← Back to Budgeting and Saving

Picture this: you walk into a dealership, fall in love with a sleek new car, and before you know it, you’re signing papers on a loan that’ll haunt your budget for the next seven years. Sound familiar? You’re not alone. The average American car payment hit a staggering $726 per month in 2025, leaving many people financially strapped and wondering where their paycheck went. But here’s the good news: there’s a simple, proven formula that can save you from car-buying regret—the 20/4/10 Rule.

This straightforward guideline has helped thousands of car buyers make smarter financial decisions, ensuring they drive away in a vehicle they can actually afford without sacrificing their financial future. Whether you’re a first-time buyer or trading in your tenth car, understanding and applying the 20/4/10 Rule can be the difference between financial freedom and years of payment stress.

TL;DR

- The 20/4/10 Rule is a car-buying budget formula: Put down 20%, finance for no more than 4 years, and keep total monthly vehicle expenses under 10% of your gross monthly income

- This rule prevents you from becoming “car poor”: It ensures you can afford your vehicle without sacrificing other financial goals like retirement savings or emergency funds

- Following this guideline typically saves buyers $15,000-$30,000 over the life of their car loan compared to traditional 6-7 year financing

- The rule applies to both new and used vehicles: It’s a flexible framework that helps you determine what you can truly afford, regardless of the car type

- Breaking any part of the rule significantly increases financial risk: Violating even one component can lead to negative equity, higher interest payments, and budget strain

What Is the 20/4/10 Rule?

In simple terms, the 20/4/10 Rule is a car-buying budget guideline that helps you determine how much vehicle you can afford. This three-part formula was developed by financial advisors to prevent buyers from overextending themselves on auto loans.

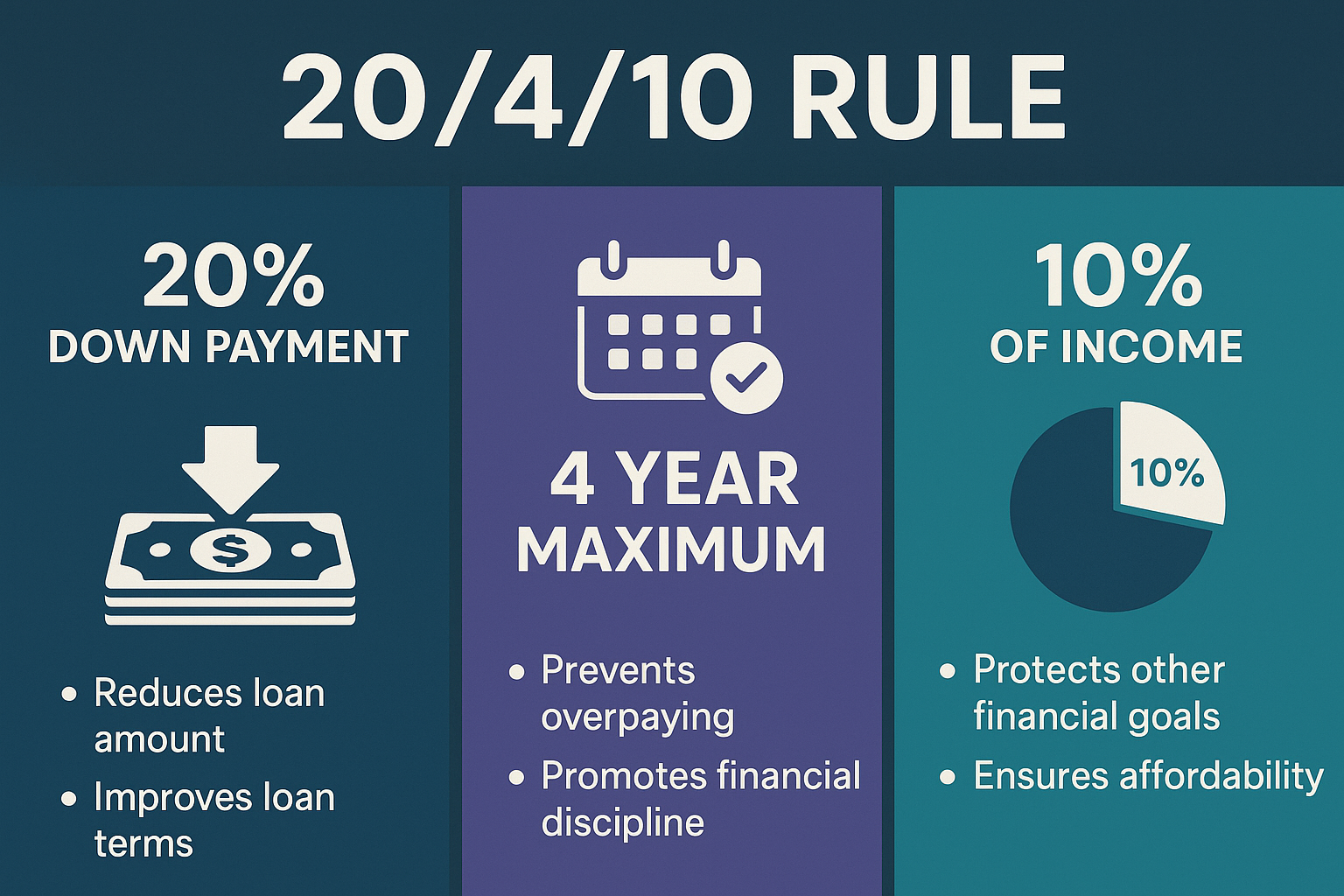

The rule breaks down into three clear components:

- 20%: Make a down payment of at least 20% of the vehicle’s purchase price

- 4: Finance the car for no more than 4 years (48 months)

- 10: Keep your total monthly vehicle expenses at or below 10% of your gross monthly income

Each number serves a specific purpose in protecting your financial health. The 20% down payment helps you avoid being “underwater” on your loan (owing more than the car is worth). The 4-year maximum loan term ensures you’re not paying interest for longer than necessary. And the 10% cap on monthly expenses prevents your car from consuming too much of your income.

This rule is designed for anyone purchasing a vehicle, whether you’re buying new or used, trading in, or starting fresh. It’s particularly valuable for first-time buyers who might not understand the true cost of car ownership beyond just the monthly payment.

Why the 20/4/10 Rule Matters in 2025

The automotive financing landscape has changed dramatically over the past decade. According to Experian’s State of the Automotive Finance Market report, the average auto loan term has stretched to 68 months for new cars and 65 months for used vehicles, far exceeding the 4-year recommendation.

Here’s why that matters:

Longer loan terms might seem appealing because they lower your monthly payment, but they come with serious downsides:

- Higher total interest costs: A $30,000 car financed at 7% APR costs $3,279 in interest over 4 years, but $5,740 over 6 years—that’s $2,461 extra!

- Negative equity risk: Cars depreciate fastest in the first few years, so longer loans mean you’ll owe more than the car is worth for a longer period

- Opportunity cost: Money tied up in car payments could be invested elsewhere, potentially earning returns that compound over time

The 20/4/10 Rule matters because it forces you to buy within your means. In an era where smart financial moves are more important than ever, this guideline helps ensure your car purchase doesn’t derail your broader financial goals.

Breaking Down Each Component of the 20/4/10 Rule

The 20% Down Payment: Why It’s Non-Negotiable

The 20% down payment is your first line of defense against financial trouble. Here’s what this component accomplishes:

Immediate Equity Building

When you put 20% down, you instantly own a meaningful portion of your vehicle. This is crucial because new cars typically depreciate 20-30% in their first year alone. With a substantial down payment, you’re less likely to find yourself owing more than the car is worth if you need to sell or if it’s totaled in an accident.

Lower Monthly Payments

A bigger down payment means borrowing less money, which directly translates to lower monthly payments. On a $30,000 car:

| Down Payment | Amount Financed | Monthly Payment (4 years @ 7% APR) |

|---|---|---|

| $0 (0%) | $30,000 | $718 |

| $3,000 (10%) | $27,000 | $646 |

| $6,000 (20%) | $24,000 | $575 |

That’s a $143 monthly difference between 0% and 20% down, money that could go toward building your passive income streams instead.

Better Interest Rates

Lenders view borrowers who make larger down payments as less risky. You’re more likely to qualify for better interest rates when you have significant skin in the game, potentially saving thousands over the life of the loan.

How to Save for Your 20% Down Payment:

- Set up automatic transfers to a dedicated car savings account

- Sell your current vehicle (if applicable) and use the proceeds

- Use a tax refund or work bonus

- Cut discretionary spending temporarily and redirect those funds

- Consider a side hustle specifically earmarked for your car fund

The 4-Year Maximum Loan Term: Short-Term Pain, Long-Term Gain

Financing for no more than 4 years (48 months) is the sweet spot for auto loans. This timeframe balances affordability with financial efficiency.

Why 4 Years Specifically?

Financial experts recommend 4 years because:

- Alignment with depreciation: Most vehicles maintain reasonable value through year four, reducing negative equity risk

- Manageable interest costs: Interest doesn’t compound excessively over this timeframe

- Psychological benefit: You’re not making payments for half a decade or more

- Faster ownership: You’ll own the vehicle outright sooner, freeing up cash flow for other priorities

The Real Cost of Longer Loans

Let’s compare financing $25,000 at 7% APR over different terms:

| Loan Term | Monthly Payment | Total Interest Paid | Total Cost |

|---|---|---|---|

| 3 years (36 months) | $772 | $2,791 | $27,791 |

| 4 years (48 months) | $598 | $3,732 | $28,732 |

| 5 years (60 months) | $495 | $4,685 | $29,685 |

| 6 years (72 months) | $426 | $5,651 | $30,651 |

Notice the pattern: Each additional year adds roughly $1,000 in interest. Over 6 years versus 4 years, you’re paying nearly $2,000 extra just in interest, money that provides zero additional value.

What If the 4-Year Payment Is Too High?

If you can’t afford the monthly payment on a 4-year loan, the 20/4/10 Rule is telling you something important: you’re looking at a car that’s too expensive for your budget. This is a feature, not a bug. The rule is designed to prevent you from overextending yourself.

Your options:

- Look at less expensive vehicles

- Save a larger down payment to reduce the amount financed

- Improve your credit score to qualify for better rates

- Consider certified pre-owned instead of new

- Don’t extend the loan term to 6-7 years just to make it “affordable”

The 10% Monthly Expense Cap: The Often-Forgotten Factor

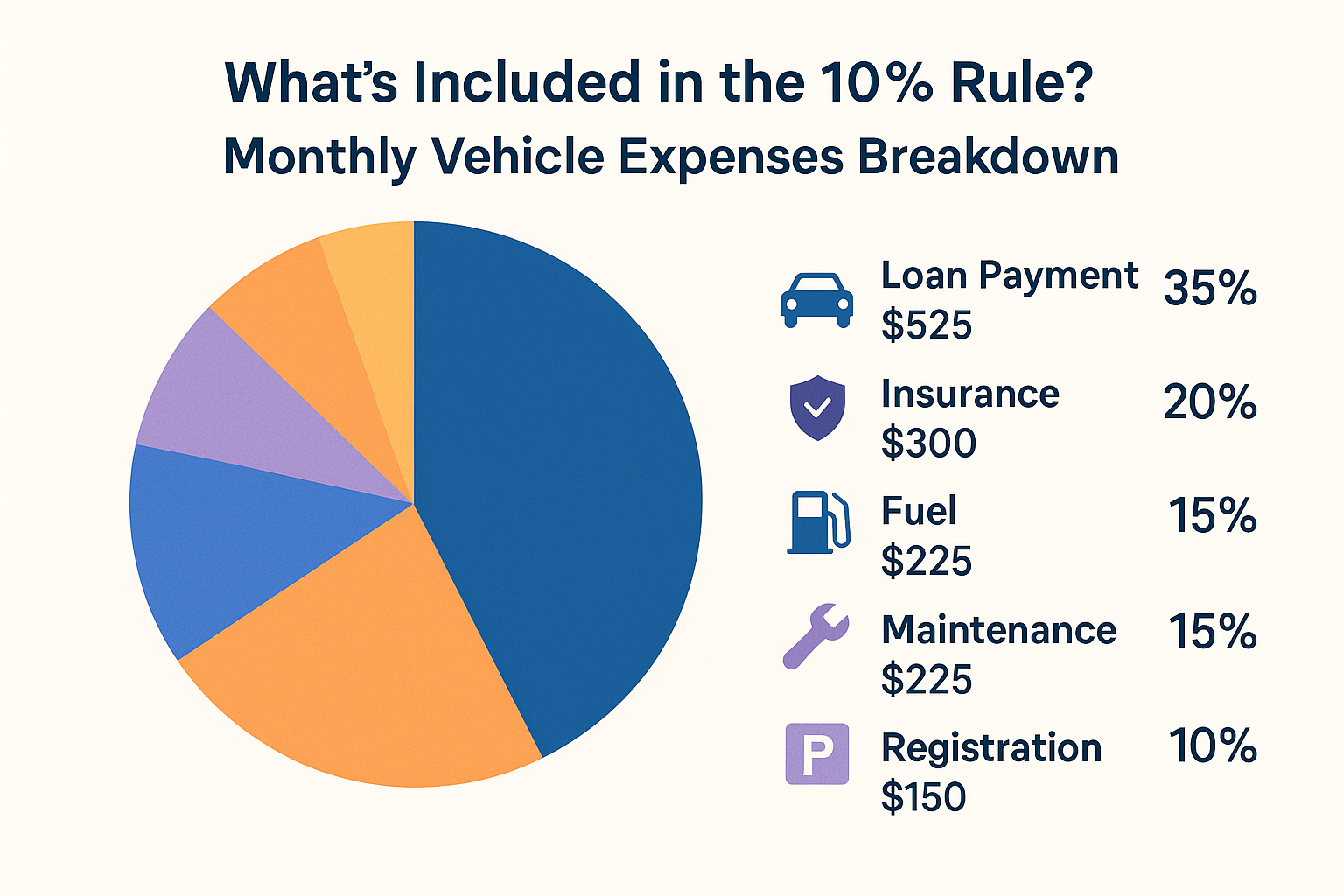

This is where most car buyers get tripped up. The 10% rule states that your total monthly vehicle expenses should not exceed 10% of your gross monthly income.

Total monthly vehicle expenses include:

- Monthly loan or lease payment

- Fuel costs

- Maintenance and repairs

- Auto insurance

- Registration and taxes

- Parking fees (if applicable)

Most people only consider the loan payment when budgeting for a car, but these other costs can add up to hundreds of dollars per month.

Example Calculation:

Let’s say you earn $60,000 per year ($5,000 gross monthly income). According to the 10% rule, your total vehicle expenses should not exceed $500 per month.

Here’s a realistic breakdown:

| Expense Category | Monthly Cost |

|---|---|

| Loan payment | $300 |

| Fuel | $120 |

| Insurance | $150 |

| Maintenance/repairs (average) | $75 |

| Registration (annual ÷ 12) | $15 |

| TOTAL | $660 |

In this scenario, you’re $160 over budget at $660 per month. You’d need to either:

- Choose a less expensive vehicle to lower the payment

- Find ways to reduce insurance costs (higher deductible, better rates)

- Consider a more fuel-efficient vehicle

Why 10% and Not More?

Financial advisors typically recommend the 50/30/20 budgeting framework: 50% for needs, 30% for wants, and 20% for savings and debt repayment. Transportation is a “need,” but it shouldn’t dominate that category. At 10% of gross income, your car remains affordable while leaving room for housing, utilities, food, healthcare, and other essentials.

Exceeding 10% puts you at risk of becoming “car poor”, where your vehicle consumes so much of your income that you can’t adequately save for retirement, build an emergency fund, or pursue other financial goals.

Real-World Example: Applying the 20/4/10 Rule

Let’s walk through a complete example to see how this works in practice.

Meet Sarah:

- Annual gross income: $55,000

- Monthly gross income: $4,583

- Current savings: $8,000

- Looking to buy a reliable commuter car

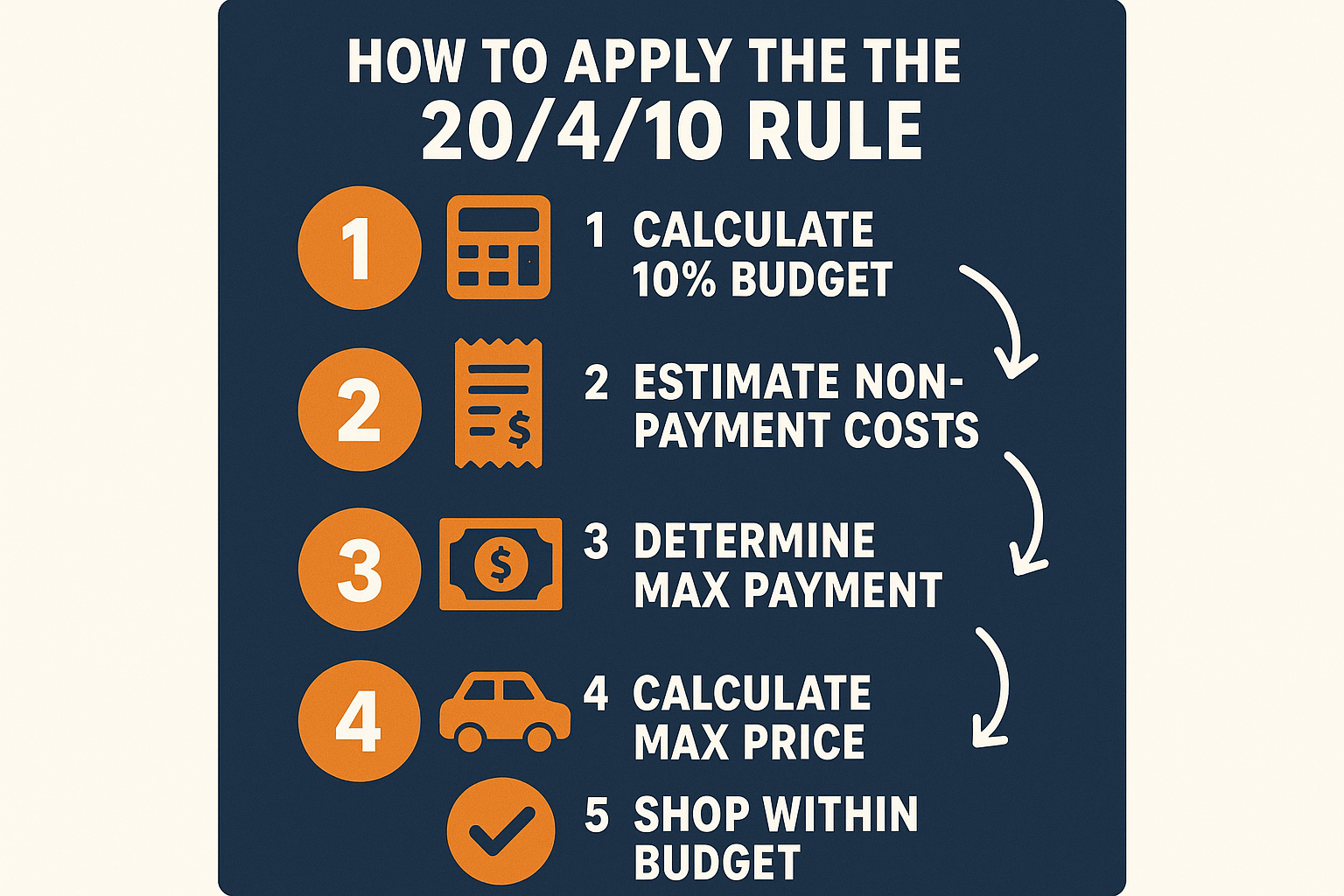

Step 1: Calculate the 10% Monthly Budget

$4,583 × 10% = $458.30 maximum for all monthly vehicle expenses

Step 2: Estimate Non-Payment Expenses

Sarah researches typical costs for the type of vehicle she wants:

- Fuel: $100/month (moderate commute)

- Insurance: $140/month (based on quotes)

- Maintenance: $60/month (average)

- Registration: $12/month ($144 annually)

Total non-payment expenses: $312/month

Step 3: Determine Maximum Payment

$458.30 – $312 = $146.30 maximum monthly payment

Wait—that seems low! This is the 20/4/10 Rule doing its job. Let’s continue.

Step 4: Calculate Maximum Vehicle Price

With $8,000 saved, Sarah can make a 20% down payment on a vehicle up to:

$8,000 ÷ 0.20 = $40,000 maximum price

But wait—can she afford the payments on a $40,000 car?

Amount to finance: $40,000 – $8,000 = $32,000

At 7% APR for 48 months: $765/month

This far exceeds her $146.30 maximum payment! The rule is preventing Sarah from making a costly mistake.

Step 5: Work Backward to Find the Right Price

Using a loan calculator, Sarah determines that at 7% APR for 48 months, a $146 monthly payment means she can finance approximately $6,100.

With her $8,000 down payment:

$6,100 + $8,000 = $14,100 maximum vehicle price

Sarah’s Realistic Options:

- Buy a quality used vehicle in the $12,000-$14,000 range

- Save more for a larger down payment to afford a nicer car

- Increase her income to raise her 10% monthly budget

- Reduce other expenses (like finding cheaper insurance) to allow a higher payment

Sarah decides to purchase a well-maintained 2020 Honda Civic with 45,000 miles for $13,500. She puts $8,000 down, finances $5,500 at 6.5% for 48 months (monthly payment: $130), and her total monthly vehicle costs come to $442—well within her budget.

The Result: Sarah drives a reliable, fuel-efficient car she can truly afford, while still having money to invest in her retirement accounts and build wealth.

Advantages of Following the 20/4/10 Rule

Financial Benefits

Lower Total Interest Costs

By financing less money (thanks to the 20% down) over a shorter period (4 years max), you’ll pay significantly less in interest. This can save you $5,000-$15,000 or more compared to typical financing.

Faster Equity Building

You’ll own your vehicle outright sooner, which means:

- No monthly payment hanging over your head

- Freedom to save and invest that money elsewhere

- Flexibility to sell or trade the vehicle on your terms

- No risk of being upside-down on your loan

Protection Against Depreciation

The substantial down payment and shorter loan term protect you from the worst effects of depreciation. Even if you need to sell unexpectedly, you’re more likely to break even or come out ahead.

Better Insurance Rates

When you own more of your vehicle, you have more flexibility with insurance coverage. Once the car is paid off, you can drop comprehensive and collision coverage if the vehicle’s value is low enough, saving hundreds annually.

Psychological Benefits

Peace of Mind

There’s something incredibly freeing about knowing your car payment will disappear in just four years, not six, seven, or eight. This psychological benefit shouldn’t be underestimated.

Reduced Financial Stress

When your car consumes only 10% of your income instead of 15-20%, you have breathing room in your budget. Unexpected expenses don’t become crises.

Alignment with Long-Term Goals

Following this rule demonstrates financial discipline and keeps you focused on what matters: building wealth, not just looking wealthy. This mindset supports other smart financial decisions throughout your life.

Lifestyle Benefits

More Money for Experiences

A reasonable car payment leaves room in your budget for travel, hobbies, dining out, and other experiences that create lasting memories.

Faster Path to Financial Independence

Money not tied up in excessive car payments can be directed toward investments, retirement accounts, or even starting a business. These opportunities compound over time, accelerating your journey to financial independence.

Flexibility for Life Changes

Life happens—job changes, relocations, family growth. When you’re not locked into a burdensome car payment, you have more flexibility to adapt to these changes without financial strain.

Common Objections and Limitations

“But I Need a Newer/Nicer Car!”

This is the most common pushback against the 20/4/10 Rule. Let’s address it honestly.

The truth: You probably want a newer/nicer car more than you need it.

Modern vehicles are incredibly reliable. A well-maintained used car from a reputable brand can easily provide 200,000+ miles of service. According to Consumer Reports, many vehicles from the 2015-2020 model years offer excellent reliability at a fraction of the cost of new.

Consider this perspective: Would you rather drive a $45,000 new car while struggling to save for retirement, or drive a $15,000 reliable used car while building a six-figure investment portfolio? Which decision will you be happier about in 20 years?

That said, there are legitimate situations where a newer vehicle makes sense:

- Your work requires a professional appearance and reliable transportation

- You drive extensively and need warranty coverage

- You have specific safety requirements (large family, medical needs)

- You can genuinely afford it within the 20/4/10 framework

The key is honesty: are you buying based on needs or ego?

“Interest Rates Are Too High for a 4-Year Loan to Work”

In 2025, interest rates on auto loans can range from 5% to 15% or higher, depending on your credit score and the lender.

Here’s the reality: If interest rates make a 4-year loan unaffordable, extending to 6-7 years doesn’t solve the problem; it makes it worse. You’ll pay even more interest over the longer term.

Better solutions:

- Improve your credit score before buying (pay down debts, dispute errors, make all payments on time)

- Save a larger down payment to reduce the amount financed

- Shop around for better rates (credit unions often offer lower rates than dealerships)

- Buy a less expensive vehicle that you can afford with a 4-year loan

- Wait to buy if possible, giving yourself time to improve your financial position

According to Experian, borrowers with excellent credit (720+) can get rates 5-8 percentage points lower than those with poor credit. The time invested in improving your score can save thousands.

“I Can Get 0% Financing for 6 Years!”

Promotional 0% financing offers sound amazing, and they can be legitimate deals—but there are important caveats:

What to watch for:

- Higher purchase price: Dealers often inflate the price to offset the interest-free loan

- Strict credit requirements: Only buyers with excellent credit qualify

- Lost rebate opportunities: You might get a better total deal with a cash rebate and standard financing

- Depreciation risk: Even at 0%, a 6-year loan means you’ll be underwater for years

The 20/4/10 Rule still applies even with 0% financing. Just because the money is “free” doesn’t mean you can afford the vehicle. Ask yourself:

- Does the vehicle price fit within your budget calculations?

- Could you get a better deal with a rebate and shorter-term financing?

- Are you buying a more expensive car than you need simply because of the promotional rate?

Pro tip: Run the numbers both ways. Calculate the total cost with 0% financing versus taking a $2,000-$4,000 rebate and financing at regular rates for 48 months. Often, the rebate wins.

“What About Leasing?”

Leasing is a different animal entirely, but the 10% rule still applies to your total monthly vehicle costs.

Leasing considerations:

Advantages:

- Lower monthly payments than buying

- Always driving a newer vehicle

- Warranty coverage throughout the lease

- No depreciation risk (you return the car)

Disadvantages:

- You never build equity

- Mileage restrictions (typically 10,000-15,000 miles/year)

- Fees for excess wear and tear

- Perpetual payment (you’ll always have a car payment)

- More expensive over the long term

The 20/4/10 Rule perspective on leasing:

If you lease, you’re essentially choosing to always have a car payment. This makes it harder to build wealth over time. However, if you absolutely must drive a newer vehicle for business or personal reasons, leasing can make sense, as long as your total monthly costs (lease payment + insurance + fuel + maintenance) stay under 10% of your gross income.

Better alternative: Buy a 2-3 year certified pre-owned vehicle and keep it for 8-10 years. You’ll enjoy low depreciation, warranty coverage for the first few years, and eventually have no payment while driving a still-modern vehicle.

How to Implement the 20/4/10 Rule: Step-by-Step Guide

Step 1: Calculate Your Maximum Budget

Start with your income:

Gross annual income: $________

Gross monthly income: $________ (annual ÷ 12)

10% of gross monthly: $________ (your maximum total vehicle budget)

Estimate your non-payment expenses:

Research typical costs for the type of vehicle you’re considering:

- Fuel: $________/month

- Insurance: $________/month (get actual quotes)

- Maintenance: $________/month (check Edmunds or AAA estimates)

- Registration/taxes: $________/month (annual cost ÷ 12)

Total non-payment expenses: $________/month

Calculate maximum payment:

Maximum total budget – Non-payment expenses = Maximum monthly payment

$________ – $________ = $________

Step 2: Determine How Much You Can Finance

Using a loan calculator (many free options online), input:

- Monthly payment: (your maximum from Step 1)

- Interest rate: (check current rates for your credit score)

- Loan term: 48 months

This gives you the maximum amount you can finance.

Step 3: Calculate Maximum Purchase Price

Maximum financed amount: $________

Your available down payment (20%): $________

Maximum purchase price = Financed amount ÷ 0.80

Or simply: Down payment ÷ 0.20 = Maximum price

Example:

If you can finance $15,000 and have $5,000 for a down payment:

$15,000 + $5,000 = $20,000 maximum purchase price

(Verify: $5,000 ÷ $20,000 = 25% down ✓)

Step 4: Research Vehicles in Your Price Range

Now the fun part! Armed with your maximum price, research vehicles that:

- Fit within your budget

- Meet your actual needs (not wants)

- Have strong reliability ratings

- Offer reasonable fuel economy

- Have affordable insurance costs

Top resources for research:

- Consumer Reports: Reliability ratings and owner reviews

- Edmunds: True cost to own calculations

- Kelley Blue Book (KBB): Fair market values

- NHTSA: Safety ratings

- Carfax: Vehicle history reports

Pro tip: Focus on vehicles known for reliability and low ownership costs. Brands like Honda, Toyota, Mazda, and Subaru typically offer excellent value in the used market.

Step 5: Get Pre-Approved for Financing

Before you step foot in a dealership, get pre-approved for an auto loan from:

- Your bank or credit union

- Online lenders (LightStream, Capital One Auto Navigator)

- Multiple sources to compare rates

Benefits of pre-approval:

- You know exactly what you can afford

- You have negotiating leverage at the dealership

- You can focus on negotiating the vehicle price, not the payment

- You avoid dealer financing tricks and add-ons

What you’ll need:

- Proof of income (pay stubs, tax returns)

- Proof of residence (utility bill, lease agreement)

- Driver’s license

- Social Security number

- Employment information

Step 6: Shop Smart and Negotiate

When you’ve found a vehicle you want:

For used cars:

- Get a pre-purchase inspection from an independent mechanic ($100-150 well spent)

- Request a Carfax or AutoCheck report

- Test drive in various conditions

- Verify the title is clean (no salvage or flood damage)

Negotiation tips:

- Negotiate the purchase price, not the monthly payment

- Keep your financing source private until you’ve agreed on a price

- Don’t discuss your trade-in until the price is set

- Be willing to walk away (there’s always another car)

- Avoid dealer add-ons (extended warranties, paint protection, etc.)

Remember: The dealer wants to sell you the most expensive car with the longest loan term. You’re armed with the 20/4/10 Rule. Stick to your numbers.

Step 7: Review the Final Numbers

Before signing anything, verify:

- Purchase price matches what you negotiated

- Down payment is at least 20%

- Loan term is 48 months or less

- Interest rate matches your pre-approval (or better)

- Monthly payment fits your budget

- Total monthly vehicle costs are under 10% of gross income

- No surprise fees or add-ons in the contract

Take your time reviewing the paperwork. Don’t let anyone rush you. If something doesn’t match what you agreed to, speak up or walk away.

Alternatives and Modifications to the Rule

The 30/3/15 Rule (More Conservative)

Some financial experts recommend an even stricter approach:

- 30%: Put down at least 30% (instead of 20%)

- 3: Finance for no more than 3 years (instead of 4)

- 15%: Keep total expenses under 15% of gross income (instead of 10%)

Wait—that 15% seems less conservative, right? Actually, this version uses net income instead of gross, which makes it more restrictive.

This approach works well for:

- People with irregular income

- Those with significant debt

- Buyers who want to build equity faster

- Anyone prioritizing aggressive wealth building

The “Drive Free” Strategy

This alternative focuses on eliminating car payments:

- Start where you are: If you currently have a car payment, keep making it

- When paid off: Continue making the same “payment” to yourself in a car fund

- After 2-4 years: You’ll have $15,000-$35,000+ saved

- Buy your next car with cash

- Repeat: Keep “paying yourself” and upgrade every 5-7 years

The result: You’ll never have a car payment again, and you’ll always be upgrading to better vehicles.

This strategy pairs beautifully with the 20/4/10 Rule. Use the rule for your current purchase, then transition to the Drive Free approach once it’s paid off.

The High-Income Modification

If you earn a high income ($150,000+), the 10% rule might be unnecessarily restrictive. A $500,000/year earner doesn’t need to spend $50,000/year on vehicle expenses.

Consider this modification:

- Follow the 20/4/10 Rule up to a certain income level (e.g., $100,000)

- Above that, cap your total vehicle expenses at a fixed dollar amount rather than a percentage

- For example: Max of $1,000/month regardless of income

The principle remains: Don’t let your car consume a disproportionate amount of your resources, even if you can technically afford it. That money could be invested in dividend stocks or other wealth-building vehicles instead.

Common Mistakes to Avoid

1: Focusing Only on the Monthly Payment

The scenario: A dealer says, “What monthly payment are you comfortable with?” You say “$400,” and they make it happen—with a 7-year loan, minimal down payment, and inflated purchase price.

Why it’s problematic:

- You pay thousands more in interest

- You’re underwater on the loan for years

- You ignore the total cost of ownership

- You might be buying more car than you need

The fix: Focus on the total purchase price, down payment, interest rate, and loan term—not just the monthly payment.

2: Skipping the Down Payment

The scenario: You have $5,000 saved, but put $0 down because the dealer offers “no money down” financing.

Why it’s problematic:

- You’re immediately underwater (owe more than the car is worth)

- Higher monthly payments

- More interest paid over time

- If totaled or you need to sell, you’ll owe money even after the car is gone

The fix: Always make at least a 20% down payment. If you don’t have it saved, wait and keep saving.

3: Buying More Cars Than You Need

The scenario: You need basic transportation, but buy a luxury SUV because “you deserve it” or want to impress others.

Why it’s problematic:

- Higher purchase price

- Higher insurance costs

- Higher fuel costs

- Higher maintenance costs

- Opportunity cost of money that could be invested

The fix: Be honest about your needs versus wants. A reliable Honda Accord or Toyota Camry will get you where you need to go just as well as a BMW or Mercedes—and leave you thousands of dollars richer.

Remember: Your car is not a measure of your worth or success. Building wealth is about making smart decisions, not impressive ones. Learn more about making smart financial moves that actually build wealth.

4: Ignoring Total Cost of Ownership

The scenario: You buy a 10-year-old luxury car because it’s “cheap” at $8,000.

Why it’s problematic:

- Luxury vehicles have expensive parts and maintenance

- Insurance costs are higher

- Fuel economy may be poor

- Repairs can easily cost $2,000-$5,000 annually

The fix: Research the total cost of ownership, not just the purchase price. AAA publishes annual reports on the true cost of owning various vehicle types. A cheaper purchase price with high ownership costs can end up more expensive than a pricier vehicle with low operating costs.

5: Not Shopping Around for Financing

The scenario: You accept the dealer’s financing offer without comparing other options.

Why it’s problematic:

- Dealer rates are often higher than credit union or bank rates

- You might qualify for better terms elsewhere

- Dealers sometimes mark up the interest rate to increase their profit

The fix: Get pre-approved from at least 2-3 lenders before shopping for a car. Use this as leverage when negotiating with the dealer. Even a 1% difference in interest rate can save you $1,000+ over the life of the loan.

6: Extending the Loan Term to “Afford” a Car

The scenario: You can’t afford the payment on a 4-year loan, so you extend to 6-7 years to make it work.

Why it’s problematic:

- You’re buying a car you can’t afford

- Significantly more interest paid

- A longer period of being underwater

- You’ll still be making payments when the car needs major repairs

The fix: If you can’t afford the 4-year payment, you’re looking at the wrong car. Choose a less expensive vehicle that fits the 20/4/10 Rule.

Real Data: The Cost of Ignoring the 20/4/10 Rule

Let’s compare two buyers purchasing the same $30,000 vehicle with different approaches:

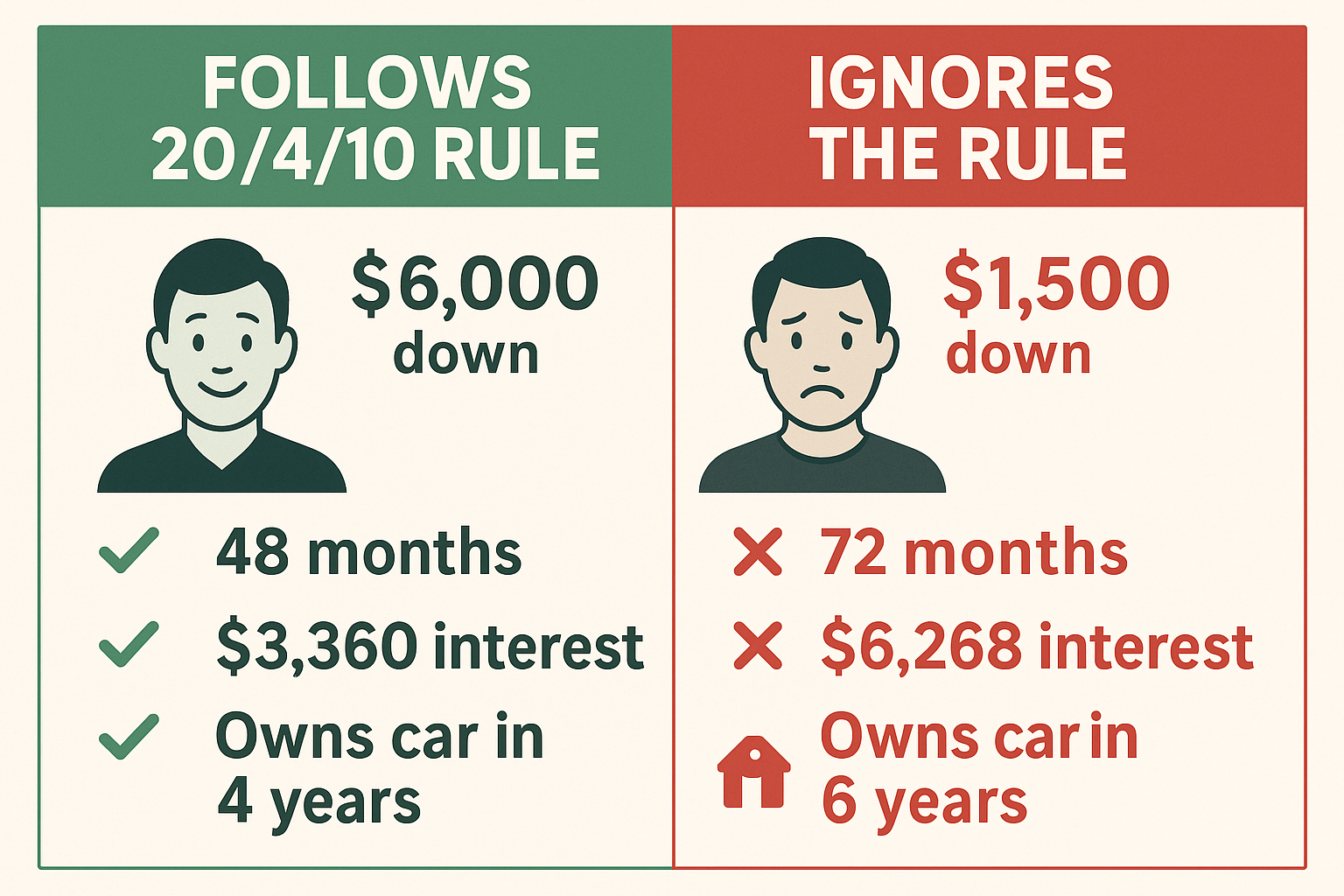

Buyer A: Follows the 20/4/10 Rule

- Purchase price: $30,000

- Down payment: $6,000 (20%)

- Amount financed: $24,000

- Interest rate: 6.5% (better rate due to larger down payment)

- Loan term: 48 months

- Monthly payment: $570

- Total interest paid: $3,360

- Total cost: $33,360

Buyer B: Ignores the Rule

- Purchase price: $30,000

- Down payment: $1,500 (5%)

- Amount financed: $28,500

- Interest rate: 8.5% (higher rate due to minimal down payment and longer term)

- Loan term: 72 months

- Monthly payment: $469

- Total interest paid: $6,268

- Total cost: $36,268

The Comparison

| Factor | Buyer A (Follows Rule) | Buyer B (Ignores Rule) | Difference |

|---|---|---|---|

| Down payment | $6,000 | $1,500 | $4,500 more |

| Monthly payment | $570 | $469 | $101 higher |

| Loan duration | 4 years | 6 years | 2 years shorter |

| Interest paid | $3,360 | $6,268 | $2,908 saved |

| Total cost | $33,360 | $36,268 | $2,908 saved |

| Time underwater | ~12 months | ~48 months | Much lower risk |

Buyer A pays $101 more per month but saves $2,908 total and owns the car outright 2 years sooner.

Even better: Once Buyer A’s car is paid off after 4 years, they continue “paying themselves” the $570/month into a car fund. After 2 more years (when Buyer B finally pays off their loan), Buyer A has $13,680 saved for their next vehicle, enough to buy a quality used car with cash.

Meanwhile, Buyer B has $0 saved and will likely need to finance their next car again, perpetuating the cycle.

This is the power of the 20/4/10 Rule.

Conclusion: Your Roadmap to Smart Car Buying

The 20/4/10 Rule isn’t just another financial guideline; it’s a proven framework that has helped thousands of car buyers avoid the trap of becoming “car poor.” By requiring a 20% down payment, limiting financing to 4 years, and capping total vehicle expenses at 10% of gross income, this rule ensures your car purchase supports your financial goals rather than derailing them.

Here’s what we’ve covered:

The 20/4/10 Rule prevents you from overextending yourself on a depreciating asset

Following all three components can save you $15,000-$30,000 or more over the life of your vehicle

The rule applies to both new and used cars and can be modified for different financial situations

Breaking even one component significantly increases your financial risk

Your car should enable your life, not consume your financial resources

Your Action Plan

This week:

- Calculate your maximum vehicle budget using the 10% rule

- Research your estimated non-payment expenses (insurance, fuel, maintenance)

- Determine your maximum monthly payment

- Check your credit score and start improving it if needed

This month:

- Set up automatic transfers to a dedicated car savings fund for your 20% down payment

- Get pre-approved for financing from 2-3 lenders

- Research vehicles in your price range, focusing on reliability and total cost of ownership

- Create a shortlist of 3-5 vehicles that meet your needs and budget

Before buying:

- Verify you have a 20% down payment saved

- Confirm your loan terms don’t exceed 48 months

- Double-check that total monthly expenses stay under 10% of gross income

- Get a pre-purchase inspection for any used vehicle

- Negotiate the purchase price, not the monthly payment

The Bigger Picture

Smart car buying is just one piece of building long-term wealth. The discipline you develop by following the 20/4/10 Rule translates to other financial decisions—from housing choices to investment strategies.

When you’re not burdened by excessive car payments, you free up cash flow to:

- Build a robust emergency fund

- Maximize retirement contributions

- Invest in dividend-paying stocks for passive income

- Save for your children’s education

- Pursue entrepreneurial opportunities

- Achieve financial independence sooner

Remember: The goal isn’t to drive the newest or fanciest car. The goal is to drive a reliable vehicle you can truly afford while building wealth that lasts.

The 20/4/10 Rule might mean buying a less expensive car than you initially wanted. But in 10 years, you won’t remember what you drove—you’ll remember the financial freedom and opportunities that smart decision created.

Ready to Take Control?

Start applying the 20/4/10 Rule today. Run your numbers, set your budget, and commit to buying only what you can truly afford. Your future self will thank you.

For more guidance on building wealth and making smart financial decisions, explore our resources on smart financial strategies and discover how to create multiple streams of passive income.

🚗 20/4/10 Rule Car Buying Calculator

Find out exactly how much car you can afford

Additional Resources and External References

To ensure you’re making the most informed car-buying decision, consult these authoritative sources:

Government Resources

- Consumer Financial Protection Bureau (CFPB): Official guidance on auto loans, understanding terms, and avoiding predatory lending

- Federal Trade Commission (FTC): Consumer protection information for car buyers

- National Highway Traffic Safety Administration (NHTSA): Safety ratings and recall information

Financial Education

- Investopedia Auto Loan Guide: Comprehensive information on auto financing

- Consumer Reports Car Buying Guide: Independent vehicle ratings, reliability data, and buying advice

- Edmunds True Cost to Own: Calculate the full 5-year cost of owning specific vehicles

Interest Rate Research

- Federal Reserve Economic Data (FRED): Track average auto loan interest rates over time

- Bankrate Auto Loan Rates: Current average rates by credit score

These resources provide data-backed information to complement the 20/4/10 Rule framework and help you make the smartest possible vehicle purchase decision.

FAQ

A good down payment is at least 20% of the vehicle’s purchase price. This amount provides immediate equity, reduces your monthly payment, helps you avoid being underwater on your loan, and often qualifies you for better interest rates. If you can afford more than 20%, even better—but 20% is the minimum recommended by financial experts.

To calculate the 20/4/10 Rule:

20%: Multiply the vehicle price by 0.20 to find your minimum down payment

4: Use a loan calculator to determine your monthly payment for 48 months at current interest rates

10%: Multiply your gross monthly income by 0.10 to find your maximum total monthly vehicle budget (including payment, insurance, fuel, and maintenance)

If the numbers work for all three components, the vehicle fits your budget.

Yes, the 20/4/10 Rule applies to both new and used vehicles. In fact, it often works even better for used cars because they’re less expensive, making it easier to meet all three criteria. Used cars also depreciate more slowly than new ones, which means you’re less likely to be underwater on your loan when following the 20% down payment rule.

If you can’t afford a 20% down payment, you should wait and save more before buying. Alternatively, consider a less expensive vehicle that makes 20% down achievable with your current savings. Buying with less than 20% down significantly increases your risk of being underwater on the loan and typically results in higher interest rates and monthly payments. The down payment requirement exists to protect your financial health.

Yes, a 4-year (48-month) car loan is absolutely realistic and should be your target. While the average loan term has stretched to 68 months, this doesn’t mean longer is better—it means buyers are purchasing vehicles they can’t truly afford. A 4-year loan ensures you’re not paying interest for longer than necessary and helps prevent buying more car than your budget allows. If a 4-year payment seems too high, you’re looking at too expensive a vehicle.

Putting more than 20% down can be smart, but it depends on your overall financial situation. If you have high-interest debt (credit cards, personal loans), pay that off first. If you don’t have an emergency fund with 3-6 months of expenses, build that first. If both of those are covered, a larger down payment (30-40%) can save you even more in interest and reduce your monthly payment. However, don’t drain your entire savings for a down payment—maintain financial flexibility.

The 20/4/10 Rule works for most income levels, but high earners may want to modify the 10% portion. For example, someone earning $500,000 annually doesn’t need to spend $50,000/year on vehicle expenses. High earners might cap total vehicle expenses at a fixed dollar amount (e.g., $1,500/month maximum) rather than a percentage. The 20% down and 4-year loan term components remain smart guidelines regardless of income level.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Vehicle purchasing decisions should be made based on your individual financial situation, goals, and circumstances. Consult with a qualified financial advisor before making major financial decisions. Interest rates, vehicle prices, and market conditions vary and change over time. The examples and calculations provided are for illustrative purposes and may not reflect current market conditions.

About Author

Written by Max Fonji — With over a decade of experience in personal finance education, Max is your go-to source for clear, data-backed investing and money management guidance. As the founder of TheRichGuyMath.com, Max has helped thousands of readers make smarter financial decisions through practical, actionable advice that cuts through the noise and delivers real results.