What Are ETFs and Why Are They Popular in 2025?

ETFs (Exchange-Traded Funds) are investment funds that trade on stock exchanges, similar to individual stocks. They typically track indexes, sectors, or commodities and offer a low-cost, diversified investment option—ideal for long-term investors. In 2025, ETFs are more popular than ever due to:

- Low expense ratios

- Tax efficiency

- Broad market exposure

- Passive income via dividends

Criteria for Selecting the Top 10 ETFs

When choosing the best ETFs, we focused on:

- Long-term performance

- Expense ratio

- Liquidity and volume

- Underlying asset quality

- Historical returns and risk profile

Top 10 ETFs to Watch and Invest in 2025

1. Vanguard Total Stock Market ETF (VTI)

- Why it stands out: Offers exposure to the entire U.S. equity market

- Expense ratio: 0.03%

- Ideal for: Long-term U.S. market exposure

2. SPDR S&P 500 ETF Trust (SPY)

- Why it stands out: Tracks the performance of the S&P 500

- Expense ratio: 0.09%

- Ideal for: Passive investors looking for market-beating returns

3. Invesco QQQ Trust (QQQ)

- Why it stands out: Focus on tech-heavy NASDAQ-100 companies

- Expense ratio: 0.20%

- Ideal for: Growth-oriented investors

4. Vanguard FTSE Developed Markets ETF (VEA)

- Why it stands out: Exposure to developed international markets

- Expense ratio: 0.05%

- Ideal for: Geographic diversification

5. iShares Core U.S. Aggregate Bond ETF (AGG)

- Why it stands out: A stable bond ETF that lowers portfolio volatility

- Expense ratio: 0.03%

- Ideal for: Conservative investors and income seekers

6. Schwab U.S. Dividend Equity ETF (SCHD)

- Why it stands out: Focus on high-dividend-paying U.S. companies

- Expense ratio: 0.06%

- Ideal for: Passive income and dividend investors

7. ARK Innovation ETF (ARKK)

- Why it stands out: High-risk, high-reward exposure to disruptive innovation

- Expense ratio: 0.75%

- Ideal for: Aggressive investors and tech enthusiasts

8. iShares MSCI Emerging Markets ETF (EEM)

- Why it stands out: Invests in high-growth emerging economies

- Expense ratio: 0.68%

- Ideal for: Global growth exposure

9. Vanguard Real Estate ETF (VNQ)

- Why it stands out: Invests in REITs for real estate market exposure

- Expense ratio: 0.12%

- Ideal for: Portfolio diversification and real asset exposure

10. iShares Global Clean Energy ETF (ICLN)

- Why it stands out: Focus on clean and renewable energy companies

- Expense ratio: 0.42%

- Ideal for: ESG-focused investors

How to Invest in ETFs in 2025

- Open a brokerage account (Fidelity, Vanguard, Charles Schwab, etc.)

- Choose your ETFs based on your financial goals

- Diversify across sectors and geographies

- Set up automatic investments for dollar-cost averaging

Final Thoughts on the Top 10 ETFs in 2025

Investing in ETFs offers a smart and low-cost way to gain exposure to diversified portfolios. Whether you’re a beginner or a seasoned investor, the Top 10 ETFs listed above can help you build long-term wealth with reduced risk. Always consider your financial goals and risk tolerance before investing.

An ETF (Exchange-Traded Fund) is a type of investment fund that holds a collection of assets like stocks, bonds, or commodities. ETFs are traded on stock exchanges, similar to individual stocks, offering investors a cost-effective and diversified way to invest.

ETFs offer diversification, low fees, liquidity, and transparency. They’re suitable for both beginner and seasoned investors who want exposure to different sectors, indexes, or asset classes without picking individual stocks.

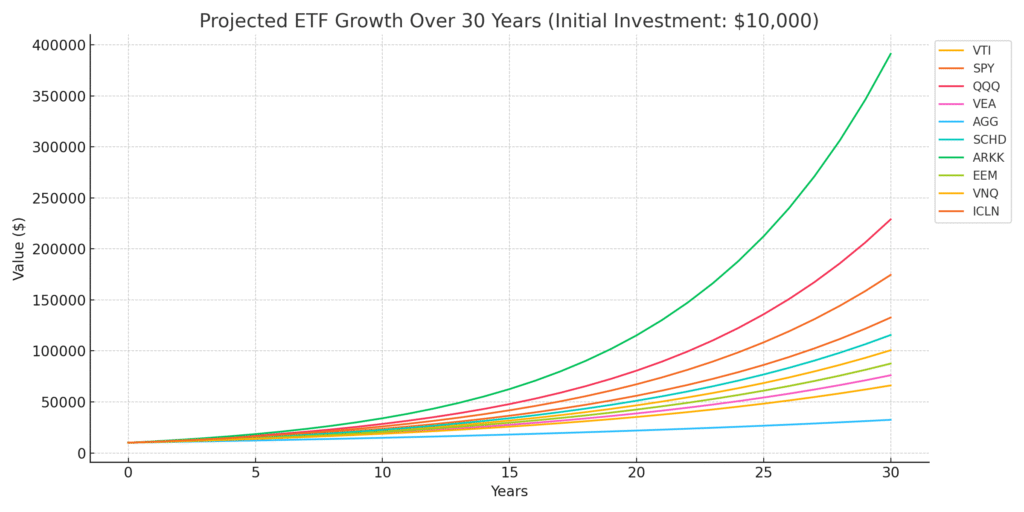

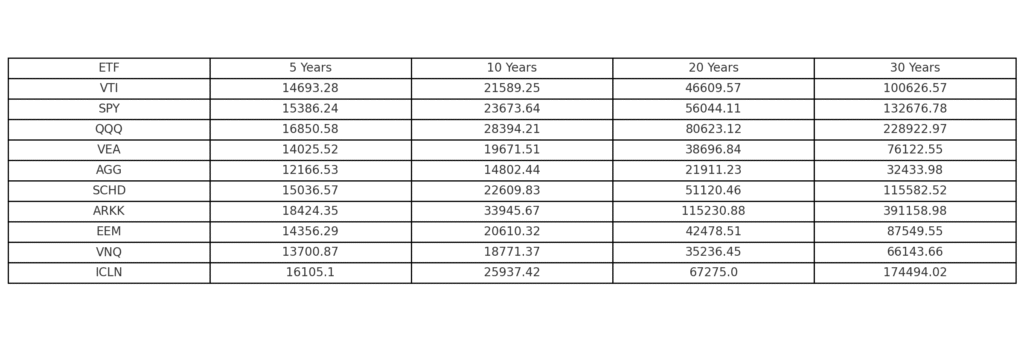

Some of the top-performing ETFs based on historical returns include:

QQQ (Invesco QQQ Trust) – Focused on tech-heavy NASDAQ-100

SPY (SPDR S&P 500 ETF) – Tracks the S&P 500 Index

ARKK (ARK Innovation ETF) – Focused on disruptive tech and innovation

These ETFs have shown strong performance over 5, 10, and 30-year horizons.

It depends on the ETF’s average annual return. For example:

A $10,000 investment in ARKK could grow to $391,158 in 30 years (13% avg. return).

The same investment in QQQ could reach $228,923 (11% avg. return).

More conservative ETFs like AGG may grow to $32,434 (4% avg. return).