or fall:

- Raw Material Prices – If suppliers increase prices, MC rises.

- Labor Efficiency – Well-trained staff can reduce MC by producing more in less time.

- Technology and Automation – New machines can reduce waste and lower MC.

- Economies of Scale – As production increases, MC can drop because fixed costs are spread over more units.

- Diminishing Returns – After a certain point, adding more workers or machines increases MC due to overcrowding or inefficiency.

Why Marginal Cost Matters for Pricing and Production

Marginal cost plays a central role in profit maximization:

- Optimal Production Rule:

A business maximizes profit when Marginal Cost = Marginal Revenue.- If MC < MR → produce more.

- If MC > MR → produce less.

- Pricing Strategy:

Understanding MC helps ensure your selling price covers all costs and leaves a profit margin. - Avoiding Losses:

If marginal cost exceeds the selling price, each additional unit reduces profit, a trap many businesses fall into when chasing sales volume.

Example in Action:

Suppose a bakery sells cupcakes at $4 each:

- If it costs $2 in materials and labor to bake one more cupcake (MC = $2), producing more is profitable.

- If a supply shortage pushes MC up to $4.50, producing more cupcakes loses money.

Beyond Business: The Social Angle

There’s also the concept of Marginal Social Cost (MSC), which includes both:

- Marginal Private Cost (MPC) → borne by the producer

- External Costs → borne by society (pollution, congestion, etc.)

Formula: MSC=MPC+External Cost MSC = MPC + External Cost MSC=MPC+External Cost

For example, a factory’s MC might be $5 per unit, but if each unit produces $1 in environmental damage, the MSC is $6. Understanding MSC can inform responsible production decisions and help shape more effective public policy.

Key Takeaways & Practical Tips

- Always base Mc on variable costs, not fixed costs.

- Compare MC to MR to decide whether to increase or reduce output.

- Watch for changes in MC as early warning signs of inefficiency.

- Consider social costs when making production decisions to maintain a good brand reputation.

Further Reading & Resources

- Marginal Cost Explained – Investopedia

- How Marginal Revenue Relates to Marginal Cost – Investopedia

- Marginal Costs Examples – Helpful Professor

Final Thought:

Mastering marginal cost isn’t just for economists, it’s for any entrepreneur, investor, or manager who wants to make smart, data-driven decisions. Whether you’re pricing a product, expanding a factory, or evaluating an investment, this metric can make the difference between steady profits and silent losses.