Picture this: You’re running a lemonade stand on a hot summer day. You’ve got lemons, sugar, cups, and cash in your pocket. But what if you run out of lemons before you can sell more lemonade and make money to buy more supplies? That’s a working capital problem, and it’s the same challenge that businesses face every single day, whether they’re selling lemonade or launching rockets.

Understanding working capital isn’t just for accountants in suits; it’s the lifeblood of every business and a critical concept for anyone who wants to invest wisely, start a company, or simply understand how money flows through an organization. If you’ve ever wondered why some businesses thrive while others struggle despite having great products, working capital often holds the answer.

In this comprehensive guide, we’ll break down everything you need to know about working capital in plain English. You’ll learn what it is, how to calculate it, why it matters for businesses and investors, and how to use this knowledge to make smarter financial decisions.

TL;DR

- Working capital is the difference between a company’s current assets and current liabilities—essentially the money available for day-to-day operations.

- The formula is simple: Working Capital = Current Assets – Current Liabilities.

- Positive working capital means a business can pay its short-term bills and invest in growth; negative working capital signals potential financial trouble.

- Investors use working capital metrics to evaluate a company’s operational efficiency and short-term financial health before buying stocks..

- Understanding working capital helps you make smarter decisions, whether you’re investing in the stock market or running your own business

What Is Working Capital?

In simple terms, working capital means the money a business has available to run its daily operations.

Think of it as the financial cushion that keeps the lights on, pays employees, buys inventory, and covers bills while waiting for customers to pay. It’s the difference between what a company owns that can quickly turn into cash (current assets) and what it owes in the near future (current liabilities).

Working capital is also called net working capital because it represents the net amount of short-term resources a business has after accounting for short-term obligations.

Why “Current” Matters

The word “current” in accounting means within one year. Current assets are things the business expects to convert to cash within 12 months. Current liabilities are debts and obligations due within the same timeframe. This one-year window is what makes working capital a measure of short-term financial health, not long-term stability.

Real-World Example

Imagine a small bakery:

Current Assets:

- Cash in the register: $5,000

- Money customers owe (accounts receivable): $2,000

- Flour, sugar, and other inventory: $3,000

- Total Current Assets: $10,000

Current Liabilities:

- Rent due next month: $2,000

- Suppliers to pay (accounts payable): $1,500

- Short-term loan payment: $1,500

- Total Current Liabilities: $5,000

Working Capital = $10,000 – $5,000 = $5,000

This bakery has $5,000 in working capital, meaning it has a comfortable cushion to operate and handle unexpected expenses.

The Working Capital Formula

The formula for working capital is:

Working Capital = Current Assets – Current Liabilities

Let’s break down each component:

Current Assets Include:

Cash and cash equivalents – Money in bank accounts, petty cash

Marketable securities – Stocks, bonds, and investments that can be quickly sold

Accounts receivable – Money customers owe the business

Inventory – Products ready to sell or raw materials

Prepaid expenses – Insurance or rent paid in advance

Current Liabilities Include:

Accounts payable – Money owed to suppliers

Short-term debt – Loans or credit lines due within a year

Accrued expenses – Wages, taxes, or utilities owed but not yet paid

Deferred revenue – Money received for services not yet delivered

Current portion of long-term debt – The part of long-term loans due this year

How to Calculate Working Capital: Step-by-Step Example

Let’s calculate working capital for a fictional tech startup, “AppGenius Inc.”

Current Assets:

- Cash: $150,000

- Accounts Receivable: $75,000

- Inventory: $25,000

- Prepaid Expenses: $10,000

- Total: $260,000

Current Liabilities:

- Accounts Payable: $50,000

- Short-term Debt: $30,000

- Accrued Expenses: $20,000

- Total: $100,000

Working Capital = $260,000 – $100,000 = $160,000

AppGenius has $160,000 in working capital, which suggests healthy short-term financial positioning.

Working Capital vs Other Financial Metrics

Understanding how working capital differs from related concepts helps you see the complete financial picture:

| Metric | What It Measures | Formula | Key Difference |

|---|---|---|---|

| Working Capital | Dollar amount of operational cushion | Current Assets – Current Liabilities | Absolute dollar figure |

| Current Ratio | Liquidity relative to obligations | Current Assets ÷ Current Liabilities | Proportional measure (ratio) |

| Quick Ratio | Immediate liquidity | (Current Assets – Inventory) ÷ Current Liabilities | Excludes inventory |

| Cash Flow | Actual cash movement | Cash Inflows – Cash Outflows | Movement, not position |

| Net Income | Profitability | Revenue – All Expenses | Profit, not liquidity |

Key insight: A company can be profitable (positive net income) but still fail if it doesn’t have enough working capital to pay bills when they’re due. This is called being “profitable but broke.”

Why Working Capital Matters (For Businesses AND Investors)

For Business Operations

1. Survival and Stability

Businesses need working capital like humans need oxygen. Without it, even profitable companies can’t pay suppliers, meet payroll, or keep operations running. A working capital shortage is one of the top reasons small businesses fail.

2. Growth and Expansion

Positive working capital provides the resources to:

- Launch new products

- Hire additional staff

- Increase inventory for busy seasons

- Negotiate better terms with suppliers by paying early

3. Handling Emergencies

Unexpected expenses happen—equipment breaks, key customers delay payments, or economic conditions shift. Strong working capital acts as a financial shock absorber.

4. Operational Efficiency

The amount of working capital needed varies by industry. Analyzing working capital trends reveals how efficiently a company manages inventory, collects payments, and negotiates with suppliers.

For Investors and Stock Analysis

When you’re evaluating stocks or considering dividend-paying companies, working capital provides crucial insights:

Red Flags:

- Declining working capital over several quarters suggests deteriorating financial health

- Negative working capital may indicate that the company can’t meet short-term obligations

- Rapidly increasing working capital needs might mean the business model isn’t scalable

Green Flags:

- Stable or growing working capital shows solid operational management

- Efficient working capital usage (not too much, not too little) indicates good financial stewardship

- Positive working capital trends support sustainable dividend payments

Understanding these patterns helps you avoid companies that might face financial distress and identify businesses with strong fundamentals—a key principle in smart investing strategies.

Positive vs Negative Working Capital (What Each Means)

Positive Working Capital

Positive working capital occurs when current assets exceed current liabilities.

What it means:

- The company can pay all short-term bills and still have money left over

- There’s a cushion for unexpected expenses or opportunities

- The business is generally in good short-term financial health

Example: A retail store with $200,000 in current assets and $120,000 in current liabilities has $80,000 in positive working capital.

However, too much working capital isn’t always good either. Excessive working capital might indicate:

- Inefficient use of resources (cash sitting idle instead of being invested)

- Poor inventory management (too much stock gathering dust)

- Overly conservative financial management

Negative Working Capital

Negative working capital happens when current liabilities exceed current assets.

What it means:

- The company owes more in the short term than it can quickly access

- Potential difficulty paying bills when due

- Higher risk of financial distress or bankruptcy

Example: A struggling restaurant with $50,000 in current assets but $75,000 in current liabilities has -$25,000 in working capital.

Important exception: Some highly efficient businesses, particularly in retail (like Walmart or Amazon), can successfully operate with negative working capital because they:

- Collect cash from customers immediately

- Pay suppliers on extended terms (30-60 days later)

- Turn inventory extremely quickly

This creates a cash conversion advantage where customer money funds operations before bills come due. But this model only works for businesses with rapid inventory turnover and strong cash collection.

The Working Capital Cycle (How Money Flows)

Understanding the working capital cycle (also called the cash conversion cycle) shows how working capital moves through a business:

The Four Stages:

1. Purchase Inventory

The company buys raw materials or products (cash goes out or payables increase)

2. Production/Storage

Inventory sits in the warehouse or gets transformed into finished goods (capital is tied up)

3. Sales

Products are sold to customers (often on credit, creating accounts receivable)

4. Collection

Cash is collected from customers (receivables convert back to cash)

The cycle time is how long it takes to complete this loop. Shorter cycles mean working capital isn’t tied up as long, improving efficiency.

Example Cycle:

A furniture manufacturer:

- Buys wood on Day 1 ($10,000 payable in 30 days)

- Manufactures furniture in over 15 days

- Sells furniture on Day 20 ($15,000, customer pays in 45 days)

- Pays supplier on Day 30 (cash out: $10,000)

- Collects from customer on Day 65 (cash in: $15,000)

Working capital is tied up for 65 days from initial purchase to final collection. During this time, the business needs sufficient working capital to cover operations.

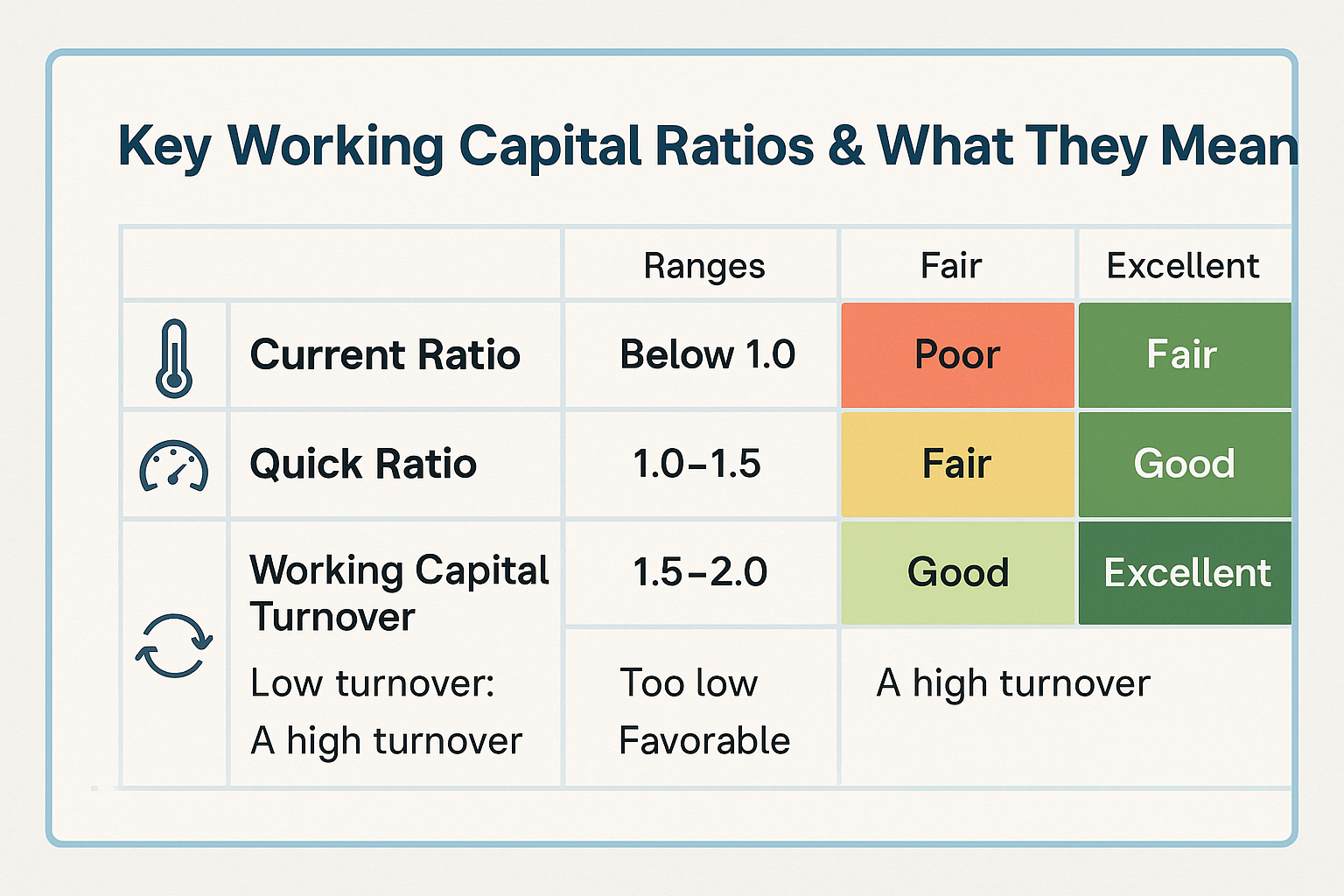

Working Capital Ratios

While the absolute working capital number is important, ratios provide context and enable comparisons across different-sized companies:

1. Current Ratio

Formula: Current Assets ÷ Current Liabilities

Interpretation:

- Above 2.0: Strong liquidity, comfortable cushion

- 1.5 to 2.0: Healthy working capital position

- 1.0 to 1.5: Adequate but tight

- Below 1.0: Warning sign—liabilities exceed liquid assets

Example: Current assets of $300,000 ÷ current liabilities of $150,000 = 2.0 current ratio

2. Quick Ratio (Acid-Test Ratio)

Formula: (Current Assets – Inventory) ÷ Current Liabilities

Why it matters: Inventory can be hard to sell quickly. The quick ratio shows if a company can pay bills using only its most liquid assets.

Interpretation:

- Above 1.0: Can cover short-term obligations without selling inventory

- Below 1.0: May struggle if inventory doesn’t sell quickly

Example: ($300,000 – $80,000) ÷ $150,000 = 1.47 quick ratio

3. Working Capital Ratio

Formula: Current Assets ÷ Current Liabilities

(Note: This is actually the same as the current ratio—different name, same calculation)

4. Working Capital Turnover

Formula: Annual Revenue ÷ Average Working Capital

What it shows: How efficiently a company uses working capital to generate sales.

Higher is generally better, but extremely high ratios might indicate the company is operating on too thin a margin.

Example: Annual revenue of $1,000,000 ÷ average working capital of $200,000 = 5.0 turnover ratio (the company generates $5 in sales for every $1 of working capital)

Industry Differences in Working Capital Needs

Working capital requirements vary dramatically by industry. Understanding these differences prevents unfair comparisons:

High Working Capital Industries:

Manufacturing

- Must maintain raw materials, work-in-progress, and finished goods inventory

- Long production cycles tie up capital

- Typical current ratio: 1.5-2.5

Retail

- Seasonal inventory needs (think holiday shopping)

- Must stock shelves before sales occur

- Typical current ratio: 1.2-2.0

Construction

- Long project timelines

- Must pay for materials and labor before receiving payment

- Typical current ratio: 1.3-1.8

Low Working Capital Industries:

Software/SaaS

- Minimal inventory (digital products)

- Subscription revenue collected upfront

- Can operate with negative working capital

- Typical current ratio: 0.8-1.5

Restaurants/Food Service

- Fast inventory turnover (food spoils quickly)

- Immediate cash collection

- Pay suppliers on terms

- Typical current ratio: 0.5-1.2

Service Businesses

- No physical inventory

- Low capital requirements

- Typical current ratio: 1.0-1.5

Key takeaway: Always compare a company’s working capital to industry peers, not to companies in different sectors.

How to Improve Working Capital (Practical Strategies)

Whether you’re running a business or analyzing one as an investor, these strategies improve working capital position:

Increase Current Assets

1. Accelerate Collections

- Offer early payment discounts (e.g., “2% off if paid within 10 days”)

- Tighten credit policies

- Send invoices immediately

- Follow up on overdue accounts promptly

2. Optimize Inventory

- Use just-in-time inventory systems

- Identify and discount slow-moving products

- Negotiate better terms with suppliers

- Improve demand forecasting

3. Increase Sales

- Boost revenue through marketing and sales efforts

- Expand to new markets or customer segments

- Improve product offerings

Decrease Current Liabilities

4. Negotiate Better Payment Terms

- Request extended payment periods from suppliers (30 days → 60 days)

- Consolidate suppliers for better leverage

- Build strong supplier relationships

5. Refinance Short-Term Debt

- Convert short-term loans to long-term debt (removes from current liabilities)

- Shop for better interest rates

- Pay down high-interest debt first

6. Manage Expenses

- Cut unnecessary operating costs

- Renegotiate contracts (rent, insurance, services)

- Improve operational efficiency

Strategic Approaches

7. Improve Cash Flow Management

- Create detailed cash flow forecasts

- Maintain a cash reserve for emergencies

- Time major purchases strategically

8. Use Technology

- Implement accounting software for better tracking

- Automate invoicing and payment reminders

- Use inventory management systems

9. Consider Financing Options

- Establish a line of credit for emergencies

- Use invoice factoring (selling receivables for immediate cash)

- Explore supply chain financing

Working Capital in Investment Analysis (What to Look For)

When you’re researching stocks or considering passive income through dividends, working capital analysis reveals important insights:

What to Examine:

1. Trend Analysis

Look at working capital over 3-5 years:

- Consistent growth: Positive sign of expanding, healthy business

- Declining trend: Warning sign, investigate why

- Volatile swings: May indicate seasonal business or management issues

2. Compare to Competitors

A company with stronger working capital than its peers may have:

- Better management

- More efficient operations

- Competitive advantages

3. Working Capital Changes

Review the cash flow statement’s “changes in working capital” section:

- Negative changes (working capital increased): Cash was used to fund operations

- Positive changes (working capital decreased): Operations generated cash

4. Sustainability of Dividends

Companies with strong working capital can more reliably maintain dividend payments, even during tough times.

Red Flags for Investors

- Consistently negative working capital (unless the business model supports it)

- Working capital is declining faster than revenue growth

- Current ratio below 1.0 for extended periods

- Increasing days’ sales outstanding (customers taking longer to pay)

- Rapidly growing inventory relative to sales

Green Flags for Investors

- Stable or improving working capital metrics

- Current ratio between 1.5-3.0 (depending on industry)

- Efficient cash conversion cycle

- Working capital that grows proportionally with revenue

- Strong quick ratio (above 1.0)

Understanding these patterns helps you avoid companies that might face financial difficulties and identify solid long-term investments.

Common Working Capital Mistakes (And How to Avoid Them)

1: Confusing Profit with Cash

The problem: A company can show profit on the income statement but run out of cash if working capital isn’t managed properly.

Example: You sell $100,000 of products on credit (profit recorded immediately), but customers won’t pay for 90 days. Meanwhile, you must pay suppliers within days. You’re profitable but cash-poor.

Solution: Monitor both profitability AND working capital. Track cash flow separately from accounting profit.

2: Over-Investing in Inventory

The problem: Tying up too much capital in inventory that sits unsold.

Impact:

- Cash is locked up in products

- Storage costs increase

- Risk of obsolescence or spoilage

- Less money available for other opportunities

Solution: Implement inventory management systems, analyze turnover rates, and use just-in-time ordering when possible.

3: Offering Too-Generous Credit Terms

The problem: Allowing customers to pay in 60, 90, or even 120 days creates a cash gap.

Impact: You’ve delivered value but can’t access the cash to pay your own bills.

Solution: Balance competitive credit terms with your own cash needs. Offer discounts for early payment. Screen customers’ creditworthiness carefully.

4: Ignoring Seasonal Fluctuations

The problem: Many businesses have seasonal peaks and valleys, but fail to plan working capital accordingly.

Example: A toy retailer must build inventory in summer/fall for holiday sales, requiring substantial working capital months before revenue arrives.

Solution: Create seasonal cash flow projections. Arrange lines of credit before you need them. Build cash reserves during peak seasons.

5: Growing Too Fast

The problem: Rapid growth often requires more working capital than expected—to fund inventory, hire staff, and extend credit to new customers.

Impact: “Growing broke”—expanding so fast that working capital can’t keep pace, leading to a cash crisis despite increasing sales.

Solution: Plan working capital needs before expanding. Grow at a sustainable pace. Secure adequate financing for growth initiatives.

6: Not Monitoring Working Capital Regularly

The problem: Treating working capital as a once-a-year consideration instead of an ongoing management priority.

Impact: Problems aren’t identified until they become crises.

Solution: Review working capital metrics monthly. Create dashboards tracking key indicators. Set up alerts for concerning trends.

Real-World Working Capital Case Study

Let’s examine how working capital challenges played out for a real business scenario:

Case: “TechGadget Distributors”

Background:

TechGadget Distributors sells consumer electronics to retailers. In Year 1, they had a healthy working capital of $500,000 with a current ratio of 2.0.

Year 2: Rapid Expansion

TechGadget secured a major contract with a large retail chain. To fulfill orders, they:

- Doubled inventory purchases: +$800,000

- Extended the 90-day payment terms (industry standard for large retailers)

- Continued paying their own suppliers in 30 days

The Working Capital Crunch:

Before Expansion:

- Current Assets: $1,000,000

- Current Liabilities: $500,000

- Working Capital: $500,000

- Current Ratio: 2.0

After Expansion (90 days in):

- Current Assets: $1,600,000 (added $800k inventory, but no cash collected yet)

- Current Liabilities: $1,100,000 (paid suppliers $800k, now have new payables)

- Working Capital: $500,000

- Current Ratio: 1.45

The Problem:

Despite landing a huge contract, TechGadget’s working capital became strained. They had to:

- Pay suppliers before collecting from the big retailer

- Fund 60 extra days of operations (90-day customer terms minus 30-day supplier terms)

- Cover increased operational costs (shipping, staff, warehousing)

The Solution:

TechGadget secured a $400,000 line of credit to bridge the cash gap. Once the retailer paid, they repaid the line of credit and emerged with stronger working capital from the profitable sales.

Lessons:

- Growth requires working capital investment

- Payment term gaps create cash flow challenges

- Planning and financing prevent cash crises

- Profitable opportunities still need adequate working capital

This scenario illustrates why smart financial moves require understanding both opportunities AND the working capital to execute them.

Working Capital and the Economic Cycle

Working capital needs and challenges shift with economic conditions:

During Economic Expansion

Characteristics:

- Sales growing

- Customers paying reliably

- Access to credit is easier

Working Capital Impact:

- Need for working capital increases with sales growth

- Inventory builds to meet demand

- Receivables grow with sales volume

- Generally easier to obtain financing

Strategy: Build working capital reserves during good times to prepare for downturns.

During the Economic Recession

Characteristics:

- Sales are declining or stagnant

- Customers delaying payments

- Credit his ardor to obtain

- Cash preservation critical

Working Capital Impact:

- Collections are low (receivables age)

- Inventory may become obsolete

- Access to credit tightens

- Working capital becomes more valuable and harder to maintain

Strategy: Tighten credit policies, reduce inventory, preserve cash, and maintain strong banking relationships.

Understanding these cycles helps both business owners and investors make better decisions. Just as market emotions cycle through fear and greed, working capital needs cycle with the economy.

Working Capital Management Best Practices

For Business Owners:

1. Create a Working Capital Policy

- Define the target current ratio for your industry

- Set maximum days sales outstanding (DSO)

- Establish inventory turnover goals

- Document credit policies

2. Monitor Key Metrics Weekly

- Current ratio

- Quick ratio

- Days sales outstanding

- Inventory turnover

- Accounts payable aging

3. Forecast Cash Flow

- Project 13 weeks ahead (rolling forecast)

- Plan for seasonal variations

- Identify potential cash gaps early

- Update forecasts weekly

4. Build Relationships

- Maintain strong banking relationships

- Communicate openly with suppliers

- Understand customer payment patterns

- Establish credit lines before you need them

5. Use Technology

- Implement cloud accounting software

- Automate invoicing and collections

- Use inventory management systems

- Generate real-time financial dashboards

For Investors:

1. Analyze Trends

- Review 5+ years of working capital data

- Compare to industry benchmarks

- Identify seasonal patterns

- Watch for deteriorating metrics

2. Read the Fine Print

- Study management discussion of working capital in annual reports

- Review cash flow statement changes in working capital

- Understand the company’s working capital strategy

- Look for red flags in footnotes

3. Compare Competitors

- Benchmark working capital efficiency

- Identify industry leaders

- Understand competitive advantages

- Spot companies with superior management

4. Consider Business Model

- Some models naturally have negative working capital (not always bad)

- Understand industry-specific working capital needs

- Evaluate the sustainability of the model

- Assess scalability

Working Capital FAQs

Interactive Working Capital Calculator

💰 Working Capital Calculator

Calculate your working capital and key financial ratios

Current Assets

Current Liabilities

Your Working Capital Analysis

Interpretation

Conclusion: Mastering Working Capital for Financial Success

Working capital isn’t just an accounting concept buried in financial statements—it’s the oxygen that keeps businesses alive and a critical indicator that smart investors use to evaluate potential investments.

Whether you’re running a business, analyzing stocks, or simply want to understand how companies really work, mastering working capital gives you a powerful lens for seeing financial health and operational efficiency.

Key Takeaways to Remember:

Working capital = Current Assets – Current Liabilities—it’s that simple

Positive working capital provides a cushion for operations and growth

Ratios provide context—compare current ratio, quick ratio, and working capital trends

Industry matters—what’s healthy for a software company differs from a manufacturer

Monitor regularly—working capital is a dynamic metric that requires ongoing attention

Your Next Steps:

If you’re a business owner:

- Calculate your current working capital using the formula above

- Benchmark against industry standards

- Implement monthly working capital monitoring

- Create a 13-week cash flow forecast

- Build relationships with banks before you need financing

If you’re an investor:

- Add working capital analysis to your stock evaluation process

- Review working capital trends for companies you own or are considering

- Compare working capital efficiency across competitors

- Watch for red flags in quarterly reports

- Use working capital insights to assess dividend sustainability for income-focused portfolios

If you’re learning about finance:

- Practice calculating working capital with real company balance sheets

- Track working capital for 3-5 companies over several quarters

- Understand the working capital cycle in different industries

- Learn to read cash flow statements to see working capital changes

- Apply these concepts to your own personal finances

The Bottom Line

Working capital might seem like just another financial metric, but it’s actually one of the most practical and actionable measures of financial health. It tells you whether a business can survive tomorrow, not just whether it was profitable yesterday.

Companies with strong working capital management can weather storms, seize opportunities, and deliver consistent returns to shareholders. Those that neglect working capital often fail despite having great products or services.

By understanding and monitoring working capital—whether for your own business or as part of your investment analysis—you’re equipping yourself with insights that separate financial success from failure.

The businesses that master working capital are the ones that thrive for decades. The investors who understand working capital are the ones who avoid costly mistakes and build wealth steadily over time.

Start applying these working capital principles today, and you’ll be making smarter financial decisions tomorrow.

FAQ: Working Capital

A “good” working capital amount depends on the business size and industry. Generally, a current ratio between 1.5 and 3.0 indicates healthy working capital. Below 1.0 signals potential problems, while above 3.0 might mean inefficient use of resources. The absolute dollar amount should grow proportionally with business size—a $10 million company needs more working capital than a $1 million company.

The formula for working capital is: Current Assets – Current Liabilities. Find current assets (cash, receivables, inventory, etc.) and current liabilities (payables, short-term debt, accrued expenses) on the balance sheet. Subtract liabilities from assets to get working capital. For example, $500,000 in current assets minus $300,000 in current liabilities equals $200,000 in working capital.

Yes, negative working capital occurs when current liabilities exceed current assets. This typically signals financial stress and difficulty paying short-term obligations. However, some highly efficient businesses (like Amazon or Walmart) successfully operate with negative working capital by collecting cash from customers before paying suppliers and turning inventory extremely quickly. For most businesses, though, negative working capital is a warning sign.

Working capital is a point-in-time snapshot showing the difference between current assets and current liabilities on a specific date. Cash flow measures the actual movement of cash into and out of the business over a period of time. A company can have positive working capital but negative cash flow (if cash is tied up in inventory or receivables), or vice versa. Both metrics are important, but they measure different aspects of financial health.

Investors use working capital to assess a company’s operational efficiency and financial stability. Strong working capital suggests the company can meet obligations, invest in growth, and weather downturns—supporting higher valuations. Declining working capital may indicate operational problems, reducing investor confidence. Working capital efficiency (generating more sales per dollar of working capital) often correlates with higher stock valuations, as it demonstrates superior management and competitive advantages.

The working capital cycle (or cash conversion cycle) measures how long it takes for a company to convert working capital investments back into cash. It includes: (1) purchasing inventory, (2) holding/producing products, (3) selling to customers, and (4) collecting payment. A shorter cycle means capital isn’t tied up as long, improving efficiency. The cycle is calculated as: Days Inventory Outstanding + Days Sales Outstanding – Days Payable Outstanding.

Startups typically need 3-6 months of operating expenses in working capital as a minimum cushion. Technology startups with low inventory needs might operate on less, while manufacturing or retail startups need more. Calculate monthly operating expenses (rent, payroll, utilities, supplies) and multiply by 3-6 to estimate minimum working capital needs. Many experts recommend 6-12 months for safety, especially in uncertain markets. Adequate working capital is often the difference between startup success and failure.

References and Further Reading

For deeper exploration of working capital concepts, consult these authoritative sources:

- U.S. Securities and Exchange Commission (SEC) – Beginner’s Guide to Financial Statements – Official guidance on reading and interpreting financial statements

- Investopedia – Working Capital Definition – Comprehensive overview with examples

- CFA Institute – Financial Statement Analysis – Professional-level financial analysis education

- Federal Reserve – Small Business Credit Survey – Data on working capital challenges for small businesses

- Morningstar – Company Financial Analysis – Tools for analyzing working capital in public companies

For more financial education and investing insights, explore these related guides on TheRichGuyMath.com.

Disclaimer:

This article is for educational purposes only and does not constitute financial, investment, or business advice. Working capital analysis should be one of many factors considered when making business or investment decisions. Consult with qualified financial professionals, accountants, or business advisors before making significant financial decisions. Past performance and financial metrics do not guarantee future results. The examples and scenarios presented are for illustrative purposes and may not reflect real-world outcomes.

Written by Max Fonji — With a decade of experience in financial education and analysis, Max is your go-to source for clear, data-backed investing education. Max specializes in breaking down complex financial concepts into actionable insights that help readers build wealth and make smarter money decisions. Learn more at TheRichGuyMath.com.