In the world of finance, understanding the types of investors is critical, not just for professionals but for anyone who wants to succeed with money. Whether you’re starting or scaling your portfolio, this guide breaks down the different investor categories and helps you identify where you fit.

What Is an Investor?

An investor is anyone who allocates money with the expectation of earning a return. Investors come in many forms: from a teenager buying their first stock on Robinhood to a trillion-dollar hedge fund making billion-dollar trades.

Why Understanding Investor Types Matters

Understanding investor types helps you:

- Tailor your investment strategy

- Manage risk appropriately

- Align with the right opportunities

- Understand market movements

Different investor types have different goals, timelines, and risk tolerances, which shape the market in big ways.

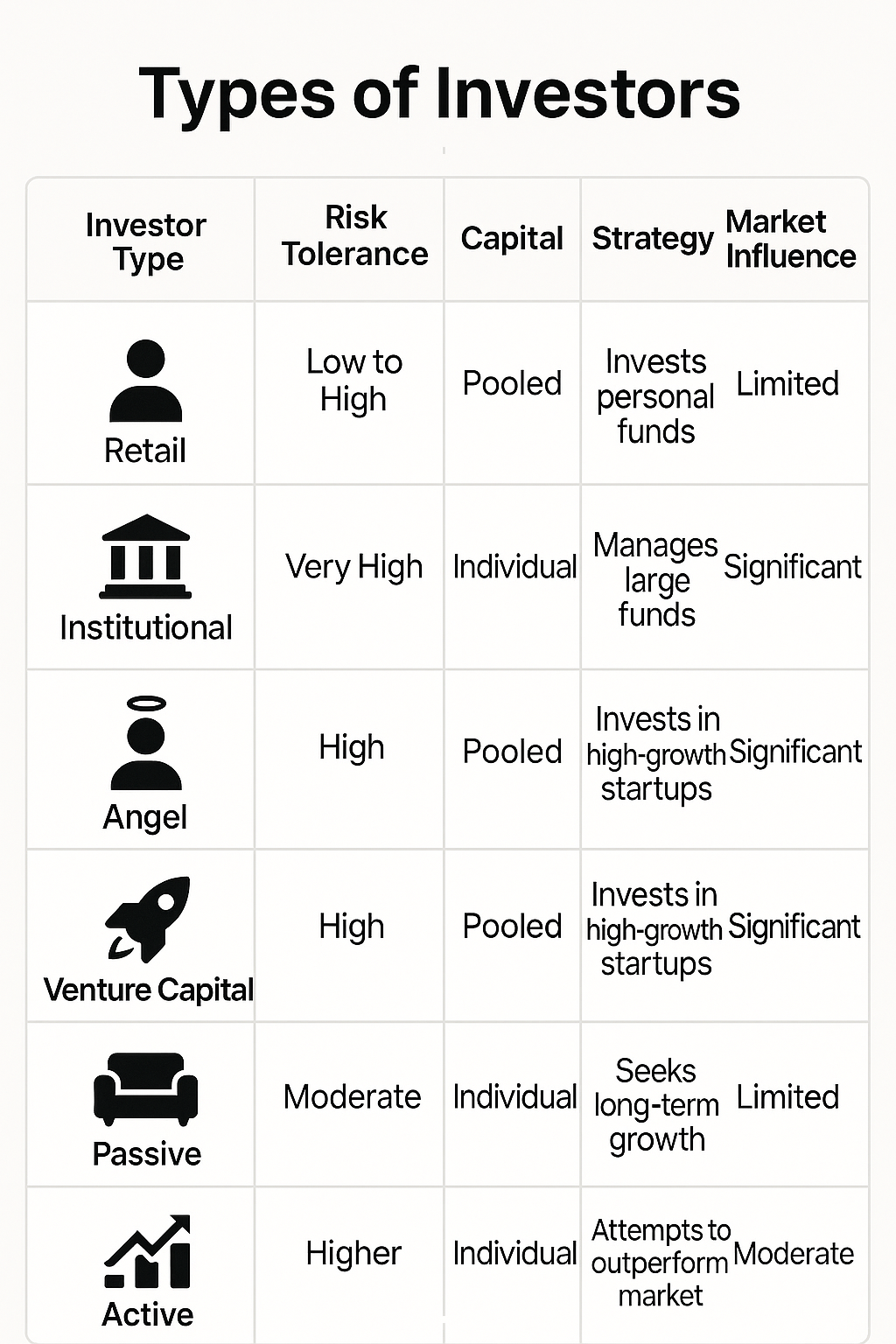

The 7 Main Types of Investors

1. Retail Investors

Who they are: Individual investors using personal capital

Goal: Long-term growth or short-term gains

Risk tolerance: Varies widely

Examples: You, your neighbor, or anyone with a brokerage app

2. Institutional Investors

Who they are: Entities like pension funds, insurance companies, and hedge funds

Goal: Long-term asset management

Risk tolerance: High, with professional strategies

Examples: BlackRock, Vanguard, CalPERS

3. Angel Investors

Who they are: High-net-worth individuals who fund startups early

Goal: High-risk, high-reward investments

Risk tolerance: Very high

Examples: Early funders of companies like Uber and Airbnb

4. Venture Capitalists (VCs)

Who they are: Firms or individuals who invest in growth-stage startups

Goal: Equity in high-growth companies

Risk tolerance: High

Examples: Sequoia Capital, Andreessen Horowitz

5. Accredited Investors

Who they are: Individuals who meet income/net worth thresholds

Goal: Access to private offerings

Risk tolerance: Medium to high

Examples: Anyone making over $200,000/year or with $1M+ net worth

6. Passive Investors

Who they are: Investors using a “buy and hold” approach

Goal: Long-term market growth

Risk tolerance: Moderate

Examples: Index fund investors, retirement savers

7. Active Investors

Who they are: Investors trying to outperform the market

Goal: Higher-than-average returns

Risk tolerance: Higher

Examples: Day traders, hedge fund managers

Retail passive investors are typically best for beginners due to simplicity and lower risk.

No. These require either accreditation or large amounts of capital and risk tolerance.

Not necessarily. They manage more capital but aren’t always better at beating the market.

Final Thoughts: Which Type of Investor Are You?

The best investor type for you depends on your goals, resources, and appetite for risk. Whether you’re a passive retail investor or an aspiring VC, understanding the different types of investors gives you the clarity to act smarter in any market.