Imagine sitting at your kitchen table in 2035, opening your investment account, and seeing a balance that’s doubled, or even tripled, from what you started with a decade ago. You didn’t win the lottery. You didn’t inherit money. You decided to invest consistently and let time work its magic. This isn’t a fantasy; it’s the reality for millions of people who chose to invest rather than save.

The truth is, keeping all your money in a savings account is like trying to win a race while standing still. With inflation eroding purchasing power year after year, what seems “safe” today might actually be costing you wealth tomorrow. Investing isn’t just for Wall Street professionals or the ultra-wealthy; it’s a practical tool that anyone can use to build financial security and achieve their long-term goals.

Whether you’re 25 or 55, earning $30,000 or $300,000 annually, understanding why you should invest is the first step toward financial freedom. This comprehensive guide will walk you through the compelling reasons to start investing, the tangible benefits you’ll enjoy, and exactly how to take your first steps, even if you’ve never bought a single share of stock.

Key Takeaways

Investing beats inflation – Your money grows faster than the rising cost of living, preserving and increasing your purchasing power over time

Compound interest is your wealth multiplier – Starting early allows your returns to generate their own returns, creating exponential growth

Multiple investment options exist – From stocks and bonds to real estate and index funds, there’s an investment strategy for every risk tolerance and goal

You don’t need thousands to start – Many platforms allow you to begin investing with as little as $5-$50

Time in the market beats timing the market – Consistent, long-term investing outperforms trying to predict market highs and lows

Understanding the Foundation: What Does It Mean to Invest?

Before diving into why you should invest, let’s clarify what investing actually means. Investing is the act of allocating money into assets with the expectation that they will generate income or appreciate over time. Unlike spending money on consumables that lose value immediately, investing puts your dollars to work building future wealth.

Think of it this way: when you buy a coffee, that $5 is gone forever. But when you invest $5 in a company’s stock, you own a tiny piece of that business. If the company grows and becomes more profitable, your investment grows with it.

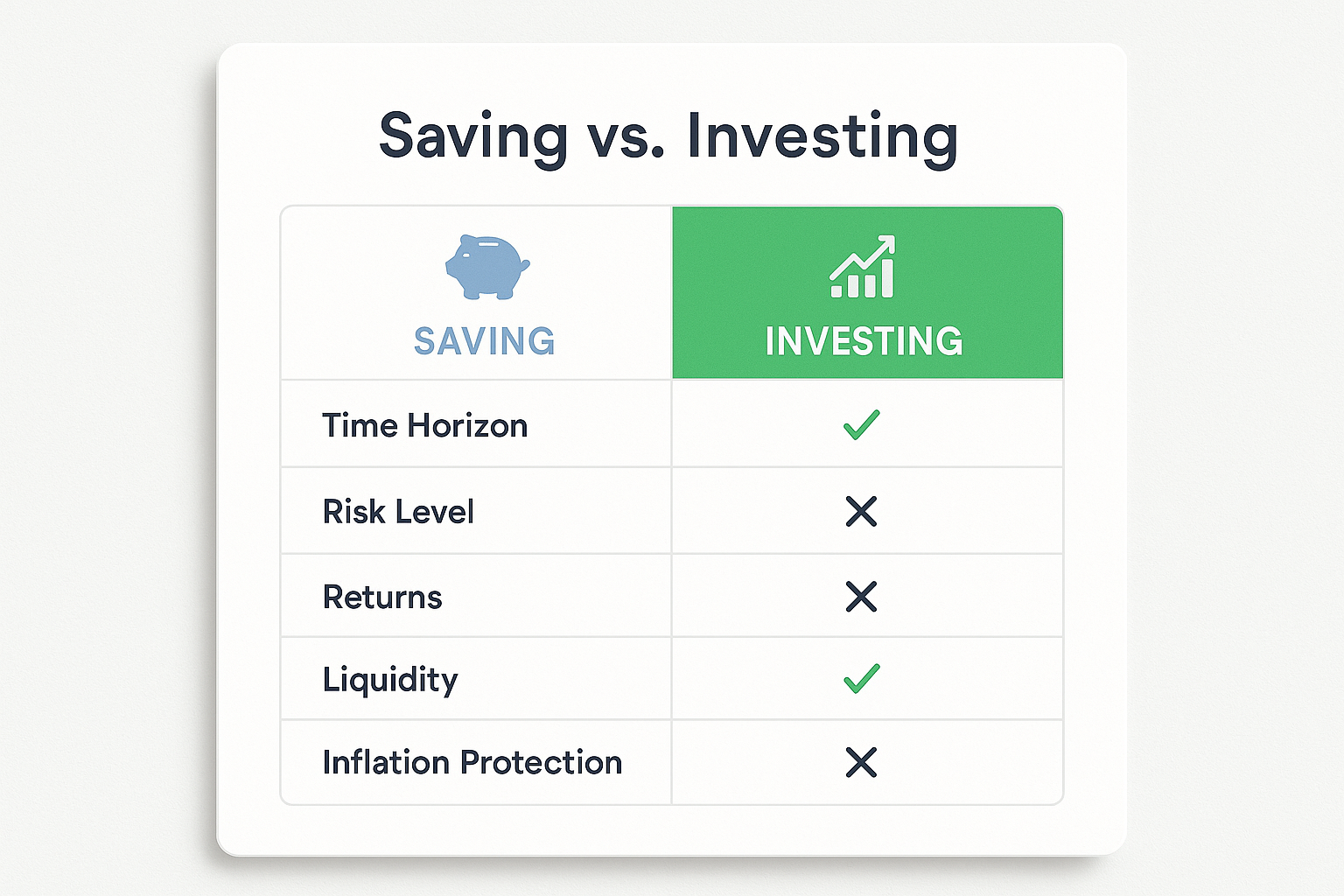

The Difference Between Saving and Investing

Many people confuse saving with investing, but they serve different purposes:

| Saving | Investing |

|---|---|

| Short-term goals (emergency fund, vacation) | Long-term goals (retirement, wealth building) |

| Low or no risk | Moderate to higher risk |

| Minimal returns (0.5-5% annually) | Potentially higher returns (7-10%+ annually) |

| High liquidity (easy access) | Lower liquidity (may take days to access) |

| Value protected but eroded by inflation | Value grows ahead of inflation |

Both saving and investing are essential components of a healthy financial plan. You need savings for emergencies and short-term needs, but you need investments to build long-term wealth and achieve major life goals. See our full guide on saving vs investing

Why You Should Invest: The Compelling Reasons

1. Beat Inflation and Preserve Your Purchasing Power

Here’s a sobering fact: the average inflation rate in the United States over the past century has been approximately 3.1% annually, according to data from the Bureau of Labor Statistics. This means that every year, your dollar buys roughly 3% less than it did the year before.

Let’s put this into perspective with a real example. In 1995, the average price of a new car was around $15,500. By 2025, that same category of vehicle costs approximately $48,000, more than triple the price. If you had simply kept $15,500 in cash under your mattress for 30 years, you’d still have $15,500, but it would only buy you about one-third of a car.

Now imagine if you had invested that $15,500 in a broad market index fund in 1995. With the historical performance of the stock market, that investment would be worth approximately $125,000 today, enough to buy two or three cars with money left over.

Investing isn’t just about getting richer; it’s about not getting poorer. When your investment returns exceed the inflation rate, you’re actually growing your purchasing power and maintaining your standard of living into the future.

2. Harness the Incredible Power of Compound Interest

Albert Einstein allegedly called compound interest “the eighth wonder of the world,” and for good reason. Compound interest means you earn returns not just on your original investment, but also on the returns that investment has already generated.

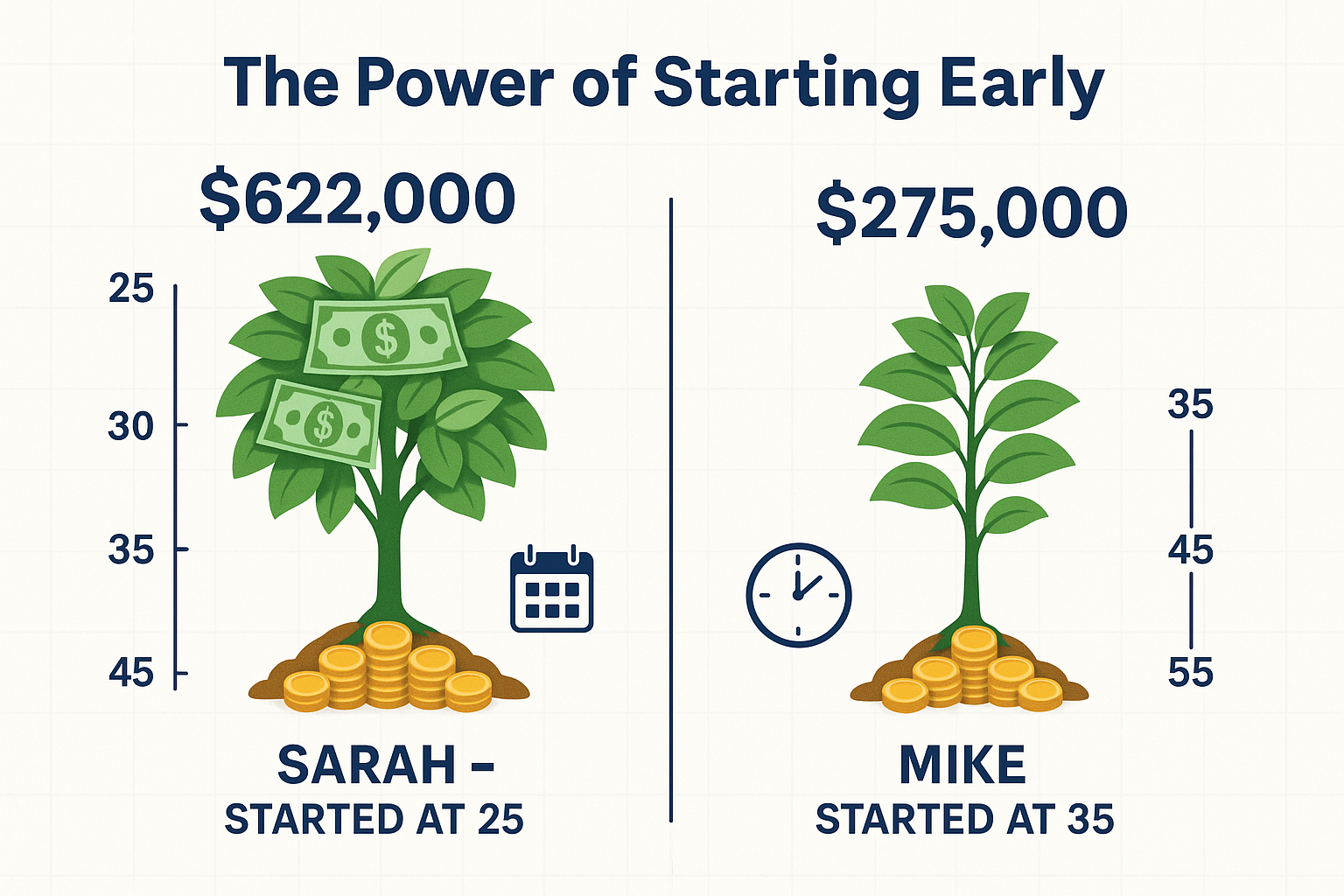

Here’s a simple story to illustrate: Sarah and Mike are both 25 years old. Sarah decides to invest $200 per month starting immediately. Mike waits until he’s 35 to start investing the same $200 per month. Both earn an average 8% annual return and continue until they’re 65.

- Sarah (started at 25): Invested $96,000 total → Ended with approximately $622,000

- Mike (started at 35): Invested $72,000 total → Ended with approximately $275,000

Even though Sarah only invested $24,000 more than Mike, she ended up with more than double his wealth, all because she gave her money an extra 10 years to compound. This is why understanding why you should invest early is so critical to long-term financial success.

3. Build Wealth and Achieve Financial Goals

Whether your goal is to retire comfortably, buy a home, fund your children’s education, or achieve financial independence, investing is the most reliable path to building substantial wealth over time.

Consider these common financial goals and how investing helps achieve them:

- Retirement: Social Security alone won’t maintain your current lifestyle. The average Social Security benefit in 2025 is approximately $1,900 per month, far less than most people need to live comfortably.

- Financial Independence: Many people dream of the freedom to work because they want to, not because they have to. Building a portfolio that generates passive income through dividend investing can make this dream a reality.

- Major Purchases: A down payment on a house, a child’s wedding, or starting a business all require significant capital that’s difficult to accumulate through saving alone.

- Legacy Building: Investing allows you to create generational wealth that can support your children, grandchildren, or favorite charitable causes long after you’re gone.

4. Generate Passive Income Streams

One of the most attractive aspects of investing is the potential to create income without actively working for it. This concept of passive income can transform your financial life.

Dividend-paying stocks are a perfect example. When you own shares in companies like Coca-Cola, Johnson & Johnson, or Procter & Gamble, they regularly send you cash payments (dividends) simply for being a shareholder. Many investors build portfolios of high dividend stocks that generate thousands of dollars in monthly income.

Other passive income investments include:

- Real Estate Investment Trusts (REITs): Own shares of commercial real estate without being a landlord

- Bonds: Receive regular interest payments from corporations or governments

- Index Funds: Benefit from the overall growth of entire market sectors

- Rental Properties: Collect monthly rent from tenants

Learning about smart ways to make passive income can significantly accelerate your journey to financial freedom.

5. Stay Ahead of Rising Costs and Economic Changes

The economy is constantly evolving, and the cost of essential goods and services continues to climb. Healthcare, education, housing, and food all become more expensive over time. Investing helps ensure your wealth grows faster than these rising costs.

According to the Federal Reserve, healthcare costs have risen an average of 5-6% annually over the past two decades, nearly double the general inflation rate. If you’re not investing and growing your wealth at a similar or higher rate, you’re effectively losing ground every year.

6. Tax Advantages That Accelerate Wealth Building

Many investment accounts offer significant tax benefits that can supercharge your wealth accumulation:

- 401(k) and Traditional IRA: Contributions reduce your taxable income today, and investments grow tax-deferred until retirement

- Roth IRA: Pay taxes on contributions now, but enjoy completely tax-free growth and withdrawals in retirement

- Health Savings Account (HSA): Triple tax advantage, deductible contributions, tax-free growth, and tax-free withdrawals for medical expenses

- Capital Gains Treatment: Long-term investment gains are taxed at lower rates than ordinary income

These tax advantages can save you thousands, even tens of thousands, of dollars over your investing lifetime, allowing more of your money to stay invested and compound.

7. Participate in Economic Growth and Innovation

When you invest in companies, you’re essentially betting on human ingenuity and economic progress. History shows that despite recessions, wars, and crises, the global economy has trended upward over the long term.

Think about the incredible innovations of the past few decades: smartphones, electric vehicles, renewable energy, artificial intelligence, and biotechnology. Investors who owned shares in companies driving these innovations didn’t just benefit financially; they participated in shaping the future.

By investing in a diversified portfolio, you’re essentially saying, “I believe humanity will continue to solve problems, create value, and improve lives.” And historically, that bet has paid off handsomely.

Common Concerns: Why People Hesitate to Invest

Understanding why you should invest is only half the battle. Many people recognize the benefits but still hesitate due to common fears and misconceptions. Let’s address them head-on.

“I Don’t Have Enough Money to Start”

Reality: You can start investing with as little as $5-$50 through modern investing apps and platforms. Many brokerages now offer fractional shares, meaning you can buy a piece of expensive stocks like Amazon or Google for just a few dollars.

The key is to start with what you have and build the habit. Investing $25 per week is infinitely better than waiting until you have thousands saved up. Remember, time in the market is your most valuable asset.

“The Stock Market Is Too Risky”

Reality: Yes, the stock market has ups and downs, and there are cycles of market emotions that can be unsettling. However, the risk of not investing, having your money lose value to inflation, is often greater than the risk of investing in a diversified portfolio.

According to data from Morningstar, the S&P 500 has never had a negative return over any 20 years in its history. Short-term volatility is normal, but long-term growth has been remarkably consistent.

Understanding why people lose money in the stock market can help you avoid common pitfalls and invest more confidently.

“I Don’t Know Anything About Investing”

Reality: You don’t need to be a financial expert to invest successfully. In fact, Warren Buffett, one of the world’s most successful investors, recommends that most people simply invest in low-cost index funds rather than trying to pick individual stocks.

There are countless free resources, including educational content on sites like TheRichGuyMath.com, that can teach you the basics in just a few hours. The fundamentals of investing are simpler than most people think.

“I’m Too Old to Start Investing”

Reality: It’s never too late to start investing. Even if you’re in your 50s or 60s, you likely have 20-30+ years of life ahead. A balanced portfolio can still grow significantly over that timeframe.

Plus, investing isn’t only about growth; it’s also about generating income during retirement and preserving wealth against inflation. These benefits apply regardless of your age.

How to Start Investing: A Step-by-Step Beginner’s Guide

Ready to take action? Here’s exactly how to begin your investing journey, even if you’re starting from zero knowledge.

Step 1: Set Clear Financial Goals

Before investing a single dollar, ask yourself:

- What am I investing in? (retirement, house, financial independence, etc.)

- When will I need this money? (in 5 years, 10 years, 30 years?)

- How much risk am I comfortable with?

- How much can I consistently invest each month?

Your answers will guide every investment decision you make. For example, money you’ll need in 5 years should be invested more conservatively than money for retirement in 30 years.

Step 2: Build Your Financial Foundation

Before investing, ensure you have:

- An Emergency Fund: 3-6 months of living expenses in a high-yield savings account

- High-Interest Debt Paid Off: Credit card debt typically charges 15-25% interest, which exceeds most investment returns

- Basic Budget: Understanding your income and expenses helps you determine how much you can invest

This foundation ensures you won’t need to sell investments at a loss to cover unexpected expenses.

Step 3: Choose Your Investment Account

Different accounts serve different purposes:

For Retirement:

- 401(k): Employer-sponsored; often includes matching contributions (free money!)

- Traditional IRA: Tax-deductible contributions; pay taxes on withdrawals

- Roth IRA: After-tax contributions; tax-free withdrawals in retirement

For General Investing:

- Taxable Brokerage Account: No tax advantages, but complete flexibility on when you can withdraw

Pro Tip: If your employer offers a 401(k) match, contribute at least enough to get the full match before investing elsewhere. It’s an instant 50-100% return on your money!

Step 4: Select a Brokerage or Investment Platform

Popular options for beginners include:

- Vanguard: Known for low-cost index funds

- Fidelity: Excellent research tools and customer service

- Charles Schwab: User-friendly with great educational resources

- Robinhood: Simple interface, good for beginners (but limited research tools)

- Betterment/Wealthfront: Robo-advisors that automatically manage your portfolio

Most of these platforms have no minimum investment requirements and charge zero commissions on stock and ETF trades.

Step 5: Decide on Your Investment Strategy

For most beginners, these strategies work best:

Index Fund Investing (Recommended for Beginners)

Invest in funds that track broad market indexes like the S&P 500. This gives you instant diversification across hundreds of companies with minimal effort and low fees.

Example allocation:

- 70% U.S. Stock Market Index Fund

- 20% International Stock Index Fund

- 10% Bond Index Fund

Target-Date Funds

These funds automatically adjust their asset allocation as you approach your goal date (like retirement). They become more conservative over time.

Dividend Growth Investing

Focus on companies with a history of consistently increasing their dividend payments. This strategy provides both income and growth potential. Learn more about dividend investing strategies.

Step 6: Automate Your Investments

The single most powerful investing habit is automation. Set up automatic transfers from your checking account to your investment account on the same day you get paid.

This approach, called dollar-cost averaging, means you buy more shares when prices are low and fewer when prices are high, automatically optimizing your purchase timing without any effort.

Step 7: Stay the Course and Avoid Common Mistakes

Once you’ve started investing, the hardest part is staying disciplined. Avoid these common mistakes:

Panic selling during market downturns – Downturns are temporary; selling locks in losses

Trying to time the market – Even professionals can’t consistently predict market movements

Chasing “hot” stocks – By the time you hear about them, the opportunity has often passed

Ignoring fees – High fees can consume 30-40% of your returns over a lifetime

Not diversifying – Don’t put all your eggs in one basket

Do this instead: Invest consistently, stay diversified, keep fees low, and maintain a long-term perspective.

Investment Options: Finding the Right Fit

Understanding the various investment vehicles helps you build a portfolio aligned with your goals and risk tolerance.

Stocks (Individual Companies)

What they are: Ownership shares in individual companies

Pros: Highest growth potential, dividend income, ownership in companies you believe in

Cons: Higher risk, requires research, can be volatile

Best for: Investors willing to research companies and accept higher volatility for potentially higher returns

Bonds (Fixed Income)

What they are: Loans to corporations or governments that pay regular interest

Pros: More stable than stocks, predictable income, and capital preservation

Cons: Lower returns, vulnerable to inflation and interest rate changes

Best for: Conservative investors, those nearing retirement, or balancing a stock-heavy portfolio

Index Funds and ETFs

What they are: Funds that hold many stocks or bonds, tracking a specific market index

Pros: Instant diversification, low fees, minimal effort required, historically strong returns

Cons: You won’t beat the market (but you won’t underperform it either)

Best for: Most beginner investors; forms the core of many successful portfolios

Real Estate

What it is: Physical property or REITs (Real Estate Investment Trusts)

Pros: Tangible asset, potential rental income, tax benefits, inflation hedge

Cons: Requires significant capital (for physical property), less liquid, and management responsibilities

Best for: Investors with capital who want diversification beyond stocks and bonds

Mutual Funds

What they are: Professionally managed pools of stocks, bonds, or other securities

Pros: Professional management, diversification, and convenience

Cons: Often higher fees than index funds, and many don’t beat the market

Best for: Investors who want professional management and don’t mind paying for it

To dive deeper into different investment vehicles, explore this comprehensive guide on understanding the stock market.

Building Your Investment Portfolio: Sample Allocations

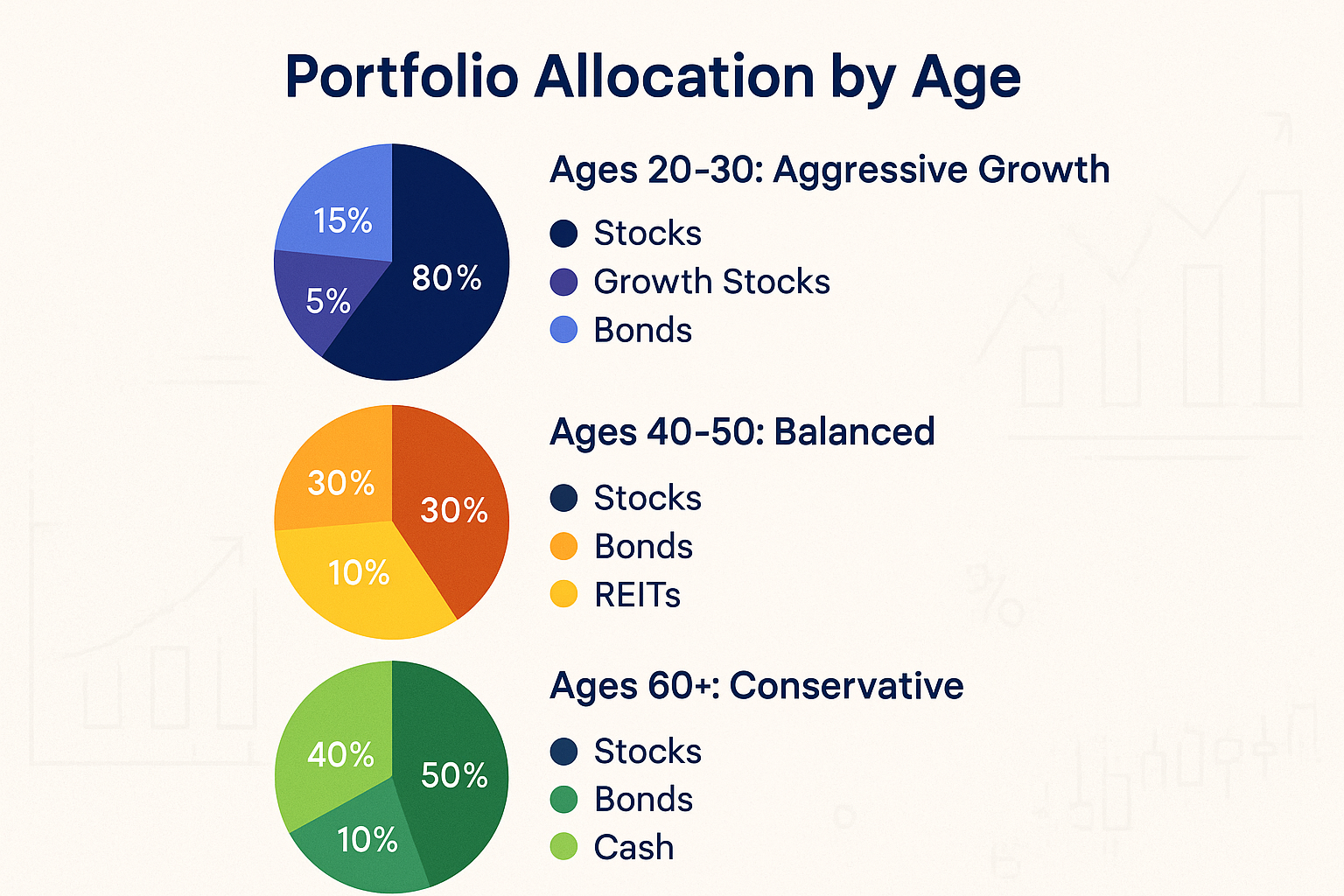

Your ideal portfolio depends on your age, goals, and risk tolerance. Here are sample allocations for different situations:

Aggressive Growth (Young Investor, 20s-30s)

- 80% Stock Index Funds (60% U.S., 20% International)

- 15% Individual Growth Stocks or Sector ETFs

- 5% Bonds

Rationale: A Long time horizon allows for higher risk and maximum growth potential

Balanced Growth (Middle Career, 40s-50s)

- 60% Stock Index Funds (45% U.S., 15% International)

- 30% Bonds

- 10% REITs or Dividend Stocks

Rationale: Still focused on growth but with more stability as retirement approaches

Conservative Income (Pre-Retirement/Retirement, 60s+)

- 40% Stock Index Funds

- 50% Bonds and Bond Funds

- 10% Cash or Money Market

Rationale: Emphasis on capital preservation and income generation while maintaining some growth

Remember, these are just examples. Your personal situation might call for a different allocation. Many financial advisors suggest the “100 minus your age” rule, subtract your age from 100 to get the percentage you should have in stocks (so a 30-year-old would have 70% in stocks).

The Role of Time: Your Most Valuable Investment Asset

One of the most important concepts in investing is understanding that time is more valuable than timing. You don’t need to invest at the perfect moment; you just need to invest consistently over a long period.

Consider this powerful example: If you invested $10,000 in the S&P 500 at its peak right before the 2008 financial crisis (literally the worst possible timing), and simply left it alone, you would have approximately $45,000 by 2025, a 350% return despite starting at the worst possible moment.

This demonstrates a crucial principle: staying invested through market cycles is far more important than trying to predict them. Markets spend more time going up than going down, and missing just a few of the best days can dramatically reduce your returns.

According to research from J.P. Morgan, if you invested $10,000 in the S&P 500 from 2003-2023 and remained fully invested, you’d have approximately $64,844. But if you missed just the 10 best days during that period, you’d only have $29,708, less than half!

While you shouldn’t obsessively check your portfolio daily (this often leads to emotional decisions), you should review it periodically:

Quarterly Reviews: Quick check to ensure everything is on track

Annual Rebalancing: Adjust your portfolio back to your target allocation. If stocks performed well and now represent 80% of your portfolio instead of your target 70%, sell some stocks and buy bonds to rebalance.

Life Event Adjustments: Major changes (marriage, children, job change, approaching retirement) may warrant portfolio adjustments

Monitoring and Adjusting Your Investments

Performance Evaluation: Compare your returns to relevant benchmarks, but remember that short-term underperformance is normal and not a reason to panic.

The Psychological Side of Investing

Successful investing isn’t just about numbers; it’s about managing your emotions and maintaining discipline during market volatility.

The cycle of market emotions is a well-documented phenomenon where investors experience euphoria during bull markets and despair during bear markets. These emotions often lead to buying high (when excited) and selling low (when scared), the opposite of what creates wealth.

Strategies to stay emotionally balanced:

- Don’t check your portfolio daily – Short-term fluctuations are meaningless noise

- Focus on your process, not outcomes – You can’t control the market, only your behavior

- Remember your “why” – Keep your long-term goals front and center

- Expect volatility – Markets go down 10-20% every few years; this is normal

- Celebrate consistency – Be proud of regular contributions, regardless of market conditions

“The stock market is a device for transferring money from the impatient to the patient.” — Warren Buffett

Advanced Strategies: Once You’ve Mastered the Basics

After you’ve been investing consistently for a while and feel comfortable with the fundamentals, you might explore these more advanced strategies:

Tax-Loss Harvesting

Strategically selling investments at a loss to offset capital gains and reduce your tax bill, then reinvesting in similar assets.

Asset Location Optimization

Placing tax-inefficient investments (like bonds) in tax-advantaged accounts and tax-efficient investments (like index funds) in taxable accounts.

Dividend Growth Investing

Building a portfolio specifically focused on companies with long histories of increasing dividends, creating a growing income stream.

Sector Rotation

Adjust your portfolio to overweight sectors expected to outperform in current economic conditions.

Options Strategies

Using options to generate income or hedge positions (this requires significant education and carries substantial risk).

Before implementing any advanced strategy, make sure you thoroughly understand it and consider consulting with a financial advisor.

Resources for Continued Learning

Investing is a lifelong learning journey. Here are trusted resources to expand your knowledge:

Government Resources:

- SEC.gov: Official guidance from the Securities and Exchange Commission

- Investor.gov: Free educational tools and resources

- BLS.gov: Bureau of Labor Statistics for economic data

Educational Websites:

- Investopedia: Comprehensive financial education and definitions

- Morningstar: Investment research and analysis

- TheRichGuyMath.com: Beginner-friendly investing guides and strategies

Books:

- “The Simple Path to Wealth” by JL Collins

- “A Random Walk Down Wall Street” by Burton Malkiel

- “The Little Book of Common Sense Investing” by John Bogle

Podcasts:

- “The Investor’s Podcast”

- “BiggerPockets Money Podcast”

- “ChooseFI”

Conclusion: Your Investing Journey Starts Now

Understanding why you should invest is the critical first step, but knowledge without action changes nothing. The difference between people who build substantial wealth and those who don’t often comes down to a single decision: the decision to start.

You now understand that investing isn’t just for the wealthy; it’s the path to wealth. You know that compound interest, time in the market, and consistent contributions are more powerful than trying to time the market or pick the perfect stock. You’ve learned that starting small is infinitely better than not starting at all.

The financial future you dream about, a comfortable retirement, financial independence, freedom from money stress, doesn’t happen by accident. It’s built one investment at a time, one month at a time, one year at a time.

Your action steps this week:

- Open an investment account (start with a Roth IRA or your employer’s 401(k))

- Set up automatic monthly contributions, even if it’s just $25-$50

- Choose a simple, diversified investment (like a target-date fund or total market index fund)

- Commit to staying the course for at least 5 years, regardless of market ups and downs

Remember, the best time to start investing was 10 years ago. The second-best time is today. Every day you wait is a day of potential compound growth you’ll never get back.

Your future self, the one sitting comfortably in retirement, the one who achieved financial independence, the one who built generational wealth, will thank you for the decision you make today.

The question isn’t whether you can afford to invest. The question is whether you can afford not to

💰 Investment Growth Calculator

See how your money can grow over time with consistent investing

Disclaimer

The information provided in this article is for educational purposes only and should not be considered financial advice. Investing involves risk, including the potential loss of principal. Past performance does not guarantee future results. Before making any investment decisions, consider your financial situation, risk tolerance, and investment objectives. Consult with a qualified financial advisor for personalized guidance.

About the Author

Max Fonji is a financial educator and investment strategist with over a decade of experience helping beginners navigate the world of investing. Through TheRichGuyMath.com, Max breaks down complex financial concepts into actionable strategies that anyone can implement. His mission is to democratize financial education and help people build lasting wealth through smart, disciplined investing.