Picture this: You check your credit score and discover it dropped 30 points seemingly overnight. You haven’t missed any payments, your income is stable, yet your score plummeted without explanation.

Here’s the truth: Your credit score is not random. It follows a precise mathematical formula designed to predict how reliably you repay borrowed money. Lenders don’t guess about your creditworthiness—they evaluate risk using a structured model with specific FICO score factors that determine your three-digit number.

If you’re new to credit fundamentals, start with our complete guide to how credit works before diving into the scoring model details.

This article will break down each factor, how much it matters, and exactly how you can improve each component of your FICO score.

Key Takeaways

- Payment history (35%) is the single most important FICO score factor — even one late payment can significantly impact your score

- Credit utilization (30%) measures how much available credit you use — keeping balances below 10% optimizes this factor

- Your income, savings, and job title do not affect your FICO score — the model only evaluates credit behavior patterns

- FICO scores predict lending risk, not financial wealth — consistent payment patterns matter more than account balances

- Each factor improves at different speeds — utilization changes quickly, while payment history builds slowly over time

The 5 FICO Score Factors

The FICO scoring model uses five specific factors from your credit report to calculate your score. Here’s exactly how much each component matters:

| Factor | Weight | What It Measures |

|---|---|---|

| Payment History | 35% | On-time vs. late payments |

| Credit Utilization | 30% | Percentage of credit used |

| Length of Credit History | 15% | Age of your accounts |

| New Credit Inquiries | 10% | Recent credit applications |

| Credit Mix | 10% | Types of credit accounts |

FICO analyzes data from your credit report to generate this score. These factors represent patterns that statistically predict whether someone will repay borrowed money reliably.

The math behind this model isn’t arbitrary—it’s based on decades of lending data showing which behaviors correlate with loan defaults. Understanding what a credit report is helps clarify where this scoring data originates.

Factor #1: Payment History (35%)

Payment history carries more weight than any other FICO score factor because lenders prioritize reliability above all else. A borrower who consistently pays on time poses less risk than someone with irregular payment patterns, regardless of income level.

What Payment History Includes

Your payment history encompasses several types of credit behavior:

- On-time payments across all accounts (credit cards, loans, mortgages)

- Late payments are categorized as 30, 60, or 90+ days past due

- Charge-offs when lenders write off unpaid debt

- Collections accounts sent to third-party agencies

- Public records like bankruptcies and tax liens

The Impact of Late Payments

A single 30-day late payment can drop your FICO score by 60-110 points, depending on your starting score and overall credit profile[2]. The higher your initial score, the more dramatic the drop becomes.

This happens because the FICO algorithm weighs recent payment behavior heavily. Someone with an 800 credit score who misses a payment signals a significant change in risk profile, triggering a larger point deduction than someone with a 650 score who misses a payment.

Building Strong Payment History

The most effective strategy involves automating minimum payments to eliminate human error. Even if you pay the full balance manually each month, automatic minimum payments provide a safety net against missed due dates.

For detailed guidance on payment timing and recovery strategies, review our analysis of how long late payments stay on your credit report.

Key Insight: Lenders trust patterns more than promises. Consistent on-time payments over 12-24 months demonstrate reliability more effectively than sporadic large payments.

Factor #2: Credit Utilization (30%)

Credit utilization measures the percentage of available credit you’re currently using across all accounts. This ratio signals financial stress levels to lenders—high utilization suggests you’re relying heavily on borrowed money.

How Utilization is Calculated

The calculation is straightforward: Total balances ÷ Total credit limits = Utilization percentage

Example:

- Credit Card A: $800 balance / $2,000 limit = 40%

- Credit Card B: $300 balance / $3,000 limit = 10%

- Overall utilization: $1,100 total balances ÷ $5,000 total limits = 22%

Optimal Utilization Ranges

FICO research shows clear utilization thresholds that impact scores differently:

- Below 10%: Optimal range for highest scores

- 10-30%: Good range with minimal negative impact

- 30-50%: Moderate negative impact on scores

- Above 50%: Significant negative impact on scores[2]

The 30% rule isn’t a target—it’s a maximum. People with the highest FICO scores typically maintain utilization below 10% across all accounts.

Per-Card vs Overall Utilization

FICO evaluates both individual card utilization and overall utilization across all accounts. Maxing out one card while keeping others at zero still hurts your score, even if overall utilization remains low.

Strategy: Distribute balances across multiple cards rather than concentrating debt on a single account, or better yet, keep all balances below 10% of their respective limits.

Understanding your available credit helps optimize this factor effectively.

Key Insight: Credit utilization updates monthly when lenders report balances to credit bureaus. Paying down balances before statement closing dates can improve this factor within 30-45 days.

Factor #3: Length of Credit History (15%)

Length of credit history demonstrates your experience managing credit over extended periods. Lenders prefer borrowers with long credit histories because they provide more data points for risk assessment.

Components of Credit History Length

FICO evaluates three time-based metrics:

- Age of oldest account: How long your first credit account has been open

- Average age of all accounts: Total account ages divided by the number of accounts

- Time since most recent account opening: How recently you’ve added new credit

Why Closing Old Cards Hurts

Closing your oldest credit card can significantly damage this factor. If your first card has been open for 10 years and you close it, your credit history length immediately shortens to your second-oldest account.

Example Impact:

- Before: Oldest account 10 years, average age 5 years

- After closing the oldest card: Oldest account 7 years, average age 4 years

This reduction can drop your FICO score by 10-20 points, especially if the closed account had a high credit limit.

Strategic Account Management

Keep old accounts open, even if unused. The annual fee consideration becomes a cost-benefit analysis: Is the fee worth maintaining a longer credit history?

For most people, keeping old accounts open outweighs annual fees unless the fees exceed $100+ annually. Consider downgrading to no-fee versions of the same card to maintain the account history.

Learn more about optimizing your length of credit history for maximum FICO score benefit.

Key Insight: Time cannot be accelerated, making this factor the slowest to improve. Focus on maintaining existing accounts rather than trying to “hack” credit history length.

Factor #4: New Credit Inquiries (10%)

New credit inquiries occur when lenders check your credit report during the application process. Multiple applications within short timeframes signal financial stress or desperation to lenders, triggering score reductions.

Hard vs. Soft Inquiries

Understanding inquiry types prevents unnecessary score damage:

Hard Inquiries (impact your score):

- Credit card applications

- Auto loan applications

- Mortgage applications

- Personal loan applications

Soft Inquiries (no score impact):

- Checking your own credit score

- Pre-approved credit offers

- Employment background checks

- Insurance quote inquiries

Rate Shopping Protection

FICO recognizes legitimate rate shopping behavior and groups similar inquiries within 14-45 days as a single inquiry for scoring purposes[2]. This applies to:

- Auto loans

- Mortgages

- Student loans

Credit card applications don’t receive this protection—each application counts as a separate inquiry.

Recovery Timeline

Hard inquiries typically reduce FICO scores by 2-5 points each and remain on credit reports for two years. However, their scoring impact diminishes after 12 months.

Strategy: Limit credit applications to essential needs and cluster similar loan shopping within 2-3 week periods to minimize inquiry impact.

Key Insight: Checking your own credit score never hurts your FICO score. Use free monitoring services to track changes without triggering inquiries.

Factor #5: Credit Mix (10%)

Credit mix evaluates your ability to manage different types of credit simultaneously. Lenders prefer borrowers who successfully handle both revolving credit (credit cards) and installment credit (loans).

Types of Credit Accounts

Revolving Credit:

- Credit cards

- Home equity lines of credit (HELOCs)

- Business lines of credit

Installment Credit:

- Auto loans

- Mortgages

- Personal loans

- Student loans

Optimal Credit Mix Strategy

Having both revolving and installment accounts demonstrates versatility, but this factor carries the least weight in FICO calculations. Don’t take unnecessary loans just to improve your credit mix.

Natural credit mix development:

- Start with a credit card for revolving credit

- Add an auto loan or mortgage when needed

- Maintain both account types long-term

Credit Mix Mistakes to Avoid

Don’t force credit diversity by taking loans you don’t need. The 10% weight means credit mix improvements might increase your score by only 5-15 points—not worth paying interest on unnecessary debt.

Focus on the major factors first (payment history and utilization) before optimizing credit mix.

For a deeper analysis of account variety benefits, explore our guide on credit mix optimization strategies.

Key Insight: Credit mix naturally improves over time as you reach life milestones requiring different credit types. Patience beats forced optimization.

Why FICO Uses These Specific Factors

FICO score factors aren’t arbitrary—they’re statistically validated predictors of lending risk. The model analyzes millions of credit histories to identify behaviors that correlate with loan defaults.

The Psychology Behind Each Factor

Payment History (35%): Past behavior predicts future behavior. Someone who consistently pays on time demonstrates reliability and financial discipline.

Credit Utilization (30%): High utilization suggests financial stress or poor money management. Low utilization indicates you’re not dependent on credit for basic expenses.

Length of History (15%): Longer credit histories provide more data points for risk assessment. They also demonstrate stability and experience managing credit.

New Credit (10%): Multiple recent applications suggest financial distress or credit shopping due to rejections elsewhere.

Credit Mix (10%): Successfully managing different credit types shows versatility and financial sophistication.

Risk Prediction Accuracy

FICO scores accurately predict default probability across different score ranges:

- 800+ scores: Less than 1% default rate

- 700-799 scores: Approximately 2% default rate

- 600-699 scores: Approximately 5% default rate

- Below 600 scores: 15%+ default rate[3]

This statistical accuracy explains why lenders rely heavily on FICO scores for approval decisions and interest rate pricing.

Key Insight: FICO scores measure credit behavior patterns, not financial wealth or social status. A high-income person with poor payment habits will have a lower score than a moderate-income person with excellent payment discipline.

What Does NOT Affect Your FICO Score Factors

Many people incorrectly assume that income and wealth impact FICO scores. Understanding what doesn’t affect your score prevents wasted effort and clarifies how the model actually works.

Financial Factors That Don’t Count

Income Level: Your salary, wages, or business income don’t appear in FICO calculations. A person earning $50,000 annually can have a higher score than someone earning $500,000.

Savings Account Balances: Bank account balances, investment portfolios, and cash reserves aren’t considered in credit scoring.

Checking Account Activity: Overdrafts, account closures, and banking relationships don’t impact FICO scores (though they may affect ChexSystems reports).

Personal Demographics That Don’t Count

Age: Your birth date doesn’t factor into FICO calculations, though account ages do matter.

Employment Status: Job title, employer, or employment history don’t directly impact scores.

Marital Status: Being single, married, or divorced doesn’t affect individual FICO scores.

Geographic Location: Where you live doesn’t influence your credit score.

Race, Gender, Religion: Federal law prohibits using these characteristics in credit scoring.

Common Misconceptions

“Closing accounts improves my score”: False. Closing accounts typically hurts scores by reducing available credit and potentially shortening credit history.

“Carrying a balance helps my score”: False. Paying balances in full monthly optimizes utilization without paying interest.

“Checking my score hurts it”: False. Self-monitoring generates soft inquiries that don’t impact scores.

Key Insight: FICO scores focus exclusively on credit management behavior, not overall financial status. This design makes credit accessible to people across all income levels who demonstrate responsible borrowing patterns.

How to Improve Each FICO Score Factor

Each factor requires different optimization strategies and timelines. Focus your efforts on factors with the highest impact potential for your specific credit profile.

Factor-Specific Improvement Strategies

| Factor | Improvement Strategy | Timeline |

|---|---|---|

| Payment History | Set up autopay for minimum payments | 3-6 months |

| Credit Utilization | Pay balances before statement dates | 1-2 months |

| Length of History | Keep old accounts open | Years |

| New Credit | Limit applications to essential needs | 12+ months |

| Credit Mix | Add account types naturally over time | Years |

Payment History Optimization

Automate minimum payments across all accounts to eliminate missed payment risk. Even if you manually pay full balances, automation provides backup protection.

For existing late payments: Focus on consistent on-time payments moving forward. Recent payment history carries more weight than old mistakes.

Consider authorized user status on family members’ accounts with excellent payment histories to boost this factor quickly.

Credit Utilization Optimization

Pay balances before statement closing dates to report lower utilization to credit bureaus. Most lenders report balances on statement closing dates, not payment due dates.

Request credit limit increases on existing accounts to lower utilization percentages without changing spending habits.

Distribute balances across multiple cards rather than maxing out individual accounts, though keeping all balances low remains optimal.

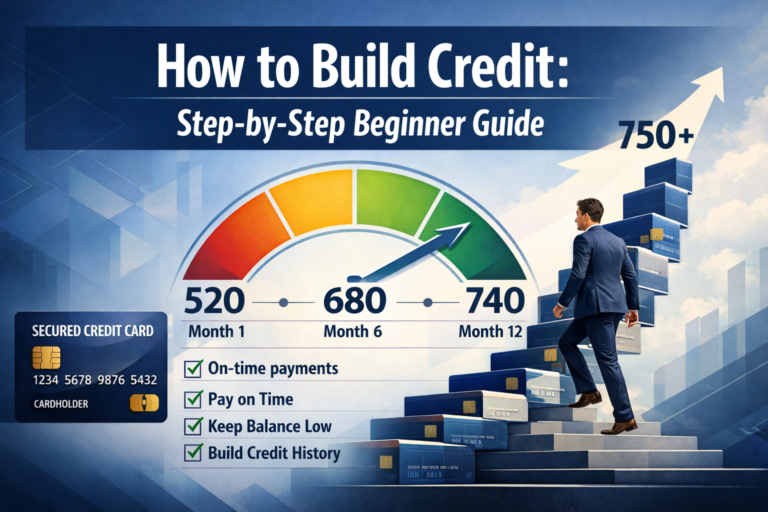

Building Credit from Zero

If you’re starting with no credit history, follow our comprehensive guide to building credit for step-by-step strategies.

Starter Strategy:

- Open a secured credit card or become an authorized user

- Make small purchases and pay in full monthly

- Keep utilization below 10%

- Wait 6-12 months before applying for additional credit

Key Insight: Consistency beats complexity in credit building. Simple habits maintained over time produce better results than complicated optimization strategies.

How Fast Your FICO Score Can Change

Different factors update at different speeds, creating varying timelines for score improvements. Understanding these timelines helps set realistic expectations.

Fast-Changing Factors (1-2 months)

Credit Utilization: Updates monthly when lenders report balances to credit bureaus. Paying down balances can improve scores within 30-45 days.

Example: Reducing utilization from 45% to 15% might increase scores by 20-40 points within two billing cycles.

Medium-Term Factors (3-12 months)

Payment History: New positive payments gradually outweigh past mistakes. Consistent on-time payments for 6-12 months can significantly improve scores.

New Credit Inquiries: Hard inquiry impact diminishes after 12 months, though inquiries remain on reports for 24 months.

Slow-Changing Factors (Years)

Length of Credit History: Cannot be accelerated. Account ages increase naturally over time.

Credit Mix: Develops organically as you reach life milestones requiring different credit types.

Realistic Score Improvement Timelines

30-60 days: Utilization optimization can improve scores by 10-50 points

3-6 months: Payment history improvements show meaningful progress

6-12 months: Comprehensive strategy implementation yields substantial gains

12+ months: Maximum score potential achieved through consistent habits

Why Scores Sometimes Drop Unexpectedly

Common causes of sudden score decreases:

- Credit limit reductions are increasing utilization

- Accounts closed by lenders

- Late payments are reported with delays

- Identity theft or reporting errors

Regular monitoring helps identify and address these issues quickly. Learn more about comprehensive credit score improvement strategies for sustained progress.

Key Insight: Credit score improvement requires patience and consistency. Quick fixes rarely produce lasting results, while steady habits create permanent positive changes.

Advanced FICO Score Factors: Recent Changes

The credit scoring landscape continues evolving as lenders adopt newer FICO models that incorporate additional data sources and refined algorithms. Understanding these changes helps optimize your credit strategy for current lending standards.

FICO 10T and Trending Data

FICO 10T analyzes credit behavior patterns over the past 24 months rather than providing a single snapshot[3]. This “trending” approach rewards consistent improvement while penalizing deteriorating credit habits.

Key differences from traditional FICO scores:

- Rising balances over time hurt scores more severely

- Declining balances over time boost scores significantly

- Payment consistency matters more than isolated incidents

- Recent behavior carries a heavier weight than older patterns

This means someone who gradually reduced credit card balances from 80% to 20% utilization over 18 months would see larger score improvements than someone who made a single large payment.

Alternative Data Integration

Newer scoring models incorporate non-traditional credit data, including rent payments, utility bills, and telecommunications accounts[1][3]. This expansion particularly benefits:

- Renters who consistently pay rent on time

- Young adults with limited traditional credit history

- Immigrants establishing credit in the United States

- People who primarily use cash or debit cards

Buy Now, Pay Later (BNPL) Reporting

BNPL services like Affirm, Klarna, and Afterpay now report payment data to credit bureaus[2][4]. This creates new opportunities and risks:

Positive impact: On-time BNPL payments can help build credit history

Negative impact: Missed BNPL payments now hurt credit scores

Strategy: Treat BNPL payments with the same priority as credit card payments

Medical Debt Removal

Paid medical collections and medical debts under $500 no longer appear on credit reports[2][4]. This change removed negative marks for millions of consumers, particularly benefiting people who faced unexpected medical expenses.

If you have medical debt:

- Verify removal from your credit reports

- Dispute any remaining small medical collections

- Negotiate payment plans for larger medical debts before they reach collections

Monitoring Your FICO Score Factors

Regular monitoring helps identify changes and opportunities for improvement across all five factors. Different monitoring strategies provide varying levels of detail and frequency.

Free Score Sources

Credit card issuers often provide monthly FICO scores to cardholders at no cost. Popular options include:

- Discover: Free FICO Score 8 for anyone (not just cardholders)

- Chase: FICO Score 8 for Chase cardholders

- American Express: FICO Score 8 for Amex cardholders

- Bank of America: FICO Score 8 for BofA cardholders

Comprehensive Credit Monitoring

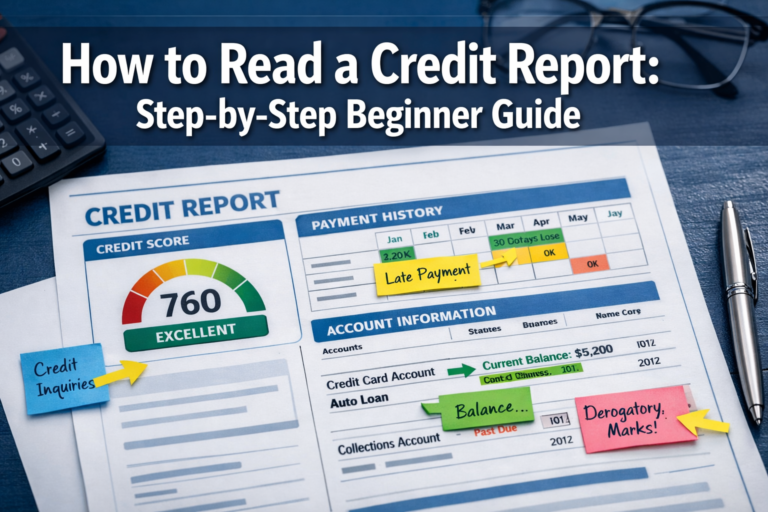

Annual credit reports from annualcreditreport.com provide detailed information about all five FICO score factors. Review reports from all three bureaus (Experian, Equifax, TransUnion) since lenders may report to different bureaus.

What to check for each factor:

- Payment history: Verify all payments are accurately reported

- Utilization: Confirm reported balances match your records

- Length: Check account opening dates for accuracy

- Inquiries: Identify any unauthorized hard inquiries

- Mix: Review account types and statuses

Setting Up Alerts

Credit monitoring services alert you to significant changes that might indicate identity theft or reporting errors. Key alerts include:

- New accounts opened

- Hard inquiries

- Significant score changes

- Late payments reported

- Collections accounts added

Understanding how to read a credit report helps interpret monitoring alerts and identify action items.

Key Insight: Monitor your credit quarterly at a minimum, monthly if actively working to improve scores. Early detection of problems prevents minor issues from becoming major obstacles.

Common FICO Score Factor Myths Debunked

Misinformation about credit scoring creates costly mistakes that can damage scores for months or years. Understanding the facts helps avoid these pitfalls.

Myth: “Carrying a Balance Helps Your Score”

Reality: Paying balances in full monthly optimizes your utilization factor without paying interest. Credit card companies profit from this myth by encouraging unnecessary interest payments.

The truth: FICO algorithms cannot distinguish between balances paid in full versus minimum payments. They only see the balance reported on your statement’s closing date.

Myth: “Closing Cards Helps Your Score”

Reality: Closing credit cards typically hurts scores by reducing available credit (increasing utilization) and potentially shortening credit history length.

Exception: Closing cards with annual fees might make financial sense despite minor score impact, especially if you have multiple other cards.

Myth: “Income Affects Your Credit Score”

Reality: FICO score factors don’t include income, employment, or wealth information. A minimum-wage worker with excellent payment habits can have a higher score than a millionaire with poor credit management.

Myth: “Multiple Checking Account Inquiries Hurt Credit”

Reality: Bank account applications typically generate soft inquiries that don’t impact credit scores. ChexSystems tracks banking history separately from credit reports.

Myth: “Paying Off Loans Hurts Your Score”

Reality: Paying off installment loans might temporarily reduce your credit mix factor, but the positive impact on payment history and reduced debt typically outweighs any minor negative effects.

Key Insight: Credit scoring myths often benefit financial institutions at consumers’ expense. Always verify credit advice against official FICO documentation or reputable financial education sources.

Industry-Specific FICO Score Variations

Different industries use specialized FICO score versions optimized for their specific lending risks. Understanding these variations helps explain why your score might differ across lenders.

Auto Industry Scores

FICO Auto Scores range from 250-900 (instead of 300-850) and weight factors differently to predict auto loan default risk specifically. These models:

- Emphasize payment history on previous auto loans

- Consider seasonal payment patterns (people may prioritize car payments in winter)

- Weight recent credit behavior more heavily

Mortgage Industry Scores

Mortgage lenders often use older FICO versions (FICO 2, 4, and 5) because government-sponsored enterprises (Fannie Mae and Freddie Mac) haven’t updated their requirements to newer models[1].

This creates situations where:

- Your credit card issuer shows a FICO 8 score of 750

- Your mortgage lender sees a FICO 4 score of 720

- Both scores are “correct” for their respective purposes

Credit Card Industry Scores

FICO Bankcard Scores focus specifically on credit card default risk and emphasize:

- Revolving credit utilization patterns

- Payment timing on credit cards specifically

- Balance transfer and cash advance usage

The Multi-Score Reality

Most consumers have dozens of different credit scores because each bureau generates its own version of each FICO model. This explains why:

- Different lenders quote different scores for the same person

- Credit monitoring services show varying numbers

- Your “credit score” isn’t a single, universal number

Strategy: Focus on improving the underlying FICO score factors rather than obsessing over specific score variations. Strong credit fundamentals improve all score versions simultaneously.

Key Insight: Score variations between lenders are normal. Concentrate on maintaining excellent credit habits rather than trying to optimize for specific scoring models.

The Future of FICO Score Factors

Credit scoring continues evolving as technology advances and consumer financial behaviors change. Understanding emerging trends helps prepare for future credit landscape shifts.

Machine Learning Integration

Newer FICO models incorporate machine learning algorithms that identify subtle patterns in credit data invisible to traditional statistical methods. These models:

- Detect fraud patterns more accurately

- Identify creditworthy consumers with thin files

- Adjust for economic cycles and regional differences

- Incorporate alternative data sources seamlessly

Open Banking Data

Open banking initiatives may eventually include bank account data in credit scoring models, potentially incorporating:

- Income stability patterns

- Savings account growth trends

- Bill payment consistency beyond credit accounts

- Financial stress indicators

Cryptocurrency and Digital Assets

As digital assets become mainstream, future scoring models might consider:

- Cryptocurrency payment histories

- Digital wallet management patterns

- Blockchain-verified financial behaviors

Real-Time Scoring Updates

Current FICO scores update monthly when lenders report to credit bureaus. Future models might incorporate:

- Daily balance updates

- Real-time payment confirmations

- Instantaneous credit limit adjustments

- Dynamic risk assessment

Key Insight: While credit scoring technology advances, the fundamental principles remain constant: consistent payments, low utilization, and responsible credit management will always be valued by lenders.

FICO Score Factor Calculator

Adjust each factor to see how changes might impact your credit score

Conclusion

Your FICO score is not a mystery—it’s a mathematical calculation based on five specific factors that measure your credit management behavior over time. Understanding these FICO score factors empowers you to make informed decisions that improve your creditworthiness systematically.

The hierarchy matters: Payment history (35%) and credit utilization (30%) control 65% of your score, making them your highest-impact optimization targets. Length of credit history (15%), new credit inquiries (10%), and credit mix (10%) provide fine-tuning opportunities but shouldn’t overshadow the major factors.

Remember that FICO scores measure credit behavior, not financial status. Your income, savings, and wealth don’t directly affect your score—only how you manage borrowed money matters to the algorithm.

Start with the fundamentals: Automate minimum payments to protect your payment history, keep credit utilization below 10% for optimal scoring, and maintain old accounts to preserve credit history length. These simple habits, maintained consistently over time, will improve your score more effectively than complex optimization strategies.

The math behind money applies to credit scoring: Small, consistent improvements compound over time to create significant results. Focus on building sustainable credit habits rather than seeking quick fixes, and your FICO score will reflect your disciplined approach to financial management.

References

[1] Watch – https://www.youtube.com/watch?v=Z7AQK1kAq8o

[2] Your 2026 Credit Score Playbook: What Really Moves The Needle – https://www.myfinancialgoals.org/blog/your-2026-credit-score-playbook-what-really-moves-the-needle

[3] Your 2026 Credit Score Playbook: The Biggest Changes And What They Mean For You – https://mcfcu.org/financialwellness/your-2026-credit-score-playbook-the-biggest-changes-and-what-they-mean-for-you/

[4] New Credit Score Rules And How They May Affect Borrowers – https://www.selco.org/education-articles/new-credit-score-rules-and-how-they-may-affect-borrowers/

Disclaimer

This article provides educational information about FICO score factors and should not be considered personalized financial advice. Credit scoring is complex, and individual results may vary based on complete credit profiles. Consult with qualified financial professionals for guidance specific to your situation. The Rich Guy Math is not affiliated with Fair Isaac Corporation (FICO) or any credit bureau.

About the Author

Max Fonji is a data-driven financial educator and the founder of The Rich Guy Math. With expertise in financial analysis and credit optimization, Max helps individuals understand the mathematical principles behind wealth building and credit management. His evidence-based approach combines analytical precision with practical strategies for long-term financial success.

Meta Description: Learn the 5 FICO score factors that determine your credit score. Payment history (35%), utilization (30%), and 3 other factors are explained with actionable tips to improve each one.

Frequently Asked Questions

What is the most important FICO score factor?

Payment history accounts for 35% of your FICO score, making it the single most important factor. Even one late payment can significantly damage your score, while consistent on-time payments build strong credit over time.

Can income improve your credit score?

No. Income does not directly affect FICO score calculations. Credit scoring models evaluate how you manage credit accounts, not how much money you earn. A person with modest income can have a higher score than someone with high income if they use credit responsibly.

How often does FICO update?

FICO scores typically update monthly when lenders report account activity to the credit bureaus. Because lenders report on different dates, your score may change multiple times throughout the month instead of on a single fixed day.

Why did my score drop after paying off a loan?

Paying off an installment loan can temporarily reduce your credit mix factor (10% of your score) and may decrease the number of active accounts on your credit report. The effect is usually small and temporary, and the long-term benefit of reducing debt is far more important.

Does checking my credit hurt my score?

No. Checking your own credit generates a soft inquiry, which does not affect your FICO score. Only hard inquiries from lender applications impact your score, and they typically reduce it by only a few points temporarily.

Is FICO the same as VantageScore?

No. FICO and VantageScore are different credit scoring models developed by separate companies. They use similar data but weight factors differently, so the numbers can vary. Most lenders rely on FICO scores when making lending decisions.